Key Insights

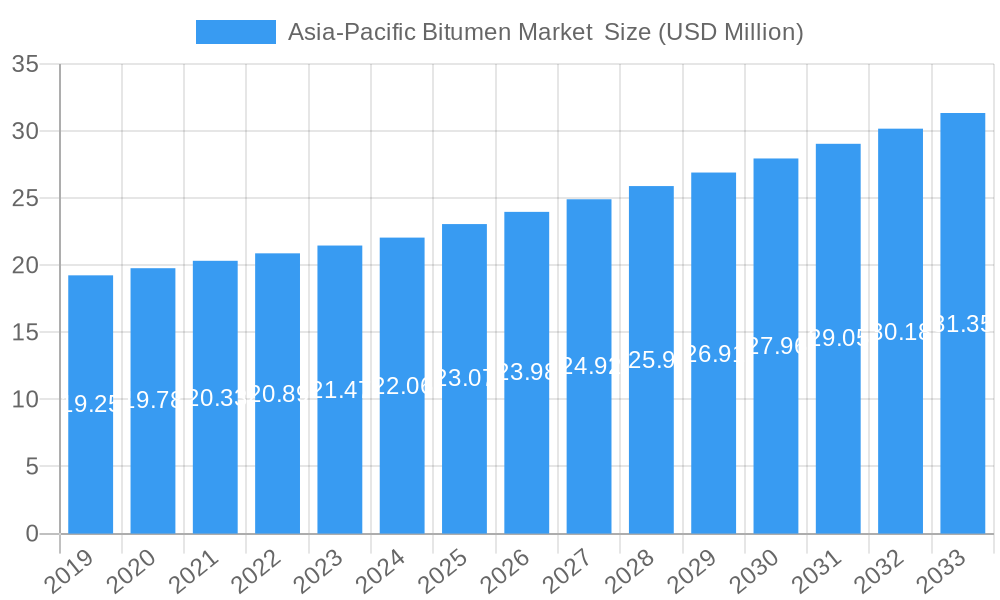

The Asia-Pacific Bitumen Market is poised for substantial growth, projected to reach an estimated USD 23.07 billion in 2025, with a steady Compound Annual Growth Rate (CAGR) of 3.96% expected through 2033. This robust expansion is primarily fueled by significant investments in infrastructure development across the region, particularly in road construction, which remains the dominant application segment. Emerging economies like China and India are at the forefront of this growth, driven by ongoing urbanization, increasing vehicle ownership, and government initiatives to improve transportation networks. The demand for bitumen emulsions and polymer-modified bitumen is also on the rise, indicating a trend towards more durable and environmentally friendly asphalt solutions in construction projects. Furthermore, the waterproofing segment, driven by the burgeoning construction of commercial and residential buildings, is contributing to the market's upward trajectory.

Asia-Pacific Bitumen Market Market Size (In Million)

The market's growth is also being shaped by evolving trends in construction materials and techniques. While traditional paving-grade bitumen continues to hold a significant share, advancements in bitumen technology, such as the increasing adoption of polymer-modified bitumen (PMB) for enhanced performance and longevity, are creating new market opportunities. The market is not without its challenges; fluctuating crude oil prices, which directly impact bitumen production costs, and stringent environmental regulations in some countries can act as restraints. However, the overall outlook remains positive, supported by continuous innovation in bitumen applications and a sustained need for infrastructure upgrades across the diverse Asia-Pacific landscape. Key players in the market are focusing on expanding their production capacities and developing specialized bitumen products to cater to the evolving demands of this dynamic region.

Asia-Pacific Bitumen Market Company Market Share

Here's the SEO-optimized report description for the Asia-Pacific Bitumen Market, crafted for maximum visibility and stakeholder engagement:

This in-depth report provides a comprehensive analysis of the Asia-Pacific Bitumen Market, a critical sector driving infrastructure development across the region. Covering the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this research delves into market dynamics, segmentation, innovation, and future potential. With an estimated market size projected to reach multi-billion dollar valuations, this report is an indispensable resource for manufacturers, suppliers, investors, and policymakers seeking to understand the intricate landscape of the APAC bitumen industry. We meticulously examine key drivers, emerging opportunities, and potential challenges, offering actionable insights for strategic decision-making in this rapidly evolving construction materials market.

Asia-Pacific Bitumen Market Market Composition & Trends

The Asia-Pacific Bitumen Market is characterized by a dynamic interplay of established players and emerging innovators, with market concentration influenced by regional production capacities and demand fluctuations. Key innovation catalysts include advancements in polymer modified bitumen technologies and the development of more sustainable, bitumen emulsion products. Regulatory landscapes vary significantly across countries, impacting product standards and adoption rates, particularly concerning environmental compliance. Substitute products, while present, are yet to fully displace bitumen's dominance in core applications like road construction. End-user profiles range from large-scale government infrastructure projects to smaller private sector construction firms. Mergers and acquisitions (M&A) activities are poised to reshape market share distribution, with estimated M&A deal values in the billions of dollars driving consolidation and strategic expansion. The overall market is witnessing a steady growth trajectory, fueled by significant infrastructure investments.

- Market Concentration: Fragmented with key players holding substantial regional influence.

- Innovation Catalysts: Focus on enhanced durability, eco-friendliness, and specialized applications of bitumen.

- Regulatory Landscape: Evolving standards for emissions and product performance across key economies.

- Substitute Products: Limited impact on core infrastructure applications currently.

- End-User Profiles: Government infrastructure agencies, road construction companies, waterproofing solution providers.

- M&A Activities: Expected to increase as companies seek market consolidation and geographical expansion.

Asia-Pacific Bitumen Market Industry Evolution

The Asia-Pacific Bitumen Market has witnessed a remarkable evolution driven by sustained economic growth, rapid urbanization, and an unprecedented surge in infrastructure development. From 2019 to 2024, the market experienced consistent growth, with projections indicating a compound annual growth rate (CAGR) of approximately 5-7% during the forecast period of 2025-2033. This trajectory is fundamentally shaped by massive government spending on transportation networks, including highways, expressways, and urban road projects, particularly in countries like China and India. Technological advancements have played a pivotal role, with the introduction of advanced polymer modified bitumen (PMB) and bitumen emulsions offering enhanced performance characteristics such as improved durability, flexibility, and resistance to rutting and cracking. These innovations are crucial for extending the lifespan of road infrastructure and reducing maintenance costs. Furthermore, shifting consumer and regulatory demands towards more sustainable construction practices are spurring the development and adoption of eco-friendlier bitumen products and application techniques. Adoption metrics for advanced bitumen products are steadily rising, reflecting their recognized benefits in large-scale projects. The increasing emphasis on resilient infrastructure in the face of extreme weather events also contributes to the demand for high-performance bitumen solutions. The overall market size is projected to expand significantly, reaching several hundred billion dollars by 2033, underscoring the critical role of bitumen in the region's development narrative.

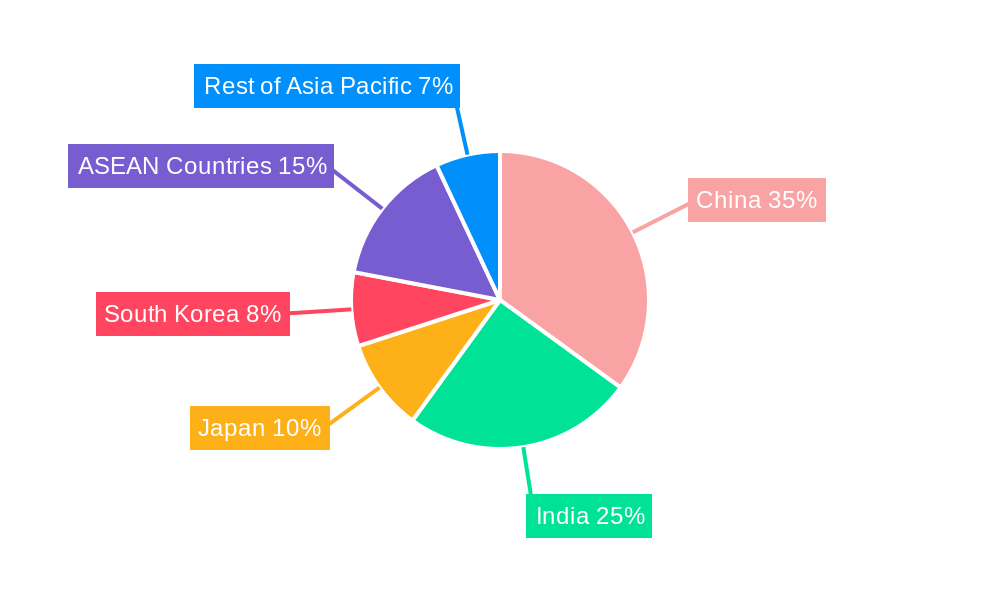

Leading Regions, Countries, or Segments in Asia-Pacific Bitumen Market

The Asia-Pacific Bitumen Market is predominantly led by its key geographical segments and product applications, with China and India emerging as the frontrunners in terms of both consumption and production. These nations, driven by ambitious infrastructure development agendas, account for a significant portion of the market share, estimated to be over 60% combined. The Road Construction application segment is the undisputed leader, absorbing the largest volume of bitumen, driven by extensive highway expansion projects and urban road network upgrades. Within product types, Paving Grade Bitumen remains the most consumed, forming the backbone of asphalt mixes. However, the demand for Polymer Modified Bitumen (PMB) is experiencing a robust growth rate, projected to be higher than the overall market average, due to its superior performance characteristics in demanding road conditions.

Dominant Geographies:

- China: Boasts the largest market share due to its extensive highway network development and rapid urbanization. Significant government investment in transportation infrastructure is a key driver.

- India: Exhibits strong growth potential driven by its 'Bharatmala Pariyojana' and 'Gati Shakti' initiatives, focusing on building multimodal infrastructure. Increasing per capita income and urbanization fuel demand.

Dominant Application:

- Road Construction: This segment is the primary consumer, propelled by ongoing national and regional road network expansion projects. The need for durable and resilient roadways is paramount.

Growth Segment (Product Type):

- Polymer Modified Bitumen (PMB): This segment is witnessing accelerated growth due to its enhanced properties, offering greater resistance to temperature variations, rutting, and fatigue cracking, thus extending pavement life and reducing long-term maintenance costs.

Key Drivers for Dominance:

- Massive Infrastructure Investment: Government-led initiatives for building and upgrading transportation networks.

- Urbanization: Increasing population density in urban centers necessitates improved urban road infrastructure.

- Technological Adoption: Growing awareness and adoption of high-performance bitumen products for better longevity.

- Economic Growth: Sustained economic expansion across the region supports infrastructure spending.

- Regulatory Support: Favorable policies and standards promoting the use of quality bitumen products.

Asia-Pacific Bitumen Market Product Innovations

Product innovation in the Asia-Pacific Bitumen Market is primarily focused on enhancing performance and sustainability. Advances in Polymer Modified Bitumen (PMB) have led to formulations offering superior elasticity, adhesion, and resistance to temperature-induced distress, thereby extending pavement lifespan by an estimated 15-20%. The development of bitumen emulsions is also a key area, providing environmentally friendly alternatives with lower VOC emissions and easier application at lower temperatures. These innovations are crucial for meeting stringent environmental regulations and improving construction efficiency, making them highly sought after for modern infrastructure projects.

Propelling Factors for Asia-Pacific Bitumen Market Growth

The growth of the Asia-Pacific Bitumen Market is propelled by several key factors. Foremost is the continuous and substantial government investment in infrastructure development, particularly road networks, across nations like China, India, and ASEAN countries. This is further amplified by rapid urbanization and increasing vehicle-to-road ratios, necessitating improved and expanded road infrastructure. Technological advancements, such as the widespread adoption of polymer-modified bitumen (PMB) and advanced bitumen emulsions, are enhancing pavement durability and performance, driving demand for higher-quality products. Economic growth across the region supports increased private sector participation in infrastructure projects and boosts consumer spending on transportation. Favorable regulatory policies promoting infrastructure upgrades and quality standards also play a crucial role.

Obstacles in the Asia-Pacific Bitumen Market Market

Despite robust growth, the Asia-Pacific Bitumen Market faces several obstacles. Volatile crude oil prices directly impact bitumen costs, leading to price fluctuations that can affect project budgets and contractor profitability. Stringent and sometimes inconsistent environmental regulations across different countries can pose compliance challenges and necessitate investment in cleaner production technologies. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities in a vast region, can lead to delays and increased costs. Intense competitive pressures from both domestic and international players can put pressure on profit margins. Furthermore, the availability of skilled labor for advanced bitumen applications can be a limiting factor in certain sub-regions, impacting the efficient deployment of new technologies.

Future Opportunities in Asia-Pacific Bitumen Market

The Asia-Pacific Bitumen Market is ripe with future opportunities. The increasing focus on sustainable infrastructure presents a significant opportunity for the growth of eco-friendly bitumen products, such as recycled asphalt pavement (RAP) integration and low-VOC emulsions. Emerging economies within the ASEAN region and the Pacific Islands offer untapped potential for infrastructure development, requiring substantial bitumen volumes. The continued advancement of smart road technologies and the demand for durable, high-performance pavements will drive the adoption of specialized bitumen grades like PMB and warm-mix asphalt (WMA) additives. Furthermore, exploring new applications beyond traditional road construction, such as industrial flooring, roofing membranes, and specialized coatings, can unlock new revenue streams.

Major Players in the Asia-Pacific Bitumen Market Ecosystem

- Marathon Oil Company

- Richmond Group

- Exxon Mobil Corporation

- ASIA Bitumen

- China Petroleum & Chemical Corporation

- Bouygues

- JXTG Nippon Oil & Energy Corporation

- KRATON CORPORATION

- BP PLC

- Indian Oil Corporation Ltd

- RAHA Bitumen Inc

- Icopal ApS

- Shell Plc

Key Developments in Asia-Pacific Bitumen Market Industry

- April 2023: Downer Group commenced an Ammann plant based on the success of its other Ammann plants in Australia. Downer can include up to three different granular additive types in a mix and up to three liquid additives. The facility can vertically store 6,000 tonnes of aggregate and 720 cubic meters of bitumen, enhancing production flexibility and efficiency.

- February 2023: Porner Group is set to construct three new Bitumen production plants for IOCL with its Biturox process in Paradip and Barauni, India. The new plant in Barauni is expected to produce 300 kilotons per annum (KTPA) of bitumen to meet the demand for bitumen products in Eastern India, whereas the new plant in Paradip, Gujarat, is expected to produce 500 KTPA, significantly boosting regional supply and catering to growing demand.

Strategic Asia-Pacific Bitumen Market Market Forecast

The strategic forecast for the Asia-Pacific Bitumen Market points towards continued robust growth, driven by sustained governmental impetus for infrastructure development and the increasing adoption of high-performance, sustainable bitumen solutions. The forecast period of 2025–2033 anticipates a multi-billion dollar market expansion, fueled by technological innovations in polymer-modified bitumen and advanced emulsions that promise greater pavement longevity and environmental compliance. Emerging economies and ongoing urbanization will continue to be significant demand drivers, while strategic investments in production capacity and supply chain optimization by key players will be crucial for meeting this escalating demand. The market is poised for a future characterized by innovation, consolidation, and a strong emphasis on sustainable and resilient infrastructure.

Asia-Pacific Bitumen Market Segmentation

-

1. Product Type

- 1.1. Paving Grade

- 1.2. Hard Grade

- 1.3. Oxidized Grade

- 1.4. Bitumen Emulsions

- 1.5. Polymer Modified Bitumen

- 1.6. Other Pr

-

2. Application

- 2.1. Road Construction

- 2.2. Waterproofing

- 2.3. Adhesives

- 2.4. Other Applications (Coating and Canal Lining)

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Bitumen Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Bitumen Market Regional Market Share

Geographic Coverage of Asia-Pacific Bitumen Market

Asia-Pacific Bitumen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Roadways Network in China and India; Increasing Demand for Waterproofing Applications; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Regarding the Usage of Bitumen; Concrete as a Substitute for Bitumen in Road Construction

- 3.4. Market Trends

- 3.4.1. Road Construction Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Paving Grade

- 5.1.2. Hard Grade

- 5.1.3. Oxidized Grade

- 5.1.4. Bitumen Emulsions

- 5.1.5. Polymer Modified Bitumen

- 5.1.6. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Road Construction

- 5.2.2. Waterproofing

- 5.2.3. Adhesives

- 5.2.4. Other Applications (Coating and Canal Lining)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Paving Grade

- 6.1.2. Hard Grade

- 6.1.3. Oxidized Grade

- 6.1.4. Bitumen Emulsions

- 6.1.5. Polymer Modified Bitumen

- 6.1.6. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Road Construction

- 6.2.2. Waterproofing

- 6.2.3. Adhesives

- 6.2.4. Other Applications (Coating and Canal Lining)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Paving Grade

- 7.1.2. Hard Grade

- 7.1.3. Oxidized Grade

- 7.1.4. Bitumen Emulsions

- 7.1.5. Polymer Modified Bitumen

- 7.1.6. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Road Construction

- 7.2.2. Waterproofing

- 7.2.3. Adhesives

- 7.2.4. Other Applications (Coating and Canal Lining)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Paving Grade

- 8.1.2. Hard Grade

- 8.1.3. Oxidized Grade

- 8.1.4. Bitumen Emulsions

- 8.1.5. Polymer Modified Bitumen

- 8.1.6. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Road Construction

- 8.2.2. Waterproofing

- 8.2.3. Adhesives

- 8.2.4. Other Applications (Coating and Canal Lining)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Paving Grade

- 9.1.2. Hard Grade

- 9.1.3. Oxidized Grade

- 9.1.4. Bitumen Emulsions

- 9.1.5. Polymer Modified Bitumen

- 9.1.6. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Road Construction

- 9.2.2. Waterproofing

- 9.2.3. Adhesives

- 9.2.4. Other Applications (Coating and Canal Lining)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. ASEAN Countries Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Paving Grade

- 10.1.2. Hard Grade

- 10.1.3. Oxidized Grade

- 10.1.4. Bitumen Emulsions

- 10.1.5. Polymer Modified Bitumen

- 10.1.6. Other Pr

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Road Construction

- 10.2.2. Waterproofing

- 10.2.3. Adhesives

- 10.2.4. Other Applications (Coating and Canal Lining)

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Asia Pacific Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Paving Grade

- 11.1.2. Hard Grade

- 11.1.3. Oxidized Grade

- 11.1.4. Bitumen Emulsions

- 11.1.5. Polymer Modified Bitumen

- 11.1.6. Other Pr

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Road Construction

- 11.2.2. Waterproofing

- 11.2.3. Adhesives

- 11.2.4. Other Applications (Coating and Canal Lining)

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Marathon Oil Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Richmond Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Exxon Mobil Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 ASIA Bitumen

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 China Petroleum & Chemical Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bouygues

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 JXTG Nippon Oil & Energy Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 KRATON CORPORATION

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 BP PLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Indian Oil Corporation Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 RAHA Bitumen Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Icopal ApS

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Shell Plc*List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Marathon Oil Company

List of Figures

- Figure 1: Asia-Pacific Bitumen Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Bitumen Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Bitumen Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Bitumen Market ?

The projected CAGR is approximately 3.96%.

2. Which companies are prominent players in the Asia-Pacific Bitumen Market ?

Key companies in the market include Marathon Oil Company, Richmond Group, Exxon Mobil Corporation, ASIA Bitumen, China Petroleum & Chemical Corporation, Bouygues, JXTG Nippon Oil & Energy Corporation, KRATON CORPORATION, BP PLC, Indian Oil Corporation Ltd, RAHA Bitumen Inc, Icopal ApS, Shell Plc*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Bitumen Market ?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Roadways Network in China and India; Increasing Demand for Waterproofing Applications; Other Drivers.

6. What are the notable trends driving market growth?

Road Construction Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Concerns Regarding the Usage of Bitumen; Concrete as a Substitute for Bitumen in Road Construction.

8. Can you provide examples of recent developments in the market?

April 2023: Downer Group commenced an Ammann plant based on the success of its other Ammann plants in Australia. Downer can include up to three different granular additive types in a mix and up to three liquid additives. The facility can vertically store 6,000 tonnes of aggregate and 720 cubic meters of bitumen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Bitumen Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Bitumen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Bitumen Market ?

To stay informed about further developments, trends, and reports in the Asia-Pacific Bitumen Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence