Key Insights

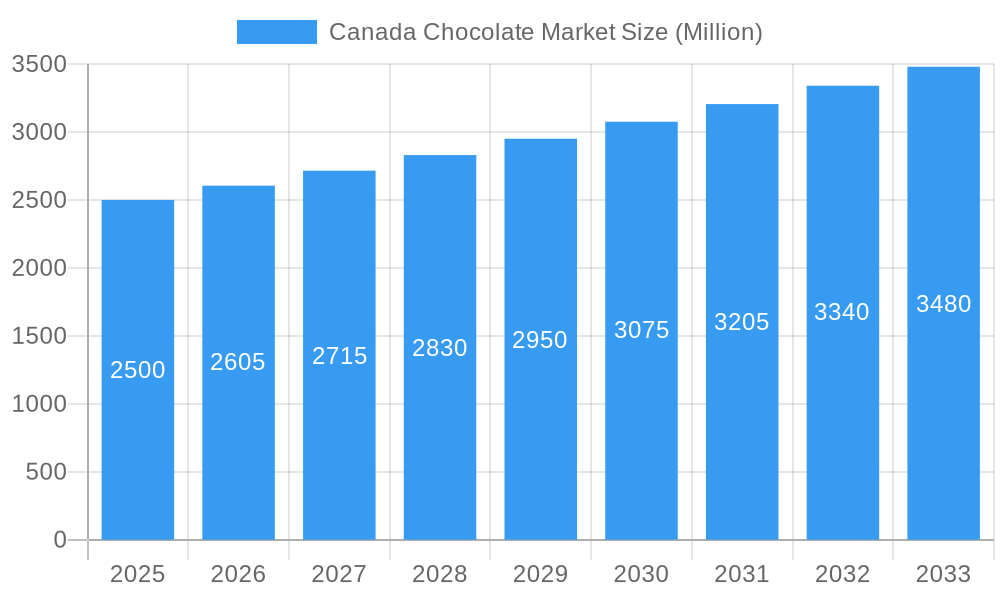

The Canadian chocolate market, projected to reach $3.9 billion by 2025, is poised for significant expansion. With a projected compound annual growth rate (CAGR) of 6.26% from 2025 to 2033, this growth is fueled by increasing disposable incomes, a rising demand for premium and artisanal chocolates, and the expanding use of chocolate in diverse products like beverages and desserts. The market is segmented by chocolate type (dark, milk, white) and distribution channels (online, supermarkets, convenience stores), reflecting shifting consumer preferences and e-commerce trends. Major players such as Nestlé, Hershey's, and Ferrero, alongside artisanal brands, are shaping market dynamics and capitalizing on the demand for unique chocolate experiences. Regional consumption patterns in Eastern, Western, and Central Canada present opportunities for further market penetration.

Canada Chocolate Market Market Size (In Billion)

Market growth faces challenges including cocoa price volatility, growing health consciousness favoring alternatives, and potential economic instability. The competitive landscape is robust, with multinational corporations and niche players employing product innovation, strategic partnerships, and targeted marketing to secure market share. The rise of online retail offers both opportunities and challenges, necessitating adaptable distribution and marketing strategies to complement a strong physical presence. Future success hinges on navigating these complexities and aligning with evolving Canadian consumer preferences.

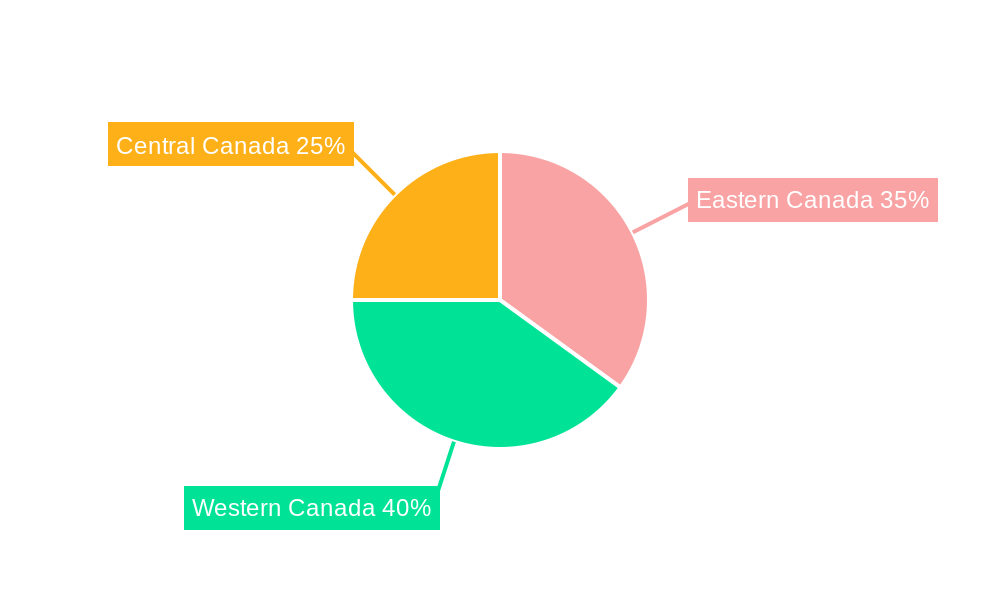

Canada Chocolate Market Company Market Share

Canada Chocolate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Canada chocolate market, offering a comprehensive overview of its current state and future trajectory. With a focus on market size, segmentation, key players, and emerging trends, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report covers the period 2019-2033, with 2025 as the base and estimated year. The market is projected to reach xx Million by 2033.

Canada Chocolate Market Composition & Trends

This section evaluates the competitive landscape of the Canadian chocolate market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user behavior, and merger & acquisition (M&A) activity. We delve into the market share distribution amongst key players and analyze the financial implications of significant M&A deals. The Canadian chocolate market is characterized by a blend of multinational giants and smaller, specialized players. Market concentration is moderately high, with the top five companies holding approximately xx% market share in 2025.

- Market Concentration: Top 5 companies hold approximately xx% market share (2025).

- Innovation Catalysts: Growing consumer demand for organic, fair-trade, and vegan options fuels innovation.

- Regulatory Landscape: Health and labeling regulations significantly influence product formulations and marketing strategies.

- Substitute Products: Competition from confectionery alternatives and healthier snacks exerts pressure on market growth.

- End-User Profiles: Consumer preferences vary significantly across age groups and demographics, impacting product demand.

- M&A Activities: Consolidation is expected to continue, with M&A deal values estimated at xx Million in 2024. Examples include [Specific examples of M&A activity if available, otherwise state "Data unavailable"].

Canada Chocolate Market Industry Evolution

This section explores the dynamic evolution of the Canadian chocolate market, analyzing growth trajectories, technological advancements, and evolving consumer preferences. We present detailed data points on growth rates and adoption metrics, providing a comprehensive understanding of the market’s historical performance and future prospects. The Canadian chocolate market has witnessed consistent growth over the historical period (2019-2024), driven primarily by rising disposable incomes, increasing consumer spending on premium chocolate, and the proliferation of new product offerings. Technological advancements in production and packaging have enhanced efficiency and sustainability.

- Growth Rate: The market experienced an average annual growth rate (AAGR) of xx% during 2019-2024 and is projected to grow at xx% from 2025-2033.

- Technological Advancements: Automation in manufacturing processes and innovative packaging solutions have improved efficiency and reduced costs.

- Consumer Demand Shifts: Growing preference for healthier options, including plant-based and organic chocolates, is influencing product development.

- Premiumization Trend: Consumers are increasingly willing to pay a premium for high-quality, ethically sourced chocolate.

Leading Regions, Countries, or Segments in Canada Chocolate Market

This section identifies the dominant regions, countries, and segments within the Canadian chocolate market, focusing on confectionery variants (Dark Chocolate, Milk and White Chocolate) and distribution channels (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others). Key drivers for dominance are detailed through bullet points and in-depth analysis.

- Confectionery Variant: Milk chocolate dominates the market, followed by dark and white chocolate. The demand for dark chocolate is increasing, driven by health consciousness and perceived health benefits.

- Distribution Channel: Supermarket/hypermarkets remain the largest distribution channel, followed by convenience stores and online retail. E-commerce is expanding rapidly, providing new avenues for market penetration.

- Key Drivers for Dominance: Strong brand recognition, extensive distribution networks, effective marketing strategies, and consumer preferences contribute to market leadership.

Canada Chocolate Market Product Innovations

This section details recent product innovations, focusing on unique selling propositions (USPs) and technological advancements. The Canadian chocolate market is witnessing a wave of innovation driven by consumer demand for healthier, more sustainable, and ethically produced chocolate. Companies are introducing plant-based alternatives, using innovative packaging materials, and focusing on unique flavor profiles to meet evolving consumer preferences. For example, the introduction of oat milk chocolate bars and biodegradable packaging demonstrate this trend.

Propelling Factors for Canada Chocolate Market Growth

Several factors are driving the growth of the Canadian chocolate market. These include rising disposable incomes, increasing consumer spending on premium chocolate, and innovative product development. Government regulations promoting fair trade and sustainable sourcing are also contributing to market expansion.

Obstacles in the Canada Chocolate Market Market

Challenges faced by the Canadian chocolate market include fluctuating raw material prices, increasing competition, and evolving consumer preferences. Regulatory changes and economic uncertainty also pose significant challenges. Supply chain disruptions and the rising cost of ingredients can affect profitability and market stability.

Future Opportunities in Canada Chocolate Market

The Canadian chocolate market presents significant opportunities for growth. The increasing demand for premium, ethically sourced, and plant-based chocolate presents avenues for expansion. Innovation in product development and packaging, coupled with effective marketing strategies targeting specific consumer segments, can unlock substantial market potential. The growth of e-commerce also presents exciting new sales channels.

Major Players in the Canada Chocolate Market Ecosystem

- La Siembra Co-operative Inc

- Nestlé SA

- Newfoundland Chocolate Company

- Chocoladefabriken Lindt & Sprüngli AG

- Palette de Bine

- Soma Chocolate

- Roger's Chocolate

- Ferrero International SA

- Mars Incorporated

- Qantu Chocolate

- The Hershey Company

- Purdys Chocolatier

- Laura Secord SEC

- Mondelēz International Inc

- Alfred Ritter GmbH & Co KG

Key Developments in Canada Chocolate Market Industry

- October 2023: Camino Chocolates launched biodegradable and compostable wood pulp inner wrappers for its chocolate bars, certified by the Forest Stewardship Council (FSC). This contributes to increasing consumer demand for sustainable products.

- March 2023: Camino Chocolates introduced two plant-based milk chocolate bars, catering to the growing demand for vegan and ethical options. This strengthens its position in a rapidly expanding market segment.

- January 2023: Ritter Sport launched a Travel Retail Edition Vegan Tower, expanding its product portfolio and catering to a growing consumer base. This supports its global presence and responds to travel market needs.

Strategic Canada Chocolate Market Market Forecast

The Canadian chocolate market is poised for continued growth, driven by several key factors. The rising demand for premium and specialized chocolate products, coupled with the increasing popularity of plant-based alternatives, will fuel market expansion in the coming years. Innovation in product development and sustainable packaging practices will also play a pivotal role. The expanding e-commerce sector presents additional opportunities for market penetration. The market is expected to maintain a strong growth trajectory over the forecast period (2025-2033).

Canada Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Canada Chocolate Market Segmentation By Geography

- 1. Canada

Canada Chocolate Market Regional Market Share

Geographic Coverage of Canada Chocolate Market

Canada Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production

- 3.3. Market Restrains

- 3.3.1. Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 La Siembra Co-operative Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Newfoundland Chocolate Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Palette de Bine

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Soma Chocolate

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Roger's Chocolate

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ferrero International SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mars Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qantu Chocolate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Hershey Compan

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Purdys Chocolatier

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Laura Secord SEC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mondelēz International Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Alfred Ritter GmbH & Co KG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 La Siembra Co-operative Inc

List of Figures

- Figure 1: Canada Chocolate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Chocolate Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Chocolate Market Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Canada Chocolate Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Canada Chocolate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Chocolate Market Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 5: Canada Chocolate Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Canada Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Chocolate Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Canada Chocolate Market?

Key companies in the market include La Siembra Co-operative Inc, Nestlé SA, Newfoundland Chocolate Company, Chocoladefabriken Lindt & Sprüngli AG, Palette de Bine, Soma Chocolate, Roger's Chocolate, Ferrero International SA, Mars Incorporated, Qantu Chocolate, The Hershey Compan, Purdys Chocolatier, Laura Secord SEC, Mondelēz International Inc, Alfred Ritter GmbH & Co KG.

3. What are the main segments of the Canada Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia.

8. Can you provide examples of recent developments in the market?

October 2023: Camino Chocolates released a new line of biodegradable and compostable wood pulp inner wrappers for its chocolate bars. The new wood pulp packaging is from responsibly managed forests and is certified by the Forest Certification Council (FSC).March 2023: Camino Chocolates announced the launch of two milk-style, plant-based chocolate bars made with oat milk. The two new flavors —Hazelnuts & Salted Caramel and Creamy Chocol-oat —are great options for milk chocolate lovers who are looking for plant-based and ethical options.January 2023: Ritter Sport launched a Travel Retail Edition Vegan Tower 5x100 g set globally, offering three varieties of non-dairy chocolate in a five-pack. The travel edition assortment's flavors include Smooth Chocolate, Roasted Peanut, and Salted Caramel, which were introduced in domestic markets in January 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Chocolate Market?

To stay informed about further developments, trends, and reports in the Canada Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence