Key Insights

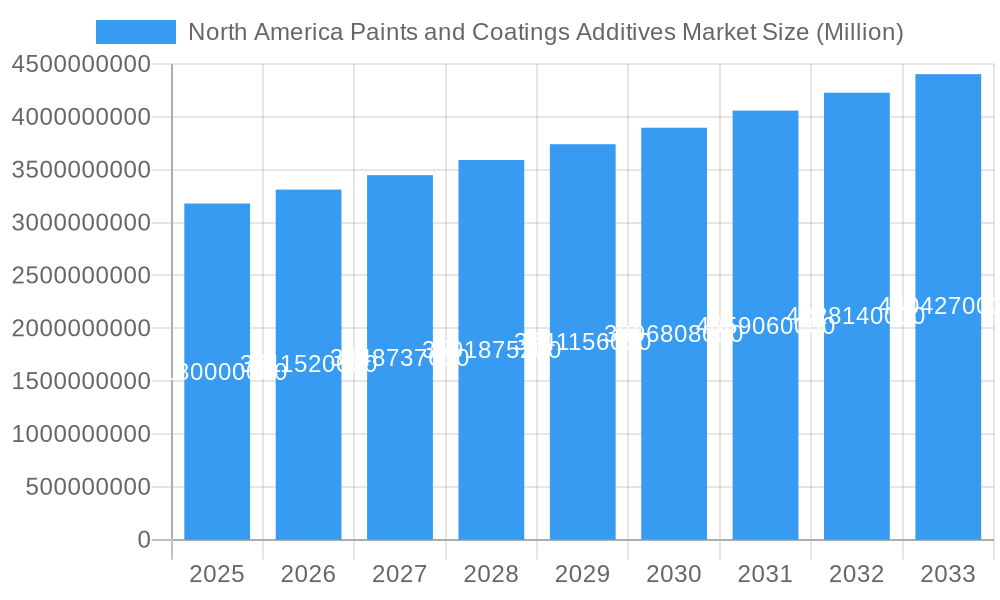

The North America Paints and Coatings Additives Market is poised for robust growth, projected to reach USD 3.18 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This expansion is fueled by escalating demand across key application segments, particularly architectural coatings, driven by ongoing construction and renovation activities. The transportation sector also presents a significant growth avenue, with increasing adoption of advanced coatings for enhanced durability and aesthetic appeal. Biocides, dispersants, wetting agents, and rheology modifiers are expected to dominate the type segments, as manufacturers continuously innovate to improve paint performance, stability, and application properties. The increasing emphasis on sustainable and eco-friendly coating solutions is also a major driving force, pushing for the development and adoption of advanced additives that meet stringent environmental regulations.

North America Paints and Coatings Additives Market Market Size (In Billion)

The market's trajectory is further bolstered by significant investments in research and development by leading global players such as BASF SE, Dow, and Eastman Chemical Company. These companies are focused on introducing novel additives that offer superior functionality, such as improved scratch resistance, UV protection, and self-cleaning properties. While the market exhibits strong growth potential, potential restraints include fluctuating raw material prices and the complexity of regulatory frameworks across different regions within North America. However, the overall outlook remains highly positive, with opportunities in the growing demand for high-performance coatings in industrial applications and a sustained need for protective coatings across various infrastructure projects. The continuous innovation in additive technology to meet evolving performance and sustainability requirements will be critical for sustained market success.

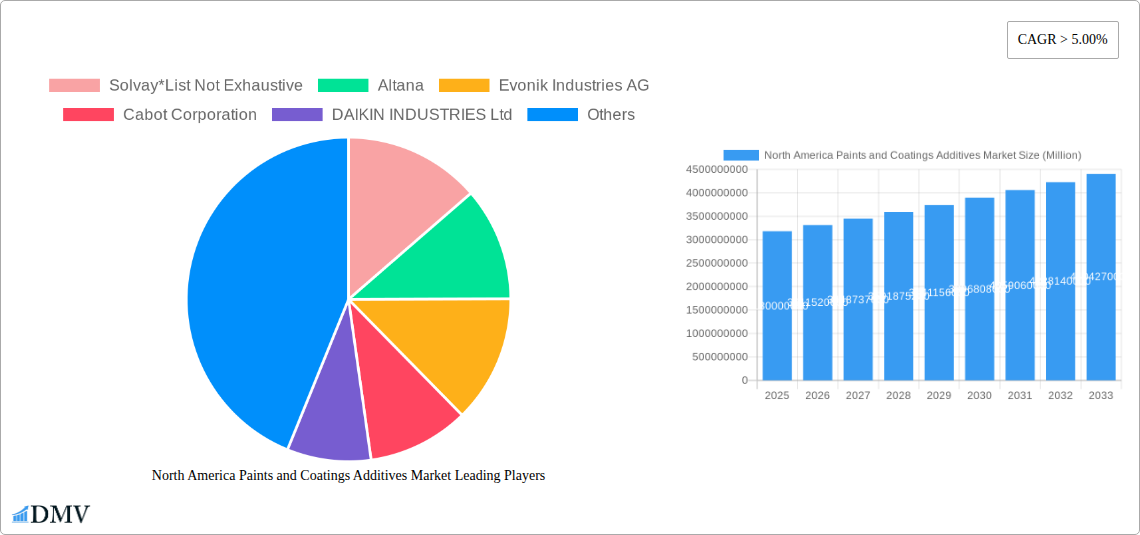

North America Paints and Coatings Additives Market Company Market Share

North America Paints and Coatings Additives Market Market Composition & Trends

The North America paints and coatings additives market is characterized by a moderate to high concentration, with key players like BASF SE, Dow, and Evonik Industries AG holding significant shares. Innovation remains a crucial catalyst, driven by the demand for sustainable, high-performance, and low-VOC (Volatile Organic Compound) additives. Stringent environmental regulations, particularly concerning biocides and solvent-based coatings, are reshaping product development and encouraging the adoption of eco-friendly alternatives. The market's competitive landscape is further influenced by the availability of substitute products, such as advanced resin technologies and innovative application techniques that reduce the reliance on certain traditional additives.

End-user profiles are diverse, spanning the architectural, wood, transportation, and protective coatings sectors. Architectural coatings, driven by residential and commercial construction, represent a substantial application segment. The transportation sector, with its demand for high-durability and aesthetically pleasing finishes, is another key consumer. M&A activities have played a pivotal role in market consolidation and expansion, with notable transactions focusing on acquiring specialized additive technologies or expanding geographical reach. For instance, acquisitions aimed at bolstering portfolios in rheology modifiers and dispersants have been observed. The overall market is projected to reach an estimated value of USD XX billion by 2025, with a compound annual growth rate (CAGR) of approximately X.X% during the forecast period.

- Market Share Distribution: Leading players collectively command over 60% of the market share.

- M&A Deal Values: Recent M&A activities have ranged from tens of millions to over a billion dollars, indicating strategic consolidation and investment in key technologies.

- Regulatory Impact: Environmental Protection Agency (EPA) regulations and similar mandates in Canada and Mexico are driving innovation in green chemistry for coatings.

- Key Innovation Areas: Focus on water-borne additives, UV-curable additives, and functional additives that enhance scratch resistance and self-healing properties.

North America Paints and Coatings Additives Market Industry Evolution

The North America paints and coatings additives market has witnessed a dynamic evolution, driven by a confluence of technological advancements, shifting consumer preferences, and an increasingly stringent regulatory environment. Over the historical period from 2019 to 2024, the market experienced steady growth, fueled by the robust demand from the construction and automotive sectors. The base year of 2025 marks a significant point, with the market valued at an estimated USD XX billion. Throughout the study period, from 2019 to 2033, the trajectory of this market is projected to be upward, underpinned by a projected CAGR of X.X% during the forecast period of 2025–2033. This sustained growth is largely attributable to the relentless pursuit of enhanced performance, durability, and aesthetic appeal in paints and coatings, which in turn drives the demand for specialized additives.

Technological advancements have been instrumental in shaping this evolution. The development of novel rheology modifiers has allowed for better application properties and improved sag resistance. Innovations in dispersants and wetting agents have led to enhanced pigment dispersion, resulting in more vibrant and uniform colors. The increasing focus on sustainability has spurred the development of biocides that are more environmentally friendly and flow and leveling additives that reduce VOC emissions. Furthermore, the rise of smart coatings and functional coatings, such as self-cleaning or anti-microbial surfaces, necessitates the incorporation of highly specialized surface modifiers and stabilizers. Consumer demands are also playing a crucial role. Homeowners and businesses are increasingly seeking coatings that offer longer lifespans, better protection against environmental factors, and improved indoor air quality, all of which are directly influenced by the types and quality of additives used. The automotive industry's push for lighter, more fuel-efficient vehicles has also led to a demand for advanced coating systems that provide superior protection and aesthetic finish with reduced weight, a requirement that additives help fulfill. The market is thus moving towards additive solutions that offer multi-functional benefits, improving not just the visual appeal but also the protective capabilities and overall sustainability of the final coating product. The adoption of digital technologies in manufacturing and R&D is also accelerating the development and deployment of new additive formulations, making the market more agile and responsive to evolving needs.

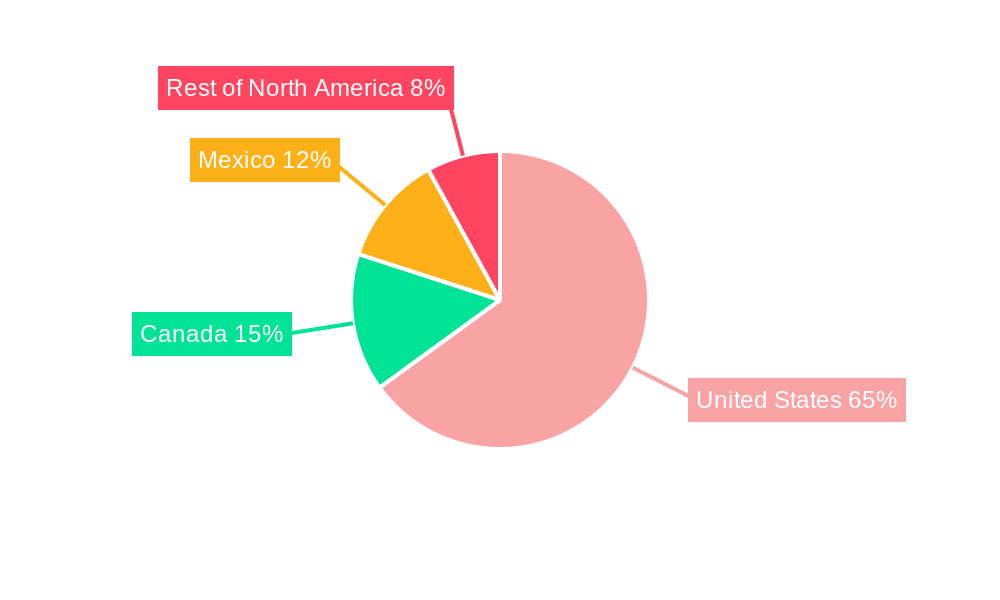

Leading Regions, Countries, or Segments in North America Paints and Coatings Additives Market

The North America paints and coatings additives market demonstrates clear regional dominance and segment leadership, driven by robust industrial activity, significant construction investments, and evolving regulatory landscapes. Within North America, the United States consistently emerges as the leading region, accounting for a substantial share of the market’s revenue and consumption. This dominance is attributed to its large industrial base, high disposable incomes driving demand for premium architectural coatings, and a thriving automotive manufacturing sector. Canada and Mexico, while smaller markets, also contribute significantly, with Mexico showing particularly strong growth potential due to its expanding manufacturing capabilities and infrastructure development.

Examining the segments, architectural applications represent the largest and fastest-growing application segment. This is propelled by ongoing residential and commercial construction projects, renovation and refurbishment activities, and a growing consumer preference for aesthetically pleasing and durable home interiors and exteriors. The United States' extensive real estate market, coupled with a continuous need for maintenance and upgrades, underpins the strength of this segment. Furthermore, the increasing adoption of DIY (Do-It-Yourself) painting trends and a focus on sustainable building practices are indirectly boosting the demand for specialized additives that enhance ease of application, durability, and low-VOC formulations.

From a product type perspective, rheology modifiers and dispersants and wetting agents are critical for achieving desired application properties and optimal pigment dispersion across various coating types. Their widespread use in both architectural and industrial coatings makes them indispensable. However, the rising emphasis on health and environmental safety is significantly driving the growth of biocides, particularly those with reduced toxicity profiles, and flow and leveling additives that contribute to low-VOC formulations. The protective coatings segment, vital for infrastructure, industrial equipment, and marine applications, also exhibits substantial demand for high-performance additives that ensure longevity and resistance to harsh environments.

Dominant Region: United States:

- Investment Trends: Significant investments in infrastructure renewal, residential construction, and manufacturing facilities.

- Regulatory Support: Favorable regulatory framework for certain additive types, coupled with increasing demand for eco-friendly solutions.

- End-User Demand: High consumer spending on home improvement and a strong automotive aftermarket.

Leading Application Segment: Architectural:

- Key Drivers: Growth in new construction and renovation projects, increasing consumer awareness of aesthetics and durability.

- Innovation Focus: Development of water-borne, low-VOC, and easy-to-apply additives for interior and exterior paints.

- Market Dynamics: Continuous demand driven by urbanization and a rising standard of living.

Key Product Segments:

- Rheology Modifiers: Essential for controlling viscosity and application characteristics in paints and coatings.

- Dispersants and Wetting Agents: Crucial for achieving uniform pigment distribution and enhancing color brilliance.

- Biocides: Increasingly important for preserving coatings and preventing microbial degradation, with a trend towards eco-friendly options.

North America Paints and Coatings Additives Market Product Innovations

Product innovation within the North America paints and coatings additives market is largely driven by the dual imperatives of enhanced performance and environmental sustainability. Manufacturers are actively developing novel additive chemistries that offer superior functionality while adhering to increasingly stringent regulatory standards. For instance, advancements in rheology modifiers are enabling coatings with better sag resistance and improved flow characteristics, leading to smoother finishes and easier application. Dispersants and wetting agents are being engineered for greater efficiency, allowing for lower additive loading and improved color development in complex pigment systems. The demand for low-VOC and waterborne coatings is also spurring innovation in biocides and defoamers that are effective without compromising environmental profiles. Unique selling propositions often lie in multi-functional additives that can simultaneously improve scratch resistance, UV stability, and adhesion, reducing the overall number of additives required in a formulation.

Propelling Factors for North America Paints and Coatings Additives Market Growth

The growth of the North America paints and coatings additives market is propelled by several key factors. Technological advancements in additive formulation are leading to higher performance, greater durability, and enhanced aesthetic qualities in paints and coatings. The increasing demand for sustainable and eco-friendly coatings, driven by consumer awareness and regulatory pressures, is a significant growth catalyst, favoring low-VOC additives and waterborne systems. Furthermore, robust activity in the construction and automotive industries, both major end-users of paints and coatings, directly translates to increased demand for additives. Government initiatives promoting energy efficiency and infrastructure development also contribute to market expansion.

Obstacles in the North America Paints and Coatings Additives Market Market

Despite its growth potential, the North America paints and coatings additives market faces several obstacles. Stringent environmental regulations concerning VOC emissions and the use of certain chemicals can increase compliance costs and necessitate product reformulation. Fluctuations in raw material prices and availability, particularly for petrochemical-derived components, can impact production costs and supply chain stability. Intense competition among established players and emerging manufacturers can lead to price pressures. Additionally, slow adoption rates of new technologies in some traditional sectors can hinder the market's full growth potential.

Future Opportunities in North America Paints and Coatings Additives Market

The North America paints and coatings additives market presents several promising future opportunities. The growing demand for high-performance coatings in sectors like aerospace, marine, and industrial maintenance offers a significant avenue for growth. The increasing focus on sustainability and circular economy principles will drive the development and adoption of bio-based and recyclable additives. Emerging trends in smart coatings, such as self-healing, anti-microbial, and color-changing functionalities, will create a need for specialized, innovative additive solutions. Furthermore, the expansion of infrastructure projects and the ongoing need for refurbishment across the region will continue to fuel demand for diverse coating applications.

Major Players in the North America Paints and Coatings Additives Market Ecosystem

- Solvay

- Altana

- Evonik Industries AG

- Cabot Corporation

- DAIKIN INDUSTRIES Ltd

- Ashland

- BASF SE

- Arkema Group

- ELEMENTIS PLC

- ALLNEX NETHERLANDS B V

- Akzo Nobel N V

- Dow

- Eastman Chemical Company

- Momentive Specialty Chemicals Inc

- The Lubrizol Corporation

- AGC Inc

- Cytec Industries Inc

Key Developments in North America Paints and Coatings Additives Market Industry

- 2024: Launch of a new series of bio-based rheology modifiers designed for improved sustainability in architectural coatings.

- 2024: Acquisition of a specialized biocides manufacturer by a major chemical company to expand its portfolio for waterborne coatings.

- 2023: Introduction of advanced dispersant technology that significantly enhances pigment stability in high-solids industrial coatings.

- 2023: Strategic partnership formed between a coatings producer and an additive supplier to co-develop next-generation protective coating solutions.

- 2022: Expansion of production capacity for defoamers catering to the growing demand in the North American automotive refinish market.

- 2022: Development of novel surface modifiers offering superior scratch and mar resistance for wood coatings.

- 2021: Merger of two leading additive companies, creating a larger entity with a broader range of product offerings and enhanced market reach.

- 2021: Increased investment in R&D for UV-curable additives driven by the trend towards faster curing times and energy efficiency.

- 2020: Introduction of eco-friendly stabilizers for plastics and coatings, addressing growing environmental concerns.

- 2019: Launch of innovative flow and leveling additives that enable the formulation of ultra-low VOC architectural paints.

Strategic North America Paints and Coatings Additives Market Market Forecast

The strategic forecast for the North America paints and coatings additives market points towards sustained and robust growth, driven by innovation and an increasing demand for high-performance, sustainable solutions. Key growth catalysts include the ongoing advancements in additive technology, enabling coatings with superior durability, enhanced aesthetics, and improved functionality. The persistent push towards eco-friendly and low-VOC formulations, mandated by stringent regulations and favored by consumer preference, will continue to propel the market, particularly for biocides, dispersants, and flow and leveling additives. The strong performance of the construction and automotive sectors, coupled with growing investments in infrastructure and industrial applications, will ensure a consistent demand base. Emerging opportunities in smart coatings and specialized functional additives further brighten the market's future outlook, positioning it for significant expansion in the coming years.

North America Paints and Coatings Additives Market Segmentation

-

1. Type

- 1.1. Biocides

- 1.2. Dispersants and Wetting Agents

- 1.3. Defoamers and Deaerators

- 1.4. Rheology Modifiers

- 1.5. Surface Modifiers

- 1.6. Stabilizers

- 1.7. Flow and Leveling Additives

- 1.8. Other Types

-

2. Application

- 2.1. Architectural

- 2.2. Wood

- 2.3. Transportation

- 2.4. Protective

- 2.5. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Paints and Coatings Additives Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Paints and Coatings Additives Market Regional Market Share

Geographic Coverage of North America Paints and Coatings Additives Market

North America Paints and Coatings Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Environment-Friendly Products; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Environmental Impacts and Regulations; Presence of low quality substitute

- 3.4. Market Trends

- 3.4.1. Architectural Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biocides

- 5.1.2. Dispersants and Wetting Agents

- 5.1.3. Defoamers and Deaerators

- 5.1.4. Rheology Modifiers

- 5.1.5. Surface Modifiers

- 5.1.6. Stabilizers

- 5.1.7. Flow and Leveling Additives

- 5.1.8. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Architectural

- 5.2.2. Wood

- 5.2.3. Transportation

- 5.2.4. Protective

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Biocides

- 6.1.2. Dispersants and Wetting Agents

- 6.1.3. Defoamers and Deaerators

- 6.1.4. Rheology Modifiers

- 6.1.5. Surface Modifiers

- 6.1.6. Stabilizers

- 6.1.7. Flow and Leveling Additives

- 6.1.8. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Architectural

- 6.2.2. Wood

- 6.2.3. Transportation

- 6.2.4. Protective

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Biocides

- 7.1.2. Dispersants and Wetting Agents

- 7.1.3. Defoamers and Deaerators

- 7.1.4. Rheology Modifiers

- 7.1.5. Surface Modifiers

- 7.1.6. Stabilizers

- 7.1.7. Flow and Leveling Additives

- 7.1.8. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Architectural

- 7.2.2. Wood

- 7.2.3. Transportation

- 7.2.4. Protective

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Biocides

- 8.1.2. Dispersants and Wetting Agents

- 8.1.3. Defoamers and Deaerators

- 8.1.4. Rheology Modifiers

- 8.1.5. Surface Modifiers

- 8.1.6. Stabilizers

- 8.1.7. Flow and Leveling Additives

- 8.1.8. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Architectural

- 8.2.2. Wood

- 8.2.3. Transportation

- 8.2.4. Protective

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Paints and Coatings Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Biocides

- 9.1.2. Dispersants and Wetting Agents

- 9.1.3. Defoamers and Deaerators

- 9.1.4. Rheology Modifiers

- 9.1.5. Surface Modifiers

- 9.1.6. Stabilizers

- 9.1.7. Flow and Leveling Additives

- 9.1.8. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Architectural

- 9.2.2. Wood

- 9.2.3. Transportation

- 9.2.4. Protective

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Solvay*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Altana

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Evonik Industries AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cabot Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DAIKIN INDUSTRIES Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ashland

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arkema Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ELEMENTIS PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ALLNEX NETHERLANDS B V

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Akzo Nobel N V

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Dow

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Eastman Chemical Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Momentive Specialty Chemicals Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 The Lubrizol Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 AGC Inc

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Cytec Industries Inc

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Solvay*List Not Exhaustive

List of Figures

- Figure 1: North America Paints and Coatings Additives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Paints and Coatings Additives Market Share (%) by Company 2025

List of Tables

- Table 1: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Paints and Coatings Additives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Paints and Coatings Additives Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the North America Paints and Coatings Additives Market?

Key companies in the market include Solvay*List Not Exhaustive, Altana, Evonik Industries AG, Cabot Corporation, DAIKIN INDUSTRIES Ltd, Ashland, BASF SE, Arkema Group, ELEMENTIS PLC, ALLNEX NETHERLANDS B V, Akzo Nobel N V, Dow, Eastman Chemical Company, Momentive Specialty Chemicals Inc, The Lubrizol Corporation, AGC Inc, Cytec Industries Inc.

3. What are the main segments of the North America Paints and Coatings Additives Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Environment-Friendly Products; Other Drivers.

6. What are the notable trends driving market growth?

Architectural Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Environmental Impacts and Regulations; Presence of low quality substitute.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Paints and Coatings Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Paints and Coatings Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Paints and Coatings Additives Market?

To stay informed about further developments, trends, and reports in the North America Paints and Coatings Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence