Key Insights

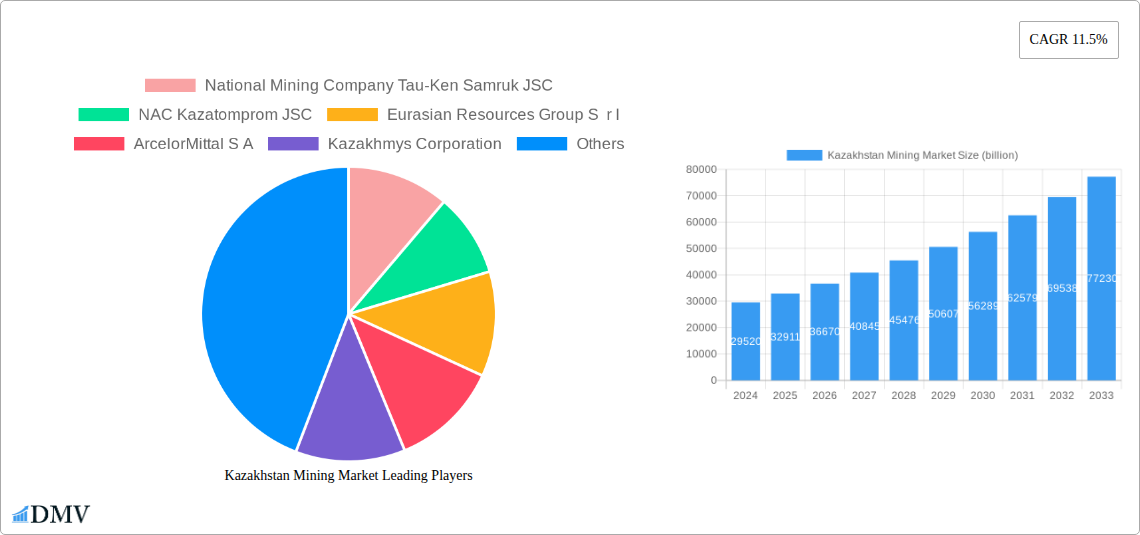

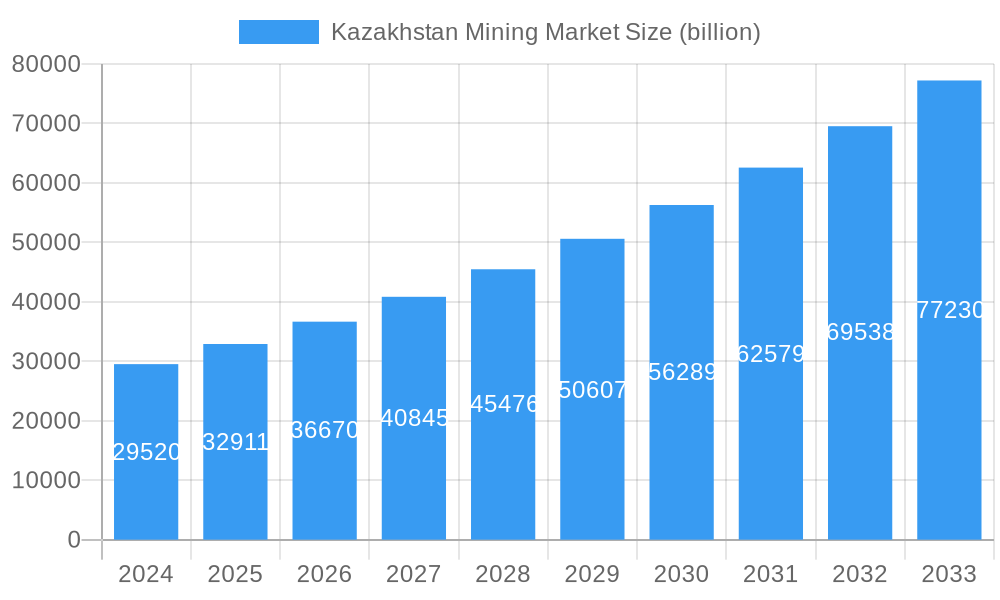

The Kazakhstan Mining Market is poised for significant expansion, projecting a market size of $29.52 billion in 2024. This robust growth is driven by a compelling CAGR of 11.5% over the forecast period. The nation's rich mineral deposits, particularly in coal, ferrous metals, and non-ferrous metals, form the bedrock of this expansion. Strategic investments in exploration, advanced extraction technologies, and infrastructure development are further fueling this upward trajectory. Key players like National Mining Company Tau-Ken Samruk JSC, NAC Kazatomprom JSC, and Eurasian Resources Group S.à r.l. are actively contributing to the market's dynamism through expansion projects and technological adoption. The growing global demand for raw materials essential for infrastructure development, renewable energy, and manufacturing industries directly benefits Kazakhstan's mining sector. Government initiatives aimed at attracting foreign investment and promoting sustainable mining practices are also playing a crucial role in shaping the market's future.

Kazakhstan Mining Market Market Size (In Billion)

The market's growth is underpinned by several critical trends, including the increasing focus on value-added processing of extracted minerals to enhance export revenues and the adoption of digital technologies for improved operational efficiency and safety. Furthermore, Kazakhstan's strategic geographical location, serving as a transit hub, facilitates easier access to major global markets. While the sector benefits from strong demand, it also faces certain restraints, such as the need for continuous investment in modernizing aging infrastructure and addressing environmental concerns associated with mining operations. Overcoming these challenges will be vital for sustained and responsible growth. The market segments of coal, ferrous metals, and non-ferrous metals are expected to witness substantial contributions, with specific demand fluctuations influenced by global commodity prices and geopolitical factors.

Kazakhstan Mining Market Company Market Share

Unlocking Kazakhstan's Mineral Wealth: A Comprehensive Market Report (2019-2033)

Dive deep into the Kazakhstan mining market with this exhaustive report, meticulously crafted for stakeholders seeking unparalleled insights into one of Central Asia's most significant resource-rich nations. Covering the study period of 2019–2033, with a base year of 2025 and a comprehensive forecast period from 2025–2033, this analysis provides a strategic roadmap for navigating the dynamic mining industry in Kazakhstan. Explore critical mining industry trends in Kazakhstan, Kazakhstan resource exports, Kazakhstan mineral production, and the burgeoning Kazakhstan metals market. Gain a competitive edge by understanding Kazakhstan mining investment opportunities and the future of Kazakhstan mining.

Kazakhstan Mining Market Market Composition & Trends

The Kazakhstan mining market exhibits a moderate concentration, with a few dominant players controlling substantial market share distribution. Innovation catalysts are primarily driven by technological advancements aimed at improving extraction efficiency and environmental sustainability, alongside increased foreign direct investment in the Kazakhstan mining sector. The regulatory landscape in Kazakhstan is evolving, with governmental efforts focused on attracting international investment while ensuring responsible resource management. Substitute products are largely non-existent for core commodities, but the exploration of alternative energy sources can indirectly impact demand for certain minerals. End-user profiles span global industries, from construction and manufacturing to energy and advanced technologies. Mergers and acquisitions (M&A) activities are a notable feature, with recent M&A deal values in the Kazakhstan mining industry signaling consolidation and strategic expansion.

- Market Concentration: Dominated by state-owned enterprises and large international corporations.

- Innovation Catalysts: Focus on automation, digitalization, and sustainable mining practices.

- Regulatory Landscape: Evolving policies to balance resource development and environmental protection.

- End-User Industries: Construction, automotive, electronics, energy, and defense.

- M&A Activities: Strategic acquisitions aimed at expanding portfolios and securing resources.

Kazakhstan Mining Market Industry Evolution

The Kazakhstan mining industry has witnessed a remarkable market growth trajectory, driven by its vast reserves and strategic geopolitical location. Over the historical period (2019-2024), the sector demonstrated robust expansion, fueled by increasing global demand for key commodities and proactive government policies aimed at modernizing infrastructure and attracting capital. Technological advancements have played a pivotal role, with the adoption of advanced exploration techniques, efficient extraction machinery, and sophisticated processing technologies significantly boosting Kazakhstan mineral production. For instance, the integration of AI and machine learning in geological surveying has led to more accurate resource identification and optimized operational planning. Shifting consumer demands, particularly the global surge in electric vehicles and renewable energy infrastructure, have intensified the demand for non-ferrous metals like copper and lithium, which are abundant in Kazakhstan. The Kazakhstan mining market is adapting by diversifying its output and focusing on high-value minerals.

The forecast period (2025-2033) is projected to see continued growth, albeit at a potentially more measured pace, influenced by global economic conditions and ongoing geopolitical dynamics. However, the inherent value of Kazakhstan's mineral wealth, coupled with strategic investments in infrastructure and technology, positions the nation to capitalize on emerging market trends. Government initiatives to streamline mining permits and enhance transparency are expected to further bolster investor confidence. Furthermore, the increasing emphasis on ESG (Environmental, Social, and Governance) principles within the global mining community is prompting local players to adopt more sustainable practices, which will be crucial for long-term market access and growth. The Kazakhstan mining market is thus poised for sustained development, driven by both intrinsic resource advantages and adaptive strategic planning.

Leading Regions, Countries, or Segments in Kazakhstan Mining Market

The Kazakhstan mining market is characterized by the significant dominance of its Non-Ferrous Metals segment, closely followed by Ferrous Metals and then Coal. This dominance is deeply rooted in the country's geological endowment, with vast deposits of copper, gold, zinc, lead, and uranium, placing Kazakhstan among the global leaders in their production and export.

Non-Ferrous Metals: Dominant Force in Kazakhstan's Mining Landscape

The non-ferrous metals segment, particularly copper and gold, has been the primary engine of growth and revenue generation for the Kazakhstan mining sector. Major international players and large domestic corporations have made substantial investments in this area, leveraging advanced extraction and processing technologies to maximize output.

- Key Drivers of Dominance:

- Abundant Reserves: Kazakhstan holds some of the world's largest reserves of copper, gold, and zinc, ensuring long-term supply capabilities.

- Global Demand: The escalating global demand for copper, driven by electrification and infrastructure development, directly benefits Kazakhstan's export-oriented mining industry. Gold's perennial status as a safe-haven asset further bolsters its market importance.

- Investment Trends: Significant foreign direct investment (FDI) has flowed into the development of large-scale copper and gold mines, leading to increased production capacities and technological modernization.

- Regulatory Support: Government policies have historically favored the development of this sector, offering incentives and streamlining investment processes for major projects.

- Technological Advancements: Continuous investment in modern mining and processing technologies has enhanced efficiency and extraction yields in the non-ferrous metals segment.

The operational scale of companies like KAZ Minerals PLC and Kazakhmys Corporation in the copper sector, and NAC Kazatomprom JSC in uranium (a critical component of nuclear energy, often grouped with non-ferrous metals), exemplifies the segment's stronghold. These companies operate some of the most significant mines, contributing a substantial portion to the Kazakhstan mining market. The profitability and export revenue generated from non-ferrous metals significantly outweigh other segments, solidifying its leadership position.

Ferrous Metals: A Significant Contributor to Kazakhstan's Mining Economy

The Ferrous Metals segment, primarily driven by iron ore and steel production, represents another cornerstone of Kazakhstan's mining industry. While not as dominant as non-ferrous metals, it plays a crucial role in domestic industrial development and international trade.

- Key Drivers of Contribution:

- Resource Availability: Kazakhstan possesses considerable reserves of iron ore, supporting a robust domestic steel industry.

- Industrial Demand: The construction and manufacturing sectors within Kazakhstan and neighboring countries are significant consumers of steel products.

- Export Potential: Kazakhstan exports a considerable volume of iron ore and steel products to regional and international markets.

- Strategic Importance: The ferrous metals industry is vital for national industrial self-sufficiency and economic diversification.

Companies like ArcelorMittal S.A. and Eurasian Resources Group S.à r.l. are key players in this segment, operating integrated mining and metallurgical facilities. The focus here is often on optimizing production costs and ensuring quality to remain competitive in global ferrous metal markets.

Coal: A Vital Energy and Export Commodity

While the Coal segment in Kazakhstan is a substantial contributor to its energy mix and export revenue, its overall market share and growth trajectory are influenced by evolving global energy policies and environmental regulations.

- Key Drivers of Contribution:

- Energy Needs: Coal remains a critical fuel source for domestic power generation, supporting industrial activities and residential energy consumption.

- Export Opportunities: As evidenced by recent industry developments, Kazakhstan's coal has found significant markets in the European Union, particularly for power plants, highlighting its strategic export value.

- Production Capacity: The country boasts considerable coal production capacity, with companies like National Mining Company Tau-Ken Samruk JSC (involved in diversified mining, including coal potential) playing a role.

- Economic Impact: Coal mining and associated industries provide significant employment and contribute to regional economies.

Despite the global push towards cleaner energy, the immediate demand for coal, especially from regions seeking energy security and affordability, continues to support this segment's economic significance for Kazakhstan. However, long-term growth may be subject to greater environmental scrutiny and a transition towards less carbon-intensive alternatives.

Kazakhstan Mining Market Product Innovations

Innovations within the Kazakhstan mining market are increasingly focused on enhancing extraction efficiency, improving resource recovery rates, and minimizing environmental impact. Companies are investing in advanced geological surveying technologies, including drone-based mineral mapping and AI-powered data analysis, to identify richer ore bodies more accurately. Furthermore, the adoption of automated mining equipment and remote-controlled operations is revolutionizing underground mining safety and productivity. In processing, advancements in flotation techniques and hydrometallurgy are enabling the extraction of valuable metals from lower-grade ores, thus extending the lifespan of existing mines and unlocking new reserves. The development of specialized alloys and materials derived from Kazakhstani minerals also represents a key area of innovation, catering to the evolving demands of the aerospace, automotive, and electronics industries.

Propelling Factors for Kazakhstan Mining Market Growth

Several key factors are propelling the growth of the Kazakhstan mining market. Firstly, the country's vast and diverse mineral reserves, including significant deposits of copper, gold, uranium, and coal, provide an unparalleled foundation for expansion. Secondly, strategic government policies aimed at attracting foreign direct investment and streamlining regulatory processes have created a more conducive environment for mining operations and capital injection. Thirdly, the increasing global demand for raw materials, particularly copper for the green energy transition and gold as a safe-haven asset, directly benefits Kazakhstan's export-oriented mining sector. Finally, technological advancements in exploration, extraction, and processing are enhancing operational efficiency and allowing for the exploitation of previously uneconomical resources, further bolstering the market's growth potential.

Obstacles in the Kazakhstan Mining Market Market

Despite its strong growth trajectory, the Kazakhstan mining market faces several significant obstacles. Regulatory challenges, including complex permitting processes and potential changes in mining legislation, can create uncertainty for investors. Supply chain disruptions, exacerbated by geopolitical tensions and logistical complexities, can impact the timely delivery of equipment and the export of finished products. Furthermore, competitive pressures from other resource-rich nations and fluctuating global commodity prices can affect profitability and investment decisions. Environmental concerns and the increasing demand for sustainable mining practices necessitate substantial investments in new technologies and compliance measures, adding to operational costs.

Future Opportunities in Kazakhstan Mining Market

The Kazakhstan mining market presents numerous future opportunities. The growing global demand for critical minerals essential for renewable energy technologies, such as lithium, cobalt, and nickel, presents a significant avenue for exploration and development, given Kazakhstan's geological potential. Furthermore, the ongoing digital transformation of the mining industry offers opportunities for implementing advanced technologies like AI, IoT, and automation to enhance efficiency and safety, creating a competitive advantage. The expansion of infrastructure projects, both domestically and regionally, will continue to drive demand for ferrous metals. Finally, increased focus on downstream processing and value-added mineral products can unlock higher profit margins and diversify export revenue streams, moving beyond raw material exports.

Major Players in the Kazakhstan Mining Market Ecosystem

- National Mining Company Tau-Ken Samruk JSC

- NAC Kazatomprom JSC

- Eurasian Resources Group S r l

- ArcelorMittal S A

- Kazakhmys Corporation

- KAZ Minerals PLC

- KAZZINC JSC

Key Developments in Kazakhstan Mining Market Industry

- July 2022: Kazakhstan exported 2.85 million tons of coal and coke to European Union (EU) countries since the beginning of the year, indicating a significant increase in export volumes driven by the suitability of Kazakhstani coal for EU power plants. This represents a substantial rise from the average of 0.81 million tons exported to EU nations in the previous year.

- January-June 2022: Kazakhstan produced 57.4 million tons of coal, a 5.9% increase compared to the same period in the prior year. This production generated a profit of 271 billion tenges, equivalent to USD 564 million, highlighting the economic significance of the coal sector.

Strategic Kazakhstan Mining Market Market Forecast

The strategic Kazakhstan mining market forecast is exceptionally promising, underpinned by the nation's abundant natural resources and a proactive approach to foreign investment. The sustained global demand for key commodities, particularly non-ferrous metals critical for the green energy transition and construction booms, will continue to drive export revenues. Investments in technological modernization and exploration are expected to unlock new resource potential and enhance operational efficiencies, thereby boosting production volumes. Furthermore, government initiatives aimed at improving the investment climate and fostering sustainable mining practices are crucial for long-term growth. The Kazakhstan mining market is poised for sustained expansion, contributing significantly to the national economy and solidifying its position as a vital global supplier of essential minerals.

Kazakhstan Mining Market Segmentation

- 1. Coal

- 2. Ferrous Metals

- 3. Non Ferrous Metals

Kazakhstan Mining Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan Mining Market Regional Market Share

Geographic Coverage of Kazakhstan Mining Market

Kazakhstan Mining Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Coal Mining to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan Mining Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coal

- 5.2. Market Analysis, Insights and Forecast - by Ferrous Metals

- 5.3. Market Analysis, Insights and Forecast - by Non Ferrous Metals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Coal

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Mining Company Tau-Ken Samruk JSC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NAC Kazatomprom JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eurasian Resources Group S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ArcelorMittal S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kazakhmys Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KAZ Minerals PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KAZZINC JSC*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 National Mining Company Tau-Ken Samruk JSC

List of Figures

- Figure 1: Kazakhstan Mining Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Kazakhstan Mining Market Share (%) by Company 2025

List of Tables

- Table 1: Kazakhstan Mining Market Revenue billion Forecast, by Coal 2020 & 2033

- Table 2: Kazakhstan Mining Market Revenue billion Forecast, by Ferrous Metals 2020 & 2033

- Table 3: Kazakhstan Mining Market Revenue billion Forecast, by Non Ferrous Metals 2020 & 2033

- Table 4: Kazakhstan Mining Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Kazakhstan Mining Market Revenue billion Forecast, by Coal 2020 & 2033

- Table 6: Kazakhstan Mining Market Revenue billion Forecast, by Ferrous Metals 2020 & 2033

- Table 7: Kazakhstan Mining Market Revenue billion Forecast, by Non Ferrous Metals 2020 & 2033

- Table 8: Kazakhstan Mining Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan Mining Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Kazakhstan Mining Market?

Key companies in the market include National Mining Company Tau-Ken Samruk JSC, NAC Kazatomprom JSC, Eurasian Resources Group S r l, ArcelorMittal S A, Kazakhmys Corporation, KAZ Minerals PLC, KAZZINC JSC*List Not Exhaustive.

3. What are the main segments of the Kazakhstan Mining Market?

The market segments include Coal, Ferrous Metals, Non Ferrous Metals.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.52 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Coal Mining to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2022, Kazakhstan exported 2.85 million tons of coal and coke to the European Union (EU) countries since the beginning of this year, as its coal is suitable for their power plants. Kazakhstan exported an average of 0.81 million tons of coal to EU nations in the previous year. From January to June 2022, Kazakhstan produced 57.4 million tons of coal, 5.9% more than a year earlier, with a profit of 271 billion tenges (USD 564 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan Mining Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan Mining Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan Mining Market?

To stay informed about further developments, trends, and reports in the Kazakhstan Mining Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence