Key Insights

The North American Clean Energy Market is projected for significant expansion, with an estimated market size of $1602 billion and a Compound Annual Growth Rate (CAGR) of 14.7% from the 2025 base year through 2033. This growth is driven by a regional commitment to decarbonization, supported by supportive government policies, increasing investor confidence in renewable technologies, and rising demand for sustainable energy. Key factors include the imperative to address climate change, evolving regulations favoring renewable energy, and technological advancements enhancing the cost-effectiveness and efficiency of solar, wind, and bioenergy. The energy transition is further accelerated by substantial investments in grid modernization and energy storage solutions, critical for integrating intermittent renewable sources.

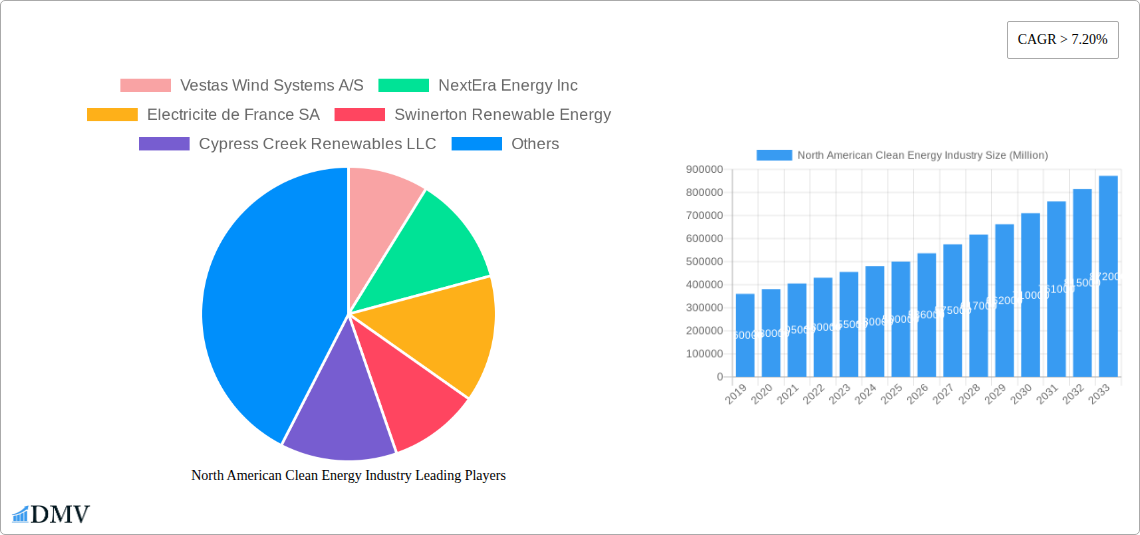

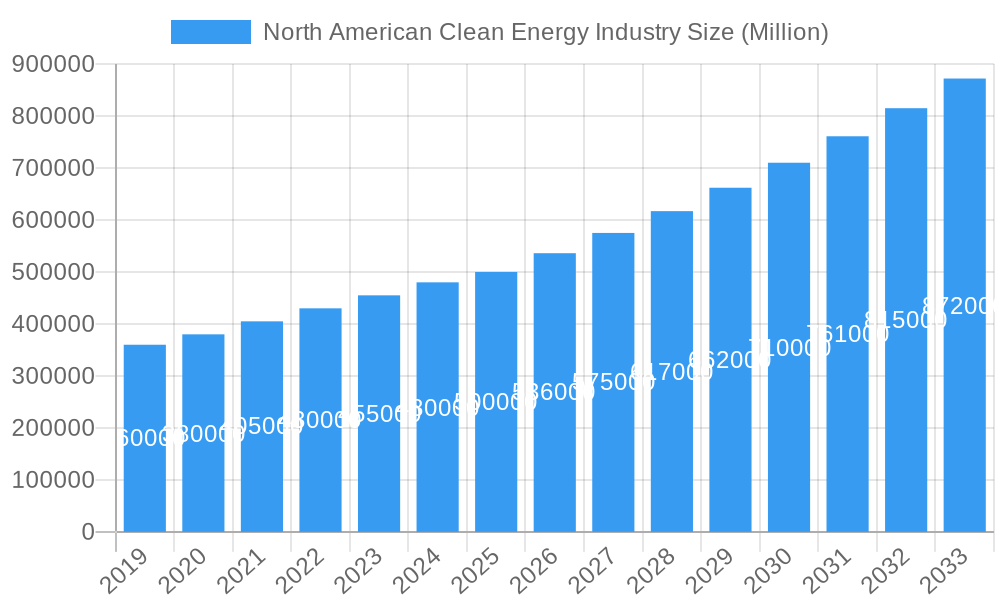

North American Clean Energy Industry Market Size (In Million)

Key trends in the North American clean energy sector include the growing adoption of hybrid renewable energy systems for improved reliability and optimized power generation. Innovations in smart grid technologies and distributed energy resources are decentralizing energy production and enhancing grid resilience. The market is also experiencing a rise in corporate power purchase agreements (PPAs) as businesses pursue renewable energy to meet sustainability objectives. While supply chain disruptions and substantial upfront capital investment pose challenges, they are being mitigated by innovative financing and strategic partnerships. The market is segmented by energy source: Hydro, Solar, Wind, Bioenergy, and Others. Solar and Wind are anticipated to lead growth, with substantial infrastructure development across Canada, the United States, and the broader North American region. Industry leaders such as Vestas Wind Systems, NextEra Energy, and General Electric are pioneering innovation and expanding market presence.

North American Clean Energy Industry Company Market Share

North American Clean Energy Industry: Market Insights and Future Outlook 2024-2033

Unlock comprehensive insights into the dynamic North American clean energy industry. This in-depth report, covering the period from 2019 to 2033 with a base and estimated year of 2025, delves into market composition, industry evolution, regional dominance, technological innovations, growth drivers, challenges, and future opportunities. Gain a strategic advantage with analysis of leading companies, pivotal industry developments, and a robust market forecast. Essential for investors, policymakers, and businesses navigating the accelerating clean energy transition across Canada and the United States.

North American Clean Energy Industry Market Composition & Trends

The North American clean energy market exhibits a dynamic and evolving composition, driven by a confluence of technological innovation, supportive regulatory frameworks, and escalating sustainability mandates. Market concentration varies across segments, with solar and wind power leading in installed capacity and investment. Innovation catalysts are primarily fueled by advancements in energy storage solutions, grid modernization technologies, and more efficient renewable energy generation methods. The regulatory landscape, particularly in the United States with the Inflation Reduction Act (IRA), plays a pivotal role in shaping investment flows and market expansion. Substitute products, such as advancements in natural gas efficiency or carbon capture technologies, are present but are increasingly overshadowed by the long-term economic and environmental advantages of renewables. End-user profiles are broadening beyond traditional utilities to include industrial corporations, commercial enterprises, and residential consumers actively seeking to reduce their carbon footprint and energy costs. Mergers and acquisitions (M&A) activity remains robust, with significant deal values indicating a consolidation trend and strategic positioning by major players to capture market share. For instance, recent M&A deals have focused on expanding utility-scale project portfolios and integrating renewable energy with battery storage. The estimated market share distribution for key segments like solar and wind is projected to shift, with solar expected to see accelerated growth due to declining costs and versatile applications.

North American Clean Energy Industry Industry Evolution

The North American clean energy industry has undergone a transformative evolution, charting a remarkable growth trajectory over the historical period of 2019–2024 and projecting continued expansion through 2033. This evolution is intrinsically linked to escalating global and national commitments to decarbonization, driving significant shifts in energy production and consumption patterns. Market growth trajectories have been consistently upward, buoyed by declining costs of renewable technologies, particularly solar photovoltaic (PV) and wind power. For example, the levelized cost of energy (LCOE) for solar PV has decreased by approximately 70% over the last decade, making it increasingly competitive with conventional energy sources. Technological advancements have been a cornerstone of this evolution. Innovations in turbine efficiency, bifacial solar panels, and advanced battery storage systems have not only improved performance but also enhanced the reliability and grid integration capabilities of renewable energy sources. The development of smart grid technologies is facilitating a more seamless integration of intermittent renewable power into the existing energy infrastructure. Furthermore, the adoption of electric vehicles (EVs) is creating a symbiotic relationship with the clean energy sector, increasing demand for electricity and incentivizing further renewable generation capacity. Consumer demands have also shifted significantly, with a growing preference for sustainable energy options driven by environmental awareness, corporate social responsibility initiatives, and the desire for greater energy independence. This shift is evident in the increasing number of green energy tariffs offered by utilities and the growing demand for behind-the-meter solar installations. Policy interventions, such as tax credits and renewable portfolio standards, have acted as powerful accelerators, stimulating investment and fostering market development. The recent Inflation Reduction Act in the United States, for instance, is expected to catalyze billions of dollars in new clean energy manufacturing and deployment. The overall evolution reflects a strategic pivot towards a more sustainable, resilient, and technologically advanced energy future.

Leading Regions, Countries, or Segments in North American Clean Energy Industry

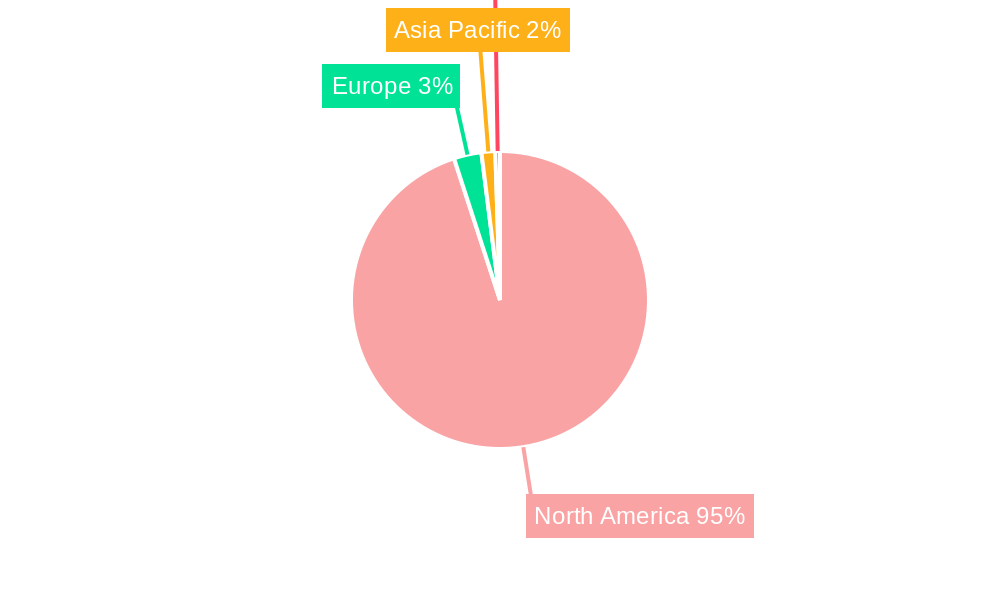

The North American clean energy industry is characterized by distinct regional strengths and dominant segments, with the United States emerging as the undisputed leader in both overall market size and growth potential, particularly within the Solar and Wind energy sectors.

In the United States, the sheer scale of its energy demand, coupled with proactive federal and state-level policies, has fostered an environment ripe for clean energy expansion. The Inflation Reduction Act (IRA) has been a game-changer, injecting substantial financial incentives and tax credits for renewable energy deployment and manufacturing. This has led to a surge in new project announcements and investments across the country. States like Texas, California, and New Mexico are at the forefront, driven by abundant solar and wind resources and supportive regulatory frameworks. The solar segment in the US has witnessed explosive growth, propelled by falling panel costs, advancements in inverter technology, and a growing appetite for distributed generation and utility-scale solar farms. In 2025, solar power is projected to account for a significant portion of new electricity generation capacity additions.

Similarly, the wind energy sector in the United States continues to expand, both onshore and offshore. The vast wind resources across the Great Plains and the emerging offshore wind potential along the East Coast are attracting substantial investment. Companies like NextEra Energy Inc. and Vestas Wind Systems A/S are key players in developing and deploying these large-scale projects.

Canada, while a smaller market in absolute terms, plays a crucial role in the North American clean energy landscape, particularly in the Hydro and Wind sectors. Canada's extensive hydropower infrastructure provides a stable and significant source of clean electricity, contributing substantially to its national grid. Provinces like Quebec and British Columbia are major hubs for hydroelectric power generation. In addition to hydro, Canada has been making strides in wind energy development, particularly in provinces with strong wind resources such as Ontario and Alberta. Regulatory support and provincial targets for renewable energy adoption are driving this growth.

The Rest of North America category, while not as prominent as the US and Canada, includes emerging markets and niche opportunities. Mexico, for instance, has been developing its renewable energy potential, particularly solar, although policy shifts have introduced some uncertainties.

Across all regions, the Solar segment is experiencing the most rapid growth due to its modularity, declining costs, and widespread applicability, from residential rooftops to massive utility-scale installations. Wind energy remains a dominant force, particularly for large-scale power generation. Hydro power continues to be a vital, stable base-load renewable source, especially in Canada. Bioenergy and Others, while contributing to the diversification of the clean energy mix, represent smaller market shares but hold potential for specific applications and localized energy generation. The continued investment trends, robust regulatory support in key regions, and the increasing demand for clean electricity are propelling these segments and geographies forward.

North American Clean Energy Industry Product Innovations

The North American clean energy industry is experiencing a wave of product innovations designed to enhance efficiency, reliability, and cost-effectiveness. In solar energy, advancements such as perovskite-silicon tandem solar cells promise significantly higher conversion efficiencies, potentially exceeding 30%. Bifacial solar panels, which capture sunlight from both sides, are becoming standard, increasing energy yield by up to 20%. For wind energy, next-generation turbine designs feature larger rotor diameters and advanced aerodynamic profiles, leading to greater power output even at lower wind speeds. Floating offshore wind platforms are unlocking vast wind resources in deeper waters previously inaccessible. Energy storage innovations are crucial, with solid-state batteries offering higher energy density, faster charging, and improved safety compared to traditional lithium-ion batteries. Furthermore, sophisticated grid management software utilizing artificial intelligence (AI) is optimizing the integration of intermittent renewables, predicting generation and demand to ensure grid stability and reduce curtailment.

Propelling Factors for North American Clean Energy Industry Growth

Several key factors are propelling the growth of the North American clean energy industry. Firstly, technological advancements have dramatically reduced the cost of renewable energy generation, making solar and wind power increasingly competitive with fossil fuels. Secondly, supportive government policies and incentives, such as tax credits, grants, and renewable portfolio standards, are providing crucial financial backing and regulatory certainty for clean energy projects. The Inflation Reduction Act in the United States, for example, has significantly boosted investment. Thirdly, growing environmental consciousness and corporate sustainability goals are driving demand for clean energy solutions as companies and consumers alike seek to reduce their carbon footprint. Finally, energy security concerns and the desire for energy independence are also pushing nations towards diversifying their energy mix with domestic renewable resources.

Obstacles in the North American Clean Energy Industry Market

Despite robust growth, the North American clean energy industry faces several significant obstacles. Grid infrastructure limitations and modernization needs pose a substantial challenge, as existing transmission lines often struggle to accommodate the distributed nature and variable output of renewables. Supply chain disruptions and raw material availability, particularly for critical minerals used in battery and solar panel manufacturing, can lead to project delays and increased costs. Permitting and siting challenges for new renewable energy projects, including public opposition and environmental reviews, can significantly slow down development timelines. Furthermore, intermittency of renewable sources remains a concern, necessitating advancements and widespread deployment of reliable energy storage solutions and sophisticated grid management. Policy uncertainty and regulatory shifts in certain regions can also deter long-term investment.

Future Opportunities in North American Clean Energy Industry

Emerging opportunities in the North American clean energy industry are vast and diverse. The ongoing development of offshore wind energy presents a significant untapped resource, particularly along the coasts of the United States and Canada. Green hydrogen production, powered by renewable electricity, offers a promising pathway for decarbonizing heavy industries and transportation. The continued expansion of energy storage solutions, including advanced battery technologies and pumped hydro, will be critical for enhancing grid reliability and enabling higher penetration of renewables. Furthermore, the integration of smart grid technologies and digital solutions will optimize energy management and create new service models. The increasing demand for electrification of transportation and buildings creates a substantial pull for clean electricity.

Major Players in the North American Clean Energy Industry Ecosystem

- Vestas Wind Systems A/S

- NextEra Energy Inc.

- Electricite de France SA

- Swinerton Renewable Energy

- Cypress Creek Renewables LLC

- General Electric Co.

- Schneider Electric SE

- Signal Energy LLC

- Canadian Solar Inc.

- Strata Solar LLC

- MA Mortenson Co.

Key Developments in North American Clean Energy Industry Industry

- October 2022: The United States and India announced the establishment of a new energy task force to promote the extensive integration of renewable energy, crucial for enabling the clean energy transition. This initiative fosters international collaboration and knowledge sharing in clean energy deployment strategies.

- October 2022: Following the signing of the Inflation Reduction Act (IRA), fresh manufacturing investments totaling almost USD 28 billion have been announced in the United States. These investments are primarily concentrated in the solar, battery, and electric vehicle production industries, signaling a significant boost to domestic clean energy manufacturing capacity and job creation.

Strategic North American Clean Energy Industry Market Forecast

The North American clean energy industry is poised for exceptional growth, driven by a potent combination of technological innovation, robust policy support, and escalating demand for sustainable energy solutions. Projections indicate continued strong investment in solar and wind power, with emerging opportunities in green hydrogen and advanced energy storage solutions. The strategic importance of the Inflation Reduction Act in catalyzing manufacturing and deployment within the United States cannot be overstated. As regulatory landscapes solidify and technological advancements continue to drive down costs, the industry is expected to achieve significant milestones in decarbonization, energy security, and economic development across Canada and the United States through the forecast period of 2025–2033.

North American Clean Energy Industry Segmentation

-

1. Type

- 1.1. Hydro

- 1.2. Solar

- 1.3. Wind

- 1.4. Bioenergy

- 1.5. Others

-

2. Geography

- 2.1. Canada

- 2.2. United States

- 2.3. Rest of North America

North American Clean Energy Industry Segmentation By Geography

- 1. Canada

- 2. United States

- 3. Rest of North America

North American Clean Energy Industry Regional Market Share

Geographic Coverage of North American Clean Energy Industry

North American Clean Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth

- 3.4. Market Trends

- 3.4.1. Solar Energy is Expected to have Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Clean Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Bioenergy

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Canada

- 5.2.2. United States

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.3.2. United States

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Canada North American Clean Energy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydro

- 6.1.2. Solar

- 6.1.3. Wind

- 6.1.4. Bioenergy

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Canada

- 6.2.2. United States

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United States North American Clean Energy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydro

- 7.1.2. Solar

- 7.1.3. Wind

- 7.1.4. Bioenergy

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Canada

- 7.2.2. United States

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North American Clean Energy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydro

- 8.1.2. Solar

- 8.1.3. Wind

- 8.1.4. Bioenergy

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Canada

- 8.2.2. United States

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Vestas Wind Systems A/S

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 NextEra Energy Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Electricite de France SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Swinerton Renewable Energy

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cypress Creek Renewables LLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 General Electric Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Schneider Electric SE

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Signal Energy LLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Canadian Solar Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Strata Solar LLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 MA Mortenson Co

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: North American Clean Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North American Clean Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: North American Clean Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: North American Clean Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 5: North American Clean Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North American Clean Energy Industry Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: North American Clean Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 9: North American Clean Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 11: North American Clean Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: North American Clean Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: North American Clean Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 15: North American Clean Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 17: North American Clean Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: North American Clean Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: North American Clean Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 21: North American Clean Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: North American Clean Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North American Clean Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Clean Energy Industry?

The projected CAGR is approximately 14.7%.

2. Which companies are prominent players in the North American Clean Energy Industry?

Key companies in the market include Vestas Wind Systems A/S, NextEra Energy Inc, Electricite de France SA, Swinerton Renewable Energy, Cypress Creek Renewables LLC, General Electric Co, Schneider Electric SE, Signal Energy LLC, Canadian Solar Inc, Strata Solar LLC, MA Mortenson Co.

3. What are the main segments of the North American Clean Energy Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1602 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Solar Energy is Expected to have Significant Growth in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth.

8. Can you provide examples of recent developments in the market?

In October 2022, the United States and India announced that a new energy task force would be established to promote the extensive integration of renewable energy required to enable the clean energy transition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Clean Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Clean Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Clean Energy Industry?

To stay informed about further developments, trends, and reports in the North American Clean Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence