Key Insights

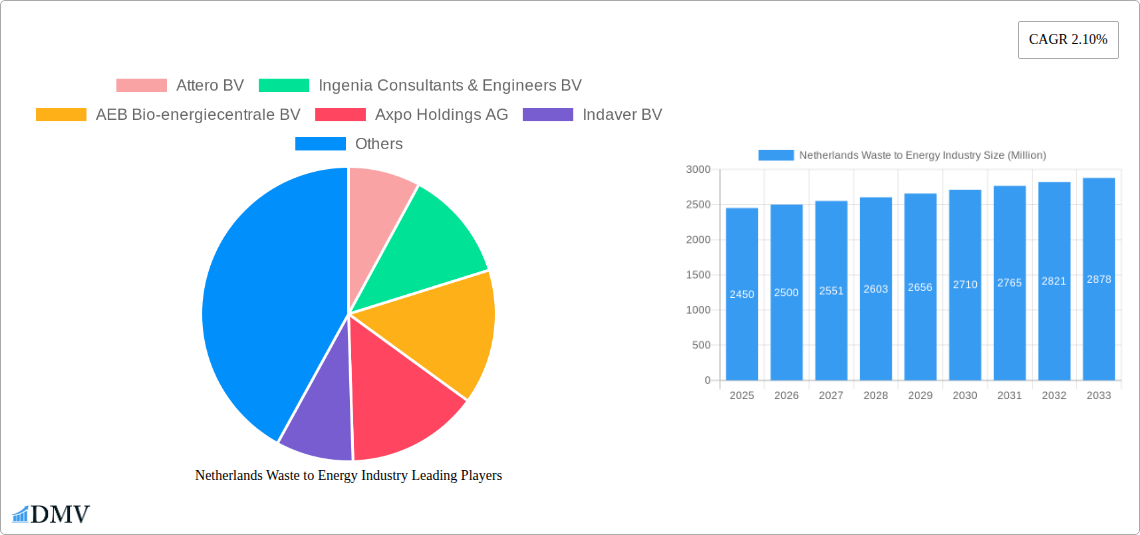

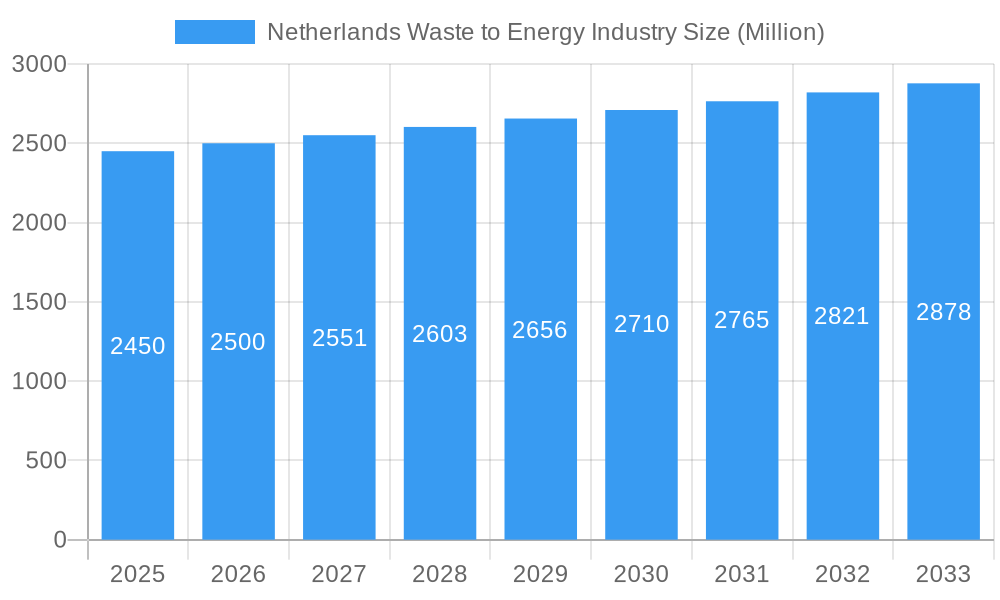

The Netherlands Waste-to-Energy (WtE) market, valued at €2.45 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.10% from 2025 to 2033. This growth is driven by stringent government regulations aimed at reducing landfill waste and promoting sustainable waste management practices. The increasing focus on renewable energy sources and the need to mitigate greenhouse gas emissions further bolster market expansion. Key market segments include municipal solid waste (MSW), industrial waste, and hazardous waste management. Technological advancements in incineration, gasification, anaerobic digestion, and pyrolysis are shaping the industry landscape, with incineration currently holding a significant market share due to its established infrastructure and efficiency. Growing environmental consciousness among both residential and commercial end-users is also contributing to market growth. Competition within the market is moderate, with key players such as Attero BV, Ingenia Consultants & Engineers BV, and AEB Bio-energiecentrale BV dominating. However, the entry of new players with innovative technologies is anticipated, fostering competition and potentially accelerating market growth. The geographic focus remains primarily within the Netherlands, although opportunities exist for regional expansion within Europe, particularly in neighboring countries with similar waste management challenges.

Netherlands Waste to Energy Industry Market Size (In Billion)

The Netherlands WtE market presents significant opportunities for investment and expansion. While the 2.10% CAGR reflects a moderate growth rate, the underlying drivers suggest potential for acceleration. Strategic partnerships between waste management companies and energy producers can significantly enhance market dynamics. Further technological advancements, particularly in areas such as improved energy efficiency and waste-to-biofuel conversion, are likely to shape future market growth. The regulatory landscape will remain a critical factor, influencing both investment decisions and market expansion strategies. Companies focused on innovative solutions, strong sustainability credentials, and efficient operations are poised to capitalize on this growing market. Furthermore, focusing on the reduction of greenhouse gas emissions from waste processing will be key to long-term success and sustainability within the Dutch Waste-to-Energy sector.

Netherlands Waste to Energy Industry Company Market Share

Netherlands Waste to Energy Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Netherlands' waste-to-energy (WtE) industry, offering crucial market intelligence for stakeholders from 2019 to 2033. The report meticulously examines market trends, technological advancements, and key players, providing a comprehensive forecast to inform strategic decision-making. With a base year of 2025 and a forecast period extending to 2033, this report is an invaluable resource for navigating the dynamic landscape of the Netherlands' WtE sector. The market is estimated to be worth xx Million in 2025, with a projected value of xx Million by 2033.

Netherlands Waste to Energy Industry Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the Netherlands WtE industry. We delve into market share distribution among key players such as Attero BV, Ingenia Consultants & Engineers BV, AEB Bio-energiecentrale BV, Axpo Holdings AG, Indaver BV, Dutch Incinerators BV, AEB Amsterdam, and Mitsubishi Heavy Industries Ltd (list not exhaustive), examining their strategies and market influence. The report also explores the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible. The analysis covers various waste types, including municipal solid waste, industrial waste, hazardous waste, and agricultural waste, and their contribution to the overall market.

- Market Concentration: The Netherlands WtE market exhibits a [describe concentration level, e.g., moderately concentrated] structure with [mention % market share held by top 3 players, if available, otherwise state xx%] held by the leading companies. Further detail on market share distribution for each major player is provided within the report.

- Innovation Catalysts: Stringent environmental regulations and the increasing scarcity of landfill space are significant drivers of innovation within the Netherlands WtE sector. The push for carbon neutrality is fostering investment in advanced technologies.

- Regulatory Landscape: The Dutch government's policies on waste management and renewable energy significantly influence the industry's growth trajectory. Detailed analysis of relevant regulations and their impact on market players is provided.

- Substitute Products: While landfill remains a viable (though increasingly less favored) alternative, the report examines the competitiveness of WtE against other waste management solutions.

- End-User Profiles: This section profiles the key end-users of WtE-generated energy, including residential, commercial, and industrial sectors, quantifying their energy demands and the WtE industry's role in meeting them.

- M&A Activity: The report details significant M&A transactions within the historical period (2019-2024), analyzing their impact on market consolidation and competitive dynamics. Estimated deal values (in Millions) are provided where data is available.

Netherlands Waste to Energy Industry Industry Evolution

This section examines the historical and projected growth of the Netherlands WtE industry (2019-2033). We trace the evolution of the market, highlighting key technological advancements such as improvements in incineration efficiency, the increasing adoption of gasification and anaerobic digestion, and the emergence of innovative waste-to-fuel technologies like pyrolysis and refuse-derived fuel (RDF). Further analysis is undertaken on shifting consumer demands concerning environmental sustainability, influencing investment patterns and driving market growth. The report incorporates detailed data on growth rates, adoption metrics for different technologies, and an assessment of their impact on the market structure. Specific data on growth rates and adoption metrics will be included for each technology segment.

Leading Regions, Countries, or Segments in Netherlands Waste to Energy Industry

This section identifies the leading regions and segments within the Netherlands WtE market. While the Netherlands is a single country, regional variations in waste generation, regulatory frameworks, and investment patterns may exist, leading to localized differences in WtE market development. The analysis will focus on the key segments across technology (incineration, gasification, pyrolysis, anaerobic digestion, refuse-derived fuel), waste type (municipal solid waste, industrial waste, hazardous waste, agricultural waste), and end-user (industrial, commercial, residential).

- Key Drivers:

- Incineration: High efficiency and established infrastructure make incineration a dominant technology.

- Gasification: Increasing interest and investment in gasification is driven by its potential for higher energy recovery and reduced emissions.

- Municipal Solid Waste: The large volume of municipal solid waste (MSW) generated annually provides a substantial feedstock for WtE plants.

- Regulatory Support: Government incentives and environmental regulations strongly influence technological adoption and market growth.

- Investment Trends: Capital investment in new WtE plants and upgrades to existing facilities will be analyzed, highlighting regional variations.

Netherlands Waste to Energy Industry Product Innovations

Recent years have witnessed significant advancements in WtE technologies. Innovations focus on improving energy efficiency, reducing emissions, and enhancing the resource recovery potential of waste materials. This includes advancements in gasification technologies for cleaner energy production, improved waste sorting techniques to increase the quality of RDF, and the exploration of advanced treatment processes for hazardous waste. The development of carbon capture technologies is also significantly impacting the sector, as illustrated by the Aker Carbon Capture project at Twence. These advancements offer unique selling propositions that improve sustainability and economic viability for WtE operators.

Propelling Factors for Netherlands Waste to Energy Industry Growth

Several factors are driving the growth of the Netherlands WtE industry. Stringent environmental regulations aimed at reducing landfill reliance and promoting renewable energy sources are key drivers. The increasing cost of landfill disposal, coupled with the potential for energy recovery from waste, makes WtE economically attractive. Technological advancements, such as improved incineration efficiency and the development of advanced gasification and pyrolysis technologies, further enhance the sector's appeal. Government support through financial incentives and supportive policies also stimulate growth.

Obstacles in the Netherlands Waste to Energy Industry Market

Despite significant growth potential, the Netherlands WtE industry faces challenges. These include securing permits and navigating complex regulatory processes, which can lead to project delays and increased costs. Supply chain disruptions, particularly concerning the availability of specialized equipment and materials, can also impact project timelines and profitability. Furthermore, intense competition among WtE operators necessitates continuous innovation and efficiency improvements to maintain market share and profitability. The fluctuating prices of fossil fuels can also affect the competitiveness of WtE-generated energy.

Future Opportunities in Netherlands Waste to Energy Industry

The Netherlands WtE industry presents promising opportunities. Further development and adoption of innovative technologies like gasification and pyrolysis are expected to drive future growth. Expanding the range of waste materials processed, including industrial and agricultural waste, also presents considerable potential. The integration of carbon capture and storage technologies will be crucial in enhancing the sustainability of WtE and attracting further investment. Exploring new markets for WtE-generated energy, such as providing heat for district heating networks, can significantly enhance the industry's contribution to the energy transition.

Major Players in the Netherlands Waste to Energy Industry Ecosystem

- Attero BV

- Ingenia Consultants & Engineers BV

- AEB Bio-energiecentrale BV

- Axpo Holdings AG

- Indaver BV

- Dutch Incinerators BV

- AEB Amsterdam

- Mitsubishi Heavy Industries Ltd *List Not Exhaustive

Key Developments in Netherlands Waste to Energy Industry Industry

- May 2022: Aker Carbon Capture commenced construction of its Just Catch modular carbon capture plant at Twence's waste-to-energy plant in Hengelo. This project aims to capture 100,000 metric tons of CO2 annually by the end of 2023, using the captured carbon as liquid fertilizer.

- January 2023: RWE secured USD 117 Million from the European Union's Innovation Fund to support the development of a waste-to-hydrogen project in a Dutch industrial cluster. This signifies a shift towards utilizing WtE for green hydrogen production.

Strategic Netherlands Waste to Energy Industry Market Forecast

The Netherlands WtE industry is poised for substantial growth, driven by stringent environmental regulations, technological advancements, and increasing economic incentives. The rising adoption of advanced WtE technologies and the exploration of new waste streams will significantly contribute to the market's expansion. Government support and the growing need for sustainable energy solutions will further accelerate growth, leading to a significantly larger market size by 2033. The increasing focus on carbon capture and utilization will also unlock new opportunities and improve the sustainability profile of the industry.

Netherlands Waste to Energy Industry Segmentation

-

1. Technology

- 1.1. Incineration

- 1.2. Gasification

- 1.3. Pyrolysis

- 1.4. Anaerobic Digestion

- 1.5. Refuse-Derived Fuel

-

2. Waste Type

- 2.1. Municipal Solid Waste

- 2.2. Industrial Waste

- 2.3. Hazardous Waste

- 2.4. Agricultural Waste

-

3. End-User

- 3.1. Industrial

- 3.2. Commercial

- 3.3. Residential

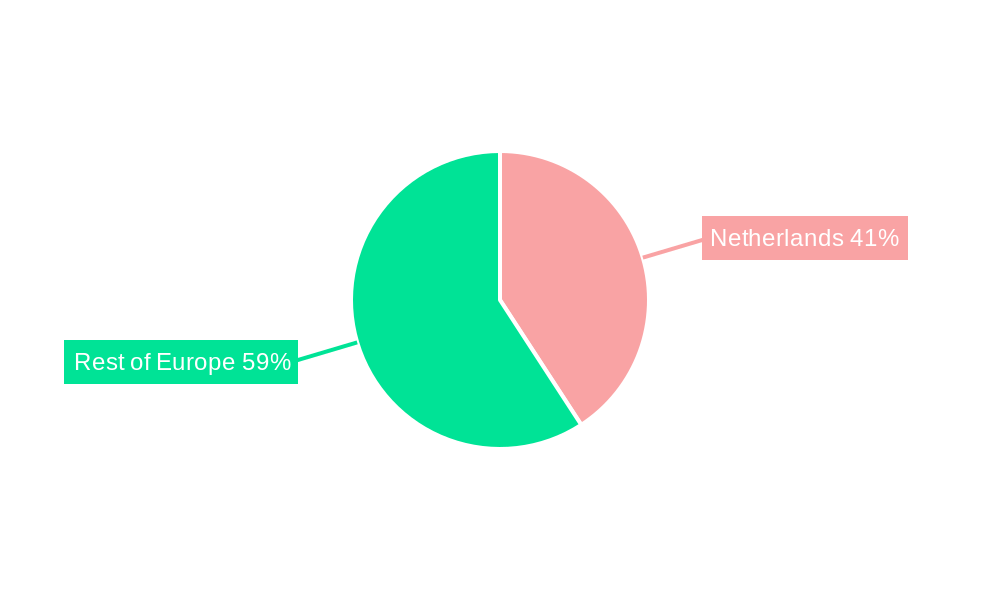

Netherlands Waste to Energy Industry Segmentation By Geography

- 1. Netherlands

Netherlands Waste to Energy Industry Regional Market Share

Geographic Coverage of Netherlands Waste to Energy Industry

Netherlands Waste to Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries

- 3.3. Market Restrains

- 3.3.1. The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned

- 3.4. Market Trends

- 3.4.1. Thermal Technologies Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Incineration

- 5.1.2. Gasification

- 5.1.3. Pyrolysis

- 5.1.4. Anaerobic Digestion

- 5.1.5. Refuse-Derived Fuel

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Municipal Solid Waste

- 5.2.2. Industrial Waste

- 5.2.3. Hazardous Waste

- 5.2.4. Agricultural Waste

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Industrial

- 5.3.2. Commercial

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Attero BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ingenia Consultants & Engineers BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AEB Bio-energiecentrale BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axpo Holdings AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indaver BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dutch Incinerators BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AEB Amsterdam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Heavy Industries Ltd *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Attero BV

List of Figures

- Figure 1: Netherlands Waste to Energy Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Waste to Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Waste to Energy Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Netherlands Waste to Energy Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 3: Netherlands Waste to Energy Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Netherlands Waste to Energy Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Netherlands Waste to Energy Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Netherlands Waste to Energy Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 7: Netherlands Waste to Energy Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Netherlands Waste to Energy Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Waste to Energy Industry?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Netherlands Waste to Energy Industry?

Key companies in the market include Attero BV, Ingenia Consultants & Engineers BV, AEB Bio-energiecentrale BV, Axpo Holdings AG, Indaver BV, Dutch Incinerators BV, AEB Amsterdam, Mitsubishi Heavy Industries Ltd *List Not Exhaustive.

3. What are the main segments of the Netherlands Waste to Energy Industry?

The market segments include Technology, Waste Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries.

6. What are the notable trends driving market growth?

Thermal Technologies Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned.

8. Can you provide examples of recent developments in the market?

January 2023: RWE received USD 117 million from the European Union's Innovation Fund to help build a waste-to-hydrogen project in an industrial cluster in the Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Waste to Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Waste to Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Waste to Energy Industry?

To stay informed about further developments, trends, and reports in the Netherlands Waste to Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence