Key Insights

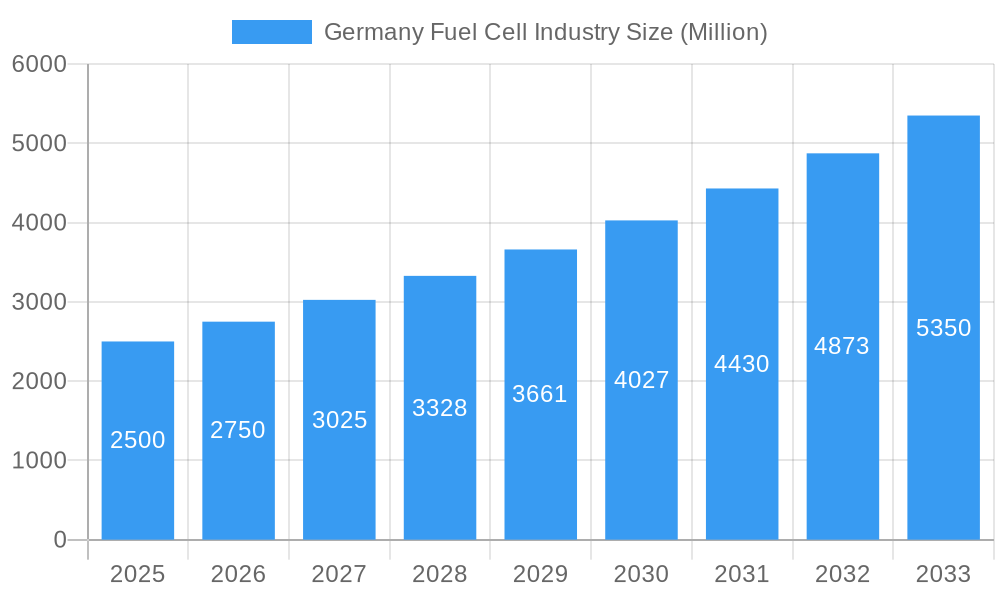

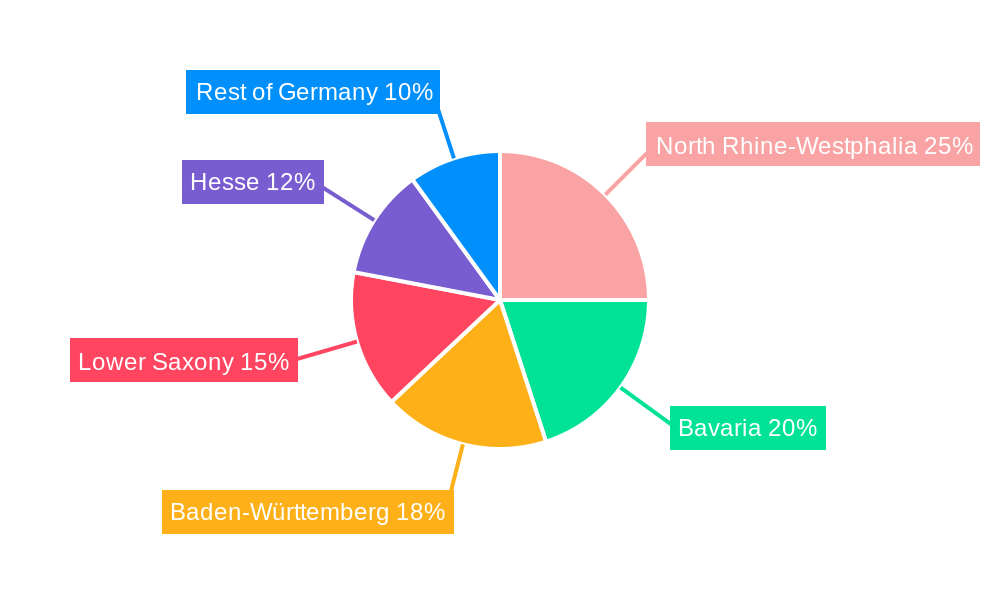

The German Fuel Cell Market is projected for substantial growth, projected to reach $10.64 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 25.9% from a base year of 2025. This expansion is fueled by escalating government backing for renewable energy, stringent emissions mandates, and heightened demand for sustainable power solutions across multiple industries. Key application segments including portable, stationary, and transportation are driving this growth, with the transportation sector demonstrating particularly strong momentum due to the increasing adoption of Fuel Cell Electric Vehicles (FCEVs). Polymer Electrolyte Membrane Fuel Cells (PEMFCs) currently lead the market, though Solid Oxide Fuel Cells (SOFCs) are gaining prominence for their efficiency in stationary power generation. Leading industrial regions include North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, benefiting from established infrastructure and favorable regulations. Key industry contributors such as SFC Energy AG, FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, and Proton Motor Fuel Cell GmbH are instrumental in market advancement through innovation and strategic expansion. Primary challenges involve high initial investment and the necessity for enhanced hydrogen infrastructure.

Germany Fuel Cell Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates accelerated market expansion driven by technological innovations that reduce costs and improve fuel cell performance. Increased integration of fuel cell technology into smart grids and microgrids, alongside broader adoption in the transportation sector, is expected. Continued government incentives and supportive policies for hydrogen production and distribution will further propel market growth. Despite existing challenges, the German fuel cell market demonstrates a highly positive long-term outlook, offering significant opportunities for economic development and environmental sustainability. Future competitiveness will be shaped by advancements in fuel cell design, cost-reduction strategies, and the development of a resilient hydrogen supply chain.

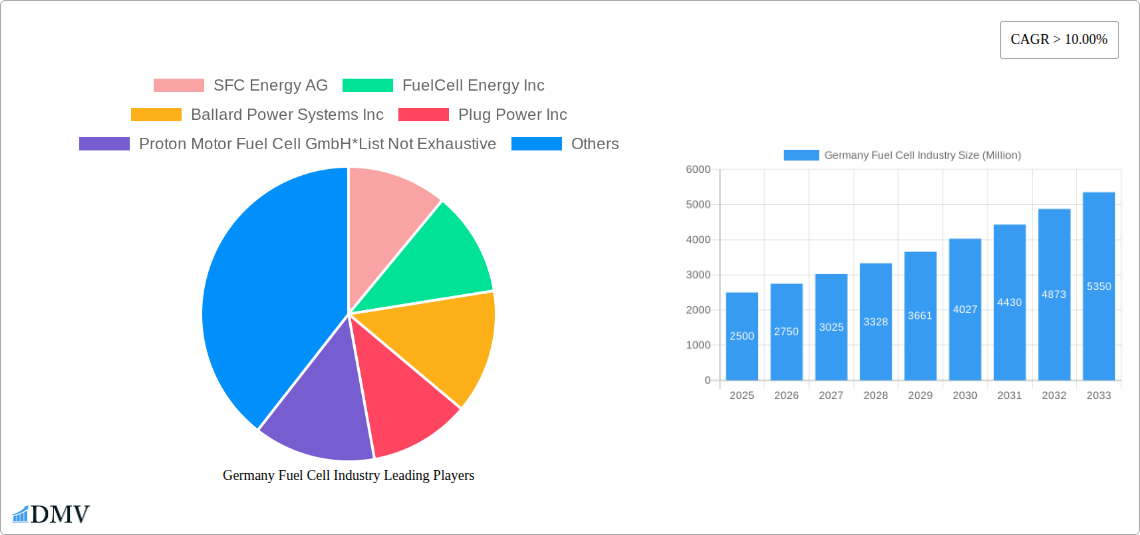

Germany Fuel Cell Industry Company Market Share

Germany Fuel Cell Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the German fuel cell industry, offering valuable insights for stakeholders seeking to understand market dynamics, technological advancements, and future growth potential. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. The report leverages extensive data analysis to illuminate key trends and opportunities within this rapidly evolving sector.

Germany Fuel Cell Industry Market Composition & Trends

This section analyzes the competitive landscape of the German fuel cell market, encompassing market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user behavior, and mergers & acquisitions (M&A) activities. The report reveals the market share distribution among key players, including estimations of M&A deal values in Millions. The analysis sheds light on the evolving dynamics of the industry and its future trajectory.

- Market Concentration: The German fuel cell market exhibits a moderately concentrated structure, with a few dominant players controlling a significant share. However, the emergence of innovative startups is increasing competition.

- Innovation Catalysts: Government funding initiatives, along with substantial private investment, are driving innovation in fuel cell technology, particularly in PEMFC and SOFC advancements.

- Regulatory Landscape: Germany’s supportive regulatory environment, emphasizing renewable energy integration and emission reduction targets, significantly boosts the adoption of fuel cells.

- Substitute Products: While competing technologies like battery storage exist, fuel cells offer unique advantages in terms of long-duration energy storage and higher energy density, particularly for specific applications.

- End-User Profiles: The primary end-users are concentrated in transportation (heavy-duty vehicles, trains), stationary power generation (backup power, industrial applications), and portable power solutions.

- M&A Activity: The total value of M&A deals within the German fuel cell industry between 2019 and 2024 is estimated at €XX Million, reflecting significant consolidation and investment in the sector.

Germany Fuel Cell Industry Industry Evolution

This section delves into the historical and projected growth trajectory of the German fuel cell industry, examining technological advancements and shifts in consumer preferences. The analysis incorporates detailed data points, highlighting growth rates and adoption metrics. The report pinpoints key milestones that have shaped the industry's evolution and assesses future growth drivers.

From 2019 to 2024, the German fuel cell market experienced a Compound Annual Growth Rate (CAGR) of XX%, driven by increased government support and technological breakthroughs. The market size in 2024 is estimated at €XX Million. By 2033, the market is projected to reach €XX Million, with a CAGR of XX% during the forecast period (2025-2033). This growth is largely attributed to the increasing demand for clean energy solutions, particularly in the transportation and stationary power sectors. Advancements in fuel cell technology, resulting in higher efficiency and lower costs, further propel market expansion. The shift towards decarbonization and stringent emission regulations provide a favorable regulatory environment stimulating growth. Consumer demand is increasingly influenced by environmental concerns, leading to a strong preference for sustainable energy alternatives.

Leading Regions, Countries, or Segments in Germany Fuel Cell Industry

This segment identifies the leading regions, countries, or segments within the German fuel cell industry. The analysis covers Application (Portable, Stationary, Transportation) and Fuel Cell Technology (PEMFC, SOFC, Other).

- Dominant Segment: Transportation currently holds the largest market share, driven by increasing demand for zero-emission vehicles and the deployment of fuel cell buses and trains.

Key Drivers for Transportation Segment Dominance:

- Significant government subsidies and incentives promoting hydrogen-based transportation solutions.

- Stringent emission regulations pushing for the adoption of clean transportation technologies.

- Technological advancements leading to improved fuel cell performance and cost reduction.

PEMFC and SOFC Technology:

- PEMFC: Polymer Electrolyte Membrane Fuel Cells dominate the market due to their relatively lower cost, higher efficiency at lower temperatures, and suitability for various applications.

- SOFC: Solid Oxide Fuel Cells show strong potential for stationary power generation, offering higher efficiency at higher temperatures, but face challenges related to cost and durability.

Germany Fuel Cell Industry Product Innovations

Recent years have witnessed significant innovation within the German fuel cell sector, leading to the development of high-efficiency, cost-effective, and durable fuel cell systems. Advancements in materials science and manufacturing processes have improved performance metrics, while enhanced design features have enhanced system reliability. Unique selling propositions encompass longer lifespan, increased power density, and reduced maintenance requirements. These innovations are paving the way for broader adoption of fuel cell technology across diverse sectors.

Propelling Factors for Germany Fuel Cell Industry Growth

The growth of the German fuel cell industry is fueled by a confluence of technological, economic, and regulatory factors. Technological advancements, such as improved durability and efficiency of fuel cells, lower production costs, and better integration with renewable energy sources, are key drivers. Government incentives and supportive policies aimed at promoting clean energy further stimulate market expansion. Furthermore, increasing concerns about climate change and the need for sustainable energy solutions propel demand for fuel cell technology.

Obstacles in the Germany Fuel Cell Industry Market

Despite the significant potential, the German fuel cell industry faces challenges including high initial investment costs, the limited availability of hydrogen infrastructure, and competition from other energy storage technologies. Regulatory hurdles and potential supply chain disruptions can also impact growth. These obstacles necessitate a strategic approach to overcome these challenges and unlock the full potential of the fuel cell industry.

Future Opportunities in Germany Fuel Cell Industry

Future opportunities lie in expanding applications of fuel cells beyond current sectors, developing advanced fuel cell technologies, and establishing a robust hydrogen infrastructure. Growing demand for decentralized power generation and increased investments in research and development will drive innovation and open new market segments. The industry's future hinges on addressing existing challenges and capitalizing on emerging opportunities.

Major Players in the Germany Fuel Cell Industry Ecosystem

- SFC Energy AG

- FuelCell Energy Inc

- Ballard Power Systems Inc

- Plug Power Inc

- Proton Motor Fuel Cell GmbH

- Hydrogenics Corporation

Key Developments in Germany Fuel Cell Industry Industry

- August 2022: Successful trials of hydrogen-fueled passenger trains led to the deployment of the first fuel cell train fleet (14 trains) in Lower Saxony. This milestone significantly boosted the visibility and acceptance of fuel cell technology in the transportation sector.

- May 2022: Wrightbus secured a contract to supply the German city of Cologne with 60 single-deck hydrogen fuel cell buses. This substantial order underscores the growing adoption of fuel cell buses in urban transportation networks.

Strategic Germany Fuel Cell Industry Market Forecast

The German fuel cell industry is poised for significant growth in the coming years. Continued government support, technological advancements, and increasing awareness of climate change are key growth catalysts. Expanding applications in transportation, stationary power, and portable power sectors, coupled with the development of a comprehensive hydrogen infrastructure, will unlock substantial market potential. The forecast indicates a robust expansion trajectory, driven by a combination of favorable market conditions and technological progress.

Germany Fuel Cell Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

Germany Fuel Cell Industry Segmentation By Geography

- 1. Germany

Germany Fuel Cell Industry Regional Market Share

Geographic Coverage of Germany Fuel Cell Industry

Germany Fuel Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Fuel Cell Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SFC Energy AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FuelCell Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ballard Power Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plug Power Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Proton Motor Fuel Cell GmbH*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hydrogenics Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 SFC Energy AG

List of Figures

- Figure 1: Germany Fuel Cell Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Fuel Cell Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Germany Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: Germany Fuel Cell Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Germany Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 6: Germany Fuel Cell Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Fuel Cell Industry?

The projected CAGR is approximately 25.9%.

2. Which companies are prominent players in the Germany Fuel Cell Industry?

Key companies in the market include SFC Energy AG, FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, Proton Motor Fuel Cell GmbH*List Not Exhaustive, Hydrogenics Corporation.

3. What are the main segments of the Germany Fuel Cell Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.64 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

August 2022: The successful trials of hydrogen-fuelled passenger trains in Germany led to the deployment of the first fuel cell train fleet (14 trains) in Lower Saxony.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Fuel Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Fuel Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Fuel Cell Industry?

To stay informed about further developments, trends, and reports in the Germany Fuel Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence