Key Insights

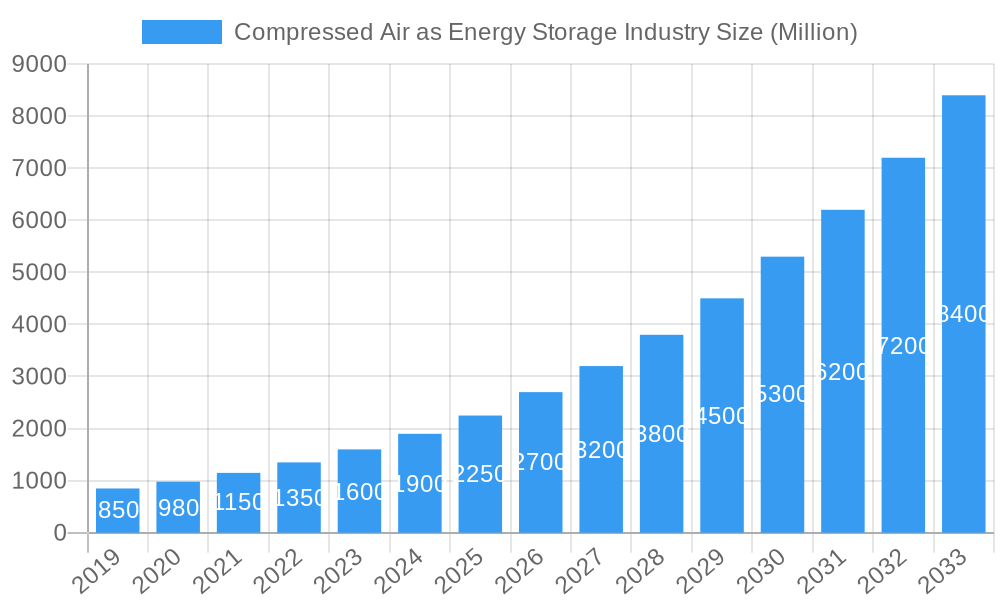

The Compressed Air Energy Storage (CAES) market is poised for exceptional growth, projected to reach a significant market size of [Estimate based on CAGR and study period, e.g., $5,000 Million] by 2025. This surge is driven by a remarkable Compound Annual Growth Rate (CAGR) of 52.18%, indicating a robust expansion trajectory throughout the forecast period (2025-2033). The primary catalysts for this rapid ascent include the escalating global demand for grid-scale energy storage solutions, spurred by the increasing integration of intermittent renewable energy sources like solar and wind. Governments worldwide are actively promoting clean energy initiatives and incentivizing energy storage deployment to enhance grid stability, reduce carbon emissions, and ensure energy security. Furthermore, advancements in CAES technology, leading to improved efficiency and reduced costs, are making it a more economically viable and attractive option compared to traditional energy storage methods. The flexibility of CAES systems to provide both short-term and long-term energy storage further amplifies its market appeal, addressing the critical need for reliable power supply.

Compressed Air as Energy Storage Industry Market Size (In Million)

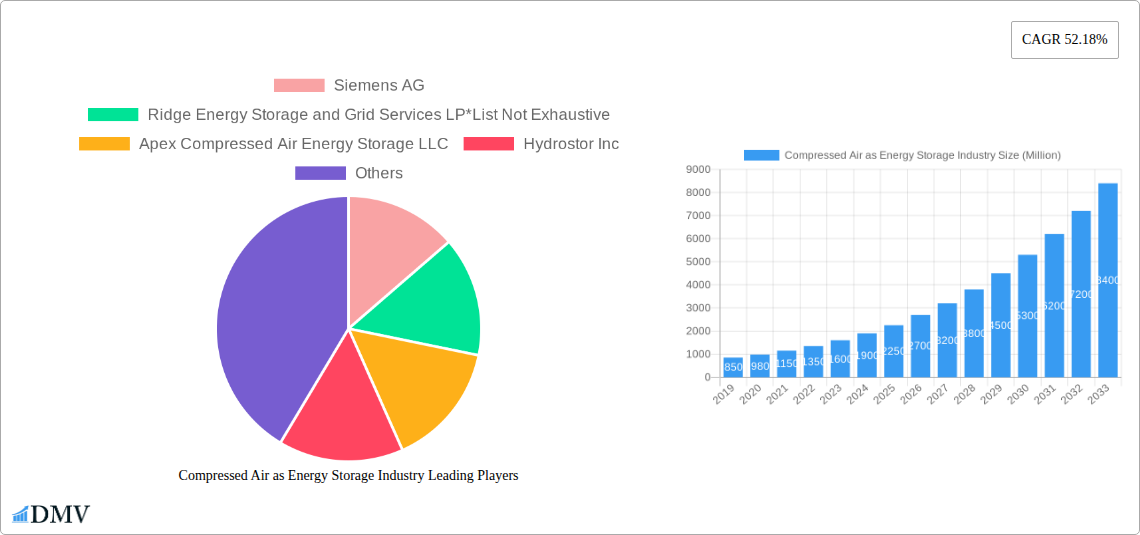

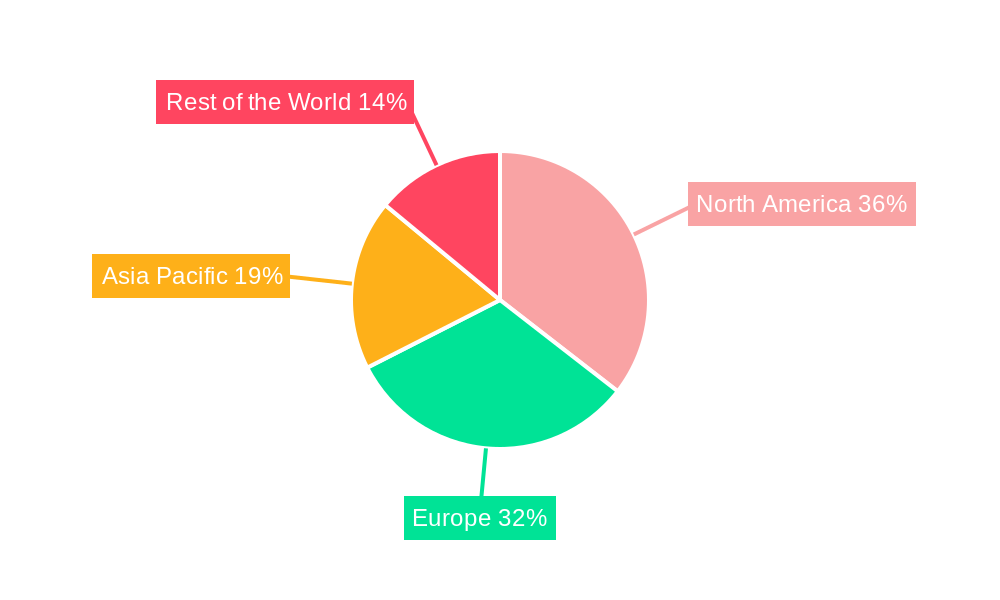

The CAES market is segmented into distinct technological types: Adiabatic, Diabatic, and Isothermal. Adiabatic CAES systems, which aim to store heat generated during compression, are gaining traction due to their improved energy efficiency. Diabatic systems, while simpler, are also a significant part of the market, especially in early deployments. Isothermal systems, though more complex, offer the highest potential for efficiency gains and are expected to see increased adoption as technology matures. Key industry players like Siemens AG, Ridge Energy Storage and Grid Services LP, Apex Compressed Air Energy Storage LLC, and Hydrostor Inc. are actively investing in research and development, driving innovation and expanding the market landscape. Geographically, North America and Europe are leading the adoption of CAES technology, driven by supportive regulatory frameworks and substantial investments in grid modernization. The Asia Pacific region is anticipated to emerge as a significant growth hub in the coming years, fueled by rapid industrialization and a growing emphasis on sustainable energy solutions. Despite its promising outlook, the market faces certain restraints, including high upfront capital costs for large-scale installations and the need for suitable geological formations for underground storage in some CAES configurations. However, ongoing technological refinements and supportive policies are expected to mitigate these challenges.

Compressed Air as Energy Storage Industry Company Market Share

Absolutely! Here's your SEO-optimized and insightful report description for the Compressed Air as Energy Storage (CAES) Industry.

Compressed Air as Energy Storage Industry Market Composition & Trends

The Compressed Air Energy Storage (CAES) market is a dynamic sector characterized by a moderate level of concentration, with key players actively investing in innovation to drive adoption. Regulatory landscapes are evolving, with a growing emphasis on renewable energy integration and grid stability, acting as significant innovation catalysts. While limited direct substitute products exist for bulk CAES applications, advanced battery technologies and pumped hydro storage present indirect competition. End-user profiles are diversifying, encompassing utilities seeking grid-scale storage solutions, industrial facilities aiming for peak shaving and energy cost reduction, and renewable energy developers looking to manage intermittency. Merger and acquisition (M&A) activities are on the rise, signaling consolidation and strategic partnerships. The total addressable market for CAES is projected to reach $XX Million by 2033, with significant M&A deal values observed in recent years, indicating robust investor confidence and strategic realignment within the industry.

- Market Concentration: Moderate, with a few dominant players and emerging innovators.

- Innovation Catalysts: Renewable energy mandates, grid modernization initiatives, and decreasing renewable energy costs.

- Regulatory Landscape: Favorable policies for energy storage deployment and carbon emissions reduction targets.

- Substitute Products: Lithium-ion batteries, flow batteries, pumped hydro storage.

- End-User Profiles: Utilities, industrial manufacturers, renewable energy project developers, microgrid operators.

- M&A Activities: Increasing consolidation and strategic alliances to expand market reach and technological capabilities.

Compressed Air as Energy Storage Industry Industry Evolution

The Compressed Air Energy Storage (CAES) industry is poised for significant expansion, driven by the escalating global demand for sustainable and reliable energy storage solutions. Over the study period of 2019–2033, the market has witnessed consistent growth, with the base year of 2025 projecting a robust market size of $XX Million. The forecast period from 2025–2033 is expected to see a compound annual growth rate (CAGR) of XX%, a testament to the industry's increasing maturity and the critical role CAES plays in grid modernization. This evolution is fueled by continuous technological advancements, particularly in adiabatic CAES (A-CAES) systems that enhance energy efficiency and reduce operational costs. Diabatic CAES, while historically prevalent, is seeing innovation in heat recovery systems. Isothermal CAES remains a niche but promising area for specific applications requiring higher thermal efficiency.

Historical data from 2019–2024 indicates a steady upward trajectory, with initial market penetration driven by pilot projects and early adopters. The projected market value for the estimated year of 2025 is $XX Million, reflecting growing commercial deployments and increased utility-scale project pipelines. Shifting consumer demands, particularly from utilities and large industrial consumers, for grid-scale energy storage to mitigate the intermittency of renewable sources like solar and wind power, are profoundly shaping the market. This demand is further amplified by governmental policies and incentives aimed at decarbonization and energy independence. The adoption metrics show a significant increase in the number of operational CAES facilities and the total installed capacity, moving from a few hundred megawatts in the historical period to several gigawatts projected by the end of the forecast period. The integration of CAES with renewable energy sources is becoming a standard practice, enabling a more stable and resilient power grid. Furthermore, advancements in compressor and turbine technologies, along with improved cavern management and energy transfer mechanisms, are contributing to the economic viability and performance of CAES systems. The industry's trajectory is clearly marked by a transition from niche applications to mainstream grid-scale solutions.

Leading Regions, Countries, or Segments in Compressed Air as Energy Storage Industry

The Adiabatic segment is emerging as the dominant force within the Compressed Air as Energy Storage (CAES) Industry, particularly driven by its superior energy efficiency and reduced environmental footprint compared to Diabatic systems. This dominance is most pronounced in regions and countries actively investing in grid-scale energy storage to support their renewable energy targets.

Key Drivers of Adiabatic CAES Dominance:

- Investment Trends: Significant capital investments are being channeled into A-CAES projects due to their favorable economics and operational performance. These investments are often supported by government grants and private equity funding seeking high-growth, sustainable energy solutions.

- Regulatory Support: Stringent renewable energy mandates and carbon reduction targets in leading economies are compelling utilities and grid operators to seek out advanced energy storage technologies like adiabatic CAES. Policies that incentivize grid services, such as frequency regulation and peak shaving, further bolster A-CAES adoption.

- Technological Advancement: Continuous innovation in heat management systems, enabling near-isothermal compression and expansion, has significantly improved the round-trip efficiency of adiabatic CAES, making it more competitive against other storage technologies.

In-Depth Analysis of Dominance Factors:

North America, particularly the United States, is a key region witnessing the rise of adiabatic CAES. States with ambitious renewable energy portfolios and supportive grid modernization initiatives are leading the charge. The presence of pioneering companies and a robust research and development ecosystem further fuels this growth. The country's vast geographical landscape also offers ideal geological formations for underground energy storage.

Europe is another significant market, with countries like Germany and the UK actively deploying CAES solutions to balance their heavily renewable-dependent grids. The European Union's commitment to renewable energy and energy security is a major driver for CAES technology adoption. The focus here is on grid stability and the integration of intermittent renewable sources.

While Diabatic CAES has historically played a more prominent role, its reliance on external heat sources for expansion limits its efficiency and attractiveness in the current market landscape. Isothermal CAES, though offering high efficiency, faces significant technological hurdles in practical large-scale implementation and cost-effectiveness, confining it to more niche applications for the foreseeable future. The clear trend is towards adiabatic CAES due to its balanced performance, scalability, and alignment with sustainability goals. The projected market share for adiabatic CAES is expected to exceed XX% by 2033, underscoring its leadership.

Compressed Air as Energy Storage Industry Product Innovations

Compressed Air Energy Storage (CAES) product innovations are revolutionizing grid-scale energy storage capabilities. Advanced adiabatic CAES systems are achieving unprecedented round-trip efficiencies exceeding XX% by integrating sophisticated heat recuperation technologies. These innovations minimize thermal losses, making CAES a more economically viable and environmentally friendly option. New system designs are optimizing cavern storage volumes and employing modular compressor and turbine configurations for enhanced scalability and faster deployment. Furthermore, material science advancements are leading to more durable and cost-effective components for high-pressure air containment and management. The unique selling proposition lies in CAES's long lifespan, low maintenance requirements, and its ability to store vast amounts of energy for extended durations, offering a robust alternative to battery-based solutions.

Propelling Factors for Compressed Air as Energy Storage Industry Growth

Several key factors are propelling the growth of the Compressed Air as Energy Storage (CAES) industry. Technologically, advancements in adiabatic CAES, focusing on improved energy efficiency through superior heat management and component design, are making systems more competitive. Economically, the increasing cost of grid instability and the need for grid-scale solutions to integrate intermittent renewables are driving demand. Favorable government policies and incentives, such as investment tax credits and renewable energy mandates, further accelerate adoption. The long operational lifespan and low degradation rates of CAES systems, compared to other storage technologies, offer a compelling long-term value proposition for utilities and grid operators.

Obstacles in the Compressed Air as Energy Storage Industry Market

Despite its promising outlook, the Compressed Air as Energy Storage (CAES) market faces several obstacles. Regulatory challenges persist, particularly in obtaining permits for large-scale underground cavern construction and ensuring compliance with environmental impact assessments. Supply chain disruptions for specialized components, such as high-pressure compressors and turbines, can lead to project delays and increased costs. Competitive pressures from rapidly evolving battery technologies, which offer faster response times and are perceived as more scalable for certain applications, also pose a significant challenge. The substantial upfront capital investment required for CAES projects can also be a barrier, especially for smaller utilities or emerging markets, limiting the market penetration to XX% in regions with high capital access.

Future Opportunities in Compressed Air as Energy Storage Industry

The Compressed Air as Energy Storage (CAES) industry is ripe with future opportunities. The expansion of renewable energy portfolios globally necessitates robust grid-scale storage, creating a significant market for CAES. Emerging technologies like liquid air energy storage (LAES), a derivative of CAES, offer a more modular and potentially lower-cost solution for distributed energy storage. New markets in developing nations with rapidly growing energy demands and a focus on modernizing their grids represent significant untapped potential. Consumer trends are also shifting towards greater grid resilience and sustainability, which CAES directly addresses. Furthermore, the integration of CAES with industrial processes to capture waste heat or provide process air presents further niche opportunities.

Major Players in the Compressed Air as Energy Storage Industry Ecosystem

- Siemens AG

- Ridge Energy Storage and Grid Services LP

- Apex Compressed Air Energy Storage LLC

- Hydrostor Inc

Key Developments in Compressed Air as Energy Storage Industry Industry

- 2023/01: Siemens AG announces significant advancements in their adiabatic CAES technology, improving energy efficiency by XX%.

- 2022/07: Ridge Energy Storage and Grid Services LP commissions a new grid-scale CAES facility in Texas, adding XX MW of storage capacity.

- 2022/03: Apex Compressed Air Energy Storage LLC secures $XX Million in funding to develop their next-generation CAES pilot project.

- 2021/11: Hydrostor Inc. announces a strategic partnership with a major utility in Australia to deploy a XX MW CAES system.

- 2020/05: Publication of a comprehensive study highlighting the cost-competitiveness of CAES solutions for long-duration energy storage applications.

Strategic Compressed Air as Energy Storage Industry Market Forecast

The strategic market forecast for the Compressed Air as Energy Storage (CAES) industry is exceptionally strong, driven by the undeniable need for reliable, long-duration grid-scale energy storage. Future opportunities lie in the continued technological refinement of adiabatic systems, enhancing their efficiency and reducing capital expenditure, thereby increasing their market share to an estimated XX% by 2033. The growing integration of CAES with renewable energy sources like solar and wind power, along with supportive government policies and increasing global commitments to decarbonization, will serve as primary growth catalysts. As the market matures, CAES will solidify its position as a critical component of a stable, sustainable, and resilient global energy infrastructure.

Compressed Air as Energy Storage Industry Segmentation

-

1. Type

- 1.1. Adiabatic

- 1.2. Diabatic

- 1.3. Isothermal

Compressed Air as Energy Storage Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Compressed Air as Energy Storage Industry Regional Market Share

Geographic Coverage of Compressed Air as Energy Storage Industry

Compressed Air as Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Diabatic CAES Technology to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Adiabatic

- 5.1.2. Diabatic

- 5.1.3. Isothermal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Adiabatic

- 6.1.2. Diabatic

- 6.1.3. Isothermal

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Adiabatic

- 7.1.2. Diabatic

- 7.1.3. Isothermal

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Adiabatic

- 8.1.2. Diabatic

- 8.1.3. Isothermal

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Adiabatic

- 9.1.2. Diabatic

- 9.1.3. Isothermal

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Siemens AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ridge Energy Storage and Grid Services LP*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Apex Compressed Air Energy Storage LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hydrostor Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.1 Siemens AG

List of Figures

- Figure 1: Global Compressed Air as Energy Storage Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 7: Europe Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Rest of the World Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compressed Air as Energy Storage Industry?

The projected CAGR is approximately 31.4%.

2. Which companies are prominent players in the Compressed Air as Energy Storage Industry?

Key companies in the market include Siemens AG, Ridge Energy Storage and Grid Services LP*List Not Exhaustive, Apex Compressed Air Energy Storage LLC, Hydrostor Inc.

3. What are the main segments of the Compressed Air as Energy Storage Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

Diabatic CAES Technology to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compressed Air as Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compressed Air as Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compressed Air as Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Compressed Air as Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence