Key Insights

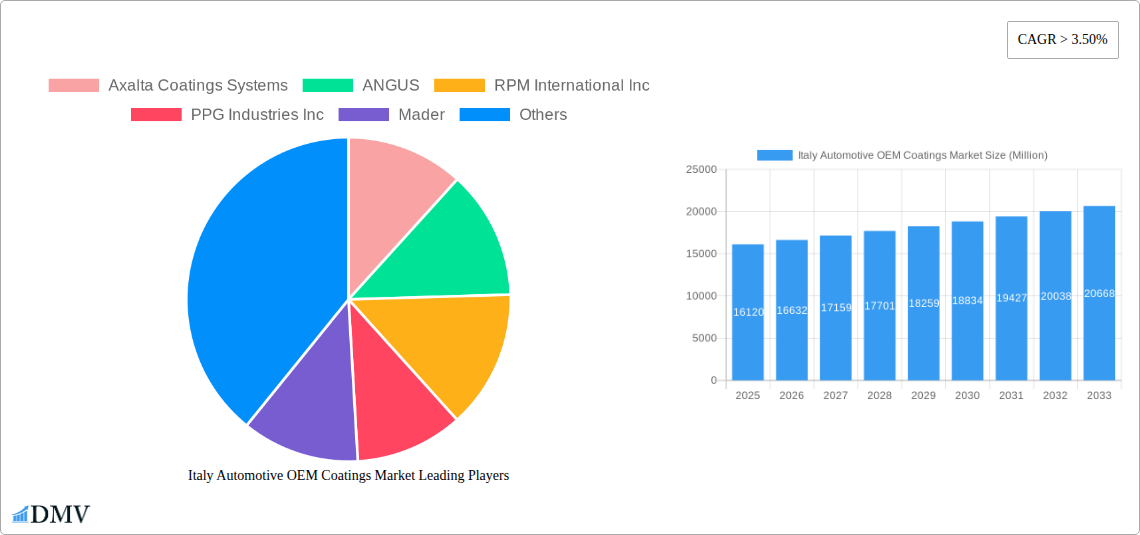

The Italian Automotive OEM Coatings Market is poised for steady growth, projected to reach an estimated $16.12 billion in 2025, with a CAGR of 3.2% anticipated through 2033. This expansion is primarily fueled by the increasing demand for sophisticated and durable automotive finishes that enhance vehicle aesthetics and protection. The passenger car segment continues to dominate the market, driven by a robust automotive manufacturing base in Italy and consumer preference for visually appealing and long-lasting paintwork. Furthermore, the commercial vehicle sector is contributing to market expansion, with evolving regulatory standards and the need for specialized coatings that offer enhanced resistance to wear and environmental factors. Innovations in coating technologies, such as the growing adoption of waterborne coatings due to their environmental benefits and the development of advanced resin formulations like polyurethanes and epoxies, are significant drivers supporting this market trajectory. These advancements allow for improved application efficiency, reduced VOC emissions, and superior performance characteristics, catering to the evolving demands of automotive manufacturers and end-users alike.

Italy Automotive OEM Coatings Market Market Size (In Billion)

Despite the positive growth outlook, the market faces certain restraints. The substantial initial investment required for implementing advanced coating technologies and the stringent environmental regulations that necessitate ongoing adaptation and compliance can pose challenges for smaller players. Fluctuations in raw material prices, particularly for resins and pigments, can also impact profitability and influence pricing strategies. Nevertheless, key trends such as the increasing focus on sustainable coating solutions, the integration of smart coatings with self-healing or color-changing properties, and the continuous research and development by leading companies like Axalta Coatings Systems, PPG Industries, and AkzoNobel NV are expected to mitigate these challenges. The Italian market's emphasis on high-quality finishes and its role as a hub for automotive design and manufacturing will ensure a dynamic and evolving landscape for OEM coatings.

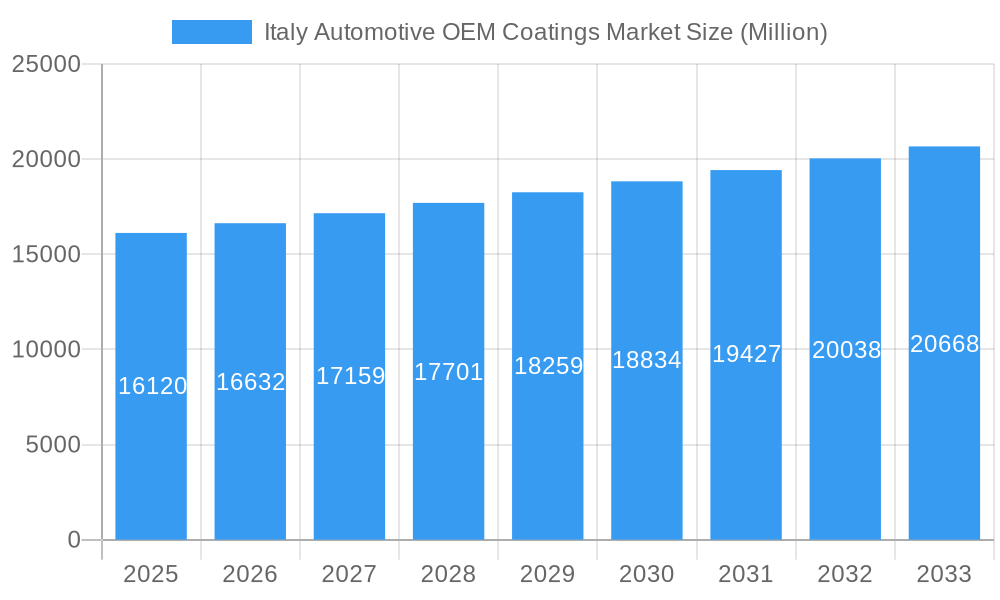

Italy Automotive OEM Coatings Market Company Market Share

This comprehensive report provides an exhaustive analysis of the Italy Automotive OEM Coatings Market, a critical segment within the European automotive industry. Delving into market composition, historical trends, and future projections, this study offers invaluable insights for stakeholders navigating this dynamic landscape. The report encompasses a detailed examination of market drivers, restraints, opportunities, and the competitive ecosystem, with a specific focus on the automotive coatings Italy sector. Our analysis spans the historical period from 2019 to 2024, with a base year of 2025 and an extensive forecast period from 2025 to 2033. We meticulously dissect the market by automotive coating technology (Waterborne, Solvent-borne, Other Technologies), resin type (Acrylic, Epoxy, Alkyd, Polyurethane, Polyester, Other Resins), and application segments including Passenger Cars, Commercial Vehicles, and ACE (Aerospace, Construction, and Electronics), though the primary focus remains on automotive. The Italian automotive coatings market size is estimated to reach billions of dollars by 2033, driven by advancements in automotive paint technology and increasing demand for sustainable solutions.

Italy Automotive OEM Coatings Market Market Composition & Trends

The Italy Automotive OEM Coatings Market exhibits a moderately concentrated structure, with key players like Axalta Coatings Systems, PPG Industries Inc., BASF SE, and AkzoNobel NV holding significant market shares. Innovation remains a primary catalyst, with continuous research and development focused on enhancing durability, aesthetics, and environmental compliance. The automotive OEM coatings Italy market is shaped by stringent European Union regulations concerning VOC emissions and the increasing adoption of sustainable practices, driving demand for waterborne and powder coatings. Substitute products, such as advanced plastic films and specialized surface treatments, are emerging but currently hold a niche position. End-user profiles primarily consist of major automotive Original Equipment Manufacturers (OEMs) and their tier-one suppliers operating within Italy and across Europe. Merger and acquisition (M&A) activities are strategic moves aimed at expanding product portfolios, geographical reach, and technological capabilities. For instance, PPG's acquisition of the Arsonisi powder coatings manufacturing facility in Milan underscores this trend. The market value for automotive OEM coatings Italy is projected to grow steadily, reflecting the resilience of the Italian automotive manufacturing sector and its commitment to technological integration.

Italy Automotive OEM Coatings Market Industry Evolution

The Italy Automotive OEM Coatings Market has undergone a significant transformation over the study period, evolving from a predominantly solvent-borne technology base to a more sustainable and technologically advanced landscape. Historically, solvent-borne coatings dominated due to their cost-effectiveness and established application processes. However, increasing environmental regulations, particularly the reduction of Volatile Organic Compounds (VOCs), have spurred a considerable shift towards waterborne automotive coatings. This transition has not only been driven by compliance but also by evolving consumer preferences for eco-friendly products and the superior performance characteristics of modern waterborne formulations, such as enhanced scratch resistance and UV protection.

Technological advancements have been instrumental in this evolution. The development of high-solids coatings, powder coatings, and UV-curable coatings has provided OEMs with a wider array of options to meet specific performance demands and aesthetic requirements. The adoption of these advanced technologies has been gradual but consistent, driven by the need for improved production efficiency, reduced environmental impact, and enhanced vehicle aesthetics. Growth trajectories have been influenced by the health of the Italian automotive manufacturing sector, which, despite facing global economic headwinds and supply chain disruptions, has shown resilience. The demand for automotive OEM coatings is intrinsically linked to vehicle production volumes, and Italy's position as a significant European automotive hub ensures a sustained market.

Shifting consumer demands have also played a crucial role. Modern consumers expect not only aesthetically pleasing vehicles but also coatings that offer superior protection against environmental factors and everyday wear and tear. This has pushed manufacturers to innovate in areas like self-healing coatings, scratch-resistant finishes, and advanced color technologies that offer deeper hues and better durability. The emphasis on lightweighting in the automotive industry has also influenced coating choices, with a growing interest in coatings that can be applied effectively to new composite materials and aluminum alloys. The market size for automotive OEM coatings Italy is therefore a dynamic reflection of these interconnected technological, regulatory, and consumer-driven shifts. The overall compound annual growth rate (CAGR) for the forecast period is estimated at xx%, indicating a steady expansion fueled by these evolutionary trends.

Leading Regions, Countries, or Segments in Italy Automotive OEM Coatings Market

Within the Italy Automotive OEM Coatings Market, the Passenger Cars segment stands as the dominant force, driven by the robust production and sales volumes of passenger vehicles in Italy and its significant export markets. This segment consistently accounts for the largest share of the automotive coatings market due to the sheer number of units produced and the high standards for aesthetic appeal and durability demanded by consumers of passenger vehicles.

Application Dominance - Passenger Cars:

- High Production Volumes: Italy remains a major European hub for passenger car manufacturing, with leading global automakers having significant production facilities. This inherently translates to a higher demand for automotive OEM coatings.

- Aesthetic Expectations: Consumers of passenger cars place a premium on visual appeal, leading to continuous innovation and demand for advanced color palettes, metallic finishes, and high-gloss topcoats.

- Durability and Protection: Coatings for passenger cars must offer exceptional protection against UV radiation, corrosion, stone chips, and other environmental aggressors to maintain resale value and vehicle longevity.

- Technological Integration: The constant drive for lighter vehicles and improved fuel efficiency necessitates coatings that are compatible with a wider range of materials, including plastics, aluminum, and advanced composites.

Technology Trends - Waterborne Leadership:

- Regulatory Compliance: The stringent EU regulations on VOC emissions have been the primary catalyst for the widespread adoption of waterborne automotive coatings. These coatings significantly reduce harmful emissions compared to traditional solvent-borne alternatives.

- Environmental Sustainability: Growing consumer and corporate emphasis on sustainability further bolsters the demand for waterborne technologies, aligning with broader eco-friendly initiatives within the automotive industry.

- Performance Enhancements: Modern waterborne coatings have overcome historical performance limitations, now offering comparable or even superior scratch resistance, chip resistance, and gloss retention compared to solvent-borne counterparts.

- OEM Investment: Major automotive OEMs in Italy are increasingly investing in infrastructure and processes capable of handling waterborne coating application, solidifying its position as the preferred technology.

Resin Dominance - Polyurethane and Acrylic:

- Polyurethane Resins: Widely used in topcoats and clearcoats, polyurethane resins offer excellent durability, chemical resistance, and a high-gloss finish, crucial for passenger car aesthetics and protection. Their versatility allows for a wide range of formulations to meet specific OEM requirements.

- Acrylic Resins: Acrylics are commonly used in basecoats, providing excellent color retention and weatherability. Their compatibility with various pigments and their ability to achieve a wide spectrum of colors make them indispensable for automotive finishes.

Investment and Regulatory Support:

- Government Incentives: The Italian government, as part of broader European Union directives, encourages investment in sustainable manufacturing processes, including the adoption of eco-friendly coating technologies.

- OEM Capital Expenditure: Major automotive manufacturers are continuously investing in upgrading their production lines to incorporate the latest coating technologies, driving demand for advanced coating systems.

- R&D Focus: Significant R&D efforts by coating manufacturers are directed towards improving the performance and environmental profile of waterborne and other advanced coating technologies, further cementing their dominance in the automotive OEM coatings Italy market.

Italy Automotive OEM Coatings Market Product Innovations

Recent product innovations in the Italy Automotive OEM Coatings Market focus on enhancing sustainability, durability, and aesthetic appeal. Manufacturers are developing advanced formulations that reduce environmental impact without compromising performance. For instance, the launch of BASF's ColorBrite Airspace Blue ReSource basecoat, utilizing biomass-based materials, exemplifies the industry's push towards eco-friendly solutions. These innovations often feature unique selling propositions such as lower VOC content, improved application efficiency, and enhanced resistance to scratching and corrosion. Technological advancements include the development of self-healing clearcoats that can repair minor surface imperfections autonomously and coatings with integrated functionalities like thermal management or enhanced sound dampening.

Propelling Factors for Italy Automotive OEM Coatings Market Growth

Several key factors are propelling the growth of the Italy Automotive OEM Coatings Market. Foremost among these is the sustained demand from the Italian automotive manufacturing sector, which remains a significant contributor to the nation's economy. Stringent environmental regulations, particularly those aimed at reducing VOC emissions, are driving the adoption of more sustainable coating technologies like waterborne and powder coatings. Technological advancements in coating formulations, leading to improved durability, scratch resistance, and aesthetic finishes, are also critical growth drivers. Furthermore, the increasing focus on vehicle lightweighting and the use of diverse materials necessitate advanced coatings that can adhere effectively and provide protection to these novel substrates. Economic recovery and increased consumer spending on vehicles, coupled with OEMs' continuous investment in product development and manufacturing efficiency, further fuel market expansion.

Obstacles in the Italy Automotive OEM Coatings Market Market

Despite robust growth prospects, the Italy Automotive OEM Coatings Market faces several obstacles. The high initial investment required for transitioning to new coating technologies, particularly waterborne and powder coatings, can be a significant barrier for smaller manufacturers and suppliers. Fluctuations in raw material prices, such as petrochemical derivatives, can impact profit margins and pricing strategies. Supply chain disruptions, as evidenced by recent global events, can lead to material shortages and production delays, affecting the entire value chain. Moreover, intense competition among established global players and emerging regional manufacturers can lead to price pressures and reduced profitability. The evolving regulatory landscape, while a driver for innovation, also presents challenges in terms of compliance costs and the need for continuous adaptation of manufacturing processes.

Future Opportunities in Italy Automotive OEM Coatings Market

The Italy Automotive OEM Coatings Market presents numerous future opportunities. The ongoing transition towards electric vehicles (EVs) opens avenues for specialized coatings that can address unique requirements, such as thermal management and electromagnetic shielding. The increasing demand for personalized vehicle aesthetics will drive innovation in custom color solutions and advanced visual effects. The growing emphasis on sustainability will continue to boost the market for bio-based and recycled content coatings. Furthermore, the expansion of autonomous driving technology may necessitate coatings with enhanced sensor compatibility and signal transparency. Opportunities also lie in developing coatings for new lightweight materials and advanced composite structures used in next-generation vehicles. Strategic collaborations between coating manufacturers and automotive OEMs can accelerate the development and adoption of innovative solutions.

Major Players in the Italy Automotive OEM Coatings Market Ecosystem

- Axalta Coatings Systems

- ANGUS

- RPM International Inc

- PPG Industries Inc

- Mader

- Beckers Group

- Nippon Paint Holdings Co Ltd

- BASF SE

- Mankiewicz

- AkzoNobel NV

- Merck Group

- Armorthane

- The Sherwin Williams Company

- Specialty Coating Systems Inc

Key Developments in Italy Automotive OEM Coatings Market Industry

- May 2022: BASF launched new automotive coatings ColorBrite Airspace Blue ReSource basecoat based on biomass, aiming to increase its sustainable product portfolio in the European region.

- March 2022: PPG acquired the Arsonisi powder coatings manufacturing facility in Milan, Italy, to increase its product portfolio in powder coatings in the European region, planning to boost powder coatings product development in the region.

Strategic Italy Automotive OEM Coatings Market Market Forecast

The strategic forecast for the Italy Automotive OEM Coatings Market indicates sustained growth, propelled by an increasing demand for sustainable and high-performance coating solutions. The shift towards electric vehicles and the ongoing quest for enhanced vehicle aesthetics and durability will continue to drive innovation. Market participants are expected to focus on expanding their portfolios of waterborne and powder coatings, alongside the development of specialized coatings for emerging automotive technologies. Investments in research and development for eco-friendly materials and advanced functionalities will be crucial for competitive advantage. The market is projected to witness significant opportunities arising from stricter environmental regulations, OEM commitments to sustainability, and the intrinsic resilience of the Italian automotive manufacturing sector, ensuring a positive outlook for the automotive OEM coatings Italy market size.

Italy Automotive OEM Coatings Market Segmentation

-

1. Application

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. ACE

-

2. Technology

- 2.1. Waterborne

- 2.2. Solvent-borne

- 2.3. Other Technologies

-

3. Resin

- 3.1. Acrylic

- 3.2. Epoxy

- 3.3. Alkyd

- 3.4. Polyurethane

- 3.5. Polyester

- 3.6. Other Resins

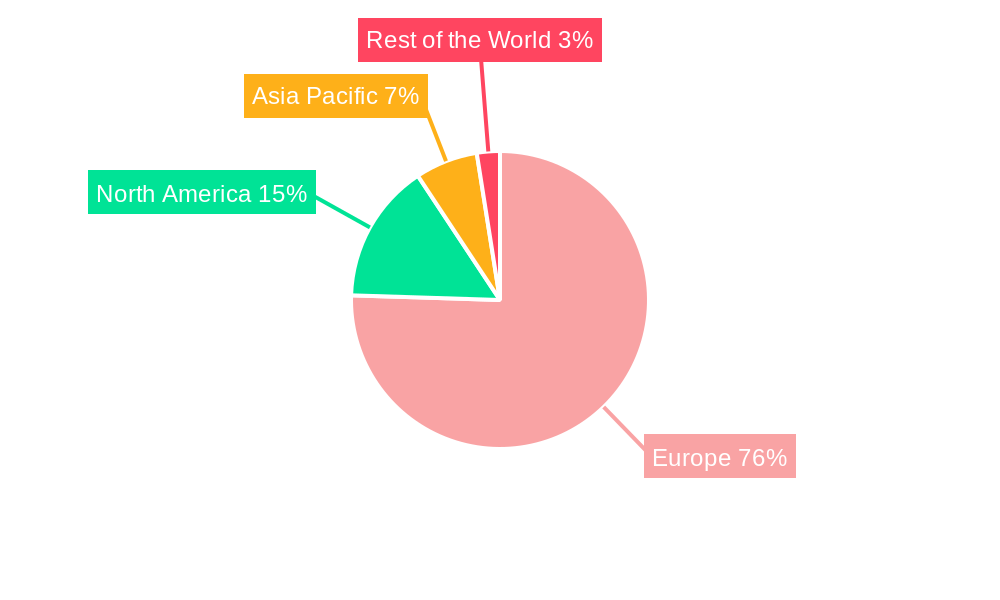

Italy Automotive OEM Coatings Market Segmentation By Geography

- 1. Italy

Italy Automotive OEM Coatings Market Regional Market Share

Geographic Coverage of Italy Automotive OEM Coatings Market

Italy Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preferences; Government Involvement Boosting Market Growth; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Shortage of semiconductors; Price Hikes of Raw Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Government Involvement to Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Automotive OEM Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. ACE

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Waterborne

- 5.2.2. Solvent-borne

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Epoxy

- 5.3.3. Alkyd

- 5.3.4. Polyurethane

- 5.3.5. Polyester

- 5.3.6. Other Resins

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axalta Coatings Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ANGUS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PPG Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mader

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beckers Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Paint Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mankiewicz

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AkzoNobel NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Merck Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Armorthane

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 The Sherwin Williams Company*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Specialty Coating Systems Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Axalta Coatings Systems

List of Figures

- Figure 1: Italy Automotive OEM Coatings Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Italy Automotive OEM Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 4: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Resin 2020 & 2033

- Table 6: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 7: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 12: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 13: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Resin 2020 & 2033

- Table 14: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 15: Italy Automotive OEM Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Automotive OEM Coatings Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Italy Automotive OEM Coatings Market?

Key companies in the market include Axalta Coatings Systems, ANGUS, RPM International Inc, PPG Industries Inc, Mader, Beckers Group, Nippon Paint Holdings Co Ltd, BASF SE, Mankiewicz, AkzoNobel NV, Merck Group, Armorthane, The Sherwin Williams Company*List Not Exhaustive, Specialty Coating Systems Inc.

3. What are the main segments of the Italy Automotive OEM Coatings Market?

The market segments include Application, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preferences; Government Involvement Boosting Market Growth; Other Drivers.

6. What are the notable trends driving market growth?

Government Involvement to Boost Market Growth.

7. Are there any restraints impacting market growth?

Shortage of semiconductors; Price Hikes of Raw Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

May 2022: BASF has launched new automotive coatings ColorBrite Airspace Blue ReSource basecoat based on biomass. The company is aiming to increase its sustainable product portfolio in European Region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the Italy Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence