Key Insights

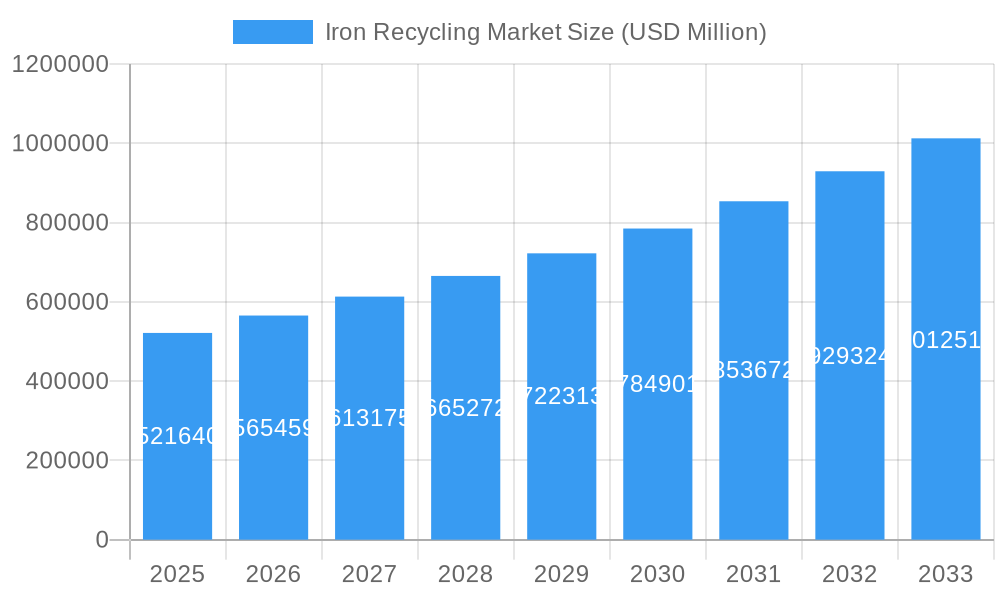

The global Iron Recycling Market is poised for significant expansion, projected to reach $521.64 billion by 2025. Driven by a robust CAGR of 8.5%, this growth trajectory indicates a burgeoning demand for sustainable metal sourcing. Key catalysts fueling this market include stringent environmental regulations, a growing emphasis on circular economy principles, and the inherent cost-effectiveness of recycled iron compared to virgin ore. The automotive sector, with its increasing use of lighter and more recyclable materials, alongside the ever-present building and construction industry, forms a substantial base for iron recycling. Furthermore, the packaging and shipbuilding industries are also contributing to this upward trend, seeking efficient and environmentally responsible material solutions. The market's expansion is further bolstered by technological advancements in scrap processing and segregation, enhancing the purity and usability of recycled iron for various applications.

Iron Recycling Market Market Size (In Billion)

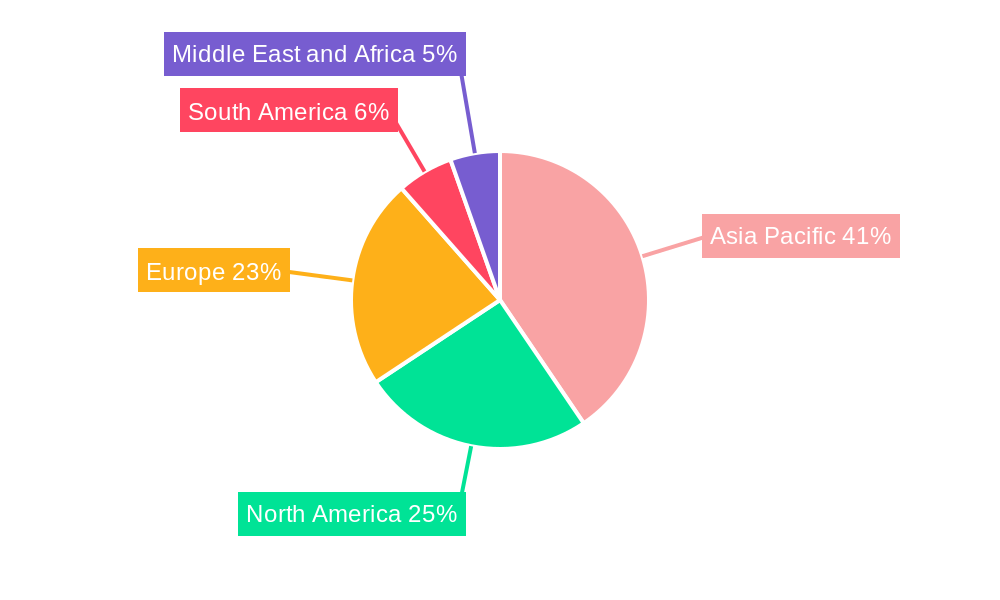

The Iron Recycling Market's upward momentum is expected to continue throughout the forecast period of 2025-2033. While the market benefits from strong demand drivers, certain restraints, such as fluctuations in scrap prices and the logistics involved in collection and transportation, present challenges that stakeholders are actively addressing. Innovations in automated sorting and processing technologies are helping to mitigate these operational hurdles. Geographically, the Asia Pacific region, led by China and India, is anticipated to dominate the market due to rapid industrialization and increasing infrastructure development. North America and Europe also represent substantial markets, driven by mature recycling infrastructure and strong policy support for sustainability. Companies like ArcelorMittal, Nucor Corporation, and Sims Limited are at the forefront, investing in advanced recycling facilities and expanding their global presence to cater to this expanding demand for recycled iron.

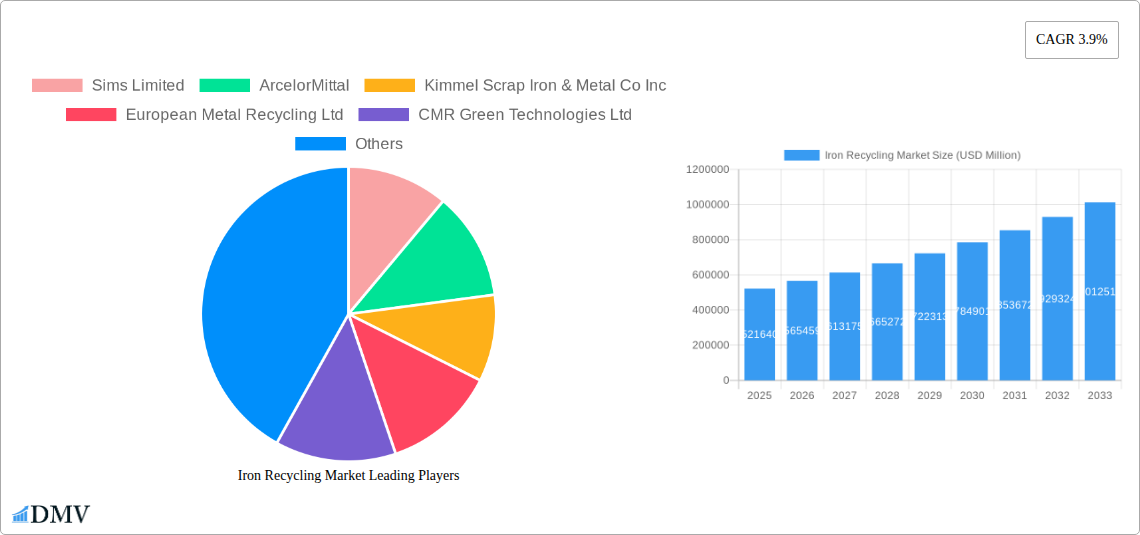

Iron Recycling Market Company Market Share

Embark on an in-depth exploration of the burgeoning iron recycling market with our latest market research report. This comprehensive analysis, spanning the historical period of 2019-2024 and projecting growth through 2033, offers unparalleled insights into market dynamics, growth drivers, and future opportunities. As the global demand for sustainable materials and responsible resource management intensifies, the iron scrap market is poised for significant expansion, driven by environmental regulations, technological advancements, and the increasing need to reduce carbon footprints in heavy industries like steel manufacturing. Our report is essential for stakeholders seeking to understand the global iron recycling industry, its leading players, and its strategic trajectory, with a projected market value of over $XXX billion by 2025.

Iron Recycling Market Market Composition & Trends

The iron recycling market exhibits a moderately concentrated structure, with key players like Sims Limited, ArcelorMittal, and Nucor Corporation holding significant market share, estimated to be approximately 45% collectively. Innovation is primarily catalyzed by advancements in sorting technologies, magnetic separation, and smelting processes aimed at enhancing purity and reducing energy consumption. The regulatory landscape is increasingly stringent, with policies promoting circular economy principles and penalizing landfilling of metallic waste. Substitute products, such as virgin iron ore, face rising extraction costs and environmental scrutiny, bolstering the demand for recycled iron. End-user profiles are diverse, with the building and construction sector and the automotive industry being the largest consumers of recycled iron, accounting for an estimated 30% and 25% of demand respectively. M&A activities are prominent, driven by the pursuit of vertical integration and expanded recycling capacities. For instance, the acquisition of John Lawrie Metals Ltd. by ArcelorMittal in March 2022, valued at an estimated $XX million, underscores this trend, aiming to secure scrap steel supplies and reduce CO2 emissions. Strategic partnerships are also on the rise, as demonstrated by Nucor Corporation's December 2022 alliance with Electra, focusing on green iron production, highlighting a strong trend towards sustainable steelmaking.

Iron Recycling Market Industry Evolution

The iron recycling market has undergone a remarkable evolution, transforming from a niche waste management activity into a critical component of the global industrial supply chain. Over the study period of 2019–2033, the industry has witnessed consistent growth, with the base year of 2025 estimated to value the market at over $XXX billion. This growth trajectory is propelled by a confluence of factors, including escalating raw material prices for virgin iron ore, increasing environmental consciousness among consumers and corporations, and supportive government policies promoting circular economy initiatives. Technological advancements have been pivotal in this evolution. Innovations in automated sorting systems, advanced magnetic separation techniques, and energy-efficient smelting technologies have significantly improved the efficiency and purity of recycled iron, making it a more viable and attractive alternative to primary iron. The adoption of these technologies has seen a substantial increase, with an estimated 70% of major recycling facilities implementing advanced sorting equipment by 2024.

Consumer demands are also playing a crucial role. A growing awareness of sustainability and the environmental impact of industrial processes has led to increased demand for products manufactured using recycled materials. This is particularly evident in the automotive and building and construction sectors, where manufacturers are increasingly prioritizing the use of recycled steel to meet corporate sustainability goals and consumer expectations for eco-friendly products. Furthermore, the packaging industry is also seeing a rise in demand for recycled iron content in steel cans, contributing to the overall market growth. The global push towards decarbonization and the reduction of greenhouse gas emissions has further amplified the importance of iron recycling. Steelmaking is an energy-intensive process, and the use of scrap steel significantly reduces the energy required and the associated carbon emissions compared to using virgin iron ore. This has led major steel producers, such as ArcelorMittal and Nucor Corporation, to actively invest in and expand their scrap recycling capabilities. The forecast period of 2025–2033 is expected to witness continued robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 6.5%, driven by ongoing technological innovation, stringent environmental regulations, and a persistent global commitment to sustainability.

Leading Regions, Countries, or Segments in Iron Recycling Market

The iron recycling market is characterized by strong regional dominance and significant contributions from specific end-user industries. Among the end-user segments, the Building and Construction sector stands out as the leading consumer of recycled iron. This dominance is driven by the sheer volume of steel used in infrastructure development, residential and commercial construction projects, and renovations globally. The construction industry's robust demand for steel, coupled with an increasing emphasis on sustainable building practices and the use of recycled materials, positions it as the primary growth engine for the iron recycling market.

- Key Drivers for Building and Construction Dominance:

- Infrastructure Investment: Government initiatives and private sector investments in infrastructure projects worldwide, including bridges, roads, and public facilities, necessitate large quantities of steel.

- Green Building Certifications: The growing adoption of green building certifications (e.g., LEED, BREEAM) encourages the use of recycled content in construction materials.

- Urbanization and Population Growth: Rapid urbanization, particularly in developing economies, fuels continuous demand for new housing and commercial spaces, thus increasing steel consumption.

- Governmental Support for Circular Economy: Policies promoting the circular economy and waste reduction in the construction sector directly benefit recycled iron adoption.

The Automotive industry follows closely as another pivotal segment, driven by the continuous demand for vehicle production and the industry's increasing commitment to lightweighting and sustainability. Manufacturers are actively incorporating recycled steel to reduce the environmental footprint of their vehicles. The Packaging industry also represents a significant segment, with steel cans being a widely used packaging solution, and the demand for recycled content in these products is steadily rising.

Geographically, Asia-Pacific is emerging as a dominant region in the iron recycling market. This dominance is fueled by rapid industrialization, significant infrastructure development, and a growing manufacturing base across countries like China, India, and Southeast Asian nations. The sheer scale of manufacturing output and the increasing focus on resource efficiency and environmental compliance in these rapidly developing economies are creating substantial demand for recycled iron.

- Factors Contributing to Asia-Pacific's Dominance:

- Massive Industrial Output: The region's status as a global manufacturing hub ensures a consistent supply of industrial scrap and a high demand for recycled iron in various manufacturing processes.

- Infrastructure Boom: Extensive investments in new infrastructure projects across the region, from high-speed rail to urban development, are driving substantial steel consumption.

- Governmental Push for Sustainability: Many countries in Asia-Pacific are implementing stricter environmental regulations and promoting circular economy principles, which directly benefits the iron recycling sector.

- Growing Automotive Sector: The booming automotive industry in countries like China and India contributes significantly to the demand for recycled steel.

While other regions like North America and Europe are mature markets with established recycling infrastructures, Asia-Pacific's growth trajectory and scale of operations are positioning it as the key driver of global demand for recycled iron.

Iron Recycling Market Product Innovations

Product innovations within the iron recycling market are primarily focused on enhancing the quality and applicability of recycled iron. Advancements in purification techniques are yielding higher-grade recycled iron, suitable for more demanding applications. Innovations in alloying and blending processes are enabling the creation of customized recycled iron products with specific mechanical properties, meeting the exact specifications of various end-user industries. For instance, the development of advanced de-slagging agents and refining processes has led to recycled iron with lower impurity levels, approaching virgin steel quality. These innovations are crucial for expanding the use of recycled iron in critical sectors like the automotive industry, where safety and performance are paramount, and in high-end construction projects requiring superior material integrity. The increasing adoption of these innovative processes allows for greater material efficiency and a reduced reliance on primary iron ore.

Propelling Factors for Iron Recycling Market Growth

Several key factors are propelling the growth of the iron recycling market. Economically, the rising cost of virgin iron ore extraction, coupled with increasing energy prices, makes recycled iron a more cost-competitive alternative for manufacturers. Environmentally, stringent government regulations and global initiatives aimed at reducing carbon emissions and promoting a circular economy are creating a strong demand for sustainable materials. Technologically, advancements in sorting, shredding, and refining processes are improving the quality and efficiency of recycled iron production, making it a more viable option for a wider range of applications. The growing consumer preference for eco-friendly products is also indirectly boosting the demand for recycled iron by pushing manufacturers to adopt sustainable sourcing practices.

Obstacles in the Iron Recycling Market Market

Despite its robust growth, the iron recycling market faces several obstacles. Regulatory challenges, including variations in waste management policies across different regions and the complexities of cross-border scrap movement, can impede efficient operations. Supply chain disruptions, such as fluctuations in the availability of scrap iron due to economic downturns or logistical issues, can lead to price volatility and affect production schedules. Furthermore, competitive pressures from virgin iron ore producers, who may benefit from subsidies or lower energy costs in certain regions, can pose a challenge. The presence of non-standardized quality grades in some scrap materials can also require significant pre-processing, adding to operational costs and potentially limiting their application.

Future Opportunities in Iron Recycling Market

The iron recycling market is ripe with future opportunities. Emerging markets in developing economies present significant untapped potential for establishing recycling infrastructure and catering to the growing industrial demand for recycled iron. Technological advancements in areas like artificial intelligence-powered sorting and advanced smelting techniques offer avenues for further improving efficiency and product quality. The increasing demand for sustainable materials across all industries, driven by corporate social responsibility and consumer awareness, will continue to fuel market growth. Furthermore, the development of new applications for recycled iron, such as in renewable energy infrastructure and advanced manufacturing, will open up novel avenues for market expansion.

Major Players in the Iron Recycling Market Ecosystem

- Sims Limited

- ArcelorMittal

- Kimmel Scrap Iron & Metal Co Inc

- European Metal Recycling Ltd

- CMR Green Technologies Ltd

- CMC

- OmniSource LLC

- Schnitzer Steel Industries Inc

- Nucor Corporation

- Tata Steel

Key Developments in Iron Recycling Market Industry

- December 2022: Nucor Corporation, the largest U.S.-based steel producer, announced its partnership with green iron company, Electra. Through this partnership, Nucor Corporation used Electra's iron to further lower the carbon emissions of its industry-leading sustainable steel and steel products.

- March 2022: ArcelorMittal acquired Scottish steel recycling business John Lawrie Metals Ltd., as part of the company's strategy of increasing the use of scrap steel to lower CO2 emissions from steelmaking.

Strategic Iron Recycling Market Market Forecast

The strategic iron recycling market forecast indicates sustained and robust growth, driven by the undeniable global imperative for sustainability and resource efficiency. The increasing integration of recycled iron into the steelmaking process, championed by industry leaders like Nucor Corporation and ArcelorMittal, will continue to be a primary growth catalyst. The market is expected to benefit significantly from ongoing technological advancements in recycling processes and the implementation of more stringent environmental regulations worldwide. As the circular economy gains further traction, the demand for high-quality recycled iron from key end-user industries such as building and construction and automotive will remain strong. The market's future trajectory is intrinsically linked to its ability to provide cost-effective, environmentally sound alternatives to virgin iron ore, making it a critical sector for a greener industrial future.

Iron Recycling Market Segmentation

-

1. End-user Industry

- 1.1. Building and Construction

- 1.2. Automotive

- 1.3. Packaging

- 1.4. Shipbuilding

- 1.5. Electronics & Electrical Equipment

- 1.6. Consumer Appliances

- 1.7. Other End-User Industries

Iron Recycling Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Iron Recycling Market Regional Market Share

Geographic Coverage of Iron Recycling Market

Iron Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Urbanization and Industrialization; Increasing Awareness regarding the Depletion of Metal Reserves; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Unorganised Flow of Waste Metals; Other Restraints

- 3.4. Market Trends

- 3.4.1. Building and Construction to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Building and Construction

- 5.1.2. Automotive

- 5.1.3. Packaging

- 5.1.4. Shipbuilding

- 5.1.5. Electronics & Electrical Equipment

- 5.1.6. Consumer Appliances

- 5.1.7. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Building and Construction

- 6.1.2. Automotive

- 6.1.3. Packaging

- 6.1.4. Shipbuilding

- 6.1.5. Electronics & Electrical Equipment

- 6.1.6. Consumer Appliances

- 6.1.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Building and Construction

- 7.1.2. Automotive

- 7.1.3. Packaging

- 7.1.4. Shipbuilding

- 7.1.5. Electronics & Electrical Equipment

- 7.1.6. Consumer Appliances

- 7.1.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Building and Construction

- 8.1.2. Automotive

- 8.1.3. Packaging

- 8.1.4. Shipbuilding

- 8.1.5. Electronics & Electrical Equipment

- 8.1.6. Consumer Appliances

- 8.1.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Building and Construction

- 9.1.2. Automotive

- 9.1.3. Packaging

- 9.1.4. Shipbuilding

- 9.1.5. Electronics & Electrical Equipment

- 9.1.6. Consumer Appliances

- 9.1.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Building and Construction

- 10.1.2. Automotive

- 10.1.3. Packaging

- 10.1.4. Shipbuilding

- 10.1.5. Electronics & Electrical Equipment

- 10.1.6. Consumer Appliances

- 10.1.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sims Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ArcelorMittal

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kimmel Scrap Iron & Metal Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 European Metal Recycling Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CMR Green Technologies Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CMC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OmniSource LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schnitzer Steel Industries Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nucor Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tata Steel

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sims Limited

List of Figures

- Figure 1: Global Iron Recycling Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Iron Recycling Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 8: Asia Pacific Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 9: Asia Pacific Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 11: North America Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 12: North America Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: North America Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 20: Europe Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: Europe Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 28: South America Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: South America Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South America Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: South America Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: South America Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: South America Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 37: Middle East and Africa Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Middle East and Africa Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 40: Middle East and Africa Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 41: Middle East and Africa Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Iron Recycling Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Iron Recycling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Iron Recycling Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: China Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: China Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: India Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Japan Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Japan Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: South Korea Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: South Korea Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 23: United States Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: United States Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Canada Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Canada Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Mexico Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Mexico Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Germany Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Germany Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Italy Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Italy Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: France Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: France Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 47: Brazil Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Brazil Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Argentina Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Argentina Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Saudi Arabia Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Saudi Arabia Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: South Africa Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Africa Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East and Africa Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iron Recycling Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Iron Recycling Market?

Key companies in the market include Sims Limited, ArcelorMittal, Kimmel Scrap Iron & Metal Co Inc, European Metal Recycling Ltd, CMR Green Technologies Ltd, CMC, OmniSource LLC, Schnitzer Steel Industries Inc, Nucor Corporation, Tata Steel.

3. What are the main segments of the Iron Recycling Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Urbanization and Industrialization; Increasing Awareness regarding the Depletion of Metal Reserves; Other Drivers.

6. What are the notable trends driving market growth?

Building and Construction to Dominate the Market.

7. Are there any restraints impacting market growth?

Unorganised Flow of Waste Metals; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Nucor Corporation, the largest U.S.-based steel producer announced its partnership with green iron company, Electra. Through this partnership, Nucor Corporation used Electra's iron to further lower the carbon emissions of its industry-leading sustainable steel and steel products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iron Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iron Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iron Recycling Market?

To stay informed about further developments, trends, and reports in the Iron Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence