Key Insights

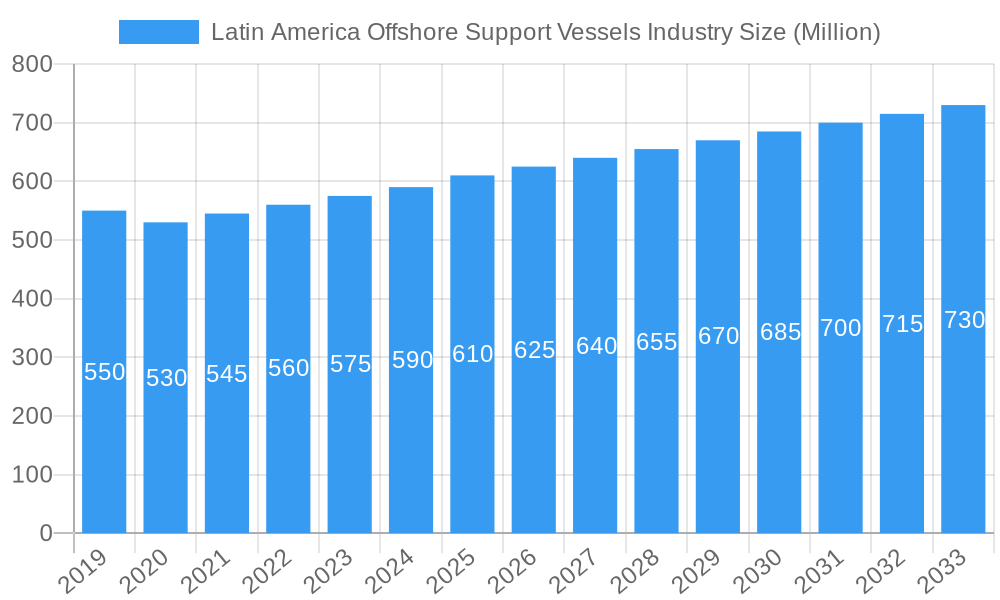

The Latin America Offshore Support Vessels (OSVs) market is projected for robust growth, with a Compound Annual Growth Rate (CAGR) of 3.2% from 2024 to 2033. The market, valued at 46.2 billion in the base year 2024, is propelled by sustained offshore oil and gas exploration and production activities in key regions like Brazil and Mexico. Significant investments in deepwater and ultra-deepwater projects are driving demand for a comprehensive range of OSVs, including Platform Supply Vessels (PSVs), Anchor Handling Tug Supply (AHTS) vessels, and specialized subsea construction and maintenance units. Enhanced Oil Recovery (EOR) initiatives and the burgeoning offshore wind farm construction and maintenance sectors are further diversifying and expanding OSV requirements.

Latin America Offshore Support Vessels Industry Market Size (In Billion)

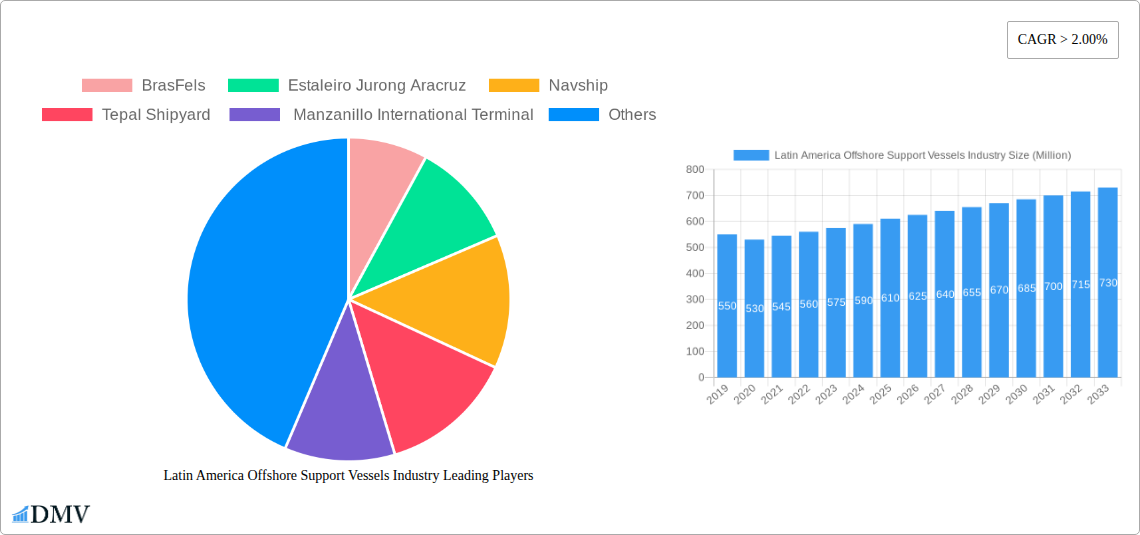

While the market demonstrates strong growth potential, certain factors present challenges. Volatile global oil prices can affect new project approvals and consequently influence OSV demand. Increasingly stringent environmental regulations and the push for decarbonization necessitate investments in fuel-efficient vessels, potentially increasing initial capital expenditure. Geopolitical uncertainties and global supply chain disruptions for new vessel construction and maintenance also pose risks. However, the fundamental energy needs of Latin America and its substantial untapped offshore resources underpin a consistent demand for OSVs. Leading companies such as BrasFels, Estaleiro Jurong Aracruz, and Navship are strategically adapting by modernizing their fleets and expanding service offerings to cater to the evolving demands of the offshore energy industry.

Latin America Offshore Support Vessels Industry Company Market Share

Latin America Offshore Support Vessels Industry Market Composition & Trends

The Latin America offshore support vessels (OSV) industry is characterized by a dynamic market composition, driven by significant offshore exploration and production activities. Market concentration varies across sub-regions, with Brazil leading in terms of fleet size and demand. Innovation catalysts include the increasing push for decarbonization and the adoption of advanced technologies like autonomous vessels and digitalization for enhanced operational efficiency. Regulatory landscapes are evolving, with governments implementing stricter environmental standards and safety protocols, impacting vessel design and operational requirements. Substitute products, such as pipeline infrastructure for shorter distances, exist but are largely constrained by geographical limitations and project-specific needs. End-user profiles are dominated by major oil and gas exploration and production (E&P) companies, alongside offshore construction firms and specialized service providers. Mergers and acquisitions (M&A) activities are key to industry consolidation and expanding service portfolios, with deal values often in the hundreds of millions of dollars, reflecting strategic realignments. For instance, in 2023, an M&A deal in the region was valued at approximately $500 Million, aimed at bolstering fleet capacity. The market share distribution sees dominant players commanding substantial portions, with key shipyards like BrasFels and Estaleiro Jurong Aracruz holding significant manufacturing capacities.

- Market Concentration: Moderate to high in key operational hubs, with major E&P companies and OSV operators wielding significant influence.

- Innovation Catalysts: Decarbonization mandates, digital transformation, and advancements in vessel design for enhanced safety and efficiency.

- Regulatory Landscapes: Increasing emphasis on environmental compliance (e.g., IMO 2030), safety certifications, and local content policies.

- Substitute Products: Limited, primarily pipeline infrastructure for specific short-haul transport needs.

- End-User Profiles: Major Oil & Gas E&P companies, Offshore Construction firms, FPSO operators, and specialized subsea service providers.

- M&A Activities: Strategic consolidation, fleet expansion, and technological integration, with recent deals ranging from $100 Million to over $700 Million.

Latin America Offshore Support Vessels Industry Industry Evolution

The evolution of the Latin America offshore support vessels (OSV) industry has been a testament to its resilience and adaptation to fluctuating global energy demands and technological advancements. Over the historical period from 2019 to 2024, the market experienced periods of robust growth driven by high oil prices and increased upstream investments, followed by contractions due to market volatility and the COVID-19 pandemic. However, the base year of 2025 marks a significant turning point, with the industry poised for sustained expansion throughout the forecast period of 2025–2033. This resurgence is underpinned by a confluence of factors, including renewed exploration efforts in deepwater and ultra-deepwater frontiers across the region, particularly off the coasts of Brazil, Guyana, and Mexico. Technological advancements have played a pivotal role in shaping this evolution. Early OSVs were primarily designed for basic logistical support, but the industry has since witnessed a dramatic shift towards highly specialized vessels equipped with sophisticated navigation systems, advanced subsea equipment, and enhanced safety features. The adoption of technologies such as dynamic positioning systems (DP), remotely operated vehicles (ROVs), and sophisticated seismic survey equipment has become standard, enabling operations in increasingly challenging environments. Furthermore, the drive towards decarbonization has spurred innovation in vessel design and propulsion systems. Companies are investing in more fuel-efficient engines, hybrid power solutions, and exploring alternative fuels like methanol and hydrogen, aligning with global environmental targets and reducing operational expenditures. Shifting consumer demands, represented by the E&P companies, have increasingly focused on vessels that offer greater operational flexibility, improved uptime, and a reduced environmental footprint. This has led to a demand for larger, more powerful, and more environmentally friendly OSVs, including platform supply vessels (PSVs), anchor handling tug supply (AHTS) vessels, and construction support vessels (CSVs). The industry's growth trajectory from a CAGR of approximately 4.5% in the historical period is projected to accelerate to over 6.0% during the forecast period. This upward trend is further supported by significant capital expenditures planned by major oil and gas players in the region, targeting new field developments and enhanced oil recovery projects. The industry's ability to innovate and respond to these evolving demands will be critical in navigating the future landscape, ensuring its continued relevance and profitability.

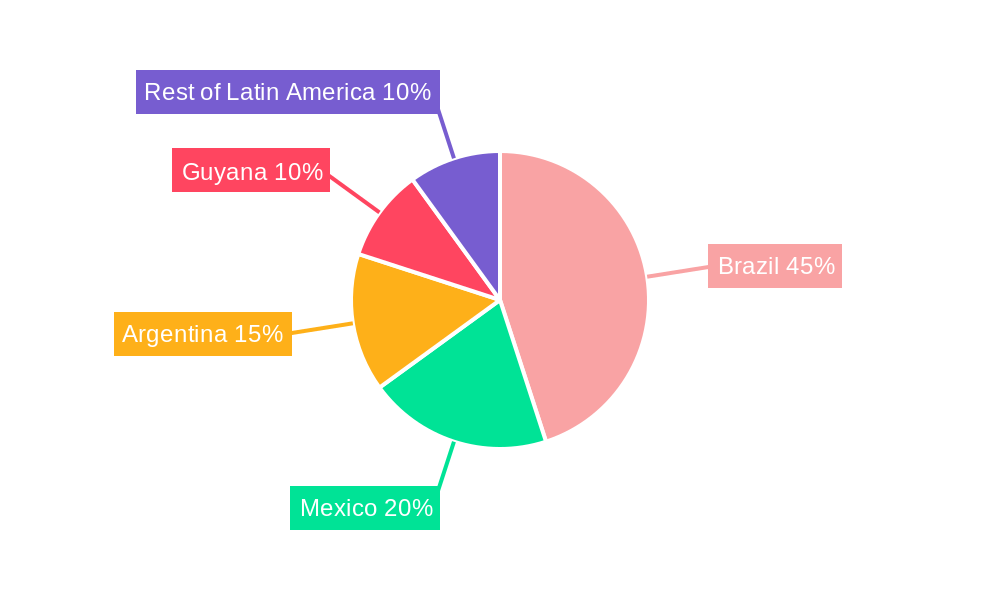

Leading Regions, Countries, or Segments in Latin America Offshore Support Vessels Industry

Brazil undeniably stands as the preeminent region in the Latin America offshore support vessels (OSV) industry, dominating across key analytical segments. Its extensive coastline, rich deepwater reserves, and ambitious oil and gas exploration plans solidify its leading position.

Production Analysis:

Brazil's shipbuilding capacity, particularly through shipyards like BrasFels and Estaleiro Jurong Aracruz, leads the region in OSV construction. These facilities are equipped to handle complex vessel designs and large-scale projects, contributing significantly to the regional fleet's expansion and modernization.

- Key Drivers:

- Petrobras's Fleet Renewal Programs: Consistent demand from Brazil's national oil company for new OSVs to support its vast offshore operations.

- Government Incentives: Policies aimed at fostering local shipbuilding and maritime industries.

- Technological Expertise: Advanced capabilities in building sophisticated offshore support vessels, including those with dynamic positioning and advanced subsea intervention systems.

Consumption Analysis:

The consumption of OSV services in Brazil is unparalleled due to the sheer scale of its offshore oil and gas activities, particularly in the pre-salt basins. Petrobras, along with international oil companies operating in Brazil, drives substantial demand for various OSV types.

- Key Drivers:

- Pre-Salt Exploration and Production: Immense deepwater fields requiring a continuous supply of OSVs for drilling, construction, and production support.

- Operational Complexity: The challenging offshore environment necessitates specialized vessels for safe and efficient operations.

- Long-Term Contracts: Major E&P players often secure long-term charters for OSVs, ensuring consistent demand.

Import Market Analysis (Value & Volume):**

While Brazil is a major producer, the import market for specialized OSVs or components not manufactured domestically remains significant. However, the trend is shifting towards increased local production capacity. The import market for new-build OSVs is relatively smaller compared to new construction within Brazil, but components and specialized equipment are frequently imported.

- Key Drivers:

- Specialized Technology: Imports of advanced subsea equipment, propulsion systems, and navigation technology not readily available locally.

- Niche Vessel Requirements: Sourcing of highly specialized vessels for unique operational needs.

- Value: Import values can range from tens of millions to over a hundred million dollars per specialized vessel.

Export Market Analysis (Value & Volume):**

Brazil's OSV export market is less developed compared to its domestic consumption and production. However, there is potential for future exports as local shipyards gain further experience and cost efficiencies. Currently, the primary focus is on servicing the domestic market.

- Key Drivers:

- Emerging Opportunity: Future potential for exporting OSVs to neighboring Latin American countries as regional demand grows.

- Competitive Pricing: Achieving cost competitiveness in the global market remains a hurdle for significant export volumes.

- Value: Export values are currently modest but expected to grow with increased capacity and international partnerships.

Export Market Analysis (Value & Volume):

Mexico and Guyana are emerging as significant consumers of OSVs, driven by substantial new oil and gas discoveries and planned production ramp-ups. Manzanillo International Terminal in Panama also plays a crucial role as a logistical hub.

- Key Drivers:

- New Discoveries: Significant exploration success in Mexico's shallow and deep waters and Guyana's Stabroek Block.

- Project Development: Large-scale offshore projects requiring extensive OSV support for drilling, construction, and production.

- Regional Demand: Increasing offshore activities across various Latin American nations creating a consolidated demand base.

- Volume: Thousands of vessel-days are contracted annually across the region, indicating substantial volume.

- Value: The combined value of OSV contracts in these growing markets is in the billions of dollars annually, with individual project values reaching hundreds of millions.

Price Trend Analysis:**

OSV charter rates are heavily influenced by supply and demand dynamics, vessel type, age, and contract duration. In Brazil, rates for high-specification vessels in high demand can be substantial, often ranging from $15,000 to over $40,000 per day depending on vessel class and services provided.

- Key Drivers:

- Fleet Utilization: Higher utilization rates generally lead to increased charter rates.

- Operational Complexity: Vessels capable of operating in harsher conditions or performing more complex tasks command premium rates.

- Fuel Prices: Fluctuations in fuel costs directly impact operational expenses and subsequently charter rates.

- Market Conditions: Periods of high oil prices and active exploration tend to drive up rates.

Latin America Offshore Support Vessels Industry Product Innovations

Product innovations in the Latin America offshore support vessels (OSV) industry are increasingly focused on enhancing efficiency, safety, and environmental performance. Advanced navigation and control systems, such as enhanced dynamic positioning (DP) and automated maneuvering, are being integrated to improve operational precision and reduce human error, especially in challenging offshore conditions. The adoption of hybrid propulsion systems and more fuel-efficient engines is a significant trend, aiming to reduce emissions and operational costs. Furthermore, innovations extend to the integration of digital technologies, including real-time data monitoring, predictive maintenance capabilities, and advanced communication systems, enabling better fleet management and operational insights. The development of specialized vessels for emerging offshore activities, such as renewable energy installations and subsea infrastructure maintenance, is also on the horizon, expanding the application scope and performance metrics of OSVs.

Propelling Factors for Latin America Offshore Support Vessels Industry Growth

Several key factors are propelling the growth of the Latin America offshore support vessels (OSV) industry. Firstly, the resumption and intensification of offshore exploration and production (E&P) activities, particularly in deepwater and ultra-deepwater frontiers of countries like Brazil, Guyana, and Mexico, is creating substantial demand for OSV services. Secondly, significant investments in new offshore field developments and the extension of existing field lifecycles necessitate a robust fleet of support vessels for drilling, construction, and ongoing production operations. Thirdly, the global push towards energy security and the strategic importance of Latin America's hydrocarbon reserves are driving sustained interest and capital allocation in the sector. Finally, technological advancements in vessel design and operational efficiency, coupled with increasing environmental consciousness leading to a demand for greener solutions, are fostering the development and deployment of more advanced and specialized OSVs.

- Robust Offshore E&P Activities: Renewed exploration and production in key regions.

- Capital Investments: Increased upstream spending on new field developments and existing asset support.

- Energy Security Imperatives: Strategic importance of regional hydrocarbon resources.

- Technological Advancements: Adoption of efficient, safe, and environmentally friendly OSV technologies.

Obstacles in the Latin America Offshore Support Vessels Industry Market

Despite the positive growth trajectory, the Latin America offshore support vessels (OSV) industry faces several obstacles. Volatile oil prices can significantly impact E&P company budgets, leading to project delays or cancellations, and subsequently reducing OSV demand. Stringent and evolving regulatory frameworks, particularly concerning environmental compliance and safety standards, can increase operational costs and require significant capital investment for vessel upgrades or new builds. Geopolitical instability and economic uncertainties within some regional countries can also deter investment and hinder operational continuity. Furthermore, intense competition and oversupply of certain vessel classes in periods of low demand can exert downward pressure on charter rates, impacting profitability for OSV operators. Supply chain disruptions and the availability of skilled labor can also pose challenges to timely project execution and vessel maintenance.

- Oil Price Volatility: Fluctuations impacting E&P investment and OSV demand.

- Regulatory Hurdles: Evolving environmental and safety standards increasing compliance costs.

- Economic & Geopolitical Risks: Instability affecting investment and operational continuity.

- Market Competition & Oversupply: Pressure on charter rates due to fleet availability.

- Supply Chain & Labor Constraints: Challenges in timely execution and maintenance.

Future Opportunities in Latin America Offshore Support Vessels Industry

The future opportunities within the Latin America offshore support vessels (OSV) industry are diverse and promising. The expanding frontiers of deepwater and ultra-deepwater exploration, particularly in regions like Guyana and Brazil, will continue to drive demand for specialized and technologically advanced OSVs. The growing interest in offshore wind farm development across the region presents a significant new avenue for OSV deployment, requiring specialized installation and maintenance support vessels. Furthermore, the increasing focus on decarbonization and the adoption of alternative fuels for vessels opens up opportunities for companies investing in and developing greener OSV solutions. The digitalization of maritime operations, including the implementation of AI, IoT, and advanced data analytics for fleet management and predictive maintenance, offers enhanced efficiency and service offerings. Finally, strategic partnerships and collaborations between OSV operators, shipbuilders, and technology providers can unlock new markets and capabilities, fostering innovation and sustainable growth.

- Deepwater & Ultra-Deepwater Exploration: Continued demand for advanced OSVs.

- Offshore Renewable Energy: Emerging market for installation and maintenance support.

- Decarbonization & Alternative Fuels: Opportunities for green OSV solutions.

- Digital Transformation: Enhanced efficiency through data analytics and automation.

- Strategic Alliances: Partnerships for market expansion and technological innovation.

Major Players in the Latin America Offshore Support Vessels Industry Ecosystem

- BrasFels

- Estaleiro Jurong Aracruz

- Navship

- Tepal Shipyard

- Manzanillo International Terminal

- Companhia Brasileira de Offshore (CBO)

- Oceanografia S.A.B. de C.V.

- DOF ASA

- Solstad Offshore

- Siem Offshore

Key Developments in Latin America Offshore Support Vessels Industry Industry

- October 2022: Brazil's Petrobras launched a public tender to procure up to 20 offshore support vessels, confirming its need for tonnage to support its ambitious growth plans.

- August 2022: Technology group Wärtsilä signed an agreement with Rio de Janeiro-based Companhia Brasileira de Offshore (CBO) on Decarbonisation Modelling. The objective is to support and accelerate CBO's journey towards decarbonized operations for its fleet of offshore support vessels, which is among the largest in Brazil in its segment. Wärtsilä's advanced platform utilizes a large amount of vessel data and machine learning algorithms, complemented by the company's extensive systems modeling experience. In this agreement, a detailed analysis will be conducted of the potential benefits to CBO of both short- and long-term solutions, including digitization, energy efficiency, and energy saving devices, hybridization, and alternative marine fuels in the future, with a specific focus on the viability of ethanol fuel in the future.

Strategic Latin America Offshore Support Vessels Industry Market Forecast

The strategic forecast for the Latin America offshore support vessels (OSV) industry indicates a robust period of growth from 2025 to 2033, driven by sustained upstream investments in key energy-producing nations like Brazil, Guyana, and Mexico. The escalating demand for OSVs to support deepwater exploration, complex field developments, and enhanced oil recovery projects will remain a primary catalyst. Furthermore, the burgeoning offshore renewable energy sector, particularly wind farms, presents a significant, albeit nascent, opportunity for fleet diversification. The industry's ability to adapt to decarbonization mandates by embracing hybrid technologies and exploring alternative fuels will be critical for long-term competitiveness. Strategic investments in modern, efficient, and environmentally compliant vessels, coupled with the adoption of digital solutions for operational optimization, will pave the way for enhanced market penetration and profitability.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Latin America Offshore Support Vessels Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Latin America Offshore Support Vessels Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Mexico

- 4. Guyana

- 5. Rest of Latin America

Latin America Offshore Support Vessels Industry Regional Market Share

Geographic Coverage of Latin America Offshore Support Vessels Industry

Latin America Offshore Support Vessels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Demand for Renewable Energy

- 3.4. Market Trends

- 3.4.1. Platform Supply Vessels (PSVs) Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Mexico

- 5.6.4. Guyana

- 5.6.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil Latin America Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Argentina Latin America Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Mexico Latin America Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Guyana Latin America Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Rest of Latin America Latin America Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BrasFels

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Estaleiro Jurong Aracruz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Navship

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tepal Shipyard

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Manzanillo International Terminal

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 BrasFels

List of Figures

- Figure 1: Latin America Offshore Support Vessels Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Offshore Support Vessels Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 20: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 26: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 32: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Latin America Offshore Support Vessels Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Offshore Support Vessels Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Latin America Offshore Support Vessels Industry?

Key companies in the market include BrasFels , Estaleiro Jurong Aracruz , Navship , Tepal Shipyard , Manzanillo International Terminal.

3. What are the main segments of the Latin America Offshore Support Vessels Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources.

6. What are the notable trends driving market growth?

Platform Supply Vessels (PSVs) Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Demand for Renewable Energy.

8. Can you provide examples of recent developments in the market?

October 2022: Brazil's Petrobras launched a public tender to procure up to 20 offshore support vessels, confirming its need for tonnage to support its ambitious growth plans.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Offshore Support Vessels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Offshore Support Vessels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Offshore Support Vessels Industry?

To stay informed about further developments, trends, and reports in the Latin America Offshore Support Vessels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence