Key Insights

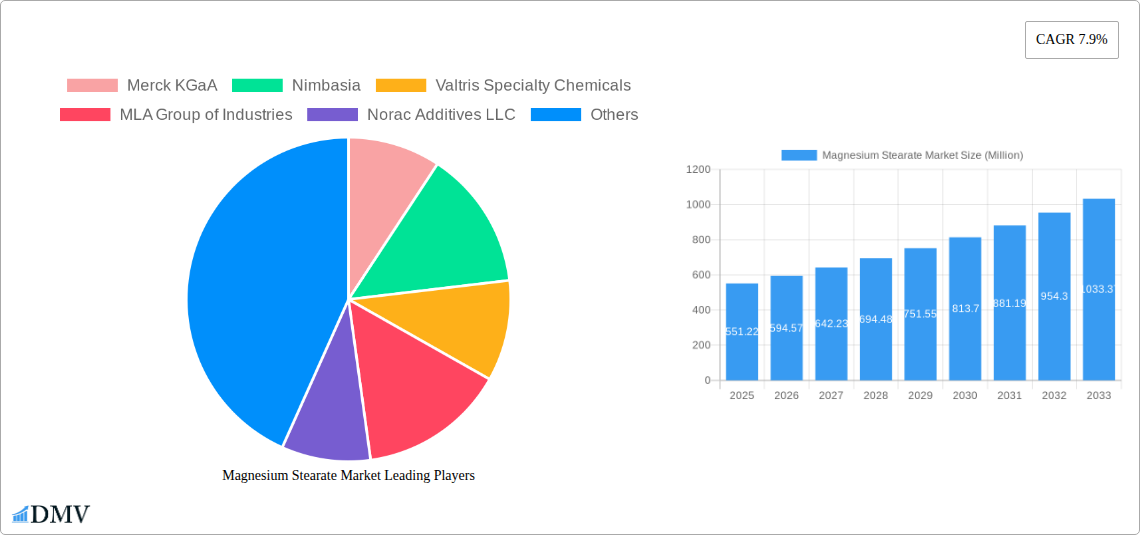

The global Magnesium Stearate market is poised for significant expansion, projected to reach $551.22 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.9% anticipated to persist through the forecast period of 2025-2033. This strong growth trajectory is primarily fueled by the escalating demand from the pharmaceutical sector, where magnesium stearate serves as a crucial excipient in tablet and capsule manufacturing, enhancing drug flow and preventing sticking during production. The food and beverage industry is another key driver, leveraging its properties as an anti-caking agent and emulsifier. Furthermore, the burgeoning personal care sector, with its increasing reliance on advanced formulations for cosmetics and skincare products, is contributing to sustained market interest. Emerging applications in plastics, acting as a lubricant and stabilizer, also present lucrative avenues for market players.

Magnesium Stearate Market Market Size (In Million)

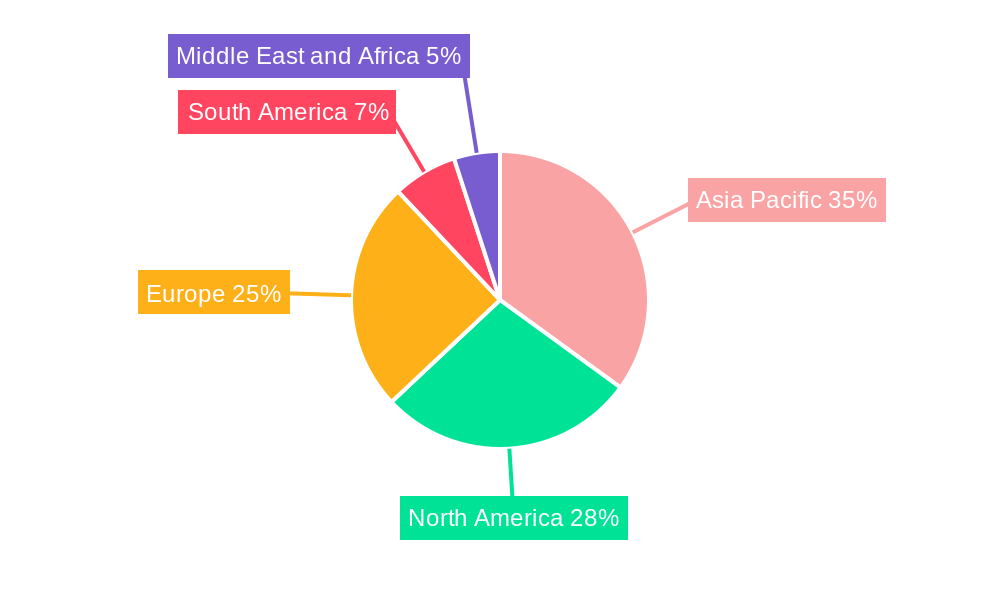

The market's dynamism is further shaped by evolving industry trends, including a growing emphasis on high-purity magnesium stearate for pharmaceutical applications and the development of specialized grades for niche markets. While the market enjoys strong growth, potential restraints include volatility in raw material prices, particularly stearic acid, and stringent regulatory compliance requirements in certain end-user industries. However, the geographical landscape indicates a substantial presence and continued growth in the Asia Pacific region, driven by rapid industrialization and a growing pharmaceutical manufacturing base in countries like China and India. North America and Europe remain significant markets, with established pharmaceutical and food industries demanding consistent quality and supply. The competitive landscape features a mix of established global players and regional manufacturers, all vying for market share through product innovation, strategic partnerships, and market penetration.

Magnesium Stearate Market Company Market Share

Magnesium Stearate Market: Comprehensive Report Analysis

Unlock critical insights into the burgeoning Magnesium Stearate market with this in-depth report. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report provides unparalleled foresight into market dynamics. Analyze the historical performance from 2019–2024 and leverage our expert projections to navigate this vital chemical compound's future. Whether you are a manufacturer, supplier, investor, or end-user, understanding the trends, innovations, and competitive landscape of magnesium stearate is paramount for strategic decision-making. This report delves into every facet, from market segmentation and key players to emerging opportunities and growth drivers, offering a definitive roadmap for success.

Magnesium Stearate Market Market Composition & Trends

The Magnesium Stearate market exhibits a moderate to consolidated structure, with a handful of key players controlling a significant portion of the global supply. Innovation catalysts primarily stem from the pharmaceutical and food & beverage sectors, demanding higher purity grades and specific functionalities. Regulatory landscapes, particularly stringent pharmacopeial standards for pharmaceutical applications and food-grade certifications, play a crucial role in shaping market entry and product development. Substitute products, while available, often fall short in cost-effectiveness and performance for core applications, reinforcing magnesium stearate's indispensable role. End-user profiles are diverse, ranging from large pharmaceutical conglomerates to specialized food manufacturers and polymer producers. Mergers and acquisition activities are sporadic, driven by the desire to expand product portfolios and geographical reach. The market share distribution is influenced by regional manufacturing capacities and the demand from burgeoning end-user industries. M&A deal values are indicative of the strategic importance placed on securing market positions and proprietary technologies within this segment.

- Market Concentration: Moderately concentrated with key global suppliers.

- Innovation Catalysts: Pharmaceutical excipient advancements, food additive requirements, and polymer processing enhancements.

- Regulatory Landscapes: USP, EP, JP monographs for pharmaceuticals; FDA, EFSA approvals for food applications.

- Substitute Products: Calcium stearate, sodium stearate (limited performance overlap).

- End-User Profiles: Pharmaceutical manufacturers, food and beverage companies, personal care product creators, plastics processors.

- M&A Activities: Strategic acquisitions to gain market share and technological expertise.

Magnesium Stearate Market Industry Evolution

The Magnesium Stearate market has undergone significant evolution, driven by relentless demand across its diverse end-user industries and continuous technological advancements. Historically, the market's growth trajectory has been primarily shaped by the pharmaceutical sector's expanding needs for high-quality excipients in tablet and capsule manufacturing. With a projected compound annual growth rate (CAGR) of approximately 5.5% over the forecast period, the market is poised for sustained expansion. Technological advancements have focused on enhancing production processes to achieve higher purity, better flowability, and reduced particle size, catering to increasingly sophisticated formulation requirements. For instance, advancements in spray drying and micronization technologies have enabled the production of magnesium stearate grades with superior compressibility and lubrication properties.

Shifting consumer demands have also played a pivotal role. In the food and beverage industry, the growing preference for processed and packaged goods has boosted the demand for magnesium stearate as an anti-caking agent and lubricant. Similarly, the personal care segment's expansion, driven by increased disposable incomes and a rising emphasis on hygiene and beauty products, has contributed to market growth. The plastics industry, a substantial consumer, leverages magnesium stearate as a lubricant and stabilizer in polymer processing, with innovations in polymer formulations directly influencing demand. The adoption of advanced manufacturing techniques, such as continuous manufacturing in pharmaceuticals, has further spurred the need for consistent and high-performance magnesium stearate. Data indicates a steady increase in the adoption of premium, high-purity grades, with their market share growing at an estimated 6% CAGR. Overall, the industry's evolution reflects a dynamic interplay between technological innovation, regulatory compliance, and the ever-changing landscape of consumer and industrial needs.

Leading Regions, Countries, or Segments in Magnesium Stearate Market

The Magnesium Stearate market sees its most dominant performance within the Pharmaceutical end-user industry, acting as a cornerstone excipient in the production of solid dosage forms like tablets and capsules globally. This segment's dominance is propelled by a confluence of factors including the ever-growing global healthcare expenditure, an aging population demanding more pharmaceuticals, and the continuous development of new drug formulations. The pharmaceutical sector's stringent regulatory requirements, particularly adherence to pharmacopeial standards such as USP (United States Pharmacopeia) and EP (European Pharmacopoeia), necessitate the use of high-purity magnesium stearate, often sourced from specialized manufacturers who invest heavily in quality control and advanced production techniques. Investment trends in pharmaceutical research and development directly translate into increased demand for this essential ingredient.

- Pharmaceutical Segment Dominance: The pharmaceutical sector consistently accounts for the largest share of the magnesium stearate market, estimated at over 45% of global consumption. This is driven by its indispensable role as a lubricant, glidant, and binder in tablet manufacturing, enhancing tablet disintegration and dissolution profiles.

- Key Drivers:

- Global Healthcare Spending: Rising healthcare budgets worldwide directly impact pharmaceutical production volumes.

- Aging Population: Increased prevalence of chronic diseases in aging populations fuels demand for a wide range of medications.

- Drug Development Innovation: Continuous research and development of new drug molecules and delivery systems require specialized excipients.

- Regulatory Stringency: Strict quality and purity standards enforced by regulatory bodies like the FDA and EMA mandate the use of pharmaceutical-grade magnesium stearate.

- Growth in Emerging Markets: Expanding healthcare infrastructure and accessibility in developing economies contribute significantly to pharmaceutical demand.

- Key Drivers:

While the pharmaceutical sector leads, other segments are also experiencing robust growth. The Food & Beverage industry, driven by the demand for processed foods and functional ingredients, utilizes magnesium stearate as an anti-caking agent and flow promoter, contributing an estimated 20% to the market share. The Personal Care segment, encompassing cosmetics and toiletries, accounts for approximately 15% of the market, using it for its thickening and emulsifying properties. The Plastics industry, representing around 10% of the market, benefits from magnesium stearate's lubrication and stabilization capabilities in polymer processing. The "Other End-User Industries," including paints and coatings, represent the remaining share, where it serves as a dispersant and lubricant. Regionally, North America and Europe remain significant markets due to their established pharmaceutical and industrial bases, but Asia Pacific is emerging as a rapid growth area, fueled by expanding manufacturing capabilities and increasing domestic consumption across all end-user sectors.

Magnesium Stearate Market Product Innovations

Product innovations in the Magnesium Stearate market are primarily focused on enhancing performance attributes for specific end-user applications. Manufacturers are developing ultra-fine particle size grades of magnesium stearate, leading to improved compressibility and reduced sticking during tablet compression in the pharmaceutical industry. Furthermore, research into stabilized and customized formulations addresses challenges like moisture sensitivity and improved flowability in demanding environments. Applications are expanding to include novel drug delivery systems and advanced polymer composites, showcasing the compound's versatility. Performance metrics like improved lubricant efficiency (e.g., reduced ejection force in tablet presses) and enhanced dispersion stability in paints are key selling propositions for these advanced grades. Technological advancements in production, such as controlled crystallization and atomization processes, are enabling greater control over particle morphology and purity, meeting the evolving needs of high-tech industries.

Propelling Factors for Magnesium Stearate Market Growth

The Magnesium Stearate market is propelled by several key factors. The ever-expanding pharmaceutical industry, driven by an aging global population and increasing healthcare access, creates consistent demand for magnesium stearate as a crucial excipient in tablet and capsule manufacturing. Technological advancements in production processes are yielding higher purity and customized grades, catering to stringent regulatory requirements and specialized applications. Furthermore, the growing demand for processed and packaged goods in the food and beverage sector, where it acts as an anti-caking agent, significantly contributes to market growth. The increasing use of magnesium stearate as a lubricant and stabilizer in the plastics industry for polymer processing also fuels expansion. Regulatory support for safe food additives and pharmaceutical excipients further solidifies its market position.

Obstacles in the Magnesium Stearate Market Market

While the Magnesium Stearate market is robust, it faces certain obstacles. Regulatory challenges related to evolving purity standards and regional compliance can impact market access and necessitate significant R&D investment. Supply chain disruptions, amplified by geopolitical events and fluctuating raw material costs, can lead to price volatility and impact profitability. Intense competition among existing players and the threat of emerging substitutes, though limited in direct performance equivalence, exert downward pressure on pricing. The increasing scrutiny on chemical additives in consumer products, particularly in food and personal care, can lead to consumer demand shifts towards perceived "cleaner" alternatives. These factors collectively influence market dynamics and require strategic mitigation.

Future Opportunities in Magnesium Stearate Market

Future opportunities in the Magnesium Stearate market are significant. The burgeoning biopharmaceutical sector presents a considerable avenue, requiring highly specialized and ultra-pure magnesium stearate for complex drug formulations. The growing demand for plant-based and natural ingredients in food and personal care could spur innovation in ethically sourced magnesium stearate or its functional alternatives. Advancements in sustainable manufacturing processes for magnesium stearate itself, focusing on reduced environmental impact, will also be a key differentiator. Emerging markets in Asia Pacific and Africa, with their rapidly developing pharmaceutical and industrial bases, offer substantial untapped potential. Furthermore, the exploration of magnesium stearate's role in advanced materials and specialty chemicals represents a promising frontier for market expansion.

Major Players in the Magnesium Stearate Market Ecosystem

- Merck KGaA

- Nimbasia

- Valtris Specialty Chemicals

- MLA Group of Industries

- Norac Additives LLC

- Kemipex

- SINWON CHEMICAL CO LTD

- NB Entrepreneurs

- Faci Asia Pacific Pte Ltd

- Alfa Aesar Thermo Fisher Scientific

- CARE

- James M Brown Ltd

- Spirochem Lifesciences Pvt Ltd

- Baerlocher GmbH

- PT Halim Sakti Pratama

Key Developments in Magnesium Stearate Market Industry

- January 2024: Faci Asia Pacific Pte Ltd announced a significant capacity expansion for its high-purity magnesium stearate production to meet growing pharmaceutical demand in Southeast Asia.

- November 2023: Baerlocher GmbH launched a new grade of magnesium stearate with enhanced lubricity for challenging polymer processing applications.

- July 2023: Nimbasia invested in advanced particle size control technology to offer specialized magnesium stearate for the nutraceutical industry.

- March 2023: Valtris Specialty Chemicals expanded its distribution network in North America, enhancing accessibility for its magnesium stearate product lines.

- December 2022: SINWON CHEMICAL CO LTD introduced a new sustainability initiative focused on reducing the carbon footprint of its magnesium stearate manufacturing processes.

- August 2022: Merck KGaA received regulatory approval for a new pharmaceutical-grade magnesium stearate, meeting enhanced purity requirements.

- April 2022: MLA Group of Industries acquired a smaller competitor to strengthen its market position in the European magnesium stearate market.

Strategic Magnesium Stearate Market Market Forecast

The strategic outlook for the Magnesium Stearate market is exceptionally positive, fueled by sustained demand from its core pharmaceutical and food & beverage applications. The forecast anticipates robust growth driven by an aging global population and increasing healthcare expenditure, directly translating into higher consumption of magnesium stearate as a critical pharmaceutical excipient. Furthermore, advancements in production technologies enabling higher purity and tailored functionalities will unlock new opportunities in specialized applications within the plastics and personal care sectors. Emerging economies are poised to become significant growth engines, presenting opportunities for market expansion and increased market share for agile and innovative players. The market's inherent stability, coupled with its essential role in various industries, positions it for continued prosperity.

Magnesium Stearate Market Segmentation

-

1. End-User Industry

- 1.1. Pharmaceutical

- 1.2. Food & Beverage

- 1.3. Personal Care

- 1.4. Plastics

- 1.5. Other End-User Industries (Paints& Coatings, etc.)

Magnesium Stearate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Magnesium Stearate Market Regional Market Share

Geographic Coverage of Magnesium Stearate Market

Magnesium Stearate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Use of Magnesium Stearate as Fillers & Binders and Lubricants in the Pharmaceutical Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations due to Presence of Toxic Compounds; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Usage in Pharmaceutical Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Magnesium Stearate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Pharmaceutical

- 5.1.2. Food & Beverage

- 5.1.3. Personal Care

- 5.1.4. Plastics

- 5.1.5. Other End-User Industries (Paints& Coatings, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Asia Pacific Magnesium Stearate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Pharmaceutical

- 6.1.2. Food & Beverage

- 6.1.3. Personal Care

- 6.1.4. Plastics

- 6.1.5. Other End-User Industries (Paints& Coatings, etc.)

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. North America Magnesium Stearate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Pharmaceutical

- 7.1.2. Food & Beverage

- 7.1.3. Personal Care

- 7.1.4. Plastics

- 7.1.5. Other End-User Industries (Paints& Coatings, etc.)

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Europe Magnesium Stearate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Pharmaceutical

- 8.1.2. Food & Beverage

- 8.1.3. Personal Care

- 8.1.4. Plastics

- 8.1.5. Other End-User Industries (Paints& Coatings, etc.)

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. South America Magnesium Stearate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9.1.1. Pharmaceutical

- 9.1.2. Food & Beverage

- 9.1.3. Personal Care

- 9.1.4. Plastics

- 9.1.5. Other End-User Industries (Paints& Coatings, etc.)

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10. Middle East and Africa Magnesium Stearate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10.1.1. Pharmaceutical

- 10.1.2. Food & Beverage

- 10.1.3. Personal Care

- 10.1.4. Plastics

- 10.1.5. Other End-User Industries (Paints& Coatings, etc.)

- 10.1. Market Analysis, Insights and Forecast - by End-User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merck KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nimbasia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Valtris Specialty Chemicals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MLA Group of Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Norac Additives LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kemipex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SINWON CHEMICAL CO LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NB Entrepreneurs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Faci Asia Pacific Pte Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alfa Aesar Thermo Fisher Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CARE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 James M Brown Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Spirochem Lifesciences Pvt Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Baerlocher GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 PT Halim Sakti Pratama

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Merck KGaA

List of Figures

- Figure 1: Global Magnesium Stearate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Magnesium Stearate Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Magnesium Stearate Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 4: Asia Pacific Magnesium Stearate Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 5: Asia Pacific Magnesium Stearate Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: Asia Pacific Magnesium Stearate Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 7: Asia Pacific Magnesium Stearate Market Revenue (Million), by Country 2025 & 2033

- Figure 8: Asia Pacific Magnesium Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 9: Asia Pacific Magnesium Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Magnesium Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 11: North America Magnesium Stearate Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 12: North America Magnesium Stearate Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 13: North America Magnesium Stearate Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 14: North America Magnesium Stearate Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 15: North America Magnesium Stearate Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Magnesium Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America Magnesium Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Magnesium Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Magnesium Stearate Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 20: Europe Magnesium Stearate Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 21: Europe Magnesium Stearate Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 22: Europe Magnesium Stearate Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 23: Europe Magnesium Stearate Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Magnesium Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Magnesium Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Magnesium Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Magnesium Stearate Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 28: South America Magnesium Stearate Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 29: South America Magnesium Stearate Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: South America Magnesium Stearate Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 31: South America Magnesium Stearate Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Magnesium Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: South America Magnesium Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Magnesium Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Magnesium Stearate Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 36: Middle East and Africa Magnesium Stearate Market Volume (K Tons), by End-User Industry 2025 & 2033

- Figure 37: Middle East and Africa Magnesium Stearate Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 38: Middle East and Africa Magnesium Stearate Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Magnesium Stearate Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Magnesium Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 41: Middle East and Africa Magnesium Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Magnesium Stearate Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Magnesium Stearate Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Global Magnesium Stearate Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Magnesium Stearate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Magnesium Stearate Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global Magnesium Stearate Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Magnesium Stearate Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 7: Global Magnesium Stearate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Magnesium Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: China Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: China Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: India Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Japan Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Japan Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: South Korea Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: South Korea Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Magnesium Stearate Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Magnesium Stearate Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 21: Global Magnesium Stearate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Magnesium Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 23: United States Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United States Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Canada Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Canada Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Mexico Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Mexico Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Global Magnesium Stearate Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 30: Global Magnesium Stearate Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 31: Global Magnesium Stearate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Magnesium Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Germany Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Italy Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: France Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: France Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Global Magnesium Stearate Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 44: Global Magnesium Stearate Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 45: Global Magnesium Stearate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Magnesium Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 47: Brazil Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Brazil Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Argentina Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Argentina Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Magnesium Stearate Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 54: Global Magnesium Stearate Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 55: Global Magnesium Stearate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Magnesium Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Saudi Arabia Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Saudi Arabia Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: South Africa Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East and Africa Magnesium Stearate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Magnesium Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Magnesium Stearate Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Magnesium Stearate Market?

Key companies in the market include Merck KGaA, Nimbasia, Valtris Specialty Chemicals, MLA Group of Industries, Norac Additives LLC, Kemipex, SINWON CHEMICAL CO LTD, NB Entrepreneurs, Faci Asia Pacific Pte Ltd, Alfa Aesar Thermo Fisher Scientific, CARE, James M Brown Ltd, Spirochem Lifesciences Pvt Ltd, Baerlocher GmbH, PT Halim Sakti Pratama.

3. What are the main segments of the Magnesium Stearate Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 551.22 Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Use of Magnesium Stearate as Fillers & Binders and Lubricants in the Pharmaceutical Industry; Other Drivers.

6. What are the notable trends driving market growth?

Growing Usage in Pharmaceutical Industry.

7. Are there any restraints impacting market growth?

Environmental Regulations due to Presence of Toxic Compounds; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Magnesium Stearate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Magnesium Stearate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Magnesium Stearate Market?

To stay informed about further developments, trends, and reports in the Magnesium Stearate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence