Key Insights

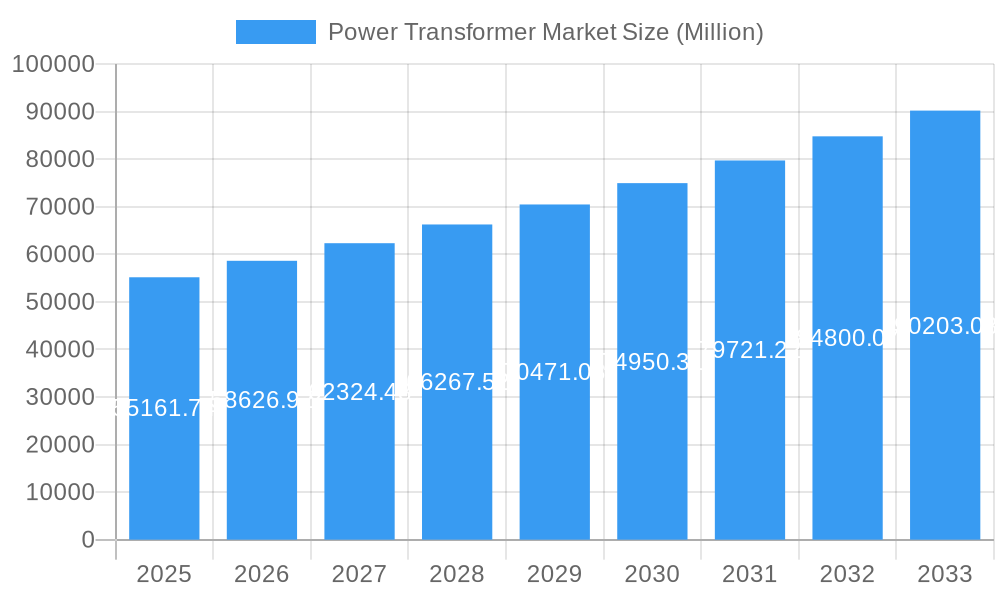

The global Power Transformer Market is poised for significant expansion, projected to reach an impressive USD 55,161.74 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 6.50% throughout the forecast period of 2025-2033. This substantial growth is primarily fueled by the escalating demand for electricity across various sectors, including industrial, commercial, and residential. The ongoing need for upgrading aging power infrastructure, coupled with the expansion of smart grids and the integration of renewable energy sources, are key drivers propelling the market forward. Increased investments in developing and developed economies for reliable power distribution and transmission further underpin this positive trajectory. The market segmentation reveals a strong emphasis on large power transformers, essential for high-voltage transmission networks, and power transformers that form the backbone of grid operations. Air-cooled transformers are also expected to witness steady demand due to their environmental advantages and operational efficiency, especially in densely populated areas.

Power Transformer Market Market Size (In Billion)

While the market exhibits strong growth prospects, certain restraints warrant attention. The high initial capital expenditure required for manufacturing and installing power transformers, along with the complex regulatory landscape in some regions, can present challenges. Furthermore, the intermittent nature of renewable energy sources necessitates advanced transformer technologies capable of handling fluctuating loads, which can add to development costs. However, technological advancements, such as the development of more efficient and sustainable transformer designs, alongside the increasing adoption of digital monitoring and predictive maintenance solutions, are expected to mitigate these restraints. Companies like Siemens AG, ABB Ltd, and General Electric Company are at the forefront of innovation, driving the market towards greater efficiency, reliability, and environmental consciousness. The Asia Pacific region is anticipated to lead the market in terms of growth, driven by rapid industrialization and increasing electricity consumption.

Power Transformer Market Company Market Share

This in-depth Power Transformer Market report provides a strategic outlook on the global transformer industry, meticulously analyzing market composition, industry evolution, key drivers, challenges, and future opportunities. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable insights for stakeholders seeking to navigate the dynamic landscape of power and distribution transformers. We delve into crucial segments including Large, Medium, and Small power ratings, alongside Air-cooled and Oil-cooled cooling types, and differentiate between Power Transformers and Distribution Transformers.

Power Transformer Market Market Composition & Trends

The global power transformer market exhibits a moderate concentration, driven by a mix of established multinational corporations and emerging regional players. Innovation remains a key catalyst, fueled by the demand for higher efficiency, enhanced grid stability, and smart grid integration. Regulatory landscapes play a pivotal role, with stringent standards dictating product design and performance, particularly concerning energy efficiency and environmental impact. Substitute products, such as advanced power electronics and distributed generation systems, are emerging but currently represent a niche threat to the core power transformer market. End-user profiles are diverse, ranging from utility companies and renewable energy developers to industrial facilities and commercial enterprises. Mergers and acquisitions (M&A) activities are strategically shaping the market, with significant deal values often associated with companies possessing specialized technologies or a strong regional presence. For instance, in the historical period, M&A activities are estimated to have reached over $500 Million, consolidating market share and fostering technological synergy.

- Market Share Distribution: Fragmented with top 5 players holding approximately 40-45% of the global market share.

- Innovation Catalysts: Demand for energy efficiency, grid modernization, smart grid technologies, and renewable energy integration.

- Regulatory Landscapes: Increasing focus on environmental compliance, energy efficiency standards (e.g., IEC standards), and grid reliability mandates.

- Substitute Products: Advanced power electronics, energy storage solutions, and microgrids are nascent but growing alternatives.

- End-User Profiles: Utilities (dominant), renewable energy sector, industrial manufacturing, data centers, and commercial real estate.

- M&A Activities: Driven by geographical expansion, technology acquisition, and portfolio diversification. Estimated M&A deal values for the historical period exceeding $500 Million.

Power Transformer Market Industry Evolution

The power transformer industry has witnessed a significant evolutionary path, driven by the relentless demand for reliable and efficient energy transmission and distribution. Historically, the market has been characterized by steady growth, propelled by infrastructure development in emerging economies and the ongoing need to upgrade aging grids in developed nations. Technological advancements have been central to this evolution, with a progressive shift towards higher voltage capabilities, improved insulation materials, and enhanced cooling systems. This has led to the development of more compact, efficient, and durable transformers. The adoption of digital technologies and the integration of smart features, such as condition monitoring and predictive maintenance, are transforming the operational paradigms of transformers. Furthermore, the increasing integration of renewable energy sources, such as solar and wind power, has introduced new challenges and opportunities, necessitating the development of transformers capable of handling bidirectional power flow and fluctuating energy inputs. Consumer demands are increasingly focused on sustainability, reduced environmental impact, and lower operational costs, pushing manufacturers to innovate with eco-friendly materials and energy-efficient designs. The power transformer market size has seen a consistent year-on-year growth of approximately 4-6% throughout the historical period. The adoption rate of smart transformer technologies is projected to reach over 30% by the end of the forecast period.

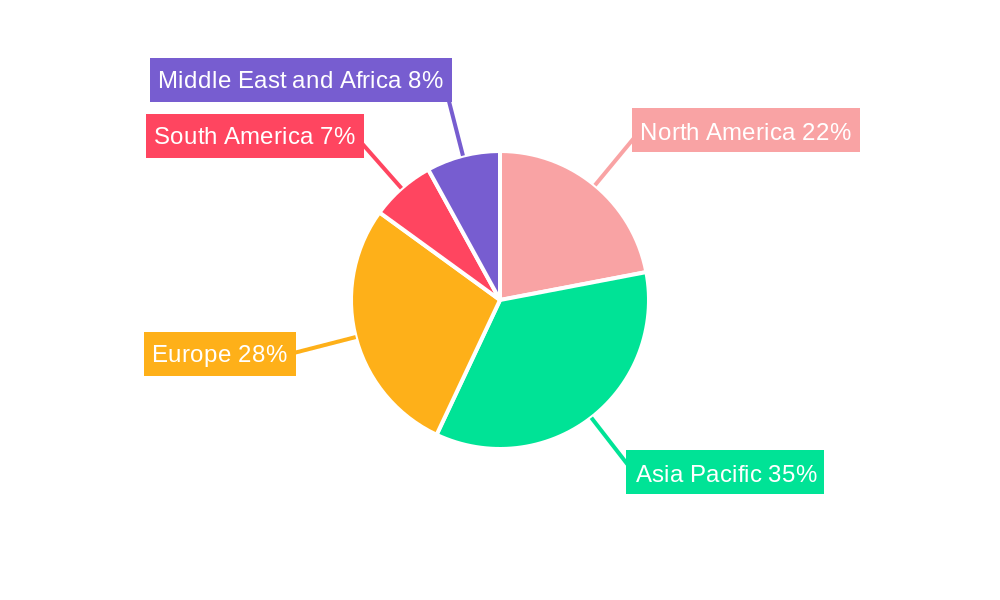

Leading Regions, Countries, or Segments in Power Transformer Market

The Asia Pacific region stands as the dominant force in the global power transformer market, driven by its rapid industrialization, burgeoning population, and extensive investments in electricity infrastructure. Within this region, China and India are particularly influential, owing to their massive domestic demand and significant government initiatives aimed at enhancing power generation and transmission capabilities. The Large power rating segment commands the largest market share, reflecting the need for high-capacity transformers in bulk power transmission networks and large industrial complexes.

Key Drivers for Dominance in Asia Pacific:

- Massive Infrastructure Development: Continuous expansion of power grids, including substations and transmission lines, to meet growing energy demands.

- Government Support and Initiatives: Favorable policies and substantial investments in the power sector, promoting grid modernization and renewable energy integration.

- Growing Industrial Sector: Rapid industrial growth across various sectors, leading to increased demand for reliable power supply and consequently, power transformers.

- Renewable Energy Push: Significant investments in solar and wind energy projects require robust transmission infrastructure and associated transformers.

Dominant Segments:

Power Rating: Large:

- Essential for bulk power transmission in national grids and large industrial applications.

- Driven by the expansion of high-voltage transmission networks and the need for efficient energy transfer over long distances.

- Technological advancements focus on increasing capacity and improving efficiency for these high-value units.

Cooling Type: Oil-cooled:

- The most prevalent cooling method due to its superior heat dissipation capabilities, making it ideal for high-capacity transformers.

- Reliable and cost-effective for large-scale power applications where efficient thermal management is paramount.

- Continuous research into biodegradable and environmentally friendly insulating oils is a key trend.

Transformer Type: Power Transformer:

- Crucial for stepping up or stepping down voltage in transmission and generation networks.

- Essential for maintaining grid stability and facilitating the efficient flow of electricity.

- The demand for high-voltage power transformers is directly linked to grid expansion and upgrades.

The North American and European markets, while mature, continue to be significant due to the ongoing replacement of aging infrastructure, the integration of renewable energy, and the demand for smart grid solutions. The Medium power rating segment also holds substantial importance, particularly for distribution networks and industrial applications.

Power Transformer Market Product Innovations

Product innovation in the power transformer market is largely centered around enhancing efficiency, reliability, and sustainability. Manufacturers are developing transformers with advanced insulation materials, such as high-temperature superconductors and novel dielectric fluids, to reduce energy losses and improve operational lifespan. Smart functionalities, including integrated sensors for real-time monitoring of temperature, vibration, and oil quality, are becoming increasingly prevalent, enabling predictive maintenance and minimizing downtime. Innovations also focus on miniaturization for space-constrained applications and the development of eco-friendly designs with reduced environmental impact, such as the use of recycled materials and biodegradable oils. The Small power rating segment is witnessing innovation in the development of highly efficient transformers for localized power distribution and specialized industrial uses.

Propelling Factors for Power Transformer Market Growth

The power transformer market is experiencing robust growth driven by several key factors. Significant global investments in power infrastructure development, particularly in emerging economies, are a primary catalyst. The increasing integration of renewable energy sources, such as solar and wind farms, necessitates a substantial number of new and upgraded transformers for grid connection and power evacuation. Furthermore, the ongoing replacement and modernization of aging electricity grids worldwide, coupled with the growing adoption of smart grid technologies, are significant growth drivers. Technological advancements, leading to more efficient, reliable, and environmentally friendly transformer designs, also fuel market expansion.

- Infrastructure Development: Expanding electricity grids globally to meet rising energy demands.

- Renewable Energy Integration: Connecting and evacuating power from an increasing number of solar and wind farms.

- Grid Modernization: Upgrading aging infrastructure and adopting smart grid solutions for improved efficiency and reliability.

- Technological Advancements: Development of higher efficiency, longer-lasting, and eco-friendly transformers.

Obstacles in the Power Transformer Market Market

Despite the positive growth trajectory, the power transformer market faces several obstacles. Stringent regulatory compliance and evolving environmental standards can increase manufacturing costs and necessitate significant R&D investments. Supply chain disruptions, particularly for critical raw materials like copper and specialized insulation components, can lead to production delays and price volatility. Intense price competition among manufacturers, especially in commoditized segments, can impact profit margins. Furthermore, the long lifespan of existing transformers can slow down the replacement cycle, posing a challenge to immediate market growth. The skilled workforce shortage for specialized transformer manufacturing and maintenance also presents a constraint.

- Regulatory Hurdles: Evolving environmental standards and safety regulations leading to increased compliance costs.

- Supply Chain Volatility: Fluctuations in raw material prices (e.g., copper, silicon steel) and potential disruptions in global logistics.

- Intense Competition: Price pressures from both established and new market entrants.

- Long Product Lifecycles: Existing transformers have a long operational life, slowing down replacement cycles.

- Skilled Workforce Shortage: Difficulty in finding and retaining skilled engineers and technicians for manufacturing and maintenance.

Future Opportunities in Power Transformer Market

The future of the power transformer market presents numerous promising opportunities. The escalating demand for energy storage solutions and the proliferation of electric vehicles (EVs) will create new avenues for specialized transformer designs. The growing trend towards decentralized power generation and microgrids offers opportunities for smaller, more adaptable transformer units. Furthermore, the development and adoption of advanced digital technologies for transformer monitoring, control, and predictive maintenance will unlock significant value. Expansion into untapped emerging markets and the development of sustainable, eco-friendly transformer solutions are also key growth areas. The global push towards digitalization of the energy sector is expected to create a market opportunity worth over $1 Billion for smart transformer solutions by 2030.

- Energy Storage & EVs: Demand for specialized transformers for battery energy storage systems and EV charging infrastructure.

- Decentralized Generation & Microgrids: Opportunities for smaller, modular, and highly efficient transformers.

- Digitalization & Smart Grids: Growth in demand for transformers with advanced monitoring and control capabilities.

- Emerging Markets: Expansion into regions with significant unmet energy infrastructure needs.

- Sustainable Transformers: Development and adoption of eco-friendly and recyclable transformer designs.

Major Players in the Power Transformer Market Ecosystem

- ABB Ltd

- Hyundai Electric & Energy Systems Co Ltd

- Schneider Electric SE

- Toshiba Corp

- Bharat Heavy Electricals Limited

- Siemens AG

- CG Power and Industrial Solutions Ltd

- General Electric Company

- Hyosung Corp

Key Developments in Power Transformer Market Industry

- May 2022: Siemens Energy exported ten mobile transformers and ten sub-stations to the Transmission Company of Nigeria, a contract secured in July 2020 and successfully completed in May 2022. This development highlights the growing demand for critical power infrastructure in Africa and Siemens' capability to deliver complex solutions.

- January 2022: Power Grid Corporation of India Ltd (PowerGrid India) signed a joint development agreement with Africa50 to develop the Kenya Transmission Project on a public-private partnership basis. This project involves the development, financing, construction, and operation of the 400kV Lessos- Loosuk and 220kV Kisumu- Musaga transmission lines, with PowerGrid India contributing its extensive technical and operational expertise, underscoring the collaborative efforts to bolster African energy infrastructure.

Strategic Power Transformer Market Market Forecast

The power transformer market is poised for substantial growth driven by the global energy transition and the continuous expansion of power grids. Key growth catalysts include escalating investments in renewable energy integration, the imperative to upgrade aging infrastructure with advanced, efficient, and smart transformer technologies, and the burgeoning demand from developing economies. The forecast period is expected to witness a significant rise in the adoption of oil-cooled and large power rating transformers, alongside increasing demand for air-cooled transformers in specific applications. Furthermore, the market will be shaped by innovative product developments, including smart transformers equipped with advanced monitoring and control systems, contributing to improved grid reliability and operational efficiency. The overall market potential is robust, driven by the fundamental need for reliable electricity transmission and distribution solutions worldwide.

Power Transformer Market Segmentation

-

1. Power Rating

- 1.1. Large

- 1.2. Medium

- 1.3. Small

-

2. Cooling Type

- 2.1. Air-cooled

- 2.2. Oil-cooled

-

3. Transformer Type

- 3.1. Power Transformer

- 3.2. Distribution Transformer

Power Transformer Market Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Power Transformer Market Regional Market Share

Geographic Coverage of Power Transformer Market

Power Transformer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Distribution Transformers Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Transformer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Large

- 5.1.2. Medium

- 5.1.3. Small

- 5.2. Market Analysis, Insights and Forecast - by Cooling Type

- 5.2.1. Air-cooled

- 5.2.2. Oil-cooled

- 5.3. Market Analysis, Insights and Forecast - by Transformer Type

- 5.3.1. Power Transformer

- 5.3.2. Distribution Transformer

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. North America Power Transformer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 6.1.1. Large

- 6.1.2. Medium

- 6.1.3. Small

- 6.2. Market Analysis, Insights and Forecast - by Cooling Type

- 6.2.1. Air-cooled

- 6.2.2. Oil-cooled

- 6.3. Market Analysis, Insights and Forecast - by Transformer Type

- 6.3.1. Power Transformer

- 6.3.2. Distribution Transformer

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 7. Asia Pacific Power Transformer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 7.1.1. Large

- 7.1.2. Medium

- 7.1.3. Small

- 7.2. Market Analysis, Insights and Forecast - by Cooling Type

- 7.2.1. Air-cooled

- 7.2.2. Oil-cooled

- 7.3. Market Analysis, Insights and Forecast - by Transformer Type

- 7.3.1. Power Transformer

- 7.3.2. Distribution Transformer

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 8. Europe Power Transformer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 8.1.1. Large

- 8.1.2. Medium

- 8.1.3. Small

- 8.2. Market Analysis, Insights and Forecast - by Cooling Type

- 8.2.1. Air-cooled

- 8.2.2. Oil-cooled

- 8.3. Market Analysis, Insights and Forecast - by Transformer Type

- 8.3.1. Power Transformer

- 8.3.2. Distribution Transformer

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 9. South America Power Transformer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 9.1.1. Large

- 9.1.2. Medium

- 9.1.3. Small

- 9.2. Market Analysis, Insights and Forecast - by Cooling Type

- 9.2.1. Air-cooled

- 9.2.2. Oil-cooled

- 9.3. Market Analysis, Insights and Forecast - by Transformer Type

- 9.3.1. Power Transformer

- 9.3.2. Distribution Transformer

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 10. Middle East and Africa Power Transformer Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Power Rating

- 10.1.1. Large

- 10.1.2. Medium

- 10.1.3. Small

- 10.2. Market Analysis, Insights and Forecast - by Cooling Type

- 10.2.1. Air-cooled

- 10.2.2. Oil-cooled

- 10.3. Market Analysis, Insights and Forecast - by Transformer Type

- 10.3.1. Power Transformer

- 10.3.2. Distribution Transformer

- 10.1. Market Analysis, Insights and Forecast - by Power Rating

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai Electric & Energy Systems Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schneider Electric SE*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bharat Heavy Electricals Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CG Power and Industrial Solutions Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hyosung Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Power Transformer Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Power Transformer Market Revenue (Million), by Power Rating 2025 & 2033

- Figure 3: North America Power Transformer Market Revenue Share (%), by Power Rating 2025 & 2033

- Figure 4: North America Power Transformer Market Revenue (Million), by Cooling Type 2025 & 2033

- Figure 5: North America Power Transformer Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 6: North America Power Transformer Market Revenue (Million), by Transformer Type 2025 & 2033

- Figure 7: North America Power Transformer Market Revenue Share (%), by Transformer Type 2025 & 2033

- Figure 8: North America Power Transformer Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Power Transformer Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Power Transformer Market Revenue (Million), by Power Rating 2025 & 2033

- Figure 11: Asia Pacific Power Transformer Market Revenue Share (%), by Power Rating 2025 & 2033

- Figure 12: Asia Pacific Power Transformer Market Revenue (Million), by Cooling Type 2025 & 2033

- Figure 13: Asia Pacific Power Transformer Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 14: Asia Pacific Power Transformer Market Revenue (Million), by Transformer Type 2025 & 2033

- Figure 15: Asia Pacific Power Transformer Market Revenue Share (%), by Transformer Type 2025 & 2033

- Figure 16: Asia Pacific Power Transformer Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Power Transformer Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Power Transformer Market Revenue (Million), by Power Rating 2025 & 2033

- Figure 19: Europe Power Transformer Market Revenue Share (%), by Power Rating 2025 & 2033

- Figure 20: Europe Power Transformer Market Revenue (Million), by Cooling Type 2025 & 2033

- Figure 21: Europe Power Transformer Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 22: Europe Power Transformer Market Revenue (Million), by Transformer Type 2025 & 2033

- Figure 23: Europe Power Transformer Market Revenue Share (%), by Transformer Type 2025 & 2033

- Figure 24: Europe Power Transformer Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Power Transformer Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Power Transformer Market Revenue (Million), by Power Rating 2025 & 2033

- Figure 27: South America Power Transformer Market Revenue Share (%), by Power Rating 2025 & 2033

- Figure 28: South America Power Transformer Market Revenue (Million), by Cooling Type 2025 & 2033

- Figure 29: South America Power Transformer Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 30: South America Power Transformer Market Revenue (Million), by Transformer Type 2025 & 2033

- Figure 31: South America Power Transformer Market Revenue Share (%), by Transformer Type 2025 & 2033

- Figure 32: South America Power Transformer Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Power Transformer Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Power Transformer Market Revenue (Million), by Power Rating 2025 & 2033

- Figure 35: Middle East and Africa Power Transformer Market Revenue Share (%), by Power Rating 2025 & 2033

- Figure 36: Middle East and Africa Power Transformer Market Revenue (Million), by Cooling Type 2025 & 2033

- Figure 37: Middle East and Africa Power Transformer Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 38: Middle East and Africa Power Transformer Market Revenue (Million), by Transformer Type 2025 & 2033

- Figure 39: Middle East and Africa Power Transformer Market Revenue Share (%), by Transformer Type 2025 & 2033

- Figure 40: Middle East and Africa Power Transformer Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Power Transformer Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Power Transformer Market Revenue Million Forecast, by Power Rating 2020 & 2033

- Table 2: Global Power Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 3: Global Power Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 4: Global Power Transformer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Power Transformer Market Revenue Million Forecast, by Power Rating 2020 & 2033

- Table 6: Global Power Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 7: Global Power Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 8: Global Power Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Power Transformer Market Revenue Million Forecast, by Power Rating 2020 & 2033

- Table 10: Global Power Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 11: Global Power Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 12: Global Power Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Power Transformer Market Revenue Million Forecast, by Power Rating 2020 & 2033

- Table 14: Global Power Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 15: Global Power Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 16: Global Power Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Power Transformer Market Revenue Million Forecast, by Power Rating 2020 & 2033

- Table 18: Global Power Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 19: Global Power Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 20: Global Power Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Power Transformer Market Revenue Million Forecast, by Power Rating 2020 & 2033

- Table 22: Global Power Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 23: Global Power Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 24: Global Power Transformer Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Transformer Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the Power Transformer Market?

Key companies in the market include ABB Ltd, Hyundai Electric & Energy Systems Co Ltd, Schneider Electric SE*List Not Exhaustive, Toshiba Corp, Bharat Heavy Electricals Limited, Siemens AG, CG Power and Industrial Solutions Ltd, General Electric Company, Hyosung Corp.

3. What are the main segments of the Power Transformer Market?

The market segments include Power Rating, Cooling Type, Transformer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55161.74 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Distribution Transformers Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

May 2022: Siemens Energy exported ten mobile transformers and ten sub-stations to the Transmission Company of Nigeria. The company acquired this contract in July 2020 and completed its contract in May 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Transformer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Transformer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Transformer Market?

To stay informed about further developments, trends, and reports in the Power Transformer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence