Key Insights

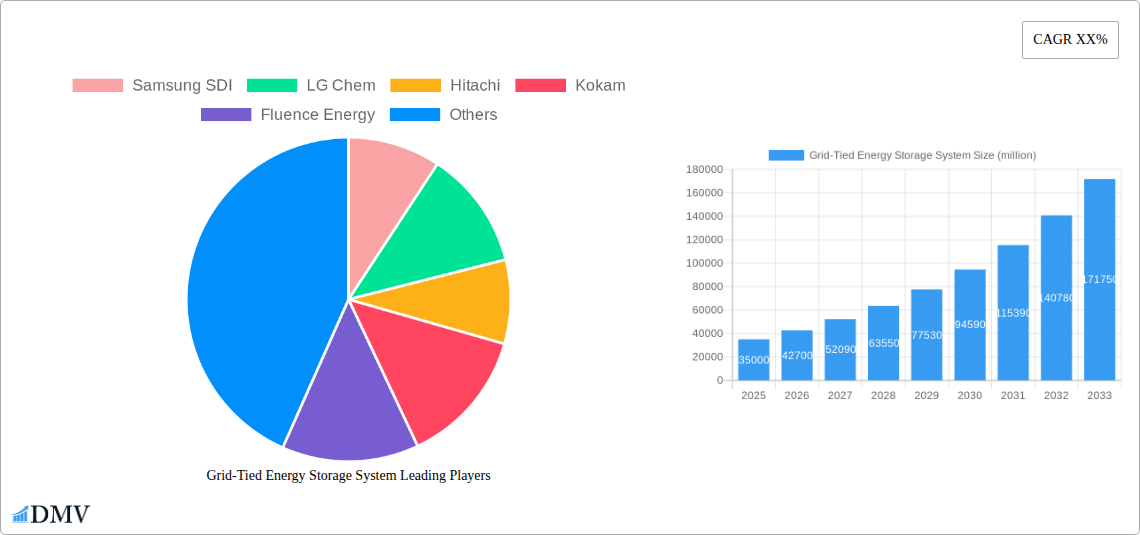

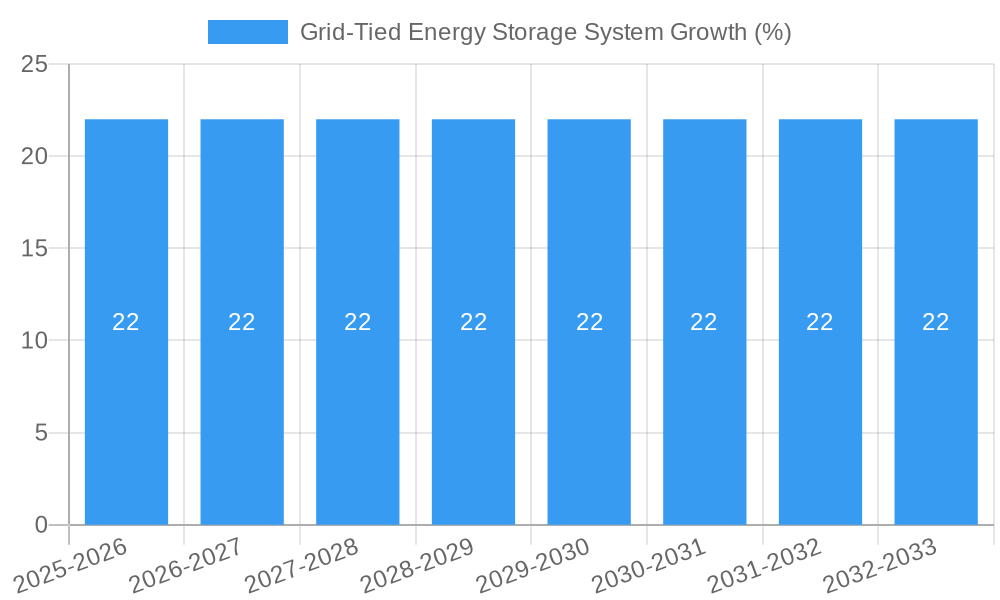

The global Grid-Tied Energy Storage System market is experiencing robust expansion, driven by an escalating demand for grid stability, renewable energy integration, and peak shaving capabilities. With an estimated market size of approximately USD 35,000 million in 2025, the sector is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of around 22% through 2033. This surge is primarily fueled by government initiatives promoting clean energy, declining battery costs, and the increasing frequency of grid disruptions. The utility and commercial segments are leading the adoption, leveraging these systems for grid-scale power management and large industrial operations. The Residential sector, while smaller, is also gaining traction as homeowners seek to optimize self-consumption of solar power and ensure energy resilience. Lithium-ion batteries continue to dominate the market due to their high energy density and cost-effectiveness, but emerging technologies like Sodium-Sulfur (NaS) batteries are gaining a niche for their long-duration storage capabilities.

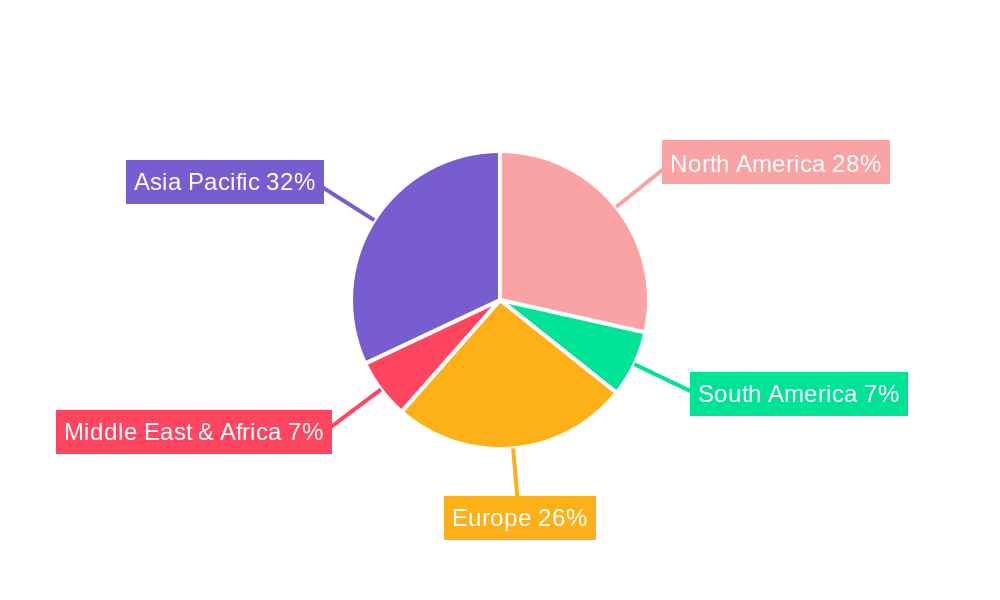

The market's growth trajectory is further bolstered by supportive regulatory frameworks and investments in grid modernization. Key drivers include the imperative to decarbonize energy sectors and meet climate targets, which necessitates more flexible and reliable power grids capable of accommodating intermittent renewable sources like solar and wind. Advanced features such as frequency regulation, voltage support, and demand response are becoming standard requirements, pushing innovation in energy storage solutions. Despite this positive outlook, certain restraints, such as high upfront costs for large-scale deployments and complex grid integration challenges, remain. However, ongoing technological advancements, economies of scale, and strategic partnerships among key players like Samsung SDI, LG Chem, BYD, and Fluence Energy are actively addressing these hurdles. Regional expansion is notably strong in Asia Pacific, particularly China and India, owing to rapid industrialization and government support, closely followed by North America and Europe, which are investing heavily in smart grid infrastructure.

Grid-Tied Energy Storage System Market Analysis: Forecast to 2033

Unlock critical insights into the burgeoning grid-tied energy storage system market. This comprehensive report delves into market dynamics, technological advancements, and strategic opportunities shaping the future of energy storage. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this analysis provides actionable intelligence for stakeholders across the energy value chain. We meticulously examine key applications, including Residential, Utility & Commercial, and diverse storage Types such as Lithium, Lead Acid, NaS, and Others. Discover the competitive landscape featuring major players like Samsung SDI, LG Chem, Hitachi, Fluence Energy, BYD, and General Electric, and understand the industry developments that are driving innovation and adoption.

Grid-Tied Energy Storage System Market Composition & Trends

The grid-tied energy storage system market exhibits dynamic concentration, driven by significant investments and strategic alliances. Leading companies like Fluence Energy, LG Chem, and BYD command substantial market shares, with recent M&A activities, such as the potential acquisition of a xx million dollar advanced battery technology firm by General Electric, signaling consolidation and innovation-driven growth. The regulatory landscape plays a pivotal role, with favorable policies for renewable energy integration and grid stability in regions like North America and Europe fostering rapid adoption. Innovation catalysts include advancements in lithium-ion battery chemistry, increasing energy density, and decreasing costs, alongside emerging technologies like solid-state batteries. Substitute products, primarily relying on traditional grid infrastructure and distributed generation without storage, face increasing competition as the economic and environmental benefits of grid-tied storage become more apparent. End-user profiles are diversifying, from large-scale utility companies seeking grid resilience to commercial entities optimizing energy costs and residential users aiming for energy independence and backup power.

- Market Concentration: Dominated by a few key players, with increasing strategic partnerships.

- Innovation Catalysts: Lithium-ion cost reduction, enhanced energy density, development of new chemistries.

- Regulatory Landscapes: Supportive policies for renewable integration, grid modernization incentives.

- Substitute Products: Traditional grid infrastructure, standalone solar PV systems.

- End-User Profiles: Utilities, commercial and industrial (C&I) businesses, residential consumers.

- M&A Activities: Active consolidation, driven by technology acquisition and market expansion.

Grid-Tied Energy Storage System Industry Evolution

The grid-tied energy storage system industry is undergoing a transformative evolution, marked by robust growth trajectories, relentless technological advancements, and evolving consumer demands. From 2019 to 2024, the historical period witnessed a foundational expansion, with cumulative deployments reaching an estimated xx million megawatt-hours. This growth was primarily fueled by utility-scale projects aiming to enhance grid reliability and integrate intermittent renewable energy sources. During the base year of 2025, the market is projected to surpass a valuation of xx million dollars, driven by increasingly favorable economics and supportive government mandates.

Looking ahead, the forecast period of 2025–2033 is poised for exponential growth, with an estimated Compound Annual Growth Rate (CAGR) of xx%. This surge will be propelled by several key factors. Firstly, the continuous decline in battery costs, particularly for Lithium-based technologies, is making grid-tied storage solutions more economically viable for a wider range of applications. For instance, the cost per kilowatt-hour for utility-scale lithium-ion battery systems is anticipated to drop by an additional xx% by 2030, according to industry forecasts from Samsung SDI and LG Chem. Secondly, advancements in battery management systems (BMS) and power conversion systems (PCS) are enhancing performance, safety, and operational efficiency. Companies like SMA Solar Technology and ABB are at the forefront of developing sophisticated PCS solutions that optimize energy flow and grid interaction.

Furthermore, shifting consumer demands are playing a crucial role. The increasing awareness of climate change, coupled with the desire for energy independence and resilience against grid outages, is driving adoption at the residential and commercial levels. The integration of electric vehicles (EVs) also presents a significant opportunity, with bidirectional charging capabilities of EVs potentially contributing to grid stability and energy storage. The market is witnessing a diversification in storage technologies beyond traditional Lead Acid, with NaS batteries gaining traction for specific high-power, long-duration applications, and emerging technologies like flow batteries and thermal energy storage exploring niche segments. The Utility & Commercial segment is expected to remain the dominant application, accounting for an estimated xx% of the total market share by 2033, due to the significant scale of projects and the pressing need for grid modernization and decarbonization efforts.

Leading Regions, Countries, or Segments in Grid-Tied Energy Storage System

The grid-tied energy storage system market is currently dominated by the Utility & Commercial application segment, which is set to maintain its leadership throughout the forecast period. This dominance is driven by a confluence of factors, including substantial investments in grid modernization, the imperative to integrate a growing share of renewable energy sources like solar and wind, and the critical need for enhanced grid stability and resilience. Regions such as North America and Europe are at the forefront of this trend, underpinned by robust policy frameworks and substantial financial incentives. For example, the Inflation Reduction Act in the United States and various European Union directives are actively promoting the deployment of grid-scale energy storage.

Within the Utility & Commercial segment, Lithium-ion batteries continue to be the most prevalent technology, accounting for an estimated xx% of installations by 2033. Their widespread adoption is attributed to declining costs, high energy density, and rapid advancements in performance and lifespan, as championed by industry leaders like BYD, Fluence Energy, and LG Chem. However, other battery Types are carving out significant niches. NaS (Sodium-Sulfur) batteries, known for their long discharge duration and high power capabilities, are increasingly favored for specific utility applications requiring extended energy delivery, with companies like NGK leading in this domain. Lead Acid batteries, while more mature, continue to find application in certain cost-sensitive or less demanding scenarios, though their market share is gradually declining against newer technologies. Emerging technologies, collectively categorized as Others, are also gaining traction, with ongoing research and development in areas like flow batteries and advanced solid-state batteries promising enhanced safety and performance characteristics.

Key drivers for the dominance of the Utility & Commercial segment include:

- Massive Infrastructure Investments: Utilities worldwide are investing billions to upgrade aging grids and incorporate distributed energy resources, with energy storage being a cornerstone of these initiatives.

- Renewable Energy Integration: The intermittency of solar and wind power necessitates flexible and responsive energy storage solutions to ensure grid stability and reliability.

- Peak Shaving and Load Leveling: Large-scale storage systems are crucial for managing peak demand, reducing strain on the grid, and optimizing energy costs for commercial enterprises.

- Grid Services and Ancillary Markets: Energy storage systems are increasingly participating in ancillary service markets, providing frequency regulation, voltage support, and black start capabilities, generating significant revenue streams for operators.

- Government Mandates and Incentives: Favorable regulations, tax credits, and renewable portfolio standards in major economies are accelerating the deployment of grid-tied energy storage systems.

Countries such as the United States, China, and Germany are leading in terms of installed capacity and investment in grid-tied energy storage within the Utility & Commercial sector. Their proactive policy environments, coupled with significant technological innovation from companies like General Electric, Hitachi, and ABB, are creating a fertile ground for market expansion.

Grid-Tied Energy Storage System Product Innovations

Product innovation in the grid-tied energy storage system market is rapidly advancing, focusing on enhanced performance, extended lifespan, and improved safety. Leading companies are developing modular battery systems that offer scalable solutions for various applications, from residential rooftops to utility-scale installations. Innovations in Lithium-ion battery chemistry, such as the increased adoption of nickel-manganese-cobalt (NMC) and lithium iron phosphate (LFP) chemistries, are yielding higher energy densities and faster charging capabilities. Furthermore, the integration of advanced battery management systems (BMS) and AI-driven forecasting algorithms optimizes energy dispatch, prolongs battery health, and maximizes system efficiency. The development of more robust and efficient power conversion systems (PCS) by players like SMA Solar Technology and ABB is also crucial, enabling seamless integration with diverse grid conditions and renewable energy sources.

Propelling Factors for Grid-Tied Energy Storage System Growth

The grid-tied energy storage system market is experiencing significant growth driven by a multifaceted interplay of technological, economic, and regulatory forces. Technologically, advancements in battery chemistries, particularly the cost reduction and performance enhancement of Lithium-ion batteries, are making these systems increasingly accessible. Economically, the declining levelized cost of storage (LCOS) is making it competitive with traditional grid infrastructure and even fossil fuel-based peaker plants. Regulatory tailwinds, such as government mandates for renewable energy integration and grid modernization initiatives in key markets like the US and Europe, are providing substantial incentives and driving demand for grid-tied solutions.

- Technological Advancements: Continuous improvements in battery energy density, lifespan, and safety, coupled with sophisticated energy management software.

- Economic Viability: Decreasing battery costs and the increasing value of grid services are making energy storage economically attractive.

- Supportive Regulatory Frameworks: Government policies, tax credits, and renewable portfolio standards are accelerating adoption.

- Grid Modernization Needs: The aging grid infrastructure requires flexible and resilient solutions, with energy storage playing a vital role.

- Renewable Energy Integration: The intermittent nature of solar and wind power necessitates storage for grid stability and reliability.

Obstacles in the Grid-Tied Energy Storage System Market

Despite the strong growth trajectory, the grid-tied energy storage system market faces several significant obstacles. Regulatory hurdles and permitting processes can be complex and time-consuming in some regions, slowing down project development. Supply chain disruptions for critical raw materials, such as lithium and cobalt, can lead to price volatility and availability issues, impacting project timelines and costs. Furthermore, the upfront capital investment for large-scale grid-tied storage systems remains a considerable barrier, though declining costs are mitigating this concern. Intense competition among battery manufacturers and system integrators, while beneficial for innovation, also puts pressure on profit margins. Interoperability standards and grid integration challenges can also present technical obstacles that require careful planning and execution.

Future Opportunities in Grid-Tied Energy Storage System

The grid-tied energy storage system market is ripe with future opportunities driven by emerging trends and evolving energy landscapes. The increasing electrification of transportation, with the rise of electric vehicles, presents a significant opportunity for Vehicle-to-Grid (V2G) technology, turning EVs into distributed energy storage assets. Furthermore, the growing demand for distributed energy resources (DERs) and microgrids for enhanced resilience and energy independence opens new avenues for smaller-scale, localized grid-tied storage solutions. Innovations in long-duration energy storage technologies, such as flow batteries and compressed air energy storage, hold the promise of addressing grid needs for extended periods, complementing the capabilities of shorter-duration Lithium-ion systems. The integration of artificial intelligence (AI) and machine learning in grid management and energy forecasting will unlock greater optimization and efficiency for grid-tied storage assets.

Major Players in the Grid-Tied Energy Storage System Ecosystem

- Samsung SDI

- LG Chem

- Hitachi

- Kokam

- Fluence Energy

- LSIS

- SMA Solar Technology

- NGK

- General Electric

- Primus

- Panasonic

- BYD

- Aggreko

- ABB

- Saft Batteries

- Lockheed Martin Energy

- Eos Energy Storage

- Con Edison Solutions

Key Developments in Grid-Tied Energy Storage System Industry

- 2023 August: Fluence Energy announces significant expansion of its battery energy storage system (BESS) manufacturing capacity, aiming to meet growing global demand.

- 2023 July: LG Chem unveils a new generation of high-energy-density cathode materials for lithium-ion batteries, promising increased performance and reduced costs for grid-tied applications.

- 2023 June: General Electric completes the acquisition of a leading advanced battery technology startup for an undisclosed, but estimated in the hundreds of million dollars, deal value, signaling a strategic push into next-generation energy storage.

- 2023 May: BYD secures a substantial contract to supply batteries for a xx-megawatt utility-scale energy storage project in Australia, highlighting its growing presence in the global market.

- 2023 April: SMA Solar Technology launches its latest generation of hybrid inverters, featuring enhanced grid-forming capabilities for seamless integration with battery energy storage systems.

- 2022 December: NGK announces successful pilot testing of its advanced Sodium-Sulfur (NaS) battery technology for long-duration grid storage applications, demonstrating improved efficiency and lifespan.

- 2022 November: Hitachi completes the integration of its energy storage solutions with a major utility in Japan, enhancing grid stability and renewable energy integration.

- 2022 October: Samsung SDI announces plans to invest xx million dollars in expanding its battery manufacturing facilities in the United States, focusing on supplying the growing domestic energy storage market.

- 2022 September: ABB announces a partnership with a major renewable energy developer to provide advanced power conversion systems for a series of large-scale solar-plus-storage projects.

- 2022 August: Fluence Energy secures a major order for its Gridattune AI software platform, aimed at optimizing the performance and economic benefits of grid-tied battery storage systems.

Strategic Grid-Tied Energy Storage System Market Forecast

The strategic forecast for the grid-tied energy storage system market is exceptionally positive, driven by an accelerating global energy transition and the increasing recognition of energy storage as a critical enabler of grid modernization and decarbonization. Future opportunities, particularly in areas like vehicle-to-grid technology and the development of long-duration storage solutions, are poised to unlock new revenue streams and expand the market's reach. The sustained decline in battery costs, coupled with supportive government policies and continued technological innovation from major players like Samsung SDI, LG Chem, and Fluence Energy, will further fuel demand across residential, utility, and commercial segments. The market is expected to witness a robust growth trajectory, becoming an indispensable component of the future energy infrastructure, with projected market size exceeding xx million dollars by 2033.

Grid-Tied Energy Storage System Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Utility & Commercial

-

2. Types

- 2.1. Lithium

- 2.2. Lead Acid

- 2.3. NaS

- 2.4. Others

Grid-Tied Energy Storage System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Grid-Tied Energy Storage System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Grid-Tied Energy Storage System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Utility & Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Lithium

- 5.2.2. Lead Acid

- 5.2.3. NaS

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Grid-Tied Energy Storage System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Utility & Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Lithium

- 6.2.2. Lead Acid

- 6.2.3. NaS

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Grid-Tied Energy Storage System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Utility & Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Lithium

- 7.2.2. Lead Acid

- 7.2.3. NaS

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Grid-Tied Energy Storage System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Utility & Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Lithium

- 8.2.2. Lead Acid

- 8.2.3. NaS

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Grid-Tied Energy Storage System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Utility & Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Lithium

- 9.2.2. Lead Acid

- 9.2.3. NaS

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Grid-Tied Energy Storage System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Utility & Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Lithium

- 10.2.2. Lead Acid

- 10.2.3. NaS

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Samsung SDI

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG Chem

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kokam

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fluence Energy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LSIS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SMA Solar Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NGK

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Primus

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Panasonic

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BYD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Aggreko

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ABB

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Saft Batteries

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Lockheed Martin Energy

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Eos Energy Storage

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Con Edison Solutions

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Samsung SDI

List of Figures

- Figure 1: Global Grid-Tied Energy Storage System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Grid-Tied Energy Storage System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Grid-Tied Energy Storage System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Grid-Tied Energy Storage System Revenue (million), by Types 2024 & 2032

- Figure 5: North America Grid-Tied Energy Storage System Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Grid-Tied Energy Storage System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Grid-Tied Energy Storage System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Grid-Tied Energy Storage System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Grid-Tied Energy Storage System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Grid-Tied Energy Storage System Revenue (million), by Types 2024 & 2032

- Figure 11: South America Grid-Tied Energy Storage System Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Grid-Tied Energy Storage System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Grid-Tied Energy Storage System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Grid-Tied Energy Storage System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Grid-Tied Energy Storage System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Grid-Tied Energy Storage System Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Grid-Tied Energy Storage System Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Grid-Tied Energy Storage System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Grid-Tied Energy Storage System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Grid-Tied Energy Storage System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Grid-Tied Energy Storage System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Grid-Tied Energy Storage System Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Grid-Tied Energy Storage System Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Grid-Tied Energy Storage System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Grid-Tied Energy Storage System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Grid-Tied Energy Storage System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Grid-Tied Energy Storage System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Grid-Tied Energy Storage System Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Grid-Tied Energy Storage System Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Grid-Tied Energy Storage System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Grid-Tied Energy Storage System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Grid-Tied Energy Storage System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Grid-Tied Energy Storage System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Grid-Tied Energy Storage System Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Grid-Tied Energy Storage System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Grid-Tied Energy Storage System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Grid-Tied Energy Storage System Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Grid-Tied Energy Storage System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Grid-Tied Energy Storage System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Grid-Tied Energy Storage System Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Grid-Tied Energy Storage System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Grid-Tied Energy Storage System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Grid-Tied Energy Storage System Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Grid-Tied Energy Storage System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Grid-Tied Energy Storage System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Grid-Tied Energy Storage System Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Grid-Tied Energy Storage System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Grid-Tied Energy Storage System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Grid-Tied Energy Storage System Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Grid-Tied Energy Storage System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Grid-Tied Energy Storage System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Grid-Tied Energy Storage System?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Grid-Tied Energy Storage System?

Key companies in the market include Samsung SDI, LG Chem, Hitachi, Kokam, Fluence Energy, LSIS, SMA Solar Technology, NGK, General Electric, Primus, Panasonic, BYD, Aggreko, ABB, Saft Batteries, Lockheed Martin Energy, Eos Energy Storage, Con Edison Solutions.

3. What are the main segments of the Grid-Tied Energy Storage System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Grid-Tied Energy Storage System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Grid-Tied Energy Storage System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Grid-Tied Energy Storage System?

To stay informed about further developments, trends, and reports in the Grid-Tied Energy Storage System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence