Key Insights

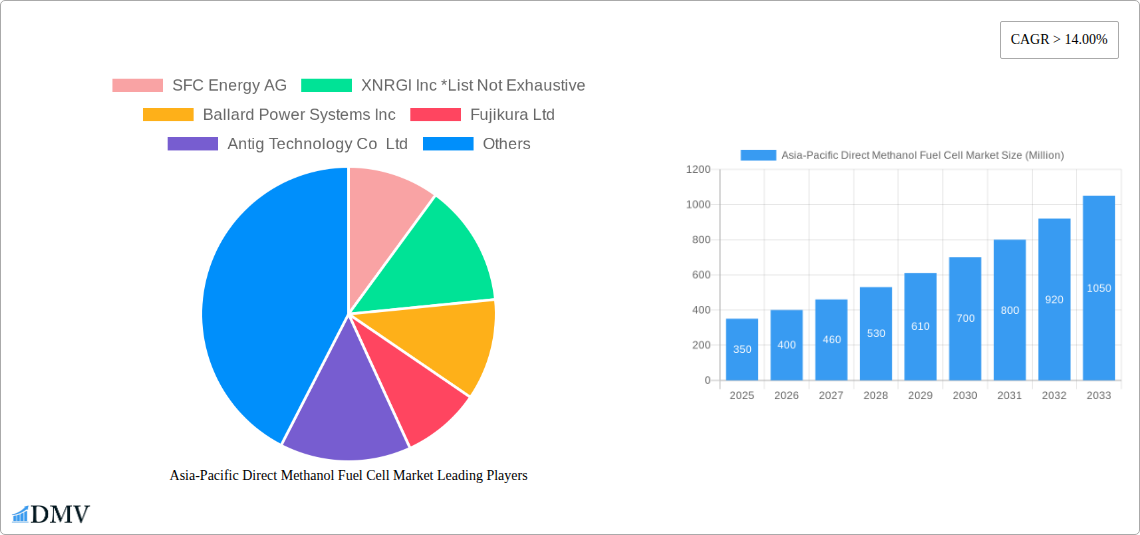

The Asia-Pacific Direct Methanol Fuel Cell (DMFC) market is experiencing robust growth, driven by increasing demand for portable power solutions and the region's commitment to clean energy initiatives. With a Compound Annual Growth Rate (CAGR) exceeding 14% and a market size estimated at several hundred million USD in 2025 (the exact figure requires further specification based on the missing "XX" value), the market presents significant opportunities for stakeholders. Key drivers include the rising adoption of DMFCs in portable electronic devices, such as laptops and smartphones, as well as their increasing use in transportation, particularly in electric vehicles and hybrid systems. Government regulations promoting clean energy technologies and the ongoing development of more efficient and cost-effective DMFC systems further fuel market expansion. While challenges remain, such as the relatively high cost of DMFCs compared to traditional battery technologies and concerns surrounding methanol's toxicity, ongoing technological advancements are steadily addressing these limitations. The market segmentation across stationary, portable, and transportation applications indicates a diverse range of opportunities, with the portable segment currently leading the market share. China, Japan, South Korea, and India are key contributors to the regional growth, fuelled by substantial investments in research and development and expanding manufacturing capabilities within these countries. The forecast period of 2025-2033 promises further expansion, with substantial market penetration expected across various sectors within the Asia-Pacific region.

Asia-Pacific Direct Methanol Fuel Cell Market Market Size (In Million)

The significant growth trajectory of the Asia-Pacific DMFC market is fueled by several interconnected factors. Firstly, the increasing urbanization and industrialization in the region demand reliable and clean power sources, making DMFCs a compelling alternative. Secondly, the rising awareness of environmental concerns and the implementation of stringent emission regulations are driving the adoption of cleaner energy technologies. Thirdly, technological advancements in DMFC technology, including improvements in efficiency, durability, and cost-effectiveness, are enhancing its competitiveness against traditional energy sources. Furthermore, the active involvement of key players like SFC Energy AG, Ballard Power Systems Inc, and others, in research, development, and commercialization, contributes to market growth. While challenges related to methanol storage and distribution and the need for further cost reduction remain, the overall market outlook for Asia-Pacific DMFCs is exceptionally positive, signaling considerable growth potential across various applications within the forecast period.

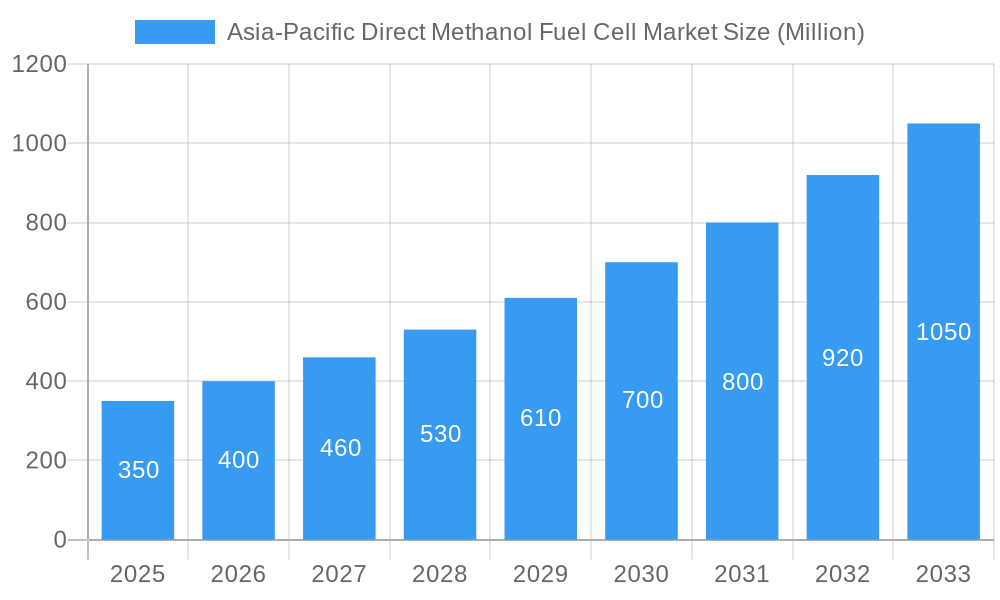

Asia-Pacific Direct Methanol Fuel Cell Market Company Market Share

Asia-Pacific Direct Methanol Fuel Cell Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia-Pacific Direct Methanol Fuel Cell (DMFC) market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. From market sizing and segmentation to technological advancements and future opportunities, this report covers all crucial aspects, enabling informed decision-making and strategic planning. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period encompasses 2019-2024. The market is projected to reach xx Million by 2033.

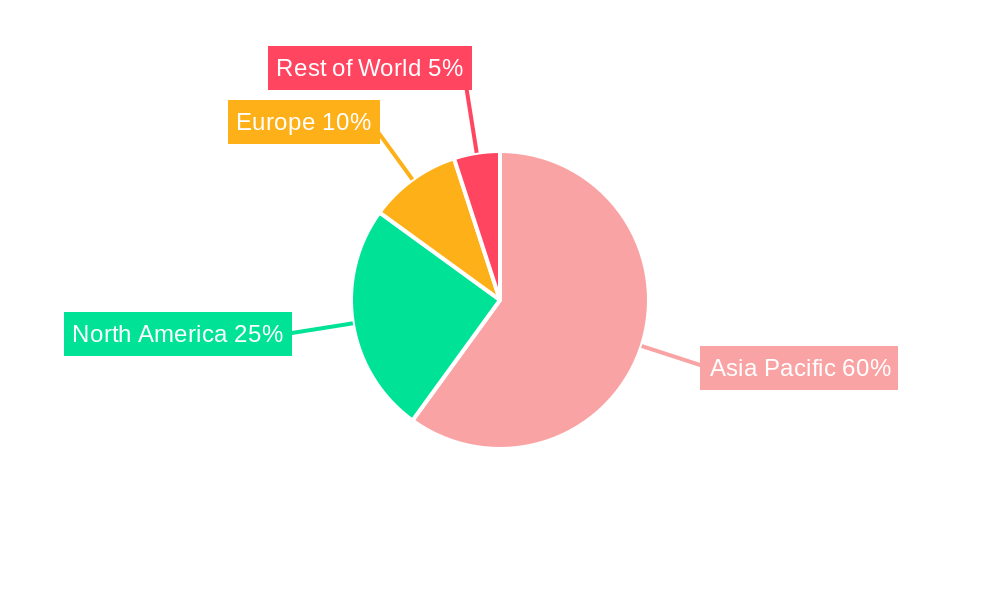

Asia-Pacific Direct Methanol Fuel Cell Market Market Composition & Trends

This section delves into the competitive dynamics of the Asia-Pacific DMFC market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately fragmented landscape, with several key players vying for market share. Innovation in DMFC technology is driven by the need for cleaner energy solutions and increasing government support for renewable energy initiatives. Stringent environmental regulations across the region are further propelling market growth. Substitute technologies, such as lithium-ion batteries, pose a significant challenge. However, the unique advantages of DMFCs, such as higher energy density and faster refueling times, are expected to sustain their market position.

- Market Share Distribution: The top five players account for approximately xx% of the total market share in 2025, with SFC Energy AG holding the largest share at xx%.

- Innovation Catalysts: Government incentives, research and development initiatives, and the rising demand for portable power solutions are key drivers of innovation.

- Regulatory Landscape: Varying environmental regulations across different countries in the Asia-Pacific region influence DMFC adoption rates.

- Substitute Products: Lithium-ion batteries and other fuel cell technologies are major substitutes.

- End-User Profiles: The primary end-users include the stationary, portable, and transportation sectors.

- M&A Activities: The past five years have witnessed xx M&A deals in the Asia-Pacific DMFC market, with a total deal value of approximately xx Million. Notable examples include the April 2022 joint venture between TecNrgy and SFC Energy.

Asia-Pacific Direct Methanol Fuel Cell Market Industry Evolution

The Asia-Pacific DMFC market has experienced significant growth over the past few years, fueled by technological advancements, increasing environmental concerns, and rising demand for portable and stationary power solutions. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is expected to continue during the forecast period (2025-2033), with a projected CAGR of xx%. Technological innovations, such as improved catalyst materials and membrane electrode assemblies (MEAs), have enhanced the efficiency and performance of DMFCs. Consumer demand is shifting towards more sustainable and reliable energy sources, making DMFCs an attractive alternative. The adoption rate of DMFCs is particularly high in sectors like portable power applications due to their compact size and ease of use.

Leading Regions, Countries, or Segments in Asia-Pacific Direct Methanol Fuel Cell Market

China currently dominates the Asia-Pacific DMFC market, driven by strong government support for renewable energy technologies and significant investments in research and development. Japan and South Korea are also major players, exhibiting strong technological capabilities and a well-established fuel cell industry. The stationary segment currently holds the largest market share, followed by the portable segment. The transportation segment is experiencing rapid growth, fueled by the increasing adoption of DMFCs in buses, forklifts, and other vehicles.

- Key Drivers for China's Dominance:

- Significant government investment in renewable energy infrastructure.

- Robust domestic manufacturing capabilities.

- Growing demand for cleaner energy solutions in various sectors.

- Key Drivers for Portable Segment Growth:

- Increased demand for portable power devices in various applications.

- Advantages of DMFCs, such as compact size and ease of use.

- Technological advancements improving efficiency and lifespan.

The transportation segment is projected to witness the highest growth rate in the forecast period driven by increasing government regulations and incentives for adopting clean transportation solutions.

Asia-Pacific Direct Methanol Fuel Cell Market Product Innovations

Recent advancements in DMFC technology have focused on enhancing efficiency, durability, and cost-effectiveness. New catalyst materials and improved MEA designs have led to significant improvements in power output and longevity. The integration of advanced control systems and innovative fuel management strategies has further improved the overall performance and reliability of DMFC systems. These innovations have expanded the range of applications for DMFCs, including portable power sources for consumer electronics and military applications, as well as backup power systems for critical infrastructure. The unique selling propositions include their quiet operation, low emissions, and ability to operate in a wide range of temperature conditions.

Propelling Factors for Asia-Pacific Direct Methanol Fuel Cell Market Growth

Several factors are driving the growth of the Asia-Pacific DMFC market. Technological advancements leading to higher efficiency and lower costs are a key driver. Stringent environmental regulations and increasing awareness of climate change are pushing the adoption of cleaner energy solutions. Government incentives and subsidies are encouraging investment in DMFC technology. The growing demand for portable power solutions in various sectors further fuels market expansion. For example, the increasing demand for backup power in remote areas is boosting the adoption of DMFC systems.

Obstacles in the Asia-Pacific Direct Methanol Fuel Cell Market Market

Despite the positive outlook, challenges remain. The high initial cost of DMFC systems compared to traditional power sources is a significant barrier to adoption. The availability and cost of methanol fuel can also impact market growth. Supply chain disruptions and the competition from other fuel cell technologies and batteries also pose challenges. Furthermore, lack of standardized infrastructure and regulations in some parts of the region can hinder wider adoption. These factors collectively limit the market's overall expansion potential.

Future Opportunities in Asia-Pacific Direct Methanol Fuel Cell Market

The Asia-Pacific DMFC market presents significant future opportunities. Expanding into new markets, particularly in developing economies with growing energy demands, offers considerable potential. Technological advancements, such as the development of high-performance, low-cost DMFC systems, will further stimulate market growth. The increasing integration of DMFCs into hybrid and electric vehicles opens up a new avenue for market expansion. The development of novel applications in diverse sectors, such as portable medical devices and remote sensing equipment, is also expected to create significant opportunities.

Major Players in the Asia-Pacific Direct Methanol Fuel Cell Market Ecosystem

- SFC Energy AG

- XNRGI Inc

- Ballard Power Systems Inc

- Fujikura Ltd

- Antig Technology Co Ltd

- Guangzhou Neerg Eco Technologies Co Ltd

- Oorja Protonics Inc

- Horizon Fuel Cell Technologies

- Viaspace Inc

- FC TecNrgy Pvt Ltd

Key Developments in Asia-Pacific Direct Methanol Fuel Cell Market Industry

- April 2022: TecNrgy and SFC Energy signed a joint venture agreement to establish a manufacturing facility, R&D center, and repair facility for hydrogen and methanol fuel cells in Gurugram, Haryana, India. This collaboration significantly boosts manufacturing capacity and R&D efforts in the region.

- February 2023: China Petroleum & Chemical Corporation (Sinopec) launched China's first methanol-to-hydrogen and hydrogen refueling station in Dalian. This signifies a significant advancement in hydrogen infrastructure and supports the broader adoption of fuel cell technologies, indirectly impacting DMFC market dynamics.

Strategic Asia-Pacific Direct Methanol Fuel Cell Market Market Forecast

The Asia-Pacific DMFC market is poised for substantial growth driven by technological progress, supportive government policies, and rising environmental concerns. The increasing demand for clean and efficient energy solutions across various sectors, coupled with ongoing innovations aimed at reducing costs and enhancing performance, will propel market expansion. New applications and expanding market penetration in both developed and developing economies will further contribute to the market's impressive growth trajectory in the coming years. The market's future potential is significant, promising substantial returns for stakeholders who strategically position themselves within this evolving landscape.

Asia-Pacific Direct Methanol Fuel Cell Market Segmentation

-

1. Application

- 1.1. Stationary

- 1.2. Portable

- 1.3. Transportation

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia Pacific

Asia-Pacific Direct Methanol Fuel Cell Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Direct Methanol Fuel Cell Market Regional Market Share

Geographic Coverage of Asia-Pacific Direct Methanol Fuel Cell Market

Asia-Pacific Direct Methanol Fuel Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing LNG Trade4.; Rising Marine Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuations in Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Portable Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Stationary

- 5.1.2. Portable

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Stationary

- 6.1.2. Portable

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Stationary

- 7.1.2. Portable

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Stationary

- 8.1.2. Portable

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Korea Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Stationary

- 9.1.2. Portable

- 9.1.3. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Asia Pacific Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Stationary

- 10.1.2. Portable

- 10.1.3. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SFC Energy AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 XNRGI Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ballard Power Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujikura Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Antig Technology Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guangzhou Neerg Eco Technologies Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oorja Protonics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Horizon Fuel Cell Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Viaspace Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FC TecNrgy Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SFC Energy AG

List of Figures

- Figure 1: Asia-Pacific Direct Methanol Fuel Cell Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Direct Methanol Fuel Cell Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Direct Methanol Fuel Cell Market?

The projected CAGR is approximately 10.79%.

2. Which companies are prominent players in the Asia-Pacific Direct Methanol Fuel Cell Market?

Key companies in the market include SFC Energy AG, XNRGI Inc *List Not Exhaustive, Ballard Power Systems Inc, Fujikura Ltd, Antig Technology Co Ltd, Guangzhou Neerg Eco Technologies Co Ltd, Oorja Protonics Inc, Horizon Fuel Cell Technologies, Viaspace Inc, FC TecNrgy Pvt Ltd.

3. What are the main segments of the Asia-Pacific Direct Methanol Fuel Cell Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing LNG Trade4.; Rising Marine Transportation.

6. What are the notable trends driving market growth?

Portable Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuations in Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

February 2023: China Petroleum & Chemical Corporation (Sinopec) launched the country's first methanol-to-hydrogen and hydrogen refueling station in Dalian, China. An advancement from the previous fueling station offering oil, gas, hydrogen, and electric charging services, the integrated complex can deliver 1,000 kg of hydrogen a day, with a purity of 99.99%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Direct Methanol Fuel Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Direct Methanol Fuel Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Direct Methanol Fuel Cell Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Direct Methanol Fuel Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence