Key Insights

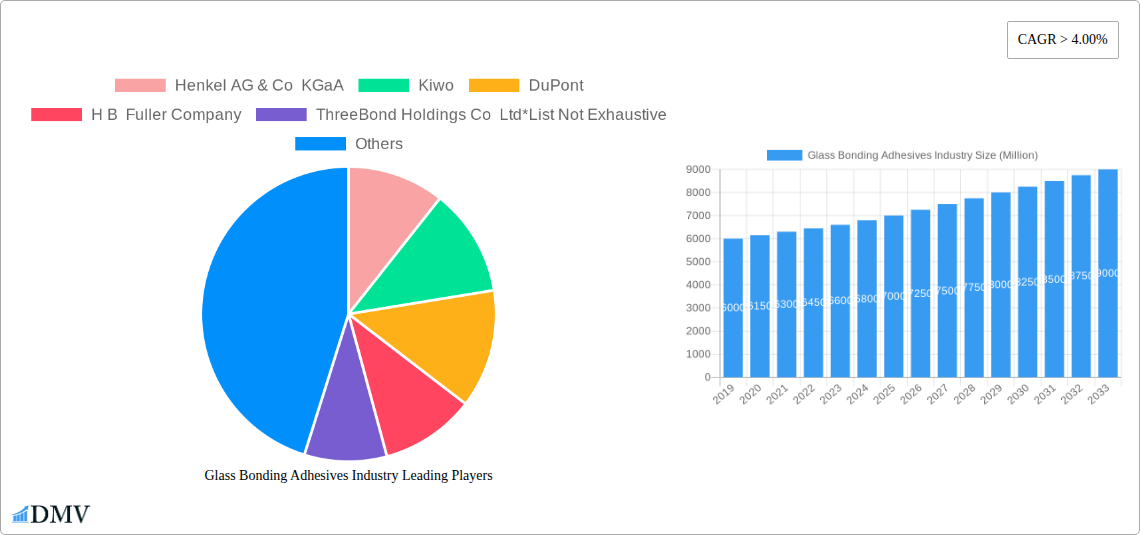

The global Glass Bonding Adhesives market is poised for significant expansion, projected to reach an estimated USD 7,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This upward trajectory is primarily fueled by escalating demand from the building and construction sector, driven by an increasing preference for aesthetically pleasing and structurally sound glass facades in commercial and residential projects. The automotive and transportation industry also presents a substantial growth avenue, as advancements in vehicle design necessitate stronger, lighter, and more durable bonding solutions for glass components, contributing to fuel efficiency and enhanced safety. Furthermore, the burgeoning electrical and electronics sector, with its growing reliance on sophisticated displays and integrated glass components, is a key influencer in this market. The rising adoption of advanced adhesive technologies, such as UV-cured and epoxy formulations, offering faster curing times and superior performance, is also a significant driver. Emerging economies, particularly in the Asia Pacific region, are expected to witness accelerated growth due to rapid industrialization and increasing disposable incomes, leading to higher investments in infrastructure and consumer electronics.

Glass Bonding Adhesives Industry Market Size (In Billion)

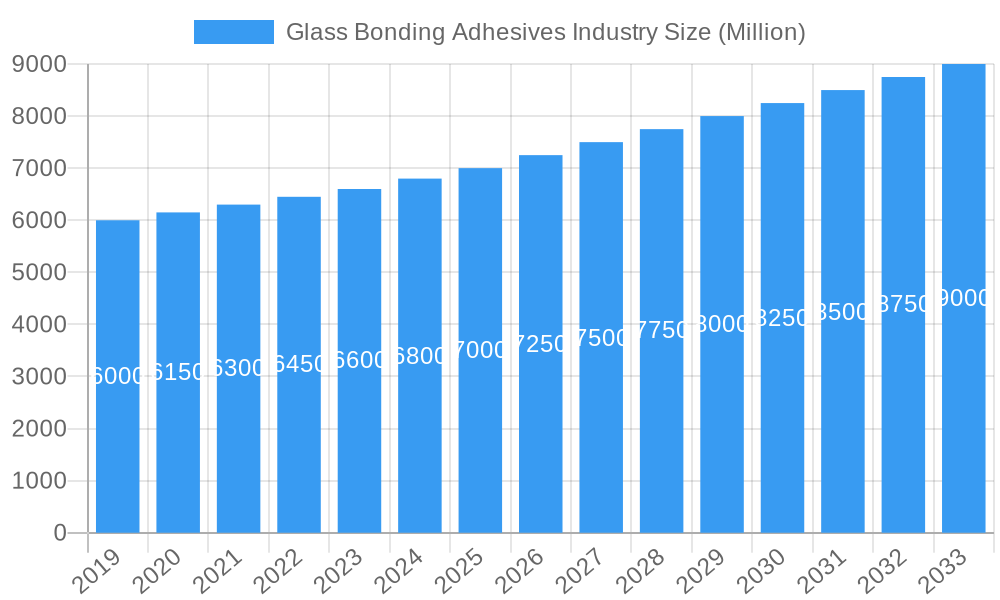

Despite the promising outlook, certain restraints could impact the market's pace. Fluctuations in raw material prices, particularly for key components like epoxy resins and silicones, can affect manufacturing costs and, consequently, product pricing. Stringent environmental regulations regarding volatile organic compounds (VOCs) in adhesives may necessitate the development and adoption of more sustainable, low-VOC or solvent-free alternatives, requiring R&D investments. However, the industry is actively addressing these challenges through innovation in bio-based and eco-friendly adhesive formulations. Key players like Henkel AG & Co. KGaA, DuPont, and H.B. Fuller Company are heavily investing in research and development to introduce novel products that cater to evolving industry needs and regulatory landscapes. The market segments of Epoxy and Silicone adhesives are anticipated to lead the growth due to their versatility and performance characteristics in diverse applications. The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at expanding market reach and enhancing product portfolios.

Glass Bonding Adhesives Industry Company Market Share

Glass Bonding Adhesives Industry Market Composition & Trends

The global Glass Bonding Adhesives market exhibits a dynamic and evolving landscape, characterized by moderate to high market concentration driven by a few key industry giants and a growing number of specialized players. Innovation remains a crucial catalyst, with ongoing research and development focused on enhanced adhesion strength, faster curing times, improved UV resistance, and eco-friendly formulations. Regulatory landscapes, particularly concerning VOC emissions and material safety, are shaping product development and market access, necessitating compliance with stringent standards worldwide. Substitute products, such as mechanical fasteners and traditional sealing methods, continue to exist but are increasingly being outperformed by advanced adhesive solutions offering superior performance and design flexibility.

End-user profiles are diverse, spanning industries that demand high-performance bonding for glass components. This includes the automotive sector for windshield and sunroof integration, the building and construction industry for façade glazing and structural elements, and the electrical and electronics sector for display bonding and device assembly. The furniture industry also leverages these adhesives for aesthetic and structural integrity.

Mergers and acquisitions (M&A) activities, while not overwhelmingly frequent, have been significant in consolidating market share and expanding product portfolios. Recent deal values, though specific figures are proprietary, have indicated substantial strategic investments in acquiring innovative technologies and expanding geographic reach. The market is projected to witness continued M&A as companies seek to strengthen their competitive positions and tap into emerging application areas.

- Market Concentration: Dominated by a mix of multinational corporations and specialized adhesive manufacturers.

- Innovation Catalysts: Focus on high-performance, faster curing, UV resistance, and sustainability.

- Regulatory Influence: Strict adherence to environmental and safety standards is paramount.

- Substitute Products: Mechanical fasteners and traditional sealants face increasing competition.

- End-User Industries: Automotive, Building & Construction, Electrical & Electronics, Furniture, and Healthcare are key.

- M&A Activity: Strategic investments aim to enhance technological capabilities and market presence.

Glass Bonding Adhesives Industry Industry Evolution

The Glass Bonding Adhesives market has experienced a remarkable evolutionary trajectory, driven by relentless technological advancements and a burgeoning demand for versatile and reliable bonding solutions across a multitude of industries. Over the study period from 2019 to 2033, the market has transitioned from basic adhesive applications to highly specialized formulations that enable complex design possibilities and enhance product performance. In the base year of 2025, the market is valued at an estimated $8,500 Million, with robust growth projected to continue.

The historical period from 2019 to 2024 laid the groundwork for this evolution, witnessing an average annual growth rate of approximately 6.5%. This growth was primarily fueled by the increasing adoption of glass in automotive manufacturing for lightweighting and enhanced safety features, the burgeoning demand for energy-efficient buildings with sophisticated façade designs, and the miniaturization of electronic devices requiring precise and robust bonding solutions. The COVID-19 pandemic, while presenting initial supply chain challenges, ultimately accelerated innovation in areas like UV-cured adhesives due to their rapid curing capabilities and reduced processing times, aligning with a global push for operational efficiency.

Technological advancements have been the linchpin of this evolution. The development of high-strength epoxy adhesives has revolutionized structural glass bonding, offering unparalleled durability and load-bearing capacity. Silicone adhesives have gained prominence for their flexibility, weather resistance, and thermal stability, making them ideal for sealing and gasketing applications in construction and automotive. Polyurethane adhesives have emerged as versatile solutions, providing a balance of strength, flexibility, and impact resistance. A significant breakthrough has been the widespread adoption of UV-cured adhesives, which offer near-instantaneous curing upon exposure to UV light, dramatically reducing production cycle times and energy consumption. This has been particularly impactful in the electrical & electronics sector and for high-volume manufacturing processes.

Shifting consumer demands have also played a pivotal role. There is an increasing emphasis on aesthetic appeal, leading to a greater reliance on invisible and seamless bonding solutions that only adhesives can provide. Furthermore, a growing environmental consciousness has driven the demand for low-VOC (Volatile Organic Compound) and solvent-free adhesive formulations, pushing manufacturers to invest in sustainable chemistry. The "Internet of Things" (IoT) and the proliferation of smart devices have opened new avenues for glass bonding adhesives, particularly in the assembly of touchscreens, sensors, and integrated glass components. The healthcare sector is also increasingly utilizing glass bonding adhesives for medical device assembly where biocompatibility and sterilization resistance are critical. The forecast period from 2025 to 2033 is expected to witness a compound annual growth rate (CAGR) of approximately 7.2%, with the market value reaching an estimated $14,800 Million by 2033. This sustained growth will be underpinned by continued innovation, expanding application areas, and the increasing demand for high-performance bonding in emerging technologies.

Leading Regions, Countries, or Segments in Glass Bonding Adhesives Industry

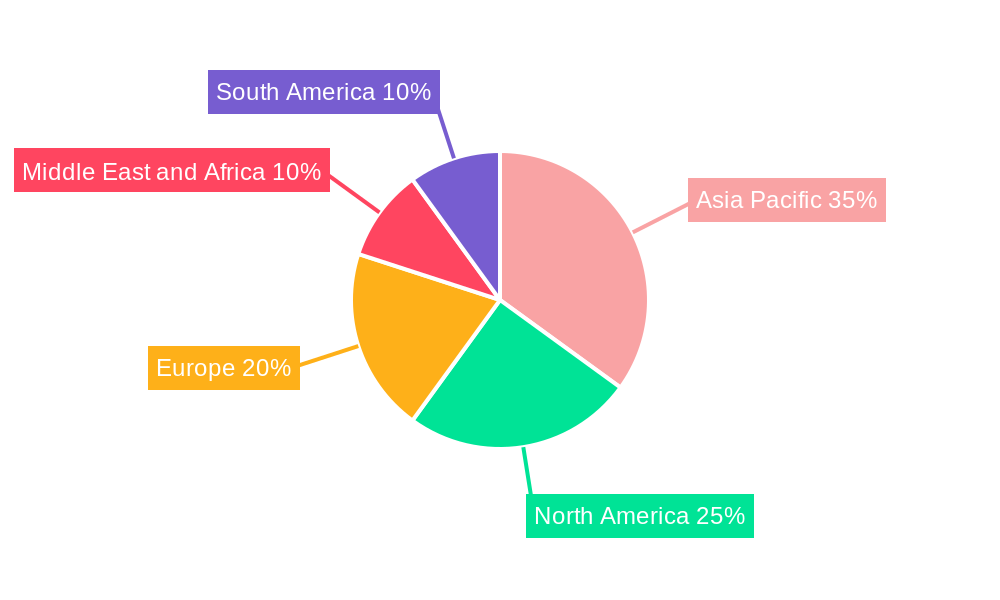

The global Glass Bonding Adhesives market is a complex ecosystem with varying degrees of dominance across different regions and segments. Analyzing these leading areas provides crucial insights into market dynamics and growth opportunities.

Dominant Segment by Type: Epoxy Adhesives Epoxy adhesives consistently hold a significant market share due to their exceptional strength, durability, and resistance to chemicals and environmental factors. Their versatility makes them indispensable in demanding applications.

- Key Drivers for Epoxy Dominance:

- High Performance: Superior bonding strength for structural applications in automotive and construction.

- Chemical Resistance: Crucial for applications exposed to harsh environments, common in industrial settings.

- Versatility: Formulated for a wide range of substrates and bonding requirements.

- Industry Adoption: Long-standing trust and proven track record in critical industries.

Epoxy adhesives are the backbone of structural glass bonding, particularly in the automotive sector for windshield and body panel assembly, as well as in the building and construction industry for structural glazing and façade elements. Their ability to withstand significant stress, temperature fluctuations, and corrosive elements makes them the preferred choice where reliability is paramount. Manufacturers are continually developing advanced epoxy formulations with faster cure times and improved impact resistance to meet evolving industry needs. The estimated market share for epoxy adhesives in 2025 is approximately 35% of the total glass bonding adhesives market.

Dominant End-User Industry: Automotive & Transportation The automotive and transportation sector represents a substantial driver for the Glass Bonding Adhesives market, consuming a significant portion of the total output. The increasing integration of glass in vehicle design for aerodynamics, safety, and aesthetics fuels this demand.

- Key Drivers for Automotive Dominance:

- Lightweighting Initiatives: Use of glass in place of heavier materials for fuel efficiency.

- Advanced Safety Features: Integration of sensors and cameras behind windshields, requiring precise optical clarity and strong adhesion.

- Panoramic Roofs and Large Glazing: Demand for aesthetic appeal and structural integrity.

- Electrification: Increased complexity in EV battery housings and component assembly.

In the automotive industry, glass bonding adhesives are critical for applications such as windshield bonding, sunroof attachment, rear window sealing, and the integration of advanced driver-assistance systems (ADAS). The need for robust, weather-resistant, and vibration-dampening adhesives is paramount. The estimated market share for the Automotive & Transportation segment in 2025 is approximately 30% of the total glass bonding adhesives market.

Leading Region: North America North America, particularly the United States, stands out as a leading region in the Glass Bonding Adhesives market. This leadership is attributed to a combination of factors including a strong industrial base, significant investments in R&D, and a mature automotive and construction sector.

- Key Drivers for North American Leadership:

- Robust Automotive Manufacturing Hubs: Presence of major automotive OEMs and their supply chains.

- Advanced Building & Construction Sector: High demand for innovative façade solutions and energy-efficient buildings.

- Technological Innovation: Strong focus on developing and adopting cutting-edge adhesive technologies.

- Favorable Regulatory Environment: Support for advanced manufacturing and material science innovation.

The region benefits from a high adoption rate of advanced bonding technologies, driven by stringent performance requirements in automotive safety and construction standards. The presence of major adhesive manufacturers and end-users fosters a dynamic market environment characterized by continuous innovation and application development. The estimated market share for North America in 2025 is approximately 28% of the global Glass Bonding Adhesives market.

Other significant segments include UV Cured adhesives, showing rapid growth due to efficiency benefits, and the Building & Construction industry, a consistent high-volume consumer. Silicone adhesives are vital for sealing and flexibility, while Polyurethane adhesives offer a balanced performance profile. The Electrical & Electronics segment is a growing area, driven by the demand for bonding in smaller, more complex devices.

Glass Bonding Adhesives Industry Product Innovations

Product innovation in the Glass Bonding Adhesives market is centered on enhancing performance, expanding application scope, and addressing sustainability concerns. Recent advancements include the development of optically clear adhesives with superior UV resistance for display bonding in consumer electronics and automotive applications, ensuring longevity and visual integrity. High-temperature resistant epoxy formulations are emerging for specialized industrial applications, capable of withstanding extreme thermal stress. Furthermore, the industry is witnessing a surge in the development of bio-based and solvent-free adhesive systems, aligning with global environmental mandates and consumer demand for sustainable solutions. These innovations not only improve product functionality but also reduce environmental impact, offering manufacturers a competitive edge.

Propelling Factors for Glass Bonding Adhesives Industry Growth

Several key growth drivers are propelling the Glass Bonding Adhesives industry forward. The increasing demand for lightweighting in the automotive sector to improve fuel efficiency is a significant factor, as adhesives offer a lighter alternative to mechanical fasteners. Advancements in construction, particularly in architectural glazing and façade design, necessitate strong, reliable, and often invisible bonding solutions provided by these adhesives. The burgeoning electrical and electronics sector, with its trend towards miniaturization and integrated components, relies heavily on precise and high-performance glass bonding. Furthermore, growing awareness and adoption of sustainable manufacturing practices are driving the demand for eco-friendly adhesive formulations with low VOC emissions.

- Technological Advancements: Development of higher-strength, faster-curing, and more durable adhesives.

- Industry Demand: Increasing use of glass in automotive, construction, and electronics.

- Sustainability Focus: Growing preference for low-VOC and eco-friendly adhesive solutions.

- Design Flexibility: Adhesives enable complex and aesthetically pleasing glass integrations.

Obstacles in the Glass Bonding Adhesives Industry Market

Despite its robust growth, the Glass Bonding Adhesives market faces several obstacles. Stringent regulatory requirements concerning environmental impact and material safety can increase research and development costs and compliance burdens for manufacturers. Fluctuations in raw material prices, such as petrochemical derivatives, can impact production costs and profitability. Furthermore, the availability of skilled labor capable of applying these specialized adhesives correctly remains a challenge in some regions, potentially hindering adoption. Supply chain disruptions, as witnessed in recent global events, can also lead to material shortages and delivery delays, impacting production schedules.

- Regulatory Hurdles: Stringent environmental and safety standards can increase R&D and compliance costs.

- Raw Material Volatility: Price fluctuations of key components can affect manufacturing costs.

- Skilled Labor Shortages: Limited availability of trained applicators can impede market expansion.

- Supply Chain Vulnerabilities: Disruptions can lead to material shortages and production delays.

Future Opportunities in Glass Bonding Adhesives Industry

The future of the Glass Bonding Adhesives market is bright with emerging opportunities. The continued expansion of electric vehicles (EVs) presents new bonding challenges and opportunities, from battery pack assembly to integration of advanced sensors. The growth of smart cities and the demand for intelligent buildings will drive the need for advanced glass bonding solutions in façades, smart windows, and integrated displays. The healthcare sector offers a growing niche, with increasing demand for biocompatible and sterilizable adhesives for medical devices. Furthermore, the development of novel adhesive chemistries, such as self-healing or conductive adhesives, holds significant potential for future innovation and market differentiation.

- Electric Vehicle Integration: Bonding solutions for battery packs and advanced components.

- Smart Cities & Buildings: Adhesives for smart windows, integrated displays, and façade elements.

- Healthcare Applications: Biocompatible and sterilizable adhesives for medical devices.

- Novel Chemistries: Exploration of self-healing, conductive, and advanced functional adhesives.

Major Players in the Glass Bonding Adhesives Industry Ecosystem

- Henkel AG & Co KGaA

- Kiwo

- DuPont

- H B Fuller Company

- ThreeBond Holdings Co Ltd

- Bohle Ltd

- Sika AG

- Permabond LLC

- 3M

- Dymax Corporation

- Ashland

Key Developments in Glass Bonding Adhesives Industry Industry

- January 2024: Henkel AG & Co KGaA launched a new line of fast-curing epoxy adhesives for automotive glass bonding, offering improved structural integrity and reduced assembly times.

- November 2023: DuPont announced the acquisition of a specialized provider of optical adhesives, enhancing its portfolio for display applications in electronics and automotive.

- July 2023: Sika AG introduced a new generation of polyurethane adhesives designed for enhanced UV resistance and flexibility in building façade applications.

- April 2023: 3M unveiled a novel UV-cured adhesive with high optical clarity and superior adhesion for electronic device assembly, meeting the demands for thinner and lighter gadgets.

- February 2023: Ashland expanded its range of silicone adhesives, focusing on formulations with improved thermal stability for demanding industrial applications.

- October 2022: H B Fuller Company announced a strategic partnership to develop sustainable, bio-based glass bonding adhesives for the construction sector.

- May 2022: Dymax Corporation introduced a series of UV-curable adhesives that offer rapid curing and excellent chemical resistance for medical device assembly.

- December 2021: Permabond LLC launched an advanced anaerobic adhesive specifically formulated for bonding glass to metal in high-vibration environments.

Strategic Glass Bonding Adhesives Industry Market Forecast

The strategic forecast for the Glass Bonding Adhesives market highlights continued robust growth driven by innovation and expanding application horizons. The increasing demand for high-performance bonding in the automotive sector, particularly with the rise of electric vehicles, will fuel market expansion. Similarly, the building and construction industry's push towards energy-efficient and architecturally complex designs will necessitate advanced adhesive solutions. The relentless pace of innovation in the electrical and electronics sector, coupled with a growing emphasis on sustainability, will also be significant growth catalysts. Emerging markets and the development of specialized adhesives for niche applications are expected to further diversify and strengthen the market. The estimated market value of $14,800 Million by 2033 underscores the significant potential and strategic importance of this industry.

Glass Bonding Adhesives Industry Segmentation

-

1. Type

- 1.1. Epoxy

- 1.2. Silicone

- 1.3. Polyurethane

- 1.4. UV Cured

- 1.5. Others

-

2. End-user Industry

- 2.1. Furniture

- 2.2. Healthcare

- 2.3. Electrical & Electronics

- 2.4. Automotive & Transportation

- 2.5. Building & Construction

- 2.6. Others

Glass Bonding Adhesives Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Glass Bonding Adhesives Industry Regional Market Share

Geographic Coverage of Glass Bonding Adhesives Industry

Glass Bonding Adhesives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Various End-user Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Epoxy

- 5.1.2. Silicone

- 5.1.3. Polyurethane

- 5.1.4. UV Cured

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Furniture

- 5.2.2. Healthcare

- 5.2.3. Electrical & Electronics

- 5.2.4. Automotive & Transportation

- 5.2.5. Building & Construction

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Epoxy

- 6.1.2. Silicone

- 6.1.3. Polyurethane

- 6.1.4. UV Cured

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Furniture

- 6.2.2. Healthcare

- 6.2.3. Electrical & Electronics

- 6.2.4. Automotive & Transportation

- 6.2.5. Building & Construction

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Epoxy

- 7.1.2. Silicone

- 7.1.3. Polyurethane

- 7.1.4. UV Cured

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Furniture

- 7.2.2. Healthcare

- 7.2.3. Electrical & Electronics

- 7.2.4. Automotive & Transportation

- 7.2.5. Building & Construction

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Epoxy

- 8.1.2. Silicone

- 8.1.3. Polyurethane

- 8.1.4. UV Cured

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Furniture

- 8.2.2. Healthcare

- 8.2.3. Electrical & Electronics

- 8.2.4. Automotive & Transportation

- 8.2.5. Building & Construction

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Epoxy

- 9.1.2. Silicone

- 9.1.3. Polyurethane

- 9.1.4. UV Cured

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Furniture

- 9.2.2. Healthcare

- 9.2.3. Electrical & Electronics

- 9.2.4. Automotive & Transportation

- 9.2.5. Building & Construction

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Epoxy

- 10.1.2. Silicone

- 10.1.3. Polyurethane

- 10.1.4. UV Cured

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Furniture

- 10.2.2. Healthcare

- 10.2.3. Electrical & Electronics

- 10.2.4. Automotive & Transportation

- 10.2.5. Building & Construction

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kiwo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DuPont

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 H B Fuller Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ThreeBond Holdings Co Ltd*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bohle Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sika AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Permabond LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3M

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dymax Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ashland

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Glass Bonding Adhesives Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass Bonding Adhesives Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Glass Bonding Adhesives Industry?

Key companies in the market include Henkel AG & Co KGaA, Kiwo, DuPont, H B Fuller Company, ThreeBond Holdings Co Ltd*List Not Exhaustive, Bohle Ltd, Sika AG, Permabond LLC, 3M, Dymax Corporation, Ashland.

3. What are the main segments of the Glass Bonding Adhesives Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Various End-user Industries; Other Drivers.

6. What are the notable trends driving market growth?

Automotive and Transportation Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glass Bonding Adhesives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glass Bonding Adhesives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glass Bonding Adhesives Industry?

To stay informed about further developments, trends, and reports in the Glass Bonding Adhesives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence