Key Insights

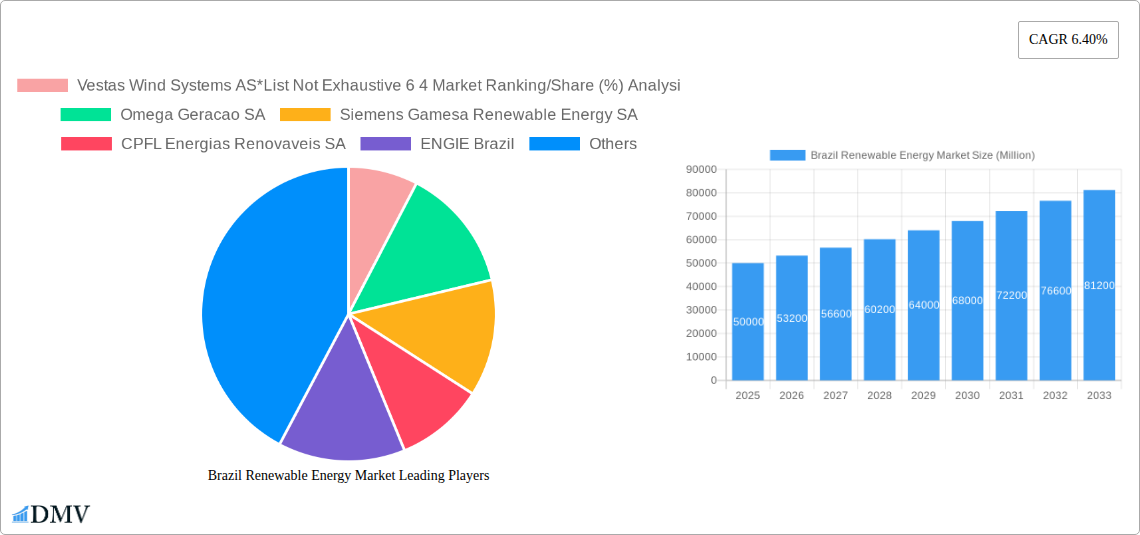

The Brazil renewable energy market is experiencing substantial growth, propelled by ambitious clean energy adoption targets and a favorable regulatory framework. With a projected Compound Annual Growth Rate (CAGR) of 5.47% from 2024 to 2033, significant expansion is anticipated across wind, solar, and hydropower sectors. The current market size, estimated at 24.27 billion in the base year 2024, is driven by rising electricity demand, government incentives, and increasing environmental awareness. Major players such as Vestas Wind Systems, Siemens Gamesa Renewable Energy, and EDP Renewables are actively investing in national projects, reinforcing the market's strength. Potential challenges include managing the intermittency of solar and wind power, enhancing grid infrastructure for renewable integration, and securing land for large-scale developments. The market's diversification into wind, solar, hydro, bioenergy, and other renewable sources highlights its resilience and capacity to meet Brazil's diverse energy requirements. The forecast period (2025-2033) indicates continued expansion, with potential for accelerated growth through technological advancements and supportive government policies.

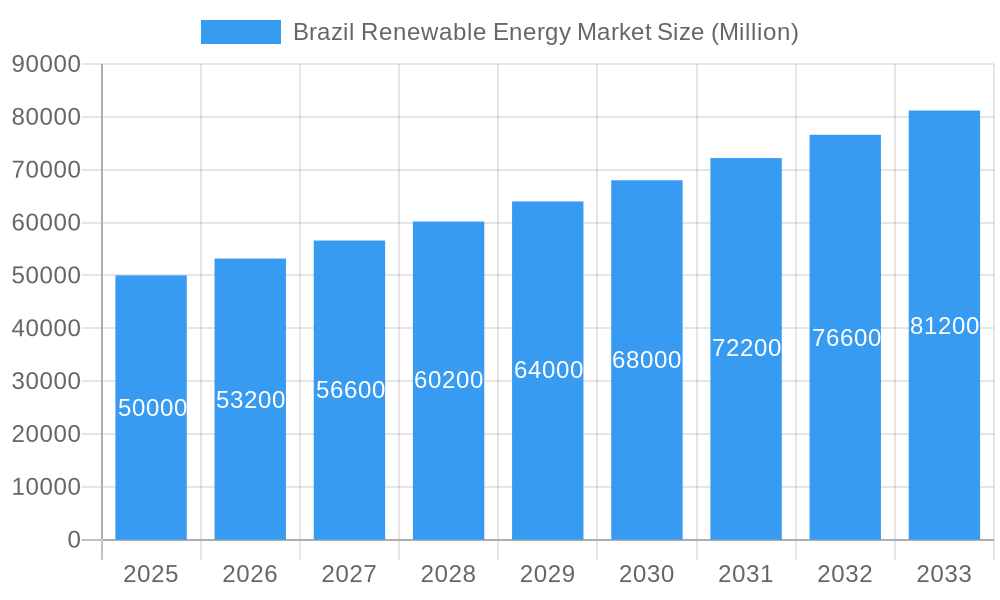

Brazil Renewable Energy Market Market Size (In Billion)

Sustained government support, advancements in energy storage technology, and improvements in infrastructural limitations are crucial for the continued success of the Brazilian renewable energy market. Robust participation from both international and domestic companies fosters healthy competition and innovation, presenting attractive investment opportunities in the emerging markets sector. Brazil's diverse renewable energy portfolio enhances energy security and reduces dependence on fossil fuels. Ongoing investments in research and development, enhanced grid connectivity, and a firm commitment to environmentally conscious energy policies will further propel growth, establishing Brazil as a global leader in renewable energy.

Brazil Renewable Energy Market Company Market Share

Brazil Renewable Energy Market Analysis: Size, Growth, and Forecast (2024-2033)

This comprehensive report analyzes the dynamic Brazil renewable energy market, providing critical insights for stakeholders. Covering the period 2024-2033, with a base year of 2024, this report details market dynamics, trends, and future projections. The market is valued at 24.27 billion in 2024 and is projected to experience robust growth, driven by a CAGR of 5.47%.

Brazil Renewable Energy Market Composition & Trends

This section delves into the competitive dynamics of the Brazilian renewable energy market, examining market concentration, innovation, regulations, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a diverse mix of players, including large multinational corporations and smaller domestic companies. Market share is currently dominated by a few major players, with Vestas Wind Systems AS, Omega Geracao SA, Siemens Gamesa Renewable Energy SA, CPFL Energias Renovaveis SA, ENGIE Brazil, Companhia Hidro Eletrica do Sao Francisco, Eletrobras Furnas, Engie Brasil, Itaipu Binacional, and EDP Renewables representing significant portions of the market. However, the market exhibits a high degree of dynamism, with ongoing M&A activities reshaping the competitive landscape.

- Market Share Distribution: Vestas Wind Systems AS and Siemens Gamesa Renewable Energy SA hold a combined market share of approximately xx%, followed by other key players with shares ranging from xx% to xx%. The remaining share is distributed among numerous smaller players.

- M&A Activity: The past five years have witnessed several significant M&A deals, with total deal values exceeding xx Million. These transactions reflect the growing consolidation within the sector and the strategic expansion efforts of major players.

- Innovation Catalysts: Government incentives, technological advancements (especially in solar and wind), and increasing consumer awareness of environmental concerns are key drivers of innovation in the Brazilian renewable energy market.

- Regulatory Landscape: The Brazilian government's supportive policies and regulatory framework have been crucial in fostering the growth of the renewable energy sector. However, regulatory complexities and inconsistencies in certain areas remain a challenge.

- Substitute Products: Fossil fuels continue to compete with renewable sources of energy, but their competitiveness is gradually diminishing due to rising fossil fuel prices and environmental concerns.

- End-User Profiles: The end-users of renewable energy in Brazil include residential consumers, industrial and commercial entities, and the power utility sector, each segment exhibiting unique energy needs and preferences.

Brazil Renewable Energy Market Industry Evolution

The Brazilian renewable energy market has witnessed substantial growth in recent years, driven by a confluence of factors, including government support, technological advancements, and increasing environmental awareness. The hydro segment has traditionally dominated the market; however, solar and wind power are rapidly gaining traction, fuelled by cost reductions and technological improvements.

The market's growth trajectory is expected to remain strong over the forecast period, fueled by investments in new renewable energy projects, improving energy efficiency, and government incentives. This growth will be particularly notable in the solar and wind segments, which are experiencing rapid technological advancements and significant cost reductions. Consumer demand for cleaner energy is also a significant driver, with a growing awareness of the environmental and economic benefits of renewable energy sources. Market growth rates are estimated at xx% annually in the period 2019-2024 and xx% in the projected period 2025-2033. Adoption of renewable energy technologies has experienced a significant increase, with approximately xx% of total energy production coming from renewable sources in 2024.

Leading Regions, Countries, or Segments in Brazil Renewable Energy Market

The Brazilian renewable energy market is geographically diverse, with several regions exhibiting strong growth potential. However, the Hydropower segment, particularly in regions with abundant water resources like the Southeast and South, currently holds the leading position.

- Key Drivers for Hydropower Dominance:

- Abundant Water Resources: Brazil possesses extensive river systems and hydropower potential.

- Established Infrastructure: A well-developed hydropower infrastructure exists, reducing the initial investment barriers.

- Government Support: Government policies have historically favored hydropower development.

- Wind and Solar Emergence: While hydropower is leading, wind and solar energy are swiftly gaining ground, especially in Northeast and North regions, driven by high solar irradiance and strong wind resources in these areas.

- Regulatory Support and Investment Trends: The government's incentives and investment in renewable energy infrastructure are key factors in promoting the growth of both established and emerging segments.

Brazil Renewable Energy Market Product Innovations

Recent innovations in renewable energy technologies have significantly enhanced efficiency and cost-effectiveness. Advanced turbine designs for wind energy, higher-efficiency solar panels, and improved energy storage solutions are noteworthy examples. These innovations have broadened the applications of renewable energy, making it viable for both large-scale projects and decentralized microgrids. This ongoing technological advancement is a key factor in driving market growth and enhancing the competitiveness of renewable energy against traditional sources.

Propelling Factors for Brazil Renewable Energy Market Growth

Several factors contribute to the growth of the Brazilian renewable energy market. Government policies offering tax breaks and incentives are crucial. Technological advances reducing the cost of renewable energy technologies, along with increasing awareness of environmental sustainability and its economic benefits, further drive the expansion. The decreasing cost of renewable energy technologies is also a major driver, making it increasingly competitive with fossil fuels.

Obstacles in the Brazil Renewable Energy Market Market

Despite its growth trajectory, the Brazilian renewable energy market faces certain challenges. Intermittency of renewable sources like solar and wind poses grid management complexities, demanding substantial investments in energy storage solutions. Supply chain disruptions, especially impacting the procurement of essential components for renewable energy projects, can cause delays and cost overruns. Lastly, although the regulatory framework is generally supportive, inconsistencies and bureaucratic hurdles can create obstacles to project development and implementation. These issues can significantly impact the overall growth of the renewable energy sector.

Future Opportunities in Brazil Renewable Energy Market

The future of the Brazilian renewable energy market is bright, with several promising opportunities on the horizon. The growth of off-grid and decentralized renewable energy systems provides significant opportunities, particularly in remote and underserved areas. Technological advancements like advanced energy storage solutions and smart grids will play a key role in improving grid reliability and integrating more renewable energy sources. Moreover, expanding into new markets like green hydrogen and exploring opportunities within the circular economy promise further growth and diversification in the sector.

Major Players in the Brazil Renewable Energy Market Ecosystem

- Vestas Wind Systems AS

- Omega Geracao SA

- Siemens Gamesa Renewable Energy SA

- CPFL Energias Renovaveis SA

- ENGIE Brazil

- Companhia Hidro Eletrica do Sao Francisco

- Eletrobras Furnas

- Engie Brasil

- Itaipu Binacional

- EDP Renewables

Key Developments in Brazil Renewable Energy Market Industry

- March 2024: Energea completed 12 new Community Solar projects, marking significant expansion in sustainable energy solutions.

- October 2023: ENGIE Brasil Energia contracted ANDRITZ for a 424 MW Jaguara hydropower plant modernization, boosting operational efficiency and capacity.

Strategic Brazil Renewable Energy Market Market Forecast

The Brazilian renewable energy market is poised for sustained growth, driven by favorable government policies, technological advancements, and increasing consumer demand for sustainable energy solutions. The ongoing expansion of solar and wind energy, coupled with modernization efforts in the hydropower sector, will significantly contribute to the market's future potential. The country's abundant renewable resources and supportive regulatory framework position it favorably for continued growth and leadership in the global renewable energy market.

Brazil Renewable Energy Market Segmentation

-

1. Type

- 1.1. Wind

- 1.2. Solar

- 1.3. Hydro

- 1.4. Bioenergy

- 1.5. Other Types

Brazil Renewable Energy Market Segmentation By Geography

- 1. Brazil

Brazil Renewable Energy Market Regional Market Share

Geographic Coverage of Brazil Renewable Energy Market

Brazil Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. The Wind Energy Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wind

- 5.1.2. Solar

- 5.1.3. Hydro

- 5.1.4. Bioenergy

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems AS*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Omega Geracao SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Gamesa Renewable Energy SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CPFL Energias Renovaveis SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENGIE Brazil

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Companhia Hidro Eletrica do Sao Francisco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eletrobras Furnas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Engie Brasil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Itaipu Binacional

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EDP Renewables

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems AS*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi

List of Figures

- Figure 1: Brazil Renewable Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Renewable Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Renewable Energy Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 3: Brazil Renewable Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Renewable Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: Brazil Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Brazil Renewable Energy Market Volume gigawatt Forecast, by Type 2020 & 2033

- Table 7: Brazil Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Brazil Renewable Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Renewable Energy Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the Brazil Renewable Energy Market?

Key companies in the market include Vestas Wind Systems AS*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi, Omega Geracao SA, Siemens Gamesa Renewable Energy SA, CPFL Energias Renovaveis SA, ENGIE Brazil, Companhia Hidro Eletrica do Sao Francisco, Eletrobras Furnas, Engie Brasil , Itaipu Binacional , EDP Renewables.

3. What are the main segments of the Brazil Renewable Energy Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.27 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy.

6. What are the notable trends driving market growth?

The Wind Energy Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

March 2024: Energea, an online investment platform that provides access to portfolios of renewable energy projects, announced the completion of 12 new projects in its Community Solar in Brazil portfolio. These latest additions mark a significant milestone in Energea's mission to provide sustainable and efficient energy solutions across Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Brazil Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence