Key Insights

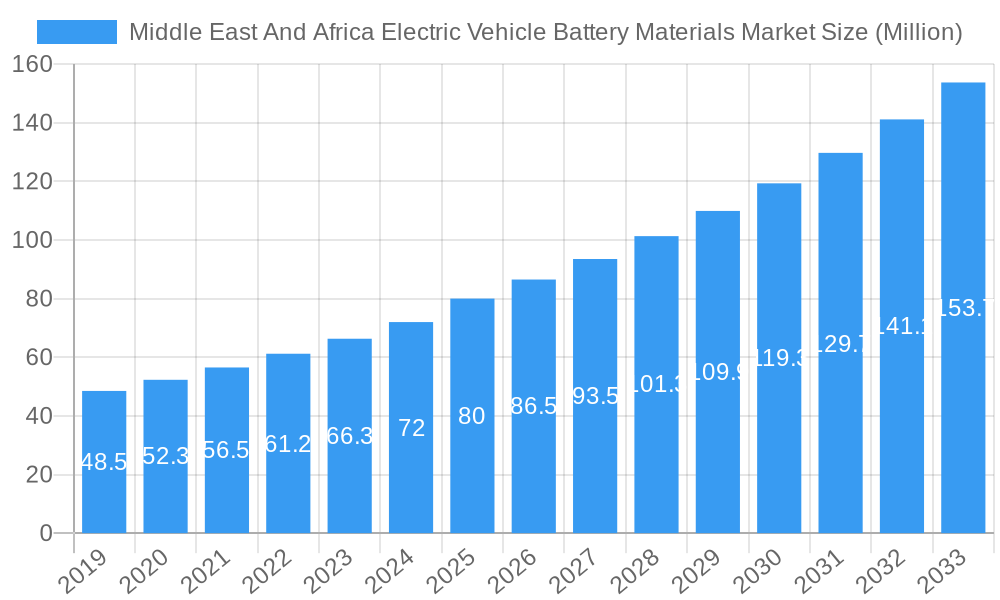

The Middle East and Africa (MEA) electric vehicle (EV) battery materials market is poised for significant expansion, projected to grow from an estimated USD 80 million in 2025 to over USD 170 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.68%. This impressive growth trajectory is propelled by several key drivers, most notably the burgeoning adoption of electric vehicles across the region, spurred by government initiatives, increasing environmental consciousness, and the declining cost of EV batteries. Countries like Saudi Arabia, the UAE, Egypt, and South Africa are at the forefront of this transformation, investing heavily in EV infrastructure and incentives to decarbonize their transportation sectors. The demand for high-performance and sustainable battery materials is thus escalating, with lithium-ion batteries dominating the market due to their superior energy density and longer lifespan, while lead-acid batteries continue to hold a niche in specific applications.

Middle East And Africa Electric Vehicle Battery Materials Market Market Size (In Million)

The market's growth is further fueled by advancements in battery technology and increasing investments in local manufacturing capabilities for critical battery components. The cathode and anode segments are expected to witness the highest demand, as manufacturers strive to enhance battery performance, charging speeds, and overall efficiency. While the MEA region presents a fertile ground for EV battery materials, certain restraints such as the initial high cost of EVs, limited charging infrastructure in some sub-regions, and reliance on imported raw materials for certain battery chemistries, need to be addressed. However, with ongoing research and development, strategic partnerships, and a growing focus on localized supply chains, the MEA EV battery materials market is on a path to becoming a vital contributor to the global clean energy transition. The competitive landscape features prominent global players alongside emerging regional manufacturers, all vying for a share of this rapidly expanding market.

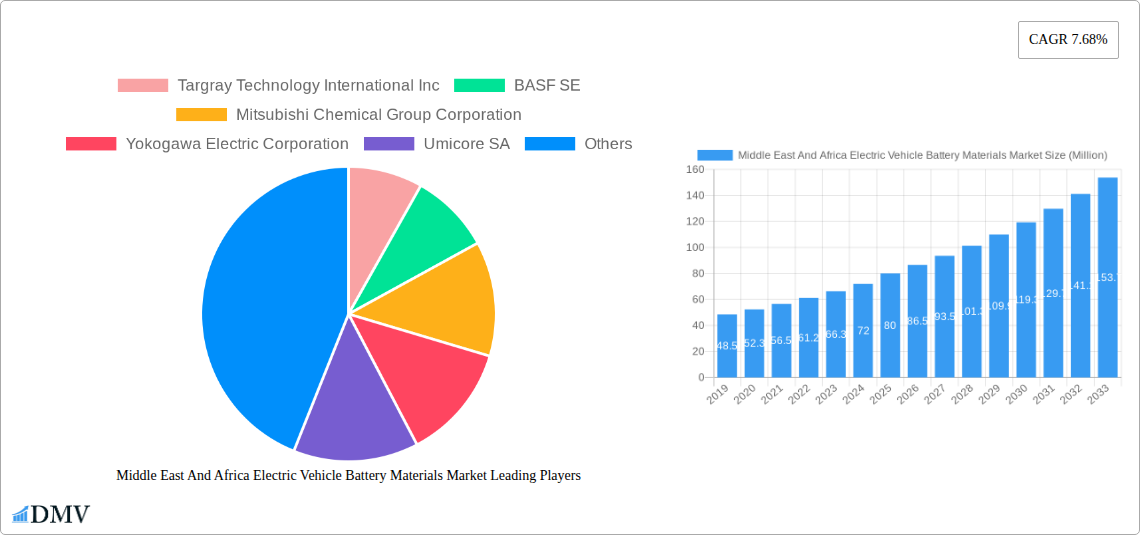

Middle East And Africa Electric Vehicle Battery Materials Market Company Market Share

Gain a strategic advantage in the rapidly evolving Middle East and Africa (MEA) electric vehicle battery materials market. This in-depth report provides an unparalleled analysis of market dynamics, key trends, and growth opportunities from 2019 to 2033, with a robust base year of 2025 and an extensive forecast period of 2025–2033. Delve into the critical components driving the MEA EV battery supply chain, including lithium-ion battery materials and lead-acid battery materials. This report is an indispensable resource for stakeholders seeking to understand the burgeoning electric vehicle market in the Middle East and the African EV battery sector.

Middle East And Africa Electric Vehicle Battery Materials Market Market Composition & Trends

The MEA electric vehicle battery materials market is characterized by a dynamic competitive landscape with significant opportunities for growth. Market concentration is influenced by the emerging infrastructure and increasing adoption of electric vehicles across the region. Innovation catalysts include government incentives for EV adoption and battery manufacturing, alongside the demand for sustainable energy solutions. Regulatory frameworks are gradually evolving to support the transition to electric mobility, impacting the development and deployment of battery technologies. While lithium-ion batteries are gaining prominence, lead-acid batteries continue to hold a significant share, particularly in certain applications. End-user profiles range from individual consumers embracing EVs to commercial fleets and utility-scale energy storage providers. Mergers and acquisitions (M&A) activities are expected to increase as companies seek to consolidate their market position and expand their geographical reach. The market share distribution will likely see shifts as new players enter and existing ones scale up operations. M&A deal values are projected to rise with substantial investments in gigafactories and material processing.

- Market Concentration: Fragmented with emerging consolidation opportunities.

- Innovation Catalysts: Government support, technological advancements, rising EV adoption.

- Regulatory Landscapes: Evolving, with increasing focus on localization and sustainability.

- Substitute Products: Limited viable substitutes for high-performance EV batteries currently.

- End-User Profiles: Individual consumers, fleet operators, energy storage providers.

- M&A Activities: Increasing, driven by strategic expansion and capacity building.

Middle East And Africa Electric Vehicle Battery Materials Market Industry Evolution

The Middle East and Africa electric vehicle battery materials market has witnessed a remarkable transformation driven by a confluence of factors, including aggressive government initiatives, a growing awareness of environmental sustainability, and a burgeoning demand for cleaner transportation solutions. During the historical period (2019–2024), the market was largely nascent, with limited local production capabilities and a heavy reliance on imports. However, this period laid the groundwork for significant future expansion. The study period (2019–2033) encapsulates this evolutionary journey, highlighting the pivotal shifts in market dynamics.

In the base year of 2025, the market is poised for accelerated growth. This growth is fueled by substantial investments in EV charging infrastructure and an increasing number of electric vehicle models becoming available across key MEA nations. The adoption of lithium-ion batteries is surging, driven by their superior energy density, longer lifespan, and faster charging capabilities compared to traditional lead-acid batteries. This surge directly translates into a higher demand for critical battery materials such as cathode materials, anode materials, electrolytes, and separators.

Technological advancements are a significant driver of this evolution. Manufacturers are continuously innovating to improve battery performance, reduce costs, and enhance safety features. The development of next-generation battery chemistries and more efficient material processing techniques are key areas of focus. Furthermore, a growing emphasis on the circular economy and battery recycling is influencing the market, with companies exploring ways to recover valuable materials from end-of-life batteries.

Shifting consumer demands are also playing a crucial role. As the cost of EVs decreases and the range anxiety associated with them diminishes, more consumers in the MEA region are opting for electric mobility. This rising consumer acceptance is creating a positive feedback loop, encouraging further investment in the EV ecosystem, including the upstream battery materials sector. The forecast period (2025–2033) is expected to see sustained double-digit growth rates as the region becomes a more significant player in the global EV battery market. Specific data points reveal a projected CAGR of XX% for the MEA electric vehicle battery materials market during the forecast period, with key regions like Saudi Arabia and the UAE spearheading this growth. The adoption of EVs, which stood at XX million units in 2025, is anticipated to reach over XX million units by 2033, underscoring the immense potential for the battery materials sector. The increasing localization of manufacturing, with gigafactories planned and under construction, will further bolster domestic production and reduce reliance on external supply chains, thereby solidifying the industry's evolution.

Leading Regions, Countries, or Segments in Middle East And Africa Electric Vehicle Battery Materials Market

The Middle East and Africa electric vehicle battery materials market is witnessing a clear demarcation of leadership, with specific regions and segments driving the overall growth trajectory. Among the various Battery Types, Lithium-ion Battery stands out as the dominant segment. This dominance is intrinsically linked to the global shift towards EVs, where lithium-ion technology offers superior performance in terms of energy density, lifespan, and charging speed. While Lead-Acid Batteries continue to serve niche applications and existing markets, the future of electric mobility is undeniably powered by lithium-ion.

Within the Material segmentation, Cathode and Anode materials are the most critical and high-value components. Their performance characteristics directly influence the battery's overall energy density, power output, and cost. The demand for these materials is expected to witness exponential growth as EV production scales up across the MEA region. Electrolyte and Separator segments are also crucial, ensuring the safe and efficient operation of the battery, and are experiencing steady demand increases.

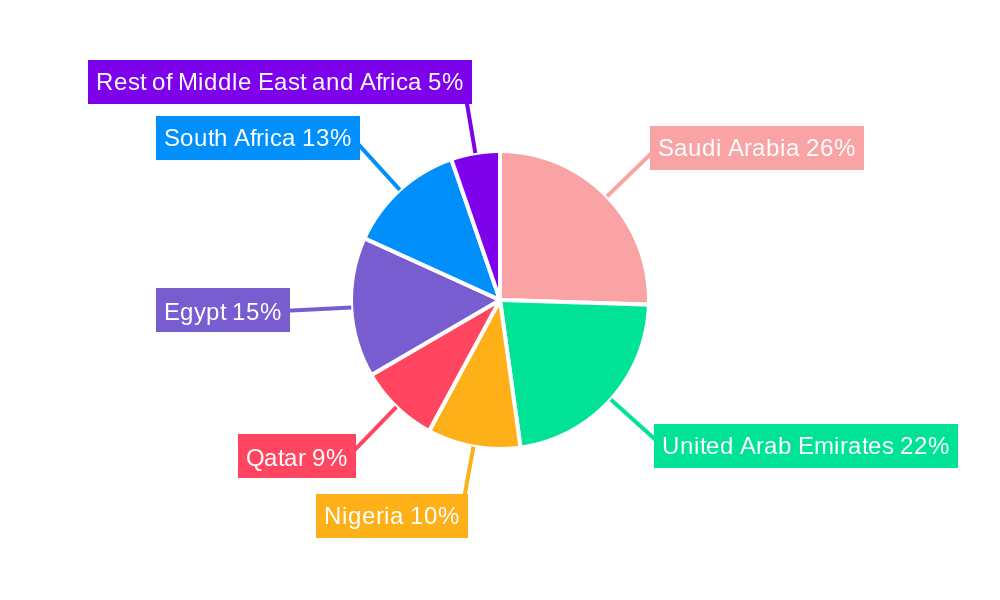

Geographically, the United Arab Emirates (UAE) and Saudi Arabia are emerging as frontrunners in the MEA electric vehicle battery materials market. Several factors contribute to their leading positions.

- Strategic Investments & Government Support: Both nations are making substantial investments in diversifying their economies and embracing future technologies, with electric mobility being a key focus. Governments are actively promoting EV adoption through incentives, tax benefits, and the development of robust charging infrastructure.

- Visionary Economic Roadmaps: Saudi Arabia's Vision 2030 and the UAE's national development strategies explicitly include targets for sustainable transportation and renewable energy, creating a fertile ground for EV battery material production and adoption.

- Gigafactory Developments: The announcement of gigafactory projects, such as China's Gotion High's investment in Morocco (though not directly in UAE/KSA, it signifies regional investment trends), highlights the growing interest in establishing local manufacturing capabilities. This trend is expected to be replicated and accelerated in key MEA hubs like the UAE and Saudi Arabia.

- Growing EV Penetration: Early adoption of electric vehicles by governments and forward-thinking businesses, coupled with a growing consumer awareness, is creating a critical mass for demand in these countries.

- Logistical Hubs & Trade Prowess: The UAE, in particular, leverages its strategic geographical location and advanced logistics infrastructure to serve as a potential hub for battery material import, processing, and export.

South Africa is another significant market, driven by its existing automotive industry and its commitment to renewable energy. However, the immediate growth in material demand and manufacturing investment is currently more pronounced in the Gulf Cooperation Council (GCC) nations. Egypt and Nigeria represent markets with substantial future potential, driven by large populations and increasing urbanization, but are in earlier stages of EV adoption and battery material development. The Rest of Middle East and Africa encompasses a diverse set of countries with varying levels of EV readiness, presenting a fragmented but collectively significant growth opportunity for battery material suppliers.

Middle East And Africa Electric Vehicle Battery Materials Market Product Innovations

The MEA electric vehicle battery materials market is experiencing a wave of innovation focused on enhancing battery performance, safety, and sustainability. Key product innovations include the development of advanced cathode materials like Nickel-Manganese-Cobalt (NMC) and Lithium Iron Phosphate (LFP) with improved energy density and faster charging capabilities. Novel anode materials, such as silicon-based anodes, are being researched to significantly boost capacity and reduce charging times. Furthermore, innovations in solid-state electrolytes promise enhanced safety by eliminating flammable liquid electrolytes, leading to more robust and reliable EV batteries. The development of eco-friendly and ethically sourced materials is also a growing trend, driven by increasing environmental consciousness and regulatory pressures.

Propelling Factors for Middle East And Africa Electric Vehicle Battery Materials Market Growth

The growth of the Middle East and Africa Electric Vehicle Battery Materials Market is propelled by a powerful synergy of technological, economic, and regulatory forces. Governments across the region are increasingly prioritizing electric vehicle (EV) adoption through ambitious national agendas and supportive policies. These include substantial investments in charging infrastructure, tax incentives for EV purchases, and mandates for cleaner transportation, creating a fertile ground for market expansion. Economically, the falling costs of battery production and the increasing global demand for EVs are making electric mobility a more viable and attractive option for consumers and businesses alike. Furthermore, the growing awareness of climate change and the need for sustainable energy solutions are acting as significant catalysts, pushing the transition away from fossil fuels.

- Government Initiatives & EV Policies: Strong regulatory support and incentives for EV adoption.

- Declining Battery Costs: Economies of scale and technological advancements are reducing production expenses.

- Growing Environmental Awareness: Increased demand for sustainable transportation solutions.

- Technological Advancements in Batteries: Improved energy density, faster charging, and longer lifespan.

- Expanding Charging Infrastructure: Government and private sector investments in charging networks.

Obstacles in the Middle East And Africa Electric Vehicle Battery Materials Market Market

Despite the promising growth trajectory, the Middle East and Africa Electric Vehicle Battery Materials Market faces several significant obstacles. A primary challenge is the nascent charging infrastructure in many parts of the region, which can lead to range anxiety for potential EV buyers. High upfront costs of electric vehicles, compared to their internal combustion engine counterparts, also remain a barrier for widespread adoption, particularly in price-sensitive markets. Furthermore, the supply chain for critical battery materials is currently concentrated in a few global regions, leading to potential vulnerabilities and price volatility for MEA manufacturers. Regulatory frameworks, while evolving, are not yet fully standardized across all countries, creating complexities for businesses operating regionally. Lastly, a lack of skilled labor in battery manufacturing and maintenance presents a challenge for scaling up local production.

- Inadequate Charging Infrastructure: Limited availability and accessibility of charging points.

- High Vehicle Purchase Prices: EVs remain expensive for a significant portion of the population.

- Supply Chain Dependencies: Reliance on imports for key raw materials.

- Fragmented Regulatory Landscape: Inconsistent policies and standards across different countries.

- Shortage of Skilled Workforce: Lack of expertise in battery technology and manufacturing.

Future Opportunities in Middle East And Africa Electric Vehicle Battery Materials Market

The future of the Middle East and Africa Electric Vehicle Battery Materials Market is ripe with emerging opportunities. The rapid expansion of the EV market across the MEA region presents a significant demand surge for various battery materials. The establishment of gigafactories and local battery manufacturing facilities, exemplified by investments in Morocco and South Africa, signals a trend towards increased localization, creating opportunities for material suppliers and component manufacturers. The growing interest in energy storage solutions beyond vehicles, such as grid-scale batteries and home energy storage systems, will further diversify demand for battery materials. Furthermore, advancements in battery recycling technologies offer a sustainable opportunity to recover valuable materials and reduce reliance on primary extraction. The untapped potential of emerging markets within Africa also presents long-term growth prospects as these economies develop and embrace electric mobility.

- Growing EV Market Penetration: Increasing adoption of electric vehicles across the region.

- Localization of Battery Manufacturing: Investment in gigafactories and production facilities.

- Expansion of Energy Storage Solutions: Demand for batteries beyond the automotive sector.

- Battery Recycling & Circular Economy: Opportunities in material recovery and sustainable practices.

- Untapped African Markets: Long-term growth potential in developing economies.

Major Players in the Middle East And Africa Electric Vehicle Battery Materials Market Ecosystem

The Middle East and Africa Electric Vehicle Battery Materials Market ecosystem is being shaped by a blend of global chemical giants and specialized battery material producers. Key players contributing to the market's growth and innovation include:

- Targray Technology International Inc

- BASF SE

- Mitsubishi Chemical Group Corporation

- Yokogawa Electric Corporation

- Umicore SA

- Sumitomo Chemical Co Ltd

- Middle East Battery Company

- ENTEK International LLC

- Arkema SA

- SGL Carbon

Key Developments in Middle East And Africa Electric Vehicle Battery Materials Market Industry

- June 2024: The Moroccan government announced a significant investment of USD 1.3 billion with China's Gotion High to construct Morocco's inaugural EV battery gigafactory. This move underscores Morocco's ambition to become a regional hub for EV battery production, with an initial capacity of 20 gigawatt-hours (GWh), signaling a major step towards localizing the EV battery supply chain in North Africa.

- January 2024: South Africa's Aqora rebranded itself as Afrivolt, signaling a strategic pivot towards establishing a lithium-ion cell gigafactory in South Africa. The facility aims to produce anodes, cathodes, and lithium-ion batteries, initially focusing on stationary storage applications and subsequently expanding to cater to the burgeoning electric vehicles (EVs) market in the region.

Strategic Middle East And Africa Electric Vehicle Battery Materials Market Market Forecast

The strategic Middle East and Africa Electric Vehicle Battery Materials Market forecast indicates robust growth, driven by escalating EV adoption and significant government investments in clean energy and transportation. The increasing focus on local manufacturing, as evidenced by gigafactory initiatives, will create substantial demand for a diverse range of battery materials, including cathodes, anodes, electrolytes, and separators. The market's trajectory is further bolstered by technological advancements that enhance battery performance and affordability. Emerging opportunities in energy storage solutions beyond the automotive sector will also contribute to market expansion. As regulatory landscapes mature and charging infrastructure expands, the MEA region is poised to become a vital component of the global electric vehicle battery supply chain, promising substantial returns for stakeholders.

Middle East And Africa Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Nigeria

- 3.4. Qatar

- 3.5. Egypt

- 3.6. South Africa

- 3.7. Rest of Middle East and Africa

Middle East And Africa Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Nigeria

- 4. Qatar

- 5. Egypt

- 6. South Africa

- 7. Rest of Middle East and Africa

Middle East And Africa Electric Vehicle Battery Materials Market Regional Market Share

Geographic Coverage of Middle East And Africa Electric Vehicle Battery Materials Market

Middle East And Africa Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Lithium-ion Batteries to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Nigeria

- 5.3.4. Qatar

- 5.3.5. Egypt

- 5.3.6. South Africa

- 5.3.7. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Nigeria

- 5.4.4. Qatar

- 5.4.5. Egypt

- 5.4.6. South Africa

- 5.4.7. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 6.1.1. Lithium-ion Battery

- 6.1.2. Lead-Acid Battery

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Cathode

- 6.2.2. Anode

- 6.2.3. Electrolyte

- 6.2.4. Separator

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Nigeria

- 6.3.4. Qatar

- 6.3.5. Egypt

- 6.3.6. South Africa

- 6.3.7. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 7. United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 7.1.1. Lithium-ion Battery

- 7.1.2. Lead-Acid Battery

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Cathode

- 7.2.2. Anode

- 7.2.3. Electrolyte

- 7.2.4. Separator

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Nigeria

- 7.3.4. Qatar

- 7.3.5. Egypt

- 7.3.6. South Africa

- 7.3.7. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 8. Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 8.1.1. Lithium-ion Battery

- 8.1.2. Lead-Acid Battery

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Cathode

- 8.2.2. Anode

- 8.2.3. Electrolyte

- 8.2.4. Separator

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Nigeria

- 8.3.4. Qatar

- 8.3.5. Egypt

- 8.3.6. South Africa

- 8.3.7. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 9. Qatar Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 9.1.1. Lithium-ion Battery

- 9.1.2. Lead-Acid Battery

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Cathode

- 9.2.2. Anode

- 9.2.3. Electrolyte

- 9.2.4. Separator

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Nigeria

- 9.3.4. Qatar

- 9.3.5. Egypt

- 9.3.6. South Africa

- 9.3.7. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 10. Egypt Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Battery Type

- 10.1.1. Lithium-ion Battery

- 10.1.2. Lead-Acid Battery

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Cathode

- 10.2.2. Anode

- 10.2.3. Electrolyte

- 10.2.4. Separator

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Nigeria

- 10.3.4. Qatar

- 10.3.5. Egypt

- 10.3.6. South Africa

- 10.3.7. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Battery Type

- 11. South Africa Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Battery Type

- 11.1.1. Lithium-ion Battery

- 11.1.2. Lead-Acid Battery

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Cathode

- 11.2.2. Anode

- 11.2.3. Electrolyte

- 11.2.4. Separator

- 11.2.5. Others

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. United Arab Emirates

- 11.3.3. Nigeria

- 11.3.4. Qatar

- 11.3.5. Egypt

- 11.3.6. South Africa

- 11.3.7. Rest of Middle East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Battery Type

- 12. Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Battery Type

- 12.1.1. Lithium-ion Battery

- 12.1.2. Lead-Acid Battery

- 12.1.3. Others

- 12.2. Market Analysis, Insights and Forecast - by Material

- 12.2.1. Cathode

- 12.2.2. Anode

- 12.2.3. Electrolyte

- 12.2.4. Separator

- 12.2.5. Others

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Saudi Arabia

- 12.3.2. United Arab Emirates

- 12.3.3. Nigeria

- 12.3.4. Qatar

- 12.3.5. Egypt

- 12.3.6. South Africa

- 12.3.7. Rest of Middle East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Battery Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Targray Technology International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 BASF SE

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Mitsubishi Chemical Group Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Yokogawa Electric Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Umicore SA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Sumitomo Chemical Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Middle East Battery Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ENTEK International LLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Arkema SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 SGL Carbon*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Targray Technology International Inc

List of Figures

- Figure 1: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 4: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 5: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 6: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 7: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 8: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 9: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 10: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 11: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 12: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 13: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Saudi Arabia Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 19: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 20: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 21: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 22: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 23: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 24: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 25: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 26: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 27: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 28: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 29: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 32: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 33: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: United Arab Emirates Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 36: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 37: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 38: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 39: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 40: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 41: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 42: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 43: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 45: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Nigeria Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 52: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 53: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 54: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 55: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 56: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 57: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 58: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 59: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 60: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 61: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 63: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Qatar Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 68: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 69: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 70: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 71: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 72: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 73: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 74: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 75: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 76: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 77: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 79: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Egypt Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 83: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 84: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 85: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 86: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 87: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 88: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 89: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 90: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 91: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 92: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 93: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 94: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 95: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 96: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 97: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: South Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 99: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 100: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 101: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 102: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 103: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Material 2025 & 2033

- Figure 104: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Material 2025 & 2033

- Figure 105: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Material 2025 & 2033

- Figure 106: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Material 2025 & 2033

- Figure 107: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Geography 2025 & 2033

- Figure 108: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Geography 2025 & 2033

- Figure 109: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Geography 2025 & 2033

- Figure 110: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Geography 2025 & 2033

- Figure 111: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 112: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume (Billion), by Country 2025 & 2033

- Figure 113: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 114: Rest of Middle East and Africa Middle East And Africa Electric Vehicle Battery Materials Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 10: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 11: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 13: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 18: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 19: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 21: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 26: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 27: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 28: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 29: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 34: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 35: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 36: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 37: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 42: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 43: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 44: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 45: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 50: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 51: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 52: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 53: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 55: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

- Table 57: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 58: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 59: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 60: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 61: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 63: Global Middle East And Africa Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Middle East And Africa Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 7.68%.

2. Which companies are prominent players in the Middle East And Africa Electric Vehicle Battery Materials Market?

Key companies in the market include Targray Technology International Inc, BASF SE, Mitsubishi Chemical Group Corporation, Yokogawa Electric Corporation, Umicore SA, Sumitomo Chemical Co Ltd, Middle East Battery Company, ENTEK International LLC, Arkema SA, SGL Carbon*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the Middle East And Africa Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.08 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Lithium-ion Batteries to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

June 2024: The Moroccan government announced that China's Gotion High will spearhead the construction of Morocco's inaugural EV battery gigafactory, with a price tag of USD 1.3 billion. Gotion High Tech's move underscores a broader trend, as Morocco, eyeing the surge in electric vehicle demand, is attracting a slew of investments in EV battery production. The investment pact inked between the Moroccan government and Gotion High Tech outlines the gigafactory's initial capacity at 20 gigawatt-hours (GWh).January 2024: South Africa's Aqora has rebranded itself as Afrivolt. Afrivolt's strategic pivot involves establishing a lithium-ion cell gigafactory in South Africa. The facility aims to craft anodes, cathodes, and lithium-ion batteries, initially targeting stationary storage applications and, later, electric vehicles (EVs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence