Key Insights

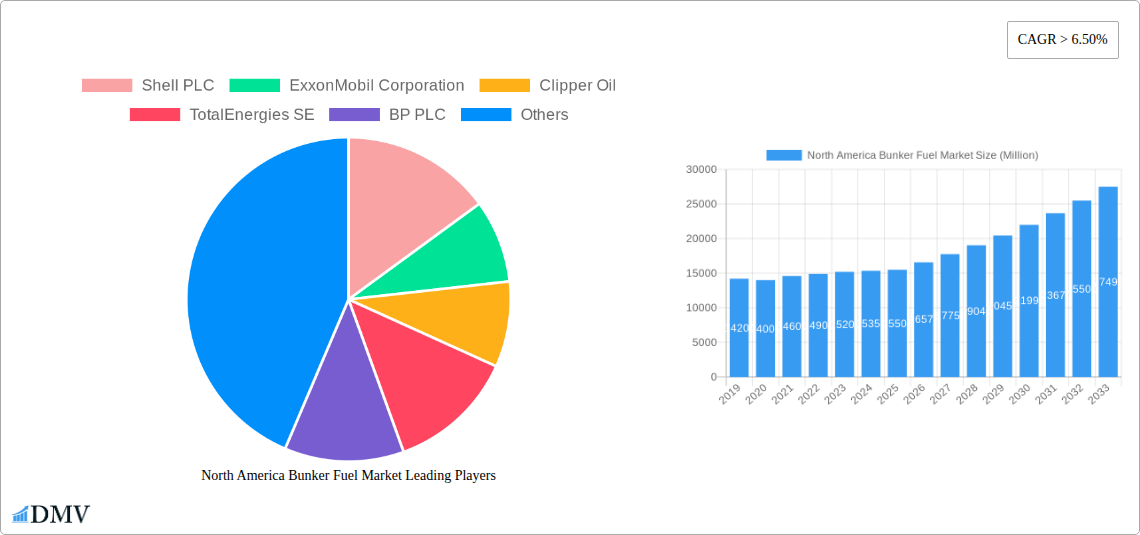

The North America Bunker Fuel Market is projected for significant expansion, with a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. Driven by increasing maritime trade and operational efficiency demands, the market is forecast to grow from an estimated $172.5 billion in 2025. Key growth factors include expanding global supply chains, the e-commerce boom necessitating more container shipping, and ongoing port infrastructure development in the United States and Canada. Increasingly stringent environmental regulations, particularly concerning sulfur emissions, are accelerating the adoption of cleaner fuel alternatives like Very Low Sulfur Fuel Oil (VLSFO) and Liquefied Natural Gas (LNG), influencing fuel consumption and market dynamics. The tanker segment, vital for energy transport, will remain a primary consumer of bunker fuel.

North America Bunker Fuel Market Market Size (In Billion)

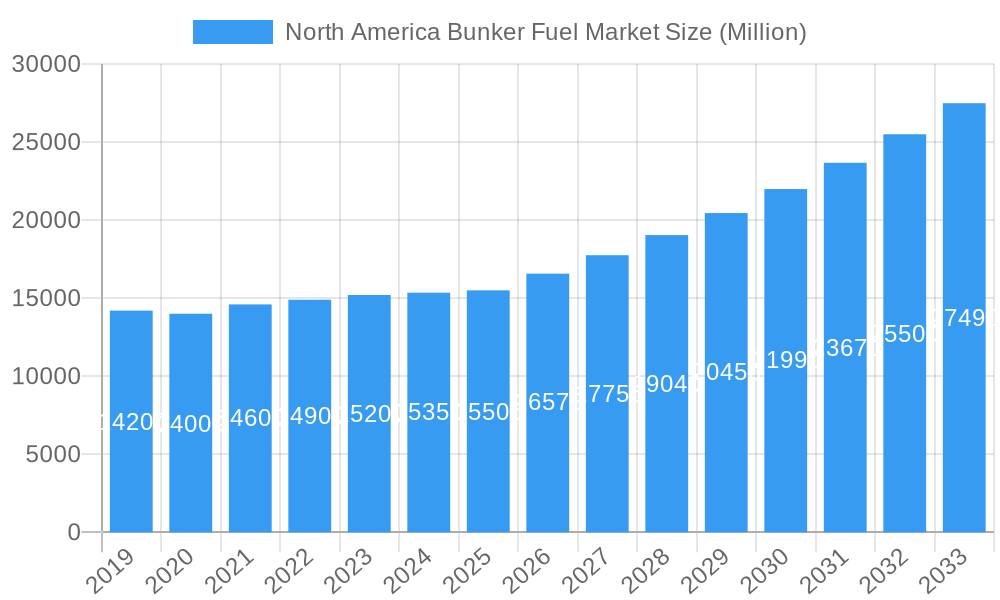

Market growth faces potential headwinds from crude oil price volatility, impacting bunker fuel costs, and the substantial capital investment required for cleaner fuel technologies. Geographically, the United States is expected to lead the North American market due to its extensive coastline and major shipping hubs. Canada and other North American regions offer developing opportunities. Major energy corporations including Shell PLC, ExxonMobil Corporation, and TotalEnergies SE dominate the competitive landscape, investing in cleaner fuel R&D and bunkering infrastructure. The industry's transition towards sustainability will significantly shape future demand and supply within the North America Bunker Fuel Market.

North America Bunker Fuel Market Company Market Share

This report offers a strategic analysis of the North America Bunker Fuel Market, providing critical insights into market dynamics, growth trajectories, and future opportunities. Covering the period from 2019 to 2033, with a detailed forecast from 2025 to 2033, this report is an essential resource for stakeholders navigating the evolving maritime fuel sector in North America. We examine market concentration, innovation, regulatory impacts, competitive strategies, and emerging technologies shaping this vital industry.

North America Bunker Fuel Market Market Composition & Trends

The North America Bunker Fuel Market is characterized by a moderate to high level of market concentration, with major players like Shell PLC, ExxonMobil Corporation, and BP PLC holding significant market shares, estimated at 15%, 12%, and 10% respectively in the base year of 2025. Innovation is being significantly driven by the increasing demand for lower sulfur fuels and alternative energy sources, spurred by stringent IMO regulations. Regulatory landscapes are constantly evolving, with a strong push towards decarbonization and emission reduction impacting fuel choices and infrastructure investments. Substitute products, such as biofuels and synthetic fuels, are gaining traction but currently represent a smaller portion of the market. End-user profiles vary from large shipping lines operating container and tanker vessels to smaller operators of general cargo and bulk carriers. Mergers and acquisitions (M&A) activities, while not at peak levels, are strategically focused on expanding supply networks and investing in new fuel technologies. For instance, a hypothetical M&A deal in 2024 between a regional distributor and a fuel technology provider was valued at approximately $50 Million, aimed at enhancing VLSFO and LNG bunkering capabilities. The market's competitive intensity is moderate, with a focus on price, availability, and environmental compliance.

North America Bunker Fuel Market Industry Evolution

The North America Bunker Fuel Market has undergone a significant transformation, driven by a confluence of regulatory mandates, technological advancements, and shifting operational demands. Historically, the market was dominated by High Sulfur Fuel Oil (HSFO), offering a cost-effective solution for vessel operators. However, the implementation of International Maritime Organization (IMO) 2020 regulations, which drastically reduced the allowable sulfur content in marine fuels, acted as a major catalyst for change. This led to a surge in demand for Very Low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO), marking a substantial shift in the fuel mix. The study period of 2019-2024 saw an average annual growth rate of approximately 4% in VLSFO and MGO consumption, while HSFO usage declined. Technological advancements have been pivotal, with ongoing research and development into alternative fuels like Liquefied Natural Gas (LNG). LNG adoption, though still nascent, has witnessed a compound annual growth rate (CAGR) of around 7% from 2021 to 2025, driven by its lower greenhouse gas emissions and potential for future regulatory compliance. Consumer demands have evolved from a primary focus on cost to a more balanced consideration of environmental impact, operational efficiency, and long-term sustainability. Shipping companies are increasingly seeking partners who can offer a diverse range of compliant fuels and reliable bunkering services across North American ports. The industry's evolution is further evidenced by the increasing investment in shore power infrastructure and the development of digital platforms for fuel procurement and logistics, aiming to streamline operations and reduce emissions. The estimated market size for bunker fuels in North America in 2025 is projected to be around $18,500 Million.

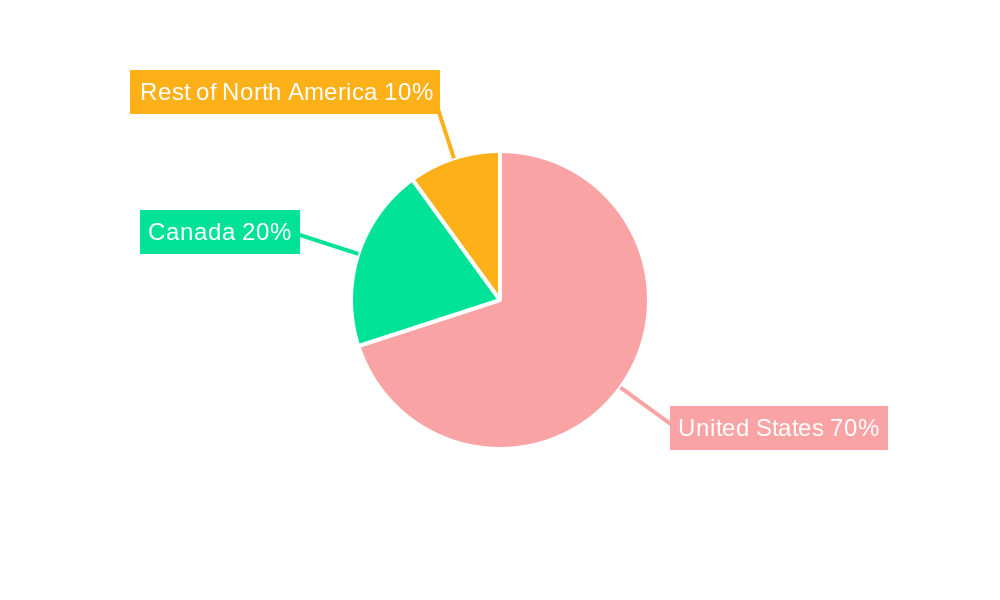

Leading Regions, Countries, or Segments in North America Bunker Fuel Market

The United States stands as the dominant region in the North America Bunker Fuel Market, commanding an estimated market share of 65% in 2025. This dominance is fueled by its extensive coastline, numerous major ports, and a high volume of maritime trade, particularly for container and tanker vessels. The country's robust economic activity and its pivotal role in global shipping lanes directly translate to substantial bunker fuel demand.

- Key Drivers for US Dominance:

- Extensive Port Infrastructure: Major hubs like Los Angeles/Long Beach, Houston, and New York/New Jersey handle millions of TEUs and vast quantities of crude oil and refined products, necessitating significant bunker fuel supply.

- Regulatory Environment: While adhering to global regulations like IMO 2020, the US has also seen state-level initiatives aimed at further emission reductions, influencing fuel choices.

- Fleet Size and Activity: A large number of container ships, tankers, and bulk carriers operate along the US coast, contributing to sustained demand for all fuel types, with VLSFO and MGO showing increasing preference.

- Investment in LNG Infrastructure: Significant investments are being made in LNG bunkering facilities, particularly in strategic locations, supporting the growth of LNG as a marine fuel.

Canada follows with an estimated market share of 20% in 2025, driven by its significant resource exports and the increasing importance of Arctic shipping routes. Key Canadian ports like Vancouver and Montreal are vital for trade, supporting demand for bunker fuels across various vessel types.

- Dominance Factors in Canada:

- Resource Exports: The export of oil, gas, and minerals necessitates the use of bulk carriers and tankers, driving demand for bunker fuels.

- Growing Arctic Shipping: As climate change opens new shipping routes, Canada's Arctic coastline is becoming more strategically important, potentially boosting demand for specialized fuels and bunkering services.

- Environmental Commitments: Canada is actively pursuing environmental targets, which indirectly influences the demand for cleaner marine fuels.

The "Rest of North America," which includes Mexico and smaller island nations in the Caribbean with significant maritime activity, accounts for the remaining 15% of the market share. Mexico's burgeoning trade, particularly through its Pacific and Gulf coasts, is a key contributor to this segment.

- Factors for "Rest of North America":

- Strategic Trade Routes: Mexico's location is crucial for trade between North and South America and with Asia.

- Cruise Industry: The Caribbean region's vibrant cruise industry contributes significantly to bunker fuel consumption, with cruise ships being major consumers of MGO and VLSFO.

In terms of Fuel Type, VLSFO is projected to be the leading segment in 2025, holding an estimated 45% market share, followed by MGO at 30%. HSFO is expected to decline further, representing around 15%, while LNG is anticipated to grow to 8% and other fuel types (e.g., biofuels) at 2%. For Vessel Type, Tankers are expected to be the largest consumers of bunker fuel, accounting for approximately 35% of the market in 2025, followed closely by Containers at 30%, Bulk Carriers at 20%, and General Cargo at 10%.

North America Bunker Fuel Market Product Innovations

Product innovation in the North America Bunker Fuel Market is increasingly focused on sustainability and compliance. The development of advanced VLSFO blends with improved combustion properties and reduced particulate matter emissions is a key area of focus for major suppliers like Shell PLC and ExxonMobil Corporation. Furthermore, significant research is underway to enhance the availability and infrastructure for Liquefied Natural Gas (LNG) as a viable alternative, with companies investing in liquefaction plants and bunkering facilities. The performance metrics for these innovations include reduced sulfur oxide (SOx) and nitrogen oxide (NOx) emissions, with VLSFO offering compliance with IMO 2020 standards, and LNG providing near-zero SOx and up to 85% reduction in NOx.

Propelling Factors for North America Bunker Fuel Market Growth

The North America Bunker Fuel Market is experiencing robust growth driven by several key factors. Firstly, stringent global environmental regulations, particularly the International Maritime Organization's (IMO) 2020 sulphur cap and ongoing discussions around greenhouse gas emissions, are compelling shipowners to adopt cleaner fuels like VLSFO and explore LNG. Secondly, the increasing volume of global trade and the expansion of shipping routes necessitate a consistent and reliable supply of bunker fuels across North American ports. Thirdly, technological advancements in fuel processing and engine efficiency are making alternative fuels more economically viable and operationally practical. For example, the development of more efficient LNG engines for various vessel types is a significant growth catalyst. Finally, strategic investments by major oil and gas companies, such as ExxonMobil Corporation and Chevron Corporation, in expanding their bunkering infrastructure and exploring new fuel solutions, are further propelling market expansion.

Obstacles in the North America Bunker Fuel Market Market

Despite the positive growth outlook, the North America Bunker Fuel Market faces several significant obstacles. The high cost of compliance fuels, such as VLSFO and LNG, remains a major deterrent for some operators, especially in a competitive shipping environment where cost optimization is paramount. Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can lead to price volatility and availability issues, impacting the reliability of fuel deliveries. Regulatory uncertainty, particularly regarding future emissions targets and the long-term viability of certain fuel types, can also create hesitation in long-term investment decisions for both fuel suppliers and end-users. Furthermore, the limited availability of LNG bunkering infrastructure in certain regions of North America, though improving, presents a practical barrier to wider adoption.

Future Opportunities in North America Bunker Fuel Market

The North America Bunker Fuel Market is ripe with future opportunities, primarily driven by the ongoing global push for decarbonization. The increasing adoption of Liquefied Natural Gas (LNG) presents a substantial opportunity for infrastructure development and fuel supply, particularly as new LNG-powered vessels enter the market. The exploration and potential commercialization of alternative marine fuels like methanol, ammonia, and biofuels also offer significant growth avenues. Furthermore, advancements in digital technologies for fuel management, route optimization, and transparent pricing platforms can create new service-based revenue streams. The development of carbon capture technologies for marine applications could also unlock new market segments and sustainability solutions.

Major Players in the North America Bunker Fuel Market Ecosystem

- Shell PLC

- ExxonMobil Corporation

- Clipper Oil

- TotalEnergies SE

- BP PLC

- Chevron Corporation

- Repsol SA

Key Developments in North America Bunker Fuel Market Industry

- September 2021: Chevron USA Inc., a subsidiary of Chevron Corporation, and Caterpillar Inc. announced a collaborative agreement to develop hydrogen demonstration projects in transportation and stationary power applications, including prime power. The goal of the collaboration is to confirm the feasibility and performance of hydrogen for use as a commercially viable alternative to traditional fuels for line-haul rail and marine vessels. The collaboration also seeks to demonstrate hydrogen's use in prime power.

- 2023: Numerous ports along the US East Coast announced significant investments in developing LNG bunkering facilities to support the growing number of LNG-powered vessels.

- 2024 (Estimated): Expansion of VLSFO availability and competitive pricing strategies by major suppliers to capture market share in key bunkering hubs.

- 2025 (Projected): Increased interest and pilot projects for methanol as a marine fuel due to its potential as a lower-emission alternative.

Strategic North America Bunker Fuel Market Market Forecast

The North America Bunker Fuel Market is poised for sustained growth, driven by an unwavering commitment to environmental sustainability and evolving global trade dynamics. The increasing adoption of VLSFO and MGO will continue to dominate the market in the near to medium term, supported by ongoing regulatory pressures. The strategic expansion of LNG bunkering infrastructure will pave the way for its significant penetration as a cleaner fuel alternative, especially for new vessel builds. Emerging opportunities in biofuels and other advanced low-carbon fuels, coupled with technological advancements in their production and utilization, will further shape the market's trajectory. Continued investment by major players in diversifying their fuel portfolios and enhancing supply chain resilience will be crucial for capitalizing on future demand and solidifying market positions. The forecast period (2025-2033) is expected to witness a CAGR of approximately 3.5%, highlighting the market's resilience and potential for expansion.

North America Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Bunker Fuel Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Bunker Fuel Market Regional Market Share

Geographic Coverage of North America Bunker Fuel Market

North America Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels

- 3.3. Market Restrains

- 3.3.1. 4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy

- 3.4. Market Trends

- 3.4.1. Very Low Sulfur Fuel Oil (VLSFO) Expected to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bunker Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. United States North America Bunker Fuel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. High Sulfur Fuel Oil (HSFO)

- 6.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 6.1.3. Marine Gas Oil (MGO)

- 6.1.4. Liquefied Natural Gas (LNG)

- 6.1.5. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Containers

- 6.2.2. Tankers

- 6.2.3. General Cargo

- 6.2.4. Bulk Carrier

- 6.2.5. Other Vessel Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Canada North America Bunker Fuel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. High Sulfur Fuel Oil (HSFO)

- 7.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 7.1.3. Marine Gas Oil (MGO)

- 7.1.4. Liquefied Natural Gas (LNG)

- 7.1.5. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Containers

- 7.2.2. Tankers

- 7.2.3. General Cargo

- 7.2.4. Bulk Carrier

- 7.2.5. Other Vessel Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Rest of North America North America Bunker Fuel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. High Sulfur Fuel Oil (HSFO)

- 8.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 8.1.3. Marine Gas Oil (MGO)

- 8.1.4. Liquefied Natural Gas (LNG)

- 8.1.5. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Containers

- 8.2.2. Tankers

- 8.2.3. General Cargo

- 8.2.4. Bulk Carrier

- 8.2.5. Other Vessel Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Shell PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ExxonMobil Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Clipper Oil

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 TotalEnergies SE

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 BP PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Chevron Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Repsol SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Shell PLC

List of Figures

- Figure 1: North America Bunker Fuel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Bunker Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: North America Bunker Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 3: North America Bunker Fuel Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 4: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 5: North America Bunker Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 7: North America Bunker Fuel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Bunker Fuel Market Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 9: North America Bunker Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 11: North America Bunker Fuel Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 12: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 13: North America Bunker Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 15: North America Bunker Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Bunker Fuel Market Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 17: North America Bunker Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 18: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 19: North America Bunker Fuel Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 20: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 21: North America Bunker Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 23: North America Bunker Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Bunker Fuel Market Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 25: North America Bunker Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 27: North America Bunker Fuel Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 28: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 29: North America Bunker Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 31: North America Bunker Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Bunker Fuel Market Volume metric tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bunker Fuel Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the North America Bunker Fuel Market?

Key companies in the market include Shell PLC, ExxonMobil Corporation, Clipper Oil, TotalEnergies SE, BP PLC, Chevron Corporation, Repsol SA.

3. What are the main segments of the North America Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels.

6. What are the notable trends driving market growth?

Very Low Sulfur Fuel Oil (VLSFO) Expected to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy.

8. Can you provide examples of recent developments in the market?

In September 2021, Chevron USA Inc., a subsidiary of Chevron Corporation, and Caterpillar Inc. announced a collaborative agreement to develop hydrogen demonstration projects in transportation and stationary power applications, including prime power. The goal of the collaboration is to confirm the feasibility and performance of hydrogen for use as a commercially viable alternative to traditional fuels for line-haul rail and marine vessels. The collaboration also seeks to demonstrate hydrogen's use in prime power.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the North America Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence