Key Insights

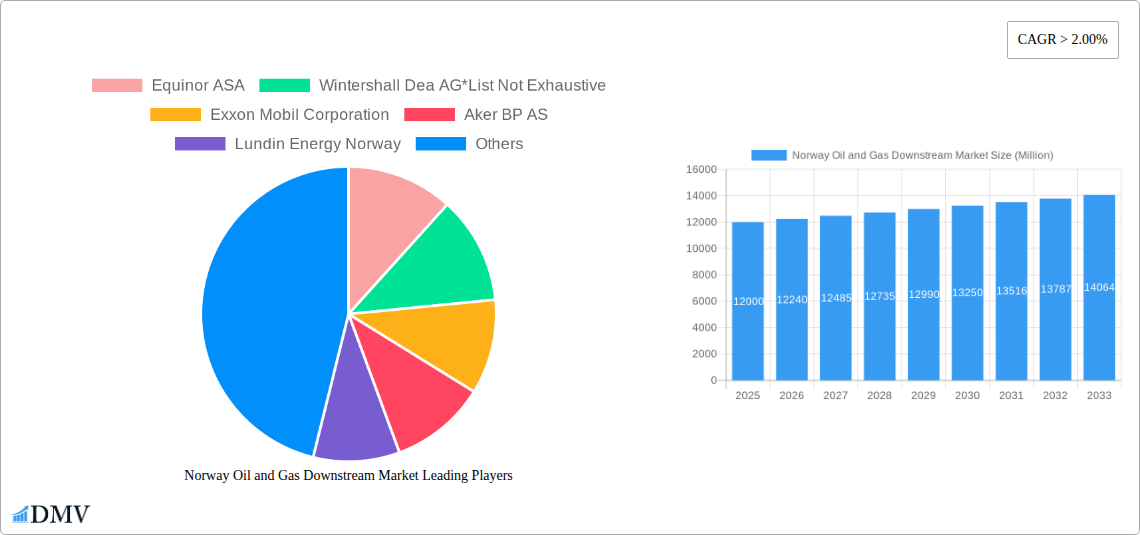

The Norway oil and gas downstream market, encompassing refineries and petrochemical plants, is projected for significant growth. With a Compound Annual Growth Rate (CAGR) of 2.0% expected from 2025 to 2033, the market is poised for expansion. While specific 2025 figures are under review, given the substantial presence of industry leaders like Equinor ASA, Exxon Mobil Corporation, and Shell, and Norway's robust energy infrastructure, the 2025 market size is estimated to be between $10 billion and $15 billion. Key growth drivers include rising domestic energy needs, strategic investments in refinery modernization to boost processing efficiency and product output, and Norway's critical role in European energy security. Emerging trends such as renewable energy integration and decarbonization initiatives are also shaping the market, driving investment in Carbon Capture, Utilization, and Storage (CCUS) technologies. Potential challenges include volatile global oil prices and evolving governmental regulations on fossil fuel consumption.

Norway Oil and Gas Downstream Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market expansion, potentially influenced by the aforementioned challenges. The competitive landscape is dominated by major multinational corporations requiring substantial capital investment for new developments and infrastructure enhancements. Norway's stringent regulatory environment and commitment to environmental sustainability will continue to guide industry operations. A detailed analysis of the refinery and petrochemical segments, considering regional variations within Norway and comparisons with other North Sea markets, is essential for stakeholders aiming to capitalize on opportunities within this dynamic sector.

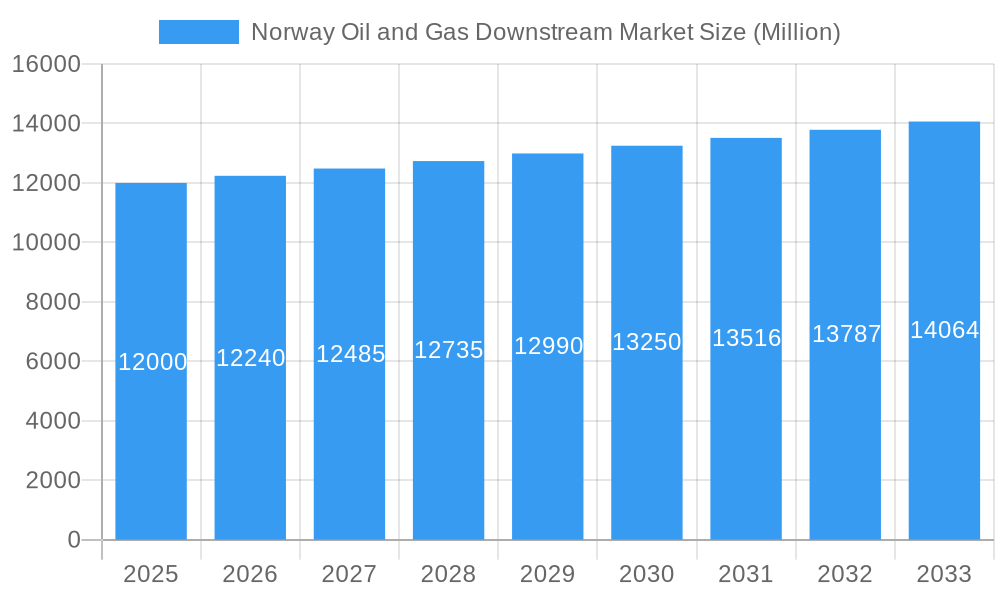

Norway Oil and Gas Downstream Market Company Market Share

Norway Oil and Gas Downstream Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Norway oil and gas downstream market, covering the period from 2019 to 2033. It examines market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, future opportunities, and key players, equipping stakeholders with crucial data for strategic decision-making. The report uses 2025 as the base year and provides forecasts until 2033, incorporating recent significant industry developments. The study period covers 2019-2024 (historical period) and 2025-2033 (forecast period).

Norway Oil and Gas Downstream Market Market Composition & Trends

This section delves into the intricate dynamics of the Norwegian oil and gas downstream market, providing a comprehensive overview of its structure and evolution. We analyze market concentration, revealing the market share distribution amongst key players such as Equinor ASA, Wintershall Dea AG, Exxon Mobil Corporation, Aker BP AS, Lundin Energy Norway, Royal Dutch Shell PLC, and Total S.A. (list not exhaustive). The report further investigates the influence of innovation catalysts, including technological advancements and regulatory frameworks, on market trends. An assessment of substitute products and their impact, along with a detailed profile of end-users, provides valuable insights into market demand. Finally, the analysis encompasses mergers and acquisitions (M&A) activities, quantifying deal values in Millions (USD) where possible and examining their effect on market consolidation. For example, the report will consider the impact of recent M&A activities where the total deal value was estimated at approximately xx Million USD in the last five years.

- Market Concentration: Analysis of market share held by major players (xx% for Equinor ASA, xx% for Wintershall Dea AG, etc.).

- Innovation Catalysts: Discussion of technological advancements driving efficiency improvements and new product development.

- Regulatory Landscape: Evaluation of environmental regulations and their effect on market operations.

- Substitute Products: Assessment of the impact of alternative energy sources on market demand.

- End-User Profiles: Detailed analysis of the major downstream sectors consuming oil and gas products in Norway.

- M&A Activities: Review of significant mergers and acquisitions, including deal values (e.g., xx Million USD for a specific deal) and their impact on market structure.

Norway Oil and Gas Downstream Market Industry Evolution

This section provides a detailed analysis of the Norwegian oil and gas downstream market's growth trajectory from 2019 to 2033. We examine market growth rates, technological advancements shaping the industry, and the evolving demands of consumers. We will explore the impact of factors such as global oil prices, government policies, and environmental concerns on market dynamics, providing specific data points such as annual growth rates (e.g., a projected average annual growth rate of xx% from 2025 to 2033) and adoption rates of new technologies. The analysis will also cover shifts in consumer preferences towards sustainable and environmentally friendly products and their implications for the industry.

Leading Regions, Countries, or Segments in Norway Oil and Gas Downstream Market

This section identifies the dominant segments within the Norwegian oil and gas downstream market, focusing on process types such as Refineries and Petrochemical Plants. A detailed analysis will pinpoint the leading region or country within Norway based on factors like production capacity, investment levels, and regulatory support.

- Refineries: Key drivers include existing infrastructure, proximity to supply sources, and government incentives (e.g., tax breaks or subsidies). The Mongstad refinery, for instance, plays a significant role despite the July 2022 fire.

- Petrochemical Plants: Key drivers include access to feedstock, demand for petrochemical products, and proximity to major industrial hubs. The INOVYN Rafnes site and its Electra project exemplify the shift toward green technology.

- Dominance Factors: This section provides an in-depth analysis explaining why a specific region or segment is dominant, supported by data and evidence. Factors considered include economic strength, available resources, and policy support.

Norway Oil and Gas Downstream Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the Norwegian oil and gas downstream sector. We will analyze unique selling propositions and technological advancements, emphasizing the drive toward sustainable and efficient solutions. This includes advancements in refinery processes to maximize yield and minimize environmental impact and the development of innovative petrochemical products with improved properties and reduced environmental footprint.

Propelling Factors for Norway Oil and Gas Downstream Market Growth

Several key factors are driving growth in the Norwegian oil and gas downstream market. Technological advancements, such as improved refining processes and the development of more efficient petrochemical production methods, are enhancing productivity and sustainability. Favorable economic conditions, including rising demand for oil and gas products both domestically and internationally, are fueling expansion. Supportive government policies and regulatory frameworks designed to stimulate investment and innovation also play a crucial role. For example, the government's focus on energy security and its support for renewable energy integration, like the Enova investment in the Electra project, is influencing market growth.

Obstacles in the Norway Oil and Gas Downstream Market Market

The Norwegian oil and gas downstream market faces several challenges. Stringent environmental regulations and the increasing pressure to reduce carbon emissions pose significant hurdles. Supply chain disruptions, exacerbated by global events, can impact the availability of feedstock and other essential materials. Intense competition from both domestic and international players adds further pressure on profit margins. The July 2022 fire at the Mongstad refinery highlights the vulnerability of critical infrastructure to unforeseen events, impacting production and supply.

Future Opportunities in Norway Oil and Gas Downstream Market

Despite the challenges, the Norwegian oil and gas downstream market presents numerous future opportunities. The increasing focus on renewable energy integration and the development of green technologies, such as the Electra project, offer pathways to sustainable growth. Expanding into new markets and diversifying product offerings can also provide significant growth potential. Developing innovative solutions to address environmental concerns and enhance energy efficiency will be key to unlocking future opportunities.

Major Players in the Norway Oil and Gas Downstream Market Ecosystem

Key Developments in Norway Oil and Gas Downstream Market Industry

- October 2022: INOVYN's Rafnes site initiates the Electra project, a USD 1.41 Million Enova-supported initiative to electrify vinyl chloride production, replacing fossil fuels with renewable electricity. This signifies a significant shift toward sustainable practices in the Norwegian petrochemical sector.

- July 2022: A fire at the Mongstad refinery resulted in the temporary shutdown of a section, impacting production capacity. This highlights the risk associated with large-scale industrial operations and underscores the importance of safety and resilience measures.

Strategic Norway Oil and Gas Downstream Market Market Forecast

The Norwegian oil and gas downstream market is poised for growth, driven by technological advancements in renewable energy integration, a strategic focus on sustainable practices, and government initiatives supporting innovation. While challenges remain, the long-term outlook is positive, with significant potential for expansion in both domestic and international markets. The shift toward greener technologies and a focus on enhancing operational efficiency will shape future market dynamics and drive growth over the forecast period.

Norway Oil and Gas Downstream Market Segmentation

-

1. Process Type

- 1.1. Refineries

- 1.2. Petrochemical Plants

Norway Oil and Gas Downstream Market Segmentation By Geography

- 1. Norway

Norway Oil and Gas Downstream Market Regional Market Share

Geographic Coverage of Norway Oil and Gas Downstream Market

Norway Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Refineries

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wintershall Dea AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aker BP AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lundin Energy Norway

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Total S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Norway Oil and Gas Downstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Oil and Gas Downstream Market Share (%) by Company 2025

List of Tables

- Table 1: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 4: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oil and Gas Downstream Market?

The projected CAGR is approximately 2%.

2. Which companies are prominent players in the Norway Oil and Gas Downstream Market?

Key companies in the market include Equinor ASA, Wintershall Dea AG*List Not Exhaustive, Exxon Mobil Corporation, Aker BP AS, Lundin Energy Norway, Royal Dutch Shell PLC, Total S A.

3. What are the main segments of the Norway Oil and Gas Downstream Market?

The market segments include Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 25 billion as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Refining Capacity to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

October 2022: INOVYN's petrochemical site in Rafnes, Norway, takes the next step in developing and implementing green technology. As a subsidiary of INEOS, INOVYN will develop and install a new world-leading technology to electrify the production of vinyl chloride on the Rafnes site, replacing fossil fuel with renewable electricity. The project is called "Electra." A decision was made on 23 August 2022 by Enova to support Electra with an investment of USD 1.41 Million, subject to the decision by INEOS to proceed with the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Norway Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence