Key Insights

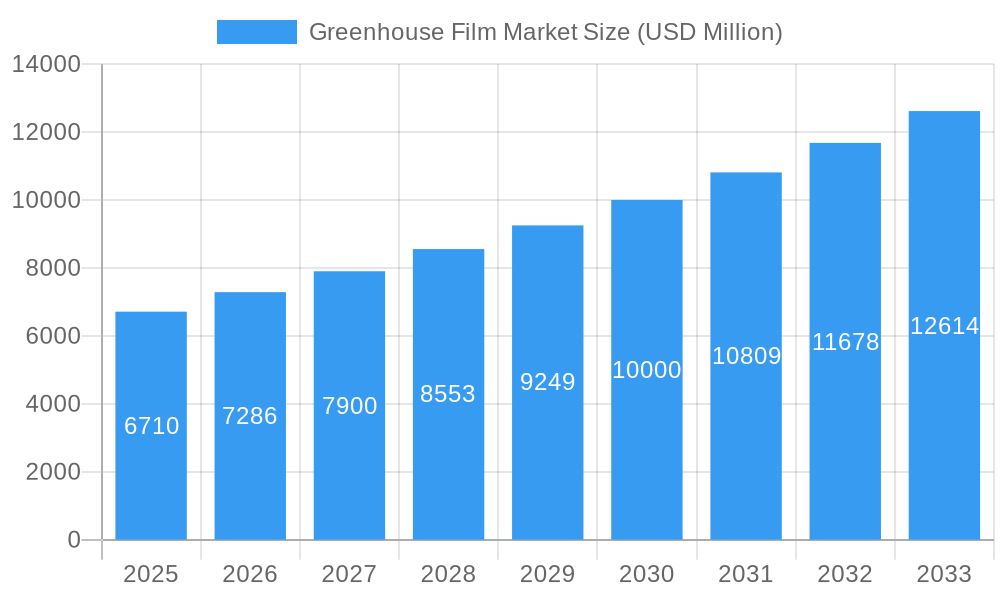

The global Greenhouse Film Market is poised for significant expansion, projected to reach an estimated USD 6.71 billion in 2025. This growth is underpinned by a robust CAGR of 8.6% over the forecast period, indicating sustained and accelerated demand. Key drivers propelling this market include the increasing need for enhanced crop yields, protection against adverse weather conditions, and the growing adoption of controlled environment agriculture (CEA) in both developed and developing economies. The demand for specialized greenhouse films that offer UV protection, thermal insulation, and improved light diffusion is on the rise, catering to the evolving needs of modern agriculture and horticulture. Furthermore, government initiatives promoting sustainable farming practices and food security are expected to further invigorate market growth.

Greenhouse Film Market Market Size (In Billion)

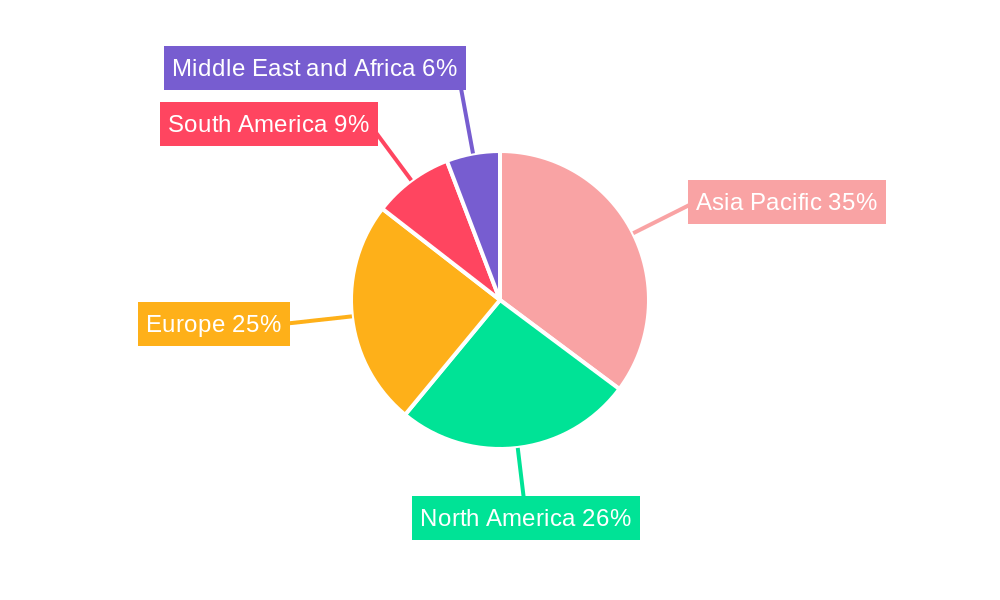

The market segmentation reveals a strong preference for polyethylene-based films, with Low Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE) dominating due to their flexibility, durability, and cost-effectiveness. Thinner films, specifically those less than 200 microns, are gaining traction for their economic benefits and suitability for various agricultural applications. Geographically, the Asia Pacific region is expected to lead the market, driven by a burgeoning agricultural sector in countries like China and India, coupled with rapid technological adoption. North America and Europe also present substantial market opportunities, fueled by advanced horticultural practices and a focus on year-round crop production. Emerging trends such as multi-layer films with enhanced properties and biodegradable options are shaping the competitive landscape and offering new avenues for innovation.

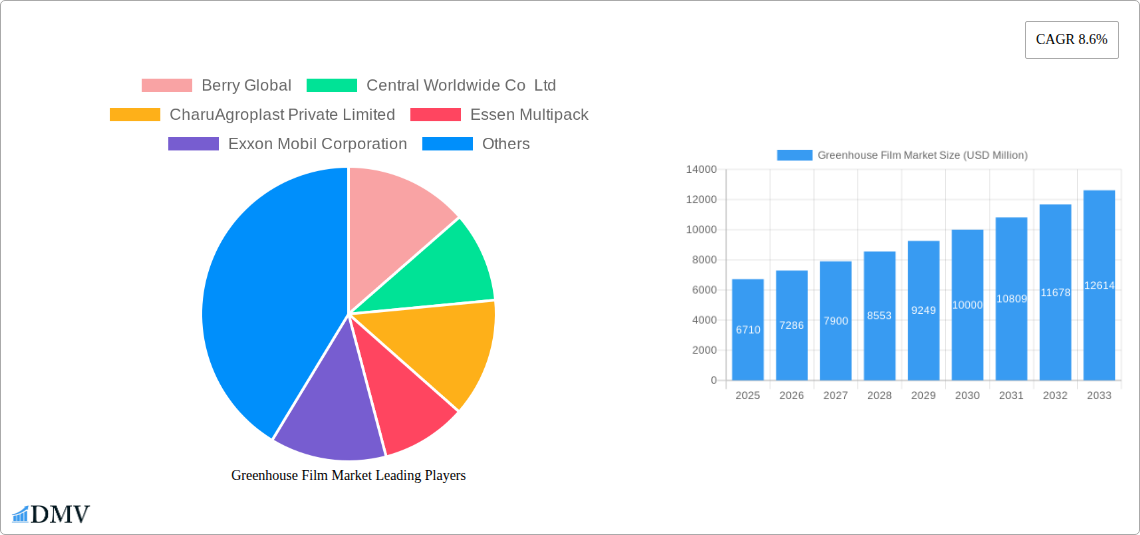

Greenhouse Film Market Company Market Share

Greenhouse Film Market: Comprehensive Industry Analysis & Forecast (2019-2033)

Unlock critical insights into the global Greenhouse Film Market with this in-depth report, meticulously crafted to illuminate market dynamics, growth drivers, and future trajectories. Spanning the historical period of 2019-2024, a base year of 2025, and a comprehensive forecast period from 2025 to 2033, this analysis is your definitive guide to understanding the evolving landscape of agricultural protection and yield enhancement. The report provides granular detail on market segmentation by Plastic Type (Low Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), Polyvinyl Chloride (PVC), Others) and Thickness (Less than 200 microns, Equal to 200 microns, Greater than 200 microns, Others). We will also delve into key industry developments and the competitive ecosystem, featuring insights into major players and strategic initiatives that are shaping this multi-billion dollar market.

Greenhouse Film Market Market Composition & Trends

The global Greenhouse Film Market exhibits a dynamic composition driven by technological advancements and evolving agricultural practices. Market concentration varies across regions, with established players and emerging innovators contributing to a competitive yet collaborative environment. Catalysts for innovation include the demand for enhanced crop yields, improved pest and disease resistance, and optimized light transmission. Regulatory landscapes, particularly concerning environmental impact and material sustainability, are increasingly influencing product development and market entry. Substitute products, such as rigid polycarbonates and glass, present ongoing competition, yet greenhouse films maintain a cost-effective and versatile advantage for many applications. End-user profiles are diverse, encompassing large-scale commercial farms, smaller horticultural operations, and research institutions, each with distinct requirements for film properties. Mergers and acquisitions (M&A) activities are a significant trend, with deal values projected to reach xx billion dollars as companies seek to expand their market reach, acquire new technologies, and consolidate their positions. Market share distribution is influenced by factors such as product innovation, manufacturing capacity, and regional demand.

- Market Concentration: Fragmented in some regions, consolidated in others due to strategic M&A.

- Innovation Catalysts: Demand for increased crop yields, climate change adaptation, disease prevention, resource efficiency.

- Regulatory Landscapes: Growing emphasis on biodegradability, UV resistance, and recyclability standards.

- Substitute Products: Rigid panels (polycarbonate, glass), shade nets; offer specialized benefits but often at higher costs.

- End-User Profiles: Commercial agriculture, horticulture, research, urban farming.

- M&A Activities: Expected to accelerate for market expansion and technology integration, with estimated deal values reaching xx billion.

Greenhouse Film Market Industry Evolution

The Greenhouse Film Market has undergone a significant evolution over the historical period of 2019-2024, transitioning from basic protective covers to highly engineered solutions designed to optimize crop production. Market growth trajectories have been consistently upward, fueled by the escalating global demand for food security and the increasing adoption of protected cultivation techniques. Technological advancements have been central to this evolution, with manufacturers investing heavily in research and development to create films with enhanced properties. These include improved UV stability for extended lifespan, advanced diffusion capabilities to reduce shading and promote uniform growth, and specific light spectrum management to influence plant development. Shifting consumer demands, particularly the growing preference for organically grown produce and year-round availability, have further propelled the market. The adoption of high-performance greenhouse films has also been driven by the economic imperative for farmers to maximize yields and minimize crop losses due to adverse weather conditions or pests. The market has witnessed a shift towards multi-layer films offering a combination of desirable properties, such as thermal insulation, anti-fog capabilities, and enhanced mechanical strength. For instance, the adoption rate of advanced LLDPE films with specialized additive packages has grown by an estimated xx% annually. The market is projected to continue its robust growth at a compound annual growth rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market size of xx billion dollars by 2033.

Leading Regions, Countries, or Segments in Greenhouse Film Market

The dominance within the Greenhouse Film Market is multifaceted, with specific regions, countries, and product segments exhibiting significant influence. Among the plastic types, Linear Low-Density Polyethylene (LLDPE) has emerged as a leading segment due to its superior tensile strength, puncture resistance, and flexibility compared to traditional LDPE. Its versatility makes it suitable for a wide range of greenhouse applications, from basic coverings to advanced multi-layer films. In terms of thickness, films less than 200 microns offer a cost-effective solution for many agricultural needs, while films equal to and greater than 200 microns are increasingly adopted for demanding environments requiring enhanced durability and thermal insulation.

Geographically, Europe and North America have historically been strong markets, driven by advanced agricultural practices, significant investment in protected cultivation, and stringent quality standards. However, the Asia-Pacific region is experiencing rapid growth, propelled by a burgeoning population, increasing demand for high-quality produce, and government initiatives to boost agricultural productivity. Countries like China and India are key contributors to this growth, with substantial investments in modern farming techniques.

- Dominant Plastic Type: Linear Low-Density Polyethylene (LLDPE)

- Key Drivers: Superior mechanical properties, enhanced durability, excellent puncture resistance, flexibility, suitability for multi-layer film manufacturing.

- Impact: Widely adopted for its cost-effectiveness and performance balance, enabling farmers to protect crops and improve yields across diverse climatic conditions.

- Dominant Thickness Segment: Less than 200 microns

- Key Drivers: Cost-effectiveness for broad agricultural use, ease of installation, and sufficient protection for many common crops.

- Impact: Appeals to a wider farmer base, particularly in developing economies, where budget constraints are a significant factor.

- Dominant Regions:

- Asia-Pacific: Experiencing the fastest growth due to increasing agricultural modernization, government support for food security, and rising demand for fresh produce.

- Europe: Strong demand driven by advanced horticultural practices, focus on high-value crops, and stringent quality requirements.

- North America: Significant market share due to large-scale agricultural operations and technological adoption.

- Key Drivers for Regional Dominance:

- Investment Trends: Increased capital expenditure in modern agricultural infrastructure and protected cultivation.

- Regulatory Support: Government subsidies, grants, and favorable policies promoting greenhouse farming.

- Technological Adoption: Higher uptake of advanced greenhouse films and farming technologies.

- Demand for Produce: Growing consumer demand for locally grown, high-quality, and out-of-season produce.

Greenhouse Film Market Product Innovations

Product innovations in the Greenhouse Film Market are revolutionizing agricultural productivity. Manufacturers are developing advanced multi-layer films with specialized additive packages that offer superior UV stabilization, leading to extended film lifespan and reduced replacement costs, estimated at xx% longer than standard films. Diffusion technologies are being integrated to scatter light evenly, minimizing hot spots and promoting uniform plant growth, resulting in yield increases of up to xx%. Furthermore, anti-fog and anti-drip coatings are crucial for maintaining light transmission and preventing the spread of diseases, with reported reductions in fungal infections by xx%. Innovations also extend to thermal properties, with films designed to trap heat efficiently, reducing heating costs by xx% during colder months. These advancements are critical for optimizing resource utilization and enhancing crop quality.

Propelling Factors for Greenhouse Film Market Growth

Several key factors are propelling the growth of the Greenhouse Film Market. The escalating global population and the resultant surge in demand for food are primary drivers, necessitating increased agricultural output. Climate change, with its unpredictable weather patterns, is driving the adoption of protected cultivation for crop resilience. Technological advancements in film manufacturing, offering enhanced durability, UV resistance, and light diffusion, are making greenhouses a more economically viable and efficient solution. Furthermore, government initiatives and subsidies aimed at modernizing agriculture and ensuring food security are providing a significant boost. The increasing adoption of advanced farming techniques, such as hydroponics and vertical farming, which often utilize controlled environments, also contributes to market expansion.

- Growing Global Food Demand: Essential for meeting the nutritional needs of an expanding world population.

- Climate Change Adaptation: Provides a shield against extreme weather events, ensuring consistent crop production.

- Technological Advancements: Development of high-performance films with improved durability, light transmission, and insulation properties.

- Government Support and Policies: Subsidies and incentives for protected agriculture and modern farming practices.

- Rise of Controlled Environment Agriculture (CEA): Increased adoption of hydroponics, vertical farming, and other CEA systems.

Obstacles in the Greenhouse Film Market Market

Despite robust growth, the Greenhouse Film Market faces several obstacles. Fluctuations in raw material prices, particularly polyethylene, can impact manufacturing costs and profitability. Stringent environmental regulations concerning plastic waste and the need for more sustainable and recyclable film options present a challenge, requiring significant investment in R&D for biodegradable alternatives. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to delayed deliveries and increased costs. Intense competition among manufacturers, coupled with price sensitivity among some end-users, can also exert downward pressure on profit margins. The initial capital investment required for greenhouse infrastructure can also be a barrier for smaller farmers.

- Raw Material Price Volatility: Fluctuations in the cost of polyethylene and other key inputs.

- Environmental Regulations: Increasing pressure for sustainable materials and waste reduction.

- Supply Chain Disruptions: Geopolitical factors, logistics challenges, and trade restrictions impacting availability.

- Price Sensitivity: Competition and cost-consciousness among certain market segments.

- High Initial Investment: Cost of greenhouse construction and associated infrastructure.

Future Opportunities in Greenhouse Film Market

The future of the Greenhouse Film Market is ripe with opportunities, driven by emerging trends and evolving agricultural needs. The increasing demand for specialty crops and out-of-season produce will fuel the need for advanced greenhouse solutions. Innovations in smart films, incorporating sensors for real-time monitoring of environmental conditions and crop health, present a significant growth avenue. The development and adoption of biodegradable and compostable greenhouse films will cater to growing environmental consciousness and regulatory pressures. Expansion into emerging markets with developing agricultural sectors, where protected cultivation is gaining traction, offers substantial untapped potential. Furthermore, the integration of greenhouse films with renewable energy sources for greenhouse operations presents synergistic growth opportunities.

- Demand for Specialty Crops: Growing market for high-value and niche produce.

- Smart Film Technologies: Integration of sensors and IoT for advanced environmental monitoring.

- Biodegradable and Sustainable Films: Development and adoption of eco-friendly alternatives.

- Emerging Market Expansion: Untapped potential in developing regions adopting modern agriculture.

- Synergies with Renewable Energy: Integration with solar and other renewable sources for greenhouse operations.

Major Players in the Greenhouse Film Market Ecosystem

- Berry Global

- Central Worldwide Co Ltd

- CharuAgroplast Private Limited

- Essen Multipack

- Exxon Mobil Corporation

- FarmTek

- Ginegar Plastic Products Ltd

- Lumite Inc

- Polifilm Group

- Thai Charoen Thong Karntor Co Ltd

Key Developments in Greenhouse Film Market Industry

- 2023: Launch of advanced multi-layer LLDPE films with enhanced UV stabilization and light diffusion properties by Ginegar Plastic Products Ltd, extending film lifespan by up to xx%.

- 2023: Berry Global announces strategic investment in R&D for biodegradable greenhouse film solutions to meet growing sustainability demands.

- 2024: Polifilm Group expands its production capacity for high-performance agricultural films to meet increasing demand in the European market.

- 2024: FarmTek introduces new greenhouse film options with improved anti-fog and anti-drip coatings, leading to reported reductions in crop diseases.

- 2024: Exxon Mobil Corporation highlights advancements in polyethylene resins for agricultural films, focusing on durability and environmental performance.

- 2024: CharuAgroplast Private Limited reports significant growth in its export market for greenhouse films in Southeast Asia.

Strategic Greenhouse Film Market Market Forecast

The strategic forecast for the Greenhouse Film Market is exceptionally positive, driven by a confluence of indispensable factors. The persistent need for enhanced food security worldwide mandates greater reliance on protected cultivation, with greenhouse films playing a pivotal role. Continued technological innovation will lead to the development of even more sophisticated films offering superior performance, longevity, and specialized functionalities, such as improved thermal regulation and advanced light spectrum management. The increasing global awareness and regulatory push towards sustainability will accelerate the adoption of eco-friendly and biodegradable film alternatives, creating new market niches and driving R&D investments. Emerging economies, with their rapidly modernizing agricultural sectors, represent substantial growth opportunities. The strategic advantage lies in leveraging these trends through continuous product development, efficient supply chain management, and targeted market expansion to capture a significant share of this burgeoning multi-billion dollar market.

Greenhouse Film Market Segmentation

-

1. Plastic Type

- 1.1. Low Density Polyethylene (LDPE)

- 1.2. Linear Low-Density Polyethylene (LLDPE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Others

-

2. Thickness(Micron)

- 2.1. Less then 200

- 2.2. Equal to 200

- 2.3. Greater than 200

- 2.4. Others

Greenhouse Film Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Greenhouse Film Market Regional Market Share

Geographic Coverage of Greenhouse Film Market

Greenhouse Film Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising demand from Food; Rising Demand for Greenhouse Protected Cultivation

- 3.3. Market Restrains

- 3.3.1. ; Rising demand from Food; Rising Demand for Greenhouse Protected Cultivation

- 3.4. Market Trends

- 3.4.1. LDPE Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Greenhouse Film Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Plastic Type

- 5.1.1. Low Density Polyethylene (LDPE)

- 5.1.2. Linear Low-Density Polyethylene (LLDPE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Thickness(Micron)

- 5.2.1. Less then 200

- 5.2.2. Equal to 200

- 5.2.3. Greater than 200

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Plastic Type

- 6. Asia Pacific Greenhouse Film Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Plastic Type

- 6.1.1. Low Density Polyethylene (LDPE)

- 6.1.2. Linear Low-Density Polyethylene (LLDPE)

- 6.1.3. Polyvinyl Chloride (PVC)

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Thickness(Micron)

- 6.2.1. Less then 200

- 6.2.2. Equal to 200

- 6.2.3. Greater than 200

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Plastic Type

- 7. North America Greenhouse Film Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Plastic Type

- 7.1.1. Low Density Polyethylene (LDPE)

- 7.1.2. Linear Low-Density Polyethylene (LLDPE)

- 7.1.3. Polyvinyl Chloride (PVC)

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Thickness(Micron)

- 7.2.1. Less then 200

- 7.2.2. Equal to 200

- 7.2.3. Greater than 200

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Plastic Type

- 8. Europe Greenhouse Film Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Plastic Type

- 8.1.1. Low Density Polyethylene (LDPE)

- 8.1.2. Linear Low-Density Polyethylene (LLDPE)

- 8.1.3. Polyvinyl Chloride (PVC)

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Thickness(Micron)

- 8.2.1. Less then 200

- 8.2.2. Equal to 200

- 8.2.3. Greater than 200

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Plastic Type

- 9. South America Greenhouse Film Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Plastic Type

- 9.1.1. Low Density Polyethylene (LDPE)

- 9.1.2. Linear Low-Density Polyethylene (LLDPE)

- 9.1.3. Polyvinyl Chloride (PVC)

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Thickness(Micron)

- 9.2.1. Less then 200

- 9.2.2. Equal to 200

- 9.2.3. Greater than 200

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Plastic Type

- 10. Middle East and Africa Greenhouse Film Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Plastic Type

- 10.1.1. Low Density Polyethylene (LDPE)

- 10.1.2. Linear Low-Density Polyethylene (LLDPE)

- 10.1.3. Polyvinyl Chloride (PVC)

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Thickness(Micron)

- 10.2.1. Less then 200

- 10.2.2. Equal to 200

- 10.2.3. Greater than 200

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Plastic Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berry Global

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Central Worldwide Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CharuAgroplast Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Essen Multipack

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Exxon Mobil Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FarmTek

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ginegar Plastic Products Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lumite Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Polifilm Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thai Charoen Thong Karntor Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Berry Global

List of Figures

- Figure 1: Global Greenhouse Film Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Greenhouse Film Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 3: Asia Pacific Greenhouse Film Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 4: Asia Pacific Greenhouse Film Market Revenue (undefined), by Thickness(Micron) 2025 & 2033

- Figure 5: Asia Pacific Greenhouse Film Market Revenue Share (%), by Thickness(Micron) 2025 & 2033

- Figure 6: Asia Pacific Greenhouse Film Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Greenhouse Film Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Greenhouse Film Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 9: North America Greenhouse Film Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 10: North America Greenhouse Film Market Revenue (undefined), by Thickness(Micron) 2025 & 2033

- Figure 11: North America Greenhouse Film Market Revenue Share (%), by Thickness(Micron) 2025 & 2033

- Figure 12: North America Greenhouse Film Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Greenhouse Film Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Greenhouse Film Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 15: Europe Greenhouse Film Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 16: Europe Greenhouse Film Market Revenue (undefined), by Thickness(Micron) 2025 & 2033

- Figure 17: Europe Greenhouse Film Market Revenue Share (%), by Thickness(Micron) 2025 & 2033

- Figure 18: Europe Greenhouse Film Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Greenhouse Film Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Greenhouse Film Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 21: South America Greenhouse Film Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 22: South America Greenhouse Film Market Revenue (undefined), by Thickness(Micron) 2025 & 2033

- Figure 23: South America Greenhouse Film Market Revenue Share (%), by Thickness(Micron) 2025 & 2033

- Figure 24: South America Greenhouse Film Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Greenhouse Film Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Greenhouse Film Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 27: Middle East and Africa Greenhouse Film Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 28: Middle East and Africa Greenhouse Film Market Revenue (undefined), by Thickness(Micron) 2025 & 2033

- Figure 29: Middle East and Africa Greenhouse Film Market Revenue Share (%), by Thickness(Micron) 2025 & 2033

- Figure 30: Middle East and Africa Greenhouse Film Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Greenhouse Film Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Greenhouse Film Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 2: Global Greenhouse Film Market Revenue undefined Forecast, by Thickness(Micron) 2020 & 2033

- Table 3: Global Greenhouse Film Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Greenhouse Film Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 5: Global Greenhouse Film Market Revenue undefined Forecast, by Thickness(Micron) 2020 & 2033

- Table 6: Global Greenhouse Film Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Greenhouse Film Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 13: Global Greenhouse Film Market Revenue undefined Forecast, by Thickness(Micron) 2020 & 2033

- Table 14: Global Greenhouse Film Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Greenhouse Film Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 19: Global Greenhouse Film Market Revenue undefined Forecast, by Thickness(Micron) 2020 & 2033

- Table 20: Global Greenhouse Film Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: France Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Greenhouse Film Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 27: Global Greenhouse Film Market Revenue undefined Forecast, by Thickness(Micron) 2020 & 2033

- Table 28: Global Greenhouse Film Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Greenhouse Film Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 33: Global Greenhouse Film Market Revenue undefined Forecast, by Thickness(Micron) 2020 & 2033

- Table 34: Global Greenhouse Film Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Greenhouse Film Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greenhouse Film Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Greenhouse Film Market?

Key companies in the market include Berry Global, Central Worldwide Co Ltd, CharuAgroplast Private Limited, Essen Multipack, Exxon Mobil Corporation, FarmTek, Ginegar Plastic Products Ltd, Lumite Inc, Polifilm Group, Thai Charoen Thong Karntor Co Ltd*List Not Exhaustive.

3. What are the main segments of the Greenhouse Film Market?

The market segments include Plastic Type, Thickness(Micron).

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising demand from Food; Rising Demand for Greenhouse Protected Cultivation.

6. What are the notable trends driving market growth?

LDPE Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Rising demand from Food; Rising Demand for Greenhouse Protected Cultivation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greenhouse Film Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greenhouse Film Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greenhouse Film Market?

To stay informed about further developments, trends, and reports in the Greenhouse Film Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence