Key Insights

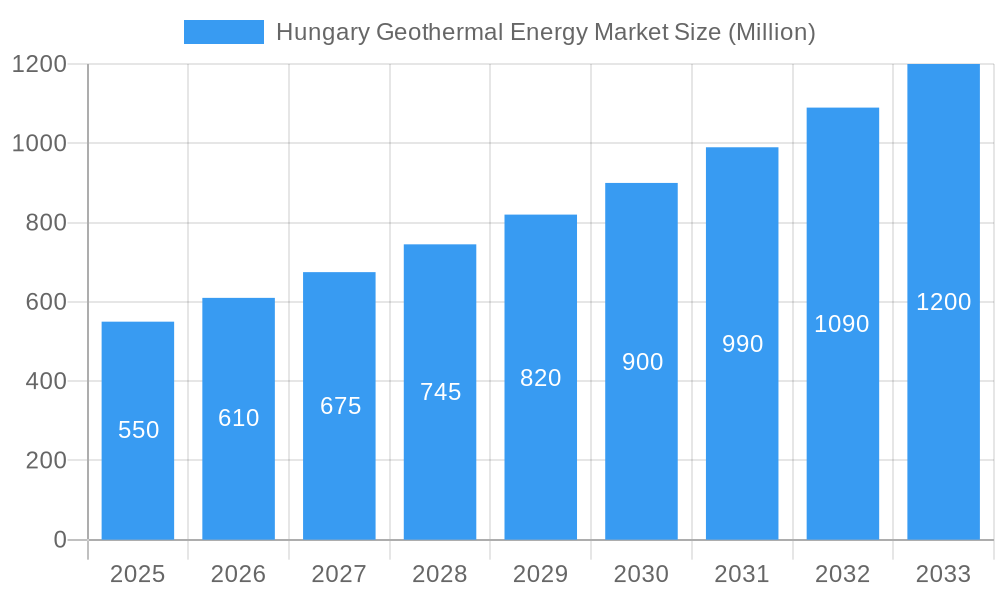

The Hungarian geothermal energy market is projected for substantial growth, anticipating a Compound Annual Growth Rate (CAGR) of 5.3%. This expansion is driven by increasing demand for sustainable energy solutions and Hungary's focus on energy independence. Key factors include abundant geothermal resources, supportive government policies, and rising environmental consciousness. Power generation and district heating are expected to lead market segments, offering dual benefits of electricity production and direct heat provision. Major industry players like Porcio Co Ltd, Enel SpA, and Engie SA are actively investing in Hungary's geothermal sector, signaling a competitive and dynamic market.

Hungary Geothermal Energy Market Market Size (In Billion)

Advancements in drilling technologies and Enhanced Geothermal Systems (EGS) are unlocking new resource potential. The emphasis on district heating aligns with existing infrastructure and efforts to reduce urban carbon emissions. While initial capital investment and the requirement for skilled labor present challenges, the overall outlook for geothermal energy's contribution to Hungary's energy security and sustainability goals from a base year of 2025 is highly positive. The market size is estimated at 6.09 billion.

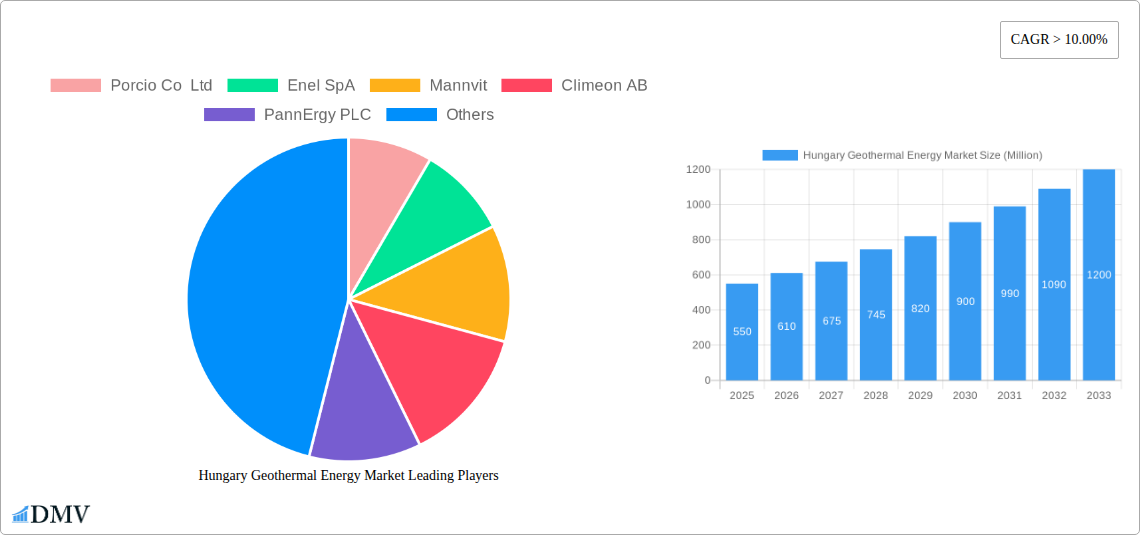

Hungary Geothermal Energy Market Company Market Share

Hungary Geothermal Energy Market: Comprehensive Analysis & Future Outlook (2019–2033)

Unlock the immense potential of Hungary's burgeoning geothermal energy sector with this in-depth market report. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast extending to 2033, this report provides an unparalleled view of market dynamics, innovations, and strategic growth opportunities. Discover how geothermal power and heat utilization are set to transform Hungary's energy landscape, driven by government initiatives and technological advancements.

Hungary Geothermal Energy Market Market Composition & Trends

The Hungary geothermal energy market exhibits a moderate concentration, characterized by a dynamic interplay of established players and emerging innovators. Key trends driving market evolution include a strong emphasis on district heat utilization to reduce reliance on fossil fuels and a growing interest in geothermal power generation for large-scale electricity production. Regulatory support from the Hungarian government, particularly the October 2022 announcement to upscale domestic geothermal energy, acts as a significant innovation catalyst. This policy aims to replace an estimated 1-1.5 billion cubic meters (bcm) of natural gas annually, underscoring the strategic importance of geothermal resources. While direct substitute products for large-scale baseload power are limited, efficient energy storage solutions and advancements in heat pump technology indirectly influence market dynamics. End-user profiles range from municipal governments and utility companies seeking sustainable heating solutions to industrial entities exploring process heat applications. Merger and acquisition (M&A) activities, though currently in nascent stages, are anticipated to increase as the market matures, with potential deal values reflecting the substantial long-term investment required for geothermal infrastructure development. The market share distribution is expected to shift as new projects come online, driven by the increasing demand for renewable energy sources and energy independence.

Hungary Geothermal Energy Market Industry Evolution

The Hungary geothermal energy market has undergone a significant evolutionary trajectory, transforming from a niche sector to a strategically vital component of the nation's energy diversification strategy. Throughout the historical period (2019-2024), the industry has witnessed a steady increase in exploration activities and pilot projects, laying the groundwork for broader adoption. The base and estimated year of 2025 mark a pivotal moment, with projected growth rates indicating a substantial acceleration in the coming forecast period (2025-2033). This growth is propelled by a confluence of factors, including a heightened awareness of climate change, the imperative to reduce dependence on imported fossil fuels, and the inherent stability and reliability of geothermal energy as a baseload power source. Technological advancements have played a crucial role in this evolution. Innovations in drilling techniques, enhanced geothermal systems (EGS), and more efficient heat exchange technologies have lowered operational costs and expanded the viable resource base. For instance, advancements in seismic imaging and reservoir characterization are enabling more precise identification of promising geothermal sites, thereby reducing exploration risks.

Consumer demand is also shifting. There is a growing appetite from both residential and commercial sectors for cleaner, more sustainable energy solutions. District heating networks, in particular, are gaining traction as a cost-effective and environmentally friendly method of heating large urban areas. The August 2022 announcement of the extensive geothermal heating network in Szeged, comprising 27 wells, 16 heating plants, and 250 kilometers of distribution pipe, exemplifies this trend. Upon completion, this project is poised to become the most extensive geothermal urban heating system outside Iceland, showcasing Hungary's commitment to large-scale geothermal deployment. Furthermore, the Hungarian government's strategic vision, outlined in October 2022, to support the upscale of domestic geothermal energy underscores a long-term commitment to this sector, projecting a significant reduction in natural gas imports. This proactive policy environment, coupled with escalating energy prices and a desire for energy security, creates a fertile ground for sustained industry evolution and substantial market expansion. The adoption metrics for geothermal energy are projected to rise exponentially, with increasing penetration in both the power generation and district heat utilization segments.

Leading Regions, Countries, or Segments in Hungary Geothermal Energy Market

The District Heat Utilization segment is poised to dominate the Hungary Geothermal Energy Market, driven by a compelling combination of strategic government support, significant urban population centers, and a direct response to the nation's energy security concerns. While Power Generation holds considerable long-term potential, the immediate and projected impact of district heating infrastructure development positions it as the leading segment in the coming years. This dominance is underpinned by several key drivers.

Key Drivers for District Heat Utilization Dominance:

- Government Mandates and Incentives: The Hungarian government's explicit plans to support the upscale of domestic geothermal energy, particularly focusing on replacing natural gas consumption, directly favors district heating applications. These initiatives are designed to decarbonize municipal heating systems, a segment heavily reliant on imported natural gas. The target of replacing 1-1.5 billion cubic meters (bcm) of natural gas annually highlights the immense scale of potential substitution through geothermal district heating.

- Urbanization and Population Density: Hungary's major cities and towns represent ideal candidates for extensive geothermal district heating networks. High population density translates to concentrated heating demand, making the investment in a centralized geothermal system more economically viable and efficient compared to individual heating solutions. The Szeged project, with its 250 kilometers of distribution pipe network, exemplifies the scale of infrastructure required and its potential impact in densely populated areas.

- Cost-Effectiveness and Energy Security: Geothermal district heating offers a stable, predictable, and often more cost-effective heating solution over the long term, especially when compared to the volatile prices of fossil fuels. By leveraging indigenous geothermal resources, municipalities can achieve greater energy independence and insulate their citizens from international energy market fluctuations. This is a critical factor given the current geopolitical landscape and Hungary's historical reliance on external energy sources.

- Environmental Benefits: The shift to geothermal district heating provides substantial environmental benefits, including significant reductions in greenhouse gas emissions and improved local air quality. This aligns with Hungary's broader environmental commitments and the growing public demand for sustainable energy solutions.

The dominance of the District Heat Utilization segment is further solidified by the nature of geothermal resources available in Hungary, which are often well-suited for direct heat applications at moderate temperatures. While high-temperature resources are ideal for Power Generation, the widespread availability of moderate-temperature geothermal fluids makes district heating an accessible and rapidly deployable solution. The investment trends clearly indicate a leaning towards developing these heating networks, with ongoing feasibility studies and planned construction projects across various municipalities. Regulatory support is tailored to encourage such projects, often through subsidies, grants, and favorable permitting processes.

Conversely, while Power Generation from geothermal sources is a significant part of the long-term energy strategy, its development timeline often involves higher upfront capital investment, more complex technological requirements (especially for higher temperature resources or enhanced geothermal systems), and a longer payback period. Therefore, while its contribution to the overall energy mix will undoubtedly grow, District Heat Utilization is expected to be the primary driver of geothermal energy deployment and market share in the foreseeable future, establishing its leading position within the Hungarian geothermal landscape.

Hungary Geothermal Energy Market Product Innovations

The Hungary geothermal energy market is witnessing a surge in product innovations aimed at enhancing efficiency and expanding application scopes. Advancements in downhole drilling technology, including high-temperature resistant drill bits and advanced directional drilling capabilities, are enabling access to deeper, hotter geothermal reservoirs. Innovations in binary cycle power plants are crucial for efficiently converting lower-temperature geothermal fluids into electricity, thereby broadening the applicability of geothermal energy for power generation. Furthermore, smart grid integration solutions are being developed to optimize the dispatch of geothermal power, ensuring its reliable contribution to the national grid. For district heating, advancements focus on improving heat exchanger performance, developing more durable and efficient piping materials for distribution networks, and implementing intelligent control systems that optimize heat delivery and minimize energy loss. These innovations collectively contribute to a more cost-effective, reliable, and environmentally friendly geothermal energy ecosystem in Hungary, offering unique selling propositions such as reduced operational costs and enhanced grid stability.

Propelling Factors for Hungary Geothermal Energy Market Growth

Several key factors are propelling the growth of the Hungary geothermal energy market. Firstly, government support and policy initiatives are paramount, evidenced by the October 2022 announcement to upscale domestic geothermal energy, aiming to significantly reduce natural gas dependence. This strategic commitment provides a stable regulatory environment and financial incentives for developers. Secondly, energy security concerns and the desire for diversification from imported fossil fuels are driving strong demand for indigenous renewable energy sources like geothermal. Thirdly, technological advancements in drilling, extraction, and energy conversion are making geothermal projects more economically viable and efficient. The development of extensive geothermal heating networks, such as the one planned for Szeged, exemplifies this momentum, leveraging the inherent reliability and sustainability of geothermal resources to meet growing energy demands.

Obstacles in the Hungary Geothermal Energy Market Market

Despite its promising trajectory, the Hungary geothermal energy market faces several obstacles. High upfront capital investment for exploration and infrastructure development remains a significant barrier, requiring substantial financial commitment from investors and developers. Geological uncertainties and exploration risks associated with identifying viable geothermal reservoirs can lead to project delays and cost overruns. Regulatory complexities and permitting processes, while improving, can still present challenges for swift project deployment. Furthermore, competition from established fossil fuel-based energy sources, which may offer lower initial costs, and potential public perception issues related to drilling and seismic activity, if not adequately addressed, can hinder market penetration. Supply chain disruptions for specialized equipment and skilled labor shortages in certain technical areas also pose ongoing challenges to the market's rapid expansion.

Future Opportunities in Hungary Geothermal Energy Market

The Hungary geothermal energy market is brimming with future opportunities. The expansion of district heating networks to numerous towns and cities across the country presents a vast untapped market, driven by the government's focus on decarbonization. Advancements in enhanced geothermal systems (EGS) could unlock deeper, more challenging geothermal resources, significantly increasing Hungary's overall geothermal potential for power generation. The integration of geothermal energy with other renewable sources and energy storage solutions offers opportunities for creating more resilient and flexible energy systems. Furthermore, industrial applications of geothermal heat, such as in agriculture (greenhouses) and various manufacturing processes, represent a growing niche market. As technological maturity increases and economies of scale are achieved, the cost-competitiveness of geothermal energy will continue to improve, attracting further investment and accelerating its role in Hungary's sustainable energy future.

Major Players in the Hungary Geothermal Energy Market Ecosystem

- Porcio Co Ltd

- Enel SpA

- Mannvit

- Climeon AB

- PannErgy PLC

- KS Orka Renewables Pte Ltd

- Engie SA

Key Developments in Hungary Geothermal Energy Market Industry

- October 2022: The Hungarian government announced plans to support the upscale of domestic geothermal energy, which can reduce the country's energy dependence by replacing about 1-1.5 billion cubic meters (bcm) of natural gas annually. This strategic announcement signals a strong commitment to geothermal development and is expected to stimulate investment and project initiation.

- August 2022: A significant geothermal heating network was planned for the city of Szeged, Hungary. This ambitious project includes 27 wells, 16 heating plants, and 250 kilometers of distribution pipe network. Upon completion, it will become the most extensive geothermal urban heating system outside Iceland, demonstrating Hungary's dedication to large-scale district heating utilizing geothermal resources.

Strategic Hungary Geothermal Energy Market Market Forecast

The strategic forecast for the Hungary geothermal energy market is one of robust and sustained growth, driven by a powerful synergy of governmental commitment, pressing energy security needs, and technological innovation. The comprehensive plans announced by the Hungarian government to accelerate domestic geothermal energy adoption are expected to be a primary growth catalyst, directly targeting the replacement of a substantial volume of imported natural gas. This policy framework, combined with the inherent reliability and environmental benefits of geothermal energy, will fuel significant investment in both power generation and, more imminently, district heat utilization. The successful development of large-scale projects like the Szeged geothermal heating network will serve as a testament to the technology's viability and scalability, encouraging further replication across the country. As drilling and energy conversion technologies continue to advance, reducing costs and improving efficiency, the market’s potential will be further unlocked, solidifying geothermal energy's position as a cornerstone of Hungary’s future sustainable and independent energy landscape.

Hungary Geothermal Energy Market Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. District Heat Utilization

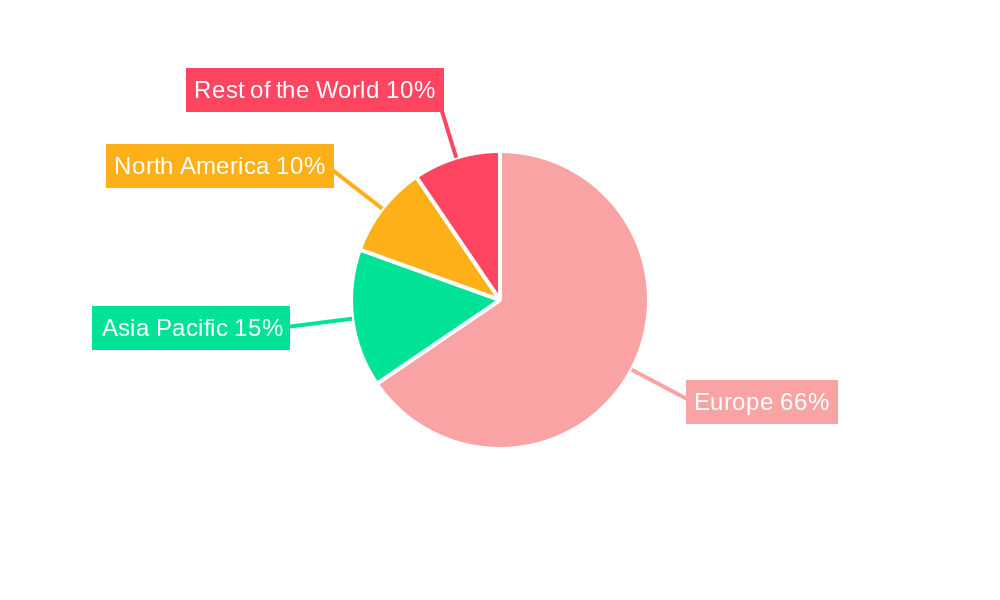

Hungary Geothermal Energy Market Segmentation By Geography

- 1. Hungary

Hungary Geothermal Energy Market Regional Market Share

Geographic Coverage of Hungary Geothermal Energy Market

Hungary Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand from Various End-user Industries

- 3.3. Market Restrains

- 3.3.1. 4.; Higher Capital and Operational Cost

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Alternative Clean Energy Sources Expected to Hinder the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Geothermal Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. District Heat Utilization

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Porcio Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enel SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mannvit

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Climeon AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PannErgy PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KS Orka Renewables Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Engie SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Porcio Co Ltd

List of Figures

- Figure 1: Hungary Geothermal Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Hungary Geothermal Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Geothermal Energy Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Hungary Geothermal Energy Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 3: Hungary Geothermal Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Hungary Geothermal Energy Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Hungary Geothermal Energy Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Hungary Geothermal Energy Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 7: Hungary Geothermal Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Hungary Geothermal Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Geothermal Energy Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Hungary Geothermal Energy Market?

Key companies in the market include Porcio Co Ltd, Enel SpA, Mannvit, Climeon AB, PannErgy PLC, KS Orka Renewables Pte Ltd, Engie SA.

3. What are the main segments of the Hungary Geothermal Energy Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.09 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand from Various End-user Industries.

6. What are the notable trends driving market growth?

Increasing Demand for Alternative Clean Energy Sources Expected to Hinder the Market.

7. Are there any restraints impacting market growth?

4.; Higher Capital and Operational Cost.

8. Can you provide examples of recent developments in the market?

In October 2022, the Hungarian government announced plans to support the upscale of domestic geothermal energy, which can reduce the country's energy dependence by replacing about 1-1.5 billion cubic meters (bcm) of natural gas annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Hungary Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence