Key Insights

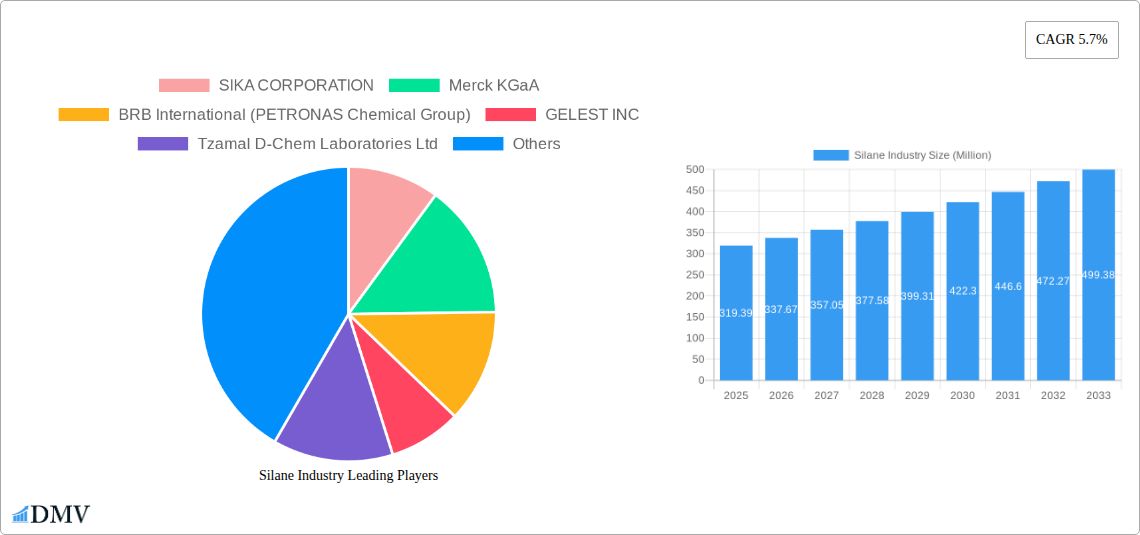

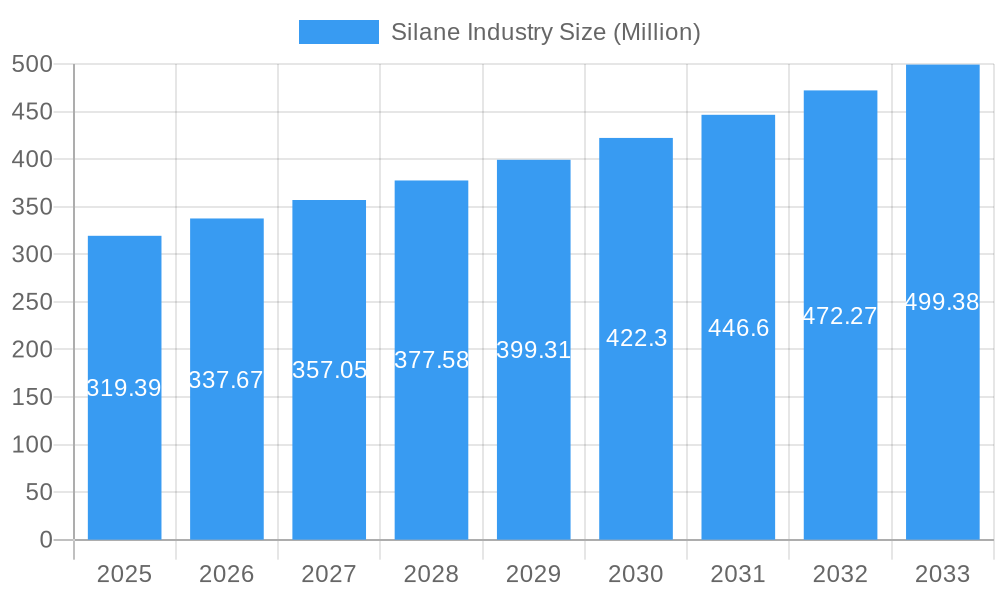

The global silane market is poised for robust expansion, projected to reach $319.39 million by 2025, driven by a compound annual growth rate (CAGR) of 5.7% from 2019 to 2033. This growth is underpinned by the increasing demand for advanced materials across a spectrum of industries, including plastics, rubber, composites, building and construction, and paints and coatings. Silanes, acting as crucial coupling agents and surface modifiers, enhance the performance and durability of these materials. Their ability to improve adhesion between organic polymers and inorganic fillers, as well as impart properties like water repellency and UV resistance, makes them indispensable in modern manufacturing processes. The expanding infrastructure development globally, coupled with the automotive industry's continuous innovation in lightweight and high-strength materials, are significant catalysts for silane consumption. Furthermore, the growing adoption of silane-based technologies in niche applications like semiconductors and pharmaceuticals further contributes to this upward trajectory.

Silane Industry Market Size (In Million)

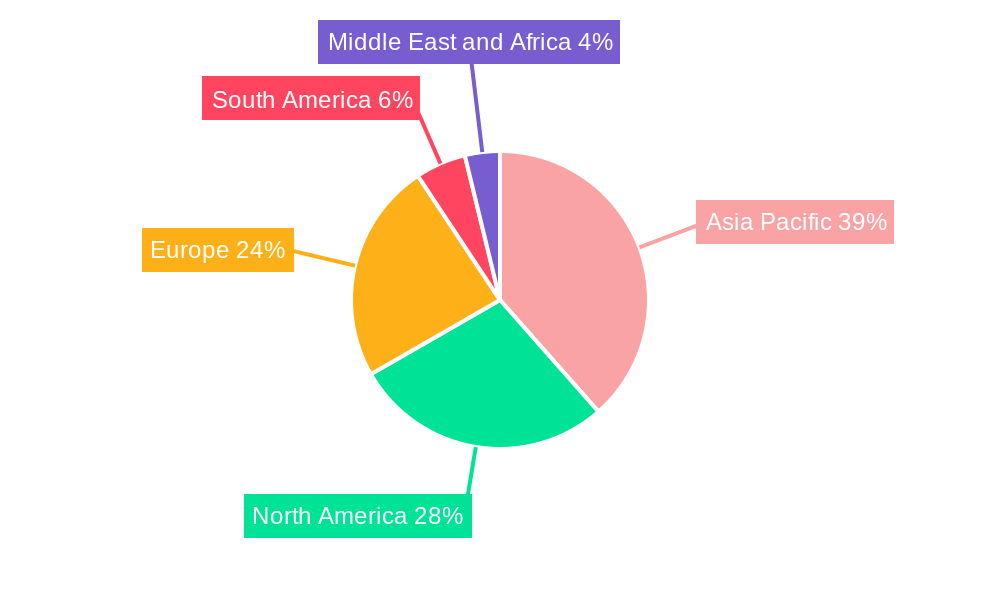

While the market demonstrates strong growth potential, certain factors necessitate strategic consideration. Restraints such as fluctuating raw material prices, particularly for silicon and methanol, and stringent environmental regulations associated with their production and handling can pose challenges. However, ongoing research and development into more sustainable and cost-effective production methods, alongside the exploration of novel silane applications, are expected to mitigate these concerns. The market is characterized by a diverse range of silane types, including Alkyl, Amino, Epoxy, Methacryloxy, Phenyl, and Vinyl silanes, each catering to specific application needs. Regional dynamics reveal Asia Pacific, led by China and India, as a key growth engine due to its expansive manufacturing base and increasing investment in infrastructure and advanced materials. North America and Europe also represent significant markets, driven by technological advancements and a strong presence of key industry players like Dow, Wacker Chemie AG, and Shin-Etsu Chemical Co Ltd. The competitive landscape is marked by strategic collaborations, mergers, and acquisitions aimed at expanding product portfolios and geographical reach.

Silane Industry Company Market Share

Here's the SEO-optimized and insightful report description for the Silane Industry, crafted to boost search visibility and captivate stakeholders:

Silane Industry Market Composition & Trends

This comprehensive report delves into the intricate silane market landscape, analyzing its composition, key trends, and future trajectory. We explore the market concentration of leading silane manufacturers, including SIKA CORPORATION, Merck KGaA, BRB International (PETRONAS Chemical Group), GELEST INC, Tzamal D-Chem Laboratories Ltd, Momentive, Genesee Polymers Corporation, Dow, Alfa Aesar (Thermo Fisher Scientific), Shin-Etsu Chemical Co Ltd, Prochimia Surfaces, United Chemical Technologies, Wacker Chemie AG, and Evonik. The report identifies crucial innovation catalysts driving the adoption of silane coupling agents and silane crosslinking technologies, such as advancements in rubber and composites and high-performance paints and coatings. We dissect the prevailing regulatory landscapes, particularly those impacting the use of silanes in building & construction and adhesives & sealants. A thorough evaluation of substitute products and their market penetration is presented, alongside detailed end-user profiles across diverse sectors including plastics, mineral & filler treatment, and emerging applications in semi-conductors and pharmaceuticals. Furthermore, the report scrutinizes significant M&A activities within the silane sector, with M&A deal values estimated to reach XX Million by 2025, highlighting strategic consolidations and partnerships shaping the competitive environment. The market share distribution for various silane types like Alkyl, Amino, Epoxy, Methacryloxy, Phenyl, and Vinyl silanes is meticulously mapped.

Silane Industry Industry Evolution

The silane industry is poised for robust growth, driven by sustained demand across critical sectors and continuous technological innovation. Our analysis of the industry evolution from 2019–2024 (Historical Period) through to 2033 (Forecast Period) reveals a compelling market growth trajectory. The base year of 2025 serves as a pivotal point for understanding current dynamics, with the estimated year of 2025 providing immediate insights into ongoing trends. Technological advancements in silane synthesis and application are key, with the development of novel epoxy silanes and amino silanes opening up new avenues in advanced materials. Shifting consumer demands towards sustainable and high-performance products are directly influencing the silane market, particularly in the paints & coatings and plastics sectors. We anticipate a Compound Annual Growth Rate (CAGR) of approximately X.XX% for the global silane market, projected to reach a valuation of over XX Million by 2033. Adoption metrics for silane coupling agents in rubber and composites are on the rise, exceeding XX% in key automotive applications. The integration of silanes in adhesives & sealants is also experiencing significant growth, with market penetration estimated at XX% in the construction industry. Emerging applications in semi-conductors, driven by miniaturization and advanced packaging technologies, are contributing an additional XX Million to market expansion annually.

Leading Regions, Countries, or Segments in Silane Industry

This section dissects the dominance within the global silane industry, focusing on leading regions, countries, and product segments. The Asia-Pacific region is identified as the powerhouse, driven by substantial investments in manufacturing and a burgeoning demand for advanced materials. Key drivers in this region include robust investment trends in plastics, rubber and composites, and the booming building & construction sectors in countries like China and India. The region benefits from supportive government policies and a vast consumer base, contributing an estimated XX% to the global silane market.

Within product types, Alkyl silanes are projected to lead in market share, valued at over XX Million by 2025, due to their widespread use as crosslinking agents and water repellents.

- Key Drivers for Alkyl Silanes: Dominance in plastics and rubber industries, essential for enhancing material properties like durability and flexibility.

- Market Value (2025): Estimated at XX Million.

Amino silanes are experiencing rapid growth, particularly in adhesives & sealants and paints & coatings.

- Key Drivers for Amino Silanes: Crucial for improving adhesion and surface treatment in high-performance applications.

- Market Value (2025): Estimated at XX Million.

Epoxy silanes are vital for high-performance composite materials and advanced coatings.

- Key Drivers for Epoxy Silanes: Essential for enhanced mechanical strength and chemical resistance in aerospace and automotive sectors.

- Market Value (2025): Estimated at XX Million.

In terms of applications, Plastics, Rubber and Composites will continue to be the largest application segment, accounting for an estimated XX% of the global market by 2025.

- Key Drivers for Plastics, Rubber & Composites: Increasing demand for lightweight and durable materials in automotive, aerospace, and consumer goods.

- Market Value (2025): Estimated at XX Million.

Building & Construction represents another significant application, driven by urbanization and infrastructure development.

- Key Drivers for Building & Construction: Demand for advanced sealants, coatings, and concrete admixtures.

- Market Value (2025): Estimated at XX Million.

The Paints & Coatings sector benefits from silanes' ability to improve durability, weather resistance, and adhesion.

- Key Drivers for Paints & Coatings: Growing use in industrial, automotive, and architectural coatings.

- Market Value (2025): Estimated at XX Million.

Silane Industry Product Innovations

Product innovations in the silane industry are revolutionizing material science and manufacturing processes. The development of novel vinyl silanes with enhanced reactivity is significantly improving crosslinking in polyethylene and other polymers, leading to superior mechanical properties and thermal stability. Specialty phenyl silanes are being engineered for high-temperature applications in electronics and automotive components, offering exceptional thermal oxidative stability. Furthermore, advanced amino silanes are exhibiting superior adhesion promotion in challenging substrates, enabling the creation of more durable and robust adhesives & sealants. Performance metrics such as tensile strength improvements exceeding XX% and enhanced chemical resistance are becoming standard for these innovative products, driving their adoption in demanding industrial environments and specialty applications like semi-conductors.

Propelling Factors for Silane Industry Growth

The silane industry is propelled by a confluence of powerful factors. Technological advancements, particularly in the synthesis of specialized silanes like epoxy and methacryloxy variants, are expanding their application scope. The increasing global demand for high-performance materials in sectors such as plastics, rubber and composites, and paints & coatings directly fuels silane consumption. Stringent regulatory requirements for improved product safety and environmental performance are also driving the adoption of silane-based solutions. For instance, the mandate for low-VOC coatings is boosting the use of silane crosslinkers. Economic growth, especially in emerging economies, is leading to increased investments in infrastructure and manufacturing, further stimulating demand. The market size is projected to reach XX Million by 2033, with a CAGR of X.XX%.

Obstacles in the Silane Industry Market

Despite its robust growth, the silane industry faces several obstacles. Regulatory challenges, including evolving environmental standards and the classification of certain silanes, can impact product development and market access. Volatility in raw material prices, such as silicon metal and methanol, can affect production costs and profit margins. Supply chain disruptions, as witnessed in recent global events, can lead to shortages and price spikes for critical silane intermediates. Intense competitive pressures from established players and emerging manufacturers also necessitate continuous innovation and cost optimization. The market for certain specialty silanes is niche, requiring significant R&D investment with uncertain returns, potentially hindering rapid expansion in these areas.

Future Opportunities in Silane Industry

The future of the silane industry is brimming with opportunities. The burgeoning demand for advanced materials in the electric vehicle sector, particularly for battery components and lightweight structures, presents a significant growth avenue. Expansion into emerging markets in Asia and Africa, driven by infrastructure development and industrialization, offers substantial untapped potential. The increasing focus on sustainable and bio-based materials is creating opportunities for novel silane derivatives with improved environmental profiles. Advancements in nanotechnology and the development of silane-based surface treatments for nanomaterials are opening doors in cutting-edge applications like pharmaceuticals and advanced electronics. The market is expected to grow to XX Million by 2033.

Major Players in the Silane Industry Ecosystem

- SIKA CORPORATION

- Merck KGaA

- BRB International (PETRONAS Chemical Group)

- GELEST INC

- Tzamal D-Chem Laboratories Ltd

- Momentive

- Genesee Polymers Corporation

- Dow

- Alfa Aesar (Thermo Fisher Scientific)

- Shin-Etsu Chemical Co Ltd

- Prochimia Surfaces

- United Chemical Technologies

- Wacker Chemie AG

- Evonik

Key Developments in Silane Industry Industry

- 2023: Shin-Etsu Chemical Co Ltd launched a new series of high-purity silanes for semiconductor applications, enhancing chip performance.

- 2023: Dow announced the expansion of its silane production capacity to meet growing demand in the Asia-Pacific region, valued at XX Million.

- 2024: Momentive introduced a novel amino silane coupling agent that significantly improves adhesion in flexible packaging applications.

- 2024: Evonik acquired a specialist silane producer, strengthening its portfolio in specialty silanes for construction chemicals.

- 2025: BRB International (PETRONAS Chemical Group) is expected to unveil a new range of sustainable silane-based additives for biodegradable plastics.

- 2025: Wacker Chemie AG is investing XX Million in advanced research for silane applications in renewable energy technologies.

Strategic Silane Industry Market Forecast

The silane industry is poised for sustained and significant growth, driven by a confluence of strategic opportunities. The increasing demand for advanced materials in evolving sectors like electric vehicles and renewable energy will be a major catalyst. Expansion into untapped emerging markets presents substantial potential for market penetration. Innovations in sustainable silane chemistries and their application in eco-friendly products will resonate with a growing environmentally conscious consumer base. Furthermore, advancements in nanotechnology and the development of silane-functionalized materials for sophisticated applications in pharmaceuticals and advanced electronics signal a bright future, projecting a market valuation of XX Million by 2033.

Silane Industry Segmentation

-

1. Type

- 1.1. Alkyl

- 1.2. Amino

- 1.3. Epoxy

- 1.4. Methacryloxy

- 1.5. Phenyl

- 1.6. Vinyl

- 1.7. Others

-

2. Application

- 2.1. Plastics, Rubber and Composites

- 2.2. Building & Construction

- 2.3. Paints & Coatings

- 2.4. Adhesives & Sealants

- 2.5. Mineral & Filler Treatment

- 2.6. Others (Semi-Conductors, Pharmaceutical, etc.,)

Silane Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Silane Industry Regional Market Share

Geographic Coverage of Silane Industry

Silane Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand form the Construction Industry; Growing Demand for Light-Weight Composites; Increasing Demand from Automotive Industry

- 3.3. Market Restrains

- 3.3.1. ; Higher Production Costs; Unfavorable Conditions Arising Due to the COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silane Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Alkyl

- 5.1.2. Amino

- 5.1.3. Epoxy

- 5.1.4. Methacryloxy

- 5.1.5. Phenyl

- 5.1.6. Vinyl

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Plastics, Rubber and Composites

- 5.2.2. Building & Construction

- 5.2.3. Paints & Coatings

- 5.2.4. Adhesives & Sealants

- 5.2.5. Mineral & Filler Treatment

- 5.2.6. Others (Semi-Conductors, Pharmaceutical, etc.,)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Silane Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Alkyl

- 6.1.2. Amino

- 6.1.3. Epoxy

- 6.1.4. Methacryloxy

- 6.1.5. Phenyl

- 6.1.6. Vinyl

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Plastics, Rubber and Composites

- 6.2.2. Building & Construction

- 6.2.3. Paints & Coatings

- 6.2.4. Adhesives & Sealants

- 6.2.5. Mineral & Filler Treatment

- 6.2.6. Others (Semi-Conductors, Pharmaceutical, etc.,)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Silane Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Alkyl

- 7.1.2. Amino

- 7.1.3. Epoxy

- 7.1.4. Methacryloxy

- 7.1.5. Phenyl

- 7.1.6. Vinyl

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Plastics, Rubber and Composites

- 7.2.2. Building & Construction

- 7.2.3. Paints & Coatings

- 7.2.4. Adhesives & Sealants

- 7.2.5. Mineral & Filler Treatment

- 7.2.6. Others (Semi-Conductors, Pharmaceutical, etc.,)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Silane Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Alkyl

- 8.1.2. Amino

- 8.1.3. Epoxy

- 8.1.4. Methacryloxy

- 8.1.5. Phenyl

- 8.1.6. Vinyl

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Plastics, Rubber and Composites

- 8.2.2. Building & Construction

- 8.2.3. Paints & Coatings

- 8.2.4. Adhesives & Sealants

- 8.2.5. Mineral & Filler Treatment

- 8.2.6. Others (Semi-Conductors, Pharmaceutical, etc.,)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Silane Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Alkyl

- 9.1.2. Amino

- 9.1.3. Epoxy

- 9.1.4. Methacryloxy

- 9.1.5. Phenyl

- 9.1.6. Vinyl

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Plastics, Rubber and Composites

- 9.2.2. Building & Construction

- 9.2.3. Paints & Coatings

- 9.2.4. Adhesives & Sealants

- 9.2.5. Mineral & Filler Treatment

- 9.2.6. Others (Semi-Conductors, Pharmaceutical, etc.,)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Silane Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Alkyl

- 10.1.2. Amino

- 10.1.3. Epoxy

- 10.1.4. Methacryloxy

- 10.1.5. Phenyl

- 10.1.6. Vinyl

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Plastics, Rubber and Composites

- 10.2.2. Building & Construction

- 10.2.3. Paints & Coatings

- 10.2.4. Adhesives & Sealants

- 10.2.5. Mineral & Filler Treatment

- 10.2.6. Others (Semi-Conductors, Pharmaceutical, etc.,)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SIKA CORPORATION

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BRB International (PETRONAS Chemical Group)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GELEST INC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tzamal D-Chem Laboratories Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Momentive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Genesee Polymers Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alfa Aesar (Thermo Fisher Scientific)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shin-Etsu Chemical Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Prochimia Surfaces

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 United Chemical Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wacker Chemie AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Evonik

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 SIKA CORPORATION

List of Figures

- Figure 1: Global Silane Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Silane Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Silane Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Silane Industry Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Silane Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Silane Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Silane Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: Asia Pacific Silane Industry Volume (K Tons), by Application 2025 & 2033

- Figure 9: Asia Pacific Silane Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Silane Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Silane Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Silane Industry Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Silane Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Silane Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Silane Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Silane Industry Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Silane Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Silane Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Silane Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: North America Silane Industry Volume (K Tons), by Application 2025 & 2033

- Figure 21: North America Silane Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Silane Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Silane Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Silane Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Silane Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Silane Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Silane Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Silane Industry Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Silane Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Silane Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Silane Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Silane Industry Volume (K Tons), by Application 2025 & 2033

- Figure 33: Europe Silane Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Silane Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Silane Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Silane Industry Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Silane Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Silane Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Silane Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Silane Industry Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Silane Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Silane Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Silane Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Silane Industry Volume (K Tons), by Application 2025 & 2033

- Figure 45: South America Silane Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Silane Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Silane Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Silane Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Silane Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Silane Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Silane Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Silane Industry Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East and Africa Silane Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Silane Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Silane Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Silane Industry Volume (K Tons), by Application 2025 & 2033

- Figure 57: Middle East and Africa Silane Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Silane Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Silane Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Silane Industry Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Silane Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Silane Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silane Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Silane Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Silane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Silane Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Silane Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Silane Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Silane Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Silane Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Silane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Silane Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Global Silane Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Silane Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Silane Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Silane Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: Global Silane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Silane Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 27: Global Silane Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Silane Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Silane Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Silane Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Silane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Silane Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 39: Global Silane Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Silane Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Italy Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Italy Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: France Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: France Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Silane Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Silane Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Global Silane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Silane Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 55: Global Silane Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Silane Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Silane Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Silane Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 65: Global Silane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Silane Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 67: Global Silane Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Silane Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Silane Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Silane Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silane Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Silane Industry?

Key companies in the market include SIKA CORPORATION, Merck KGaA, BRB International (PETRONAS Chemical Group), GELEST INC, Tzamal D-Chem Laboratories Ltd, Momentive, Genesee Polymers Corporation, Dow, Alfa Aesar (Thermo Fisher Scientific), Shin-Etsu Chemical Co Ltd, Prochimia Surfaces, United Chemical Technologies, Wacker Chemie AG, Evonik.

3. What are the main segments of the Silane Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 319.39 Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand form the Construction Industry; Growing Demand for Light-Weight Composites; Increasing Demand from Automotive Industry.

6. What are the notable trends driving market growth?

Growing Demand from the Construction Industry.

7. Are there any restraints impacting market growth?

; Higher Production Costs; Unfavorable Conditions Arising Due to the COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silane Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silane Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silane Industry?

To stay informed about further developments, trends, and reports in the Silane Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence