Key Insights

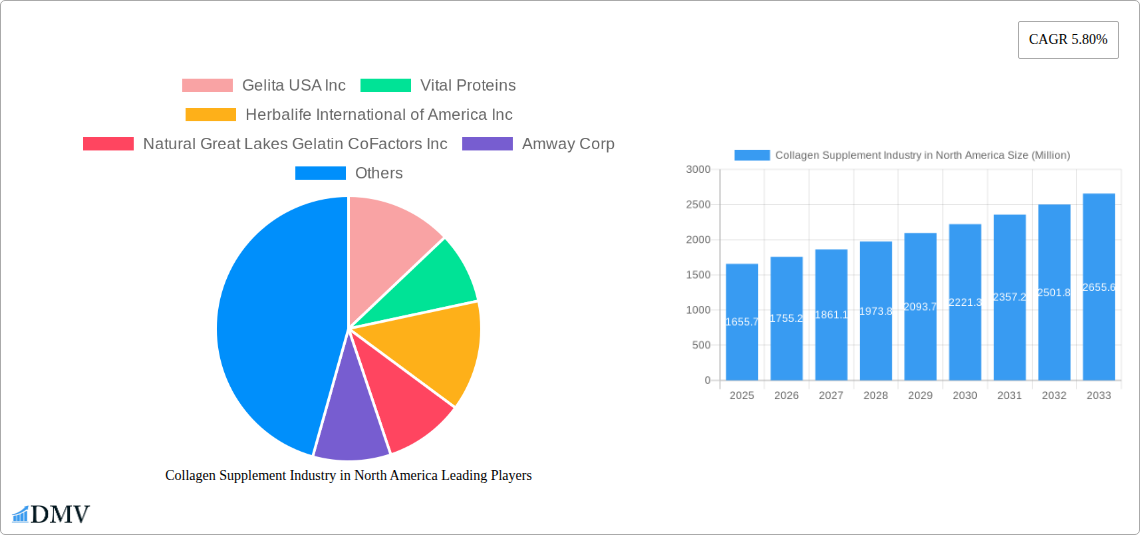

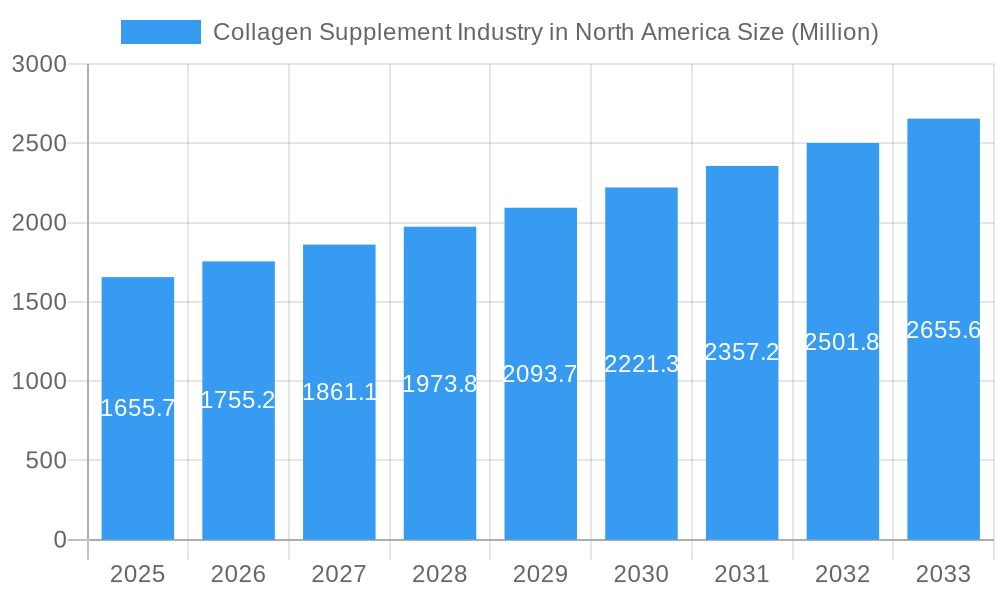

The North American collagen supplement market, valued at approximately $1,655.7 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This surge is driven by increasing consumer awareness of collagen's benefits for skin health, joint mobility, and gut health, fueled by extensive marketing and influencer endorsements. The rising prevalence of age-related ailments and the growing demand for natural beauty solutions further propel market expansion. Within the market, animal-based collagen dominates the sources segment, reflecting established consumer preference and familiarity. However, marine-based collagen is gaining traction due to its sustainability and perceived health benefits. Distribution channels are diversified, with hypermarkets/supermarkets holding a significant share, followed by pharmacies and a rapidly growing online retail segment reflecting evolving consumer shopping habits. Major players like Gelita USA Inc, Vital Proteins, and Herbalife International of America Inc are actively shaping the market through product innovation and strategic marketing, fostering competition and driving further growth.

Collagen Supplement Industry in North America Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, particularly within the online retail channel. Factors such as increasing disposable incomes in North America and the growing popularity of wellness and preventative healthcare contribute to the optimistic outlook. However, potential restraints include concerns about sourcing and sustainability, coupled with varying product quality and inconsistent regulatory frameworks. To maintain growth, manufacturers need to focus on transparent sourcing practices, robust quality control, and targeted marketing campaigns to educate consumers about collagen's benefits and address potential concerns. Furthermore, exploring innovative delivery methods and expanding product offerings to meet diverse consumer needs are crucial for continued success in this dynamic market.

Collagen Supplement Industry in North America Company Market Share

Collagen Supplement Industry in North America: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the North American collagen supplement market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a focus on 2025, this research meticulously examines market size, segmentation, leading players, and key growth drivers, equipping stakeholders with actionable intelligence for strategic decision-making. The market, valued at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Collagen Supplement Industry in North America Market Composition & Trends

This section delves into the competitive landscape of the North American collagen supplement market, evaluating market concentration, innovation catalysts, regulatory landscapes, substitute products, end-user profiles, and M&A activities. The market exhibits a moderately concentrated structure, with key players such as Gelita USA Inc, Vital Proteins, and Herbalife International of America Inc holding significant market share. However, the presence of numerous smaller players indicates a dynamic and competitive environment.

- Market Share Distribution (2025): Gelita USA Inc (xx%), Vital Proteins (xx%), Herbalife International of America Inc (xx%), Others (xx%).

- Innovation Catalysts: Growing consumer awareness of collagen's benefits, advancements in extraction and processing technologies, and the development of novel delivery formats are key innovation drivers.

- Regulatory Landscape: The FDA's regulations concerning dietary supplements shape the industry's practices and product development. Stringent labeling requirements and safety standards influence market dynamics.

- Substitute Products: Other dietary supplements aimed at joint health and skin elasticity pose competition.

- End-User Profiles: The primary end-users are health-conscious individuals aged 35-65, predominantly women, seeking anti-aging benefits and improved joint health.

- M&A Activities: The past five years have witnessed xx M&A deals in the industry, with a total value of approximately xx Million, reflecting industry consolidation and expansion efforts.

Collagen Supplement Industry in North America Industry Evolution

The North American collagen supplement market has witnessed remarkable growth over the historical period (2019-2024), fueled by several factors. Increased consumer awareness about the health benefits of collagen, particularly for skin, hair, and joint health, has significantly boosted demand. Technological advancements in extraction methods and product formulation have resulted in higher-quality, more bioavailable collagen supplements. Moreover, the emergence of diverse product formats, such as powders, capsules, and gummies, has broadened the appeal to a wider consumer base. The market's growth trajectory is projected to continue its upward trend during the forecast period (2025-2033), driven by the factors mentioned above. Adoption rates of collagen supplements have increased steadily, particularly among the health-conscious demographic. The market experienced a CAGR of xx% between 2019 and 2024. The market is anticipated to maintain a CAGR of xx% from 2025 to 2033.

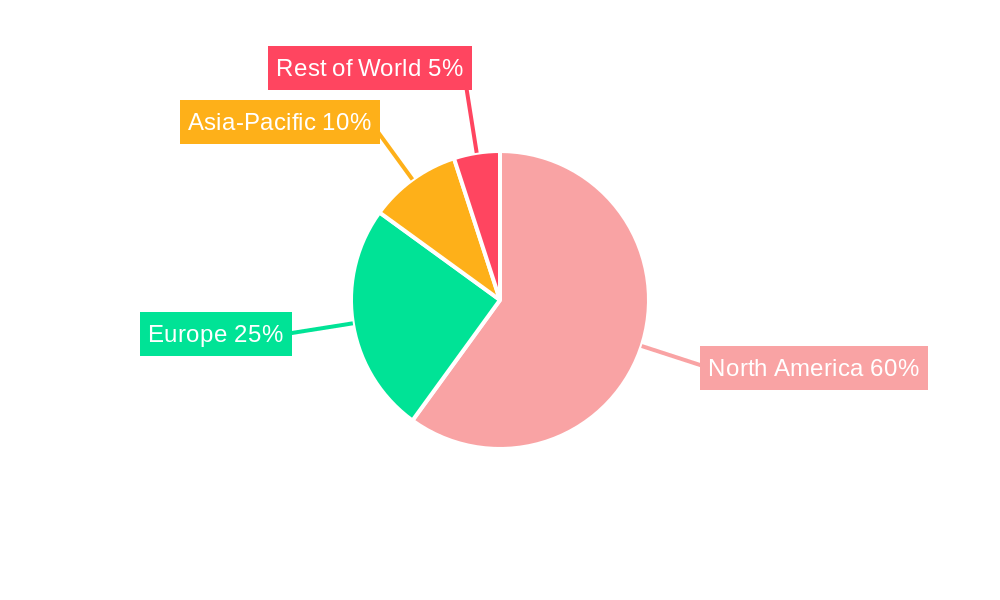

Leading Regions, Countries, or Segments in Collagen Supplement Industry in North America

The United States represents the largest market within North America, driven by high consumer spending on health and wellness products and a strong focus on anti-aging solutions. Animal-based collagen dominates the market by source, followed by marine-based collagen. Hypermarkets/supermarkets and internet retailing are the leading distribution channels.

By Source:

- Animal-Based Collagen: Dominates due to its established history, higher collagen content, and cost-effectiveness. Key drivers include established supply chains and consumer familiarity.

- Marine-Based Collagen: Growing popularity due to its sustainability and hypoallergenic properties. Drivers include increasing consumer preference for sustainable products and expanding supply chains.

By Distribution Channel:

- Hypermarket/Supermarket: High accessibility and established distribution networks contribute to its dominance.

- Internet Retailing: Rapid growth due to convenience and expanding e-commerce platforms. Drivers include increasing online shopping penetration and targeted digital marketing.

- Pharmacies: Strong presence due to consumer trust in healthcare professionals' recommendations.

- Other Distribution Channels: Includes specialized health food stores and direct-to-consumer sales.

Collagen Supplement Industry in North America Product Innovations

Recent innovations include hydrolyzed collagen peptides for improved absorption, collagen formulations with added vitamins and antioxidants for enhanced efficacy, and novel delivery systems such as collagen-infused beverages and beauty products. These innovations address consumer demand for convenient and effective products, boosting market growth. Unique selling propositions include improved bioavailability, targeted benefits (e.g., skin elasticity, joint health), and sustainable sourcing.

Propelling Factors for Collagen Supplement Industry in North America Growth

Several factors contribute to the market's growth. The rising prevalence of aging-related issues, growing consumer awareness of collagen's health benefits, and technological advancements leading to improved product quality and efficacy are key drivers. Favorable regulatory environments and increasing consumer spending on health and wellness products further propel market expansion.

Obstacles in the Collagen Supplement Industry in North America Market

Challenges include the high cost of production, particularly for premium collagen types, potential supply chain disruptions due to reliance on animal-derived sources, and increasing competition from other health and wellness supplements. Concerns regarding the efficacy and safety of some collagen products also pose a challenge. Inconsistent labeling and quality control practices in the supplement industry may negatively impact growth.

Future Opportunities in Collagen Supplement Industry in North America

Emerging opportunities lie in the development of innovative product formats, personalized collagen supplements targeting specific demographics, and expansion into new markets. Growing demand for plant-based collagen alternatives creates exciting possibilities for companies pursuing sustainable solutions. The use of collagen in functional foods and beverages offers significant potential.

Major Players in the Collagen Supplement Industry in North America Ecosystem

- Gelita USA Inc

- Vital Proteins

- Herbalife International of America Inc

- Natural Great Lakes Gelatin CoFactors Inc

- Amway Corp

- Nutrawise Health & Beauty Corporation

- Natures Bounty

Key Developments in Collagen Supplement Industry in North America Industry

- 2022 Q3: Vital Proteins launched a new line of collagen peptides with added antioxidants.

- 2023 Q1: Gelita USA Inc announced a strategic partnership to expand its distribution network.

- 2024 Q2: A major M&A deal involving two leading collagen supplement companies was finalized. (Further details on specific developments require more data.)

Strategic Collagen Supplement Industry in North America Market Forecast

The collagen supplement market in North America is poised for continued expansion, driven by sustained consumer demand and innovative product development. The market's growth will be fueled by expanding product lines, increasing consumer awareness, and further technological advancements that enhance the bioavailability and efficacy of collagen supplements. The market shows strong potential for sustained growth over the forecast period.

Collagen Supplement Industry in North America Segmentation

-

1. Sources

- 1.1. Animal-Based Collagen

- 1.2. Marine-Based Collagen

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Pharmacies

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

Collagen Supplement Industry in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

Collagen Supplement Industry in North America Regional Market Share

Geographic Coverage of Collagen Supplement Industry in North America

Collagen Supplement Industry in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. United States is the dominating the Overall Sales in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 5.1.1. Animal-Based Collagen

- 5.1.2. Marine-Based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Pharmacies

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gelita USA Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vital Proteins

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Herbalife International of America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Natural Great Lakes Gelatin CoFactors Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amway Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutrawise Health & Beauty Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Natures Bounty*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Gelita USA Inc

List of Figures

- Figure 1: Collagen Supplement Industry in North America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Collagen Supplement Industry in North America Share (%) by Company 2025

List of Tables

- Table 1: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2020 & 2033

- Table 2: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Collagen Supplement Industry in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2020 & 2033

- Table 6: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Collagen Supplement Industry in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Collagen Supplement Industry in North America?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Collagen Supplement Industry in North America?

Key companies in the market include Gelita USA Inc, Vital Proteins, Herbalife International of America Inc, Natural Great Lakes Gelatin CoFactors Inc, Amway Corp, Nutrawise Health & Beauty Corporation, Natures Bounty*List Not Exhaustive.

3. What are the main segments of the Collagen Supplement Industry in North America?

The market segments include Sources, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1,655.7 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

United States is the dominating the Overall Sales in the region.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Collagen Supplement Industry in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Collagen Supplement Industry in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Collagen Supplement Industry in North America?

To stay informed about further developments, trends, and reports in the Collagen Supplement Industry in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence