Key Insights

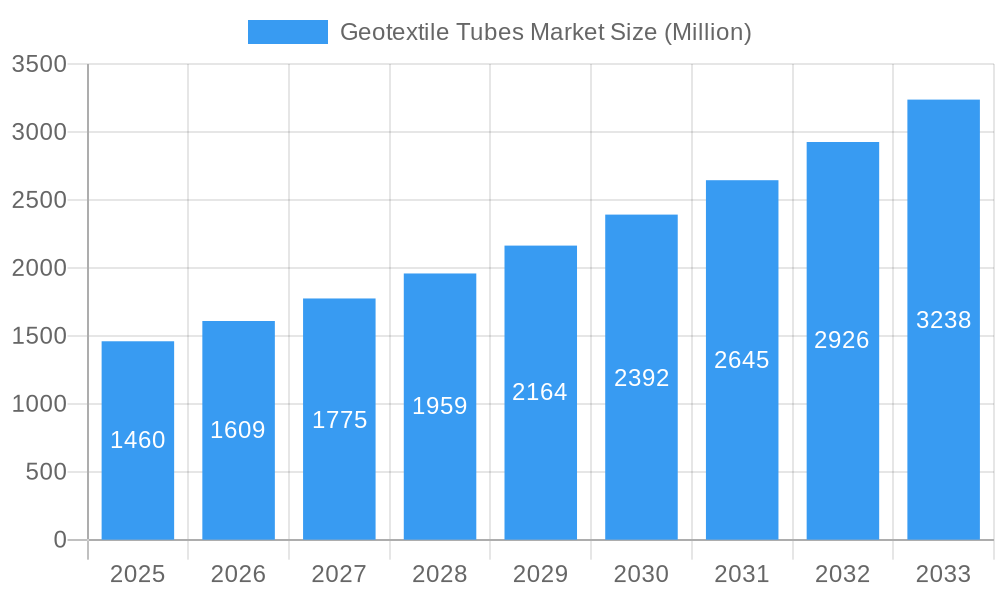

The global Geotextile Tubes market is poised for significant expansion, projected to reach an estimated $1,460 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 10.34%. This impressive growth trajectory is fueled by an increasing global emphasis on sustainable infrastructure development and environmental protection. Key market drivers include the rising demand for effective erosion control solutions in coastal areas and riverbanks, the expanding use of geotextile tubes in road construction and pavement repair for enhanced stability and longevity, and the growing adoption of these products in drainage systems to manage water runoff efficiently. Furthermore, the agricultural sector is increasingly recognizing the benefits of geotextile tubes for soil stabilization and water management, contributing to overall market momentum. Emerging economies, particularly in the Asia Pacific region, are expected to be major contributors to this growth due to substantial investments in infrastructure projects and a greater awareness of environmental challenges.

Geotextile Tubes Market Market Size (In Billion)

The market is segmented by material, type, and application, with Polypropylene and Polyester dominating the material segment, and Woven and Non-woven types holding significant market share. Road construction and pavement repair, along with erosion control, represent the leading application areas. Despite the optimistic outlook, certain restraints such as the initial cost of installation and the availability of alternative solutions in specific niche applications might pose challenges. However, continuous innovation in geotextile materials and manufacturing processes, coupled with the inherent environmental benefits and cost-effectiveness of geotextile tubes over traditional methods, are expected to outweigh these limitations. Leading companies are actively engaged in research and development to enhance product performance and expand their global footprint, further solidifying the market's growth potential. The forecast period from 2025 to 2033 is anticipated to witness sustained demand, driven by governmental regulations promoting eco-friendly construction practices and increasing awareness of the long-term economic and environmental advantages offered by geotextile tube solutions.

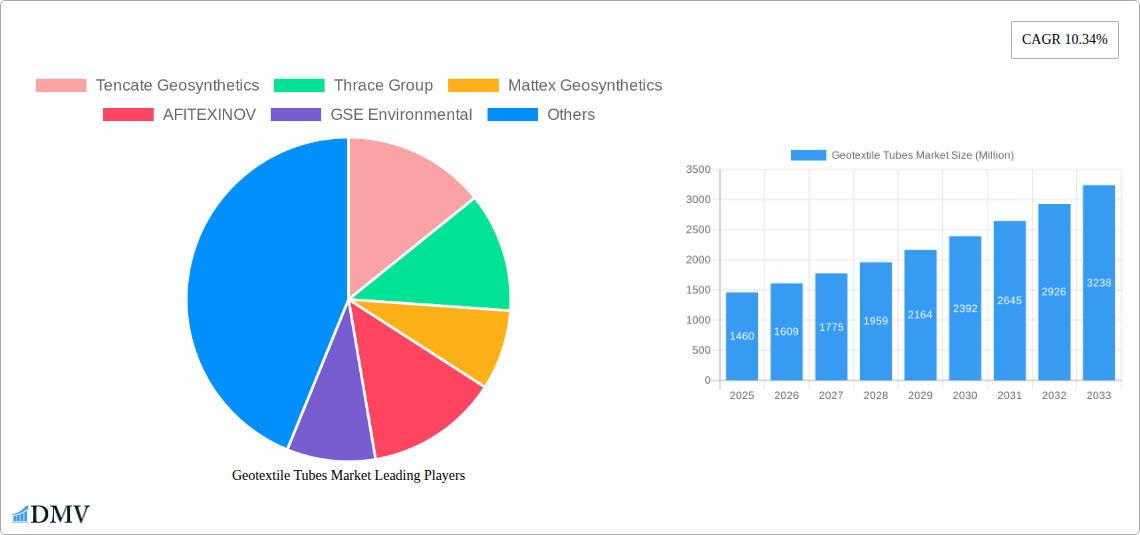

Geotextile Tubes Market Company Market Share

Unlock unparalleled insights into the global Geotextile Tubes Market with this definitive research report. Covering the extensive historical period of 2019–2024 and projecting growth through 2033, this report provides critical data for stakeholders seeking to capitalize on the burgeoning demand for advanced erosion control, civil engineering, and infrastructure solutions. Dive deep into market dynamics, technological advancements, and emerging opportunities, guided by expert analysis and precise data. The base year is 2025, with the estimated year also being 2025, setting a clear benchmark for the forecast period of 2025–2033. This report is an essential tool for understanding market composition, industry evolution, and strategic growth imperatives in the geotextile market.

Geotextile Tubes Market Market Composition & Trends

The geotextile tubes market exhibits a dynamic composition, driven by a concentrated presence of key players and continuous innovation. Market share distribution is influenced by a blend of established manufacturers and emerging innovators, with strategic acquisitions playing a significant role in shaping the competitive landscape. For instance, the February 2024 acquisition of a majority stake in Officine Maccaferri by Ambienta SGR SpA underscores the robust M&A activity, aiming to consolidate market position and leverage synergies. Innovation catalysts range from developing sustainable materials to enhancing product durability and application versatility. Regulatory landscapes, particularly those focused on environmental protection and infrastructure development, significantly impact market entry and product adoption. Substitute products, though present, often fall short in offering the specialized performance and cost-effectiveness of geotextile tubes for demanding applications like erosion control and coastal defense. End-user profiles are diverse, spanning governmental agencies, construction firms, mining operations, and agricultural entities.

- Market Concentration: Characterized by a mix of large, established manufacturers and specialized regional players.

- Innovation Drivers: Focus on high-strength synthetic fibers, improved permeability, and extended service life.

- M&A Activities: Significant consolidation driven by private equity and strategic partnerships, with deal values impacting market valuations.

- Regulatory Impact: Stringent environmental regulations and infrastructure spending boost demand for geosynthetic solutions.

- End-User Demand: Driven by large-scale infrastructure projects, environmental remediation efforts, and sustainable land management practices.

Geotextile Tubes Market Industry Evolution

The geotextile tubes market has witnessed remarkable evolution, transforming from niche applications to indispensable components in modern civil engineering and environmental management. The industry's growth trajectory is characterized by a consistent upward trend, fueled by increasing global investment in infrastructure development and a growing awareness of sustainable environmental practices. Over the historical period of 2019–2024, advancements in polymer science and manufacturing technologies have led to the development of geotextile tubes with enhanced tensile strength, improved durability, and greater resistance to environmental degradation. This evolution directly correlates with a significant increase in the adoption of geotextile tubes for a widening array of applications, from robust coastal protection systems and riverbank stabilization to effective containment solutions for dredged materials and industrial waste.

Technological advancements have been pivotal, with the introduction of advanced weaving, non-woven, and knitting techniques enabling the production of geotextile tubes tailored to specific performance requirements. These innovations have not only improved the functional capabilities of the products—such as superior dewatering efficiency and sediment retention—but have also contributed to cost efficiencies in installation and long-term maintenance. Shifting consumer demands, particularly from governmental bodies and large construction firms, are increasingly prioritizing environmentally friendly and sustainable construction materials. Geotextile tubes align perfectly with this demand, offering a means to mitigate erosion, stabilize soil, and manage water resources with minimal ecological impact. The forecast period of 2025–2033 is expected to see this trend intensify, with greater emphasis on biodegradable and recycled material-based geotextiles.

Specific data points highlight this growth: The October 2022 investment of USD 24.5 million by Owens Corning in expanding its non-woven geotextile production exemplifies the capital being injected into expanding manufacturing capacities to meet rising demand. The July 2022 development of novel geotextile container systems by Huesker Group for erosion control in coastal areas showcases the innovative solutions being brought to market. Furthermore, the acquisition of Geotexan SA by BontexGeo Group in March 2022 signals a strategic consolidation within the European geosynthetics sector, indicating a robust market outlook and the pursuit of expanded market share. As infrastructure projects worldwide continue to expand, and environmental concerns gain prominence, the geotextile tubes market is poised for sustained high growth, with adoption rates projected to accelerate.

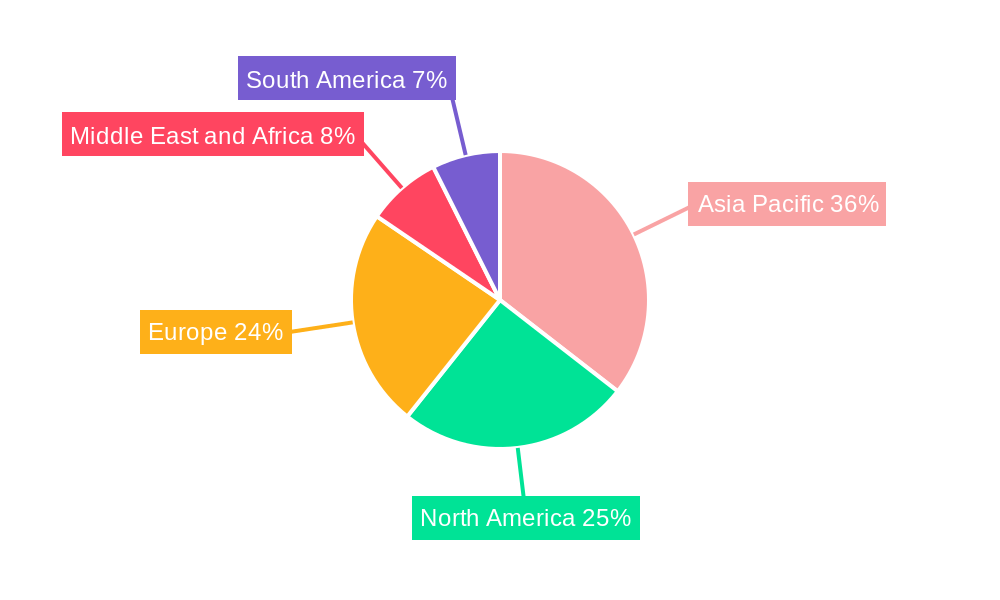

Leading Regions, Countries, or Segments in Geotextile Tubes Market

The global geotextile tubes market is a complex ecosystem, with dominance varying across different segments, regions, and material types. Analysis reveals that Asia Pacific consistently emerges as a leading region, driven by rapid industrialization, extensive infrastructure development, and significant government investments in flood control and coastal protection projects. Within this region, countries like China, India, and Southeast Asian nations are major consumers and producers of geotextile tubes.

The Polypropylene (PP) segment, within the Material type, holds a commanding share. Its widespread availability, excellent tensile strength, and resistance to UV degradation and chemical attack make it the preferred choice for most applications, especially in challenging environmental conditions.

In terms of Type, Woven geotextile tubes often lead due to their high tensile strength and dimensional stability, which are crucial for applications requiring robust soil reinforcement and containment. However, Non-woven geotextile tubes are gaining traction, particularly in applications where filtration and drainage are paramount.

The Road Construction and Pavement Repair application segment is a significant driver of market growth. The increasing need for durable and cost-effective road infrastructure, especially in emerging economies, fuels the demand for geotextile tubes in sub-base stabilization, embankment construction, and pavement reinforcement. Erosion control, including coastal defense and riverbank stabilization, represents another substantial application, directly benefiting from the environmental protection mandates and the need to mitigate natural disasters.

- Dominant Region: Asia Pacific leads due to massive infrastructure projects and government initiatives for disaster mitigation and coastal defense.

- Key Material Segment: Polypropylene (PP) is dominant owing to its superior strength, durability, and cost-effectiveness.

- Leading Type: Woven geotextile tubes are favored for their high tensile strength and stability in reinforcement applications.

- Primary Application: Road construction and pavement repair drive significant demand, supported by global infrastructure development.

- Emerging Application: Erosion control, particularly in coastal and riparian zones, is a rapidly growing segment driven by climate change adaptation efforts.

- Investment Trends: Substantial foreign direct investment in infrastructure in emerging economies is a key growth enabler.

- Regulatory Support: Favorable government policies promoting the use of geosynthetics in infrastructure and environmental projects are critical.

- Technological Advancements: Innovations in material science and manufacturing processes are continually enhancing product performance and expanding application scope.

Geotextile Tubes Market Product Innovations

Product innovations in the geotextile tubes market are intensely focused on enhancing performance metrics and expanding application versatility. Manufacturers are developing advanced geotextile tubes with higher tensile strength, superior UV resistance, and improved puncture resistance, crucial for long-term durability in harsh environments. Innovations include the development of multi-layered tubes offering combined filtration and separation functions, as well as specialized coatings that enhance abrasion resistance. Furthermore, there's a growing emphasis on sustainable materials, with research into recycled content and biodegradable alternatives to meet growing environmental demands. For instance, the development of novel membrane systems by Asahi Kasei Advance Corporation for dehydrating organic solvents, while not directly a geotextile tube, signifies the broader innovation drive within material science that can influence future geotextile tube design.

Propelling Factors for Geotextile Tubes Market Growth

The geotextile tubes market is propelled by a confluence of powerful factors. A primary driver is the escalating global investment in infrastructure projects, particularly in developing economies, encompassing roads, bridges, and railway networks, where geotextile tubes are vital for soil stabilization and reinforcement. Increasing environmental consciousness and stringent regulations mandating erosion control and sustainable land management practices are also significant growth catalysts. Technological advancements in polymer science and manufacturing processes continue to yield higher-performing, more durable, and cost-effective geotextile tubes, expanding their applicability. Furthermore, the growing need for effective containment solutions for dredged materials and industrial waste, coupled with the increasing frequency of extreme weather events necessitating robust coastal and riverbank protection, are crucial growth stimulants.

Obstacles in the Geotextile Tubes Market Market

Despite its robust growth, the geotextile tubes market faces several obstacles. Fluctuations in raw material prices, particularly for polypropylene and polyester, can impact manufacturing costs and product pricing, affecting market stability. Stringent and evolving environmental regulations in some regions, while a growth driver, can also create compliance challenges and increase operational costs for manufacturers. Intense competition among a multitude of players, including established global giants and smaller regional manufacturers, leads to price pressures and limits profit margins. Supply chain disruptions, as witnessed in recent global events, can affect the availability of raw materials and finished products, impacting project timelines and delivery schedules. Furthermore, a lack of widespread awareness and technical understanding of geotextile tube benefits among certain end-users can hinder adoption in nascent markets.

Future Opportunities in Geotextile Tubes Market

The geotextile tubes market is ripe with future opportunities. The increasing focus on climate change adaptation and mitigation presents significant prospects, particularly for coastal protection, flood defense, and riverbank stabilization projects. Emerging economies, with their ongoing infrastructure development boom, offer vast untapped potential for market penetration. The growing demand for sustainable construction materials is driving innovation in biodegradable and recycled geotextile tubes, creating a niche for environmentally conscious products. Moreover, advancements in geotextile tube design for specialized applications, such as in landfill lining, mining operations, and agricultural water management, are opening new avenues for growth. The development of smart geotextiles with integrated sensors for real-time monitoring of soil conditions also represents a frontier for innovation.

Major Players in the Geotextile Tubes Market Ecosystem

- Tencate Geosynthetics

- Thrace Group

- Mattex Geosynthetics

- AFITEXINOV

- GSE Environmental

- Officine Maccaferri SpA

- Owens Corning

- Carthage Mills Inc

- Kaytech

- Low & Bonar

- Swicofil AG

- Naue GmbH & Co KG

- Asahi Kasei Advance Corporation

- AGRU AMERICA INC

- TYPAR Geosynthetics

- Fibertex Nonwovens AS (Schouw & Co)

- HUESKER

Key Developments in Geotextile Tubes Market Industry

- February 2024: Ambienta SGR SpA announced the acquisition of a majority stake in Officine Maccaferri to hold a majority stake in the company. The transaction is expected to close in Q2 2024, signifying strategic consolidation and investment.

- February 2024: The HUESKER Group announced its new subsidiary in South Africa to strengthen its commitment in the country, aiming to target new customers and expand existing business relationships, indicating geographic expansion and market penetration efforts.

- December 2023: Asahi Kasei Advance Corporation announced the development of a novel membrane system for dehydrating organic solvents for pharmaceutical applications without the application of heat or pressure, highlighting material science innovation with potential cross-application benefits.

- October 2022: Owens Corning, a global building and construction materials leader, expanded its non-woven geotextile production in Arkansas with an investment of USD 24.5 million. This expansion broadened the company's portfolio and contributed to its market value, demonstrating capacity growth.

- July 2022: Huesker Group offered novel solutions to reduce the risk of erosion for transport infrastructure located in coastal areas. The company developed geotextile container systems that feature large-format tubes and bags, showcasing product development for critical environmental challenges.

- March 2022: BontexGeo Group, an industry leader in Europe that specializes in the sale and production of geosynthetics for civil engineering applications, acquired 100% of the shares of Minas de Riotinto, Huelva (ES)-based company Geotexan SA, specialized in the production and sale of geosynthetics and fibers with a strong market position in Spain, indicating market consolidation and expansion.

Strategic Geotextile Tubes Market Market Forecast

The geotextile tubes market is poised for substantial growth through 2033, driven by an increasing global demand for sustainable infrastructure solutions and robust environmental protection measures. Anticipated growth catalysts include ongoing urbanization, leading to increased construction of resilient infrastructure, and heightened governmental focus on mitigating the impacts of climate change through coastal defense and flood control projects. Emerging economies in Asia and Africa will represent significant expansion territories due to their burgeoning infrastructure needs. Technological advancements in material science, leading to more durable, cost-effective, and environmentally friendly geotextile tubes, will further fuel market adoption. The strategic importance of geotextile tubes in geotechnical engineering, combined with their cost-efficiency and environmental benefits, solidifies their role in shaping future construction and environmental management practices.

Geotextile Tubes Market Segmentation

-

1. Material

- 1.1. Polypropylene

- 1.2. Polyester

- 1.3. Polyethylene

- 1.4. Other Materials

-

2. Type

- 2.1. Woven

- 2.2. Non-woven

- 2.3. Knitted

- 2.4. Other Types

-

3. Application

- 3.1. Road Construction and Pavement Repair

- 3.2. Erosion

- 3.3. Drainage

- 3.4. Railworks

- 3.5. Agriculture

- 3.6. Other Applications

Geotextile Tubes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Thailand

- 1.6. Malaysia

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. NORDIC

- 3.7. Spain

- 3.8. Turkey

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. United Arab Emirates

- 5.4. Qatar

- 5.5. Nigeria

- 5.6. Egypt

- 5.7. Rest of Middle East and Africa

Geotextile Tubes Market Regional Market Share

Geographic Coverage of Geotextile Tubes Market

Geotextile Tubes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage of Geotextiles in Construction Industry; Increase Usage of Geotextiles in Mining Activities; Stringent Regulatory Framework for Environmental Protection

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand in Road Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polypropylene

- 5.1.2. Polyester

- 5.1.3. Polyethylene

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Woven

- 5.2.2. Non-woven

- 5.2.3. Knitted

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Road Construction and Pavement Repair

- 5.3.2. Erosion

- 5.3.3. Drainage

- 5.3.4. Railworks

- 5.3.5. Agriculture

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polypropylene

- 6.1.2. Polyester

- 6.1.3. Polyethylene

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Woven

- 6.2.2. Non-woven

- 6.2.3. Knitted

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Road Construction and Pavement Repair

- 6.3.2. Erosion

- 6.3.3. Drainage

- 6.3.4. Railworks

- 6.3.5. Agriculture

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polypropylene

- 7.1.2. Polyester

- 7.1.3. Polyethylene

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Woven

- 7.2.2. Non-woven

- 7.2.3. Knitted

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Road Construction and Pavement Repair

- 7.3.2. Erosion

- 7.3.3. Drainage

- 7.3.4. Railworks

- 7.3.5. Agriculture

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polypropylene

- 8.1.2. Polyester

- 8.1.3. Polyethylene

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Woven

- 8.2.2. Non-woven

- 8.2.3. Knitted

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Road Construction and Pavement Repair

- 8.3.2. Erosion

- 8.3.3. Drainage

- 8.3.4. Railworks

- 8.3.5. Agriculture

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polypropylene

- 9.1.2. Polyester

- 9.1.3. Polyethylene

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Woven

- 9.2.2. Non-woven

- 9.2.3. Knitted

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Road Construction and Pavement Repair

- 9.3.2. Erosion

- 9.3.3. Drainage

- 9.3.4. Railworks

- 9.3.5. Agriculture

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Polypropylene

- 10.1.2. Polyester

- 10.1.3. Polyethylene

- 10.1.4. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Woven

- 10.2.2. Non-woven

- 10.2.3. Knitted

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Road Construction and Pavement Repair

- 10.3.2. Erosion

- 10.3.3. Drainage

- 10.3.4. Railworks

- 10.3.5. Agriculture

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tencate Geosynthetics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thrace Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mattex Geosynthetics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AFITEXINOV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GSE Environmental

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Officine Maccaferri SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Owens Corning

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Carthage Mills Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kaytech

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Low & Bonar

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Swicofil AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Naue GmbH & Co KG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Asahi Kasei Advance Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AGRU AMERICA INC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 TYPAR Geosynthetics*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Fibertex Nonwovens AS (Schouw & Co )

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 HUESKER

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Tencate Geosynthetics

List of Figures

- Figure 1: Global Geotextile Tubes Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 3: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 5: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 11: North America Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: North America Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 13: North America Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 27: South America Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: South America Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Geotextile Tubes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Thailand Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Vietnam Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 19: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: United States Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Canada Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 26: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Germany Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Italy Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Russia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: NORDIC Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Turkey Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 39: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Brazil Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Argentina Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Colombia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 47: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 49: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Saudi Arabia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: South Africa Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Arab Emirates Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Qatar Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Nigeria Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Egypt Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Geotextile Tubes Market?

The projected CAGR is approximately 10.34%.

2. Which companies are prominent players in the Geotextile Tubes Market?

Key companies in the market include Tencate Geosynthetics, Thrace Group, Mattex Geosynthetics, AFITEXINOV, GSE Environmental, Officine Maccaferri SpA, Owens Corning, Carthage Mills Inc, Kaytech, Low & Bonar, Swicofil AG, Naue GmbH & Co KG, Asahi Kasei Advance Corporation, AGRU AMERICA INC, TYPAR Geosynthetics*List Not Exhaustive, Fibertex Nonwovens AS (Schouw & Co ), HUESKER.

3. What are the main segments of the Geotextile Tubes Market?

The market segments include Material, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage of Geotextiles in Construction Industry; Increase Usage of Geotextiles in Mining Activities; Stringent Regulatory Framework for Environmental Protection.

6. What are the notable trends driving market growth?

Increasing Demand in Road Construction.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2024: Ambienta SGR SpA announced the acquisition of a majority stake in Officine Maccaferri to hold a majority stake in the company. The transaction is expected to close in Q2 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Geotextile Tubes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Geotextile Tubes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Geotextile Tubes Market?

To stay informed about further developments, trends, and reports in the Geotextile Tubes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence