Key Insights

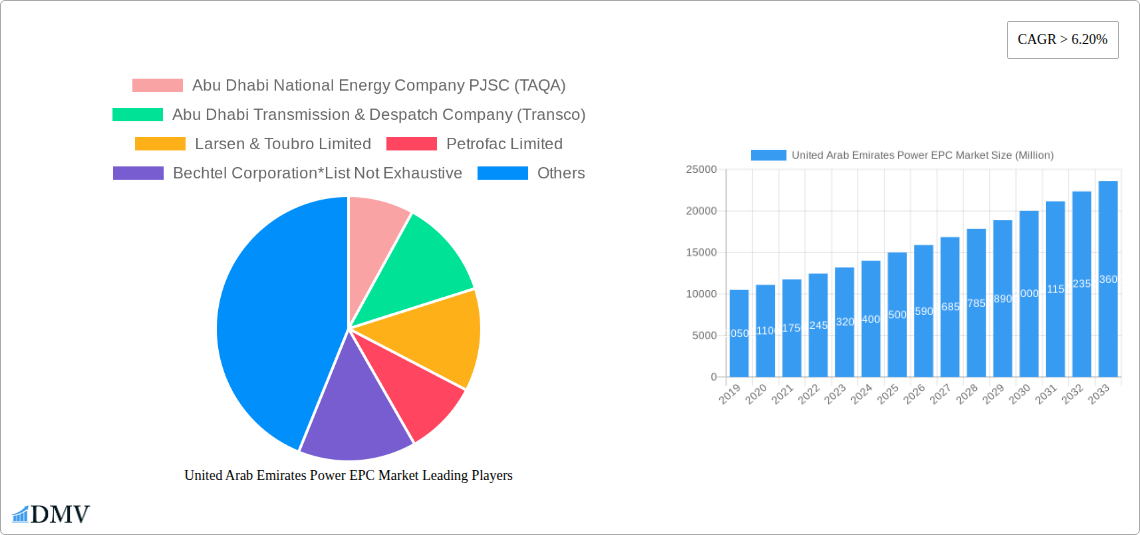

The United Arab Emirates Power EPC Market is forecast to reach USD 34.18 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.43% through 2033. This growth is propelled by strategic government initiatives focused on energy diversification, grid enhancement, and meeting escalating electricity demand. The nation's commitment to renewable energy, particularly solar power, is attracting substantial investment in solar farms and associated infrastructure. Continued development in advanced thermal power generation also contributes to market dynamism, driven by energy security objectives and a vision for a sustainable future.

United Arab Emirates Power EPC Market Market Size (In Billion)

The market sees significant investment in new power generation capacity and the modernization of existing infrastructure. While renewable energy projects, especially solar, are prominent, the expansion and upgrading of transmission and distribution networks are crucial for reliable power delivery. Key players include Abu Dhabi National Energy Company (TAQA), Dubai Electricity and Water Authority (DEWA), Larsen & Toubro, and ACWA Power. Potential challenges include fluctuating raw material costs, the need for skilled labor, and grid integration of intermittent renewables. However, a supportive regulatory environment and a commitment to energy transition are expected to sustain market growth.

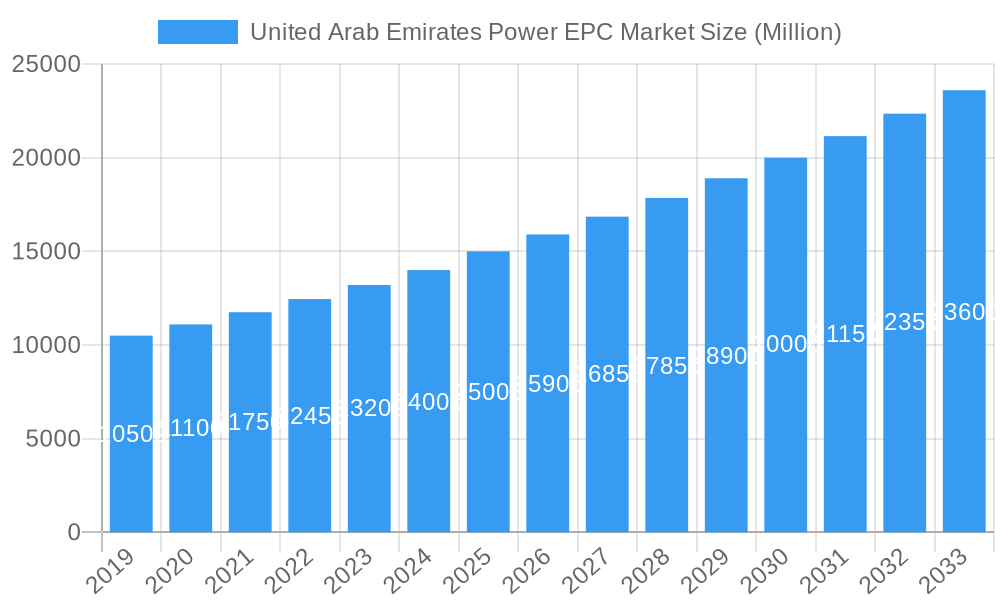

United Arab Emirates Power EPC Market Company Market Share

The United Arab Emirates Power EPC Market features a dynamic mix of established and emerging players, driven by the nation's ambitious energy transition goals. Market concentration is influenced by major state-owned entities and prominent international EPC contractors. Innovation is spurred by the rapid adoption of renewable energy technologies and smart grid development. A supportive regulatory landscape encourages investment in clean energy and grid modernization. Emerging solutions in distributed generation and energy storage offer alternatives to traditional power plants. End-users include government utilities, large industrial conglomerates, real estate developers, and commercial enterprises focused on sustainability. Mergers and acquisitions are a significant trend, with strategic alliances aimed at consolidating market share and expanding service offerings. Deal values in M&A are projected to be in the hundreds of millions. Key market share holders include Abu Dhabi National Energy Company PJSC (TAQA) and Dubai Electricity and Water Authority (DEWA), alongside global firms like Larsen & Toubro Limited and Petrofac Limited.

United Arab Emirates Power EPC Market Industry Evolution

The United Arab Emirates Power EPC Market has undergone a significant evolution, transforming from a predominantly fossil fuel-dependent infrastructure to a forward-looking sector embracing diversification and sustainability. This trajectory is underpinned by a clear vision to achieve energy security while simultaneously reducing carbon emissions and positioning the UAE as a leader in renewable energy adoption. Over the historical period from 2019–2024, the market witnessed steady growth driven by substantial investments in both conventional power generation and the nascent stages of renewable energy projects. The base year, 2025, marks a pivotal point where the shift towards cleaner energy sources becomes more pronounced, fueled by government targets and international commitments.

Technological advancements have been a constant theme, with the EPC sector continuously adapting to incorporate cutting-edge solutions. This includes the implementation of advanced gas turbine technologies for thermal power generation, enhancing efficiency and reducing emissions. Simultaneously, the renewable energy segment has seen rapid advancements in solar photovoltaic (PV) technology, including the deployment of bifacial solar panels and innovative tracking systems, leading to increased energy yield and reduced levelized cost of electricity (LCOE). The integration of battery energy storage systems (BESS) with renewable power plants is also becoming increasingly prevalent, addressing intermittency challenges and improving grid stability.

Shifting consumer demands, primarily influenced by environmental consciousness and the pursuit of cost savings, have further propelled this evolution. Utilities and industrial consumers are actively seeking more sustainable and cost-effective energy solutions. This has led to an increased demand for Engineering, Procurement, and Construction (EPC) services that can deliver projects incorporating a higher percentage of renewable energy. The forecast period from 2025–2033 is expected to witness accelerated growth, with renewable energy sources such as solar and potentially nuclear power playing an increasingly dominant role. The Transmission & Distribution segment is also experiencing significant upgrades and expansion to accommodate the evolving generation mix and enhance grid resilience. The market’s growth trajectory is expected to average a compound annual growth rate (CAGR) of approximately 7-9% during the forecast period, reaching an estimated market size of over $30,000 million by 2033. This growth is directly correlated with the aggressive renewable energy targets and the continuous need for power infrastructure upgrades.

Leading Regions, Countries, or Segments in United Arab Emirates Power EPC Market

The United Arab Emirates Power EPC Market is a testament to focused national development strategies, with the Generation-Source: Renewable segment emerging as a clear leader, driven by substantial governmental impetus and global decarbonization trends. While Generation-Source: Thermal continues to be a significant contributor, its dominance is progressively yielding to the rapid expansion of solar and, to a lesser extent, other renewable sources. Transmission & Distribution infrastructure development remains crucial, acting as the backbone for integrating new generation capacities, but the sheer volume of new project announcements and investments in renewable energy capacity positions it as the primary growth engine.

Key Drivers for Renewable Segment Dominance:

- Ambitious National Targets: The UAE has set aggressive targets for renewable energy integration, most notably the Dubai Clean Energy Strategy 2050 aiming for 75% clean energy by 2050 and the UAE Energy Strategy 2050 aiming for 50% clean energy by 2050. These targets translate directly into significant EPC opportunities for renewable power projects, particularly solar PV.

- Decreasing LCOE of Solar PV: The cost-competitiveness of solar photovoltaic technology has made it an economically attractive option, surpassing the operational costs of traditional power sources in many instances. This has spurred massive investment in utility-scale solar farms.

- Governmental Support and Incentives: Policymakers have actively fostered an environment conducive to renewable energy investment through favorable regulations, land allocation, and power purchase agreements (PPAs) that offer long-term price stability.

- International Collaboration and Investment: The UAE is attracting significant international investment and expertise in the renewable energy sector, further accelerating project development and EPC execution. Companies like ACWA Power have been instrumental in developing some of the world's largest solar projects in the region.

The dominance of the renewable segment is further evidenced by the continuous pipeline of mega-projects. For instance, the Mohammed bin Rashid Al Maktoum Solar Park in Dubai is a prime example, continuously expanding its capacity and driving demand for specialized EPC contractors. This segment's dominance is not just about installed capacity but also about the technological innovation and specialized expertise required for its development and execution. The EPC contractors operating within this segment are increasingly focusing on advanced solar technologies, including bifacial panels, floating solar arrays, and integrated energy storage solutions, thereby pushing the boundaries of power generation technology in the region. The Transmission & Distribution segment, while not experiencing the same explosive growth rate in terms of new capacity announcements as renewables, remains a vital area for continuous investment. Upgrades and expansion of the transmission network are imperative to efficiently integrate the growing renewable energy generation and ensure grid stability and reliability, particularly with the intermittent nature of solar power.

United Arab Emirates Power EPC Market Product Innovations

Innovation in the United Arab Emirates Power EPC Market is predominantly focused on enhancing efficiency, sustainability, and grid integration. This includes the deployment of advanced solar PV modules with higher energy conversion efficiencies, such as bifacial panels that capture sunlight from both sides, significantly boosting energy yield. Furthermore, integrated battery energy storage systems (BESS) are increasingly becoming a standard offering, enabling better grid management, peak shaving, and reliable power supply from intermittent renewable sources. Intelligent grid management systems, leveraging AI and IoT, are also a key innovation, optimizing power distribution and reducing transmission losses. These advancements offer unique selling propositions of improved ROI, enhanced grid stability, and a reduced environmental footprint for power generation projects.

Propelling Factors for United Arab Emirates Power EPC Market Growth

The United Arab Emirates Power EPC Market is propelled by several key factors:

- Aggressive Renewable Energy Targets: The UAE's commitment to significantly increase its renewable energy share, particularly solar power, creates substantial demand for new power generation and associated infrastructure.

- Government Initiatives and Investment: Strong government backing through supportive policies, financial incentives, and strategic vision provides a stable and attractive investment climate for EPC projects.

- Technological Advancements: The continuous evolution of solar PV technology, energy storage solutions, and smart grid systems makes new projects more efficient, cost-effective, and environmentally sound.

- Growing Energy Demand: The nation's expanding population and economic growth necessitate continuous investment in power generation capacity and transmission infrastructure.

Obstacles in the United Arab Emirates Power EPC Market Market

Despite robust growth prospects, the United Arab Emirates Power EPC Market faces certain obstacles:

- Supply Chain Volatility: Global supply chain disruptions, particularly for critical components like solar panels and advanced materials, can lead to project delays and increased costs.

- Intense Competition: The market attracts numerous international and local EPC players, leading to price pressures and the need for highly competitive bidding, impacting profit margins.

- Skilled Workforce Availability: The demand for specialized engineering and construction expertise in renewable energy and advanced power technologies can outpace local availability, necessitating reliance on expatriate labor.

- Grid Integration Challenges: Integrating large-scale intermittent renewable energy sources into an already robust grid requires significant upgrades and sophisticated management systems, posing technical and financial hurdles.

Future Opportunities in United Arab Emirates Power EPC Market

The United Arab Emirates Power EPC Market presents compelling future opportunities:

- Expansion of Energy Storage Solutions: The increasing need for grid stability and reliability will drive significant demand for battery energy storage systems, offering substantial EPC opportunities.

- Green Hydrogen Development: The UAE's strategic focus on becoming a hub for green hydrogen production opens up new avenues for EPC services in developing the necessary infrastructure, including electrolyzers and associated power supply.

- Decentralized and Distributed Energy Systems: The growing interest in microgrids and distributed generation, especially for industrial and commercial applications, presents opportunities for smaller-scale, specialized EPC projects.

- Digitalization and Smart Grid Enhancements: Continued investment in smart grid technologies, AI-driven grid management, and IoT integration offers ongoing EPC work in upgrading and optimizing existing and new power infrastructure.

Major Players in the United Arab Emirates Power EPC Market Ecosystem

- Abu Dhabi National Energy Company PJSC (TAQA)

- Abu Dhabi Transmission & Despatch Company (Transco)

- Larsen & Toubro Limited

- Petrofac Limited

- Bechtel Corporation

- Dubai Electricity and Water Authority (DEWA)

- ACWA Power

Key Developments in United Arab Emirates Power EPC Market Industry

- 2023/2024: Continued awarding of large-scale solar PV projects, including significant expansions of existing solar parks, demonstrating ongoing commitment to renewable energy.

- 2023: Increased focus on integrating battery energy storage systems (BESS) into new and existing renewable energy projects to enhance grid stability.

- 2023: Announcement of ambitious targets for green hydrogen production and export, signaling the emergence of a new sector for EPC services.

- 2023: Major transmission and distribution network upgrades planned to accommodate increasing renewable energy generation and enhance grid resilience.

- 2023: Several international EPC firms secured contracts for advanced thermal power plant upgrades focused on efficiency and emission reduction.

Strategic United Arab Emirates Power EPC Market Market Forecast

The strategic forecast for the United Arab Emirates Power EPC Market points towards sustained and robust growth, primarily fueled by the nation's unwavering commitment to its renewable energy targets and energy diversification strategies. The forecast period of 2025–2033 is expected to witness a significant acceleration in project development within the solar PV sector, driven by technological advancements that continue to lower costs and improve efficiency. Furthermore, the burgeoning green hydrogen economy represents a substantial new frontier for EPC services, with the UAE positioning itself as a global leader in this nascent industry. The ongoing investments in transmission and distribution infrastructure, crucial for integrating these evolving generation sources, will also contribute significantly to market expansion. Overall, the market is projected to witness a compound annual growth rate (CAGR) of approximately 7-9%, driven by innovation, supportive government policies, and increasing global demand for sustainable energy solutions.

United Arab Emirates Power EPC Market Segmentation

-

1. Generation-Source

- 1.1. Thermal

- 1.2. Renewable

- 1.3. Others

- 2. Transmission & Distribution

United Arab Emirates Power EPC Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Power EPC Market Regional Market Share

Geographic Coverage of United Arab Emirates Power EPC Market

United Arab Emirates Power EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Urbanization and Infrastructure Development4.; Increasing Renewable Power Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Grid Infrastructure Challenges

- 3.4. Market Trends

- 3.4.1. Growth in Renewable Energy Sector to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Power EPC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Generation-Source

- 5.1.1. Thermal

- 5.1.2. Renewable

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Transmission & Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Generation-Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abu Dhabi National Energy Company PJSC (TAQA)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abu Dhabi Transmission & Despatch Company (Transco)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Larsen & Toubro Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petrofac Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bechtel Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dubai Electricity and Water Authority (DEWA)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACWA Power

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Abu Dhabi National Energy Company PJSC (TAQA)

List of Figures

- Figure 1: United Arab Emirates Power EPC Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Power EPC Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Power EPC Market Revenue billion Forecast, by Generation-Source 2020 & 2033

- Table 2: United Arab Emirates Power EPC Market Revenue billion Forecast, by Transmission & Distribution 2020 & 2033

- Table 3: United Arab Emirates Power EPC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United Arab Emirates Power EPC Market Revenue billion Forecast, by Generation-Source 2020 & 2033

- Table 5: United Arab Emirates Power EPC Market Revenue billion Forecast, by Transmission & Distribution 2020 & 2033

- Table 6: United Arab Emirates Power EPC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Power EPC Market?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the United Arab Emirates Power EPC Market?

Key companies in the market include Abu Dhabi National Energy Company PJSC (TAQA), Abu Dhabi Transmission & Despatch Company (Transco), Larsen & Toubro Limited, Petrofac Limited, Bechtel Corporation*List Not Exhaustive, Dubai Electricity and Water Authority (DEWA), ACWA Power.

3. What are the main segments of the United Arab Emirates Power EPC Market?

The market segments include Generation-Source, Transmission & Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.18 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Urbanization and Infrastructure Development4.; Increasing Renewable Power Generation.

6. What are the notable trends driving market growth?

Growth in Renewable Energy Sector to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Grid Infrastructure Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Power EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Power EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Power EPC Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Power EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence