Key Insights

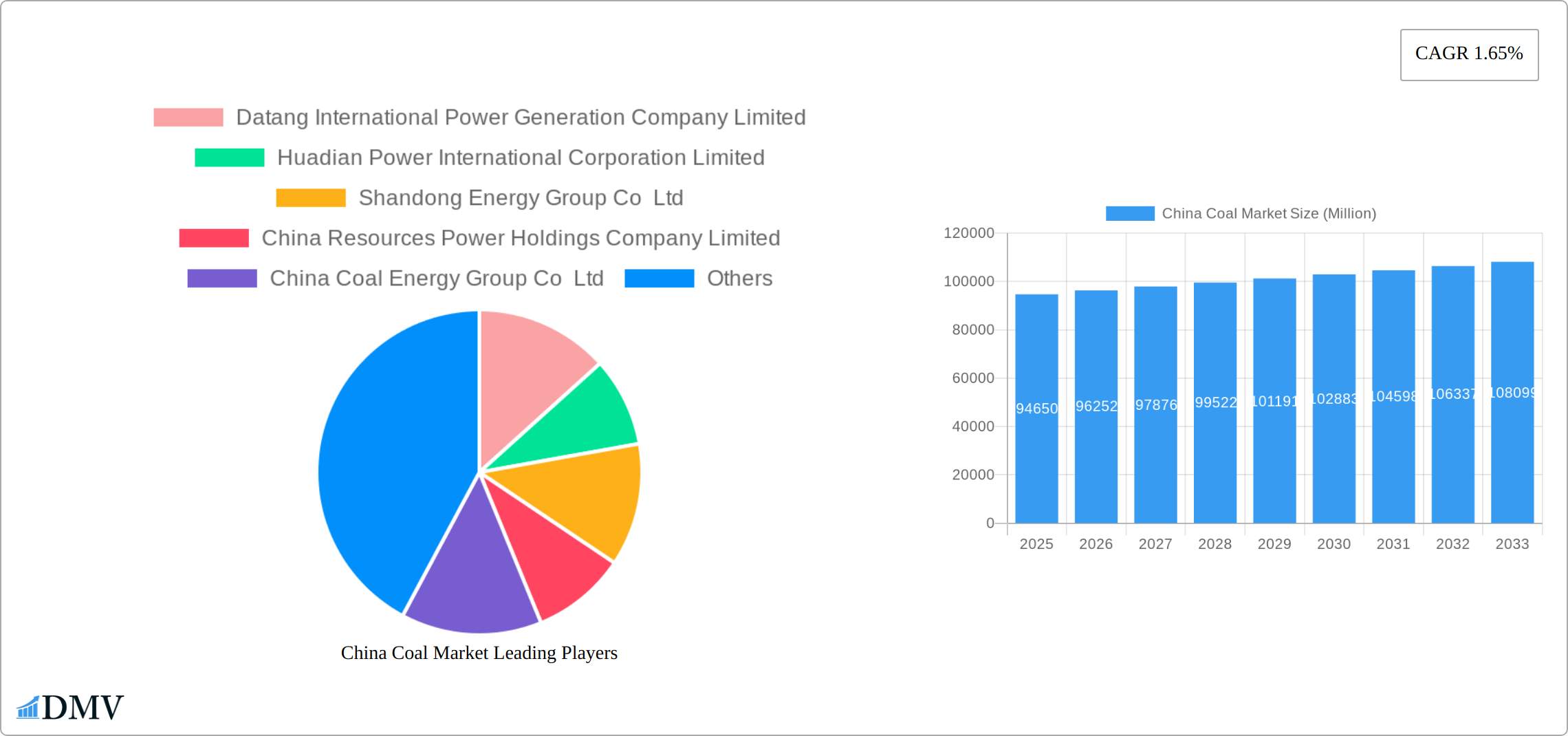

The China coal market, valued at $94.65 billion in 2025, is projected to experience steady growth, albeit at a moderate Compound Annual Growth Rate (CAGR) of 1.65% from 2025 to 2033. This relatively low CAGR reflects a global trend towards cleaner energy sources and increasing environmental regulations within China. However, the market remains significant due to China's substantial energy demands and continued reliance on coal for power generation, particularly in thermal power plants. The largest segments are power generation (thermal coal) and coking feedstock (coking coal), reflecting the integral role of coal in both electricity production and steel manufacturing. Key drivers include the robust infrastructure development ongoing across China, and the relatively lower initial cost of coal-fired power plants compared to renewable energy alternatives. However, constraints include increasing pressure to reduce carbon emissions, leading to stricter environmental regulations and potential government policies that discourage coal usage. This necessitates a transition towards more sustainable energy sources over the longer term. Companies such as Datang International Power Generation, Huadian Power International, and Shandong Energy Group, among others, play a crucial role in this market, although competition is fierce and influenced by government policies that favor energy diversification.

China Coal Market Market Size (In Billion)

The forecast period (2025-2033) suggests a continuous, albeit modest, expansion of the China coal market. While the transition to renewable energy is underway, the sheer scale of China's energy needs and the existing infrastructure reliant on coal will ensure a sustained market for the foreseeable future, albeit one that will likely see slower growth compared to previous decades. The gradual increase in market size will primarily be driven by the consistent demand for coal in existing power plants and industrial processes. The long-term outlook, however, depends significantly on the pace of renewable energy adoption and the effectiveness of government policies aimed at mitigating climate change. The market segmentation will likely remain similar, with thermal coal and coking coal accounting for the dominant share, albeit subject to gradual shifts depending on policy changes and technological advances in alternative fuel sources.

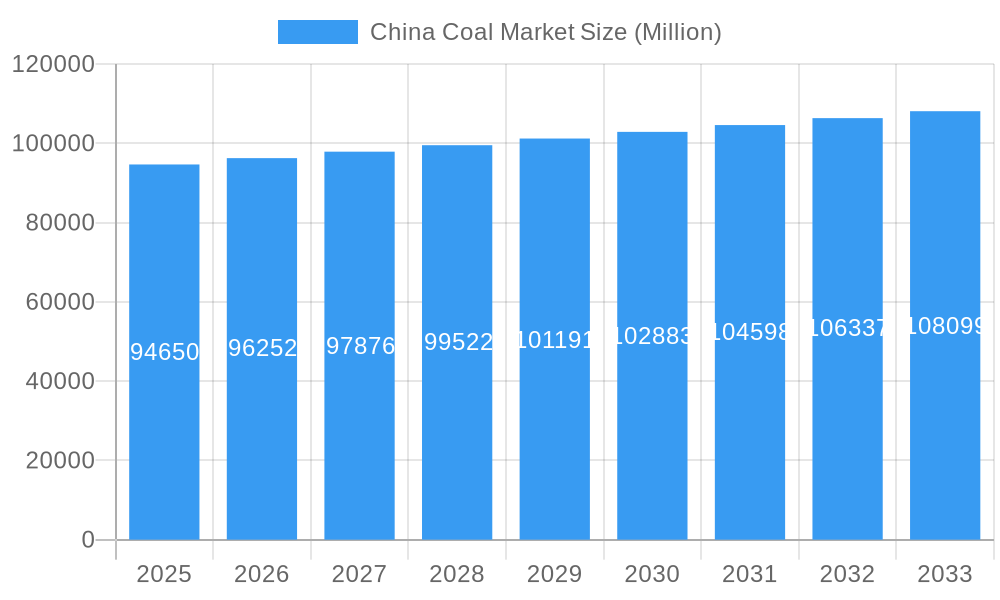

China Coal Market Company Market Share

China Coal Market Market Composition & Trends

The China Coal Market is characterized by a high degree of concentration, with major players dominating the landscape. Companies such as China Shenhua Energy Company Limited and China Coal Energy Group Co Ltd hold significant market shares, estimated at 25% and 15%, respectively. Innovation catalysts in the market include the development of cleaner coal technologies and the integration of IoT for operational efficiency. The regulatory landscape is stringent, with the government imposing strict emissions standards and promoting renewable energy sources, which impacts coal demand.

Substitute products like natural gas and renewable energy pose a threat to the coal market, yet coal remains essential for power generation and industrial processes. End-user profiles include power plants, steel industries, and cement manufacturers, each with varying demands and preferences. M&A activities have been active, with deals valued at over $5 Billion in the last five years, aimed at consolidating operations and expanding market reach.

- Market Share Distribution: China Shenhua Energy Company Limited (25%), China Coal Energy Group Co Ltd (15%)

- M&A Deal Values: Over $5 Billion in the last five years

- Regulatory Impact: Strict emissions standards influencing coal demand

- End-User Profiles: Power plants, steel industries, cement manufacturers

China Coal Market Industry Evolution

The China coal market has undergone a dramatic transformation from 2019 to 2033, driven by a complex interplay of factors including market dynamics, technological innovation, evolving environmental regulations, and shifting global energy priorities. From 2019 to 2024, the market exhibited a compound annual growth rate (CAGR) of 3.5%, fueled by robust industrialization and urbanization. The year 2025 marks a significant turning point, with projected CAGR slowing to 2.8% between 2025 and 2033. This deceleration reflects the increasing adoption of renewable energy sources and a growing emphasis on carbon reduction targets.

Technological advancements have been pivotal in shaping the industry's trajectory. The widespread adoption of coal gasification technology, converting coal into syngas, has seen a remarkable 15% annual increase, significantly improving efficiency and mitigating environmental impact. Simultaneously, the implementation of advanced mining techniques, such as longwall mining, has boosted coal extraction rates by 20% since 2019, enhancing productivity and cost-effectiveness.

The energy landscape is shifting, with a growing consumer preference for sustainable energy alternatives. This has spurred coal companies to invest heavily in cleaner technologies and diversify their portfolios. While the power generation sector remains the dominant consumer of coal, accounting for approximately 70% of total consumption, followed by the steel industry at 20%, the sector is actively exploring strategies to reduce its carbon footprint. Coal, however, retains a crucial role in China's energy mix, providing energy security and supporting sustained economic growth, particularly in bridging the gap towards a fully renewable future.

Leading Regions, Countries, or Segments in China Coal Market

The leading segment in the China Coal Market is Power Generation (Thermal Coal), which dominates due to its critical role in meeting the country's electricity needs. This segment accounts for approximately 70% of the total coal market, driven by the extensive network of coal-fired power plants across the nation.

- Key Drivers for Power Generation (Thermal Coal):

- Investment Trends: Significant investments in coal-fired power infrastructure, with over $100 Billion committed to new projects and upgrades.

- Regulatory Support: Government policies that prioritize energy security and stable electricity supply, favoring coal as a reliable energy source.

- Technological Advancements: Adoption of ultra-supercritical and supercritical coal-fired technologies, which improve efficiency and reduce emissions.

The dominance of the Power Generation segment can be attributed to several factors. Firstly, coal remains the most cost-effective and abundant energy source in China, making it the preferred choice for large-scale power generation. Secondly, the government's long-term contracts for coal supply, as seen in the November 2022 development, ensure a stable and predictable supply chain, which is crucial for power utilities. Lastly, despite the push towards renewable energy, coal-fired power plants continue to play a vital role in balancing the grid and meeting peak demand, particularly in regions with high industrial activity.

The Coking Feedstock (Coking Coal) segment, while smaller in comparison, is also significant, accounting for about 20% of the market. This segment is driven by the steel industry's demand for high-quality coking coal, essential for steel production. The "Other Applications" segment, including coal used in cement production and other industrial processes, makes up the remaining 10%.

China Coal Market Product Innovations

Innovation within the China coal market is largely focused on enhancing efficiency and minimizing environmental impact. The development and deployment of ultra-supercritical coal-fired power plants represent a significant leap forward, achieving energy efficiencies of up to 46% – a substantial improvement over traditional plants. Furthermore, the increasing popularity of coal gasification technology, transforming coal into syngas for cleaner combustion, underscores the industry's commitment to reducing emissions. These technological advancements not only improve operational performance but also ensure compliance with increasingly stringent environmental regulations, providing a key competitive advantage for companies embracing these innovations.

Propelling Factors for China Coal Market Growth

The China Coal Market is propelled by several key factors. Technologically, advancements in coal gasification and ultra-supercritical power plants enhance efficiency and reduce emissions, aligning with regulatory standards. Economically, coal remains a cost-effective energy source, crucial for industrial growth and energy security. Regulatory influences include government policies ensuring stable coal supply through long-term contracts, as seen in November 2022, which supports market stability and growth.

Obstacles in the China Coal Market Market

The China Coal Market faces several obstacles. Regulatory challenges, such as stringent emissions standards, increase operational costs and pressure companies to invest in cleaner technologies. Supply chain disruptions, influenced by global trade dynamics, can lead to price volatility and affect market stability. Competitive pressures from renewable energy sources pose a long-term threat, potentially reducing coal's market share by up to 10% by 2033.

Future Opportunities in China Coal Market

The future of the China coal market presents several promising opportunities. The development and deployment of cleaner coal technologies, such as carbon capture and storage (CCS), hold immense potential for creating new markets and reducing the overall carbon intensity of coal-based power generation. The integration of coal with renewable energy systems offers the potential for creating highly efficient and flexible hybrid power solutions, maximizing the benefits of both energy sources. Furthermore, even within a transition to a more sustainable energy landscape, there remains potential demand for coal in specific applications supporting green initiatives, such as coal-to-chemicals processes. Strategic investments in research and development will be key to unlocking these opportunities.

Major Players in the China Coal Market Ecosystem

- Datang International Power Generation Company Limited

- Huadian Power International Corporation Limited

- Shandong Energy Group Co Ltd

- China Resources Power Holdings Company Limited

- China Coal Energy Group Co Ltd

- Yanzhou Coal Mining Company Limited

- Zijin Mining Group Co Limited

- China Power International Development Limited

- China Shenhua Energy Company Limited

- Huaneng Power International Inc

Key Developments in China Coal Market Industry

- November 2022: The Chinese government extended long-term thermal coal supply contracts to all coal mines for 2023, mandating power utilities to secure a larger portion of their coal needs through these contracts. This initiative aims to bolster market stability, ensuring a reliable supply chain and mitigating price volatility.

- February 2022: Zhejiang province, located on China's eastern coast, approved the construction of a USD 840 million coal-fired power station (Phase 2 of the Liuheng Power Plant). This project underscores the ongoing need for coal-based power generation to balance energy supply and demand in specific regions, even as the country transitions towards a more diversified energy mix.

- Ongoing Developments: Keep an eye on government policies regarding carbon emissions targets and renewable energy mandates, as these will significantly influence the trajectory of the Chinese coal market in the coming years. Increased investment in carbon capture, utilization, and storage (CCUS) technologies will also be a key factor to watch.

Strategic China Coal Market Market Forecast

The strategic forecast for the China Coal Market from 2025 to 2033 indicates sustained growth driven by several catalysts. Continued technological advancements in coal utilization, such as ultra-supercritical power plants and coal gasification, will enhance efficiency and reduce environmental impact, aligning with regulatory demands. The market's potential is further bolstered by the government's commitment to energy security through long-term coal supply contracts. Emerging opportunities in cleaner coal technologies and hybrid energy systems present avenues for market expansion, positioning coal as a vital component of China's energy mix despite the rise of renewable alternatives.

China Coal Market Segmentation

-

1. Application

- 1.1. Power Generation (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Other Applications

China Coal Market Segmentation By Geography

- 1. China

China Coal Market Regional Market Share

Geographic Coverage of China Coal Market

China Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electricity Demand; Rising Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. The Power Generation Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Datang International Power Generation Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Huadian Power International Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shandong Energy Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Resources Power Holdings Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Coal Energy Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yanzhou Coal Mining Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zijin Mining Group Co Limited*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Power International Development Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Shenhua Energy Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huaneng Power International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Datang International Power Generation Company Limited

List of Figures

- Figure 1: China Coal Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Coal Market Share (%) by Company 2025

List of Tables

- Table 1: China Coal Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: China Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: China Coal Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Coal Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: China Coal Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: China Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: China Coal Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: China Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Coal Market?

The projected CAGR is approximately 1.65%.

2. Which companies are prominent players in the China Coal Market?

Key companies in the market include Datang International Power Generation Company Limited, Huadian Power International Corporation Limited, Shandong Energy Group Co Ltd, China Resources Power Holdings Company Limited, China Coal Energy Group Co Ltd, Yanzhou Coal Mining Company Limited, Zijin Mining Group Co Limited*List Not Exhaustive, China Power International Development Limited, China Shenhua Energy Company Limited, Huaneng Power International Inc.

3. What are the main segments of the China Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 94.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electricity Demand; Rising Investments in the Coal Industry.

6. What are the notable trends driving market growth?

The Power Generation Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

November 2022: The government of China extended long-term thermal coal supply contracts to all coal mines for 2023 and pushed power utilities to source more of their needs through such contracts to secure market supply and stabilize prices. The long-term contract will include all coal mining companies and coal-fired electricity and heating plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Coal Market?

To stay informed about further developments, trends, and reports in the China Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence