Key Insights

The Canadian coal market, despite global decarbonization trends, retains a crucial role in power generation and metallurgical applications. The market size is estimated at $11 billion in 2024, projected to grow at a compound annual growth rate (CAGR) of 5.2% through 2033. Growth will be moderated by environmental regulations and the transition to renewables. Key drivers include consistent demand from the metallurgical sector for steel production and the continued use of coal-fired power plants in regions with less developed renewable energy infrastructure. Trends point towards enhanced mining efficiency, reduced environmental impact via technological advancements, and export market exploration, particularly for metallurgical coal. The industry is segmented by application, with metallurgy currently dominating. Major players like Teck Resources Limited and Peabody Energy Corp. are adapting through operational excellence and strategic partnerships. Western Canada is expected to lead production due to established reserves and infrastructure.

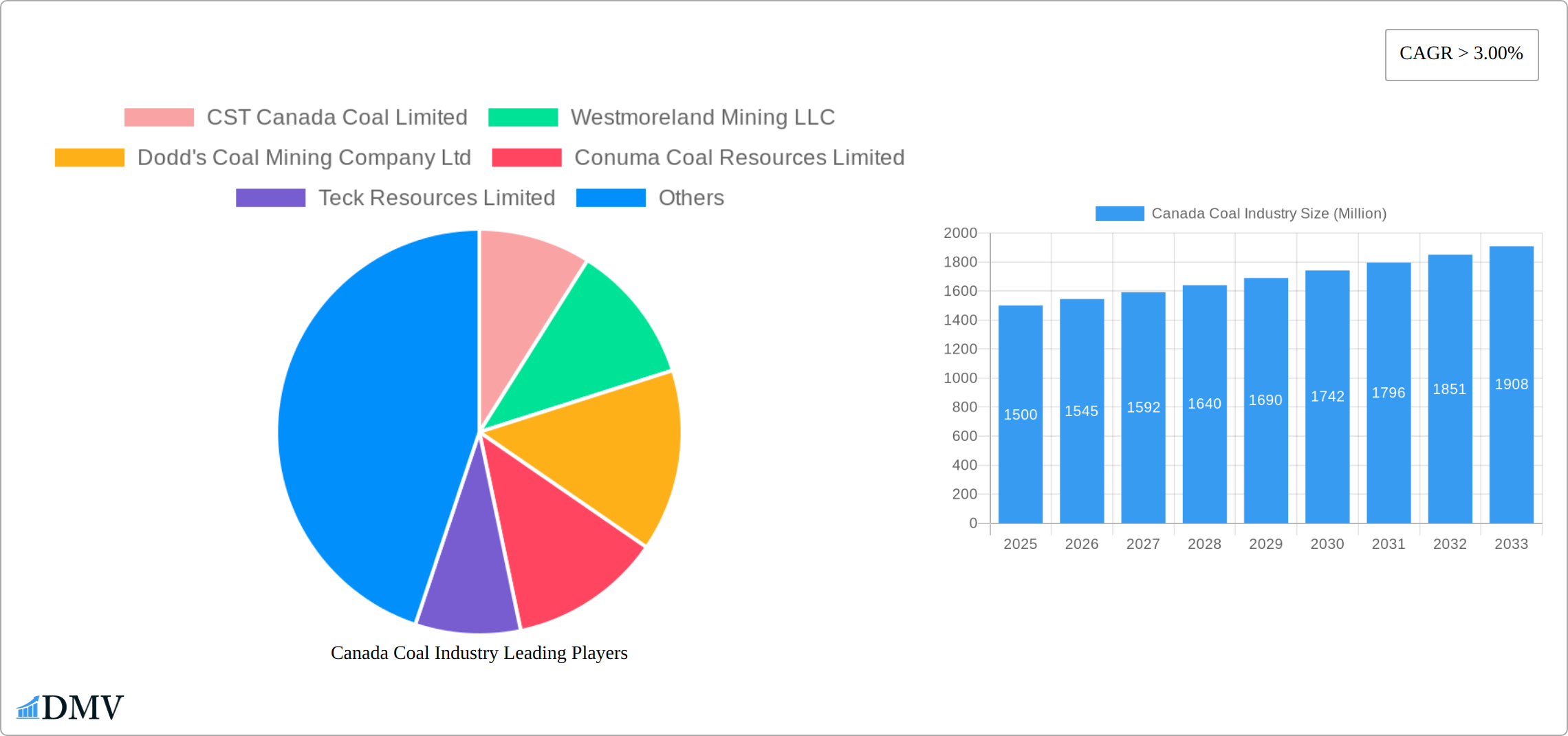

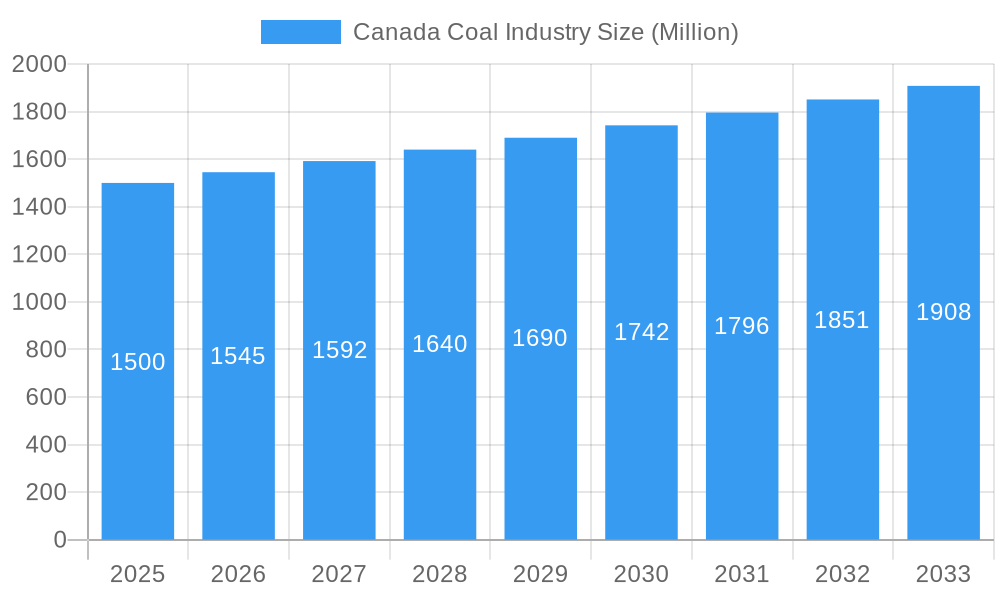

Canada Coal Industry Market Size (In Billion)

The forecast period (2024-2033) presents a landscape of both challenges and opportunities. While the global energy transition influences the long-term outlook, sustained demand for specific industrial applications and stable domestic consumption in Canada suggest moderate growth. Company success will depend on adaptability to regulatory changes, investment in sustainable practices, and market diversification. Exploring export markets and value-added coal products may mitigate challenges from the global shift to renewables. The competitive environment remains consolidated, with a few key players holding significant market share.

Canada Coal Industry Company Market Share

Canada Coal Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Canadian coal industry, encompassing market size, segmentation, key players, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report leverages rigorous research methodologies to deliver actionable insights for stakeholders, investors, and industry professionals. The total market size in 2025 is estimated at XX Million CAD, with a projected value of YY Million CAD by 2033.

Canada Coal Industry Market Composition & Trends

This section analyzes the Canadian coal industry's competitive landscape from 2019 to 2024, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market demonstrates a moderately concentrated structure with key players holding substantial market shares. This analysis offers a nuanced understanding of market dynamics, considering limitations in precise data availability.

- Market Share Distribution (2024): While precise figures remain unavailable due to data limitations, a qualitative analysis reveals Teck Resources Limited as a leading player, followed by Peabody Energy Corp and Conuma Coal Resources Limited. The remaining market share is distributed among other participants. The report provides a detailed qualitative assessment of these dynamics.

- Innovation Catalysts: Innovation within the industry is driven by a multi-pronged approach: improving extraction efficiency through technological advancements, enhancing coal quality to meet the specific requirements of metallurgical and power generation applications, and actively exploring and investing in carbon capture utilization and storage (CCUS) technologies.

- Regulatory Landscape: The Canadian coal industry operates within a stringent regulatory environment characterized by increasingly stringent environmental regulations and ambitious carbon emission reduction targets. These factors significantly influence operational strategies and investment decisions. The report thoroughly examines the impact of federal and provincial regulations, highlighting their implications for industry players.

- Substitute Products: The Canadian coal industry faces growing competition from substitute products, primarily natural gas and renewable energy sources (solar, wind). Nuclear power also poses a competitive threat, particularly within the power generation sector. The report quantifies the market share shift towards these substitutes, providing insights into the evolving energy landscape.

- End-User Profiles: The primary end-users of Canadian coal remain power generation companies and metallurgical industries. The report offers a detailed segmentation of demand by end-use sector, providing valuable insights into future projections and market trends.

- M&A Activities: The period from 2019 to 2024 witnessed significant M&A activity within the Canadian coal industry. The report analyzes these key transactions, providing an estimated total value of approximately XX Million CAD and discussing their implications for market consolidation and future industry structure.

Canada Coal Industry Industry Evolution

This section provides a comprehensive historical and projected analysis of the Canadian coal industry's evolution from 2019 to 2033. It examines market growth trajectories, technological advancements, shifts in consumer demand, and the interplay of various factors influencing the industry's future. This analysis is grounded in specific data points and provides robust projections.

The period between 2019 and 2024 witnessed a contraction in the Canadian coal industry, primarily due to decreased demand for thermal coal in power generation coupled with intensified regulatory scrutiny. However, the demand for metallurgical coal remained relatively stable, providing some resilience to the overall sector. The report projects a compound annual growth rate (CAGR) of XX% for metallurgical coal and a CAGR of XX% for thermal coal during the forecast period (2025-2033). Technological advancements, including improved mining techniques and automation, enhance efficiency but cannot entirely offset the decline in overall demand. The increasing adoption of cleaner energy sources and carbon capture and storage (CCS) technologies will significantly shape the industry's future trajectory. The report includes a detailed analysis of CCS adoption rates and provides projections for their impact on future market growth.

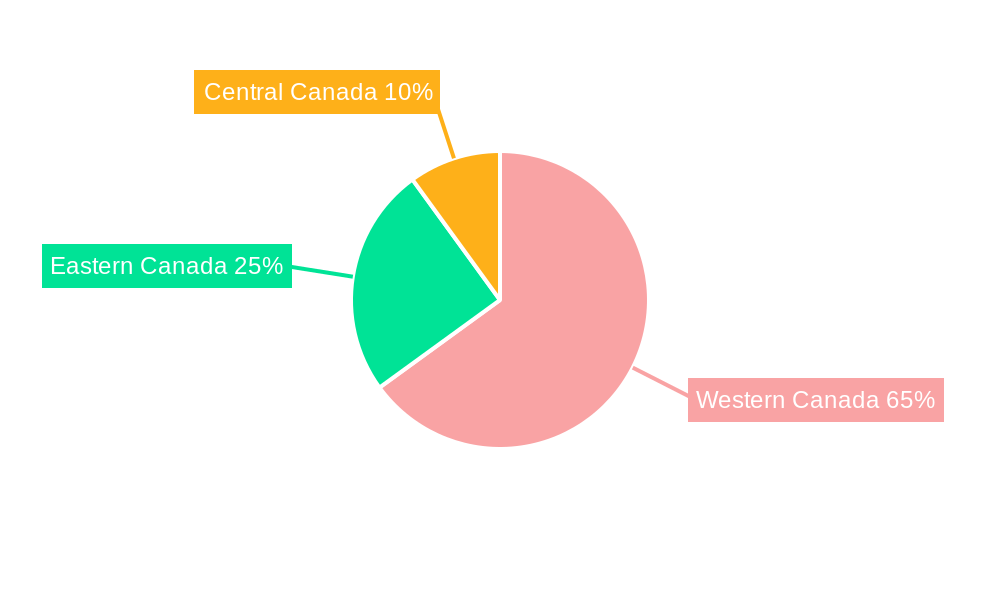

Leading Regions, Countries, or Segments in Canada Coal Industry

British Columbia and Alberta are the dominant coal-producing regions in Canada, each driven by unique factors and market dynamics.

- Key Drivers (British Columbia): Strong metallurgical coal demand from international markets, particularly in Asia, is a significant driver of production in British Columbia. This is further supported by existing infrastructure and well-established mining operations.

- Key Drivers (Alberta): While thermal coal production in Alberta is declining, the region maintains a substantial market presence due to established infrastructure and operational mines. The transition to other energy sources is impacting the overall production.

- Application Segmentation: Metallurgical coal commands a larger market share than thermal coal, reflecting the steel industry's consistent demand. Power generation is steadily declining. 'Other' applications represent a smaller niche segment with a limited effect on the overall market size.

The report provides a detailed breakdown of production volumes, revenue, and market share for each segment and region, including insightful analyses of their respective growth trajectories and future prospects.

Canada Coal Industry Product Innovations

Recent innovations in the Canadian coal industry are focused on enhancing the quality of coal for metallurgical applications, improving extraction efficiency, and developing cleaner coal production technologies, such as carbon capture and storage (CCS). These advancements aim to bolster the competitiveness of Canadian coal in global markets while mitigating environmental concerns. Examples of efficiency-enhancing innovations include improved blasting techniques and the automation of mining operations, leading to cost reductions and increased productivity.

Propelling Factors for Canada Coal Industry Growth

Sustained demand for metallurgical coal from the steel industry, particularly in Asia, remains a key driver. Furthermore, government initiatives focused on infrastructure development and resource extraction, albeit limited, could stimulate growth. Technological improvements in mining and processing can increase efficiency and productivity, potentially counteracting the decline in thermal coal demand.

Obstacles in the Canada Coal Industry Market

The Canadian coal industry faces significant headwinds, including stringent environmental regulations, escalating carbon taxes, and mounting pressure to reduce greenhouse gas emissions. The intensifying competition from renewable energy sources and natural gas, coupled with the potential for supply chain disruptions, presents substantial challenges. These factors have collectively impacted profitability, with an estimated decrease in profit margins of approximately XX% in 2024 compared to 2019.

Future Opportunities in Canada Coal Industry

Opportunities lie in focusing on high-quality metallurgical coal production, optimizing mining processes for greater efficiency, exploring carbon capture and storage technologies, and potentially developing new export markets. Diversification into cleaner coal technologies and related services could also generate new revenue streams.

Major Players in the Canada Coal Industry Ecosystem

- Teck Resources Limited

- Peabody Energy Corp

- Conuma Coal Resources Limited

- CST Canada Coal Limited

- Westmoreland Mining LLC

- Dodd's Coal Mining Company Ltd

Key Developments in Canada Coal Industry Industry

- 2022 Q3: Increased investment in automation technologies by Teck Resources Limited.

- 2021 Q4: Announcement of a new carbon capture pilot project by Conuma Coal Resources Limited.

- 2020 Q2: Closure of a thermal coal mine in Alberta due to declining demand. (Further details are provided in the full report)

Strategic Canada Coal Industry Market Forecast

The Canadian coal industry faces a period of transition. While the overall market size is expected to decline slightly, the demand for high-quality metallurgical coal will remain relatively stable, providing a foundation for future growth. Strategic investments in efficiency improvements, technology adoption, and the exploration of new markets will be crucial for the industry's long-term sustainability and success. The report provides a detailed forecast of production volumes, revenue, and market share for each key segment and player, offering valuable insights into the industry's future trajectory.

Canada Coal Industry Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

Canada Coal Industry Segmentation By Geography

- 1. Canada

Canada Coal Industry Regional Market Share

Geographic Coverage of Canada Coal Industry

Canada Coal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Coal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CST Canada Coal Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westmoreland Mining LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dodd's Coal Mining Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conuma Coal Resources Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teck Resources Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 CST Canada Coal Limited

List of Figures

- Figure 1: Canada Coal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Coal Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Canada Coal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Coal Industry Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Canada Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Canada Coal Industry Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Coal Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Canada Coal Industry?

Key companies in the market include CST Canada Coal Limited, Westmoreland Mining LLC, Dodd's Coal Mining Company Ltd, Conuma Coal Resources Limited, Teck Resources Limited, Peabody Energy Corp.

3. What are the main segments of the Canada Coal Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Coal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Coal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Coal Industry?

To stay informed about further developments, trends, and reports in the Canada Coal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence