Key Insights

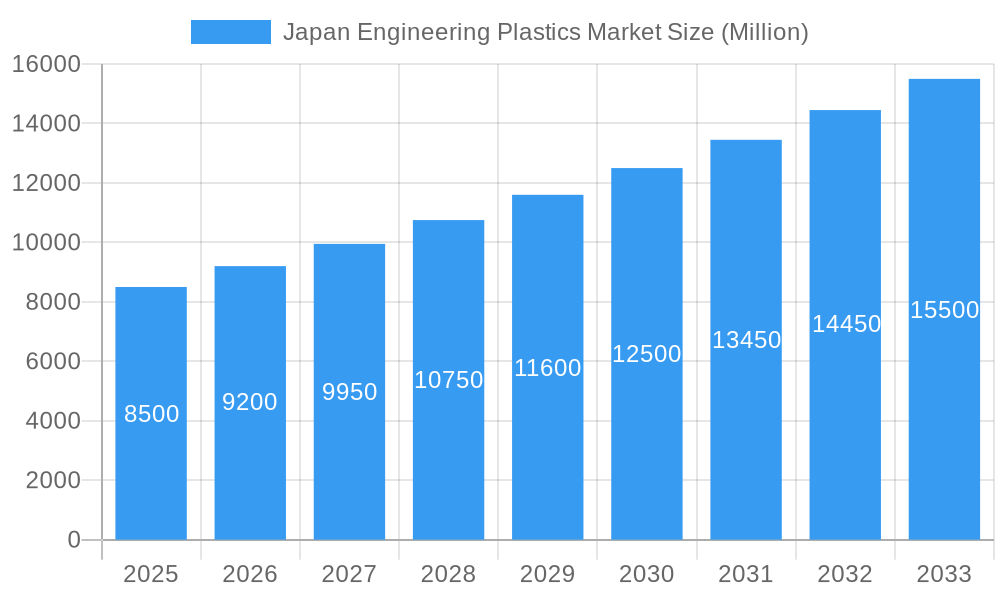

The Japan Engineering Plastics Market is projected for substantial growth, anticipating a Compound Annual Growth Rate (CAGR) of 8.00% from 2025 to 2033. The market size, estimated at 2.2 million in the base year 2025, is driven by escalating demand across key sectors including Aerospace, Automotive, and Electrical & Electronics. This growth is primarily attributed to the increasing adoption of lightweight, high-performance materials, necessitated by stringent regulations for fuel efficiency and enhanced safety. Product development advancements and a growing focus on sustainable and recyclable materials are also opening new opportunities for market expansion and innovation. Further growth is supported by expanding applications in advanced electronics, renewable energy infrastructure, and sophisticated medical devices.

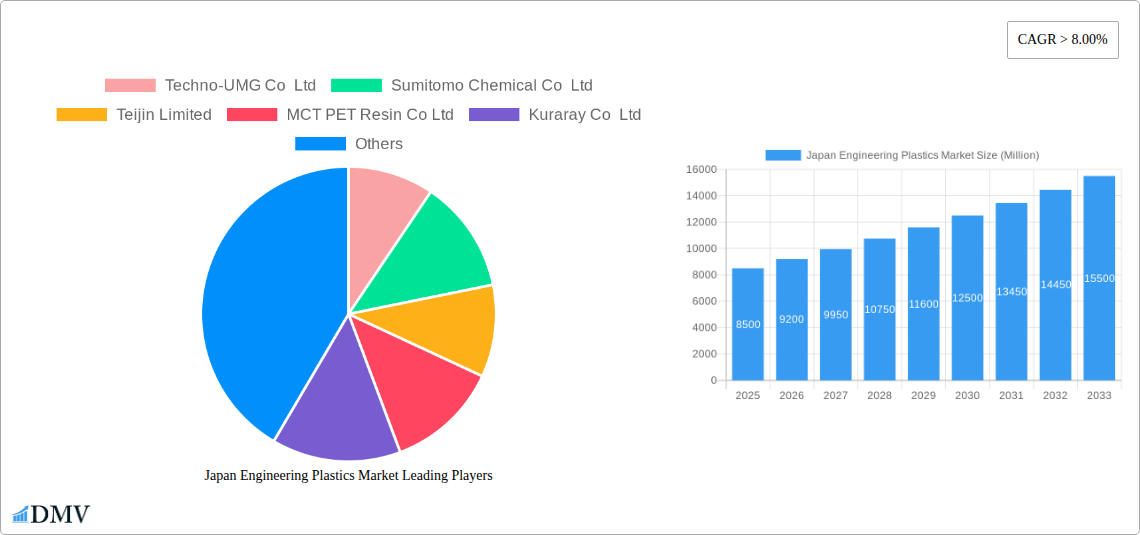

Japan Engineering Plastics Market Market Size (In Million)

The competitive environment features leading global and domestic players such as Daikin Industries Ltd., Mitsubishi Chemical Corporation, and Toray Industries Inc. These companies are actively investing in research and development to launch new polymer grades and refine existing product lines. Market challenges, including volatile raw material prices and the emergence of alternative materials, are being mitigated through supply chain optimization and the development of cost-efficient manufacturing processes. Segmentation by resin type highlights significant demand for Fluoropolymers, Liquid Crystal Polymers (LCP), and Polycarbonate (PC), owing to their exceptional thermal stability, chemical resistance, and mechanical properties. Japan is expected to retain its leading position, powered by its advanced manufacturing capabilities and a strong commitment to technological innovation, reinforcing a positive market outlook.

Japan Engineering Plastics Market Company Market Share

Unveiling the Japan Engineering Plastics Market: A Comprehensive Forecast and Analysis (2019–2033)

This in-depth report offers a definitive analysis of the Japan Engineering Plastics Market, providing critical insights into its current landscape and projected trajectory. Spanning the historical period of 2019–2024, the base year of 2025, and a robust forecast period from 2025–2033, this study is meticulously crafted for stakeholders seeking to understand market dynamics, growth drivers, and competitive strategies within Japan's advanced materials sector. We delve into the intricacies of resin types, end-user industries, and cutting-edge innovations shaping the future of high-performance polymers in Japan.

Japan Engineering Plastics Market Market Composition & Trends

The Japan Engineering Plastics Market is characterized by a highly competitive yet concentrated landscape, driven by stringent quality demands and a relentless pursuit of innovation. Key players like Mitsubishi Chemical Corporation and Toray Industries Inc. hold significant market share, fostering an environment where technological advancements are paramount. Regulatory frameworks, while generally supportive of advanced materials, focus on environmental sustainability and safety, influencing product development and market entry. The market grapples with the constant threat of substitute materials, necessitating continuous improvement in the performance and cost-effectiveness of engineering plastics. Understanding the evolving profiles of end-users, particularly within the Automotive and Electrical and Electronics sectors, is crucial for identifying emerging demand patterns. Mergers and acquisitions (M&A), though not as frequent as in some other industries, represent strategic moves to consolidate market presence and acquire new technologies, with deal values often reflecting the strategic importance of acquiring specialized expertise or market access.

- Market Concentration: Dominated by a few major Japanese chemical giants, with strategic partnerships and alliances influencing competitive dynamics.

- Innovation Catalysts: Strong R&D investments, a focus on lightweighting, enhanced durability, and sustainable solutions.

- Regulatory Landscapes: Emphasis on environmental compliance, material safety, and end-of-life recycling protocols.

- Substitute Products: Competition from traditional materials and emerging bio-based alternatives, driving the need for superior performance.

- End-User Profiles: Growing demand from Automotive (EVs, lightweight components), Electrical and Electronics (miniaturization, high-temperature resistance), and Aerospace (weight reduction, extreme environment durability).

- M&A Activities: Strategic acquisitions focused on specialized resin technologies and market expansion, with recent deals in the range of hundreds of Million.

Japan Engineering Plastics Market Industry Evolution

The Japan Engineering Plastics Market has undergone a significant transformation, evolving from foundational polymers to highly specialized materials tailored for demanding applications. The industry's growth trajectory has been consistently upward, propelled by Japan's robust manufacturing base and its pioneering role in technological innovation. Historically, demand was primarily driven by the Automotive sector's need for lighter and more fuel-efficient components, a trend that has only intensified with the rise of electric vehicles. Similarly, the Electrical and Electronics industry's constant drive for miniaturization and enhanced performance has fueled the adoption of advanced engineering plastics capable of withstanding higher temperatures and electrical stresses.

Technological advancements have been a cornerstone of this evolution. Innovations in polymerization processes, compounding techniques, and material science have led to the development of resins with superior mechanical strength, thermal stability, chemical resistance, and electrical insulation properties. For instance, the development of advanced Fluoropolymers like PTFE and PVDF has opened up critical applications in semiconductor manufacturing and harsh industrial environments. The introduction of Polyether Ether Ketone (PEEK) and Polyimide (PI) has revolutionized sectors requiring extreme heat resistance and mechanical integrity, such as aerospace and medical implants.

Shifting consumer demands, influenced by global megatrends like sustainability and digitalization, are now shaping the future of the Japan Engineering Plastics Market. There is an increasing emphasis on recycled and bio-based engineering plastics, prompting manufacturers to invest in sustainable production methods and circular economy initiatives. The rise of 3D printing (Additive Manufacturing) has also created new avenues for engineering plastics, demanding materials with specific flow characteristics, strength, and thermal properties suitable for complex part fabrication. The market has witnessed a steady compound annual growth rate (CAGR) of approximately 4-6% over the past decade, with projections indicating continued robust expansion driven by these evolving technological and consumer landscapes. Adoption metrics for specialized resins in key industries have seen double-digit percentage increases year-on-year in niche applications, underscoring the market's dynamic nature.

Leading Regions, Countries, or Segments in Japan Engineering Plastics Market

The Japan Engineering Plastics Market exhibits dominance across several key segments, driven by specific industrial demands and technological advancements. Within the End User Industry segmentation, the Automotive sector stands out as a primary driver of growth. The relentless pursuit of vehicle lightweighting for improved fuel efficiency and extended range in electric vehicles (EVs) has propelled the demand for high-strength, low-density engineering plastics like Polyamide (PA) (particularly PA 6 and PA 66), Polycarbonate (PC), and Polybutylene Terephthalate (PBT) for structural components, interior parts, and under-the-hood applications.

The Electrical and Electronics industry is another significant segment, fueled by the rapid pace of technological innovation in consumer electronics, telecommunications, and industrial automation. Here, resins like Polyethylene Terephthalate (PET), Polyoxymethylene (POM), and various Styrene Copolymers (ABS and SAN) are crucial for insulation, housing, and intricate component manufacturing. The increasing demand for miniaturization and higher operating temperatures necessitates the use of advanced materials like Liquid Crystal Polymer (LCP) and specialized Fluoropolymers for printed circuit boards and connectors.

In terms of Resin Type, Polyamide (PA), encompassing PA 6, PA 66, and Polyphthalamide, consistently holds a substantial market share due to its versatility, excellent mechanical properties, and cost-effectiveness. Polycarbonate (PC) is also a leading resin, prized for its impact resistance, transparency, and heat deflection temperature, making it indispensable for automotive lighting, electronic enclosures, and safety equipment. Polybutylene Terephthalate (PBT) is favored for its electrical insulation properties and chemical resistance, finding applications in automotive connectors and electrical components.

The Aerospace sector, while smaller in volume, represents a high-value segment, demanding specialized polymers like Polyimide (PI) and PEEK for their exceptional high-temperature performance, lightweighting capabilities, and superior mechanical strength, contributing to aircraft efficiency and safety. The Packaging segment, particularly for specialized industrial and food-grade applications, utilizes PET and certain Styrene Copolymers for their barrier properties and durability.

- Key Drivers in Automotive:

- Stringent fuel efficiency and emissions regulations.

- Growth of the Electric Vehicle (EV) market.

- Demand for lightweight and impact-resistant components.

- Advancements in interior and exterior design.

- Investment trends in new automotive manufacturing technologies.

- Key Drivers in Electrical and Electronics:

- Rapid innovation in consumer electronics and telecommunications.

- Demand for miniaturization and higher performance.

- Increased adoption of smart devices and IoT.

- Stringent safety and insulation standards.

- Regulatory support for RoHS and WEEE compliance.

- Dominance Factors for Polyamide (PA):

- Exceptional balance of mechanical properties (strength, stiffness, toughness).

- Good chemical and wear resistance.

- Cost-effectiveness for a wide range of applications.

- Versatile processing options.

- Dominance Factors for Polycarbonate (PC):

- Outstanding impact strength.

- High clarity and transparency.

- Good heat resistance.

- Ease of processing and moldability.

Japan Engineering Plastics Market Product Innovations

The Japan Engineering Plastics Market is a hotbed of innovation, with companies continuously developing advanced materials to meet evolving industry demands. AGC Inc.'s introduction of Fluon+ Composites in October 2022, functionalized fluoropolymers for enhanced carbon fiber-reinforced thermoplastic (CFRP and CFRTP) composites, marks a significant leap for the Automotive and Aerospace sectors, promising lighter and stronger components. Toray Industries Inc.'s Toraypearl PA6, launched in August 2022, offers exceptional high strength and surface smoothness specifically for 3D printing applications, catering to the burgeoning additive manufacturing market. These innovations underscore a trend towards materials with tailored properties for specific manufacturing processes and end-use performance requirements.

Propelling Factors for Japan Engineering Plastics Market Growth

The Japan Engineering Plastics Market is propelled by a confluence of powerful factors. A primary driver is the nation's advanced industrial ecosystem, particularly in the Automotive and Electrical and Electronics sectors, which are constantly seeking lightweight, durable, and high-performance materials to enhance product functionality and efficiency. The growing emphasis on sustainability is also a significant catalyst, encouraging the development and adoption of recycled and bio-based engineering plastics. Furthermore, continuous technological advancements in material science and polymer processing are enabling the creation of specialized resins with superior properties, opening up new application frontiers. Government initiatives promoting innovation and advanced manufacturing also play a crucial role in fostering market growth.

Obstacles in the Japan Engineering Plastics Market Market

Despite its robust growth, the Japan Engineering Plastics Market faces several obstacles. Supply chain disruptions, exacerbated by global geopolitical events and raw material price volatility, can impact production costs and lead times. The high cost of advanced engineering plastics compared to conventional materials can be a barrier to adoption in cost-sensitive applications. Furthermore, stringent environmental regulations and the increasing demand for sustainable materials necessitate significant R&D investments and can pose challenges for manufacturers unable to adapt quickly. Intense competition from both domestic and international players also pressures profit margins and drives the need for continuous innovation and cost optimization.

Future Opportunities in Japan Engineering Plastics Market

The Japan Engineering Plastics Market is poised for significant future opportunities. The burgeoning electric vehicle (EV) market presents immense potential for lightweight and high-performance plastics in battery components, structural parts, and charging infrastructure. The growing demand for advanced medical devices and healthcare solutions opens avenues for biocompatible and sterilizable engineering plastics. The expansion of 5G infrastructure and IoT devices will drive the need for specialized plastics with excellent electrical properties and miniaturization capabilities. Furthermore, the increasing focus on the circular economy presents opportunities for companies investing in the development and commercialization of recyclable and bio-based engineering plastics.

Major Players in the Japan Engineering Plastics Market Ecosystem

- Techno-UMG Co Ltd

- Sumitomo Chemical Co Ltd

- Teijin Limited

- MCT PET Resin Co Ltd

- Kuraray Co Ltd

- Daikin Industries Ltd

- Asahi Kasei Corporation

- Mitsubishi Chemical Corporation

- Toray Industries Inc

- UBE Corporation

- Kureha Corporation

- Daicel Corporation

- PBI Advanced Materials Co Ltd

- Polyplastics-Evonik Corporation

- AGC Inc

Key Developments in Japan Engineering Plastics Market Industry

- October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers that improve the performance of carbon fiber-reinforced thermoplastic (CFRP and CFRTP) composites used in automobiles, aircraft, sports products, and printed circuit boards.

- August 2022: Toray Industries Inc. introduced Toraypearl PA6, which claims to provide outstanding high strength, heat resistance, and surface smoothness for powder bed fusion 3D printers.

- August 2022: Mitsui Chemicals and Teijin Limited formed a joint venture to produce and supply biomass polycarbonate resins across Japan.

Strategic Japan Engineering Plastics Market Market Forecast

The strategic forecast for the Japan Engineering Plastics Market indicates a period of sustained and dynamic growth. The ongoing drive for innovation in the Automotive sector, particularly with the transition to electric vehicles, will remain a cornerstone of demand for lightweight and high-performance polymers. Advancements in the Electrical and Electronics industry, coupled with the expansion of 5G and IoT, will fuel the need for specialized materials with enhanced thermal and electrical properties. The increasing global emphasis on sustainability will propel the adoption of recycled and bio-based engineering plastics, creating new market opportunities and R&D investments. Emerging applications in aerospace, medical devices, and additive manufacturing will further diversify and strengthen the market's growth trajectory.

Japan Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

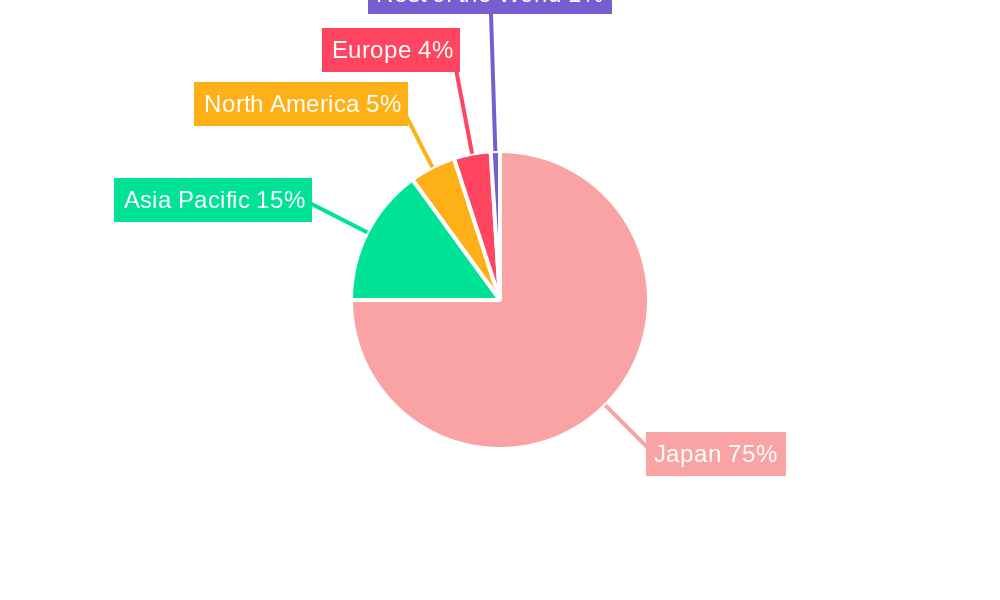

Japan Engineering Plastics Market Segmentation By Geography

- 1. Japan

Japan Engineering Plastics Market Regional Market Share

Geographic Coverage of Japan Engineering Plastics Market

Japan Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Electronics and Electrical Industries; Demand for Lightweight Materials

- 3.3. Market Restrains

- 3.3.1. Engineering plastics are generally more expensive than traditional materials

- 3.4. Market Trends

- 3.4.1. Growing focus on developing sustainable and bio-based engineering plastics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Engineering Plastics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Techno-UMG Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Teijin Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MCT PET Resin Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuraray Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daikin Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Asahi Kasei Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Chemical Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toray Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 UBE Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kureha Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Daicel Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PBI Advanced Materials Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Polyplastics-Evonik Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 AGC Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Techno-UMG Co Ltd

List of Figures

- Figure 1: Japan Engineering Plastics Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan Engineering Plastics Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Engineering Plastics Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 2: Japan Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2020 & 2033

- Table 3: Japan Engineering Plastics Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 4: Japan Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 5: Japan Engineering Plastics Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Japan Engineering Plastics Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Japan Engineering Plastics Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 8: Japan Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2020 & 2033

- Table 9: Japan Engineering Plastics Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 10: Japan Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 11: Japan Engineering Plastics Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Japan Engineering Plastics Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Engineering Plastics Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Japan Engineering Plastics Market?

Key companies in the market include Techno-UMG Co Ltd, Sumitomo Chemical Co Ltd, Teijin Limited, MCT PET Resin Co Ltd, Kuraray Co Ltd, Daikin Industries Ltd, Asahi Kasei Corporation, Mitsubishi Chemical Corporation, Toray Industries Inc, UBE Corporatio, Kureha Corporation, Daicel Corporation, PBI Advanced Materials Co Ltd, Polyplastics-Evonik Corporation, AGC Inc.

3. What are the main segments of the Japan Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.2 million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Electronics and Electrical Industries; Demand for Lightweight Materials.

6. What are the notable trends driving market growth?

Growing focus on developing sustainable and bio-based engineering plastics.

7. Are there any restraints impacting market growth?

Engineering plastics are generally more expensive than traditional materials.

8. Can you provide examples of recent developments in the market?

October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers that improve the performance of carbon fiber-reinforced thermoplastic (CFRP and CFRTP) composites used in automobiles, aircraft, sports products, and printed circuit boards.August 2022: Toray Industries Inc. introduced Toraypearl PA6, which claims to provide outstanding high strength, heat resistance, and surface smoothness for powder bed fusion 3D printers.August 2022: Mitsui Chemicals and Teijin Limited formed a joint venture to produce and supply biomass polycarbonate resins across Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Japan Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence