Key Insights

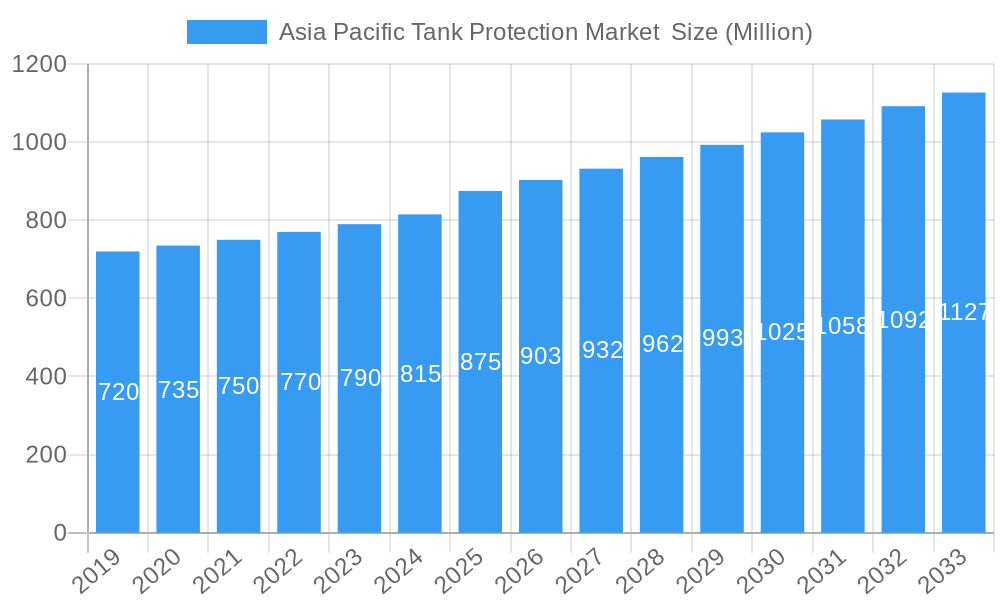

The Asia Pacific Tank Protection Market is set for significant growth, projected to reach USD 728 million by 2024 and expand at a Compound Annual Growth Rate (CAGR) of 4% through 2033. This expansion is driven by substantial investments in oil and gas infrastructure development across the region, particularly in upstream and downstream operations. The demand for new construction projects is a key factor, as nations like China and India expand their refining capacities and explore new energy reserves. Additionally, the need for replacement of aging infrastructure in developed markets such as Japan and Australia is driving demand for essential tank protection equipment, including valves, vents, and flame arrestors, crucial for safety and operational efficiency.

Asia Pacific Tank Protection Market Market Size (In Million)

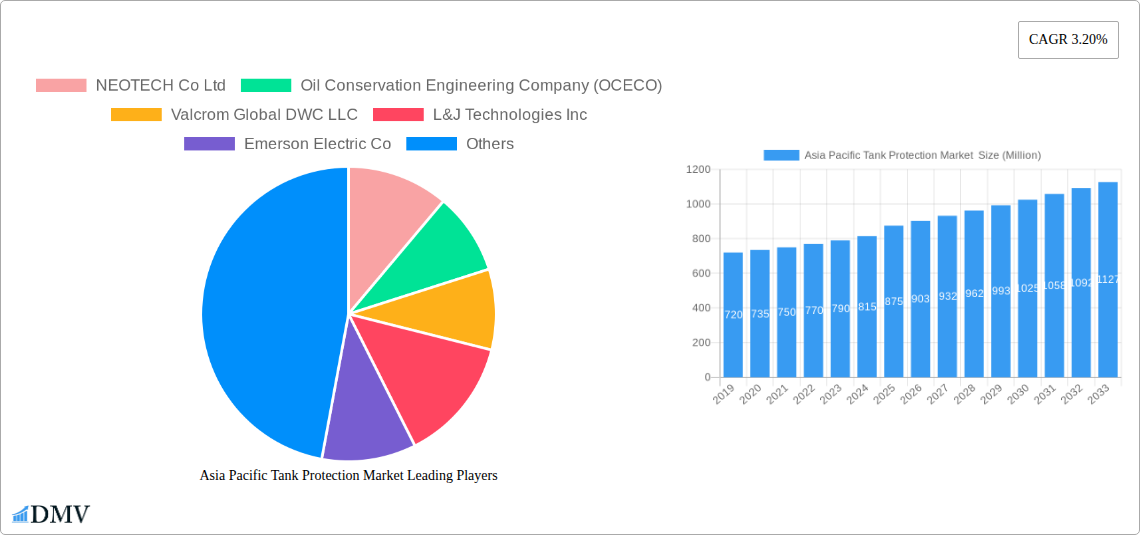

Evolving environmental regulations and a focus on asset integrity management are also shaping the market. Companies are increasingly adopting advanced tank protection solutions to mitigate risks from corrosion, emissions, and leaks, improving safety and environmental compliance. While opportunities abound, potential restraints, including volatile crude oil prices and the initial cost of advanced systems, may influence adoption rates. However, robust industrial growth and the need for reliable energy infrastructure in Asia Pacific are expected to sustain market vitality. Key players include NEOTECH Co Ltd, Oil Conservation Engineering Company (OCECO), Emerson Electric Co, and Zhejiang Zhenchao Petroleum And Chemical Equipment Co Ltd, contributing to a competitive market.

Asia Pacific Tank Protection Market Company Market Share

Asia Pacific Tank Protection Market: Enhancing Energy Infrastructure Resilience

This report provides an in-depth analysis of the Asia Pacific Tank Protection Market for stakeholders in the Oil & Gas, Petrochemical, and related industries. Covering the period from 2019 to 2033, with a base year of 2024 and a forecast period to 2033, the study examines market dynamics, industry trends, regional factors, product innovations, growth drivers, challenges, future opportunities, and the competitive landscape. The Asia Pacific Tank Protection Market is a vital and expanding sector with a projected value by 2033.

Asia Pacific Tank Protection Market Market Composition & Trends

The Asia Pacific Tank Protection Market exhibits a dynamic composition, characterized by a moderate to high concentration of key players vying for market share. Innovation catalysts are primarily driven by increasing stringency in environmental regulations and a growing emphasis on operational safety and asset integrity within the Oil & Gas sector. The regulatory landscape is continually evolving, with governments across the region implementing stricter guidelines for storage tank emissions and safety protocols. Substitute products, while present in nascent forms, are largely outpaced by the proven efficacy and reliability of traditional tank protection solutions like specialized coatings, inerting systems, and venting technologies. End-user profiles are diverse, ranging from major national oil companies to independent refiners and petrochemical manufacturers, all with a shared imperative to minimize product loss, prevent environmental contamination, and ensure worker safety. Mergers and acquisitions (M&A) activities, though not yet dominant, are expected to increase as larger players seek to consolidate their market position and acquire specialized technologies. While specific M&A deal values are proprietary, the trend signifies a maturing market consolidation phase. The market share distribution is currently fragmented, with established global players and strong regional contenders sharing significant portions, reflecting ongoing competition and strategic partnerships.

Asia Pacific Tank Protection Market Industry Evolution

The Asia Pacific Tank Protection Market has witnessed a significant evolution, driven by a confluence of economic growth, technological advancements, and increasing awareness of environmental sustainability. Over the historical period (2019-2024), the market has experienced steady growth, underpinned by ongoing investments in energy infrastructure across the region. The upstream, midstream, and downstream sectors of the Oil & Gas industry have all contributed to this expansion, with new project developments and the imperative to upgrade existing facilities necessitating advanced tank protection solutions. A notable trend has been the shift towards more sophisticated and eco-friendly tank protection technologies, responding to stricter environmental regulations and a growing demand for reduced volatile organic compound (VOC) emissions. This has spurred innovation in areas such as advanced venting systems, specialized coatings with enhanced chemical resistance and fire retardancy, and inert gas blanketing systems. Consumer demand, interpreted as the needs and expectations of end-users, has evolved from basic containment to comprehensive asset protection, encompassing longevity, efficiency, and minimal environmental impact. Growth rates have been robust, consistently exceeding the regional GDP growth, with specific segments demonstrating higher adoption metrics for new technologies. The base year of 2025 represents a pivotal point, with the market poised for accelerated growth in the forecast period (2025-2033) due to anticipated increases in exploration and production activities, coupled with the continuous modernization of refining and petrochemical complexes. The industry's evolution is a testament to its critical role in ensuring the safe, efficient, and environmentally responsible handling of vast quantities of stored hydrocarbons.

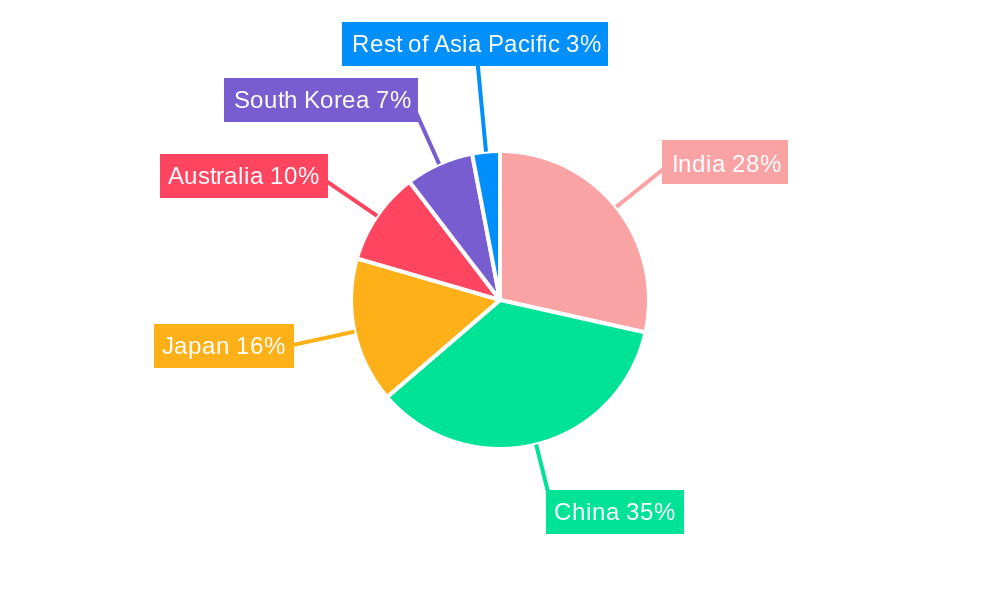

Leading Regions, Countries, or Segments in Asia Pacific Tank Protection Market

The Asia Pacific Tank Protection Market's dominance is intricately linked to the robust growth and expansive nature of the Oil & Gas sector across key geographies and segments.

Dominant Geography: China China stands out as the leading region in the Asia Pacific Tank Protection Market. This dominance is propelled by several interconnected factors:

- Massive Energy Demand & Infrastructure Development: China's insatiable appetite for energy, coupled with extensive ongoing investments in refining capacity, petrochemical complexes, and fuel storage infrastructure, creates a perpetual demand for tank protection solutions. The recent ExxonMobil investment in a multi-billion dollar chemical complex in the Dayawan Petrochemical Industrial Park is a prime example of the scale of projects driving the market.

- Government Initiatives & Environmental Regulations: The Chinese government's commitment to industrial modernization and environmental protection, albeit with its unique pace and focus, has led to the implementation of stricter safety and emission control standards for storage facilities. This regulatory push necessitates the adoption of advanced tank protection equipment.

- Extensive Upstream, Midstream, and Downstream Operations: China boasts a vast and integrated Oil & Gas value chain. From significant upstream exploration and production activities to extensive midstream pipeline networks and massive downstream refining and petrochemical operations, each stage requires comprehensive tank protection.

Dominant Sector: Oil & Gas - Downstream Within the Oil & Gas sector, the Downstream segment currently exhibits the strongest demand for tank protection solutions.

- Refining and Petrochemical Hubs: Asia Pacific, particularly China and India, hosts numerous large-scale refineries and petrochemical plants. These facilities store vast quantities of crude oil, refined products, and intermediate chemicals, making robust tank protection paramount.

- New Project Orders and Replacement Orders: The continuous expansion of refining capacity and the establishment of new petrochemical complexes drive significant demand for New Project (New Orders). Simultaneously, aging infrastructure in established facilities necessitates Existing Project (Replacement Orders) for valves, vents, and flame arrestors, ensuring compliance with modern safety and environmental standards.

- Volatile Product Storage: The storage of highly volatile and potentially hazardous refined products and petrochemicals in large volumes amplifies the need for advanced protection mechanisms to prevent evaporation losses, emissions, and potential safety hazards.

Key Equipment Driving Demand:

- Valves: Essential for controlling flow and pressure within tanks, specialized tank valves are crucial for preventing vapor loss and maintaining product integrity.

- Vents: Critical for managing pressure changes due to temperature fluctuations and filling/emptying operations, advanced conservation vents and emergency vents are in high demand to minimize emissions and prevent tank damage.

- Flame Arrestors: Indispensable for preventing the propagation of flames into storage tanks, especially in hazardous environments, their adoption is driven by stringent safety regulations.

The interplay of these geographic and sectoral factors creates a potent demand for innovative and reliable tank protection solutions, positioning China and the downstream Oil & Gas segment as key drivers of the Asia Pacific Tank Protection Market's growth.

Asia Pacific Tank Protection Market Product Innovations

Product innovations in the Asia Pacific Tank Protection Market are increasingly focused on enhanced efficiency, environmental compliance, and extended asset life. Advancements in material science have led to the development of novel coatings offering superior resistance to corrosion, extreme temperatures, and aggressive chemicals, thereby increasing the lifespan of storage tanks. Smart venting systems are emerging, integrating sensor technology to monitor internal tank conditions, optimize vapor recovery, and provide real-time alerts for potential issues. Furthermore, developments in flame arrestor technology include materials with improved heat absorption capabilities and designs that offer higher flow rates with minimal pressure drop, enhancing both safety and operational efficiency. The unique selling proposition of these innovations lies in their ability to significantly reduce product loss through evaporation, minimize harmful emissions, and bolster safety protocols, directly impacting the bottom line and environmental footprint of tank operators.

Propelling Factors for Asia Pacific Tank Protection Market Growth

Several key factors are propelling the growth of the Asia Pacific Tank Protection Market. Firstly, the escalating demand for energy across the region, fueled by economic development and population growth, necessitates continuous expansion and upgrades of oil and gas infrastructure, including storage facilities. Secondly, increasingly stringent environmental regulations and safety standards imposed by governments are compelling operators to invest in advanced tank protection technologies to mitigate emissions and prevent accidents. Thirdly, the growing awareness among businesses about the economic benefits of effective tank protection, such as reduced product loss, lower maintenance costs, and extended asset lifespan, acts as a significant driver. Lastly, technological advancements in materials science and engineering are leading to the development of more efficient, durable, and environmentally friendly tank protection solutions, further stimulating market demand.

Obstacles in the Asia Pacific Tank Protection Market Market

Despite robust growth prospects, the Asia Pacific Tank Protection Market faces certain obstacles. High upfront capital investment required for advanced tank protection systems can be a deterrent for smaller players or in regions with limited financial resources. Furthermore, the presence of diverse regulatory frameworks across different countries within the Asia Pacific can create complexities for manufacturers and end-users alike, requiring product customization and compliance with varying standards. Supply chain disruptions, particularly those related to raw materials or specialized components, can impact production timelines and costs. Lastly, competitive pressures from established players and the potential for uncertified or lower-quality alternatives to enter the market can also pose challenges to market growth and the adoption of premium solutions.

Future Opportunities in Asia Pacific Tank Protection Market

The Asia Pacific Tank Protection Market is ripe with future opportunities. The ongoing exploration and production initiatives, as highlighted by India's ambition to double its exploration area by 2030, will create substantial demand for new tank installations and associated protection systems. The increasing focus on sustainability and decarbonization presents an opportunity for innovative solutions that further reduce greenhouse gas emissions from storage tanks, such as advanced vapor recovery units and bio-based protective coatings. The expansion of liquefied natural gas (LNG) import and storage infrastructure across the region also opens up new avenues for specialized tank protection technologies. Moreover, the growing trend of digitalization and the integration of IoT in industrial operations will drive demand for smart tank monitoring and protection systems, offering predictive maintenance and enhanced operational insights.

Major Players in the Asia Pacific Tank Protection Market Ecosystem

- NEOTECH Co Ltd

- Oil Conservation Engineering Company (OCECO)

- Valcrom Global DWC LLC

- L&J Technologies Inc

- Emerson Electric Co

- KMC Oil and Gas Equipment

- Korean Steel Power Corp

- Zhejiang Zhenchao Petroleum And Chemical Equipment Co Ltd

- Motherwell Tank Protection

Key Developments in Asia Pacific Tank Protection Market Industry

- February 2022: The Ministry of Petroleum and Natural Gas, India, announced an ambitious plan to double the country's oil and gas exploration area to 0.5 million square kilometers by 2025 and further to 1 million square kilometers by 2030. This initiative is expected to significantly boost demand for new tank installations and consequently, tank protection equipment across India's upstream sector.

- November 2021: ExxonMobil made a final investment decision for a multi-billion dollar chemical complex in the Dayawan Petrochemical Industrial Park, Huizhou, Guangdong Province, China. Expected to be operational by the end of 2024, this project signifies substantial new capacity for petrochemical storage, driving demand for state-of-the-art tank protection solutions in China's downstream sector.

Strategic Asia Pacific Tank Protection Market Market Forecast

The Asia Pacific Tank Protection Market is poised for significant strategic growth, driven by a confluence of robust energy demand, stringent environmental mandates, and technological innovation. The forecast period from 2025 to 2033 will witness accelerated adoption of advanced solutions as countries like India expand their exploration frontiers and China continues its massive petrochemical investments. The market's potential is further amplified by the imperative to enhance operational safety and minimize environmental impact, leading to increased investment in specialized valves, vents, and flame arrestors. Emerging opportunities in LNG infrastructure and the growing integration of smart technologies will also contribute to a dynamic and expanding market landscape, solidifying the region's critical role in global energy security and sustainability efforts.

Asia Pacific Tank Protection Market Segmentation

-

1. Oil & Gas - Sector

- 1.1. Upstream

- 1.2. Downstream

- 1.3. Midstream

-

2. Application

- 2.1. New Project (New Orders)

- 2.2. Existing Project (Replacement Orders)

-

3. Equipment

- 3.1. Valves

- 3.2. Vents

- 3.3. Flame Arrestors

-

4. Geography

- 4.1. India

- 4.2. China

- 4.3. Japan

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia Pacific

Asia Pacific Tank Protection Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia Pacific Tank Protection Market Regional Market Share

Geographic Coverage of Asia Pacific Tank Protection Market

Asia Pacific Tank Protection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities

- 3.3. Market Restrains

- 3.3.1. 4.; Rising adoption of cleaner alternatives

- 3.4. Market Trends

- 3.4.1. Increase investment in the oilfield exploration will drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Tank Protection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 5.1.1. Upstream

- 5.1.2. Downstream

- 5.1.3. Midstream

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. New Project (New Orders)

- 5.2.2. Existing Project (Replacement Orders)

- 5.3. Market Analysis, Insights and Forecast - by Equipment

- 5.3.1. Valves

- 5.3.2. Vents

- 5.3.3. Flame Arrestors

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.5.2. China

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 6. India Asia Pacific Tank Protection Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 6.1.1. Upstream

- 6.1.2. Downstream

- 6.1.3. Midstream

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. New Project (New Orders)

- 6.2.2. Existing Project (Replacement Orders)

- 6.3. Market Analysis, Insights and Forecast - by Equipment

- 6.3.1. Valves

- 6.3.2. Vents

- 6.3.3. Flame Arrestors

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 7. China Asia Pacific Tank Protection Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 7.1.1. Upstream

- 7.1.2. Downstream

- 7.1.3. Midstream

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. New Project (New Orders)

- 7.2.2. Existing Project (Replacement Orders)

- 7.3. Market Analysis, Insights and Forecast - by Equipment

- 7.3.1. Valves

- 7.3.2. Vents

- 7.3.3. Flame Arrestors

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 8. Japan Asia Pacific Tank Protection Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 8.1.1. Upstream

- 8.1.2. Downstream

- 8.1.3. Midstream

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. New Project (New Orders)

- 8.2.2. Existing Project (Replacement Orders)

- 8.3. Market Analysis, Insights and Forecast - by Equipment

- 8.3.1. Valves

- 8.3.2. Vents

- 8.3.3. Flame Arrestors

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. India

- 8.4.2. China

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 9. Australia Asia Pacific Tank Protection Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 9.1.1. Upstream

- 9.1.2. Downstream

- 9.1.3. Midstream

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. New Project (New Orders)

- 9.2.2. Existing Project (Replacement Orders)

- 9.3. Market Analysis, Insights and Forecast - by Equipment

- 9.3.1. Valves

- 9.3.2. Vents

- 9.3.3. Flame Arrestors

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. India

- 9.4.2. China

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 10. South Korea Asia Pacific Tank Protection Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 10.1.1. Upstream

- 10.1.2. Downstream

- 10.1.3. Midstream

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. New Project (New Orders)

- 10.2.2. Existing Project (Replacement Orders)

- 10.3. Market Analysis, Insights and Forecast - by Equipment

- 10.3.1. Valves

- 10.3.2. Vents

- 10.3.3. Flame Arrestors

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. India

- 10.4.2. China

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 11. Rest of Asia Pacific Asia Pacific Tank Protection Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 11.1.1. Upstream

- 11.1.2. Downstream

- 11.1.3. Midstream

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. New Project (New Orders)

- 11.2.2. Existing Project (Replacement Orders)

- 11.3. Market Analysis, Insights and Forecast - by Equipment

- 11.3.1. Valves

- 11.3.2. Vents

- 11.3.3. Flame Arrestors

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. India

- 11.4.2. China

- 11.4.3. Japan

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia Pacific

- 11.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 NEOTECH Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Oil Conservation Engineering Company (OCECO)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Valcrom Global DWC LLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 L&J Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Emerson Electric Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 KMC Oil and Gas Equipment

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Korean Steel Power Corp

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Zhejiang Zhenchao Petroleum And Chemical Equipment Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Motherwell Tank Protection

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 NEOTECH Co Ltd

List of Figures

- Figure 1: Asia Pacific Tank Protection Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Tank Protection Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Tank Protection Market Revenue million Forecast, by Oil & Gas - Sector 2020 & 2033

- Table 2: Asia Pacific Tank Protection Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Tank Protection Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 4: Asia Pacific Tank Protection Market Revenue million Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Tank Protection Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Tank Protection Market Revenue million Forecast, by Oil & Gas - Sector 2020 & 2033

- Table 7: Asia Pacific Tank Protection Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Asia Pacific Tank Protection Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 9: Asia Pacific Tank Protection Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Tank Protection Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Tank Protection Market Revenue million Forecast, by Oil & Gas - Sector 2020 & 2033

- Table 12: Asia Pacific Tank Protection Market Revenue million Forecast, by Application 2020 & 2033

- Table 13: Asia Pacific Tank Protection Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 14: Asia Pacific Tank Protection Market Revenue million Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Tank Protection Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Tank Protection Market Revenue million Forecast, by Oil & Gas - Sector 2020 & 2033

- Table 17: Asia Pacific Tank Protection Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: Asia Pacific Tank Protection Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 19: Asia Pacific Tank Protection Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Tank Protection Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Tank Protection Market Revenue million Forecast, by Oil & Gas - Sector 2020 & 2033

- Table 22: Asia Pacific Tank Protection Market Revenue million Forecast, by Application 2020 & 2033

- Table 23: Asia Pacific Tank Protection Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 24: Asia Pacific Tank Protection Market Revenue million Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Tank Protection Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Tank Protection Market Revenue million Forecast, by Oil & Gas - Sector 2020 & 2033

- Table 27: Asia Pacific Tank Protection Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Asia Pacific Tank Protection Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 29: Asia Pacific Tank Protection Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Tank Protection Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: Asia Pacific Tank Protection Market Revenue million Forecast, by Oil & Gas - Sector 2020 & 2033

- Table 32: Asia Pacific Tank Protection Market Revenue million Forecast, by Application 2020 & 2033

- Table 33: Asia Pacific Tank Protection Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 34: Asia Pacific Tank Protection Market Revenue million Forecast, by Geography 2020 & 2033

- Table 35: Asia Pacific Tank Protection Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Tank Protection Market ?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Asia Pacific Tank Protection Market ?

Key companies in the market include NEOTECH Co Ltd, Oil Conservation Engineering Company (OCECO), Valcrom Global DWC LLC, L&J Technologies Inc, Emerson Electric Co, KMC Oil and Gas Equipment, Korean Steel Power Corp, Zhejiang Zhenchao Petroleum And Chemical Equipment Co Ltd, Motherwell Tank Protection.

3. What are the main segments of the Asia Pacific Tank Protection Market ?

The market segments include Oil & Gas - Sector, Application, Equipment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 728 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities.

6. What are the notable trends driving market growth?

Increase investment in the oilfield exploration will drive the market.

7. Are there any restraints impacting market growth?

4.; Rising adoption of cleaner alternatives.

8. Can you provide examples of recent developments in the market?

In February 2022, the Ministry of Petroleum and Natural Gas India announced that the country is expected to double its area under exploration and production of oil and gas to 0.5 million square kilometers by 2025 and 1 million square kilometers by 2030, to reduce dependence on imports and increase domestic output.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Tank Protection Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Tank Protection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Tank Protection Market ?

To stay informed about further developments, trends, and reports in the Asia Pacific Tank Protection Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence