Key Insights

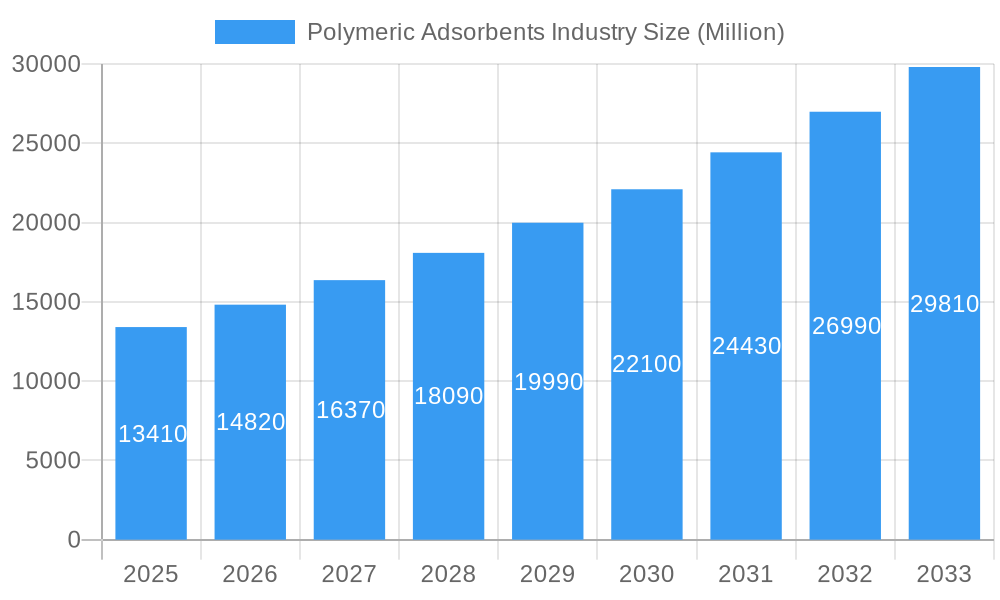

The global Polymeric Adsorbents market is poised for significant expansion, projected to reach an impressive USD 13.41 billion in 2025. This robust growth is fueled by a CAGR of 10.45% over the forecast period of 2025-2033. The market's dynamism is driven by several key factors, including the increasing demand for high-purity chemicals and pharmaceuticals, stringent environmental regulations promoting effective wastewater treatment, and the growing need for efficient separation and purification processes across diverse industries. Polymeric adsorbents offer superior performance, selectivity, and regenerability compared to traditional adsorbents, making them an attractive choice for critical applications. The escalating adoption in the food and beverage sector for decolorization and purification, alongside expanding applications in the chemical and pharmaceutical industries for the removal of specific contaminants and the purification of valuable compounds, underpins this upward trajectory. Furthermore, advancements in material science are leading to the development of novel polymeric adsorbents with enhanced capacities and tailored functionalities, further stimulating market penetration.

Polymeric Adsorbents Industry Market Size (In Billion)

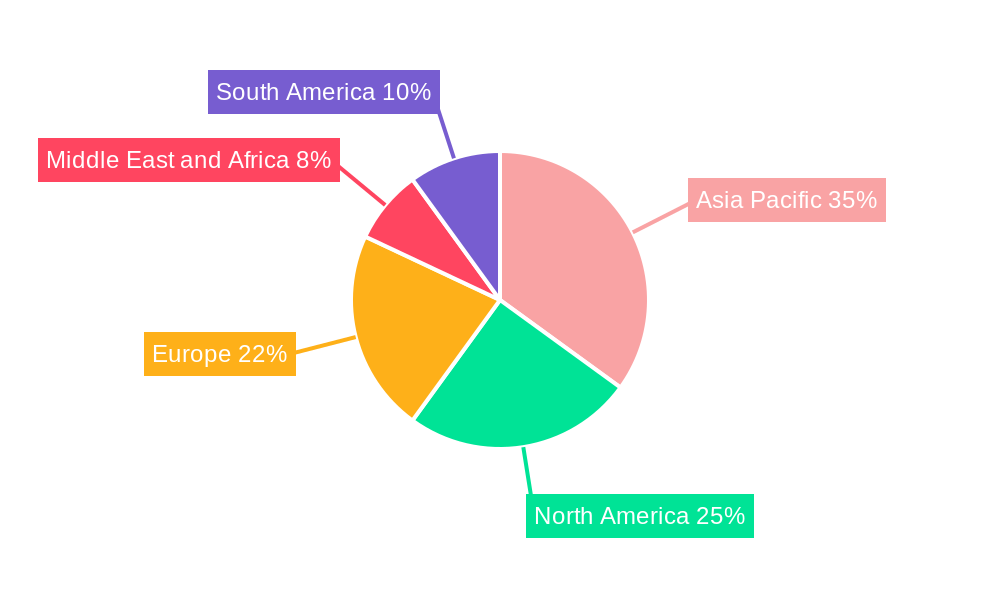

The Polymeric Adsorbents market segmentation reveals a diverse landscape of opportunities. Within "Type," Methacrylic and Modified Aromatic adsorbents are expected to lead in adoption due to their broad applicability and effectiveness in various purification tasks. The "Application" segment is characterized by strong demand in Anthocyanin Removal, Chlorinated Solvents Removal, and Heterocyclic Amines Removal, reflecting the industry's focus on specialized purification challenges. Sugar Decolorization also presents a substantial market. Leading end-user industries such as Food and Beverage, Industrial, Chemicals, and Pharmaceutical are primary consumers, with the Textile industry also contributing to market growth. Geographically, Asia Pacific, particularly China and India, is anticipated to be a dominant region, driven by rapid industrialization, growing manufacturing capabilities, and increasing environmental awareness. North America and Europe remain crucial markets due to established industrial bases and stringent regulatory frameworks. The competitive landscape features prominent players like Purolite, DuPont, and LANXESS, alongside emerging innovators, all contributing to the market's technological advancement and expansion.

Polymeric Adsorbents Industry Company Market Share

This in-depth report provides a definitive analysis of the global Polymeric Adsorbents Market, encompassing a comprehensive study from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this research delves into market dynamics, competitive landscapes, technological advancements, and future growth trajectories. Our meticulous analysis covers key segments including Methacrylic, Aromatic, Modified Aromatic, and Others by Type, and applications such as Anthocyanin Removal, Chlorinated Solvents Removal, Heterocyclic Amines Removal, Purification of Alkanolamines, Sugar Decolorization, and Others. The report also examines the influence of end-user industries like Food and Beverage, Industrial, Chemicals, Pharmaceutical, Textile, and Others. Uncover critical insights into market size, trends, regional dominance, product innovations, growth drivers, potential obstacles, and future opportunities within this vital adsorbent materials industry.

Polymeric Adsorbents Industry Market Composition & Trends

The polymeric adsorbents market is characterized by a moderate to high degree of concentration, with key players actively investing in research and development to drive innovation. Emerging trends indicate a growing demand for high-performance adsorbents with superior selectivity and capacity. Regulatory landscapes, particularly concerning environmental protection and food safety, are increasingly shaping product development and adoption. Substitute products, such as activated carbon and zeolites, present ongoing competition, necessitating continuous improvement in polymeric adsorbent formulations. End-user profiles are diversifying, with significant growth anticipated from the pharmaceutical and food and beverage sectors, driven by stringent purity requirements. Merger and acquisition (M&A) activities are notable, with significant deal values observed as companies seek to expand their product portfolios and market reach. For instance, recent M&A activities in the specialty chemicals sector, involving players in adsorbent resins, suggest strategic consolidations aimed at leveraging synergistic capabilities. The estimated market share distribution across key players will be detailed, alongside an analysis of M&A deal values reaching potentially billions in strategic acquisitions.

Polymeric Adsorbents Industry Industry Evolution

The polymeric adsorbents industry has witnessed a dynamic evolution, driven by relentless technological advancements and a growing imperative for efficient separation and purification solutions across various sectors. From its inception, the market has expanded from niche applications to become a cornerstone in numerous industrial processes. The historical period (2019–2024) saw steady growth, fueled by increasing awareness of environmental regulations and the need for higher product purity in the food and beverage and pharmaceutical industries. The base year, 2025, marks a pivotal point where demand for specialized polymeric adsorbents is projected to surge, influenced by innovations in material science and process engineering.

The growth trajectory of the polymeric adsorbents market is significantly shaped by technological leaps. The development of novel polymeric structures, such as macroporous resins with tailored pore sizes and surface chemistries, has enabled unprecedented separation efficiencies for complex molecules. For example, advancements in the synthesis of methacrylic and aromatic based adsorbents have led to their widespread adoption in applications like purification of alkanolamines and heterocyclic amines removal in the chemical industry, with adoption rates exceeding 15% annually in these specific niches. Furthermore, the integration of nanotechnology in designing modified aromatic adsorbents is opening new avenues for highly selective adsorption of trace contaminants.

Shifting consumer demands, particularly in the food and beverage sector, have also played a crucial role. The drive for natural and healthy products has increased the demand for efficient sugar decolorization and anthocyanin removal solutions, areas where advanced polymeric adsorbents offer superior performance compared to traditional methods. In the pharmaceutical industry, the stringent requirements for drug purity and the development of complex biologics necessitate highly effective separation techniques, driving the demand for specialized polymeric adsorbents with biocompatible properties and exceptional selectivity for target molecules. The industrial segment is witnessing increased adoption for chlorinated solvents removal and general waste stream purification, reflecting a growing commitment to environmental sustainability and resource recovery. The textile industry is also exploring these adsorbents for wastewater treatment and dye removal, indicating a broadening application spectrum. Overall, the polymeric adsorbents market is projected for robust growth, with estimated compound annual growth rates (CAGR) of approximately 8-10% through the forecast period (2025–2033). This growth is underpinned by continuous innovation, expanding application areas, and increasing global emphasis on sustainability and product quality.

Leading Regions, Countries, or Segments in Polymeric Adsorbents Industry

The Polymeric Adsorbents Industry is experiencing robust growth across various regions, with North America and Europe currently leading in terms of market share and technological adoption. However, the Asia-Pacific region is emerging as a significant growth engine, driven by rapid industrialization, increasing environmental regulations, and a burgeoning pharmaceutical and food processing sector.

Within the Type segment, Aromatic polymeric adsorbents command a substantial market share due to their broad applicability in solvent recovery, decolorization, and purification processes. Their versatility in handling a wide range of organic compounds makes them indispensable in the chemicals and industrial sectors. Methacrylic adsorbents are gaining traction, particularly in applications requiring higher thermal stability and resistance to harsh chemical environments. The Modified Aromatic segment is characterized by its specialized applications, often developed to address unique purification challenges with high selectivity and efficiency.

In terms of Application, Purification of Alkanolamines and Sugar Decolorization are significant growth drivers. The escalating demand for high-purity ingredients in the food and beverage and pharmaceutical industries directly fuels the need for effective decolorization and purification techniques. The chemical industry's growing focus on solvent recovery and environmental compliance also boosts applications like Chlorinated Solvents Removal.

The End-user Industry landscape is dominated by the Food and Beverage and Industrial sectors. The Food and Beverage industry's stringent quality standards and consumer demand for natural products are propelling the use of polymeric adsorbents for decolorization and impurity removal. The Industrial sector, encompassing chemical manufacturing, petrochemicals, and water treatment, utilizes these adsorbents for process optimization, waste reduction, and environmental remediation. The Pharmaceutical industry, with its ever-increasing demand for highly purified active pharmaceutical ingredients (APIs) and biologics, represents a high-growth segment, with an estimated market penetration of over 20% for specialized adsorbents.

Key Drivers in Dominant Segments:

North America & Europe:

- Investment Trends: Significant R&D investments by major players like DuPont and LANXESS in advanced polymeric adsorbent technologies.

- Regulatory Support: Strict environmental regulations and mandates for cleaner production processes, particularly in the chemical and pharmaceutical industries.

- Technological Sophistication: High adoption rates for advanced separation technologies driven by a mature industrial base and a strong focus on product quality.

- Pharmaceutical Purity Demands: Rigorous standards for API purification and drug formulation.

Asia-Pacific:

- Industrial Growth: Rapid expansion of manufacturing capabilities, especially in China and India, leading to increased demand for process chemicals and purification solutions.

- Food & Beverage Expansion: A growing middle class and increasing consumer spending on processed foods and beverages.

- Government Initiatives: Favorable government policies promoting manufacturing and environmental protection technologies.

- Cost-Effectiveness: A growing demand for cost-effective purification solutions in developing economies.

The dominance of these regions and segments is a testament to the evolving needs of global industries and the increasing reliance on specialized materials for efficient and sustainable operations. The Polymeric Adsorbents Industry is poised for continued expansion, with these leading segments acting as primary catalysts for innovation and market penetration.

Polymeric Adsorbents Industry Product Innovations

The polymeric adsorbents industry is witnessing a surge in product innovations, driven by the relentless pursuit of enhanced performance and tailored solutions. Companies are developing novel adsorbent materials with superior selectivity, higher capacity, and improved regeneration capabilities. Innovations focus on creating adsorbents capable of efficiently removing specific contaminants, such as challenging organic compounds or precious metals, from complex matrices. For instance, the development of highly specific aromatic adsorbents for the purification of valuable compounds in the pharmaceutical industry, achieving impurity removal rates exceeding 99.9%, exemplifies this trend. Furthermore, advancements in adsorbent surface modification are leading to improved hydrophilicity or hydrophobicity, enabling better performance in diverse operational environments and across various end-user industries. The integration of stimuli-responsive polymers for on-demand release or capture further showcases the cutting-edge nature of recent product developments.

Propelling Factors for Polymeric Adsorbents Industry Growth

Several key factors are propelling the growth of the Polymeric Adsorbents Industry. Firstly, the increasing global emphasis on environmental sustainability and stringent regulations for wastewater treatment and emission control are driving demand for effective adsorbent materials. Secondly, the pharmaceutical and food and beverage industries' demand for high-purity products necessitates advanced separation and purification techniques, a role admirably filled by polymeric adsorbents. Technological advancements in material science, leading to the development of highly selective and efficient adsorbents, are also crucial growth drivers. Furthermore, the growing trend of solvent recovery and recycling in the chemical industry further boosts the adoption of these materials.

Obstacles in the Polymeric Adsorbents Industry Market

Despite its strong growth potential, the Polymeric Adsorbents Industry faces certain obstacles. The high initial cost of some advanced polymeric adsorbents can be a deterrent for smaller businesses. Competition from established alternatives like activated carbon and zeolites, which are often more cost-effective for certain applications, presents a continuous challenge. Disruptions in global supply chains for raw materials and the increasing complexity of regulatory compliance across different regions can also impact market growth. Furthermore, the need for specialized knowledge in selecting and operating polymeric adsorbent systems can be a barrier to widespread adoption in less technically advanced sectors.

Future Opportunities in Polymeric Adsorbents Industry

The Polymeric Adsorbents Industry is ripe with future opportunities. Emerging markets in developing economies with growing industrial bases offer significant expansion potential. The development of bio-based and biodegradable polymeric adsorbents aligns with increasing sustainability demands and opens new market segments. Advancements in nanotechnology-enabled adsorbents promise unprecedented selectivity and efficiency for highly complex separation challenges. Furthermore, the expanding use of polymeric adsorbents in niche applications such as precious metal recovery, catalyst separation, and biopharmaceutical purification presents substantial growth avenues. The increasing focus on resource recovery and circular economy principles will further fuel innovation and market penetration for these versatile materials.

Major Players in the Polymeric Adsorbents Industry Ecosystem

- Purolite

- DuPont

- Thermax Limited

- LANXESS

- Mitsubishi Chemical Corporation

- CHEMRA COMPANY

- Sunresin New Materials Co Ltd Xi'an

- Suzhou Nanomicro Technology Co Ltd

- Tianjin Nankai HECHENG S&T Co Ltd

Key Developments in Polymeric Adsorbents Industry Industry

- 2023: Launch of new generation macroporous adsorbent resins by Lanxess for enhanced purification of APIs, marking a significant step in pharmaceutical processing.

- 2023: Sunresin New Materials Co Ltd Xi'an announces expansion of its production capacity for adsorption resins, anticipating increased demand in the mining and chemical sectors.

- 2024 (Q1): DuPont introduces a novel series of polymeric adsorbents with improved thermal stability for high-temperature industrial applications.

- 2024 (Q2): Thermax Limited unveils an advanced adsorbent system for the removal of specific volatile organic compounds (VOCs) from industrial emissions, addressing stricter environmental regulations.

- 2024 (Q3): Mitsubishi Chemical Corporation partners with a leading food processing company to optimize sugar decolorization processes using their advanced adsorbent technology.

Strategic Polymeric Adsorbents Industry Market Forecast

The strategic forecast for the Polymeric Adsorbents Industry projects continued robust growth, driven by persistent demand from key sectors like pharmaceuticals, food and beverage, and chemicals. The increasing global focus on sustainability, resource recovery, and stringent quality control will act as significant catalysts. Innovations in material science, particularly in creating highly selective and regenerable adsorbents, will unlock new applications and enhance market penetration. The rising industrialization in emerging economies further presents a vast untapped market potential. Investments in R&D and strategic partnerships are expected to dominate the landscape, ensuring the industry's adaptability to evolving global challenges and opportunities.

Polymeric Adsorbents Industry Segmentation

-

1. Type

- 1.1. Methacrylic

- 1.2. Aromatic

- 1.3. Modified Aromatic

- 1.4. Others

-

2. Application

- 2.1. Anthocyanin Removal

- 2.2. Chlorinated Solvents Removal

- 2.3. Heterocyclic Amines Removal

- 2.4. Purification of Alkanolamines

- 2.5. Sugar Decolorization

- 2.6. Others

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Industrial

- 3.3. Chemicals

- 3.4. Pharmaceutical

- 3.5. Textile

- 3.6. Others

Polymeric Adsorbents Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polymeric Adsorbents Industry Regional Market Share

Geographic Coverage of Polymeric Adsorbents Industry

Polymeric Adsorbents Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.4499999999999% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Purification Processes in Food & Beverage and Pharmaceutical Industries; Increasing Use of the Product in Separation and Purification Processes

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand for Purification Processes in Food & Beverage and Pharmaceutical Industries; Increasing Use of the Product in Separation and Purification Processes

- 3.4. Market Trends

- 3.4.1. Growing Demand for Purification Processes in Food & Beverage and Pharmaceutical Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polymeric Adsorbents Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Methacrylic

- 5.1.2. Aromatic

- 5.1.3. Modified Aromatic

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Anthocyanin Removal

- 5.2.2. Chlorinated Solvents Removal

- 5.2.3. Heterocyclic Amines Removal

- 5.2.4. Purification of Alkanolamines

- 5.2.5. Sugar Decolorization

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Industrial

- 5.3.3. Chemicals

- 5.3.4. Pharmaceutical

- 5.3.5. Textile

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Polymeric Adsorbents Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Methacrylic

- 6.1.2. Aromatic

- 6.1.3. Modified Aromatic

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Anthocyanin Removal

- 6.2.2. Chlorinated Solvents Removal

- 6.2.3. Heterocyclic Amines Removal

- 6.2.4. Purification of Alkanolamines

- 6.2.5. Sugar Decolorization

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Industrial

- 6.3.3. Chemicals

- 6.3.4. Pharmaceutical

- 6.3.5. Textile

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Polymeric Adsorbents Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Methacrylic

- 7.1.2. Aromatic

- 7.1.3. Modified Aromatic

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Anthocyanin Removal

- 7.2.2. Chlorinated Solvents Removal

- 7.2.3. Heterocyclic Amines Removal

- 7.2.4. Purification of Alkanolamines

- 7.2.5. Sugar Decolorization

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Industrial

- 7.3.3. Chemicals

- 7.3.4. Pharmaceutical

- 7.3.5. Textile

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Polymeric Adsorbents Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Methacrylic

- 8.1.2. Aromatic

- 8.1.3. Modified Aromatic

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Anthocyanin Removal

- 8.2.2. Chlorinated Solvents Removal

- 8.2.3. Heterocyclic Amines Removal

- 8.2.4. Purification of Alkanolamines

- 8.2.5. Sugar Decolorization

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Industrial

- 8.3.3. Chemicals

- 8.3.4. Pharmaceutical

- 8.3.5. Textile

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Polymeric Adsorbents Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Methacrylic

- 9.1.2. Aromatic

- 9.1.3. Modified Aromatic

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Anthocyanin Removal

- 9.2.2. Chlorinated Solvents Removal

- 9.2.3. Heterocyclic Amines Removal

- 9.2.4. Purification of Alkanolamines

- 9.2.5. Sugar Decolorization

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Industrial

- 9.3.3. Chemicals

- 9.3.4. Pharmaceutical

- 9.3.5. Textile

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Polymeric Adsorbents Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Methacrylic

- 10.1.2. Aromatic

- 10.1.3. Modified Aromatic

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Anthocyanin Removal

- 10.2.2. Chlorinated Solvents Removal

- 10.2.3. Heterocyclic Amines Removal

- 10.2.4. Purification of Alkanolamines

- 10.2.5. Sugar Decolorization

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food and Beverage

- 10.3.2. Industrial

- 10.3.3. Chemicals

- 10.3.4. Pharmaceutical

- 10.3.5. Textile

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Purolite

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DuPont

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thermax Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LANXESS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi Chemical Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CHEMRA COMPANY

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sunresin New Materials Co Ltd Xi'an

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Suzhou Nanomicro Technology Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tianjin Nankai HECHENG S&T Co Ltd*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Purolite

List of Figures

- Figure 1: Global Polymeric Adsorbents Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Polymeric Adsorbents Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Polymeric Adsorbents Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Polymeric Adsorbents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Polymeric Adsorbents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Polymeric Adsorbents Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Polymeric Adsorbents Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Polymeric Adsorbents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Asia Pacific Polymeric Adsorbents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Polymeric Adsorbents Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: North America Polymeric Adsorbents Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Polymeric Adsorbents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 13: North America Polymeric Adsorbents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Polymeric Adsorbents Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: North America Polymeric Adsorbents Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Polymeric Adsorbents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: North America Polymeric Adsorbents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Polymeric Adsorbents Industry Revenue (undefined), by Type 2025 & 2033

- Figure 19: Europe Polymeric Adsorbents Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Polymeric Adsorbents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 21: Europe Polymeric Adsorbents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Polymeric Adsorbents Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Europe Polymeric Adsorbents Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Polymeric Adsorbents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Polymeric Adsorbents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Polymeric Adsorbents Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Polymeric Adsorbents Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Polymeric Adsorbents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: South America Polymeric Adsorbents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Polymeric Adsorbents Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: South America Polymeric Adsorbents Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Polymeric Adsorbents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Polymeric Adsorbents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Polymeric Adsorbents Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: Middle East and Africa Polymeric Adsorbents Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Polymeric Adsorbents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 37: Middle East and Africa Polymeric Adsorbents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Polymeric Adsorbents Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Polymeric Adsorbents Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Polymeric Adsorbents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Polymeric Adsorbents Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Japan Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: South Korea Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: United States Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Canada Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Mexico Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Germany Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: France Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Italy Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 31: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Argentina Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Polymeric Adsorbents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: South Africa Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Polymeric Adsorbents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polymeric Adsorbents Industry?

The projected CAGR is approximately 10.4499999999999%.

2. Which companies are prominent players in the Polymeric Adsorbents Industry?

Key companies in the market include Purolite, DuPont, Thermax Limited, LANXESS, Mitsubishi Chemical Corporation, CHEMRA COMPANY, Sunresin New Materials Co Ltd Xi'an, Suzhou Nanomicro Technology Co Ltd, Tianjin Nankai HECHENG S&T Co Ltd*List Not Exhaustive.

3. What are the main segments of the Polymeric Adsorbents Industry?

The market segments include Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Purification Processes in Food & Beverage and Pharmaceutical Industries; Increasing Use of the Product in Separation and Purification Processes.

6. What are the notable trends driving market growth?

Growing Demand for Purification Processes in Food & Beverage and Pharmaceutical Industries.

7. Are there any restraints impacting market growth?

; Growing Demand for Purification Processes in Food & Beverage and Pharmaceutical Industries; Increasing Use of the Product in Separation and Purification Processes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polymeric Adsorbents Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polymeric Adsorbents Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polymeric Adsorbents Industry?

To stay informed about further developments, trends, and reports in the Polymeric Adsorbents Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence