Key Insights

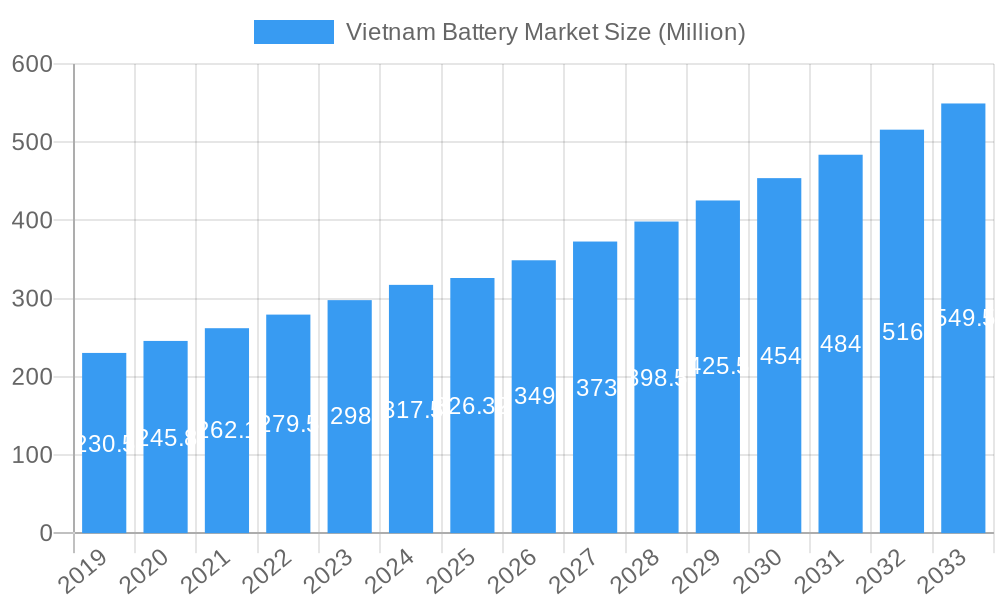

The Vietnam battery market is poised for significant growth, projected to reach an estimated USD 326.32 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.83% through 2033. This expansion is fueled by burgeoning demand across diverse applications, notably in the automotive sector, propelled by increasing vehicle production and the accelerating adoption of electric vehicles (EVs). Data centers are another critical growth engine, necessitating reliable power backup solutions to support Vietnam's rapidly digitizing economy. The telecommunications industry also plays a vital role, requiring dependable batteries for base stations and network infrastructure. Furthermore, the government's increasing focus on renewable energy integration is creating substantial opportunities for energy storage solutions, reinforcing the upward trajectory of the battery market.

Vietnam Battery Market Market Size (In Million)

Key segments driving this growth include Lithium-ion batteries, which are gaining prominence due to their superior energy density, longer lifespan, and faster charging capabilities, making them ideal for EVs and portable electronics. Lead-acid batteries, while more established, continue to hold a significant share, particularly in automotive starting, lighting, and ignition (SLI) applications and stationary power backup. Emerging battery technologies also present promising avenues for innovation and market penetration. The market landscape is characterized by the presence of both established international players and increasingly capable domestic manufacturers, fostering a competitive environment that benefits consumers through improved product offerings and potentially more competitive pricing. Key players like Ritar Power, PINACO, GS Battery Vietnam, and TIA Sang Battery are actively shaping the market, alongside emerging entities like Eni- Florence Vietnam and Heng Li (Vietnam) Battery Technology, indicating a dynamic and evolving industry.

Vietnam Battery Market Company Market Share

Vietnam Battery Market: Comprehensive Insights and Strategic Forecast (2019-2033)

This in-depth report provides an exhaustive analysis of the Vietnam Battery Market, exploring its current landscape, historical trends, and projected future growth from 2019 to 2033. Delve into critical segments like Lead-acid Battery, Lithium-ion Battery, and Other Battery Types, alongside key applications including Automotive, Data Centers, Telecommunication, Energy Storage, and Other Applications. Understand the strategic moves of leading players such as Ritar Power (Vietnam) Company Limited, PINACO, GS Battery Vietnam Co Ltd, Leoch International Technology Limited, TIA Sang Battery Joint Stock Company, and Kung Long Batteries Industrial Co Ltd. Uncover market dynamics influenced by industry developments, regulatory frameworks, and evolving consumer demands. This report is an indispensable tool for stakeholders seeking to navigate the rapidly expanding Vietnamese battery sector.

Vietnam Battery Market Market Composition & Trends

The Vietnam Battery Market is characterized by a moderate to high concentration, with key players actively investing in capacity expansion and technological upgrades. Innovation is primarily driven by the burgeoning demand for Electric Vehicles (EVs) and renewable energy storage solutions. Regulatory landscapes are becoming more favorable, with government initiatives aimed at promoting sustainable energy and local manufacturing. Substitute products, particularly advancements in battery chemistries, are continuously emerging, pushing established technologies to innovate. End-user profiles are diversifying, ranging from individual consumers for automotive applications to large-scale industrial users for energy storage and telecommunication infrastructure. Merger and acquisition (M&A) activities, while currently moderate, are anticipated to increase as companies seek to consolidate market share and acquire advanced technologies. The market share distribution is influenced by the dominance of lead-acid batteries in traditional applications and the rapid growth of lithium-ion batteries in emerging sectors. We anticipate M&A deal values to escalate, particularly in the renewable energy storage and EV battery segments.

Vietnam Battery Market Industry Evolution

The Vietnam Battery Market has witnessed a dynamic evolution over the historical period (2019-2024), driven by a confluence of technological advancements, increasing industrialization, and a growing emphasis on sustainable energy solutions. Initially dominated by the robust demand for traditional Lead-acid Batteries in the Automotive and Telecommunication sectors, the market is now experiencing a significant shift towards more advanced Lithium-ion Battery technologies. This transition is fueled by the exponential growth of the electric vehicle industry, a key driver of market expansion, and the increasing adoption of renewable energy sources, necessitating efficient Energy Storage solutions.

The base year of 2025 sets the stage for significant projected growth, with the forecast period (2025-2033) anticipating a CAGR of xx% for the overall market. This impressive growth trajectory is underpinned by substantial investments in research and development, leading to improvements in battery performance, longevity, and safety. For instance, the adoption rate of lithium-ion batteries in consumer electronics and portable power solutions has seen a consistent upward trend, estimated at xx% annually over the past few years. Similarly, the demand for industrial-grade battery systems for grid-scale energy storage and data center operations has surged, with projected growth rates of xx% and xx% respectively.

Shifting consumer demands are also playing a pivotal role. As environmental consciousness rises and the cost-effectiveness of battery-powered solutions improves, consumers are increasingly opting for EVs and energy-efficient appliances. This has directly translated into higher demand for batteries across all application segments. The Vietnamese government’s commitment to developing a green economy and reducing carbon emissions further bolsters this evolution, creating a supportive ecosystem for battery manufacturers and adopters. The industry's ability to adapt to these evolving needs and technological frontiers will be crucial for sustained growth in the coming years.

Leading Regions, Countries, or Segments in Vietnam Battery Market

The Vietnam Battery Market is currently dominated by the Automotive application segment, driven by the country's large and growing vehicle parc. This segment consistently exhibits high demand for both original equipment manufacturer (OEM) and aftermarket batteries, primarily comprising Lead-acid Batteries due to their established cost-effectiveness and reliability in traditional internal combustion engine vehicles. However, the nascent but rapidly expanding Electric Vehicle (EV) market is a significant growth propeller, increasingly favoring Lithium-ion Batteries.

Dominant Segment (Application): Automotive:

- Key Drivers: High vehicle ownership, a growing used car market, and the increasing adoption of electric scooters and motorcycles.

- Market Share: Estimated to hold approximately xx% of the total market revenue in the base year 2025.

- Technological Trend: Gradual shift from traditional lead-acid to lithium-ion in new EV models and premium ICE vehicles.

- Regulatory Support: Government incentives for EV adoption and manufacturing indirectly boost demand for automotive batteries.

Emerging Growth Driver (Technology): Lithium-ion Battery:

- Key Drivers: Declining manufacturing costs, enhanced energy density, and longer lifespan compared to lead-acid alternatives.

- Application Expansion: Beyond EVs, lithium-ion batteries are gaining traction in Telecommunication (backup power), Data Centers (UPS systems), and Energy Storage (grid-scale and residential).

- Investment Trends: Significant foreign and domestic investments are pouring into lithium-ion cell manufacturing and battery pack assembly in Vietnam.

Critical Support Segment (Application): Telecommunication:

- Key Drivers: Expansion of 4G and 5G networks, requiring reliable backup power solutions for base stations.

- Technological Preference: A mix of lead-acid and increasingly lithium-ion batteries, with a trend towards higher energy density and longer cycle life.

The dominance of the automotive segment is intrinsically linked to the technological preference for lead-acid batteries in the immediate term, but the future trajectory clearly points towards the ascendancy of lithium-ion batteries, especially with the burgeoning EV sector and renewable energy initiatives. The government's commitment to fostering local manufacturing capabilities for advanced battery technologies further solidifies the position of lithium-ion as a key growth enabler across multiple applications.

Vietnam Battery Market Product Innovations

Product innovations in the Vietnam Battery Market are largely centered on enhancing energy density, improving charging speeds, and extending cycle life, particularly within the Lithium-ion Battery segment. Manufacturers are actively developing advanced battery chemistries like NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate) to cater to the specific demands of the automotive sector, especially for electric vehicles. These innovations offer increased range and faster charging capabilities, addressing key consumer concerns. Furthermore, advancements in battery management systems (BMS) are improving safety and overall performance. In the Lead-acid Battery domain, innovations focus on higher cranking power and longer service life for automotive applications, while for stationary uses, enhanced deep-cycle capabilities and spill-proof designs are being introduced.

Propelling Factors for Vietnam Battery Market Growth

Several key factors are propelling the growth of the Vietnam Battery Market. Technologically, the rapid advancements and declining costs of Lithium-ion Battery technologies, particularly for Electric Vehicles (EVs) and renewable energy storage, are major catalysts. Economically, Vietnam's strong economic growth, increasing disposable incomes, and a burgeoning manufacturing sector are driving demand for batteries across various applications. Regulatory influences, such as government support for renewable energy deployment and policies promoting EV adoption, are creating a favorable environment for market expansion. The strategic focus on building domestic battery manufacturing capabilities further strengthens the industry's growth potential.

Obstacles in the Vietnam Battery Market Market

Despite robust growth, the Vietnam Battery Market faces several obstacles. Regulatory challenges persist, with the need for clearer frameworks for battery recycling and disposal to ensure environmental sustainability. Supply chain disruptions, particularly for critical raw materials like lithium and cobalt, can impact production costs and lead times. Competitive pressures are increasing, both from established global players and emerging local manufacturers, leading to price sensitivities. Furthermore, the upfront cost of advanced battery technologies like lithium-ion can still be a barrier for some consumer segments, slowing widespread adoption in price-sensitive markets.

Future Opportunities in Vietnam Battery Market

The Vietnam Battery Market is ripe with future opportunities. The accelerating adoption of Electric Vehicles (EVs) presents a significant avenue for growth, not only for EV batteries but also for charging infrastructure components. The expansion of renewable energy projects, such as solar and wind farms, will drive substantial demand for Energy Storage solutions. There is also a growing opportunity in the development of advanced battery recycling and second-life applications to promote a circular economy. Furthermore, the increasing digitalization and growth of data centers will fuel the demand for reliable backup power systems, predominantly using advanced battery technologies.

Major Players in the Vietnam Battery Market Ecosystem

- Ritar Power (Vietnam) Company Limited

- PINACO

- GS Battery Vietnam Co Ltd

- Leoch International Technology Limited

- TIA Sang Battery Joint Stock Company

- Kung Long Batteries Industrial Co Ltd

- Eni- Florence Vietnam Co Ltd

- Heng Li (Vietnam) Battery Technology Co Ltd

- Saite Power Source(Vietnam) Co Ltd

- Vision Group

Key Developments in Vietnam Battery Market Industry

- October 2023: VinES announced its merger with VinFast to enhance battery technology's self-efficiency and leverage resources to increase battery research and development for EVs. This strategic move aims to strengthen Vietnam's position in the global EV battery supply chain.

- May 2023: Marubeni Corporation of Japan announced its collaboration with VinES, a Vietnamese battery and energy-as-a-service provider, to create energy storage facilities in the Southeast Asian country. Marubeni will initiate its part of the collaboration with a feasibility study of battery energy storage system (BESS) installations that might be deployed at Vingroup commercial and industrial (C&I) locations. This partnership signifies growing international interest and investment in Vietnam's energy storage sector.

Strategic Vietnam Battery Market Market Forecast

The Vietnam Battery Market is poised for remarkable growth, driven by the convergence of technological advancements and supportive government policies. The escalating adoption of Electric Vehicles (EVs) and the burgeoning renewable energy sector are key growth catalysts, creating substantial demand for both Lithium-ion Battery and advanced Lead-acid Battery solutions. Investments in domestic manufacturing capabilities and R&D for next-generation battery technologies will further solidify Vietnam's position as a key player in the regional battery market. The forecast indicates a sustained upward trajectory, offering significant opportunities for market participants across the value chain, from raw material suppliers to battery manufacturers and end-users.

Vietnam Battery Market Segmentation

-

1. Battery Technology

- 1.1. Lead-acid Battery

- 1.2. Lithium-ion Battery

- 1.3. Other Battery Types

-

2. Application

- 2.1. Automotive

- 2.2. Data Centers

- 2.3. Telecommunication

- 2.4. Energy Storage

- 2.5. Other Applications

Vietnam Battery Market Segmentation By Geography

- 1. Vietnam

Vietnam Battery Market Regional Market Share

Geographic Coverage of Vietnam Battery Market

Vietnam Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country

- 3.3. Market Restrains

- 3.3.1. 4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems

- 3.4. Market Trends

- 3.4.1. The Lead-acid Battery Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Technology

- 5.1.1. Lead-acid Battery

- 5.1.2. Lithium-ion Battery

- 5.1.3. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Data Centers

- 5.2.3. Telecommunication

- 5.2.4. Energy Storage

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Battery Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ritar Power (Vietnam) Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PINACO

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GS Battery Vietnam Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leoch International Technology Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TIA Sang Battery Joint Stock Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kung Long Batteries Industrial Co Ltd*List Not Exhaustive 6 4 Potential List of Distributors/Importers with Their Battery Brands6 5 Market Ranking Analysi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eni- Florence Vietnam Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heng Li (Vietnam) Battery Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saite Power Source(Vietnam) Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vision Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ritar Power (Vietnam) Company Limited

List of Figures

- Figure 1: Vietnam Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Battery Market Revenue Million Forecast, by Battery Technology 2020 & 2033

- Table 2: Vietnam Battery Market Volume K Units Forecast, by Battery Technology 2020 & 2033

- Table 3: Vietnam Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Vietnam Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 5: Vietnam Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Vietnam Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Vietnam Battery Market Revenue Million Forecast, by Battery Technology 2020 & 2033

- Table 8: Vietnam Battery Market Volume K Units Forecast, by Battery Technology 2020 & 2033

- Table 9: Vietnam Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Vietnam Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 11: Vietnam Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Vietnam Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Battery Market?

The projected CAGR is approximately 6.83%.

2. Which companies are prominent players in the Vietnam Battery Market?

Key companies in the market include Ritar Power (Vietnam) Company Limited, PINACO, GS Battery Vietnam Co Ltd, Leoch International Technology Limited, TIA Sang Battery Joint Stock Company, Kung Long Batteries Industrial Co Ltd*List Not Exhaustive 6 4 Potential List of Distributors/Importers with Their Battery Brands6 5 Market Ranking Analysi, Eni- Florence Vietnam Co Ltd, Heng Li (Vietnam) Battery Technology Co Ltd, Saite Power Source(Vietnam) Co Ltd, Vision Group.

3. What are the main segments of the Vietnam Battery Market?

The market segments include Battery Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 326.32 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country.

6. What are the notable trends driving market growth?

The Lead-acid Battery Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems.

8. Can you provide examples of recent developments in the market?

October 2023: VinES announced its merger with VinFast to enhance battery technology's self-efficiency and leverage resources to increase battery research and development for EVs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Battery Market?

To stay informed about further developments, trends, and reports in the Vietnam Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence