Key Insights

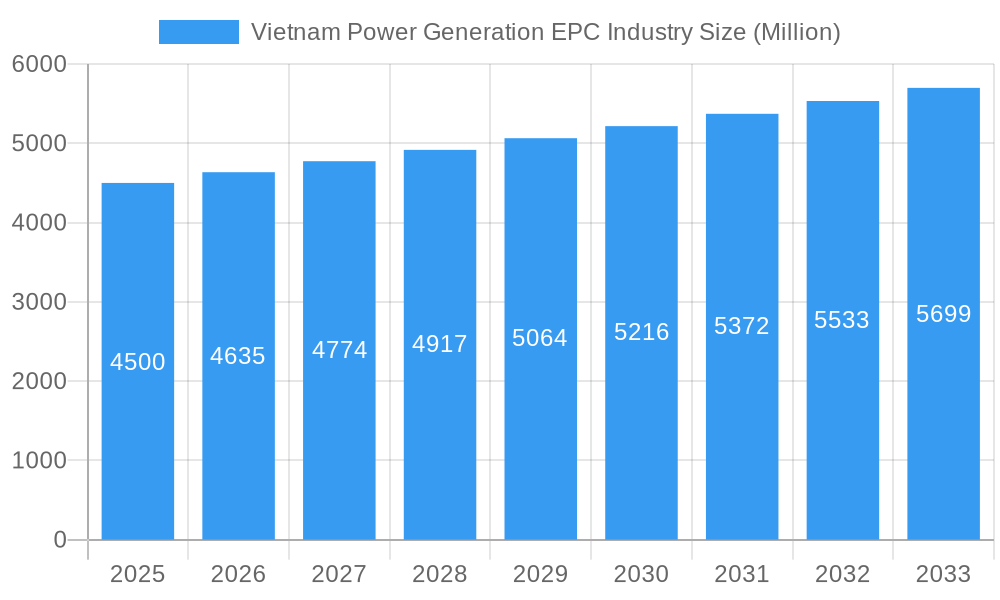

The Vietnam Power Generation EPC market is set for significant expansion, forecasted to reach USD 947 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.88%. This growth is primarily propelled by Vietnam's increasing energy needs, driven by rapid economic development, industrialization, and a growing middle class. Government initiatives prioritizing energy security and diversification, particularly the strong push for renewable energy sources like solar and wind, are key drivers. The modernization of existing power infrastructure and the development of new, large-scale projects necessitate specialized Engineering, Procurement, and Construction (EPC) services. The industry emphasizes adopting advanced technologies for enhanced efficiency and sustainability, with substantial investments in both traditional and renewable power projects.

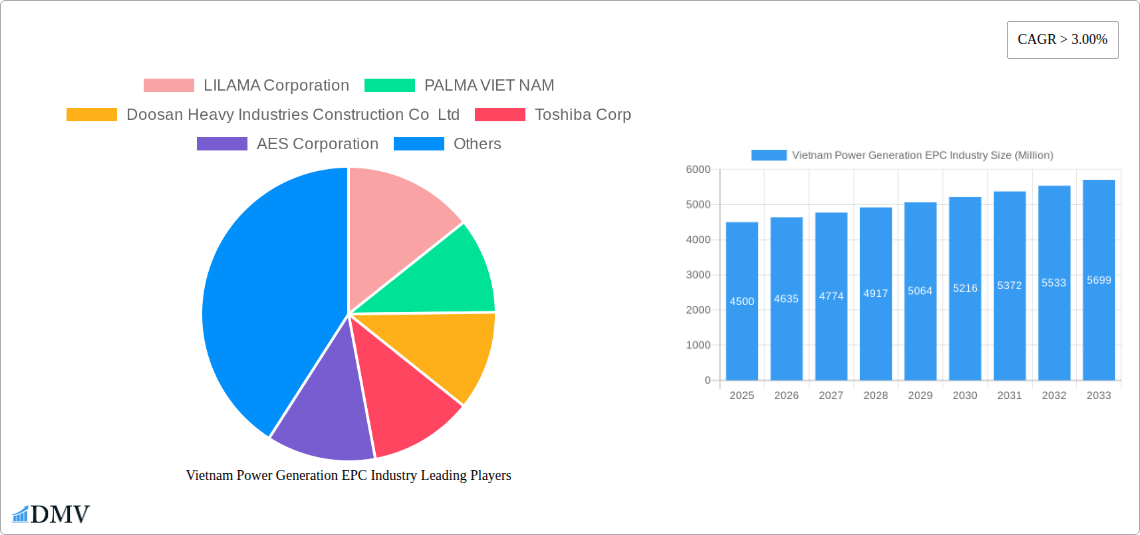

Vietnam Power Generation EPC Industry Market Size (In Million)

Market dynamics are influenced by trends such as the increasing adoption of smart grid technologies, the integration of advanced energy storage solutions, and a preference for cleaner fuel sources to meet environmental regulations and sustainability objectives. Potential challenges include financing mega-projects, navigating regulatory complexities, and the availability of skilled labor and specialized equipment. Despite these, prominent international and domestic players like LILAMA Corporation, Doosan Heavy Industries Construction Co Ltd, and Toshiba Corp highlight a competitive and opportunity-rich landscape. Production, consumption, import, export, and price trends are expected to show considerable activity, reflecting the comprehensive nature of power generation project development. Vietnam's pivotal role in advancing regional power infrastructure is underscored.

Vietnam Power Generation EPC Industry Company Market Share

Vietnam Power Generation EPC Industry Market Composition & Trends

The Vietnam Power Generation EPC industry is characterized by a moderately concentrated market, with key players vying for substantial power plant construction projects. Innovation is primarily driven by the increasing demand for renewable energy solutions, particularly solar and wind power, alongside the critical need for reliable baseload power generation fueled by LNG. Regulatory frameworks are evolving to encourage foreign investment and promote sustainable energy development, creating a conducive environment for EPC contractors. While direct substitute products for large-scale power generation infrastructure are limited, the efficiency and cost-competitiveness of different energy generation technologies (e.g., coal vs. LNG vs. renewables) influence project selection. End-user profiles primarily include state-owned utilities like PetroVietnam Power and Electricity of Vietnam (EVN), alongside an increasing number of private developers. Mergers and Acquisitions (M&A) activities are anticipated to grow as companies seek to consolidate expertise, expand their project portfolios, and achieve economies of scale. The Vietnam EPC market share distribution sees established international players alongside emerging domestic giants, all contributing to a dynamic M&A landscape with projected deal values in the billions of USD.

Vietnam Power Generation EPC Industry Industry Evolution

The Vietnam Power Generation EPC industry has witnessed a transformative evolution, driven by the nation's escalating energy demands and ambitious development goals. Throughout the historical period (2019-2024), the market has primarily revolved around traditional coal-fired power plant construction, reflecting Vietnam's reliance on fossil fuels for its baseload power needs. However, this has been gradually complemented by a surge in renewable energy project development, particularly solar and wind farms, fueled by government incentives and a global push towards decarbonization. The base year of 2025 represents a pivotal point, with significant investment flowing into new generation capacity. The forecast period (2025-2033) is projected to see sustained power project development, with an increasing emphasis on cleaner energy sources and advanced technologies. Technological advancements are a cornerstone of this evolution. EPC contractors are increasingly integrating sophisticated engineering, procurement, and construction methodologies, leveraging digital tools for project management, simulation, and risk assessment. Furthermore, the adoption of more efficient turbine technologies, advanced grid integration solutions for renewables, and the nascent exploration of LNG power plant construction are indicative of this technological shift. Shifting consumer demands, manifested through government policies and growing environmental awareness, are pushing the industry towards sustainable power solutions. This includes a greater focus on energy efficiency, grid modernization, and the potential for distributed generation. The growth trajectory of the Vietnam power generation EPC market is intrinsically linked to the nation's economic expansion and its commitment to energy security. Expected CAGR for Vietnam EPC market is projected to be robust, mirroring the country's industrialization and urbanization. The increasing complexity of projects, including the development of large-scale solar farms and offshore wind projects, necessitates specialized expertise and a sophisticated supply chain, further shaping the industry's evolution. The transition from predominantly coal-based power to a more diversified and cleaner energy mix, including the introduction of Vietnam's first LNG power plants, underscores the dynamic and forward-looking nature of this sector. The Vietnam power EPC market size is expected to expand significantly, driven by both new capacity additions and the need to upgrade existing infrastructure to meet future energy needs.

Leading Regions, Countries, or Segments in Vietnam Power Generation EPC Industry

Vietnam's power generation landscape, particularly within the EPC sector, is predominantly characterized by national-level focus and significant provincial activity. While no single "region" can be definitively singled out as dominant in a monolithic sense, the Northern and Southern economic hubs of Vietnam consistently emerge as epicenters for major power generation EPC projects. This dominance stems from a confluence of factors including high industrial and urban energy consumption, established grid infrastructure, and proximity to potential LNG import terminals and renewable energy resource potential.

Production Analysis:

- Key Drivers: Proximity to major industrial zones and urban centers in the North (e.g., Hanoi and surrounding provinces) and South (e.g., Ho Chi Minh City and the Mekong Delta) drives demand for new power generation capacity. Government-led industrial park development further fuels this demand.

- Dominance Factors: The concentration of state-owned enterprises and major private developers in these regions facilitates streamlined project initiation and execution. Access to skilled labor and established logistical networks are also crucial.

Consumption Analysis:

- Key Drivers: The industrial sector, encompassing manufacturing, textiles, and electronics, is the primary consumer of electricity, with higher concentrations in the North and South. Urbanization and a growing middle class also contribute to increased residential energy consumption.

- Dominance Factors: The economic dynamism of these regions translates directly into higher electricity demand, necessitating continuous investment in new power generation facilities.

Import Market Analysis (Value & Volume):

- Key Drivers: Vietnam heavily imports specialized equipment and technology for power generation, including turbines, boilers, and advanced control systems. The Vietnam power plant equipment import market is substantial.

- Dominance Factors: The lack of domestic manufacturing capabilities for high-end power generation components makes import a necessity. Major international EPC players often manage these import logistics, influencing regional trade patterns. The value of these imports can run into hundreds of millions of USD annually.

Export Market Analysis (Value & Volume):

- Key Drivers: Vietnam's primary export in this sector is its EPC services expertise. While not exporting physical power generation assets, Vietnamese EPC companies are increasingly bidding for and securing projects in neighboring Southeast Asian countries.

- Dominance Factors: Companies like LILAMA Corporation have a proven track record and are leveraging this to expand their regional footprint, contributing to Vietnam's service export revenue. The Vietnam EPC services export market is nascent but growing.

Price Trend Analysis:

- Key Drivers: Global commodity prices (e.g., coal, natural gas), currency exchange rates, and the cost of specialized equipment significantly influence EPC project costs. The Vietnam power EPC pricing trends are subject to these global and local economic factors.

- Dominance Factors: The increasing demand for renewable energy, while reducing reliance on fossil fuels, introduces new pricing dynamics related to solar panel costs, wind turbine prices, and battery storage solutions. The cost of EPC services in Vietnam is competitive internationally, attracting investment.

Vietnam Power Generation EPC Industry Product Innovations

Product innovations in the Vietnam power generation EPC industry are heavily focused on enhancing efficiency, reducing environmental impact, and improving grid integration. The advent of advanced gas turbine technology offers higher thermal efficiencies for LNG power plants, reducing fuel consumption and emissions. For renewables, breakthroughs in photovoltaic cell efficiency and wind turbine blade design are leading to higher energy yields from smaller footprints. Furthermore, innovations in energy storage solutions, such as advanced battery systems and potentially green hydrogen technologies, are crucial for stabilizing the grid with intermittent renewable sources. The integration of digital twins and AI-driven predictive maintenance for power plants represents a significant leap in operational efficiency and asset longevity, ensuring reliable power delivery.

Propelling Factors for Vietnam Power Generation EPC Industry Growth

The Vietnam power generation EPC industry's growth is propelled by a confluence of potent factors. Economic growth and industrialization are creating an insatiable appetite for electricity, demanding continuous expansion of generation capacity. Government initiatives, including ambitious renewable energy targets and the development of Vietnam's first LNG power projects, are creating significant investment opportunities. Furthermore, increasing foreign direct investment (FDI) in Vietnam's manufacturing sector translates into higher energy demand and a need for reliable power infrastructure. Technological advancements, such as more efficient turbines and advanced grid management systems, are making new projects more viable and cost-effective. The Vietnam power market growth drivers are robust and multifaceted.

Obstacles in the Vietnam Power Generation EPC Industry Market

Despite its growth potential, the Vietnam power generation EPC industry faces several significant obstacles. Regulatory complexities and bureaucratic hurdles can often cause project delays and increase costs. The supply chain for specialized equipment can be vulnerable to global disruptions, impacting project timelines. Fierce competition among EPC contractors, both domestic and international, can lead to compressed profit margins. Securing adequate and timely project financing for large-scale power infrastructure remains a critical challenge. Furthermore, the transition to new energy sources, like LNG power plant construction, requires significant investment in new infrastructure and skilled labor, presenting an additional hurdle.

Future Opportunities in Vietnam Power Generation EPC Industry

The future of the Vietnam power generation EPC industry is brimming with opportunities. The ongoing energy transition in Vietnam presents a vast landscape for renewable energy projects, particularly offshore wind and advanced solar technologies. The development of LNG import infrastructure and the subsequent LNG power plant construction will be a major growth area, requiring significant EPC expertise. The modernization of the existing power grid to accommodate higher penetration of renewables and smart grid technologies offers substantial project potential. Furthermore, the increasing focus on energy efficiency solutions and the exploration of distributed energy resources will open new avenues for EPC contractors. The Vietnam solar EPC market opportunities and Vietnam wind EPC market opportunities are particularly significant.

Major Players in the Vietnam Power Generation EPC Industry Ecosystem

- LILAMA Corporation

- PALMA VIET NAM

- Doosan Heavy Industries Construction Co Ltd

- Toshiba Corp

- AES Corporation

- IHI Corp

- JGC HOLDINGS CORPORATION

- CTCI Corporation

Key Developments in Vietnam Power Generation EPC Industry Industry

- March 2022: Samsung C&T and Lilama secured an engineering, procurement, and construction (EPC) contract worth VND 24.14 billion (USD1.04 billion) from PetroVietnam Power for the 1.5 GW Nhon Trach 3&4 power plant in Vietnam. The project is expected to be commissioned during the 2023-2024 period. Nhon Trach 3&4 is Vietnam's first liquefied natural gas (LNG) fueled power plant.

- December 2021: The Power Project Management Board contracted Risen Energy Co. Ltd and Tasco Joint Stock Company for the EPC (engineering, procurement, construction) contract for Phuoc Thai 2 and Phuoc Thai 3 Solar Power Plant Projects. The projects would have installed capacities of 100MWp and 50MWp, respectively.

Strategic Vietnam Power Generation EPC Industry Market Forecast

The strategic forecast for the Vietnam Power Generation EPC industry anticipates robust growth, fueled by the nation's unwavering commitment to energy security and decarbonization. The increasing demand for clean energy, coupled with significant government backing for renewable energy development and the introduction of LNG-powered electricity generation, will drive substantial investment in new capacity. The forecast period (2025-2033) is expected to witness an acceleration in the construction of large-scale solar farms, onshore and offshore wind power projects, and the critical LNG terminal and power plant infrastructure. Continued advancements in technology will enhance project efficiency and sustainability, while favorable regulatory frameworks will attract both domestic and international players, solidifying Vietnam's position as a key market for power generation EPC services. The Vietnam power generation market forecast indicates sustained expansion.

Vietnam Power Generation EPC Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Power Generation EPC Industry Segmentation By Geography

- 1. Vietnam

Vietnam Power Generation EPC Industry Regional Market Share

Geographic Coverage of Vietnam Power Generation EPC Industry

Vietnam Power Generation EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Thermal Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Power Generation EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LILAMA Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PALMA VIET NAM

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Doosan Heavy Industries Construction Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AES Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IHI Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JGC HOLDINGS CORPORATION*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CTCI Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 LILAMA Corporation

List of Figures

- Figure 1: Vietnam Power Generation EPC Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Vietnam Power Generation EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Power Generation EPC Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Vietnam Power Generation EPC Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Vietnam Power Generation EPC Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Vietnam Power Generation EPC Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Vietnam Power Generation EPC Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Vietnam Power Generation EPC Industry Revenue million Forecast, by Region 2020 & 2033

- Table 7: Vietnam Power Generation EPC Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Vietnam Power Generation EPC Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Vietnam Power Generation EPC Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Vietnam Power Generation EPC Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Vietnam Power Generation EPC Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Vietnam Power Generation EPC Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Power Generation EPC Industry?

The projected CAGR is approximately 2.88%.

2. Which companies are prominent players in the Vietnam Power Generation EPC Industry?

Key companies in the market include LILAMA Corporation, PALMA VIET NAM, Doosan Heavy Industries Construction Co Ltd, Toshiba Corp, AES Corporation, IHI Corp, JGC HOLDINGS CORPORATION*List Not Exhaustive, CTCI Corporation.

3. What are the main segments of the Vietnam Power Generation EPC Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 947 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Thermal Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

March 2022: Samsung C&T and Lilama secured an engineering, procurement, and construction (EPC) contract worth VND 24.14 billion (USD1.04 billion) from PetroVietnam Power for the 1.5 GW Nhon Trach 3&4 power plant in Vietnam. The project is expected to be commissioned during the 2023-2024 period. Nhon Trach 3&4 is Vietnam's first liquefied natural gas (LNG) fueled power plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Power Generation EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Power Generation EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Power Generation EPC Industry?

To stay informed about further developments, trends, and reports in the Vietnam Power Generation EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence