Key Insights

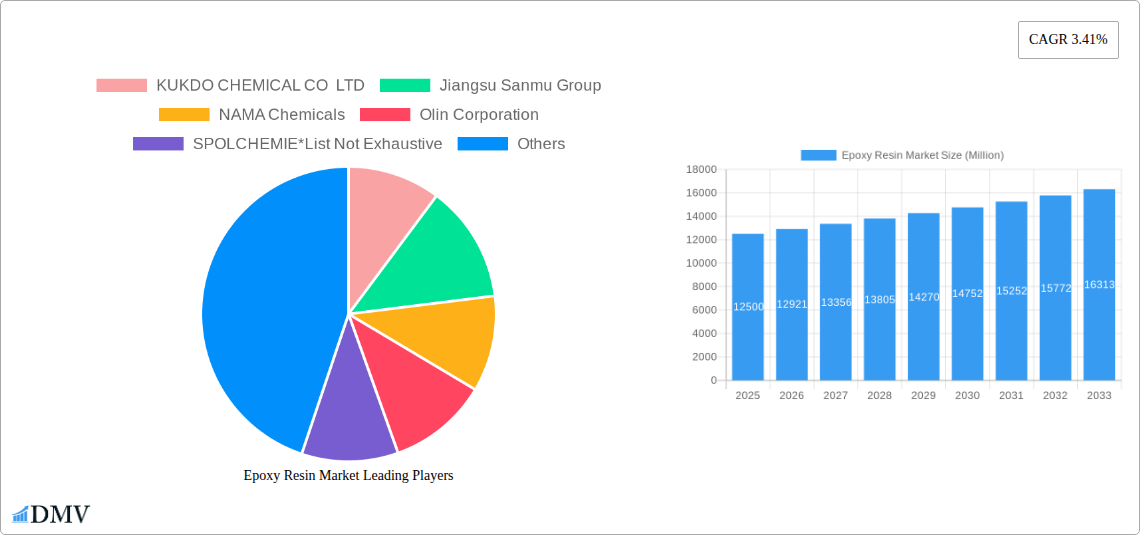

The global Epoxy Resin Market is poised for steady expansion, driven by robust demand across a multitude of industrial applications. With a projected Compound Annual Growth Rate (CAGR) of 3.41% from 2025 to 2033, the market is expected to reach a substantial valuation, reflecting its indispensable role in sectors like paints and coatings, adhesives, composites, and electronics. Key growth catalysts include the increasing use of epoxy resins in lightweight and high-strength composite materials for the automotive and aerospace industries, as well as the expanding infrastructure development and renewable energy projects, particularly wind turbines. The demand for advanced materials offering superior chemical resistance, mechanical strength, and electrical insulation properties will continue to fuel market penetration. Furthermore, the burgeoning construction industry, especially in emerging economies, is a significant contributor to the demand for epoxy-based flooring, protective coatings, and sealants.

Epoxy Resin Market Market Size (In Billion)

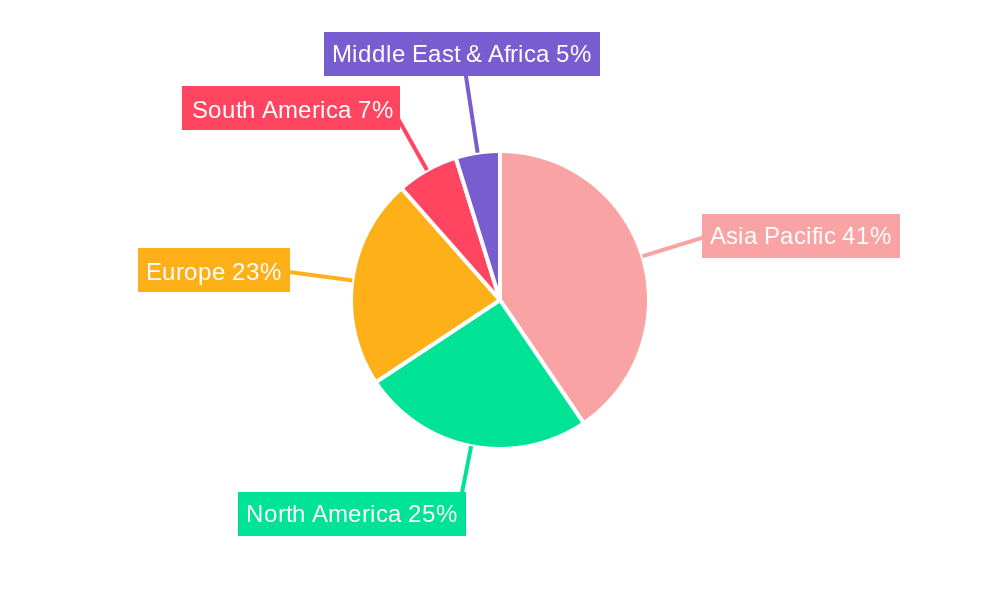

The market's trajectory will be shaped by strategic developments in raw material sourcing and technological innovations. While Bisphenol A (BPA) and Epichlorohydrin (ECH) remain primary raw materials, the industry is witnessing a growing interest in alternative and more sustainable feedstocks. Restraints such as fluctuating raw material prices and stringent environmental regulations concerning certain chemical components could pose challenges. However, ongoing research and development efforts are focused on creating bio-based epoxy resins and enhancing the performance characteristics of existing formulations. Geographically, the Asia Pacific region, led by China and India, is anticipated to remain the largest and fastest-growing market, owing to its rapidly industrializing economy, extensive manufacturing base, and significant investments in infrastructure. North America and Europe are also expected to exhibit consistent growth, driven by technological advancements and the demand for high-performance materials in specialized applications. Key players like KUKDO CHEMICAL, BASF, and Hexion are actively investing in capacity expansion and product innovation to capitalize on these market dynamics.

Epoxy Resin Market Company Market Share

This in-depth Epoxy Resin Market report provides a critical analysis of the global market landscape, offering unparalleled insights into growth drivers, emerging trends, competitive dynamics, and future projections. Designed for stakeholders seeking to understand the complexities and opportunities within the epoxy resin industry, this report covers raw materials, applications, regional dominance, and key player strategies.

Epoxy Resin Market Market Composition & Trends

The Epoxy Resin Market is characterized by a moderate level of concentration, with key players strategically expanding their capacities and geographical reach. Innovation catalysts are primarily driven by the demand for high-performance materials in advanced applications, such as wind energy and electrical insulation. The epoxy resin market share is influenced by the development of novel formulations and the increasing adoption of sustainable alternatives. Regulatory landscapes, particularly concerning environmental impact and worker safety, are shaping product development and manufacturing processes. Substitute products, while present, often fall short of the superior mechanical strength, chemical resistance, and adhesive properties offered by epoxy resins, especially in demanding sectors like composites and paints and coatings. End-user profiles are diverse, spanning construction, automotive, aerospace, electronics, and marine industries. Mergers and acquisition (M&A) activities are significant, with companies strategically acquiring businesses to enhance their product portfolios and market penetration. For instance, the acquisition of Hexion Holdings Corporation's epoxy businesses by Westlake Chemical Corporation for approximately USD 1.2 billion underscores the consolidation trend. The market's overall growth is estimated to be robust, driven by its versatile applications and continuous technological advancements.

Epoxy Resin Market Industry Evolution

The Epoxy Resin Market has undergone a significant evolutionary journey, transforming from a niche material to a cornerstone of numerous industrial applications. Over the study period of 2019–2033, with a base and estimated year of 2025, the industry has witnessed consistent growth trajectories fueled by technological advancements and evolving consumer demands. In the historical period (2019–2024), the market saw steady expansion driven by increased infrastructure development and the burgeoning electronics sector. The forecast period (2025–2033) is poised for even more accelerated growth, with an anticipated compound annual growth rate (CAGR) of approximately 5.5% to 6.0%. This surge is largely attributed to the increasing demand for lightweight, durable materials in sectors like automotive and aerospace, where epoxy composites are replacing traditional metal components to improve fuel efficiency and performance. Furthermore, the electrical and electronics sector continues to be a major consumer of epoxy resins for insulation and encapsulation, a trend expected to intensify with the proliferation of advanced electronic devices and renewable energy infrastructure, such as wind turbines.

Technological advancements have played a pivotal role in shaping the industry. Innovations in epoxy resin formulations, including the development of low-VOC (volatile organic compound) systems and bio-based epoxies, are addressing environmental concerns and expanding market reach. The introduction of advanced curing agents and modifiers has enhanced the performance characteristics of epoxy resins, such as improved thermal stability, UV resistance, and faster curing times. These innovations cater to the evolving consumer demands for more sustainable, higher-performing, and application-specific solutions. Adoption metrics for these advanced formulations are rising, particularly in developed economies with stringent environmental regulations and a strong focus on sustainable manufacturing. The epoxy resin market size is expected to reach approximately USD 25,000 million by 2025 and project towards USD 35,000 million by 2033. The increasing use of epoxy resins in protective paints and coatings for infrastructure and marine applications, driven by their excellent corrosion resistance and durability, further solidifies the market's growth trajectory. The demand for adhesives and sealants in construction and manufacturing also contributes significantly to the market's evolution.

Leading Regions, Countries, or Segments in Epoxy Resin Market

The Epoxy Resin Market is dominated by several key regions, with Asia Pacific emerging as the leading force in both production and consumption. This dominance is fueled by a confluence of factors including robust industrialization, significant manufacturing output, and a rapidly growing construction sector across countries like China, India, and South Korea. The region’s substantial investments in infrastructure development, particularly in transportation networks and renewable energy projects like wind farms, directly translate into heightened demand for epoxy resin applications in composites, paints and coatings, and adhesives and sealants. Furthermore, Asia Pacific is a major hub for electronics manufacturing, driving the consumption of epoxy resins in the electrical and electronics segment for insulation and encapsulation purposes.

Raw Material Dominance

Within the raw materials segment, DGBEA (Bisphenol A and ECH) remains a cornerstone, largely due to its cost-effectiveness and widespread availability, making it a preferred choice for a broad spectrum of epoxy resin applications. Its extensive use in producing standard liquid epoxy resins for coatings and adhesives underpins its market leadership. The growing demand for enhanced performance and specialized properties is, however, driving increased adoption of other raw materials. For instance, DGBEF (Bisphenol F and ECH) is gaining traction in applications requiring higher chemical resistance and lower viscosity, such as in high-performance coatings and structural composites. Novolac (Formaldehyde and Phenols) resins are crucial for high-temperature applications and demanding environments, finding their way into advanced composites and electrical insulation. While Aliphatic (Aliphatic Alcohols) and Glycidylamine (Aromatic Amines and ECH) offer specific performance benefits, their market share is relatively smaller, catering to niche, high-value applications. The Other Raw Materials category includes specialized additives and modifiers that enhance the properties of epoxy systems.

Application Dominance

In terms of applications, Paints and Coatings represent the largest and most dynamic segment within the Epoxy Resin Market. This dominance is attributed to the superior protective properties of epoxy coatings, including excellent adhesion, chemical resistance, hardness, and durability. They are indispensable in protecting industrial machinery, marine vessels, automotive components, and infrastructure from corrosion and environmental degradation. The growing emphasis on extending the lifespan of assets and reducing maintenance costs further bolsters demand.

- Investment Trends: Significant investments are flowing into advanced coating technologies that incorporate specialized epoxy formulations, driving innovation and market growth.

- Regulatory Support: Stringent regulations in developed economies promoting low-VOC and eco-friendly coating solutions are indirectly boosting the adoption of waterborne and high-solids epoxy coatings.

Composites stand as another highly significant and rapidly expanding application. The drive for lightweighting in the automotive and aerospace industries, coupled with the increasing use of composite materials in wind turbines and sporting goods, propels the demand for epoxy resins as matrix materials. Their high strength-to-weight ratio and excellent mechanical properties make them ideal for manufacturing advanced composite structures.

- Investment Trends: Substantial investments are being made in the development of advanced composite manufacturing techniques, such as resin transfer molding (RTM) and filament winding, which rely heavily on epoxy resins.

- Technological Advancements: Continuous improvements in resin systems and reinforcement fibers are enabling the creation of stronger, lighter, and more durable composite parts.

The Adhesives and Sealants segment also holds a substantial market share, driven by their exceptional bonding capabilities across a wide range of substrates, including metals, plastics, and composites. Their use in construction, automotive assembly, and general manufacturing is critical for structural integrity and sealing applications.

- Investment Trends: Research and development efforts are focused on creating faster-curing, higher-strength adhesives with improved environmental resistance.

- Market Drivers: The trend towards modular construction and advanced manufacturing processes necessitates reliable and high-performance bonding solutions.

The Electrical and Electronics segment is another crucial area, where epoxy resins are vital for their excellent electrical insulation properties, thermal stability, and mechanical protection. They are extensively used in encapsulating electronic components, manufacturing printed circuit boards (PCBs), and insulating electrical equipment like transformers and motors.

- Investment Trends: The burgeoning demand for electronic devices, electric vehicles, and renewable energy infrastructure is a major driver for epoxy resin consumption in this sector.

- Innovation Focus: Development of specialized epoxy formulations with enhanced thermal management capabilities and flame retardancy is a key area of focus.

The Marine and Wind Turbines segments, while more specialized, are significant growth areas. Epoxy resins' excellent resistance to saltwater corrosion and their ability to form strong, lightweight structures are critical for shipbuilding and offshore installations. For wind turbines, epoxy composites are essential for manufacturing large, durable rotor blades, contributing to the growth of renewable energy.

- Market Drivers: Government initiatives promoting renewable energy and sustainable development directly fuel the demand for epoxy resins in wind turbine manufacturing.

- Performance Requirements: The harsh operating conditions in marine environments necessitate high-performance epoxy coatings and composites with superior durability.

Epoxy Resin Market Product Innovations

Product innovation within the Epoxy Resin Market is centered on enhancing performance, improving sustainability, and expanding application scope. Novel formulations are emerging that offer faster cure times, improved thermal resistance, and greater flexibility, catering to demanding applications in aerospace and automotive. For instance, advanced toughened epoxy systems are being developed to increase impact resistance in composites, a critical parameter for applications like wind turbines and vehicle structures. The development of waterborne and high-solids epoxy systems addresses growing environmental regulations, providing low-VOC alternatives for paints and coatings without compromising on performance. Furthermore, the integration of nanoparticles and other functional additives is yielding epoxy resins with enhanced electrical conductivity or antimicrobial properties, opening avenues in specialized electronic and healthcare applications. These innovations are crucial for maintaining the competitive edge in a market driven by evolving industry needs.

Propelling Factors for Epoxy Resin Market Growth

The Epoxy Resin Market is propelled by several interconnected factors. Technologically, the demand for high-performance materials with superior strength, durability, and chemical resistance in sectors like aerospace, automotive, and renewable energy (especially wind turbines) is a primary driver. Economically, global infrastructure development, increasing disposable incomes in emerging economies, and the growth of the construction industry translate into higher demand for paints and coatings, adhesives and sealants, and composite materials that utilize epoxy resins. Regulatory influences, while sometimes posing challenges, also act as a catalyst for innovation, particularly in pushing for the development of environmentally friendly, low-VOC epoxy systems and bio-based alternatives. The increasing focus on lightweighting in transportation to improve fuel efficiency and reduce emissions significantly favors the adoption of epoxy composites.

Obstacles in the Epoxy Resin Market Market

Despite its robust growth, the Epoxy Resin Market faces several obstacles. Regulatory challenges, particularly concerning the handling and disposal of certain raw materials like Bisphenol A, necessitate continuous investment in compliance and the development of safer alternatives. Supply chain disruptions, as evidenced by recent global events, can impact the availability and pricing of key raw materials, leading to increased production costs and potential delays. Competitive pressures from alternative materials, though often lacking the comprehensive performance profile of epoxies, can limit market share in certain price-sensitive applications. Furthermore, the volatile pricing of crude oil, a key feedstock for many epoxy resin precursors, poses a constant economic challenge.

Future Opportunities in Epoxy Resin Market

The Epoxy Resin Market presents a wealth of future opportunities. The growing global emphasis on renewable energy, particularly wind power, will continue to drive demand for epoxy composites in rotor blade manufacturing. The expansion of electric vehicle (EV) production creates opportunities for epoxy resins in lightweight structural components and battery encapsulation. The increasing demand for protective coatings in aging infrastructure and harsh marine environments offers sustained growth potential. Furthermore, the exploration and commercialization of bio-based epoxy resins and advanced recycling technologies represent significant avenues for sustainable growth and market differentiation. The development of smart epoxy materials with integrated functionalities could also unlock novel applications.

Major Players in the Epoxy Resin Market Ecosystem

- KUKDO CHEMICAL CO LTD

- Jiangsu Sanmu Group

- NAMA Chemicals

- Olin Corporation

- SPOLCHEMIE

- Chang Chun Group

- 3M

- Kemipex

- BASF SE

- Huntsman International LLC

- DuPont

- Aditya Birla Chemicals

- Daicel Corporation

- Hexion

- Sika AG

- Covestro AG

- Atul Ltd

- NAN YA PLASTICS CORPORATION

Key Developments in Epoxy Resin Market Industry

- March 2022: Aditya Birla Chemicals announced plans to double its epoxy manufacturing capacity and expand overseas operations, significantly strengthening its global market position and catering to growing demand for specialty chemicals.

- February 2022: Westlake Chemical Corporation completed the acquisition of Hexion Holdings Corporation's epoxy-based coatings and composite businesses for approximately USD 1.2 billion. This strategic move enhanced Westlake's portfolio, integrating epoxy specialty, base epoxy resins, and intermediates product lines and consolidating its presence in key end-use markets.

Strategic Epoxy Resin Market Market Forecast

The strategic forecast for the Epoxy Resin Market anticipates continued robust growth, fueled by escalating demand for high-performance materials across diverse industries. Key growth catalysts include the expanding renewable energy sector, particularly wind power, and the burgeoning automotive industry's focus on lightweighting for enhanced fuel efficiency and the proliferation of electric vehicles. The increasing need for durable and protective paints and coatings in infrastructure projects and the marine sector will also significantly contribute to market expansion. Innovations in sustainable epoxy formulations and the development of advanced composite materials are poised to unlock new market segments and reinforce the dominant position of epoxy resins in critical applications, driving the market towards an estimated value of over USD 35,000 million by 2033.

Epoxy Resin Market Segmentation

-

1. Raw Material

- 1.1. DGBEA (Bisphenol A and ECH)

- 1.2. DGBEF (Bisphenol F and ECH)

- 1.3. Novolac (Formaldehyde and Phenols)

- 1.4. Aliphatic (Aliphatic Alcohols)

- 1.5. Glycidylamine (Aromatic Amines and ECH)

- 1.6. Other Raw Materials

-

2. Application

- 2.1. Paints and Coatings

- 2.2. Adhesives and Sealants

- 2.3. Composites

- 2.4. Electrical and Electronics

- 2.5. Marine

- 2.6. Wind Turbines

- 2.7. Other Applications

Epoxy Resin Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. Qatar

- 6.2. United Arab Emirates

- 6.3. Nigeria

- 6.4. Egypt

- 6.5. South Africa

- 6.6. Rest of Middle East

Epoxy Resin Market Regional Market Share

Geographic Coverage of Epoxy Resin Market

Epoxy Resin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Epoxy-based Composites from the Aerospace and Automotive Industries; Strong Growth in the Construction Industry; Rising Demand for Electrical and Electronic Devices

- 3.3. Market Restrains

- 3.3.1. Hazardous Impact of Epoxy Resins; Other Restraints

- 3.4. Market Trends

- 3.4.1. The Paints and Coatings Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Epoxy Resin Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. DGBEA (Bisphenol A and ECH)

- 5.1.2. DGBEF (Bisphenol F and ECH)

- 5.1.3. Novolac (Formaldehyde and Phenols)

- 5.1.4. Aliphatic (Aliphatic Alcohols)

- 5.1.5. Glycidylamine (Aromatic Amines and ECH)

- 5.1.6. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Paints and Coatings

- 5.2.2. Adhesives and Sealants

- 5.2.3. Composites

- 5.2.4. Electrical and Electronics

- 5.2.5. Marine

- 5.2.6. Wind Turbines

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Asia Pacific Epoxy Resin Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. DGBEA (Bisphenol A and ECH)

- 6.1.2. DGBEF (Bisphenol F and ECH)

- 6.1.3. Novolac (Formaldehyde and Phenols)

- 6.1.4. Aliphatic (Aliphatic Alcohols)

- 6.1.5. Glycidylamine (Aromatic Amines and ECH)

- 6.1.6. Other Raw Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Paints and Coatings

- 6.2.2. Adhesives and Sealants

- 6.2.3. Composites

- 6.2.4. Electrical and Electronics

- 6.2.5. Marine

- 6.2.6. Wind Turbines

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. North America Epoxy Resin Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. DGBEA (Bisphenol A and ECH)

- 7.1.2. DGBEF (Bisphenol F and ECH)

- 7.1.3. Novolac (Formaldehyde and Phenols)

- 7.1.4. Aliphatic (Aliphatic Alcohols)

- 7.1.5. Glycidylamine (Aromatic Amines and ECH)

- 7.1.6. Other Raw Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Paints and Coatings

- 7.2.2. Adhesives and Sealants

- 7.2.3. Composites

- 7.2.4. Electrical and Electronics

- 7.2.5. Marine

- 7.2.6. Wind Turbines

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Europe Epoxy Resin Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. DGBEA (Bisphenol A and ECH)

- 8.1.2. DGBEF (Bisphenol F and ECH)

- 8.1.3. Novolac (Formaldehyde and Phenols)

- 8.1.4. Aliphatic (Aliphatic Alcohols)

- 8.1.5. Glycidylamine (Aromatic Amines and ECH)

- 8.1.6. Other Raw Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Paints and Coatings

- 8.2.2. Adhesives and Sealants

- 8.2.3. Composites

- 8.2.4. Electrical and Electronics

- 8.2.5. Marine

- 8.2.6. Wind Turbines

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South America Epoxy Resin Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. DGBEA (Bisphenol A and ECH)

- 9.1.2. DGBEF (Bisphenol F and ECH)

- 9.1.3. Novolac (Formaldehyde and Phenols)

- 9.1.4. Aliphatic (Aliphatic Alcohols)

- 9.1.5. Glycidylamine (Aromatic Amines and ECH)

- 9.1.6. Other Raw Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Paints and Coatings

- 9.2.2. Adhesives and Sealants

- 9.2.3. Composites

- 9.2.4. Electrical and Electronics

- 9.2.5. Marine

- 9.2.6. Wind Turbines

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Middle East Epoxy Resin Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. DGBEA (Bisphenol A and ECH)

- 10.1.2. DGBEF (Bisphenol F and ECH)

- 10.1.3. Novolac (Formaldehyde and Phenols)

- 10.1.4. Aliphatic (Aliphatic Alcohols)

- 10.1.5. Glycidylamine (Aromatic Amines and ECH)

- 10.1.6. Other Raw Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Paints and Coatings

- 10.2.2. Adhesives and Sealants

- 10.2.3. Composites

- 10.2.4. Electrical and Electronics

- 10.2.5. Marine

- 10.2.6. Wind Turbines

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Saudi Arabia Epoxy Resin Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 11.1.1. DGBEA (Bisphenol A and ECH)

- 11.1.2. DGBEF (Bisphenol F and ECH)

- 11.1.3. Novolac (Formaldehyde and Phenols)

- 11.1.4. Aliphatic (Aliphatic Alcohols)

- 11.1.5. Glycidylamine (Aromatic Amines and ECH)

- 11.1.6. Other Raw Materials

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Paints and Coatings

- 11.2.2. Adhesives and Sealants

- 11.2.3. Composites

- 11.2.4. Electrical and Electronics

- 11.2.5. Marine

- 11.2.6. Wind Turbines

- 11.2.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 KUKDO CHEMICAL CO LTD

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Jiangsu Sanmu Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NAMA Chemicals

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Olin Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 SPOLCHEMIE*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Chang Chun Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 3M

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kemipex

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 BASF SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Huntsman International LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 DuPont

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Aditya Birla Chemicals

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Daicel Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Hexion

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Sika AG

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Covestro AG

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Atul Ltd

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 NAN YA PLASTICS CORPORATION

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.1 KUKDO CHEMICAL CO LTD

List of Figures

- Figure 1: Global Epoxy Resin Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Epoxy Resin Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Epoxy Resin Market Revenue (undefined), by Raw Material 2025 & 2033

- Figure 4: Asia Pacific Epoxy Resin Market Volume (Million), by Raw Material 2025 & 2033

- Figure 5: Asia Pacific Epoxy Resin Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 6: Asia Pacific Epoxy Resin Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 7: Asia Pacific Epoxy Resin Market Revenue (undefined), by Application 2025 & 2033

- Figure 8: Asia Pacific Epoxy Resin Market Volume (Million), by Application 2025 & 2033

- Figure 9: Asia Pacific Epoxy Resin Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Epoxy Resin Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Epoxy Resin Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: Asia Pacific Epoxy Resin Market Volume (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Epoxy Resin Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Epoxy Resin Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Epoxy Resin Market Revenue (undefined), by Raw Material 2025 & 2033

- Figure 16: North America Epoxy Resin Market Volume (Million), by Raw Material 2025 & 2033

- Figure 17: North America Epoxy Resin Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 18: North America Epoxy Resin Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 19: North America Epoxy Resin Market Revenue (undefined), by Application 2025 & 2033

- Figure 20: North America Epoxy Resin Market Volume (Million), by Application 2025 & 2033

- Figure 21: North America Epoxy Resin Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Epoxy Resin Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Epoxy Resin Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: North America Epoxy Resin Market Volume (Million), by Country 2025 & 2033

- Figure 25: North America Epoxy Resin Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Epoxy Resin Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Epoxy Resin Market Revenue (undefined), by Raw Material 2025 & 2033

- Figure 28: Europe Epoxy Resin Market Volume (Million), by Raw Material 2025 & 2033

- Figure 29: Europe Epoxy Resin Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 30: Europe Epoxy Resin Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 31: Europe Epoxy Resin Market Revenue (undefined), by Application 2025 & 2033

- Figure 32: Europe Epoxy Resin Market Volume (Million), by Application 2025 & 2033

- Figure 33: Europe Epoxy Resin Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Epoxy Resin Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Epoxy Resin Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Epoxy Resin Market Volume (Million), by Country 2025 & 2033

- Figure 37: Europe Epoxy Resin Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Epoxy Resin Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Epoxy Resin Market Revenue (undefined), by Raw Material 2025 & 2033

- Figure 40: South America Epoxy Resin Market Volume (Million), by Raw Material 2025 & 2033

- Figure 41: South America Epoxy Resin Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 42: South America Epoxy Resin Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 43: South America Epoxy Resin Market Revenue (undefined), by Application 2025 & 2033

- Figure 44: South America Epoxy Resin Market Volume (Million), by Application 2025 & 2033

- Figure 45: South America Epoxy Resin Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Epoxy Resin Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Epoxy Resin Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America Epoxy Resin Market Volume (Million), by Country 2025 & 2033

- Figure 49: South America Epoxy Resin Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Epoxy Resin Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Epoxy Resin Market Revenue (undefined), by Raw Material 2025 & 2033

- Figure 52: Middle East Epoxy Resin Market Volume (Million), by Raw Material 2025 & 2033

- Figure 53: Middle East Epoxy Resin Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 54: Middle East Epoxy Resin Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 55: Middle East Epoxy Resin Market Revenue (undefined), by Application 2025 & 2033

- Figure 56: Middle East Epoxy Resin Market Volume (Million), by Application 2025 & 2033

- Figure 57: Middle East Epoxy Resin Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East Epoxy Resin Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East Epoxy Resin Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Middle East Epoxy Resin Market Volume (Million), by Country 2025 & 2033

- Figure 61: Middle East Epoxy Resin Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Epoxy Resin Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Saudi Arabia Epoxy Resin Market Revenue (undefined), by Raw Material 2025 & 2033

- Figure 64: Saudi Arabia Epoxy Resin Market Volume (Million), by Raw Material 2025 & 2033

- Figure 65: Saudi Arabia Epoxy Resin Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 66: Saudi Arabia Epoxy Resin Market Volume Share (%), by Raw Material 2025 & 2033

- Figure 67: Saudi Arabia Epoxy Resin Market Revenue (undefined), by Application 2025 & 2033

- Figure 68: Saudi Arabia Epoxy Resin Market Volume (Million), by Application 2025 & 2033

- Figure 69: Saudi Arabia Epoxy Resin Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Saudi Arabia Epoxy Resin Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Saudi Arabia Epoxy Resin Market Revenue (undefined), by Country 2025 & 2033

- Figure 72: Saudi Arabia Epoxy Resin Market Volume (Million), by Country 2025 & 2033

- Figure 73: Saudi Arabia Epoxy Resin Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Saudi Arabia Epoxy Resin Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Epoxy Resin Market Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 2: Global Epoxy Resin Market Volume Million Forecast, by Raw Material 2020 & 2033

- Table 3: Global Epoxy Resin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Epoxy Resin Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Global Epoxy Resin Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Epoxy Resin Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Epoxy Resin Market Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 8: Global Epoxy Resin Market Volume Million Forecast, by Raw Material 2020 & 2033

- Table 9: Global Epoxy Resin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Epoxy Resin Market Volume Million Forecast, by Application 2020 & 2033

- Table 11: Global Epoxy Resin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Epoxy Resin Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: China Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: China Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: India Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Malaysia Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Malaysia Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Thailand Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Thailand Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Vietnam Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Epoxy Resin Market Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 32: Global Epoxy Resin Market Volume Million Forecast, by Raw Material 2020 & 2033

- Table 33: Global Epoxy Resin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Epoxy Resin Market Volume Million Forecast, by Application 2020 & 2033

- Table 35: Global Epoxy Resin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Epoxy Resin Market Volume Million Forecast, by Country 2020 & 2033

- Table 37: United States Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United States Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 39: Canada Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Canada Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 41: Mexico Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Mexico Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: Global Epoxy Resin Market Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 44: Global Epoxy Resin Market Volume Million Forecast, by Raw Material 2020 & 2033

- Table 45: Global Epoxy Resin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 46: Global Epoxy Resin Market Volume Million Forecast, by Application 2020 & 2033

- Table 47: Global Epoxy Resin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Epoxy Resin Market Volume Million Forecast, by Country 2020 & 2033

- Table 49: Germany Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Germany Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 53: France Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: France Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Italy Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Italy Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Spain Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Spain Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: NORDIC Countries Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: NORDIC Countries Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Turkey Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Russia Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Russia Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 65: Rest of Europe Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Europe Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 67: Global Epoxy Resin Market Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 68: Global Epoxy Resin Market Volume Million Forecast, by Raw Material 2020 & 2033

- Table 69: Global Epoxy Resin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 70: Global Epoxy Resin Market Volume Million Forecast, by Application 2020 & 2033

- Table 71: Global Epoxy Resin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Epoxy Resin Market Volume Million Forecast, by Country 2020 & 2033

- Table 73: Brazil Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 75: Argentina Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 77: Colombia Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Colombia Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 79: Rest of South America Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: Rest of South America Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 81: Global Epoxy Resin Market Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 82: Global Epoxy Resin Market Volume Million Forecast, by Raw Material 2020 & 2033

- Table 83: Global Epoxy Resin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 84: Global Epoxy Resin Market Volume Million Forecast, by Application 2020 & 2033

- Table 85: Global Epoxy Resin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 86: Global Epoxy Resin Market Volume Million Forecast, by Country 2020 & 2033

- Table 87: Global Epoxy Resin Market Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 88: Global Epoxy Resin Market Volume Million Forecast, by Raw Material 2020 & 2033

- Table 89: Global Epoxy Resin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 90: Global Epoxy Resin Market Volume Million Forecast, by Application 2020 & 2033

- Table 91: Global Epoxy Resin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 92: Global Epoxy Resin Market Volume Million Forecast, by Country 2020 & 2033

- Table 93: Qatar Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: Qatar Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 95: United Arab Emirates Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 96: United Arab Emirates Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 97: Nigeria Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: Nigeria Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 99: Egypt Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: Egypt Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 101: South Africa Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: South Africa Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 103: Rest of Middle East Epoxy Resin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 104: Rest of Middle East Epoxy Resin Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Epoxy Resin Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Epoxy Resin Market?

Key companies in the market include KUKDO CHEMICAL CO LTD, Jiangsu Sanmu Group, NAMA Chemicals, Olin Corporation, SPOLCHEMIE*List Not Exhaustive, Chang Chun Group, 3M, Kemipex, BASF SE, Huntsman International LLC, DuPont, Aditya Birla Chemicals, Daicel Corporation, Hexion, Sika AG, Covestro AG, Atul Ltd, NAN YA PLASTICS CORPORATION.

3. What are the main segments of the Epoxy Resin Market?

The market segments include Raw Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Epoxy-based Composites from the Aerospace and Automotive Industries; Strong Growth in the Construction Industry; Rising Demand for Electrical and Electronic Devices.

6. What are the notable trends driving market growth?

The Paints and Coatings Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Hazardous Impact of Epoxy Resins; Other Restraints.

8. Can you provide examples of recent developments in the market?

March 2022: Aditya Birla Chemicals announced to double its epoxy manufacturing capacity and expand overseas operations, enhancing its position in the global market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Epoxy Resin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Epoxy Resin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Epoxy Resin Market?

To stay informed about further developments, trends, and reports in the Epoxy Resin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence