Key Insights

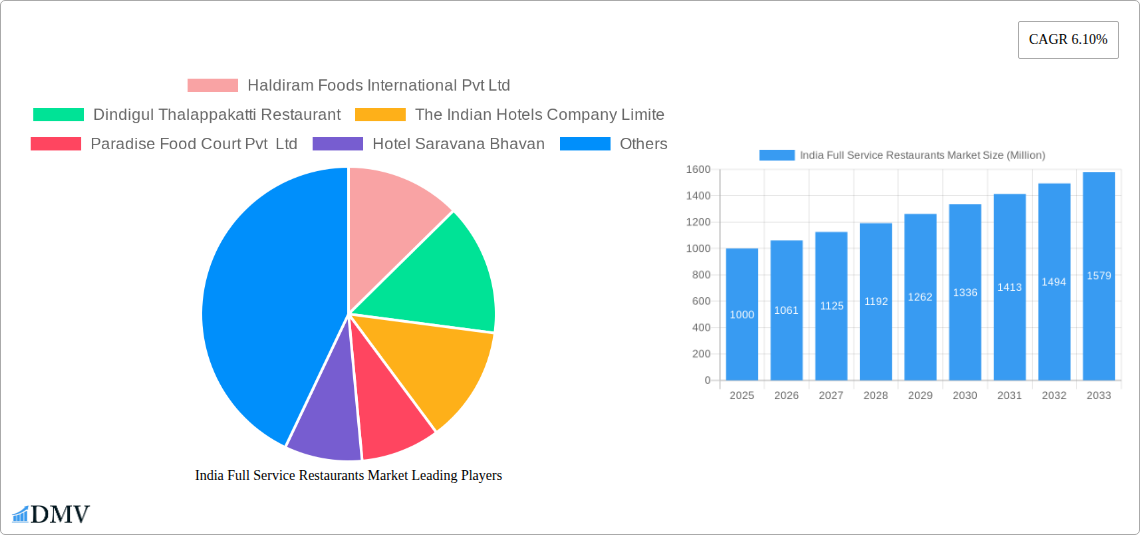

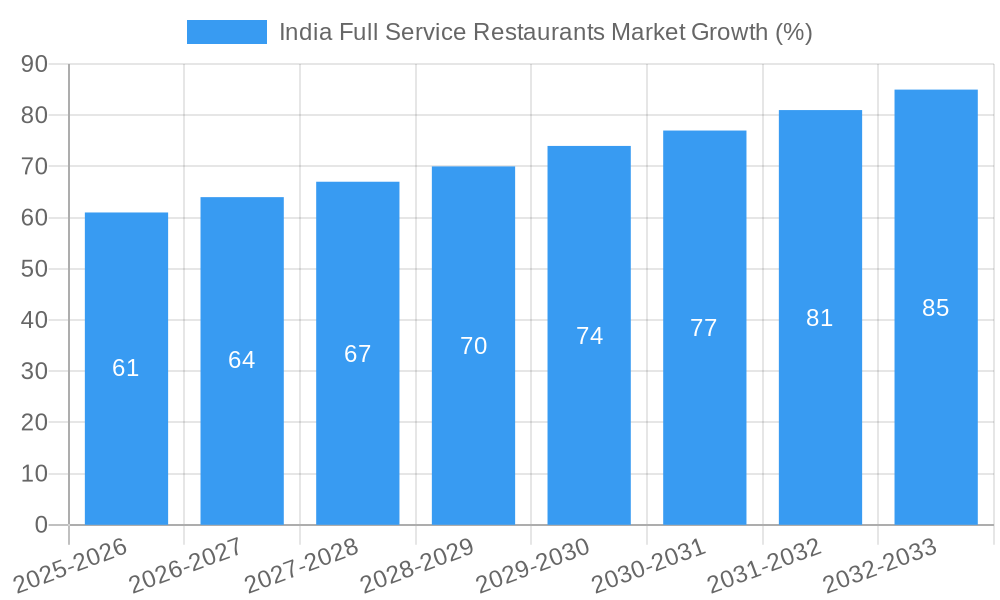

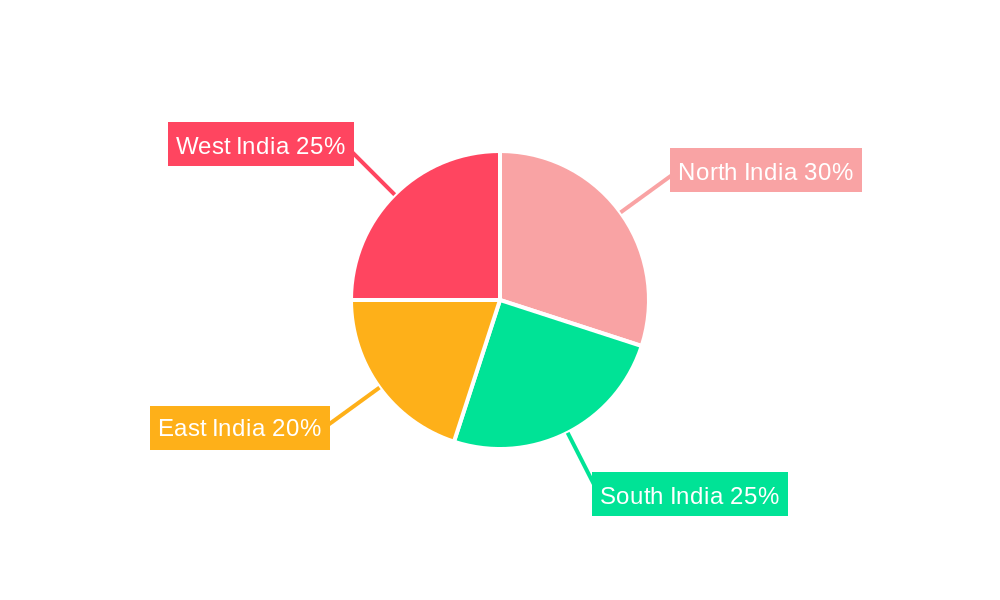

The India Full Service Restaurant (FSR) market is experiencing robust growth, driven by rising disposable incomes, a burgeoning middle class with a preference for dining out, and increasing urbanization. The market's diverse culinary landscape, encompassing Asian, European, Latin American, Middle Eastern, and North American cuisines, caters to a wide range of palates. The segment breakdown reveals a significant contribution from both chained and independent outlets, highlighting the competitive dynamics within the industry. Location-wise, leisure, lodging, and retail spaces are key drivers, with standalone restaurants maintaining a strong presence. Growth is further fueled by the increasing popularity of themed restaurants, experiential dining, and the integration of technology for improved service and ordering. While challenges remain, such as fluctuating raw material costs and stringent regulatory compliance, the overall outlook for the India FSR market remains positive. Based on a CAGR of 6.10% and a 2025 market size of XX million (assuming this represents the missing value of the initial market size information), we can project significant expansion over the forecast period (2025-2033). Key players like Haldiram Foods, Dindigul Thalappakatti, and Barbeque Nation are shaping the market through expansion strategies, brand building, and innovative menu offerings. The regional distribution shows variations in growth rates across North, South, East, and West India, influenced by local preferences, economic conditions, and consumer behavior.

The competitive landscape is characterized by both established players and emerging brands, leading to continuous innovation in menu offerings, service quality, and customer experience. The increasing adoption of online ordering and delivery platforms is transforming the FSR landscape, expanding reach and convenience for customers. Further growth will be influenced by factors like the evolving tastes of Indian consumers, the impact of global culinary trends, and government policies relating to the food service industry. Strategic partnerships, mergers, and acquisitions will likely play a significant role in shaping the market's future. The sustained growth trajectory points towards substantial opportunities for investment and expansion in the India FSR market over the next decade.

India Full Service Restaurants (FSR) Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Full Service Restaurants market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The report covers a total market size exceeding xx Million.

India Full Service Restaurants Market Composition & Trends

This section dives deep into the competitive landscape of the Indian FSR market, examining market concentration, innovation drivers, regulatory influences, substitute offerings, customer profiles, and merger & acquisition (M&A) activities. We analyze market share distribution among key players, revealing the dominance of established chains alongside the emergence of innovative independent outlets. The impact of evolving consumer preferences and regulatory changes on market dynamics is also explored. M&A activities are analyzed, including deal values and their effect on market consolidation. The report includes a detailed analysis of the xx Million market, segmented by cuisine type (Asian, European, Latin American, Middle Eastern, North American, Other FSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel).

- Market Concentration: Analysis of market share held by top players like Haldiram Foods International Pvt Ltd, Dindigul Thalappakatti Restaurant, and ITC Limited.

- Innovation Catalysts: Examination of technological advancements (e.g., online ordering platforms, kitchen automation) and their impact on market growth.

- Regulatory Landscape: Discussion of government regulations, licensing requirements, and their influence on market expansion.

- Substitute Products: Analysis of alternative dining options (e.g., quick-service restaurants, home delivery services) and their competitive influence.

- End-User Profiles: Segmentation of customers based on demographics, lifestyle preferences, and dining habits.

- M&A Activities: Review of significant M&A deals in the FSR sector, with an analysis of deal values and their strategic implications. Example: The xx Million acquisition of [Company A] by [Company B] in [Year].

India Full Service Restaurants Market Industry Evolution

This section provides a thorough analysis of the India FSR market's growth trajectory from 2019 to 2024, projecting future trends until 2033. It explores the influence of technological advancements, changing consumer preferences (e.g., health-conscious choices, experiential dining), and evolving culinary trends on market expansion. The report identifies key growth phases, analyzing the factors contributing to periods of accelerated or decelerated growth and offers detailed data points like annual growth rates and market penetration metrics for various segments. This in-depth analysis illuminates how the market has evolved and will continue to transform in the coming years.

Leading Regions, Countries, or Segments in India Full Service Restaurants Market

This section identifies the dominant regions, cuisines, outlet types, and locations within the Indian FSR market. We delve into the reasons behind their leading positions, providing a detailed analysis of their dominance factors. The report highlights key market drivers like investment trends, regulatory support, and consumer preferences that contribute to regional and segment-specific success.

- Key Drivers (Examples):

- Metropolitan Areas: High population density, disposable income, and tourism contribute to the dominance of major cities like Mumbai, Delhi, and Bengaluru.

- Asian Cuisine: Strong cultural preference for Indian and other Asian cuisines drives segment dominance.

- Chained Outlets: Economies of scale, brand recognition, and standardized quality contribute to the success of larger restaurant chains.

- Retail Locations: High foot traffic and visibility in busy retail spaces drive success for outlets in malls and commercial areas.

India Full Service Restaurants Market Product Innovations

This section showcases recent product innovations within the Indian FSR sector, highlighting unique selling propositions (USPs) and technological advancements driving market differentiation. Examples include the introduction of specialized menus, the use of sustainable ingredients, and the integration of technology for improved customer experience. Innovations such as personalized dining experiences and technology-driven kitchen efficiencies contribute to enhanced customer satisfaction and operational optimization.

Propelling Factors for India Full Service Restaurants Market Growth

Several factors are driving the growth of the India FSR market. Rising disposable incomes, increasing urbanization, and a growing preference for dining out among young consumers are all key contributors. Technological advancements, such as online ordering and delivery platforms, further fuel market expansion. Favorable government policies and regulatory reforms further stimulate investments in the FSR sector.

Obstacles in the India Full Service Restaurants Market

Despite the significant growth potential, the Indian FSR market faces challenges. These include fluctuating raw material costs, stringent regulations on food safety and hygiene, and intense competition from both established and emerging players. Supply chain disruptions can also impact operational efficiency and profitability.

Future Opportunities in India Full Service Restaurants Market

The Indian FSR market presents significant future opportunities, including untapped potential in smaller cities and towns. The growing popularity of international cuisines, and rising demand for specialized dining experiences provide avenues for expansion and innovation. Technological advancements in food delivery and restaurant management systems will create new opportunities for growth.

Major Players in the India Full Service Restaurants Market Ecosystem

- Haldiram Foods International Pvt Ltd

- Dindigul Thalappakatti Restaurant

- The Indian Hotels Company Limited

- Paradise Food Court Pvt Ltd

- Hotel Saravana Bhavan

- Ohri's Group

- Barbeque Nation Hospitality Ltd

- Speciality Restaurants Ltd

- Sagar Ratna Restaurants Private limited

- ITC Limited

Key Developments in India Full Service Restaurants Market Industry

- August 2023: ITC invested nearly USD 72.415 Million in opening its 12th luxury hotel chain in Gujarat, signifying significant investment in the hospitality sector and its impact on the FSR market.

- January 2023: Indian Hotels Company (IHCL) announced a new hotel in Indore, indicating expansion plans and future growth potential within the market.

- December 2022: Ohri's Group's expansion plans to major cities (Bengaluru, Pune, Mumbai, Goa) demonstrates confidence in market growth and potential for brand expansion.

Strategic India Full Service Restaurants Market Forecast

The Indian FSR market is poised for substantial growth over the forecast period (2025-2033), driven by a confluence of factors including rising disposable incomes, urbanization, changing consumer preferences, and technological advancements. The increasing popularity of diverse cuisines, the expansion of organized retail, and the burgeoning middle class will further fuel market expansion. The report provides detailed forecasts for different segments, offering valuable insights for strategic decision-making.

India Full Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

India Full Service Restaurants Market Segmentation By Geography

- 1. India

India Full Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Residents looking for international cuisines and increased dine-out culture fueling the sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North India India Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Haldiram Foods International Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dindigul Thalappakatti Restaurant

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Indian Hotels Company Limite

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Paradise Food Court Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hotel Saravana Bhavan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ohri's Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Barbeque Nation Hospitality Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Speciality Restaurants Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sagar Ratna Restaurants Private limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ITC Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Haldiram Foods International Pvt Ltd

List of Figures

- Figure 1: India Full Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Full Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: India Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: India Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: India Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: India Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 12: India Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: India Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: India Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Full Service Restaurants Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the India Full Service Restaurants Market?

Key companies in the market include Haldiram Foods International Pvt Ltd, Dindigul Thalappakatti Restaurant, The Indian Hotels Company Limite, Paradise Food Court Pvt Ltd, Hotel Saravana Bhavan, Ohri's Group, Barbeque Nation Hospitality Ltd, Speciality Restaurants Ltd, Sagar Ratna Restaurants Private limited, ITC Limited.

3. What are the main segments of the India Full Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Residents looking for international cuisines and increased dine-out culture fueling the sales.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

August 2023: ITC invested nearly USD 72.415 million in opening its 12th luxury hotel chain in Gujarat.January 2023: Indian Hotels Company (IHCL) announced the signing of its first hotel in Indore, Madhya Pradesh, under the Vivanta brand. The Greenfield project is slated to open in 2026.December 2022: Ohri's Group identified four brands: Qaffeine-The Coffee Shop, Sahib's Barbeque, Cake Nation, and Ming's Court, to expand its operations in India. By 2026, the company plans to expand, with its first phase beginning operations in Bengaluru, Pune, Mumbai, and Goa. In the next two years, Ohri's will be visible across major towns in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Full Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Full Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Full Service Restaurants Market?

To stay informed about further developments, trends, and reports in the India Full Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence