Key Insights

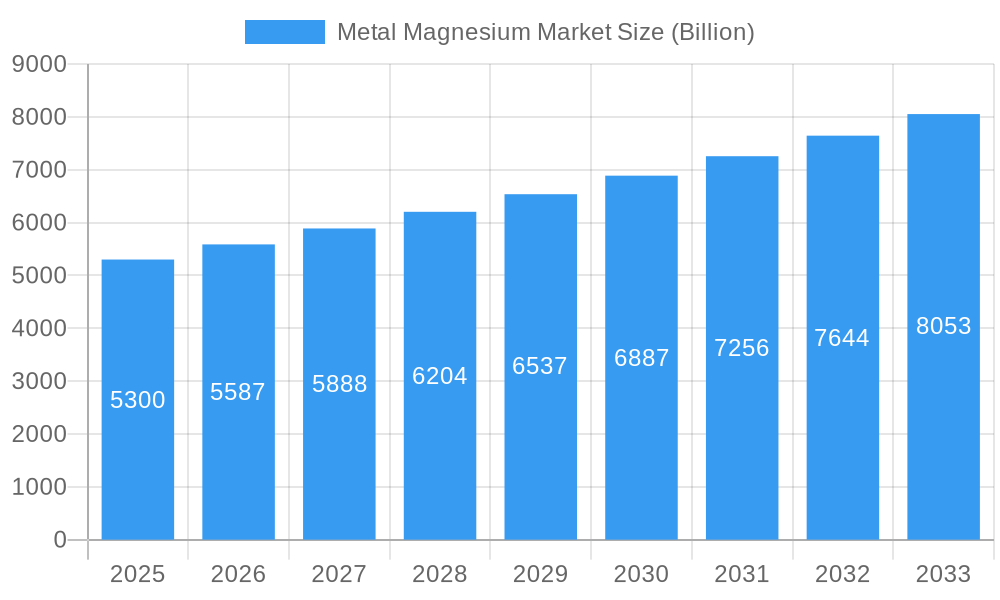

The global Metal Magnesium market is poised for significant growth, projected to reach $5.3 Billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.4% from 2019 to 2033. This upward trajectory is fueled by a robust demand from key end-user industries, notably the automotive sector driven by the lightweighting trend to improve fuel efficiency and reduce emissions. The increasing adoption of magnesium alloys in aerospace, electronics, and consumer goods further bolsters market expansion. Technological advancements in magnesium extraction and processing, leading to cost reductions and improved material properties, are also key drivers. Furthermore, growing investments in research and development for novel magnesium applications are expected to unlock new market opportunities. The market's momentum is supported by its versatility and excellent strength-to-weight ratio, making it a preferred material in a wide array of applications.

Metal Magnesium Market Market Size (In Billion)

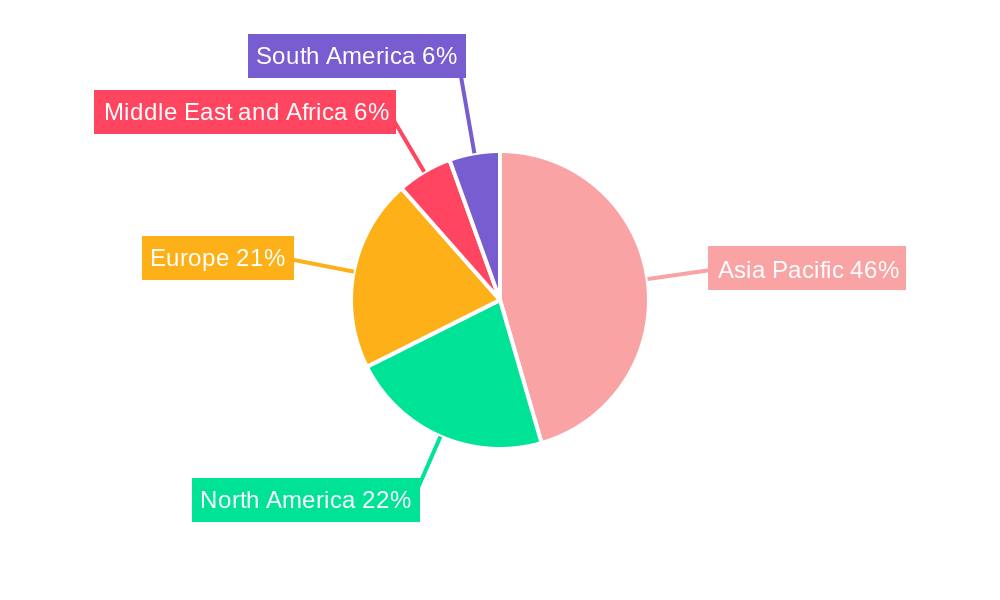

The market's growth is strategically underpinned by its diverse applications and a favorable economic outlook across major regions. While the aluminum alloys and die-casting sectors represent substantial segments, the iron and steel and metal reduction industries are also demonstrating consistent demand. Emerging economies, particularly in the Asia Pacific region, are expected to spearhead this growth due to rapid industrialization and increasing manufacturing capabilities. However, the market faces certain restraints, including the relatively higher cost of magnesium production compared to some alternatives and the complexities associated with recycling and waste management of magnesium products. Geopolitical factors and fluctuations in raw material prices can also present challenges. Nevertheless, the inherent advantages of metal magnesium, coupled with ongoing innovation, are expected to outweigh these challenges, ensuring a steady and promising market expansion.

Metal Magnesium Market Company Market Share

Metal Magnesium Market Market Composition & Trends

The global Metal Magnesium market is characterized by a dynamic interplay of supply and demand, influenced by innovation and strategic consolidations. Market concentration is moderate, with key players like American Magnesium and Regal Metal holding significant positions. Innovation catalysts are primarily driven by advancements in extraction technologies and the development of advanced magnesium alloys for specialized applications. The regulatory landscape, while generally supportive of industrial growth, can vary by region, impacting production costs and market access. Substitute products, though present in certain applications, often fall short in terms of magnesium's unique properties like its lightweight nature and high strength-to-weight ratio. End-user profiles are diverse, spanning critical sectors that rely on magnesium's advantageous characteristics. Mergers and acquisitions (M&A) activities are ongoing, with recent deals valued in the hundreds of millions of dollars, aiming to consolidate market share and enhance operational efficiencies.

- Market Share Distribution: Key players hold approximately 60-70% of the global market share.

- M&A Deal Values: Recent transactions have ranged from $50 million to $300 million.

- Innovation Focus: Advancements in pyrometallurgical and electrolytic extraction processes, alongside the creation of new magnesium-lithium alloys.

Metal Magnesium Market Industry Evolution

The Metal Magnesium market has witnessed a significant evolutionary trajectory over the historical period of 2019-2024, driven by an increasing demand for lightweight materials across various high-growth industries. The market growth trajectory has been consistently upward, with an average annual growth rate of approximately 5.5% during this period. Technological advancements have played a pivotal role, particularly in improving the efficiency and cost-effectiveness of magnesium production processes. Innovations in electrolytic and pyrometallurgical extraction methods have not only reduced energy consumption but also minimized environmental impact, thereby aligning with growing sustainability mandates. The adoption of advanced magnesium alloys, such as magnesium-aluminum and magnesium-lithium alloys, has surged due to their superior performance characteristics, including exceptional strength-to-weight ratios and corrosion resistance. This surge in adoption is evident in the automotive sector, where lightweighting is crucial for fuel efficiency and reduced emissions, and in the aerospace industry, where weight optimization directly translates to enhanced performance and reduced operational costs. Consumer demands have increasingly shifted towards more sustainable and energy-efficient products, further bolstering the demand for lightweight materials like magnesium. The market has also seen a rise in specialized applications, including in the electronics industry for device casings and in defense for durable yet lightweight components. The base year of 2025 is expected to continue this trend, with a projected growth rate of 6.2%, setting the stage for robust expansion throughout the forecast period of 2025-2033.

Leading Regions, Countries, or Segments in Metal Magnesium Market

The global Metal Magnesium market demonstrates significant regional dominance and segment leadership, with the Aluminum Alloys end-user industry emerging as the undisputed leader. This dominance is propelled by the intrinsic synergy between aluminum and magnesium, where the latter is extensively used as an alloying element to enhance the strength, ductility, and corrosion resistance of aluminum. This enhancement is critical for applications in the automotive and aerospace sectors, which are continuously seeking to reduce vehicle weight for improved fuel efficiency and performance.

Key Drivers for Aluminum Alloys Segment Dominance:

- Automotive Lightweighting Initiatives: The relentless pursuit of fuel economy standards and emissions reduction targets in the automotive industry directly translates into a higher demand for lightweight materials. Magnesium, as an alloying element in aluminum, plays a crucial role in achieving these lightweighting goals.

- Aerospace Material Requirements: The stringent performance and safety standards in the aerospace industry necessitate materials with exceptional strength-to-weight ratios. Magnesium-enhanced aluminum alloys are vital for structural components, reducing overall aircraft weight and consequently fuel consumption.

- Infrastructure Development and Expansion: Growing investments in infrastructure projects globally, including bridges, buildings, and transportation networks, are driving demand for durable and corrosion-resistant construction materials, where aluminum alloys are increasingly utilized.

- Technological Advancements in Alloying: Continuous research and development in creating advanced magnesium-aluminum alloys with tailored properties for specific applications further solidify the segment's leadership.

Beyond aluminum alloys, other end-user industries such as Die-casting, Iron and Steel, and Metal Reduction also contribute significantly to the Metal Magnesium market. The die-casting segment leverages magnesium's excellent castability and fluidity for producing intricate components for consumer electronics and automotive parts. The iron and steel industry utilizes magnesium for desulfurization, improving the quality and properties of steel. The metal reduction segment, particularly in the production of titanium and zirconium, relies on magnesium as a reducing agent. However, the sheer volume and breadth of applications within the aluminum alloys sector firmly establish it as the primary growth engine and largest segment of the Metal Magnesium market. The estimated market size for the aluminum alloys segment alone is projected to reach over $20 Billion by 2025, with a sustained growth rate exceeding 7% annually during the forecast period.

Metal Magnesium Market Product Innovations

Product innovations in the Metal Magnesium market are largely focused on developing specialized magnesium alloys with enhanced performance characteristics and expanding their application reach. Recent advancements include the creation of high-strength, lightweight magnesium alloys for the automotive sector, aiming to improve fuel efficiency and reduce emissions. In the aerospace industry, novel magnesium alloys are being engineered for increased temperature resistance and superior fatigue life. Furthermore, research into biodegradable magnesium alloys for medical implants is gaining traction, offering a biocompatible alternative to traditional metallic implants. These innovations are driven by the unique properties of magnesium, such as its low density, excellent vibration damping, and high specific strength, making it a critical material for next-generation technologies.

Propelling Factors for Metal Magnesium Market Growth

The Metal Magnesium market is propelled by a confluence of technological, economic, and environmental factors.

- Lightweighting Demand: The automotive and aerospace industries' relentless drive for fuel efficiency and reduced emissions is a primary growth engine, as magnesium offers the highest strength-to-weight ratio among structural metals.

- Technological Advancements: Innovations in extraction processes, such as improved electrolytic and pyrometallurgical techniques, are making magnesium production more cost-effective and sustainable.

- Expanding Applications: The development of advanced magnesium alloys with tailored properties is opening new avenues in electronics, defense, and medical devices.

- Governmental Support and Regulations: Initiatives promoting energy efficiency and sustainable manufacturing are indirectly boosting demand for lightweight materials like magnesium.

Obstacles in the Metal Magnesium Market Market

Despite robust growth, the Metal Magnesium market faces several obstacles.

- High Production Costs: Magnesium production is energy-intensive, leading to higher costs compared to other light metals like aluminum, impacting its widespread adoption.

- Corrosion Susceptibility: Certain magnesium alloys can be susceptible to corrosion, requiring protective coatings and limiting their use in harsh environments.

- Supply Chain Volatility: Geopolitical factors and reliance on specific regions for raw material extraction can lead to supply chain disruptions and price fluctuations.

- Limited Awareness and Expertise: In some emerging applications, a lack of widespread awareness regarding magnesium's benefits and limited expertise in its processing can hinder market penetration.

Future Opportunities in Metal Magnesium Market

The future of the Metal Magnesium market is brimming with opportunities.

- Electric Vehicle (EV) Lightweighting: As the EV market expands, the demand for lightweight materials to optimize battery range and performance will significantly increase magnesium's role.

- Sustainable Materials Development: The growing emphasis on eco-friendly and recyclable materials presents a substantial opportunity for magnesium, especially in its closed-loop recycling potential.

- Advanced Manufacturing Techniques: The integration of magnesium in additive manufacturing (3D printing) for complex, customized components in aerospace and defense offers significant growth potential.

- Emerging Economies: Increasing industrialization and infrastructure development in developing nations will drive demand for lightweight and durable materials.

Major Players in the Metal Magnesium Market Ecosystem

- American Magnesium

- Regal Metal

- Wenxi Yinguang Magnesium Industry (group) Co Ltd

- Fu Gu Yi De Magnesium Alloy Co Ltd

- Taiyuan Tonghang Metal Magnesium Co Ltd

- Rima Industrial

- Shanxi Bada Magnesium Co Ltd

- Southern Magnesium & Chemicals Limited (SMCL)

- Nanjing Yunhai Special Metals Co Ltd

- Solikamsk Magnesium Works

- Western Magnesium Corporation

- US Magnesium LLC

- Dead Sea Magnesium (ICL Group)

Key Developments in Metal Magnesium Market Industry

- February 2023: Western Magnesium Corporation announced its plan to build a new production facility for magnesium metal with an initial annual capacity of 25,000 metric tons and a new research and development center in Nevada. With the help of this new production facility, the company aims to serve automotive, aerospace, airline, eco-friendly technology companies, and Defense Contractors through this expansion.

- July 2022: Chongqing Boao Magnesium-Aluminum Metal Manufacturing Co. Ltd (a wholly owned subsidiary of RSM Group/ Nanjing Yunhai Special Metals Co. Ltd) announced the completion of a high-performance magnesium-aluminum alloy and deep processing project (Phase II project) located in Pingshan Industrial Park, Chongqing City. The new production facilities could have various workshops, including a magnesium particle production workshop with a 7,200 tons/year capacity.

Strategic Metal Magnesium Market Market Forecast

The Metal Magnesium market is poised for substantial growth from 2025 to 2033, driven by escalating demand for lightweight materials, particularly in the automotive and aerospace sectors. The increasing adoption of electric vehicles, coupled with stringent emission regulations, will further accelerate this trend, as magnesium's superior strength-to-weight ratio is critical for enhancing battery range and overall vehicle efficiency. Innovations in magnesium alloy development, focusing on improved corrosion resistance and high-temperature performance, will unlock new applications in defense and renewable energy technologies. Furthermore, advancements in sustainable extraction and recycling processes are expected to mitigate production costs and environmental concerns, making magnesium a more attractive material choice. Strategic investments in R&D and capacity expansion by major players will be crucial in meeting the projected market demand, which is estimated to reach over $30 Billion by 2033, exhibiting a compound annual growth rate of approximately 6.5% during the forecast period.

Metal Magnesium Market Segmentation

-

1. End-user Industry

- 1.1. Aluminum Alloys

- 1.2. Die-casting

- 1.3. Iron and Steel

- 1.4. Metal Reduction

- 1.5. Other End-user Industries

Metal Magnesium Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Metal Magnesium Market Regional Market Share

Geographic Coverage of Metal Magnesium Market

Metal Magnesium Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Alloying with Other Metals; Increasing Demand for Lightweight Materials in the Aerospace and Automotive Industry

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Prices of Metal

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Production of Aluminum Alloys

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Magnesium Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Aluminum Alloys

- 5.1.2. Die-casting

- 5.1.3. Iron and Steel

- 5.1.4. Metal Reduction

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Metal Magnesium Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Aluminum Alloys

- 6.1.2. Die-casting

- 6.1.3. Iron and Steel

- 6.1.4. Metal Reduction

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Metal Magnesium Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Aluminum Alloys

- 7.1.2. Die-casting

- 7.1.3. Iron and Steel

- 7.1.4. Metal Reduction

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Metal Magnesium Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Aluminum Alloys

- 8.1.2. Die-casting

- 8.1.3. Iron and Steel

- 8.1.4. Metal Reduction

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Metal Magnesium Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Aluminum Alloys

- 9.1.2. Die-casting

- 9.1.3. Iron and Steel

- 9.1.4. Metal Reduction

- 9.1.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Metal Magnesium Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Aluminum Alloys

- 10.1.2. Die-casting

- 10.1.3. Iron and Steel

- 10.1.4. Metal Reduction

- 10.1.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 American Magnesium

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Regal Metal

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wenxi Yinguang Magnesium Industry (group) Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fu Gu Yi De Magnesium Alloy Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Taiyuan Tongxiang Metal Magnesium Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rima Industrial

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shanxi Bada Magnesium Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Southern Magnesium & Chemicals Limited (SMCL)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nanjing Yunhai Special Metals Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Solikamsk Magnesium Works

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Western Magnesium Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 US Magnesium LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dead Sea Magnesium (ICL Group)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 American Magnesium

List of Figures

- Figure 1: Global Metal Magnesium Market Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: Global Metal Magnesium Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Metal Magnesium Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Metal Magnesium Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Metal Magnesium Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Metal Magnesium Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Metal Magnesium Market Revenue (Billion), by Country 2025 & 2033

- Figure 8: Asia Pacific Metal Magnesium Market Volume (K Tons), by Country 2025 & 2033

- Figure 9: Asia Pacific Metal Magnesium Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Metal Magnesium Market Volume Share (%), by Country 2025 & 2033

- Figure 11: North America Metal Magnesium Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 12: North America Metal Magnesium Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: North America Metal Magnesium Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Metal Magnesium Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Metal Magnesium Market Revenue (Billion), by Country 2025 & 2033

- Figure 16: North America Metal Magnesium Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America Metal Magnesium Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Metal Magnesium Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Metal Magnesium Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 20: Europe Metal Magnesium Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: Europe Metal Magnesium Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Metal Magnesium Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Metal Magnesium Market Revenue (Billion), by Country 2025 & 2033

- Figure 24: Europe Metal Magnesium Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Metal Magnesium Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Metal Magnesium Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Metal Magnesium Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 28: South America Metal Magnesium Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: South America Metal Magnesium Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South America Metal Magnesium Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: South America Metal Magnesium Market Revenue (Billion), by Country 2025 & 2033

- Figure 32: South America Metal Magnesium Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: South America Metal Magnesium Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Metal Magnesium Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Metal Magnesium Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Metal Magnesium Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 37: Middle East and Africa Metal Magnesium Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Middle East and Africa Metal Magnesium Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Metal Magnesium Market Revenue (Billion), by Country 2025 & 2033

- Figure 40: Middle East and Africa Metal Magnesium Market Volume (K Tons), by Country 2025 & 2033

- Figure 41: Middle East and Africa Metal Magnesium Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Metal Magnesium Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Magnesium Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Metal Magnesium Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Metal Magnesium Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 4: Global Metal Magnesium Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global Metal Magnesium Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Metal Magnesium Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Metal Magnesium Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 8: Global Metal Magnesium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: China Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 10: China Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: India Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 12: India Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Japan Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: Japan Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: South Korea Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 16: South Korea Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Metal Magnesium Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Metal Magnesium Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Metal Magnesium Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 22: Global Metal Magnesium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 23: United States Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 24: United States Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Canada Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 26: Canada Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Mexico Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 28: Mexico Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Global Metal Magnesium Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Metal Magnesium Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Metal Magnesium Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 32: Global Metal Magnesium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Germany Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 34: Germany Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Italy Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: France Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 40: France Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Global Metal Magnesium Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Metal Magnesium Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Metal Magnesium Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 46: Global Metal Magnesium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 47: Brazil Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 48: Brazil Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Argentina Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Argentina Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Metal Magnesium Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Metal Magnesium Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Metal Magnesium Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 56: Global Metal Magnesium Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Saudi Arabia Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 58: Saudi Arabia Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: South Africa Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East and Africa Metal Magnesium Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Metal Magnesium Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Magnesium Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Metal Magnesium Market?

Key companies in the market include American Magnesium, Regal Metal, Wenxi Yinguang Magnesium Industry (group) Co Ltd, Fu Gu Yi De Magnesium Alloy Co Ltd, Taiyuan Tongxiang Metal Magnesium Co Ltd, Rima Industrial, Shanxi Bada Magnesium Co Ltd, Southern Magnesium & Chemicals Limited (SMCL), Nanjing Yunhai Special Metals Co Ltd, Solikamsk Magnesium Works, Western Magnesium Corporation, US Magnesium LLC, Dead Sea Magnesium (ICL Group).

3. What are the main segments of the Metal Magnesium Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.3 Billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Alloying with Other Metals; Increasing Demand for Lightweight Materials in the Aerospace and Automotive Industry.

6. What are the notable trends driving market growth?

Increasing Usage in the Production of Aluminum Alloys.

7. Are there any restraints impacting market growth?

Fluctuation in Prices of Metal.

8. Can you provide examples of recent developments in the market?

February 2023: Western Magnesium Corporation announced its plan to build a new production facility for magnesium metal with an initial annual capacity of 25,000 metric tons and a new research and development center in Nevada. With the help of this new production facility, the company aims to serve automotive, aerospace, airline, eco-friendly technology companies, and Defense Contractors through this expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Magnesium Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Magnesium Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Magnesium Market?

To stay informed about further developments, trends, and reports in the Metal Magnesium Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence