Key Insights

The Brazilian soft drinks market, projected at $14.18 billion in 2025, is set for significant expansion with a Compound Annual Growth Rate (CAGR) of 6.32% from 2025 to 2033. This growth is propelled by rising disposable incomes within Brazil's expanding middle class, driving increased spending on discretionary products like soft drinks. The nation's consistently hot climate further boosts demand for refreshing beverages year-round. Shifting consumer preferences towards healthier alternatives, including low-sugar and functional drinks, are actively reshaping market dynamics. Aggressive marketing by industry leaders such as Coca-Cola and Ambev, alongside the growing popularity of energy drinks and novel flavor profiles, further stimulates market growth. However, market expansion faces challenges from fluctuating raw material costs, particularly sugar, impacting production expenses and profitability. Growing consumer health consciousness also presents a challenge, encouraging a move away from traditional, high-sugar sodas towards healthier options. The market is segmented by product type (beverages, shots, mixers) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist retailers, and others). Key industry players including Coca-Cola, Ambev, and Red Bull are fiercely competing for market share through diverse strategies targeting varied consumer segments and channels. The competitive environment is dynamic, characterized by a strong presence of both global multinationals and local enterprises.

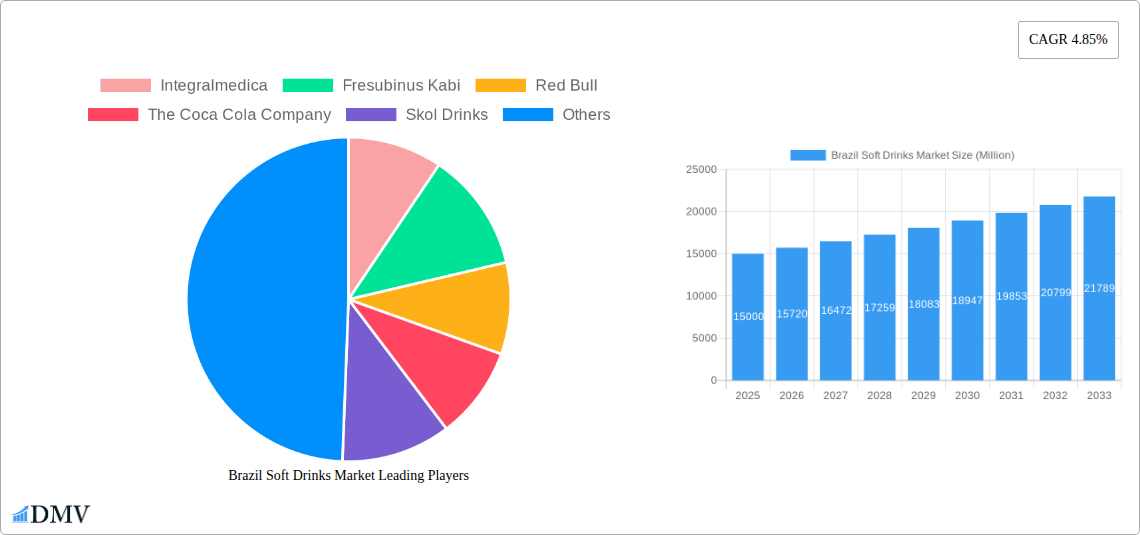

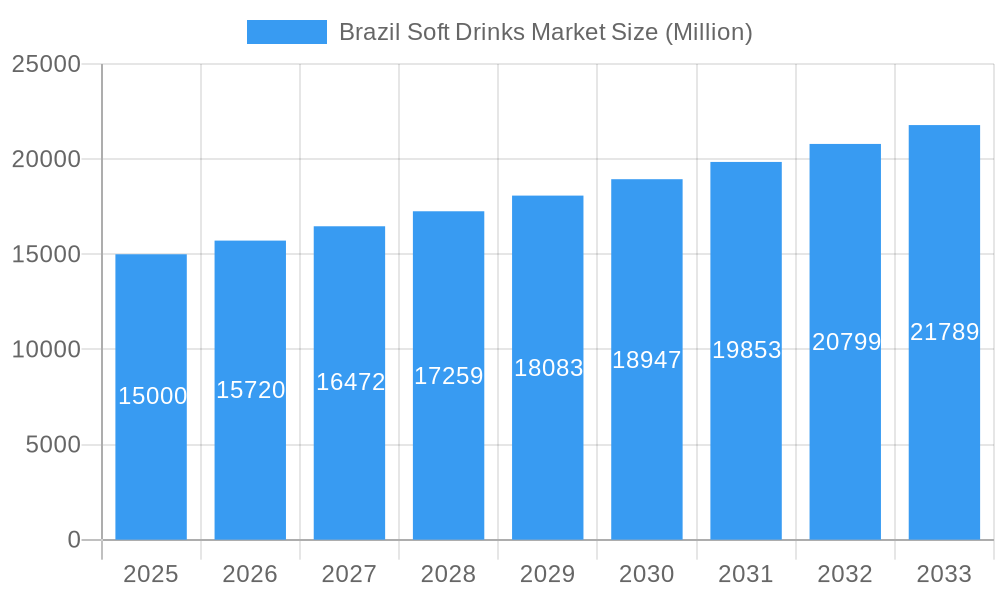

Brazil Soft Drinks Market Market Size (In Billion)

The substantial Brazilian soft drink market offers significant investment opportunities. Robust growth, driven by key demographic and economic factors, indicates sustained potential for both established leaders and emerging brands. Strategic product diversification and channel optimization are essential for success, particularly in meeting the escalating consumer demand for healthier and more innovative beverage choices. Effectively managing the volatility of raw material prices and adapting to evolving consumer preferences will be critical for achieving sustained long-term growth and profitability in this dynamic market. Intense competition underscores the importance of a strong brand identity, impactful marketing initiatives, and a focused product development strategy.

Brazil Soft Drinks Market Company Market Share

Brazil Soft Drinks Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Brazil soft drinks market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study is essential for stakeholders seeking to understand and capitalize on opportunities within this lucrative market. The report utilizes meticulous data analysis and expert insights to deliver actionable intelligence for informed decision-making.

Brazil Soft Drinks Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the Brazilian soft drinks market. We analyze market concentration, revealing the market share distribution among key players like Ambev, Coca-Cola Company, and Red Bull. The report also explores the impact of substitute products, evolving consumer preferences, and the influence of mergers and acquisitions (M&A) activities. Data on M&A deal values (in Millions) for the period 2019-2024 will be presented, along with a forecast for 2025-2033. The analysis delves into the end-user profiles, identifying key consumer segments and their purchasing behaviors. Finally, the regulatory landscape and its implications for market participants are thoroughly examined.

- Market Share Distribution (2024): Ambev (xx%), Coca-Cola Company (xx%), Red Bull (xx%), Others (xx%)

- M&A Activity (2019-2024): Total deal value: xx Million; Number of deals: xx

- Key Regulatory Factors: Analysis of relevant legislation impacting the industry.

- Substitute Products: Impact of alternative beverages on market growth.

Brazil Soft Drinks Market Industry Evolution

This section provides a detailed analysis of the historical (2019-2024) and projected (2025-2033) growth trajectory of the Brazilian soft drinks market. We examine the influence of technological advancements, such as innovative packaging and production techniques, and their impact on market expansion. Furthermore, we investigate the evolving consumer preferences, exploring shifts in demand towards healthier options, functional beverages, and premium products. The report includes detailed growth rate projections (CAGR) for different segments and identifies key factors contributing to the overall market evolution. Specific data points, like adoption rates of new technologies and changes in per capita consumption, will be provided.

Leading Regions, Countries, or Segments in Brazil Soft Drinks Market

This section identifies the dominant regions, countries, and segments within the Brazil soft drinks market. Analysis will focus on By Product Type (Drinks, Shots, Mixers) and By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Others). The section will pinpoint the leading segment based on revenue generation and growth potential. Key drivers contributing to the dominance of specific regions or segments are highlighted using bullet points, followed by in-depth analysis using paragraphs.

By Product Type:

- Drinks: Key Drivers: High consumer demand, wide product variety, extensive distribution networks.

- Shots: Key Drivers: Growing popularity of ready-to-drink cocktails and alcoholic beverages.

- Mixers: Key Drivers: Increased demand for customized drinks and cocktail culture.

By Distribution Channel:

- Supermarkets/Hypermarkets: Key Drivers: High volume sales, established infrastructure, broad reach.

- Convenience Stores: Key Drivers: Accessibility, impulse purchases, strategic locations.

- Specialist Stores: Key Drivers: Focus on niche products and premium brands.

- Others: Key Drivers: Online sales, direct-to-consumer models.

Brazil Soft Drinks Market Product Innovations

This section highlights recent product innovations, including new flavors, functional ingredients, sustainable packaging, and technological advancements in production methods. We will explore the unique selling propositions (USPs) of these innovations and their impact on market competition. Performance metrics, such as sales growth and consumer acceptance, will be included where available.

Propelling Factors for Brazil Soft Drinks Market Growth

Several factors contribute to the growth of the Brazil soft drinks market. These include rising disposable incomes leading to increased spending on beverages, favorable demographics with a large young population, and the growing popularity of convenient and ready-to-drink options. Government regulations promoting sustainable packaging practices also play a role. Specific examples of these growth drivers will be detailed.

Obstacles in the Brazil Soft Drinks Market

The Brazilian soft drinks market faces challenges like intense competition, increasing health consciousness leading to a shift towards healthier alternatives, and fluctuations in raw material prices which impact production costs. Supply chain disruptions and stringent regulatory frameworks also pose hurdles. Quantifiable impacts of these obstacles on market growth will be assessed.

Future Opportunities in Brazil Soft Drinks Market

The future presents promising opportunities, including the expansion into untapped markets, the development of innovative functional beverages, and the increasing adoption of e-commerce channels for beverage sales. Furthermore, the growing interest in sustainable and ethically sourced ingredients provides scope for market expansion.

Major Players in the Brazil Soft Drinks Market Ecosystem

- Integralmedica

- Fresenius Kabi

- Red Bull

- The Coca-Cola Company

- Skol Drinks

- Budweiser

- Beverages Grassi

- Petropolis Group

- Ambev

- Monster Beverage Corp

Key Developments in Brazil Soft Drinks Market Industry

This section will present a chronological list (year/month) of key industry developments, including product launches, mergers and acquisitions, regulatory changes, and technological advancements, and their impact on market dynamics.

Strategic Brazil Soft Drinks Market Forecast

The Brazilian soft drinks market is poised for continued growth, driven by factors such as increasing disposable incomes, favorable demographics, and evolving consumer preferences. The forecast incorporates the impact of technological advancements, regulatory changes, and competitive dynamics. The report offers projections for market size and segment growth, providing valuable insights for strategic decision-making.

Brazil Soft Drinks Market Segmentation

-

1. Product Type

- 1.1. Drinks

- 1.2. Shots

- 1.3. Mixers

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Store

- 2.4. Others

Brazil Soft Drinks Market Segmentation By Geography

- 1. Brazil

Brazil Soft Drinks Market Regional Market Share

Geographic Coverage of Brazil Soft Drinks Market

Brazil Soft Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand For Non-Alcoholic Beverages in Brazil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Soft Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Drinks

- 5.1.2. Shots

- 5.1.3. Mixers

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Store

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Integralmedica

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fresubinus Kabi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Red Bull

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Coca Cola Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skol Drinks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Budweiser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Beverages Grassi*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petropolis Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ambev

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Monster Beverage Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Integralmedica

List of Figures

- Figure 1: Brazil Soft Drinks Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Soft Drinks Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Soft Drinks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Brazil Soft Drinks Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Brazil Soft Drinks Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Soft Drinks Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Brazil Soft Drinks Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Brazil Soft Drinks Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Soft Drinks Market?

The projected CAGR is approximately 6.32%.

2. Which companies are prominent players in the Brazil Soft Drinks Market?

Key companies in the market include Integralmedica, Fresubinus Kabi, Red Bull, The Coca Cola Company, Skol Drinks, Budweiser, Beverages Grassi*List Not Exhaustive, Petropolis Group, Ambev, Monster Beverage Corp.

3. What are the main segments of the Brazil Soft Drinks Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rising Demand For Non-Alcoholic Beverages in Brazil.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Soft Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Soft Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Soft Drinks Market?

To stay informed about further developments, trends, and reports in the Brazil Soft Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence