Key Insights

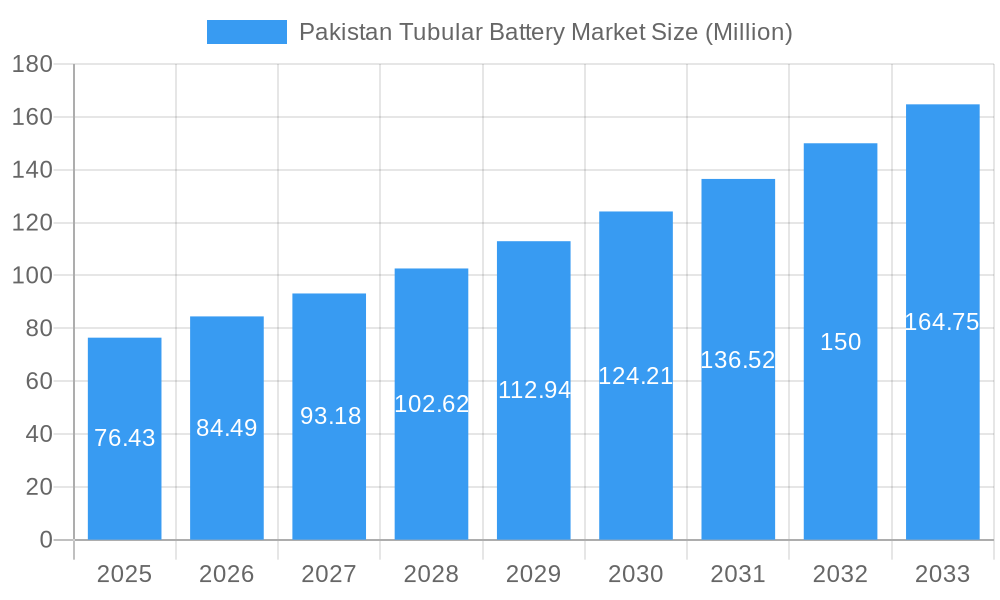

The Pakistan tubular battery market, valued at $76.43 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 10.35% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for reliable power backup solutions in both residential and commercial sectors, particularly in areas with frequent power outages, significantly contributes to market growth. Furthermore, the rising adoption of renewable energy sources like solar power, which often necessitates robust and durable battery storage solutions, further bolsters market demand. The expanding telecommunications infrastructure and the growth of the industrial sector in Pakistan also create a strong need for high-capacity tubular batteries. Key players like Exide Pakistan Limited, Atlas Battery Limited, and Zhejiang Narada Power Source Co Ltd are actively competing in this market, each leveraging its strengths in technology, distribution networks, and brand reputation to capture market share. Competitive pricing strategies and technological advancements in battery life and performance are also shaping the market landscape.

Pakistan Tubular Battery Market Market Size (In Million)

However, certain challenges remain. Fluctuations in raw material prices, particularly lead and other critical components, can impact production costs and profitability. Moreover, the market faces potential constraints from the emergence of alternative battery technologies, such as lithium-ion batteries, which offer higher energy density and potentially longer lifespans. Despite these challenges, the overall outlook for the Pakistan tubular battery market remains positive, with continued growth anticipated throughout the forecast period. The market's trajectory hinges on the sustained growth of key industries, government initiatives supporting infrastructure development, and the ongoing demand for reliable and cost-effective power backup solutions in a country grappling with frequent power shortages. Strategic investments in research and development, focusing on enhancing battery performance and lifespan while addressing environmental concerns, will be crucial for sustained market expansion.

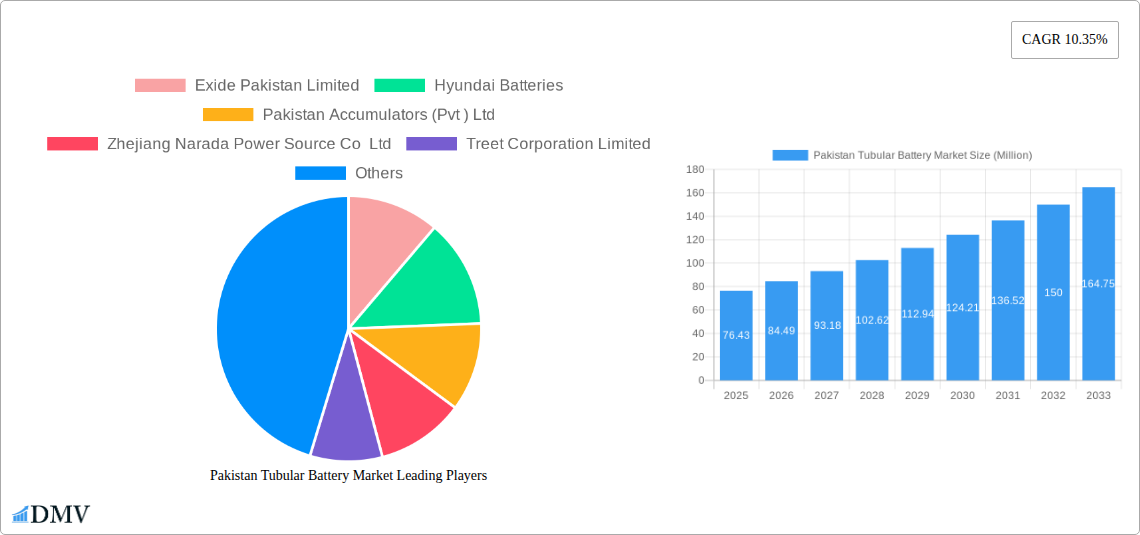

Pakistan Tubular Battery Market Company Market Share

Pakistan Tubular Battery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Pakistan tubular battery market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is estimated to be valued at xx Million in 2025.

Pakistan Tubular Battery Market Composition & Trends

This section delves into the intricate makeup of the Pakistan tubular battery market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The report utilizes both descriptive paragraphs and concise bullet points to provide a clear picture of market dynamics. Market share distribution among leading players like Exide Pakistan Limited, Atlas Battery Limited, and Treet Corporation Limited is meticulously analyzed, revealing the competitive intensity of the sector. Furthermore, significant M&A activities, including their values (where available), are detailed, offering insights into strategic market consolidation and emerging trends. The analysis includes a comprehensive evaluation of substitute products and their market impact, along with a thorough assessment of the regulatory environment shaping market growth. Finally, the report profiles key end-users of tubular batteries in Pakistan, providing granular insights into market demand drivers.

- Market Concentration: High/Medium/Low (Specify based on analysis, if xx use a predicted value like Medium)

- Top 3 Players Market Share: xx%, xx%, xx% (Predicted values if unavailable)

- M&A Activity: xx Million in deals recorded in the last 5 years (Predicted values if unavailable)

- Key End-Users: Telecom, UPS systems, Solar Energy, Automotive (etc.)

Pakistan Tubular Battery Market Industry Evolution

This section provides a detailed chronological account of the Pakistan tubular battery market's evolution, tracing its growth trajectory, technological advancements, and the changing demands of consumers. This in-depth analysis encompasses the historical period (2019-2024) and projects the market's future course. Specific data points, including historical and projected growth rates and adoption metrics for various tubular battery technologies, are meticulously presented to offer a clear understanding of market trends. The report explores the influence of technological advancements on market growth, including the adoption of new manufacturing processes and improved battery chemistries.

- CAGR (2019-2024): xx% (Predicted if unavailable)

- Projected CAGR (2025-2033): xx% (Predicted if unavailable)

- Adoption Rate of Advanced Technologies: xx% (Predicted if unavailable)

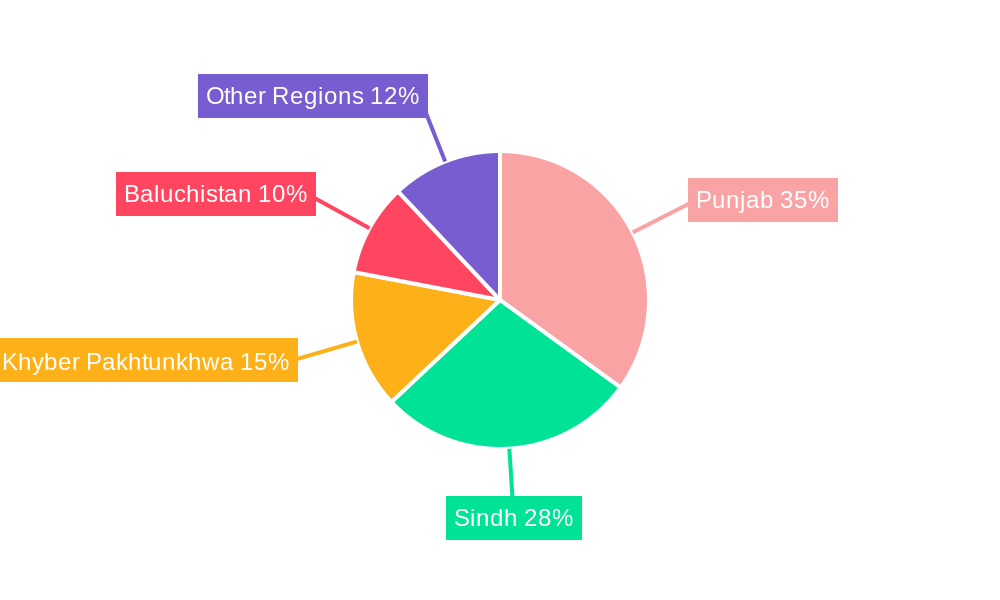

Leading Regions, Countries, or Segments in Pakistan Tubular Battery Market

This section identifies and analyzes the dominant regions, countries, or segments within the Pakistan tubular battery market. The analysis utilizes both detailed paragraphs and bullet points to highlight key factors driving regional/segment dominance. The report meticulously examines investment trends, regulatory support, and other influential factors that contribute to the market leadership of specific regions or segments. For example, the growing adoption of solar energy in Punjab might be detailed as a driver for higher market share in that region.

- Dominant Region/Segment: (Specify with justification - e.g., Punjab due to higher solar energy adoption)

- Key Drivers in Dominant Region/Segment:

- Increased government investment in renewable energy infrastructure.

- Favorable regulatory policies supporting the solar energy sector.

- Growing adoption of tubular batteries in off-grid power solutions.

Pakistan Tubular Battery Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics of tubular batteries in the Pakistan market. It emphasizes unique selling propositions and technological advancements driving market evolution. The analysis showcases how innovative features such as extended lifespan and improved energy density are impacting market adoption and consumer preferences.

(Paragraph detailing specific innovations, including examples like improved electrolyte formulations or enhanced grid designs, and their impact on battery performance metrics like cycle life and energy density)

Propelling Factors for Pakistan Tubular Battery Market Growth

This section identifies and analyzes the key factors driving the growth of the Pakistan tubular battery market. It focuses on technological advancements, economic influences, and the regulatory environment, providing concrete examples to substantiate each driver. The analysis might include factors like increasing demand for backup power solutions due to unreliable grid electricity and government initiatives promoting renewable energy adoption.

(Paragraphs or bullet points detailing factors such as government incentives for renewable energy, increasing demand from telecom sector, and technological improvements leading to longer battery lifespan and higher efficiency.)

Obstacles in the Pakistan Tubular Battery Market

This section examines the challenges and constraints hindering the growth of the Pakistan tubular battery market. It analyzes regulatory hurdles, supply chain disruptions, and competitive pressures, quantifying their impact on market expansion. This might include challenges in sourcing raw materials, fluctuating lead prices, and competition from alternative battery technologies.

(Paragraphs or bullet points explaining factors like import restrictions, lead price volatility, and competition from other battery technologies.)

Future Opportunities in Pakistan Tubular Battery Market

This section explores emerging opportunities in the Pakistan tubular battery market. It focuses on potential new markets, technological advancements, and evolving consumer trends that could drive future growth. This could include exploring new applications in electric vehicles or advancements in battery management systems.

(Paragraphs or bullet points illustrating opportunities such as expansion into electric vehicle market, development of advanced battery technologies, and increased focus on energy storage solutions.)

Major Players in the Pakistan Tubular Battery Market Ecosystem

- Exide Pakistan Limited (Exide Pakistan Limited)

- Hyundai Batteries

- Pakistan Accumulators (Pvt ) Ltd

- Zhejiang Narada Power Source Co Ltd

- Treet Corporation Limited (Treet Corporation Limited)

- Atlas Battery Limited (Atlas Battery Limited)

- Phoenix Battery (Century Engineering Industries [Private] Limited)

- Solarshop

- APT Inverex Solar LLC

- List Not Exhaustive

Key Developments in Pakistan Tubular Battery Market Industry

- May 2024: Oracle Power and China Electric Power Equipment and Technology's collaboration on a 1.3GW solar, wind, and BESS project significantly boosts demand for tubular batteries.

- April 2024: Treet Battery Ltd's joint venture with Hexing Energy strengthens the lead-acid battery market, positively impacting tubular battery demand, particularly in the solar energy sector.

Strategic Pakistan Tubular Battery Market Forecast

The Pakistan tubular battery market is poised for robust growth driven by the increasing adoption of renewable energy sources and the expansion of the telecom and UPS sectors. Government initiatives promoting energy independence and technological advancements leading to improved battery performance and lifespan further contribute to this positive outlook. The market is expected to witness significant expansion over the forecast period, presenting lucrative opportunities for existing and new players.

Pakistan Tubular Battery Market Segmentation

- 1. Data Centers

- 2. Renewable Energy

- 3. Other Applications (Automotive, Industrial, Etc.)

Pakistan Tubular Battery Market Segmentation By Geography

- 1. Pakistan

Pakistan Tubular Battery Market Regional Market Share

Geographic Coverage of Pakistan Tubular Battery Market

Pakistan Tubular Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Unstable Power Supply in the Country Leading To Look For Alternative Options For Backup4.; Rising Solar Energy Adoption

- 3.3. Market Restrains

- 3.3.1. 4.; Unstable Power Supply in the Country Leading To Look For Alternative Options For Backup4.; Rising Solar Energy Adoption

- 3.4. Market Trends

- 3.4.1. Unstable Power Supply in the Country Leading to Looking for Alternative Options for Backup

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Tubular Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Data Centers

- 5.2. Market Analysis, Insights and Forecast - by Renewable Energy

- 5.3. Market Analysis, Insights and Forecast - by Other Applications (Automotive, Industrial, Etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Data Centers

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Exide Pakistan Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Batteries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pakistan Accumulators (Pvt ) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zhejiang Narada Power Source Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Treet Corporation Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Atlas Battery Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Phoenix Battery (Century Engineering Industries [Private] Limited)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Solarshop

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 APT Inverex Solar LLC*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Exide Pakistan Limited

List of Figures

- Figure 1: Pakistan Tubular Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Pakistan Tubular Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Pakistan Tubular Battery Market Revenue Million Forecast, by Data Centers 2020 & 2033

- Table 2: Pakistan Tubular Battery Market Volume Million Forecast, by Data Centers 2020 & 2033

- Table 3: Pakistan Tubular Battery Market Revenue Million Forecast, by Renewable Energy 2020 & 2033

- Table 4: Pakistan Tubular Battery Market Volume Million Forecast, by Renewable Energy 2020 & 2033

- Table 5: Pakistan Tubular Battery Market Revenue Million Forecast, by Other Applications (Automotive, Industrial, Etc.) 2020 & 2033

- Table 6: Pakistan Tubular Battery Market Volume Million Forecast, by Other Applications (Automotive, Industrial, Etc.) 2020 & 2033

- Table 7: Pakistan Tubular Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Pakistan Tubular Battery Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Pakistan Tubular Battery Market Revenue Million Forecast, by Data Centers 2020 & 2033

- Table 10: Pakistan Tubular Battery Market Volume Million Forecast, by Data Centers 2020 & 2033

- Table 11: Pakistan Tubular Battery Market Revenue Million Forecast, by Renewable Energy 2020 & 2033

- Table 12: Pakistan Tubular Battery Market Volume Million Forecast, by Renewable Energy 2020 & 2033

- Table 13: Pakistan Tubular Battery Market Revenue Million Forecast, by Other Applications (Automotive, Industrial, Etc.) 2020 & 2033

- Table 14: Pakistan Tubular Battery Market Volume Million Forecast, by Other Applications (Automotive, Industrial, Etc.) 2020 & 2033

- Table 15: Pakistan Tubular Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Pakistan Tubular Battery Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Tubular Battery Market?

The projected CAGR is approximately 10.35%.

2. Which companies are prominent players in the Pakistan Tubular Battery Market?

Key companies in the market include Exide Pakistan Limited, Hyundai Batteries, Pakistan Accumulators (Pvt ) Ltd, Zhejiang Narada Power Source Co Ltd, Treet Corporation Limited, Atlas Battery Limited, Phoenix Battery (Century Engineering Industries [Private] Limited), Solarshop, APT Inverex Solar LLC*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the Pakistan Tubular Battery Market?

The market segments include Data Centers, Renewable Energy, Other Applications (Automotive, Industrial, Etc.).

4. Can you provide details about the market size?

The market size is estimated to be USD 76.43 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Unstable Power Supply in the Country Leading To Look For Alternative Options For Backup4.; Rising Solar Energy Adoption.

6. What are the notable trends driving market growth?

Unstable Power Supply in the Country Leading to Looking for Alternative Options for Backup.

7. Are there any restraints impacting market growth?

4.; Unstable Power Supply in the Country Leading To Look For Alternative Options For Backup4.; Rising Solar Energy Adoption.

8. Can you provide examples of recent developments in the market?

May 2024: Oracle Power, an international project developer, and China Electric Power Equipment and Technology collaborated to develop and construct a 1.3GW project in Pakistan that combines solar, wind, and battery energy storage system (BESS) technology. Tubular batteries are a significant part of this project. Therefore, such developments are expected to boost the demand for tubular batteries in Pakistan.April 2024: Treet Battery Ltd, a Pakistan-based lead-acid battery manufacturer, entered a joint venture with Hexing Energy (Private) Limited, a subsidiary of Hexing Electrical Co. Ltd. Such developments are expected to boost the demand for lead-acid batteries, including tubular batteries, especially in the solar energy industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Tubular Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Tubular Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Tubular Battery Market?

To stay informed about further developments, trends, and reports in the Pakistan Tubular Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence