Key Insights

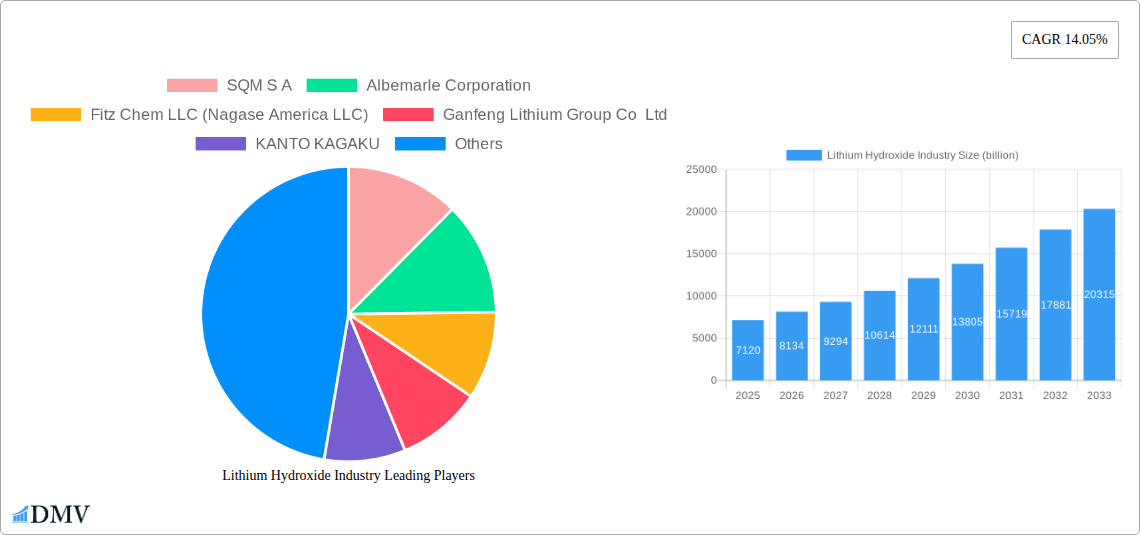

The global Lithium Hydroxide market is poised for remarkable expansion, projected to reach $7.12 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 14.05% throughout the forecast period of 2025-2033. This significant growth is primarily fueled by the burgeoning demand for lithium-ion batteries, which are indispensable for electric vehicles (EVs) and portable electronics. The increasing global focus on decarbonization and sustainable energy solutions further bolsters this trend, driving substantial investments in battery production and, consequently, lithium hydroxide. Beyond batteries, applications in lubricating greases and purification processes also contribute to market vitality, showcasing the versatility of this critical chemical compound. The market's trajectory is set to be influenced by innovative production techniques and strategic expansions by leading players, aiming to meet the escalating global appetite for high-purity lithium hydroxide.

Lithium Hydroxide Industry Market Size (In Billion)

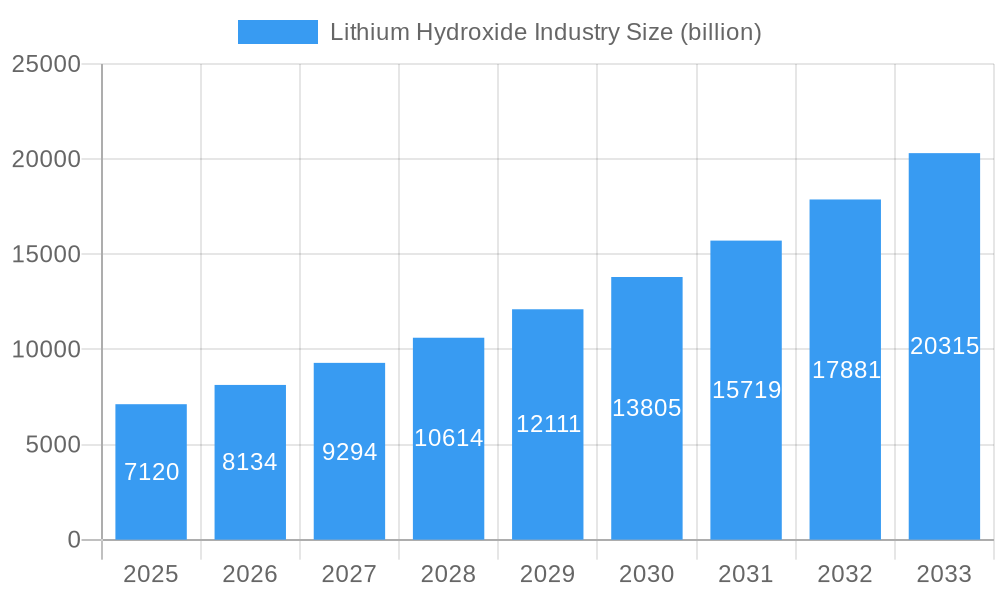

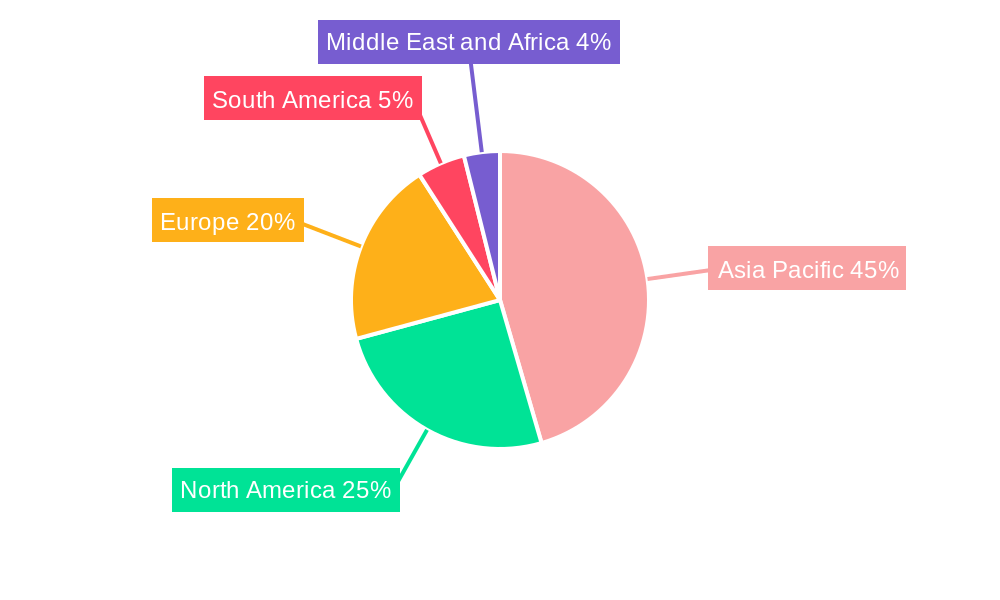

However, the market faces certain constraints, including the volatile pricing of lithium raw materials and the intricate, capital-intensive nature of lithium hydroxide production. The development of advanced recycling technologies for lithium-ion batteries could also impact primary demand over the long term. Geographically, the Asia Pacific region, particularly China, is expected to lead market growth due to its dominant position in battery manufacturing and a strong push towards EV adoption. North America and Europe are also key growth areas, driven by supportive government policies and increasing investments in battery gigafactories. The competitive landscape features prominent companies like SQM S.A., Albemarle Corporation, and Ganfeng Lithium Group Co. Ltd., all actively engaged in expanding their production capacities and technological capabilities to secure a significant share in this rapidly evolving market.

Lithium Hydroxide Industry Company Market Share

This in-depth market analysis delves into the dynamic lithium hydroxide industry, a critical component driving the global transition towards sustainable energy. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report provides unparalleled insights into market composition, trends, and future trajectories. We examine battery-grade lithium hydroxide, crucial for the burgeoning electric vehicle (EV) market, and its applications across sectors like lubricating greases, purification, and polymer production. For stakeholders seeking to navigate the complexities of this high-growth market, this report offers a data-driven roadmap, highlighting market share distribution, investment trends, and strategic M&A activities. Our forecast period from 2025 to 2033 anticipates significant expansion, driven by innovation and increasing demand for advanced battery materials. This comprehensive study is essential for anyone involved in the lithium chemical sector, EV battery supply chain, or renewable energy investments.

Lithium Hydroxide Industry Market Composition & Trends

The lithium hydroxide market is characterized by a moderate to high level of concentration, with a few key players dominating global production. Innovation remains a significant catalyst, primarily driven by the relentless demand for higher-purity, battery-grade lithium hydroxide essential for next-generation lithium-ion batteries. The regulatory landscape is increasingly focused on sustainable sourcing and production practices, influencing investment decisions and operational strategies. While substitutes for lithium in certain applications exist, the superior performance of lithium hydroxide in high-energy-density batteries solidifies its irreplaceable role. End-user profiles are dominated by EV manufacturers and battery producers, followed by industries requiring specialized greases and purification agents. Mergers and acquisitions are a recurring theme, as companies seek to secure supply chains and expand production capacity. Recent M&A deal values are substantial, reflecting the strategic importance of this sector. Market share distribution is a key indicator of competitive intensity, with leading companies vying for dominance.

- Market Concentration: Dominated by a handful of global producers, with a growing influence of new entrants.

- Innovation Catalysts: Driven by EV battery performance enhancements, cost reduction, and sustainability initiatives.

- Regulatory Landscapes: Focus on environmental compliance, ethical sourcing, and battery recycling mandates.

- Substitute Products: Limited viable substitutes for high-performance EV batteries, reinforcing lithium hydroxide's critical role.

- End-User Profiles: Primarily electric vehicle manufacturers, battery cell producers, and specialized industrial applications.

- M&A Activities: Strategic acquisitions to secure raw materials, expand processing capabilities, and gain market share.

Lithium Hydroxide Industry Industry Evolution

The lithium hydroxide industry has witnessed a remarkable evolution, transitioning from a niche chemical to a cornerstone of the global energy transition. Over the historical period (2019-2024), market growth trajectories have been consistently upward, primarily propelled by the exponential rise in electric vehicle adoption. Technological advancements have been central to this evolution, with a relentless pursuit of higher purity levels and more efficient production processes for battery-grade lithium hydroxide. This has involved significant investment in research and development to enhance electrochemical performance and battery lifespan. Shifting consumer demands, driven by increasing environmental awareness and government incentives for EVs, have further accelerated this growth. Adoption metrics for electric vehicles, directly correlating with lithium hydroxide demand, have seen double-digit annual growth rates. The forecast period (2025-2033) is projected to witness even more robust expansion, as global automotive manufacturers solidify their EV commitments and battery technology continues to mature. Market growth rates are anticipated to remain strong, fueled by the increasing electrification of transportation and the expanding applications of lithium-ion batteries in grid storage and consumer electronics. The industry's ability to scale production efficiently and sustainably will be a critical determinant of its future success.

Leading Regions, Countries, or Segments in Lithium Hydroxide Industry

The lithium hydroxide industry is experiencing a significant surge in demand, with the Lithium-ion Batteries application segment emerging as the undisputed leader. This dominance is driven by the global proliferation of electric vehicles, a trend that is expected to intensify throughout the forecast period. Investment trends in this segment are overwhelmingly directed towards expanding production capacity and enhancing the performance of battery-grade lithium hydroxide. Regulatory support, through government mandates and incentives for EV adoption and renewable energy storage, further solidifies the preeminence of the lithium-ion battery segment.

- Dominant Segment: Lithium-ion Batteries. This segment accounts for the vast majority of global lithium hydroxide consumption and is projected to maintain its leading position due to the ongoing EV revolution.

- Key Drivers:

- Electric Vehicle Growth: Rapidly expanding EV market worldwide, leading to unprecedented demand for battery materials.

- Energy Storage Solutions: Increasing deployment of grid-scale battery storage systems to support renewable energy integration.

- Consumer Electronics: Sustained demand for portable electronic devices powered by lithium-ion batteries.

- Technological Advancements: Continuous improvements in battery energy density, charging speed, and lifespan.

- Government Policies: Favorable regulations, subsidies, and targets for EV sales and emissions reduction.

- Key Drivers:

While Lubricating Greases, Purification, and Other Applications (Polymer Production) represent important, albeit smaller, market segments, their growth is outpaced by the sheer scale of demand from the battery sector. However, advancements in high-performance lubricants and specialized polymers may offer niche growth opportunities. The geographical landscape for lithium hydroxide production and consumption is also evolving, with key players in Asia, North America, and South America strategically positioned to meet future demand. Investment in new mining and refining projects is concentrated in regions with abundant lithium reserves and supportive regulatory environments.

Lithium Hydroxide Industry Product Innovations

Product innovation in the lithium hydroxide industry is primarily focused on achieving ultra-high purity levels, crucial for maximizing the performance and lifespan of lithium-ion batteries. Manufacturers are developing advanced refining techniques to minimize impurities such as sodium, potassium, and iron, which can degrade battery performance. Innovations also extend to enhancing the physical characteristics of lithium hydroxide, such as particle size and morphology, to optimize handling and integration into battery cathode materials. Performance metrics are being continuously improved, with a focus on increasing electrochemical stability, reducing degradation rates, and enabling faster charging capabilities. The unique selling proposition of leading suppliers lies in their ability to consistently deliver high-quality, battery-grade lithium hydroxide that meets the stringent specifications of global battery manufacturers.

Propelling Factors for Lithium Hydroxide Industry Growth

The lithium hydroxide industry is experiencing robust growth, propelled by a confluence of powerful factors. The accelerating adoption of electric vehicles (EVs) is the most significant driver, creating a massive and expanding market for battery-grade lithium hydroxide. Government policies worldwide, including emissions targets and EV purchase incentives, are further stimulating this demand. Technological advancements in lithium-ion battery technology, leading to improved energy density, longer lifespans, and faster charging, are also key growth catalysts. Economically, the decreasing cost of battery production and the increasing focus on energy independence and security are making EVs and related technologies more attractive. The ongoing expansion of renewable energy infrastructure, requiring large-scale battery storage, also contributes significantly to the upward trajectory of the lithium hydroxide market.

- Electric Vehicle Revolution: Unprecedented demand from the EV sector.

- Government Mandates & Incentives: Supportive policies driving EV adoption and renewable energy.

- Battery Technology Advancements: Enabling higher performance and lower costs.

- Energy Storage Solutions: Growing need for grid-scale battery storage.

- Global Energy Transition: Shift towards sustainable and electrified energy systems.

Obstacles in the Lithium Hydroxide Industry Market

Despite its strong growth prospects, the lithium hydroxide industry faces several significant obstacles. The supply chain for lithium raw materials remains volatile, with geopolitical factors and limited geographical concentration of reserves posing risks. Regulatory challenges related to environmental impact and permitting for new mining and processing facilities can lead to project delays and increased costs. Competitive pressures from established players and new entrants, coupled with the need for substantial capital investment, create a challenging landscape. Furthermore, fluctuations in lithium prices can impact profitability and investment decisions. Supply chain disruptions, as seen in recent global events, can severely affect production volumes and lead times.

- Supply Chain Volatility: Dependence on a few key producing regions and potential disruptions.

- Environmental Regulations: Stringent regulations impacting mining and processing operations.

- Capital Intensive Operations: High upfront investment required for extraction and refining.

- Price Fluctuations: Volatility in lithium commodity prices affecting profitability.

- Geopolitical Risks: Potential impact of international relations on resource access and trade.

Future Opportunities in Lithium Hydroxide Industry

The lithium hydroxide industry is ripe with future opportunities, driven by ongoing innovation and market expansion. The development of novel lithium-ion battery chemistries requiring even higher purity or different forms of lithium hydroxide presents new avenues for growth. Expansion into emerging markets with nascent EV adoption and renewable energy initiatives offers significant untapped potential. Technological advancements in recycling spent lithium-ion batteries could create a circular economy, reducing reliance on primary extraction and offering a sustainable source of lithium. Furthermore, the increasing integration of lithium hydroxide in applications beyond batteries, such as advanced ceramics and pharmaceuticals, could diversify revenue streams.

- Advanced Battery Technologies: Development of next-generation battery chemistries.

- Emerging Market Penetration: Tapping into new geographic regions with growing EV adoption.

- Lithium-ion Battery Recycling: Establishing a sustainable circular economy for lithium.

- Diversification of Applications: Expanding into non-battery related industrial uses.

- Vertical Integration: Opportunities for companies to control more of the supply chain.

Major Players in the Lithium Hydroxide Industry Ecosystem

- SQM S A

- Albemarle Corporation

- Fitz Chem LLC (Nagase America LLC)

- Ganfeng Lithium Group Co Ltd

- KANTO KAGAKU

- LevertonHELM Limited

- Livent

- Nemaska Lithium

- Shangai China Lithium Industrial Co Ltd

- SICHUAN BRIVO LITHIUM MATERIALS CO LTD

- Tianqi Lithium

Key Developments in Lithium Hydroxide Industry Industry

- June 2023: Nemaska Lithium announced the commencement of construction of its new production facility in Bécancour. This new facility would produce lithium hydroxide for batteries, which the Whabouchi mine would supply. This development signifies a significant expansion in Nemaska Lithium's production capacity and strengthens its supply chain integration.

- May 2023: Nemaska Lithium collaborated with Ford to provide lithium hydroxide produced at the company's production facility in Bécancour. According to this collaboration, Nemaska Lithium would provide up to 13,000 tons of lithium hydroxide to Ford for manufacturing electric vehicle batteries. This strategic partnership highlights the growing demand from major automotive manufacturers and reinforces Nemaska Lithium's position as a key supplier.

- March 2023: Albemarle Corporation expanded its lithium-processing facility in Chester County, South Carolina. This production facility is expected to support the production of around 2.4 million electric vehicles annually. Albemarle Corporation has announced a new lithium processing facility that will produce approximately 50,000 tons of battery-grade lithium hydroxide. This expansion underscores Albemarle's commitment to meeting the surging demand for battery materials and its significant role in the North American EV supply chain.

Strategic Lithium Hydroxide Industry Market Forecast

The strategic outlook for the lithium hydroxide industry is exceptionally positive, underpinned by accelerating global trends towards electrification and sustainability. The forecast period (2025-2033) is expected to witness sustained, high-level growth, driven by the insatiable demand from the electric vehicle (EV) sector and the burgeoning market for energy storage solutions. Technological advancements in battery chemistry and manufacturing processes will continue to be key growth catalysts, enabling higher performance and lower costs. Strategic investments in expanding production capacity, securing raw material supply chains, and developing advanced refining techniques will be crucial for market leaders. Emerging opportunities in new geographic markets and innovative recycling technologies will further shape the industry's future landscape, promising substantial market potential for agile and forward-thinking stakeholders.

Lithium Hydroxide Industry Segmentation

-

1. Application

- 1.1. Lithium-ion Batteries

- 1.2. Lubricating Greases

- 1.3. Purification

- 1.4. Other Applications (Polymer Production)

Lithium Hydroxide Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Turkey

- 3.7. Russia

- 3.8. NORDIC

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Nigeria

- 5.4. Qatar

- 5.5. Egypt

- 5.6. UAE

- 5.7. Rest of Middle East and Africa

Lithium Hydroxide Industry Regional Market Share

Geographic Coverage of Lithium Hydroxide Industry

Lithium Hydroxide Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Electric Vehicles; Increasing Demand for Power Tools

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Electric Vehicles; Increasing Demand for Power Tools

- 3.4. Market Trends

- 3.4.1. Batteries Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lithium Hydroxide Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Lithium-ion Batteries

- 5.1.2. Lubricating Greases

- 5.1.3. Purification

- 5.1.4. Other Applications (Polymer Production)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Lithium Hydroxide Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Lithium-ion Batteries

- 6.1.2. Lubricating Greases

- 6.1.3. Purification

- 6.1.4. Other Applications (Polymer Production)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Lithium Hydroxide Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Lithium-ion Batteries

- 7.1.2. Lubricating Greases

- 7.1.3. Purification

- 7.1.4. Other Applications (Polymer Production)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Lithium Hydroxide Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Lithium-ion Batteries

- 8.1.2. Lubricating Greases

- 8.1.3. Purification

- 8.1.4. Other Applications (Polymer Production)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Lithium Hydroxide Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Lithium-ion Batteries

- 9.1.2. Lubricating Greases

- 9.1.3. Purification

- 9.1.4. Other Applications (Polymer Production)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Lithium Hydroxide Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Lithium-ion Batteries

- 10.1.2. Lubricating Greases

- 10.1.3. Purification

- 10.1.4. Other Applications (Polymer Production)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SQM S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Albemarle Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fitz Chem LLC (Nagase America LLC)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ganfeng Lithium Group Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KANTO KAGAKU

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LevertonHELM Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Livent

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nemaska Lithium

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shangai China Lithium Industrial Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SICHUAN BRIVO LITHIUM MATERIALS CO LTD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tianqi Lithium*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SQM S A

List of Figures

- Figure 1: Global Lithium Hydroxide Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Lithium Hydroxide Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: Asia Pacific Lithium Hydroxide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Lithium Hydroxide Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Asia Pacific Lithium Hydroxide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Lithium Hydroxide Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Lithium Hydroxide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Lithium Hydroxide Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Lithium Hydroxide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Lithium Hydroxide Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Lithium Hydroxide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Lithium Hydroxide Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Lithium Hydroxide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Lithium Hydroxide Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: South America Lithium Hydroxide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Lithium Hydroxide Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Lithium Hydroxide Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Lithium Hydroxide Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa Lithium Hydroxide Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Lithium Hydroxide Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Lithium Hydroxide Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lithium Hydroxide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Lithium Hydroxide Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Lithium Hydroxide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Lithium Hydroxide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: India Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Japan Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Korea Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Malaysia Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Thailand Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Vietnam Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Lithium Hydroxide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Lithium Hydroxide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Canada Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Lithium Hydroxide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Lithium Hydroxide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Turkey Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Russia Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: NORDIC Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Lithium Hydroxide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Lithium Hydroxide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Colombia Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Lithium Hydroxide Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Lithium Hydroxide Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: South Africa Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Nigeria Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Qatar Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Egypt Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: UAE Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Lithium Hydroxide Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lithium Hydroxide Industry?

The projected CAGR is approximately 14.05%.

2. Which companies are prominent players in the Lithium Hydroxide Industry?

Key companies in the market include SQM S A, Albemarle Corporation, Fitz Chem LLC (Nagase America LLC), Ganfeng Lithium Group Co Ltd, KANTO KAGAKU, LevertonHELM Limited, Livent, Nemaska Lithium, Shangai China Lithium Industrial Co Ltd, SICHUAN BRIVO LITHIUM MATERIALS CO LTD, Tianqi Lithium*List Not Exhaustive.

3. What are the main segments of the Lithium Hydroxide Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Electric Vehicles; Increasing Demand for Power Tools.

6. What are the notable trends driving market growth?

Batteries Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Electric Vehicles; Increasing Demand for Power Tools.

8. Can you provide examples of recent developments in the market?

June 2023: Nemaska Lithium announced the commencement of construction of its new production facility in Bécancour. This new facility would produce lithium hydroxide for batteries, which the Whabouchi mine would supply.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lithium Hydroxide Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lithium Hydroxide Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lithium Hydroxide Industry?

To stay informed about further developments, trends, and reports in the Lithium Hydroxide Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence