Key Insights

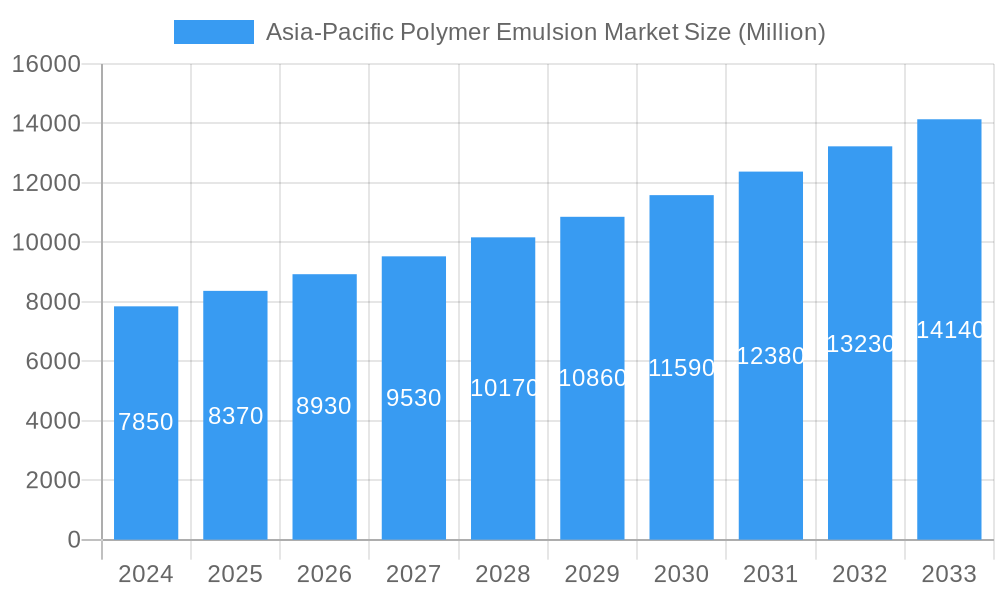

The Asia-Pacific Polymer Emulsion Market is poised for robust expansion, demonstrating a significant market size of $7.85 billion in 2024. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 7.15%, indicating a dynamic and evolving landscape for polymer emulsions across the region. The market's expansion is primarily driven by the escalating demand from key end-use industries such as paints and coatings, adhesives, and paper and paperboard coatings. Increasing urbanization, infrastructure development, and a growing automotive sector in countries like China and India are substantial contributors to this upward trajectory. Furthermore, the rising adoption of environmentally friendly and sustainable solutions, leading to an increased preference for water-based polymer emulsions over solvent-based alternatives, acts as a significant market accelerator. The continuous innovation in product development, focusing on enhanced performance characteristics like durability, adhesion, and resistance, further bolsters market penetration.

Asia-Pacific Polymer Emulsion Market Market Size (In Billion)

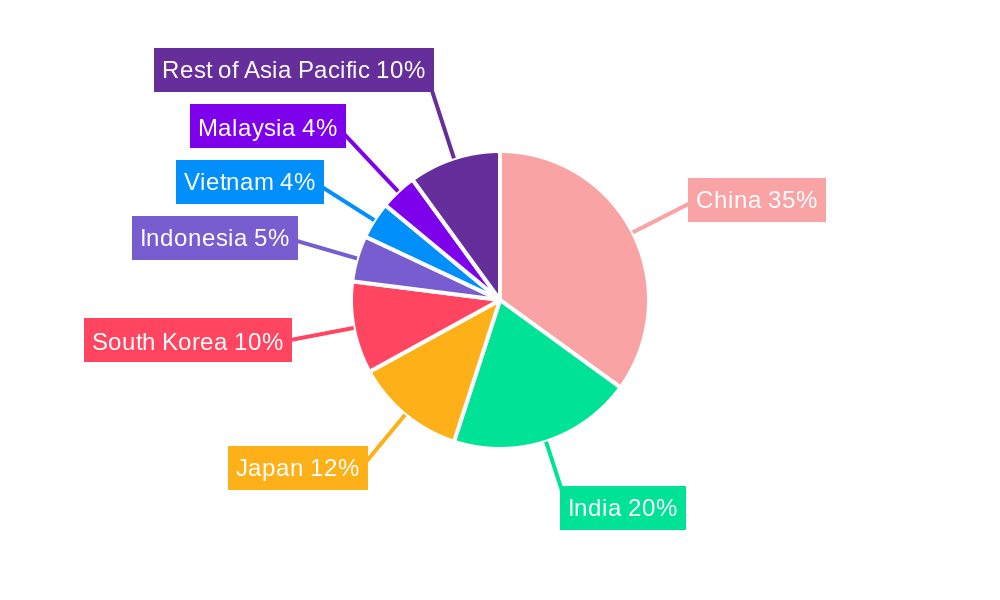

While the outlook is overwhelmingly positive, certain factors could influence the market's pace. Fluctuations in raw material prices, particularly those derived from petrochemicals, can pose a challenge to manufacturers. Additionally, stringent environmental regulations concerning VOC emissions in some sub-regions, while also driving the adoption of eco-friendly emulsions, can necessitate significant investment in compliance and advanced manufacturing processes. The market segmentation reveals dominance of Acrylics and Polyurethane (PU) dispersions as key product types, owing to their versatility and wide-ranging applications. Geographically, China stands out as the largest market, with India showing remarkable growth potential. The competitive landscape is characterized by the presence of both multinational corporations and emerging regional players, all vying for market share through strategic expansions, product innovations, and collaborations.

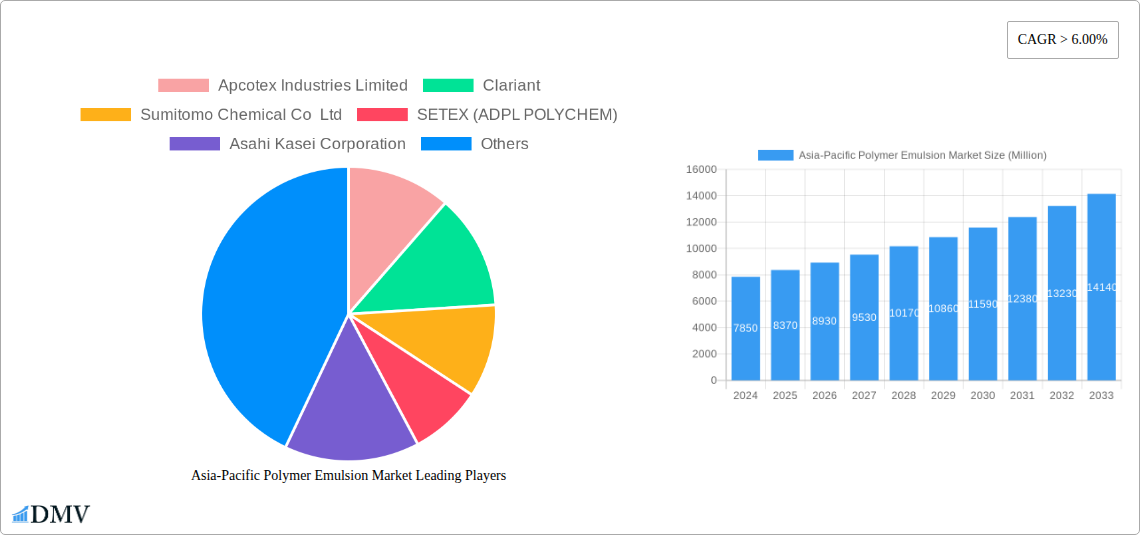

Asia-Pacific Polymer Emulsion Market Company Market Share

Unlock the immense potential of the Asia-Pacific Polymer Emulsion Market with this in-depth, SEO-optimized report. Covering the period from 2019 to 2033, this report delivers unparalleled insights into market dynamics, key players, emerging trends, and strategic growth opportunities. Essential for stakeholders seeking to navigate and capitalize on this rapidly evolving sector.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Asia-Pacific Polymer Emulsion Market Market Composition & Trends

The Asia-Pacific Polymer Emulsion Market exhibits a dynamic landscape characterized by increasing market concentration driven by strategic mergers and acquisitions, and a fervent pursuit of innovation. Key market players are actively investing in R&D to develop high-performance, sustainable polymer emulsions, addressing the growing demand for eco-friendly solutions. Regulatory landscapes are evolving, with governments across the region promoting the use of low-VOC (Volatile Organic Compound) and water-based emulsions, particularly in the paints & coatings and adhesives sectors. The competitive intensity is high, with significant rivalry among established global chemical giants and agile local manufacturers. Substitutes, such as solvent-based alternatives or entirely different material solutions, are present but are increasingly being phased out due to environmental concerns and performance limitations of polymer emulsions. End-user profiles are diverse, ranging from construction companies and automotive manufacturers to paper mills and textile producers. M&A activities are pivotal in shaping market concentration, with significant deal values observed as major companies seek to expand their product portfolios and geographical reach. For instance, recent acquisitions aimed at bolstering capabilities in acrylic and polyurethane dispersions have been notable. The market share distribution is undergoing continuous shifts, influenced by technological advancements and regional demand fluctuations.

Asia-Pacific Polymer Emulsion Market Industry Evolution

The Asia-Pacific polymer emulsion market has witnessed a remarkable evolution, transforming from a niche segment to a cornerstone of numerous industrial value chains. This evolution is underscored by a consistent and robust growth trajectory, fueled by burgeoning economies, rapid urbanization, and a significant upswing in manufacturing activities across the region. Over the historical period of 2019-2024, the market has consistently demonstrated resilience and adaptability, navigating global economic shifts and supply chain challenges. The base year of 2025 marks a pivotal point, with projections indicating accelerated expansion. The forecast period from 2025 to 2033 is expected to be a period of significant innovation and market diversification.

Technological advancements have been a primary catalyst for this evolution. The development of novel polymer architectures, such as high-solid content emulsions and functionalized dispersions, has significantly enhanced the performance characteristics of end-products. This includes improved durability, enhanced adhesion properties, and superior resistance to environmental factors like UV radiation and chemical exposure. For example, the innovation in styrene-butadiene (SB) latex has led to its wider adoption in advanced paper coatings and carpet backing applications, offering superior strength and flexibility. Similarly, the continuous refinement of acrylic emulsions has solidified their dominance in the paints & coatings sector, driven by their excellent weatherability and color retention.

Shifting consumer demands have also played a crucial role. There's a palpable global and regional shift towards sustainability, compelling manufacturers to prioritize the development and production of environmentally friendly polymer emulsions. This translates to a strong preference for water-based, low-VOC formulations that minimize environmental impact and comply with increasingly stringent environmental regulations. This trend is particularly evident in the paints & coatings and adhesives industries, where consumer and regulatory pressure for greener alternatives is at its peak. The demand for bio-based or recycled content in polymer emulsions is also on the rise, signaling a paradigm shift in manufacturing practices.

The economic growth across key Asia-Pacific nations, particularly China and India, has provided a fertile ground for the expansion of polymer emulsion applications. Growing disposable incomes have boosted demand for consumer goods, construction, and infrastructure development, all of which are significant end-users of polymer emulsions. The automotive sector's resurgence, with its demand for advanced coatings and adhesives, further contributes to this growth. The adoption metrics for advanced polymer emulsion technologies are steadily increasing, as manufacturers recognize their potential to deliver superior performance and meet evolving market expectations. The market is not just growing in volume but also in value, as higher-performance, specialized emulsions gain traction.

Leading Regions, Countries, or Segments in Asia-Pacific Polymer Emulsion Market

The Asia-Pacific Polymer Emulsion Market is a complex web of regional dominance, country-specific growth, and segment leadership, with China emerging as the undeniable powerhouse. This dominance stems from a confluence of factors including its massive industrial base, rapid urbanization, substantial infrastructure development, and proactive government policies favoring domestic manufacturing and technological advancement. China's vast market size translates into significant demand across all major product types and applications, making it a critical bellwether for the entire region.

Dominant Geography: China

- Massive Industrial Output: China's status as the "world's factory" translates into unparalleled demand for polymer emulsions across its vast manufacturing sectors, including textiles, paper, automotive, and construction.

- Infrastructure Boom: Continuous investment in infrastructure projects, such as high-speed rail, airports, and residential developments, drives substantial consumption of polymer emulsions in paints & coatings and adhesives.

- Urbanization & Consumer Demand: Growing middle class and rapid urbanization fuel demand for better quality housing, improved consumer goods, and enhanced automotive production, all reliant on polymer emulsions.

- Government Support & Investment: Favorable government policies, including R&D incentives and support for local manufacturing, have fostered a robust domestic polymer emulsion industry and attracted significant foreign investment.

- Technological Adoption: China is quick to adopt new technologies and production processes, leading to increased demand for advanced and specialized polymer emulsions.

Key Segments Driving Growth:

Within this dominant geographical landscape, specific product types and application segments are spearheading growth:

Product Type: Acrylics

- Dominance in Paints & Coatings: Acrylic emulsions are the backbone of the region's booming paints and coatings industry, offering superior durability, weather resistance, and aesthetic appeal for architectural, industrial, and automotive applications.

- Versatility and Performance: Their inherent versatility allows for customization to meet specific performance requirements, making them a preferred choice for various demanding applications.

- Growth in Specialty Applications: Beyond traditional coatings, acrylics are finding increasing use in specialty adhesives, textiles, and construction chemicals, further amplifying their market share.

Application: Paints & Coatings

- Largest End-Use Sector: This segment consistently represents the largest share of the polymer emulsion market, driven by new construction, renovation activities, and the automotive industry.

- Shift Towards Waterborne Technologies: Growing environmental regulations and consumer preference for low-VOC products are accelerating the transition from solvent-based to water-based acrylic and other polymer emulsions.

- High-Value Applications: The demand for high-performance coatings in sectors like automotive and industrial manufacturing contributes significantly to the segment's value.

Geography: India

- Rapid Industrialization and Infrastructure Development: India's sustained economic growth, coupled with ambitious infrastructure projects and a burgeoning manufacturing sector, is creating immense demand for polymer emulsions.

- Growing Construction and Automotive Sectors: Increased urbanization and a rising middle class are driving the construction industry, while the automotive sector's expansion requires advanced coatings and adhesives.

- Government Initiatives: Programs like "Make in India" and investments in infrastructure are further bolstering the demand for materials like polymer emulsions.

Product Type: Polyurethane (PU) Dispersions

- Growing Demand in High-Performance Applications: PU dispersions are gaining traction in applications demanding superior flexibility, abrasion resistance, and chemical inertness, such as wood coatings, leather finishes, and industrial coatings.

- Sustainable Alternative: They offer a more environmentally friendly alternative to solvent-borne polyurethanes, aligning with regional sustainability trends.

The interconnectedness of these segments and geographies creates a dynamic market where innovation in one area often spurs growth in others. The dominance of China, supported by the robust growth of India and the strategic importance of acrylics in paints & coatings, sets the stage for continued expansion and evolution of the Asia-Pacific polymer emulsion market.

Asia-Pacific Polymer Emulsion Market Product Innovations

Innovation within the Asia-Pacific Polymer Emulsion Market is intensely focused on enhancing performance, sustainability, and specialized functionalities. Manufacturers are continuously developing novel emulsion formulations with improved adhesion properties for challenging substrates, superior durability against extreme environmental conditions, and enhanced flexibility for dynamic applications. For instance, the development of self-healing polymer emulsions is a significant advancement, offering extended product lifecycles and reduced maintenance needs, particularly in coatings and adhesives. Furthermore, the integration of nanomaterials into polymer emulsions is leading to enhanced scratch resistance, UV protection, and antimicrobial properties. The focus on bio-based and biodegradable polymer emulsions is also a critical innovation, addressing the escalating demand for eco-friendly solutions and aligning with stringent environmental regulations across the region.

Propelling Factors for Asia-Pacific Polymer Emulsion Market Growth

The Asia-Pacific Polymer Emulsion Market is propelled by a synergistic combination of technological advancements, robust economic growth, and increasingly stringent regulatory frameworks. Technological innovations, such as the development of high-solid content emulsions and advanced functionalities like self-healing capabilities, are expanding application horizons and improving product performance. The rapid industrialization and urbanization across key economies, particularly in China and India, are driving substantial demand from the construction, automotive, and manufacturing sectors. Furthermore, the global and regional emphasis on sustainability is a significant growth catalyst, accelerating the adoption of environmentally friendly, low-VOC, water-based polymer emulsions in response to evolving consumer preferences and stricter environmental regulations.

Obstacles in the Asia-Pacific Polymer Emulsion Market Market

Despite robust growth, the Asia-Pacific Polymer Emulsion Market faces several obstacles. Regulatory hurdles, particularly concerning environmental compliance and chemical safety standards, can slow down product development and market entry for new formulations. Supply chain disruptions, exacerbated by geopolitical tensions and global economic volatility, pose a significant risk to the availability and cost of raw materials, impacting production timelines and pricing. Intense competitive pressures from both established global players and agile local manufacturers can lead to price wars and compressed profit margins. The initial cost of investing in new, sustainable technologies can also be a barrier for some smaller players.

Future Opportunities in Asia-Pacific Polymer Emulsion Market

Emerging opportunities in the Asia-Pacific Polymer Emulsion Market lie in the increasing demand for high-performance, specialty emulsions tailored for niche applications. The growing focus on circular economy principles presents opportunities for the development and adoption of bio-based and recycled content polymer emulsions. Expansion into underdeveloped Southeast Asian markets, with their burgeoning industrial sectors, offers significant untapped potential. Furthermore, the continued push for sustainable construction materials and advanced packaging solutions will create sustained demand for innovative and eco-friendly polymer emulsion formulations.

Major Players in the Asia-Pacific Polymer Emulsion Market Ecosystem

- Apcotex Industries Limited

- Clariant

- Sumitomo Chemical Co Ltd

- SETEX (ADPL POLYCHEM)

- Asahi Kasei Corporation

- JSR Corporation

- Solvay

- Celanese Corporation

- 3M

- BASF SE

- Arkema Group

- Akzo Nobel N V

- Dow

- Dairen Chemical Corporation

- Wacker Chemie AG

- Kamsons Chemical Pvt Ltd

- Synthomer plc

Key Developments in Asia-Pacific Polymer Emulsion Market Industry

- 2024 Q1: Launch of new generation acrylic emulsions with ultra-low VOC content, enhancing environmental compliance and performance in architectural coatings.

- 2023 Q4: Significant investment by a leading chemical company in expanding its polyurethane dispersion manufacturing capacity in Southeast Asia to meet rising demand.

- 2023 Q3: Acquisition of a specialty polymer emulsion producer by a global chemical giant, aiming to strengthen its portfolio in adhesives and carpet backing.

- 2023 Q2: Introduction of bio-based styrene-butadiene latex for paper coatings, aligning with circular economy initiatives.

- 2023 Q1: Development of advanced polymer emulsions with enhanced fire retardant properties for construction applications.

- 2022 Q4: Establishment of a joint venture for producing innovative vinyl acetate-based emulsions in a rapidly developing Asian market.

- 2022 Q3: Launch of high-performance SB latex for enhanced durability in technical textile coatings.

- 2022 Q2: Focus on digital transformation and smart manufacturing to optimize production and supply chain efficiency for polymer emulsions.

- 2022 Q1: Increased research into functionalized polymer emulsions for advanced electronics and automotive components.

- 2021 Q4: Consolidation trend continues with strategic mergers aimed at achieving economies of scale and broader market reach.

- 2021 Q3: Greater emphasis on developing solutions for the packaging industry, particularly for food-grade and sustainable packaging applications.

- 2021 Q2: Growing adoption of sustainable raw materials in the production of acrylic and vinyl acetate emulsions.

- 2021 Q1: Innovations in waterborne PU dispersions for furniture coatings and automotive interiors.

- 2020 Q4: Accelerated development of polymer emulsions for use in medical devices and personal protective equipment.

- 2020 Q3: Supply chain resilience became a key focus, with companies diversifying sourcing and increasing local production capabilities.

- 2020 Q2: Heightened demand for polymer emulsions in hygiene-related products and coatings.

- 2020 Q1: Initial impacts of global events leading to a temporary slowdown in some sectors but increased focus on essential industries.

- 2019: Baseline year for market analysis, with steady growth driven by construction and manufacturing sectors.

Strategic Asia-Pacific Polymer Emulsion Market Market Forecast

The Asia-Pacific Polymer Emulsion Market is poised for continued robust growth, driven by persistent industrial expansion, increasing demand for high-performance and sustainable materials, and favorable government policies promoting green technologies. The forecast indicates sustained expansion driven by the construction, automotive, and packaging sectors, with a particular emphasis on the adoption of eco-friendly, low-VOC, and bio-based polymer emulsions. Technological advancements in acrylics, PU dispersions, and SB latex will unlock new application avenues, further solidifying the market's strategic importance in the global chemical landscape. The market is expected to witness continued consolidation through M&A activities, leading to a more concentrated but highly competitive environment, offering significant opportunities for innovative and sustainability-focused players.

Asia-Pacific Polymer Emulsion Market Segmentation

-

1. Product Type

- 1.1. Acrylics

- 1.2. Polyurethane (PU) Dispersions

- 1.3. Styrene Butadiene (SB) Latex

- 1.4. Vinyl Acetate

- 1.5. Other Product Types

-

2. Application

- 2.1. Adhesives & Carpet Backing

- 2.2. Paper & Paperboard Coatings

- 2.3. Paints & Coatings

- 2.4. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Indonesia

- 3.6. Vietnam

- 3.7. Malaysia

- 3.8. Rest of Asia-Pacific

Asia-Pacific Polymer Emulsion Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Indonesia

- 6. Vietnam

- 7. Malaysia

- 8. Rest of Asia Pacific

Asia-Pacific Polymer Emulsion Market Regional Market Share

Geographic Coverage of Asia-Pacific Polymer Emulsion Market

Asia-Pacific Polymer Emulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Awareness with Regard to Volatile Organic Compound (VOC); Rising Demand from the Automotive and Construction Industry

- 3.3. Market Restrains

- 3.3.1. ; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Paints and Coatings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Acrylics

- 5.1.2. Polyurethane (PU) Dispersions

- 5.1.3. Styrene Butadiene (SB) Latex

- 5.1.4. Vinyl Acetate

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Adhesives & Carpet Backing

- 5.2.2. Paper & Paperboard Coatings

- 5.2.3. Paints & Coatings

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Indonesia

- 5.3.6. Vietnam

- 5.3.7. Malaysia

- 5.3.8. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Indonesia

- 5.4.6. Vietnam

- 5.4.7. Malaysia

- 5.4.8. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Acrylics

- 6.1.2. Polyurethane (PU) Dispersions

- 6.1.3. Styrene Butadiene (SB) Latex

- 6.1.4. Vinyl Acetate

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Adhesives & Carpet Backing

- 6.2.2. Paper & Paperboard Coatings

- 6.2.3. Paints & Coatings

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Indonesia

- 6.3.6. Vietnam

- 6.3.7. Malaysia

- 6.3.8. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Acrylics

- 7.1.2. Polyurethane (PU) Dispersions

- 7.1.3. Styrene Butadiene (SB) Latex

- 7.1.4. Vinyl Acetate

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Adhesives & Carpet Backing

- 7.2.2. Paper & Paperboard Coatings

- 7.2.3. Paints & Coatings

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Indonesia

- 7.3.6. Vietnam

- 7.3.7. Malaysia

- 7.3.8. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Acrylics

- 8.1.2. Polyurethane (PU) Dispersions

- 8.1.3. Styrene Butadiene (SB) Latex

- 8.1.4. Vinyl Acetate

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Adhesives & Carpet Backing

- 8.2.2. Paper & Paperboard Coatings

- 8.2.3. Paints & Coatings

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Indonesia

- 8.3.6. Vietnam

- 8.3.7. Malaysia

- 8.3.8. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Acrylics

- 9.1.2. Polyurethane (PU) Dispersions

- 9.1.3. Styrene Butadiene (SB) Latex

- 9.1.4. Vinyl Acetate

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Adhesives & Carpet Backing

- 9.2.2. Paper & Paperboard Coatings

- 9.2.3. Paints & Coatings

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Indonesia

- 9.3.6. Vietnam

- 9.3.7. Malaysia

- 9.3.8. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Indonesia Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Acrylics

- 10.1.2. Polyurethane (PU) Dispersions

- 10.1.3. Styrene Butadiene (SB) Latex

- 10.1.4. Vinyl Acetate

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Adhesives & Carpet Backing

- 10.2.2. Paper & Paperboard Coatings

- 10.2.3. Paints & Coatings

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Indonesia

- 10.3.6. Vietnam

- 10.3.7. Malaysia

- 10.3.8. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Vietnam Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Acrylics

- 11.1.2. Polyurethane (PU) Dispersions

- 11.1.3. Styrene Butadiene (SB) Latex

- 11.1.4. Vinyl Acetate

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Adhesives & Carpet Backing

- 11.2.2. Paper & Paperboard Coatings

- 11.2.3. Paints & Coatings

- 11.2.4. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. Indonesia

- 11.3.6. Vietnam

- 11.3.7. Malaysia

- 11.3.8. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Malaysia Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Acrylics

- 12.1.2. Polyurethane (PU) Dispersions

- 12.1.3. Styrene Butadiene (SB) Latex

- 12.1.4. Vinyl Acetate

- 12.1.5. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Adhesives & Carpet Backing

- 12.2.2. Paper & Paperboard Coatings

- 12.2.3. Paints & Coatings

- 12.2.4. Other Applications

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. India

- 12.3.3. Japan

- 12.3.4. South Korea

- 12.3.5. Indonesia

- 12.3.6. Vietnam

- 12.3.7. Malaysia

- 12.3.8. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Asia Pacific Asia-Pacific Polymer Emulsion Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Acrylics

- 13.1.2. Polyurethane (PU) Dispersions

- 13.1.3. Styrene Butadiene (SB) Latex

- 13.1.4. Vinyl Acetate

- 13.1.5. Other Product Types

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Adhesives & Carpet Backing

- 13.2.2. Paper & Paperboard Coatings

- 13.2.3. Paints & Coatings

- 13.2.4. Other Applications

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. India

- 13.3.3. Japan

- 13.3.4. South Korea

- 13.3.5. Indonesia

- 13.3.6. Vietnam

- 13.3.7. Malaysia

- 13.3.8. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Apcotex Industries Limited

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Clariant

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Sumitomo Chemical Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 SETEX (ADPL POLYCHEM)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Asahi Kasei Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 JSR Corporation*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Solvay

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Celanese Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 3M

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 BASF SE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Arkema Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Akzo Nobel N V

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Dow

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Dairen Chemical Corporation

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Wacker Chemie AG

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 Kamsons Chemical Pvt Ltd

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.17 synthomer plc

- 14.2.17.1. Overview

- 14.2.17.2. Products

- 14.2.17.3. SWOT Analysis

- 14.2.17.4. Recent Developments

- 14.2.17.5. Financials (Based on Availability)

- 14.2.1 Apcotex Industries Limited

List of Figures

- Figure 1: Asia-Pacific Polymer Emulsion Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Polymer Emulsion Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 30: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 31: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 32: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 36: Asia-Pacific Polymer Emulsion Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Polymer Emulsion Market?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Asia-Pacific Polymer Emulsion Market?

Key companies in the market include Apcotex Industries Limited, Clariant, Sumitomo Chemical Co Ltd, SETEX (ADPL POLYCHEM), Asahi Kasei Corporation, JSR Corporation*List Not Exhaustive, Solvay, Celanese Corporation, 3M, BASF SE, Arkema Group, Akzo Nobel N V, Dow, Dairen Chemical Corporation, Wacker Chemie AG, Kamsons Chemical Pvt Ltd, synthomer plc.

3. What are the main segments of the Asia-Pacific Polymer Emulsion Market?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Awareness with Regard to Volatile Organic Compound (VOC); Rising Demand from the Automotive and Construction Industry.

6. What are the notable trends driving market growth?

Increasing Demand from Paints and Coatings.

7. Are there any restraints impacting market growth?

; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Polymer Emulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Polymer Emulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Polymer Emulsion Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Polymer Emulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence