Key Insights

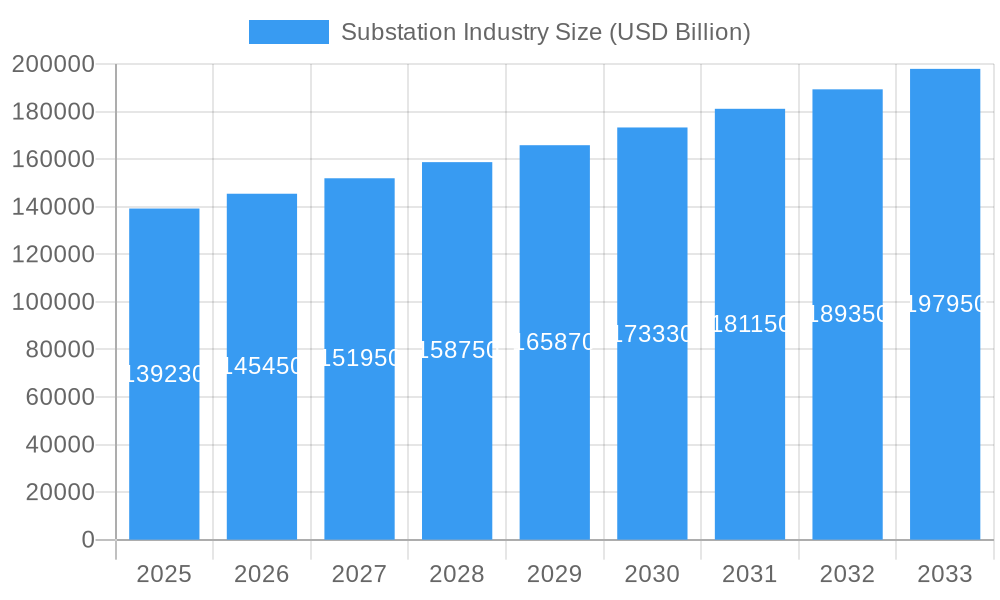

The global Substation Industry is poised for robust growth, projected to reach $139.23 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.50%. This expansion is primarily driven by the escalating demand for electricity fueled by rapid urbanization, industrialization, and the increasing adoption of renewable energy sources. Governments worldwide are investing heavily in upgrading aging grid infrastructure and expanding transmission and distribution networks to enhance reliability and meet growing power demands. The burgeoning smart grid initiatives, which integrate advanced technologies like IoT, AI, and automation, are further propelling the market forward. These smart substations offer improved operational efficiency, predictive maintenance capabilities, and enhanced grid stability, making them a key focus for industry players. Furthermore, the ongoing transition towards cleaner energy, including solar and wind power, necessitates significant investment in substation infrastructure to facilitate the integration of these intermittent sources into the main grid.

Substation Industry Market Size (In Billion)

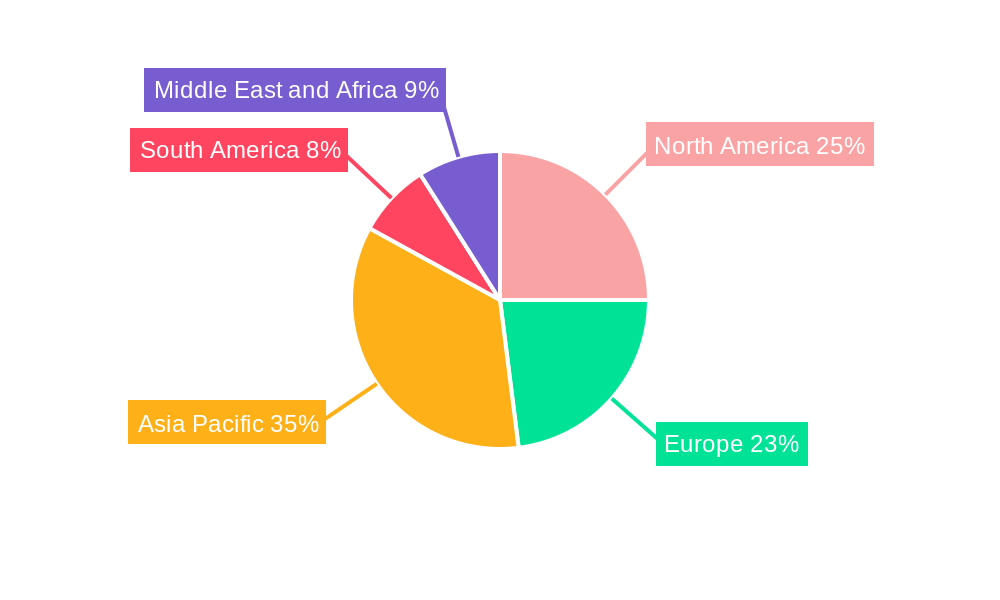

The market is segmented by voltage into High, Medium, and Low, with High Voltage substations representing a substantial share due to their critical role in long-distance power transmission. Application-wise, Power Utilities dominate the market, followed by Commercial & Industrial sectors, and other applications. Geographically, the Asia Pacific region is expected to witness the fastest growth, driven by rapid economic development, a growing population, and substantial government investments in power infrastructure. North America and Europe, with their mature markets, are focused on modernizing existing infrastructure and adopting smart grid technologies. Key players like Siemens AG, ABB Ltd, and General Electric Company are at the forefront of innovation, offering advanced substation solutions and technologies. The industry also faces challenges such as high initial investment costs and complex regulatory frameworks, but the overarching trend towards grid modernization and decarbonization presents significant opportunities for sustained market expansion.

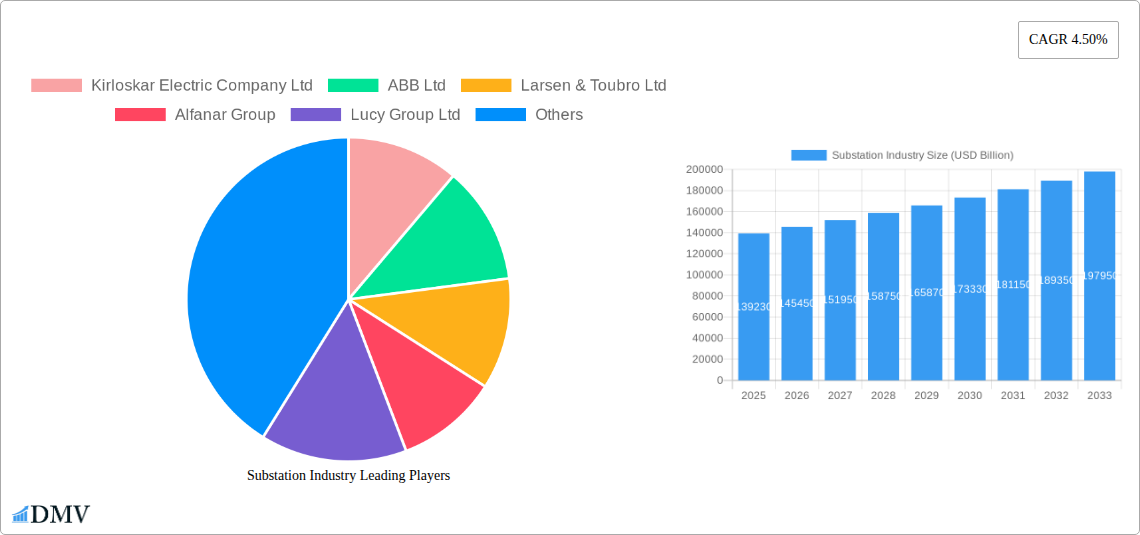

Substation Industry Company Market Share

Dive into the dynamic world of the substation industry with this comprehensive market report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides critical insights into market composition, trends, and a detailed forecast for the global substation market. Explore key segments including voltage levels (High, Medium, Low) and applications (Power Utilities, Commercial & Industrial, Other Applications). Discover the strategies of industry giants such as Siemens AG, ABB Ltd, General Electric Company, Schneider Electric SE, Larsen & Toubro Ltd, Eaton Corporation PLC, Kirloskar Electric Company Ltd, Alfanar Group, and Lucy Group Ltd. Understand the driving forces behind market evolution, technological innovations, regional dominance, and future opportunities shaping this vital sector. This report is essential for stakeholders seeking to navigate the evolving substation landscape, capitalize on growth opportunities, and make informed strategic decisions in the coming decade.

Substation Industry Market Composition & Trends

The global substation market, projected to reach substantial figures in the coming years, is characterized by a moderately concentrated landscape with key players like Siemens AG, ABB Ltd, and General Electric Company holding significant sway. Innovation is a primary catalyst, driven by continuous investments in smart grid technologies and advanced automation solutions. The regulatory environment plays a crucial role, with government initiatives in regions like North America and Europe fostering grid modernization and the adoption of renewable energy integration. Substitute products, while emerging in niche applications, have not significantly eroded the core market share of traditional substations. End-user profiles are diverse, with Power Utilities representing the largest segment, followed by Commercial & Industrial sectors and other specialized applications. Mergers and Acquisitions (M&A) activity is a notable trend, with strategic consolidation aimed at expanding market reach and technological capabilities. For instance, recent M&A deals in the substation automation sector have seen values in the range of hundreds of millions to over a billion USD, reflecting a strong drive towards integration and synergy. The market share distribution among top players is dynamic, with an estimated XX% held by the top five companies, showcasing a competitive yet evolving ecosystem.

Substation Industry Industry Evolution

The substation industry has undergone a significant transformation over the historical period of 2019–2024, and its evolution is set to accelerate dramatically through the forecast period of 2025–2033. Driven by the escalating global demand for electricity, the imperative for grid modernization, and the widespread integration of renewable energy sources, the market is poised for robust growth. During the historical period, the market witnessed an average annual growth rate of approximately X.XX%, a trend anticipated to continue and potentially exceed Y.YY% during the forecast period. Technological advancements have been at the forefront of this evolution. The shift from traditional, analog substations to digital and smart substations is a defining characteristic. Increased adoption of advanced technologies such as IoT sensors, artificial intelligence (AI) for predictive maintenance, and enhanced cybersecurity measures are becoming standard. Consumer demands are also evolving; utilities are seeking more reliable, resilient, and efficient power delivery systems capable of handling bidirectional power flow and variable renewable generation. This has spurred investments in flexible AC transmission systems (FACTS) and flexible DC transmission systems (FDC) within substations. Furthermore, the increasing electrification of transportation and industries necessitates upgraded and expanded substation infrastructure. The estimated market size in the base year of 2025 is valued at over XXX Billion USD, with projections indicating a rise to over YYY Billion USD by 2033, underscoring the significant expansion trajectory of this critical sector.

Leading Regions, Countries, or Segments in Substation Industry

North America currently dominates the global substation industry, driven by substantial investments in grid modernization, an aging infrastructure requiring upgrades, and strong government support for renewable energy integration. The United States, in particular, is a powerhouse, accounting for a significant portion of the market share due to its extensive electricity network and ongoing smart grid initiatives. The demand for High Voltage substations is particularly pronounced here, supporting long-distance transmission and the integration of large-scale solar and wind farms.

- North America (Dominant Region): Key drivers include the U.S. government's focus on grid resiliency and the Biden administration's clean energy agenda, which directly translates into substation infrastructure development. Canada also contributes significantly with its own renewable energy targets. The market size in North America is estimated at over XX Billion USD in 2025.

- Europe (Strong Contender): European countries like Germany, the UK, and France are actively investing in upgrading their electrical grids to accommodate a higher penetration of renewable energy sources. The European Green Deal further incentivizes this development. The focus here is on Medium Voltage substations for distributed generation and smart grid solutions.

- Asia Pacific (Fastest Growing Region): Countries like China and India are experiencing rapid industrialization and urbanization, leading to a massive increase in electricity demand. Significant investments are being made in both High and Medium Voltage substations to expand grid capacity and improve reliability. The region's market size is projected to grow at the fastest CAGR of approximately Z.ZZ% during the forecast period.

- Voltage Segments:

- High Voltage: Dominant in regions with extensive transmission networks and large-scale renewable projects, enabling efficient long-distance power transfer.

- Medium Voltage: Crucial for distribution networks, serving industrial and commercial areas, and integrating distributed energy resources. This segment is witnessing rapid growth due to its flexibility and applicability in urban environments.

- Low Voltage: Primarily serves residential and small commercial applications, with increasing demand for smart metering and localized energy storage integration.

- Application Segments:

- Power Utilities: The largest and most consistent segment, encompassing transmission and distribution substations, driven by grid expansion and modernization efforts.

- Commercial & Industrial: Growing demand from data centers, manufacturing facilities, and large commercial complexes requiring reliable and efficient power supply.

- Other Applications: Includes specialized substations for railways, mining, and oil & gas industries, often requiring customized solutions.

Substation Industry Product Innovations

Product innovations in the substation industry are rapidly transforming grid operations. Advancements in digital substation technologies, including intelligent electronic devices (IEDs), fiber-optic communication networks, and digital substations with enhanced monitoring and control capabilities, are at the forefront. These innovations offer unprecedented levels of automation, real-time data analytics for predictive maintenance, and improved fault detection, leading to enhanced reliability and reduced downtime. Furthermore, the development of modular and compact substation designs is addressing space constraints and facilitating faster deployment. The unique selling proposition of these innovations lies in their ability to improve grid efficiency, safety, and resilience, while also paving the way for seamless integration of renewable energy sources and electric vehicles. Performance metrics such as reduced operational costs, enhanced asset lifespan, and improved power quality are key indicators of these technological strides.

Propelling Factors for Substation Industry Growth

Several key factors are propelling the growth of the substation industry. Government initiatives promoting grid modernization, including smart grid deployment and the integration of renewable energy sources, are a significant driver. Increased investments in research and development by leading companies are fostering the creation of advanced substation technologies, such as AI-powered analytics and enhanced cybersecurity solutions. The growing demand for electricity due to industrial expansion, urbanization, and the electrification of transportation necessitates the expansion and upgrading of substation infrastructure. Furthermore, strategic partnerships between utilities and technology providers are accelerating the adoption of innovative solutions and ensuring the efficient deployment of new technologies. Economic recovery and increased capital expenditure by utilities worldwide are also contributing to market expansion.

Obstacles in the Substation Industry Market

Despite robust growth, the substation industry faces several obstacles. High upfront capital investment for new substation construction and upgrades can be a significant barrier, especially in developing economies. Stringent regulatory compliance and lengthy approval processes can also slow down project timelines. Supply chain disruptions, particularly for specialized components and raw materials, can lead to project delays and increased costs. Furthermore, the increasing cybersecurity threats pose a constant challenge, requiring continuous investment in robust security measures. Intense competition among established players and emerging market entrants also exerts pressure on pricing and profit margins, demanding continuous innovation and efficiency improvements.

Future Opportunities in Substation Industry

Emerging opportunities in the substation industry are abundant, driven by the global energy transition and technological advancements. The rapid growth of renewable energy sources, such as solar and wind power, presents a significant opportunity for expanding and upgrading substations to accommodate their integration. The increasing adoption of electric vehicles (EVs) necessitates the development of charging infrastructure and grid upgrades, creating demand for new substation designs. The ongoing digitalization of the grid, leading to the concept of "smart substations," opens avenues for providing advanced analytics, remote monitoring, and predictive maintenance services. Furthermore, opportunities exist in developing countries with nascent power infrastructure, requiring substantial investment in new substation construction. The focus on grid resilience and the need to withstand extreme weather events also drives demand for advanced and robust substation solutions.

Major Players in the Substation Industry Ecosystem

- Siemens AG

- ABB Ltd

- General Electric Company

- Schneider Electric SE

- Larsen & Toubro Ltd

- Eaton Corporation PLC

- Kirloskar Electric Company Ltd

- Alfanar Group

- Lucy Group Ltd

- C&S Electric Limited

Key Developments in Substation Industry Industry

- Strategic Partnerships: In 2023, Siemens AG partnered with a major European utility to deploy advanced digital substation solutions, enhancing grid flexibility and reliability.

- R&D Investments: In Q1 2024, ABB Ltd announced significant investments in R&D for next-generation substation automation technologies, focusing on AI-driven diagnostics and predictive maintenance.

- Government Initiatives: In 2023, the U.S. Department of Energy launched a new grant program to fund grid modernization projects, encouraging the adoption of advanced substation technologies.

- M&A Activity: In late 2023, a prominent private equity firm acquired a specialized substation component manufacturer, signaling ongoing consolidation in the sector.

- Digitalization & Automation: Throughout 2023–2024, numerous utilities globally have accelerated the rollout of digital substation components and automated control systems to improve operational efficiency and response times.

Strategic Substation Industry Market Forecast

The substation industry is set for substantial growth, driven by the imperative for grid modernization, the integration of renewable energy, and the increasing global demand for electricity. Forecasts indicate a Compound Annual Growth Rate (CAGR) of approximately X.XX% from 2025 to 2033, with the market reaching an estimated value of over YYY Billion USD by the end of the forecast period. Key growth catalysts include ongoing government initiatives promoting sustainable energy, significant investments in R&D for smart and digital substations, and the continuous expansion of electrical networks to meet growing energy needs. The increasing focus on grid resilience and the proactive response to cybersecurity threats will further fuel demand for advanced and robust substation solutions. This evolving landscape presents lucrative opportunities for stakeholders looking to invest and innovate in this critical infrastructure sector.

Substation Industry Segmentation

-

1. Voltage

- 1.1. High

- 1.2. Medium

- 1.3. Low

-

2. Application

- 2.1. Power Utilities

- 2.2. Commercial & Industrial

- 2.3. Other Applications

Substation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Substation Industry Regional Market Share

Geographic Coverage of Substation Industry

Substation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Energy Demand4.; Renewable Energy Transition

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing out of Conventional Sources of Electricity

- 3.4. Market Trends

- 3.4.1. Power Utilities Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Substation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. High

- 5.1.2. Medium

- 5.1.3. Low

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Utilities

- 5.2.2. Commercial & Industrial

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. North America Substation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. High

- 6.1.2. Medium

- 6.1.3. Low

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Utilities

- 6.2.2. Commercial & Industrial

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. Europe Substation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. High

- 7.1.2. Medium

- 7.1.3. Low

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Utilities

- 7.2.2. Commercial & Industrial

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Asia Pacific Substation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. High

- 8.1.2. Medium

- 8.1.3. Low

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Utilities

- 8.2.2. Commercial & Industrial

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. South America Substation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 9.1.1. High

- 9.1.2. Medium

- 9.1.3. Low

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Utilities

- 9.2.2. Commercial & Industrial

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 10. Middle East and Africa Substation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Voltage

- 10.1.1. High

- 10.1.2. Medium

- 10.1.3. Low

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Power Utilities

- 10.2.2. Commercial & Industrial

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Voltage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kirloskar Electric Company Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Larsen & Toubro Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alfanar Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lucy Group Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schneider Electric SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eaton Corporation PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 C&S Electric Limited*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Siemens AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Kirloskar Electric Company Ltd

List of Figures

- Figure 1: Global Substation Industry Revenue Breakdown (USD Billion, %) by Region 2025 & 2033

- Figure 2: North America Substation Industry Revenue (USD Billion), by Voltage 2025 & 2033

- Figure 3: North America Substation Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 4: North America Substation Industry Revenue (USD Billion), by Application 2025 & 2033

- Figure 5: North America Substation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Substation Industry Revenue (USD Billion), by Country 2025 & 2033

- Figure 7: North America Substation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Substation Industry Revenue (USD Billion), by Voltage 2025 & 2033

- Figure 9: Europe Substation Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 10: Europe Substation Industry Revenue (USD Billion), by Application 2025 & 2033

- Figure 11: Europe Substation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Substation Industry Revenue (USD Billion), by Country 2025 & 2033

- Figure 13: Europe Substation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Substation Industry Revenue (USD Billion), by Voltage 2025 & 2033

- Figure 15: Asia Pacific Substation Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 16: Asia Pacific Substation Industry Revenue (USD Billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Substation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Substation Industry Revenue (USD Billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Substation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Substation Industry Revenue (USD Billion), by Voltage 2025 & 2033

- Figure 21: South America Substation Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 22: South America Substation Industry Revenue (USD Billion), by Application 2025 & 2033

- Figure 23: South America Substation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Substation Industry Revenue (USD Billion), by Country 2025 & 2033

- Figure 25: South America Substation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Substation Industry Revenue (USD Billion), by Voltage 2025 & 2033

- Figure 27: Middle East and Africa Substation Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 28: Middle East and Africa Substation Industry Revenue (USD Billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Substation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Substation Industry Revenue (USD Billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Substation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Substation Industry Revenue USD Billion Forecast, by Voltage 2020 & 2033

- Table 2: Global Substation Industry Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 3: Global Substation Industry Revenue USD Billion Forecast, by Region 2020 & 2033

- Table 4: Global Substation Industry Revenue USD Billion Forecast, by Voltage 2020 & 2033

- Table 5: Global Substation Industry Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 6: Global Substation Industry Revenue USD Billion Forecast, by Country 2020 & 2033

- Table 7: Global Substation Industry Revenue USD Billion Forecast, by Voltage 2020 & 2033

- Table 8: Global Substation Industry Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 9: Global Substation Industry Revenue USD Billion Forecast, by Country 2020 & 2033

- Table 10: Global Substation Industry Revenue USD Billion Forecast, by Voltage 2020 & 2033

- Table 11: Global Substation Industry Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 12: Global Substation Industry Revenue USD Billion Forecast, by Country 2020 & 2033

- Table 13: Global Substation Industry Revenue USD Billion Forecast, by Voltage 2020 & 2033

- Table 14: Global Substation Industry Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 15: Global Substation Industry Revenue USD Billion Forecast, by Country 2020 & 2033

- Table 16: Global Substation Industry Revenue USD Billion Forecast, by Voltage 2020 & 2033

- Table 17: Global Substation Industry Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 18: Global Substation Industry Revenue USD Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Substation Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Substation Industry?

Key companies in the market include Kirloskar Electric Company Ltd, ABB Ltd, Larsen & Toubro Ltd, Alfanar Group, Lucy Group Ltd, Schneider Electric SE, Eaton Corporation PLC, General Electric Company, C&S Electric Limited*List Not Exhaustive, Siemens AG.

3. What are the main segments of the Substation Industry?

The market segments include Voltage, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.23 USD Billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Energy Demand4.; Renewable Energy Transition.

6. What are the notable trends driving market growth?

Power Utilities Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Phasing out of Conventional Sources of Electricity.

8. Can you provide examples of recent developments in the market?

Strategic partnerships between utilities and technology providers

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Substation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Substation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Substation Industry?

To stay informed about further developments, trends, and reports in the Substation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence