Key Insights

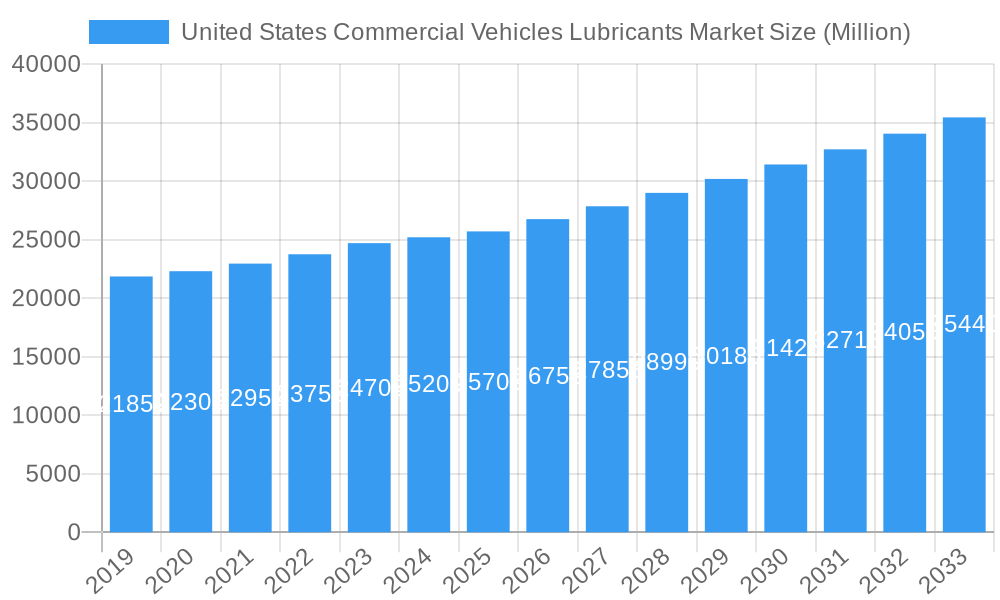

The United States commercial vehicle lubricants market is poised for steady expansion, projected to reach $25.7 billion in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This robust growth is primarily driven by the increasing fleet size of commercial vehicles, including trucks and buses, essential for the nation's thriving logistics and transportation sectors. A strong emphasis on fleet operational efficiency and extended vehicle lifespan further fuels demand for high-performance lubricants. Advancements in lubricant formulations, offering enhanced wear protection, fuel efficiency, and extended drain intervals, are key trends shaping the market. These innovative products cater to the evolving needs of modern commercial vehicles, which are increasingly equipped with sophisticated engine technologies and operate under demanding conditions. The market also benefits from stringent environmental regulations that encourage the adoption of more efficient and eco-friendly lubricant solutions.

United States Commercial Vehicles Lubricants Market Market Size (In Billion)

The market is segmented into essential product types such as Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils, each vital for the smooth and reliable operation of commercial vehicles. Leading companies like ExxonMobil Corporation, Royal Dutch Shell Plc, Chevron Corporation, BP PLC (Castrol), and CITGO are actively investing in research and development to introduce next-generation lubricants that meet industry standards and customer expectations. While the market demonstrates strong growth potential, certain restraints could influence its trajectory. These may include fluctuating raw material prices, particularly for base oils and additives, and the high initial cost of some advanced lubricant technologies. However, the overall outlook remains positive, with the continuous need for effective lubrication in the extensive US commercial vehicle fleet underpinning sustained market demand.

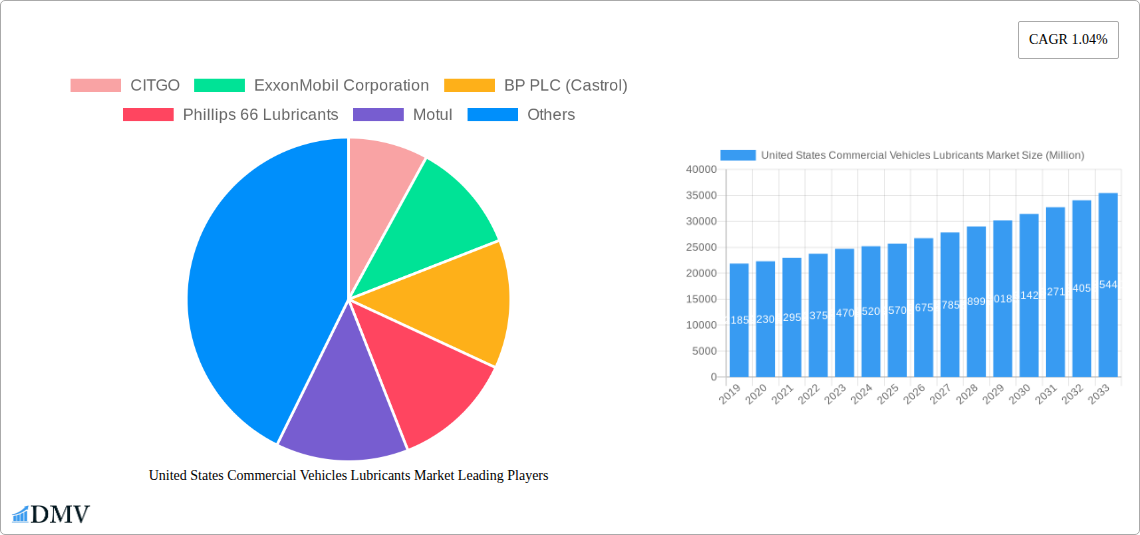

United States Commercial Vehicles Lubricants Market Company Market Share

United States Commercial Vehicles Lubricants Market Market Composition & Trends

The United States commercial vehicles lubricants market is a dynamic and competitive landscape characterized by a moderate to high degree of market concentration. Key players like ExxonMobil Corporation, Chevron Corporation, and Royal Dutch Shell Plc dominate with substantial market share, driven by extensive distribution networks and brand recognition. Innovation is a significant catalyst, with companies investing heavily in research and development to produce high-performance, fuel-efficient lubricants that meet stringent environmental regulations and evolving OEM specifications. The regulatory landscape, particularly concerning emissions standards and biodegradability, plays a crucial role in shaping product development and market entry strategies. Substitute products, such as advanced synthetic lubricants and bio-based alternatives, are gaining traction, pushing incumbents to continuously enhance their offerings. End-user profiles vary from large fleet operators prioritizing cost-effectiveness and operational efficiency to smaller businesses seeking specialized lubrication solutions for niche applications. Mergers and acquisitions (M&A) activities, while not always at the highest deal values, are strategically focused on consolidating market share, expanding product portfolios, and gaining access to new distribution channels. For instance, the ongoing consolidation within the automotive aftermarket indirectly impacts lubricant suppliers through shifts in distribution partnerships. The market is projected to reach an estimated value of over $25 billion by 2033, reflecting robust growth driven by increased commercial vehicle parc and the demand for advanced lubrication technologies.

- Market Concentration: Dominated by a few major players, with significant market share held by ExxonMobil Corporation, Chevron Corporation, and Royal Dutch Shell Plc.

- Innovation Catalysts: Driven by the need for enhanced fuel efficiency, extended drain intervals, and compliance with stricter environmental regulations.

- Regulatory Landscapes: US EPA regulations, OEM specifications, and state-specific mandates significantly influence product formulations and market access.

- Substitute Products: Rise of synthetic lubricants and bio-based alternatives challenging traditional mineral oil dominance.

- End-User Profiles: Diverse, ranging from large logistics companies to smaller service providers, each with distinct lubrication needs.

- M&A Activities: Strategic acquisitions aimed at market consolidation, portfolio expansion, and enhanced distribution reach.

- Market Share Distribution: Top 5 players account for over 60% of the market share.

- M&A Deal Values: Estimated to be in the hundreds of millions of dollars for significant strategic acquisitions within the lubricant sector.

United States Commercial Vehicles Lubricants Market Industry Evolution

The United States commercial vehicles lubricants market has undergone a significant transformation over the historical period of 2019-2024, with the base year of 2025 setting the stage for sustained growth through to 2033. This evolution is deeply rooted in the increasing demands of a robust and expanding commercial transportation sector, encompassing everything from long-haul trucking to specialized construction and delivery vehicles. The market's trajectory has been profoundly influenced by technological advancements in engine design, which necessitate lubricants with superior performance characteristics. Modern diesel engines, for instance, operate under higher pressures and temperatures, requiring advanced formulations that offer exceptional thermal stability, oxidation resistance, and wear protection. This has driven a notable shift away from conventional mineral oils towards high-performance synthetic and semi-synthetic lubricants. The adoption of these advanced lubricants is not merely a trend but a necessity for optimizing engine longevity, reducing maintenance costs, and improving overall fleet efficiency.

Consumer demand has also played a pivotal role in shaping the industry. Fleet managers and owner-operators are increasingly prioritizing lubricants that contribute to fuel economy, thereby reducing operational expenses and their carbon footprint. This push for sustainability aligns with broader environmental concerns and regulatory pressures. Consequently, lubricant manufacturers have responded by developing products with lower viscosity, improved detergency, and enhanced anti-wear properties, all designed to minimize friction and maximize fuel efficiency. The base year 2025 is expected to witness a compound annual growth rate (CAGR) of approximately 4.5%, a testament to the ongoing demand for high-quality lubricants. This growth is further bolstered by the increasing complexity of vehicle powertrains and emission control systems, which require specialized lubricant formulations to function optimally. For example, the extended drain intervals offered by premium synthetic lubricants contribute significantly to reducing downtime and operational costs for commercial fleets. The adoption rate of full synthetic engine oils in the heavy-duty commercial vehicle segment is projected to surpass 70% by 2028, indicating a strong market preference for advanced lubrication solutions. The industry's evolution is therefore characterized by a continuous pursuit of innovation, driven by the symbiotic relationship between technological advancements in vehicles and the ever-increasing expectations of end-users for performance, efficiency, and environmental responsibility. The forecast period of 2025-2033 is poised to see continued innovation, with a focus on electrification and alternative fuels, presenting new lubrication challenges and opportunities for market players.

Leading Regions, Countries, or Segments in United States Commercial Vehicles Lubricants Market

The United States commercial vehicles lubricants market is demonstrably led by the Engine Oils segment, which consistently commands the largest market share due to its foundational role in powering the vast commercial fleet. This dominance is underpinned by several key drivers, including the sheer volume of commercial vehicles requiring regular engine oil replenishment, the critical importance of engine health for operational uptime, and the continuous evolution of engine technology demanding superior lubrication. Within the broader United States market, specific regions often exhibit higher demand based on economic activity and transportation infrastructure. For instance, the Midwest, with its extensive agricultural and manufacturing base and trucking routes, and the Southeast, experiencing rapid economic growth and an expanding logistics network, tend to be high-volume markets for commercial vehicle lubricants.

- Dominant Segment: Engine Oils

- Volume of Usage: Every internal combustion engine commercial vehicle requires engine oil, making it the most frequently consumed lubricant.

- Criticality of Performance: Engine health directly impacts operational efficiency, vehicle longevity, and maintenance costs for commercial fleets.

- Technological Advancements: Modern engines, including heavy-duty diesel and natural gas engines, demand specialized engine oils with advanced additive packages for wear protection, deposit control, and emissions compliance.

- Market Value: Engine oils constitute an estimated 55-60% of the total commercial vehicle lubricants market value.

- Investment Trends: Significant R&D investments by manufacturers focus on developing next-generation engine oils that meet API, ACEA, and OEM specifications, including those for low-SAPS (sulfated ash, phosphorus, and sulfur) formulations.

- Regulatory Support: Emission standards, such as those set by the EPA, necessitate engine oils that facilitate the performance of exhaust after-treatment systems, further solidifying the demand for compliant engine oil formulations.

In-depth analysis reveals that the demand for Engine Oils is further amplified by the stringent performance requirements of modern commercial diesel engines. These engines are engineered for higher thermal efficiency and lower emissions, necessitating lubricants that can withstand extreme operating conditions, provide excellent detergency to keep engines clean, and offer superior wear protection under heavy loads. The push towards extended drain intervals, driven by cost-saving initiatives from fleet operators, also favors advanced synthetic and semi-synthetic engine oils, which offer greater durability and performance retention compared to conventional oils. Furthermore, the diverse applications of commercial vehicles, from long-haul trucking to construction and municipal services, each present unique engine operating profiles that necessitate tailored engine oil solutions, thereby maintaining Engine Oils as the leading segment. The market value for Engine Oils in the US commercial vehicle sector is projected to exceed $14 billion by 2033.

United States Commercial Vehicles Lubricants Market Product Innovations

Product innovation in the United States commercial vehicles lubricants market is primarily focused on enhancing performance, extending service life, and improving environmental sustainability. Manufacturers are developing advanced synthetic engine oils with novel additive packages that offer superior wear protection, exceptional thermal and oxidative stability, and significantly improved fuel economy. Hydraulic fluids are being engineered for wider operating temperature ranges and enhanced shear stability, ensuring consistent performance in demanding hydraulic systems. Transmission and gear oils are evolving to meet the needs of complex drivelines, offering better protection against scuffing and pitting under high torque conditions, while greases are being formulated with improved water washout resistance and extreme pressure properties for specialized applications in heavy-duty equipment. These innovations are driven by the need to meet increasingly stringent OEM specifications and regulatory requirements, such as API CK-4 and FA-4 for diesel engine oils, and to address the growing demand for lubricants that reduce friction, minimize emissions, and extend equipment lifespan.

Propelling Factors for United States Commercial Vehicles Lubricants Market Growth

The United States commercial vehicles lubricants market is propelled by several interconnected factors. Economically, the robust growth in e-commerce and logistics continues to drive demand for commercial vehicles, necessitating regular lubricant replenishment. Technologically, advancements in engine designs, particularly for heavy-duty diesel and natural gas engines, require higher-performance lubricants that offer improved fuel efficiency and extended drain intervals. Regulatory drivers, such as emissions standards set by the EPA, also compel the use of advanced lubricants that facilitate the operation of after-treatment systems. Furthermore, the increasing trend towards fleet modernization and the adoption of synthetic lubricants for their superior performance and durability are significant growth catalysts.

Obstacles in the United States Commercial Vehicles Lubricants Market Market

Despite strong growth prospects, the United States commercial vehicles lubricants market faces several obstacles. Volatility in crude oil prices can impact the cost of raw materials, leading to price fluctuations for finished lubricants. Stringent environmental regulations, while driving innovation, can also increase R&D and manufacturing costs for compliance. Supply chain disruptions, as witnessed in recent years, can affect the availability and timely delivery of both raw materials and finished products. Intense competition among established global players and smaller regional formulators leads to price pressures and necessitates continuous investment in marketing and product development to maintain market share.

Future Opportunities in United States Commercial Vehicles Lubricants Market

Emerging opportunities in the United States commercial vehicles lubricants market are manifold. The electrification of commercial fleets, while shifting away from traditional engine oils, presents new avenues for specialized lubricants for electric drivetrains, thermal management fluids, and greases for electric motors and transmissions. The growing demand for sustainable and bio-based lubricants offers a significant niche for environmentally friendly alternatives. Furthermore, the increasing complexity of advanced vehicle technologies, such as autonomous driving systems and sophisticated powertrains, will create a need for highly specialized and tailored lubrication solutions. Expansion into underserved regions and the development of innovative service models, like lubricant analysis and fleet management services, also present promising growth avenues.

Major Players in the United States Commercial Vehicles Lubricants Market Ecosystem

- CITGO

- ExxonMobil Corporation

- BP PLC (Castrol)

- Phillips 66 Lubricants

- Motul

- Royal Dutch Shell Plc

- Chevron Corporation

- TotalEnergies

- Valvoline Inc

- AMSOIL Inc

Key Developments in United States Commercial Vehicles Lubricants Market Industry

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

- October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.

- July 2021: Mighty Distributing System (Mighty Auto Parts), a pioneer in automotive aftermarket goods and services, announced a new relationship with Total Specialties USA. It would target the Quartz Ineo and Quartz 9000 sub-ranges, geared for light automobiles and meet European OEMs' most stringent criteria.

Strategic United States Commercial Vehicles Lubricants Market Market Forecast

The strategic United States commercial vehicles lubricants market forecast indicates a period of robust and sustained growth, driven by an expanding commercial vehicle parc and the relentless pursuit of operational efficiency and environmental compliance. Key growth catalysts include the ongoing demand for advanced engine oils that meet evolving API and OEM specifications, particularly those enhancing fuel economy and reducing emissions. The increasing adoption of synthetic and semi-synthetic lubricants, offering extended drain intervals and superior protection, will continue to fuel market expansion. Furthermore, emerging opportunities in the burgeoning electric commercial vehicle sector, requiring specialized thermal management fluids and lubricants for electric drivetrains, present a significant future growth avenue. Investments in R&D to develop innovative, high-performance, and sustainable lubrication solutions will be critical for players to capitalize on these opportunities and maintain a competitive edge in this dynamic market, projected to exceed $25 billion by 2033.

United States Commercial Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

United States Commercial Vehicles Lubricants Market Segmentation By Geography

- 1. United States

United States Commercial Vehicles Lubricants Market Regional Market Share

Geographic Coverage of United States Commercial Vehicles Lubricants Market

United States Commercial Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants

- 3.3. Market Restrains

- 3.3.1. Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Commercial Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CITGO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BP PLC (Castrol)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Phillips 66 Lubricants

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Motul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chevron Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valvoline Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AMSOIL Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CITGO

List of Figures

- Figure 1: United States Commercial Vehicles Lubricants Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Commercial Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: United States Commercial Vehicles Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: United States Commercial Vehicles Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: United States Commercial Vehicles Lubricants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Commercial Vehicles Lubricants Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: United States Commercial Vehicles Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: United States Commercial Vehicles Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 7: United States Commercial Vehicles Lubricants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Commercial Vehicles Lubricants Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Commercial Vehicles Lubricants Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the United States Commercial Vehicles Lubricants Market?

Key companies in the market include CITGO, ExxonMobil Corporation, BP PLC (Castrol), Phillips 66 Lubricants, Motul, Royal Dutch Shell Plc, Chevron Corporation, TotalEnergies, Valvoline Inc, AMSOIL Inc.

3. What are the main segments of the United States Commercial Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future.

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.July 2021: Mighty Distributing System (Mighty Auto Parts), a pioneer in automotive aftermarket goods and services, announced a new relationship with Total Specialties USA. It would target the Quartz Ineo and Quartz 9000 sub-ranges, geared for light automobiles and meet European OEMs' most stringent criteria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Commercial Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Commercial Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Commercial Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the United States Commercial Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence