Key Insights

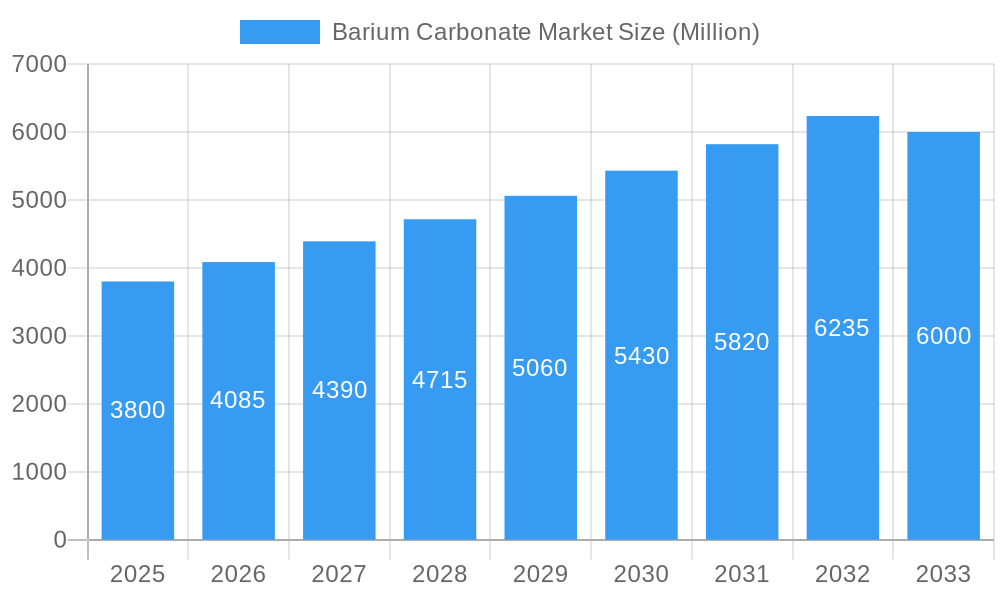

The global Barium Carbonate market is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 7.50% throughout the forecast period of 2025-2033. The market size, estimated to be around $3,800 million in 2025, is expected to reach approximately $6,000 million by 2033, signifying a substantial expansion. This growth is primarily fueled by the increasing demand from key end-user industries such as construction, ceramics, and electronics. The burgeoning construction sector, particularly in developing economies, necessitates the use of barium carbonate in bricks and tiles for enhanced durability and aesthetic appeal. Similarly, the electro-ceramic industry's reliance on barium carbonate for advanced components in electronics and automotive applications continues to be a significant growth driver. Furthermore, the specialty glass sector, which utilizes barium carbonate for its unique optical properties, is also contributing to the market's upward trajectory. Innovations in production techniques and the development of ultra-fine barium carbonate grades are further poised to unlock new application areas and market opportunities.

Barium Carbonate Market Market Size (In Billion)

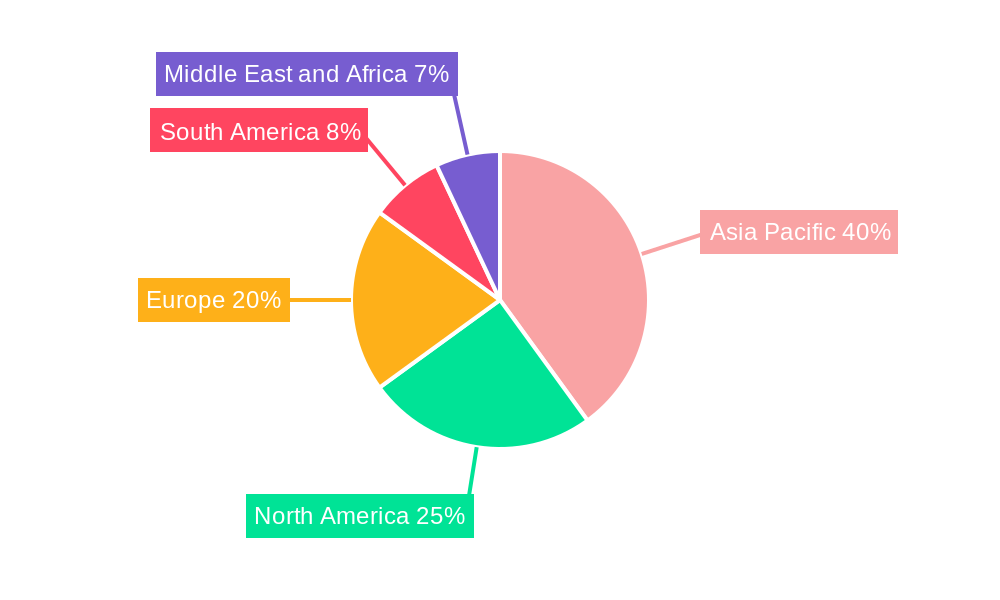

The market's expansion is also shaped by evolving trends and strategic initiatives by leading players. The growing emphasis on sustainable manufacturing practices and the development of eco-friendly alternatives are influencing product development and market strategies. However, challenges such as volatile raw material prices and stringent environmental regulations in certain regions may pose minor restraints to the market's pace. Geographically, the Asia Pacific region, led by China and India, is expected to dominate the market due to its rapidly industrializing economy and substantial manufacturing base, especially in ceramics and electronics. North America and Europe also represent significant markets, driven by their advanced manufacturing capabilities and demand for high-performance materials. The competitive landscape features prominent companies like Honeywell International Inc, Solvay, and Nippon Chemical Industrial Co Ltd, actively engaged in research and development, capacity expansion, and strategic partnerships to capitalize on emerging opportunities and maintain their market leadership. The diverse applications and essential role of barium carbonate across multiple industries underscore its continued importance and promising future growth.

Barium Carbonate Market Company Market Share

This in-depth report provides a strategic analysis of the global Barium Carbonate Market, a critical inorganic chemical essential across numerous industrial applications. Covering the extensive Historical Period (2019-2024), Base Year (2025), and an ambitious Forecast Period (2025-2033), this report equips stakeholders with unparalleled insights into market dynamics, growth trajectories, and emerging opportunities. Discover detailed segmentation by Form (Granular, Powder, Ultra fine, Other Forms), Application (Bricks and Tiles, Speciality Glass, Glazes, Electro Ceramic, Enamel, Other Applications), and End-user Industry (Construction, Oil and Gas, Ceramic, Electronics, Other End-user Industries). Uncover the impact of pivotal Industry Developments, such as the October 2022 elimination of anti-dumping tariffs on Chinese imports by the Indian Finance Ministry. The Barium Carbonate Market is poised for significant evolution, driven by innovation and evolving industrial demands.

Barium Carbonate Market Market Composition & Trends

The Barium Carbonate Market exhibits a moderate concentration, with key players strategizing for market share expansion through product diversification and geographic reach. Innovation catalysts include advancements in purification technologies and the development of specialized barium carbonate grades for high-performance applications. The regulatory landscape, while generally stable, can be influenced by environmental considerations and trade policies, as evidenced by recent anti-dumping duty adjustments. Substitute products, while present in certain niche applications, struggle to replicate the cost-effectiveness and broad utility of barium carbonate. End-user profiles are diverse, spanning the Construction, Ceramic, Oil and Gas, and Electronics sectors, each with distinct demand drivers. Mergers and acquisitions (M&A) activity, though not at a fever pitch, remains a strategic tool for market consolidation and synergy realization. For instance, the Barium Carbonate Market saw M&A deal values ranging from XX million to XX million in the past five years, influencing market share distribution. The global market size is projected to reach approximately XXX million by 2033.

Barium Carbonate Market Industry Evolution

The Barium Carbonate Market has undergone a significant evolution throughout the Study Period (2019–2033), demonstrating robust growth trajectories and adaptability to technological advancements and shifting consumer demands. From 2019 to 2024, the market witnessed a compound annual growth rate (CAGR) of approximately 4.5%, fueled by the expanding Construction and Ceramic industries, major consumers of barium carbonate for bricks, tiles, and glazes. Technological advancements in the extraction and processing of barite ore, the primary raw material, have improved purity and reduced production costs, thereby enhancing market competitiveness. Furthermore, the increasing demand for specialty glass in electronics and optical applications has opened new avenues for high-purity barium carbonate grades. Consumer demand for enhanced durability and aesthetic appeal in construction materials, coupled with the growing sophistication of Electro Ceramic components in electronic devices, has directly translated into increased consumption of barium carbonate. The adoption of barium carbonate in oil and gas exploration, particularly for drilling fluids, has also seen a steady rise, contributing to overall market expansion. The market size in the estimated year of 2025 is projected to be around XXX million. The forecast period of 2025-2033 anticipates a sustained CAGR of approximately 4.8%, driven by continued industrialization in emerging economies and ongoing innovation in its applications. The industry is characterized by a continuous quest for higher purity, improved particle size control, and more sustainable production methods.

Leading Regions, Countries, or Segments in Barium Carbonate Market

Asia Pacific is currently the dominant region in the Barium Carbonate Market, with China leading in both production and consumption. This dominance is driven by the region's burgeoning Construction sector, its extensive Ceramic industry, and its significant manufacturing base for Speciality Glass and Enamel products. Key drivers for this regional leadership include substantial government investments in infrastructure development, a robust supply chain for raw materials like barite, and favorable trade policies that have historically supported export growth.

- Form: The Powder segment holds the largest market share due to its versatility across various applications. Granular barium carbonate is increasingly favored in certain ceramic and glass manufacturing processes for improved handling and reduced dusting. Ultra-fine barium carbonate is gaining traction in niche applications requiring high surface area and reactivity.

- Application: The Bricks and Tiles segment represents a significant portion of the market, driven by the global demand for construction materials. The Speciality Glass segment is experiencing robust growth due to its use in display screens, optical lenses, and laboratory glassware. Glazes and Enamel applications also contribute substantially, providing aesthetic and protective finishes for a wide range of products.

- End-user Industry: The Construction industry is the primary end-user, consuming large volumes of barium carbonate for its role in brick and tile manufacturing. The Ceramic industry follows closely, utilizing it in glazes and body formulations. The Electronics sector is a growing consumer, leveraging specialty glass and electro-ceramic components. The Oil and Gas industry uses barium carbonate in drilling fluids.

Barium Carbonate Market Product Innovations

Product innovation in the Barium Carbonate Market focuses on enhancing purity levels to meet stringent application requirements, particularly in the electronics and specialty glass sectors. Manufacturers are developing barium carbonate with precisely controlled particle size distributions to optimize performance in glazes, enamels, and electro-ceramics. Novel applications are emerging in advanced materials, such as barium titanate for high-performance capacitors. The unique selling proposition of these innovations lies in improved dielectric properties, enhanced thermal stability, and greater chemical inertness, catering to the evolving needs of high-technology industries.

Propelling Factors for Barium Carbonate Market Growth

The Barium Carbonate Market is propelled by several key factors. The burgeoning Construction sector globally, especially in emerging economies, drives demand for bricks, tiles, and glazes. Advancements in the Ceramic industry, leading to the development of higher-quality and specialized ceramic products, further boost consumption. The expanding Electronics sector, with its increasing reliance on Speciality Glass and Electro Ceramic components for displays and electronic devices, is a significant growth catalyst. Furthermore, the use of barium carbonate in oil and gas drilling fluids for density modification presents a consistent demand.

Obstacles in the Barium Carbonate Market Market

Despite its strong growth prospects, the Barium Carbonate Market faces certain obstacles. Volatility in the prices of raw materials, primarily barite, can impact production costs and profit margins. Stringent environmental regulations concerning mining and processing activities can lead to increased operational expenses and potential production disruptions. Global supply chain complexities and logistical challenges can affect the timely delivery of finished products, particularly during periods of high demand or unforeseen events. Moreover, the presence of alternative materials in some specific applications poses a degree of competitive pressure.

Future Opportunities in Barium Carbonate Market

Emerging opportunities in the Barium Carbonate Market are diverse and promising. The growing demand for energy-efficient building materials in the Construction sector presents an avenue for enhanced barium carbonate applications. The continued miniaturization and increased functionality of electronic devices will drive the demand for high-purity barium carbonate in Electro Ceramic and Speciality Glass production. Furthermore, research into novel applications, such as in advanced battery technologies and specialized chemical synthesis, holds significant future potential. The development of more sustainable and environmentally friendly production processes could also unlock new market segments.

Major Players in the Barium Carbonate Market Ecosystem

- Honeywell International Inc

- Solvay

- Nippon Chemical Industrial Co Ltd

- Akshya Chemicals Pvt Ltd

- Chemical Products Corporation

- AG CHEMI GROUP s r o

- PVS Chemicals

- SHAANXI ANKANG JIANGHUA GROUP CO LTD

- SAKAI CHEMICAL INDUSTRY CO LTD

- Latour Capital

Key Developments in Barium Carbonate Market Industry

- October 2022: The Indian Finance Ministry eliminated the existing anti-dumping tariff on Chinese imports of Barium Carbonate. This move, advised by the Directorate General of Trade Remedies (DGTR), is expected to influence pricing and import dynamics within the Indian Barium Carbonate Market.

- [XX Month, 2023]: [Company Name] launched a new grade of ultra-fine barium carbonate optimized for advanced ceramic applications, aiming to capture a larger share of the high-growth Electronics segment.

- [XX Month, 2024]: [Company Name] announced a significant capacity expansion for its barium carbonate production facility in [Region], anticipating increased demand from the Construction and Speciality Glass industries.

Strategic Barium Carbonate Market Market Forecast

The strategic forecast for the Barium Carbonate Market indicates robust growth driven by sustained demand from its core end-user industries. The ongoing technological advancements in Speciality Glass and Electro Ceramic applications, coupled with the expanding global Construction sector, will continue to be primary growth catalysts. The Indian government's decision to eliminate anti-dumping duties on Chinese imports is likely to reshape regional trade flows and competitive landscapes, potentially leading to increased market accessibility. Emerging applications in new technologies and a focus on sustainable production methods are expected to unlock further market potential. The Barium Carbonate Market is well-positioned for continued expansion throughout the forecast period.

Barium Carbonate Market Segmentation

-

1. Form

- 1.1. Granular

- 1.2. Powder

- 1.3. Ultra fine

- 1.4. Other Forms

-

2. Application

- 2.1. Bricks and Tiles

- 2.2. Speciality Glass

- 2.3. Glazes

- 2.4. Electro Ceramic

- 2.5. Enamel

- 2.6. Other Applications

-

3. End-user Industry

- 3.1. Construction

- 3.2. Oil and Gas

- 3.3. Ceramic

- 3.4. Electronics

- 3.5. Other End-user Industries

Barium Carbonate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Barium Carbonate Market Regional Market Share

Geographic Coverage of Barium Carbonate Market

Barium Carbonate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction Industry; Increasing Demand from the Ceramic Industry

- 3.3. Market Restrains

- 3.3.1. Toxic Nature of Barium Carbonate; Other Restraints

- 3.4. Market Trends

- 3.4.1. Construction Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Barium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Granular

- 5.1.2. Powder

- 5.1.3. Ultra fine

- 5.1.4. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bricks and Tiles

- 5.2.2. Speciality Glass

- 5.2.3. Glazes

- 5.2.4. Electro Ceramic

- 5.2.5. Enamel

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Construction

- 5.3.2. Oil and Gas

- 5.3.3. Ceramic

- 5.3.4. Electronics

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Asia Pacific Barium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Granular

- 6.1.2. Powder

- 6.1.3. Ultra fine

- 6.1.4. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bricks and Tiles

- 6.2.2. Speciality Glass

- 6.2.3. Glazes

- 6.2.4. Electro Ceramic

- 6.2.5. Enamel

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Construction

- 6.3.2. Oil and Gas

- 6.3.3. Ceramic

- 6.3.4. Electronics

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. North America Barium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Granular

- 7.1.2. Powder

- 7.1.3. Ultra fine

- 7.1.4. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bricks and Tiles

- 7.2.2. Speciality Glass

- 7.2.3. Glazes

- 7.2.4. Electro Ceramic

- 7.2.5. Enamel

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Construction

- 7.3.2. Oil and Gas

- 7.3.3. Ceramic

- 7.3.4. Electronics

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Europe Barium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Granular

- 8.1.2. Powder

- 8.1.3. Ultra fine

- 8.1.4. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bricks and Tiles

- 8.2.2. Speciality Glass

- 8.2.3. Glazes

- 8.2.4. Electro Ceramic

- 8.2.5. Enamel

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Construction

- 8.3.2. Oil and Gas

- 8.3.3. Ceramic

- 8.3.4. Electronics

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. South America Barium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Granular

- 9.1.2. Powder

- 9.1.3. Ultra fine

- 9.1.4. Other Forms

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bricks and Tiles

- 9.2.2. Speciality Glass

- 9.2.3. Glazes

- 9.2.4. Electro Ceramic

- 9.2.5. Enamel

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Construction

- 9.3.2. Oil and Gas

- 9.3.3. Ceramic

- 9.3.4. Electronics

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Middle East and Africa Barium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Granular

- 10.1.2. Powder

- 10.1.3. Ultra fine

- 10.1.4. Other Forms

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bricks and Tiles

- 10.2.2. Speciality Glass

- 10.2.3. Glazes

- 10.2.4. Electro Ceramic

- 10.2.5. Enamel

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Construction

- 10.3.2. Oil and Gas

- 10.3.3. Ceramic

- 10.3.4. Electronics

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solvay*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippon Chemical Industrial Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Akshya Chemicals Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chemical Products Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AG CHEMI GROUP s r o

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PVS Chemicals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SHAANXI ANKANG JIANGHUA GROUP CO LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SAKAI CHEMICAL INDUSTRY CO LTD

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Latour Capital

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Barium Carbonate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Barium Carbonate Market Revenue (Million), by Form 2025 & 2033

- Figure 3: Asia Pacific Barium Carbonate Market Revenue Share (%), by Form 2025 & 2033

- Figure 4: Asia Pacific Barium Carbonate Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Barium Carbonate Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Barium Carbonate Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Barium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Barium Carbonate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Barium Carbonate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Barium Carbonate Market Revenue (Million), by Form 2025 & 2033

- Figure 11: North America Barium Carbonate Market Revenue Share (%), by Form 2025 & 2033

- Figure 12: North America Barium Carbonate Market Revenue (Million), by Application 2025 & 2033

- Figure 13: North America Barium Carbonate Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Barium Carbonate Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: North America Barium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Barium Carbonate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Barium Carbonate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Barium Carbonate Market Revenue (Million), by Form 2025 & 2033

- Figure 19: Europe Barium Carbonate Market Revenue Share (%), by Form 2025 & 2033

- Figure 20: Europe Barium Carbonate Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Barium Carbonate Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Barium Carbonate Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Barium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Barium Carbonate Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Barium Carbonate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Barium Carbonate Market Revenue (Million), by Form 2025 & 2033

- Figure 27: South America Barium Carbonate Market Revenue Share (%), by Form 2025 & 2033

- Figure 28: South America Barium Carbonate Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Barium Carbonate Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Barium Carbonate Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: South America Barium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Barium Carbonate Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Barium Carbonate Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Barium Carbonate Market Revenue (Million), by Form 2025 & 2033

- Figure 35: Middle East and Africa Barium Carbonate Market Revenue Share (%), by Form 2025 & 2033

- Figure 36: Middle East and Africa Barium Carbonate Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Barium Carbonate Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Barium Carbonate Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Barium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Barium Carbonate Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Barium Carbonate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Barium Carbonate Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Global Barium Carbonate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Barium Carbonate Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Barium Carbonate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Barium Carbonate Market Revenue Million Forecast, by Form 2020 & 2033

- Table 6: Global Barium Carbonate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Barium Carbonate Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Barium Carbonate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Barium Carbonate Market Revenue Million Forecast, by Form 2020 & 2033

- Table 15: Global Barium Carbonate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Barium Carbonate Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Barium Carbonate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Barium Carbonate Market Revenue Million Forecast, by Form 2020 & 2033

- Table 22: Global Barium Carbonate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Barium Carbonate Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Barium Carbonate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Barium Carbonate Market Revenue Million Forecast, by Form 2020 & 2033

- Table 31: Global Barium Carbonate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Barium Carbonate Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Barium Carbonate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Barium Carbonate Market Revenue Million Forecast, by Form 2020 & 2033

- Table 38: Global Barium Carbonate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Barium Carbonate Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Barium Carbonate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Barium Carbonate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Barium Carbonate Market?

The projected CAGR is approximately > 7.50%.

2. Which companies are prominent players in the Barium Carbonate Market?

Key companies in the market include Honeywell International Inc, Solvay*List Not Exhaustive, Nippon Chemical Industrial Co Ltd, Akshya Chemicals Pvt Ltd, Chemical Products Corporation, AG CHEMI GROUP s r o, PVS Chemicals, SHAANXI ANKANG JIANGHUA GROUP CO LTD, SAKAI CHEMICAL INDUSTRY CO LTD, Latour Capital.

3. What are the main segments of the Barium Carbonate Market?

The market segments include Form, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction Industry; Increasing Demand from the Ceramic Industry.

6. What are the notable trends driving market growth?

Construction Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Toxic Nature of Barium Carbonate; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: The Indian Finance Ministry eliminated the existing anti-dumping tariff on Chinese imports of Barium Carbonate, an inorganic chemical in the form of white powder or granules. The tax department's action came more than a month after the Directorate General of Trade Remedies (DGTR) advised the "rapid cessation" of anti-dumping duties on Chinese imports of barium carbonate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Barium Carbonate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Barium Carbonate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Barium Carbonate Market?

To stay informed about further developments, trends, and reports in the Barium Carbonate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence