Key Insights

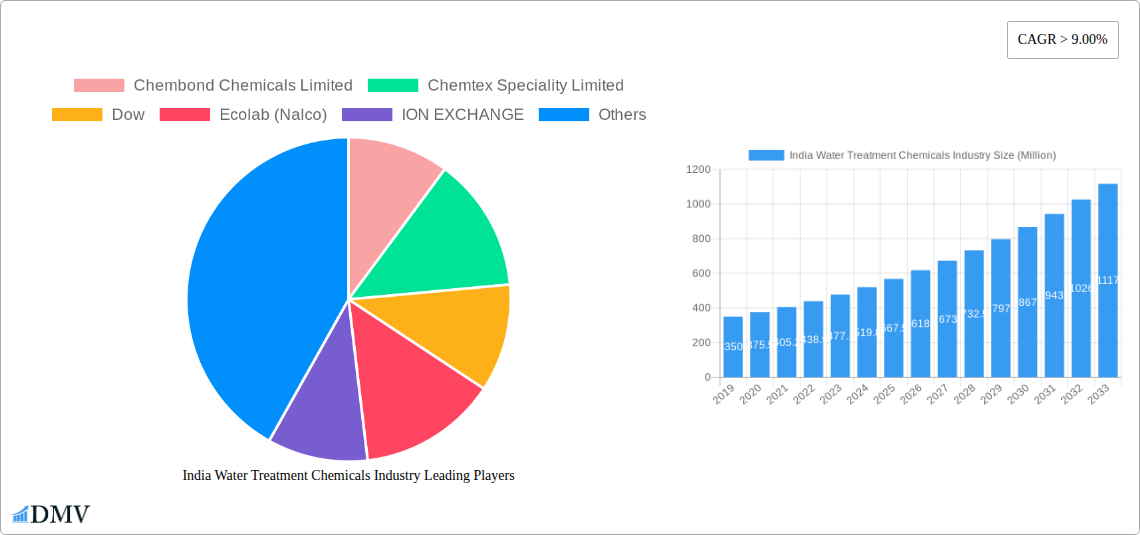

The Indian water treatment chemicals market is poised for robust expansion, projected to reach USD 622.38 Million by 2025, demonstrating a significant growth trajectory with a Compound Annual Growth Rate (CAGR) exceeding 9.00% during the forecast period of 2025-2033. This upward trend is underpinned by a confluence of factors, prominently driven by the escalating demand for clean water across various industrial sectors and the increasing focus on stringent environmental regulations governing water discharge. The power generation sector, a major consumer, requires substantial volumes of water treatment chemicals for boiler feed water and cooling tower operations to ensure efficiency and prevent equipment damage. Similarly, the oil and gas industry's reliance on water for extraction and refining processes, coupled with the need to manage produced water and wastewater, further fuels market growth. Chemical manufacturing, mining, and municipal water treatment also represent significant demand drivers, reflecting the nationwide emphasis on water resource management and public health.

India Water Treatment Chemicals Industry Market Size (In Million)

The market's dynamism is further characterized by evolving trends and a diverse segmentation. Biocides and disinfectants are witnessing increased adoption due to growing concerns about microbial contamination in industrial and potable water. Coagulants and flocculants play a crucial role in effective wastewater treatment, while corrosion and scale inhibitors are essential for maintaining the longevity and efficiency of water systems across all major end-user industries. The rise of advanced treatment technologies and a growing preference for customized chemical solutions tailored to specific industrial needs are also shaping the market landscape. While the market exhibits strong growth, certain restraints such as fluctuating raw material prices and the initial capital investment for advanced treatment systems may pose challenges. However, the sustained government initiatives promoting water conservation and pollution control, alongside technological advancements, are expected to outweigh these restraints, ensuring a vibrant and expanding Indian water treatment chemicals market.

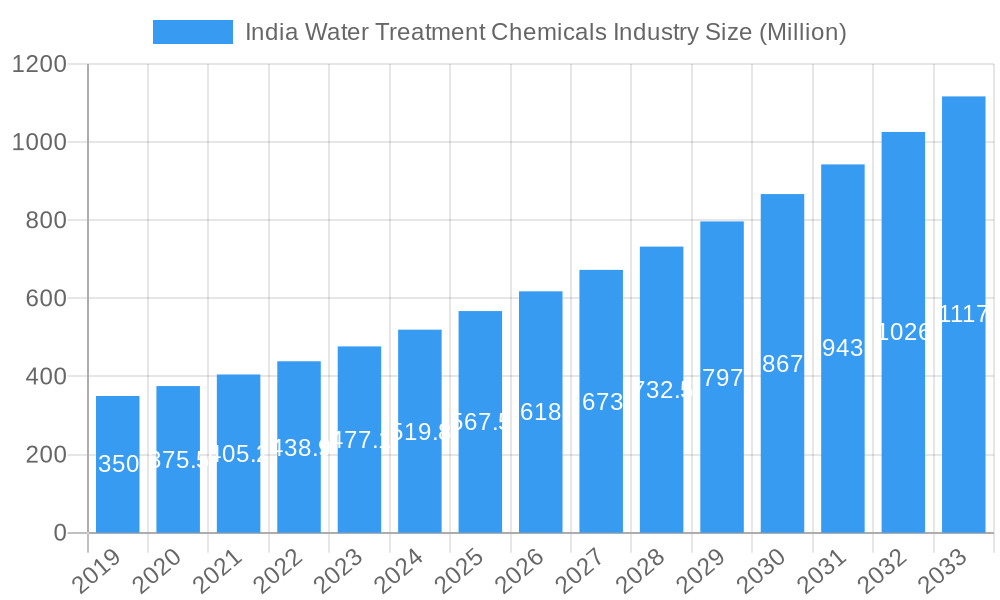

India Water Treatment Chemicals Industry Company Market Share

India Water Treatment Chemicals Industry Market Report: Growth, Trends, and Forecasts (2019-2033)

Unlock critical insights into India's burgeoning water treatment chemicals market. This comprehensive report, spanning the historical period of 2019-2024 and forecasting through 2033 with a base year of 2025, offers an in-depth analysis of market dynamics, product innovations, key players, and future opportunities. Essential for stakeholders seeking to navigate this high-growth sector, the report details the impact of regulatory shifts, technological advancements, and evolving end-user demands. Discover the strategic landscape, competitive environment, and investment potential within this vital industry.

India Water Treatment Chemicals Industry Market Composition & Trends

The Indian water treatment chemicals market is characterized by a moderately concentrated landscape, driven by increasing industrialization, stringent environmental regulations, and a growing awareness of water scarcity. Innovation catalysts include the demand for advanced, eco-friendly chemical formulations, particularly in segments like biocides and disinfectants, and corrosion and scale inhibitors. Regulatory frameworks, such as those promoting water reuse and zero liquid discharge (ZLD), are significantly shaping market trends, favoring sustainable chemical solutions. Substitute products, while present in some basic applications, are increasingly being outperformed by specialized chemical treatments offering superior efficacy and reduced environmental impact. End-user profiles range from large-scale industrial operations in power generation and oil & gas to essential municipal water treatment facilities, each with unique chemical requirements. Mergers and acquisitions (M&A) activities are on the rise, with deal values anticipated to surge as major players consolidate their market positions and expand their product portfolios. The market share distribution is dynamic, with established global and domestic companies vying for dominance in key segments.

India Water Treatment Chemicals Industry Industry Evolution

The India water treatment chemicals industry has witnessed a remarkable evolution, transitioning from basic commodity chemicals to sophisticated, high-performance solutions. Over the study period (2019–2033), market growth trajectories have been consistently upward, driven by a confluence of factors including rapid urbanization, expanding industrial output, and a heightened emphasis on public health and environmental sustainability. Technological advancements have been pivotal, with a notable shift towards specialized formulations that address specific water quality issues and operational challenges. For instance, the development of advanced coagulants and flocculants has significantly improved the efficiency of solid-liquid separation in wastewater treatment, leading to cleaner effluents. Similarly, the demand for intelligent corrosion and scale inhibitors has grown as industries seek to optimize asset lifespan and minimize operational downtime.

Consumer demands have also played a crucial role, with a growing preference for environmentally benign and cost-effective chemical treatments. This has spurred research and development into bio-based chemicals and low-dosage formulations that minimize chemical waste. The adoption metrics for advanced water treatment chemicals have seen a significant increase, particularly in sectors like chemical manufacturing and pulp and paper, where stringent discharge norms necessitate high-purity water and effective effluent management. The market has responded by introducing innovative products that offer enhanced biodegradability, reduced toxicity, and improved cost-efficiency. The overall growth rate of the industry has been robust, with projections indicating continued expansion fueled by ongoing infrastructure development and a proactive approach to water resource management. The transition from a reactive approach to water treatment to a proactive and sustainable one underscores the industry's maturation and its critical role in India's economic and environmental future.

Leading Regions, Countries, or Segments in India Water Treatment Chemicals Industry

Within the India water treatment chemicals industry, a clear dominance emerges from both geographical and product/end-user perspectives. Regionally, Western India, driven by its significant industrial hubs in Gujarat and Maharashtra, leads the market. This dominance is attributed to the high concentration of chemical manufacturing (including petrochemicals), oil and gas refining, and pharmaceutical industries, all of which are major consumers of water treatment chemicals. The robust infrastructure and established industrial ecosystem in these states foster significant investment trends and provide a fertile ground for the adoption of advanced water treatment technologies.

- Key Drivers in Western India:

- Industrial Proximity: Concentration of key end-user industries like chemical manufacturing, oil & gas, and pharmaceuticals.

- Regulatory Support: Proactive implementation of environmental regulations and incentives for water conservation and pollution control.

- Investment Trends: Substantial private and public sector investments in industrial expansion and water infrastructure.

- Technological Adoption: Higher willingness and capacity to adopt advanced and specialized water treatment chemicals.

In terms of Product Type, Coagulants and Flocculants represent a foundational segment with consistent demand across nearly all end-user industries due to their critical role in removing suspended solids and impurities from raw and wastewater. However, Corrosion and Scale Inhibitors are experiencing particularly strong growth, driven by the need to protect expensive industrial infrastructure, especially in the power generation and oil and gas sectors, where maintaining operational efficiency and asset longevity is paramount. The rising cost of equipment repair and replacement due to scaling and corrosion is a significant factor.

- Dominance Factors for Corrosion and Scale Inhibitors:

- Asset Protection: Crucial for extending the lifespan of boilers, cooling towers, pipelines, and other vital industrial equipment.

- Operational Efficiency: Prevents reduced heat transfer efficiency in cooling systems and boiler performance degradation.

- Cost Savings: Minimizes unscheduled downtime, maintenance costs, and the need for premature equipment replacement.

- Technological Sophistication: Development of high-performance, multi-functional inhibitors tailored to specific water chemistries and operating conditions.

From an End-user Industry perspective, Power Generation is a leading consumer of water treatment chemicals, primarily for boiler feed water treatment, cooling tower operations, and flue gas desulfurization. The increasing demand for energy and the emphasis on improving the efficiency of thermal power plants directly translate into higher consumption of specialized water treatment chemicals. The Chemical Manufacturing (including Petrochemicals) sector also ranks high, requiring extensive water treatment for process water, effluent treatment, and cooling.

- Key Drivers in Power Generation:

- Stringent Quality Requirements: High-purity water is essential for boiler efficiency and to prevent scaling and corrosion.

- Environmental Compliance: Meeting strict discharge standards for cooling tower blowdown and other wastewater streams.

- Operational Continuity: Preventing equipment failure and ensuring uninterrupted power generation.

- Growth in Thermal Power: Continued reliance on thermal power necessitates ongoing investment in associated water treatment.

India Water Treatment Chemicals Industry Product Innovations

Product innovations in the India water treatment chemicals industry are increasingly focused on sustainability, efficiency, and specialized applications. Advanced polymer-based coagulants and flocculants offer higher charge densities, leading to improved removal of challenging suspended solids and reduced sludge volumes. Smart corrosion inhibitors, incorporating real-time monitoring capabilities, are emerging to optimize dosage based on actual system conditions, thereby minimizing chemical consumption and environmental impact. Biocides and disinfectants are seeing advancements in formulations that provide longer-lasting efficacy, reduced residual toxicity, and broader-spectrum microbial control, crucial for preventing biofouling in industrial systems and ensuring potable water safety. The development of eco-friendly and biodegradable formulations across all product categories is a significant trend, addressing growing environmental concerns and regulatory pressures.

Propelling Factors for India Water Treatment Chemicals Industry Growth

Several key factors are propelling the growth of the India water treatment chemicals industry. Technological advancements in developing more efficient and environmentally friendly chemical formulations are a primary driver. Economic growth and expanding industrial activities across sectors like manufacturing, power, and oil & gas necessitate greater water treatment capacity and sophisticated chemical solutions. Furthermore, stringent regulatory frameworks aimed at pollution control and water conservation, coupled with increasing government initiatives promoting water reuse and ZLD, are creating a robust demand for effective water treatment chemicals. The growing awareness among industries regarding the importance of water management for operational efficiency and environmental responsibility also fuels market expansion.

Obstacles in the India Water Treatment Chemicals Industry Market

Despite robust growth, the India water treatment chemicals industry faces several obstacles. Regulatory challenges, including complex approval processes and variations in enforcement across regions, can hinder market penetration. Supply chain disruptions, exacerbated by logistical complexities and the reliance on imported raw materials for certain specialized chemicals, can impact availability and pricing. Intense competitive pressures from both domestic and international players, particularly in commoditized segments, can lead to price wars and reduced profit margins. Additionally, the high cost of advanced chemical technologies can be a barrier for smaller industries or those with limited capital expenditure budgets. Lack of widespread awareness among certain smaller industrial units regarding the benefits of advanced water treatment chemicals can also limit adoption.

Future Opportunities in India Water Treatment Chemicals Industry

The future of the India water treatment chemicals industry is ripe with opportunities. The growing emphasis on Zero Liquid Discharge (ZLD) across industries presents a significant market for advanced chemical treatment and recovery technologies. The burgeoning pharmaceutical and biopharmaceutical sectors, with their stringent ultra-pure water requirements, offer substantial growth potential for specialized chemicals. The expansion of smart cities and municipal water infrastructure projects will drive demand for municipal water treatment chemicals. Furthermore, the development and adoption of novel, eco-friendly, and bio-based water treatment chemicals present a key opportunity to capture market share and address sustainability concerns. Emerging markets and untapped rural industrial clusters also represent areas for future expansion.

Major Players in the India Water Treatment Chemicals Industry Ecosystem

- Chembond Chemicals Limited

- Chemtex Speciality Limited

- Dow

- Ecolab (Nalco)

- ION EXCHANGE

- Lonza

- Nouryon

- SicagenChem

- SNF

- Solenis

- Solvay

- Thermax Limited

- VASU CHEMICALS LLP

Key Developments in India Water Treatment Chemicals Industry Industry

- February 2024: Thermax Group signs an agreement to acquire a 51% stake in TSA Process Equipments to offer a one-stop solution for high-purity water requirements of its customers in sectors such as pharma, biopharma, personal care, and food and beverages. This strategic move enhances Thermax's integrated water solutions portfolio.

- October 2023: WABAG Group entered into a partnership with a water treatment optimization technology company called Pani Energy Inc. to implement applied artificial intelligence (AI) for treatment plants to reduce downtime, energy consumption, and chemical usage. This collaboration signifies a push towards digital transformation and efficiency in water treatment.

- September 2022: Toray Industries Inc. opened the Toray India Water Research Center in Chennai, India. The center will step up R&D into applications for its water-treatment membrane technology to help India meet surging treatment demand. This development underscores a focus on advanced membrane technologies and localized research for the Indian market.

Strategic India Water Treatment Chemicals Industry Market Forecast

The strategic forecast for the India water treatment chemicals industry indicates sustained robust growth, fueled by intensified regulatory mandates, escalating industrial demand, and a pervasive focus on water security. Opportunities lie in capitalizing on the increasing adoption of advanced chemical formulations that offer enhanced sustainability and operational efficiency. The predicted market expansion is underpinned by significant investment in infrastructure, the growing prowess of domestic manufacturers, and the imperative for industries to comply with stringent environmental standards. The industry's ability to innovate and adapt to emerging technologies, such as AI-driven optimization and bio-based solutions, will be crucial in shaping its future trajectory and unlocking its full market potential.

India Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides and Disinfectants

- 1.2. Coagulants and Flocculants

- 1.3. Corrosion and Scale Inhibitors

- 1.4. Defoamers and Defoaming Agents

- 1.5. pH Adjuster and Softener

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Oil and Gas

- 2.3. Chemical Manufacturing (including Petrochemicals)

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Pulp and Paper

- 2.7. Other End-user Industries

India Water Treatment Chemicals Industry Segmentation By Geography

- 1. India

India Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of India Water Treatment Chemicals Industry

India Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Corrosion and Scale Inhibitors Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides and Disinfectants

- 5.1.2. Coagulants and Flocculants

- 5.1.3. Corrosion and Scale Inhibitors

- 5.1.4. Defoamers and Defoaming Agents

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufacturing (including Petrochemicals)

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Pulp and Paper

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chembond Chemicals Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemtex Speciality Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecolab (Nalco)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ION EXCHANGE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lonza

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nouryon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SicagenChem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SNF

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Solenis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Solvay

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Thermax Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VASU CHEMICALS LLP*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Chembond Chemicals Limited

List of Figures

- Figure 1: India Water Treatment Chemicals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: India Water Treatment Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Water Treatment Chemicals Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: India Water Treatment Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Water Treatment Chemicals Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Water Treatment Chemicals Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the India Water Treatment Chemicals Industry?

Key companies in the market include Chembond Chemicals Limited, Chemtex Speciality Limited, Dow, Ecolab (Nalco), ION EXCHANGE, Lonza, Nouryon, SicagenChem, SNF, Solenis, Solvay, Thermax Limited, VASU CHEMICALS LLP*List Not Exhaustive.

3. What are the main segments of the India Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 622.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Corrosion and Scale Inhibitors Segment.

7. Are there any restraints impacting market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

8. Can you provide examples of recent developments in the market?

February 2024: Thermax Group signs an agreement to acquire a 51% stake in TSA Process Equipments to offer a one-stop solution for high-purity water requirements of its customers in sectors such as pharma, biopharma, personal care, and food and beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the India Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence