Key Insights

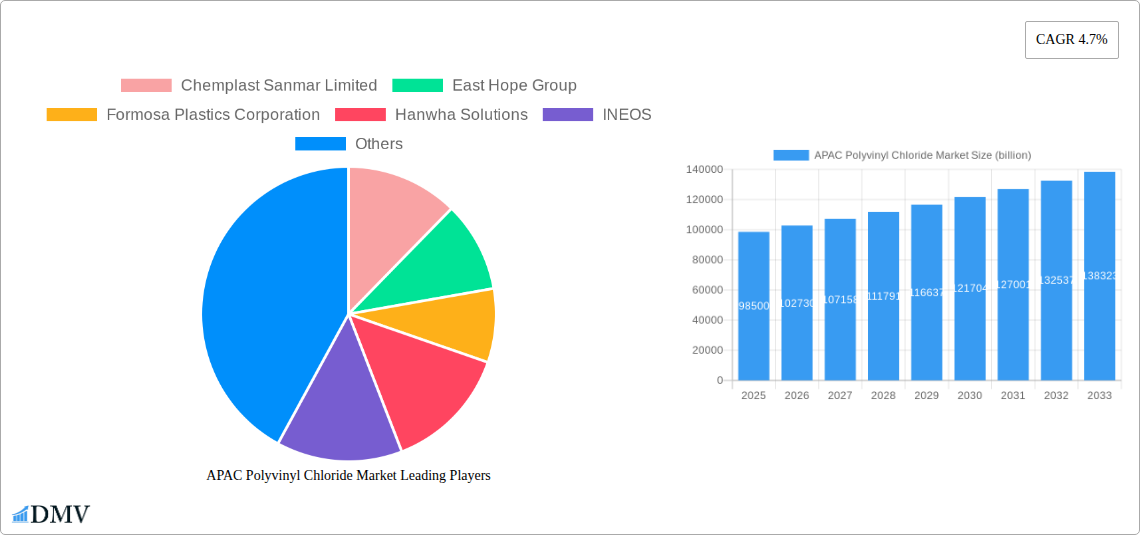

The APAC Polyvinyl Chloride (PVC) market is poised for robust growth, with an estimated market size of $98.5 billion in 2025. This expansion is driven by a healthy Compound Annual Growth Rate (CAGR) of 4.7% projected over the forecast period. Key drivers propelling this market include the burgeoning demand from the building and construction sector, fueled by rapid urbanization and infrastructure development across the region. The automotive industry's increasing reliance on PVC for lightweight and durable components, alongside the expanding electrical and electronics sector, further contributes to this upward trajectory. Furthermore, the packaging and healthcare industries are consistently leveraging PVC's versatility and cost-effectiveness, creating sustained demand. The market is segmented across various product types like Rigid PVC, Flexible PVC, Low-smoke PVC, and Chlorinated PVC, catering to a wide array of applications including pipes and fittings, films and sheets, wires and cables, bottles, profiles, and hoses.

APAC Polyvinyl Chloride Market Market Size (In Billion)

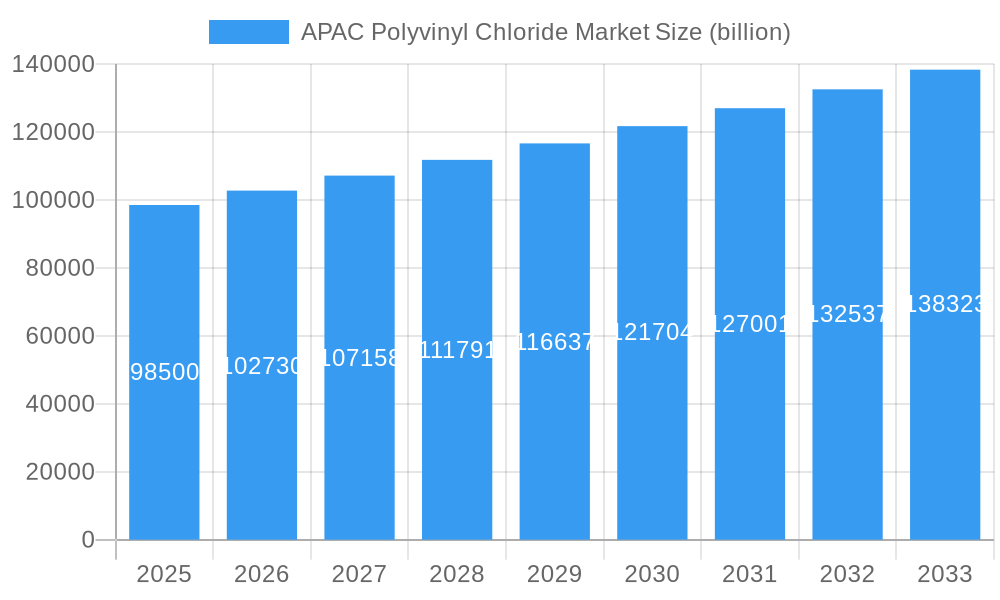

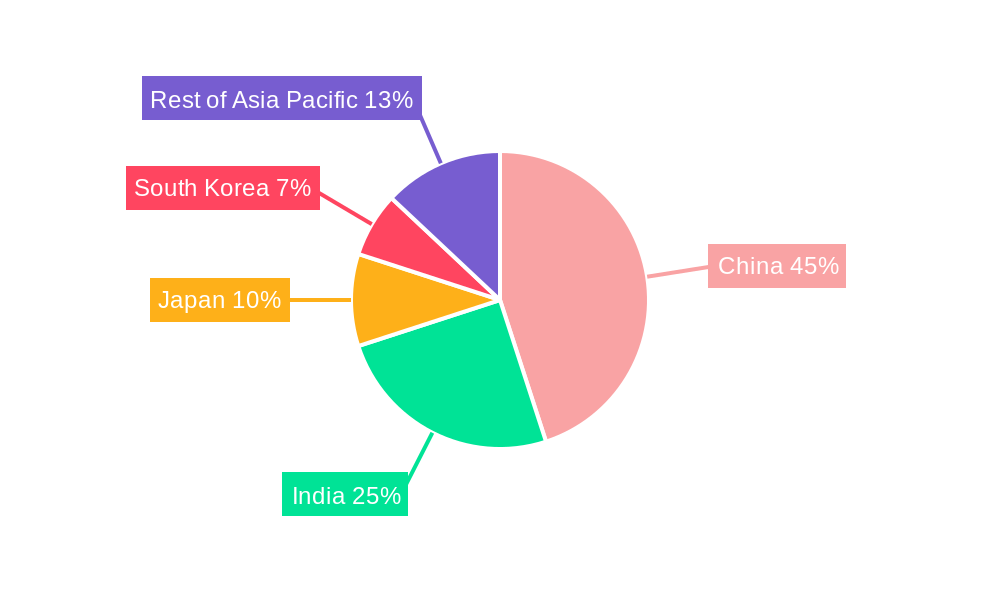

The competitive landscape is dynamic, featuring prominent players such as Formosa Plastics Corporation, INEOS, LG Chem, Shin-Etsu Chemical Co Ltd, and Westlake Corporation, alongside significant regional entities like Chemplast Sanmar Limited and Reliance Industries Limited. China and India are expected to remain dominant markets due to their large populations, expanding industrial bases, and substantial investments in infrastructure. Japan and South Korea, while mature markets, continue to contribute through their advanced manufacturing and technological innovations. The "Rest of Asia-Pacific" region presents a significant opportunity for growth as developing economies focus on industrialization and infrastructure enhancement. Anticipated trends include a greater emphasis on sustainable PVC production, the development of specialized PVC grades with enhanced properties, and an increasing adoption of recycling initiatives to address environmental concerns, thereby reinforcing the market's resilience and long-term viability.

APAC Polyvinyl Chloride Market Company Market Share

This in-depth report delivers a pivotal analysis of the APAC Polyvinyl Chloride (PVC) market, a dynamic sector integral to numerous industries across the region. Uncovering growth trajectories, technological advancements, and competitive landscapes, this study provides strategic insights for stakeholders navigating the evolving Asia-Pacific PVC market. With a meticulous examination covering the historical period (2019–2024), base year (2025), and an extended forecast period (2025–2033), this report is your definitive guide to the global PVC industry's most crucial regional hub.

APAC Polyvinyl Chloride Market Market Composition & Trends

The APAC Polyvinyl Chloride market exhibits a moderate level of concentration, with key players like Formosa Plastics Corporation, INEOS, and Shin-Etsu Chemical Co Ltd dominating significant market shares. Innovation catalysts are primarily driven by advancements in PVC production technologies, leading to enhanced product performance and sustainability. The regulatory landscape is increasingly focused on environmental compliance and the development of eco-friendly PVC alternatives, impacting manufacturing processes and product formulations. Substitute products, such as polyethylene (PE) and polypropylene (PP), present ongoing competition, particularly in packaging and certain infrastructure applications. End-user profiles showcase a strong reliance on the building and construction sector, followed by automotive, electrical and electronics, and packaging. Mergers and acquisitions (M&A) activities, valued in the billions, are strategically shaping the market by consolidating capabilities and expanding geographical reach. For instance, significant PVC market deal values are anticipated as companies seek to capitalize on the region's burgeoning demand. The market share distribution is expected to see shifts, driven by these strategic moves and evolving end-user preferences. The adoption of sustainable PVC solutions and the development of specialized grades are becoming critical differentiation factors.

APAC Polyvinyl Chloride Market Industry Evolution

The APAC Polyvinyl Chloride market has witnessed a remarkable evolution, driven by robust economic growth and escalating industrialization across the region. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth is underpinned by a substantial increase in demand from the building and construction industry, which accounts for a significant portion of PVC consumption, estimated to be around XX% of the total market value. Infrastructure development projects, urbanization initiatives, and the need for durable and cost-effective building materials are key contributors. Technological advancements have played a crucial role in shaping the industry. Innovations in PVC polymerization techniques have led to the development of specialized grades with improved properties, such as enhanced fire resistance, flexibility, and weatherability. The increasing focus on sustainability has also spurred the development of recycled PVC grades and bio-based PVC alternatives, catering to growing environmental consciousness among consumers and regulators. Shifting consumer demands are further influencing product development. There's a discernible trend towards high-performance PVC applications in sectors like automotive, where lightweight and durable components are sought after. The electrical and electronics sector also demands specialized PVC for insulation and jacketing, with an increasing preference for low-smoke and halogen-free variants. The adoption metrics for these advanced PVC materials are on an upward trajectory, indicating a willingness of end-users to invest in superior performance and safety features. The market's evolution is a testament to its adaptability and its integral role in supporting the region's development agenda, with an estimated market value reaching over $XX billion by 2033.

Leading Regions, Countries, or Segments in APAC Polyvinyl Chloride Market

The APAC Polyvinyl Chloride market is a complex tapestry of regional strengths and segment dominance.

China stands as the undisputed leader, driven by its massive manufacturing base, extensive infrastructure projects, and significant domestic consumption. Its dominance is fueled by substantial investments in PVC production capacity and a robust downstream industry that consumes vast quantities of rigid PVC and flexible PVC. The sheer scale of its building and construction sector, coupled with a rapidly expanding automotive industry, makes China the primary engine of growth.

India emerges as a rapidly growing market, propelled by government initiatives like "Housing for All" and increasing urbanization. The demand for PVC pipes and fittings is particularly strong, owing to the need for improved water management and sanitation infrastructure. The burgeoning electrical and electronics sector also contributes significantly to India's PVC consumption. Regulatory support for infrastructure development and a growing middle class are key drivers.

Japan and South Korea, while mature markets, continue to exhibit steady demand, particularly for high-performance and specialized PVC applications. Their focus is on advanced PVC formulations for sectors like automotive (e.g., interior components) and electrical and electronics (e.g., specialized cables). The Chlorinated PVC (CPVC) segment sees notable traction in these countries due to its superior heat resistance.

Rest of Asia-Pacific presents a diverse picture, with countries like Vietnam, Thailand, and Indonesia showing significant potential. Growth in these economies is linked to expanding manufacturing capabilities and rising consumer spending, leading to increased demand for PVC films and sheets, bottles, and other common applications.

Dominant Segments:

- Product Type: Rigid PVC holds the largest market share, primarily due to its extensive use in pipes and fittings, profiles, and construction materials. Its durability and cost-effectiveness make it the preferred choice for many applications. Flexible PVC follows, driven by its use in films, sheets, wires and cables, and medical devices.

- Application: Pipes and Fittings dominate the APAC PVC market, representing a substantial share of consumption due to water infrastructure development and sewage systems. Films and Sheets are also significant, utilized in packaging, flooring, and decorative applications. Wires and Cables are crucial for the expanding electrical and electronics industry.

- End-User Industry: The Building and Construction industry is the largest consumer of PVC, accounting for over XX% of the market. Its versatility in applications like pipes, window profiles, flooring, and roofing materials makes it indispensable. The Automotive sector is a growing consumer, utilizing PVC for interior and exterior components, contributing to its lightweighting and cost-efficiency. The Electrical and Electronics sector also presents robust demand for PVC in insulation and jacketing.

Investment trends in these regions are characterized by capacity expansions in China and India, while Japan and South Korea focus on R&D for specialized PVC grades. Regulatory support for infrastructure and manufacturing, coupled with economic growth, are the primary factors driving the dominance of these regions and segments.

APAC Polyvinyl Chloride Market Product Innovations

Innovations in the APAC Polyvinyl Chloride market are increasingly focused on enhancing sustainability and performance. Companies are developing eco-friendly PVC formulations utilizing recycled content and bio-based plasticizers, aiming to reduce environmental impact. Advances in low-smoke PVC are crucial for the electrical and electronics sector, offering improved safety standards in enclosed spaces. Furthermore, the development of high-strength and weather-resistant PVC grades is expanding its application in durable construction materials and automotive components. These innovations are driven by evolving regulatory requirements and growing consumer demand for greener and safer products, ensuring the continued relevance and competitiveness of PVC in a rapidly changing market.

Propelling Factors for APAC Polyvinyl Chloride Market Growth

The APAC Polyvinyl Chloride market's growth is propelled by several key factors. Firstly, robust economic expansion and increasing urbanization across the region are driving significant demand from the building and construction sector for applications like pipes, fittings, and window profiles. Secondly, government investments in infrastructure development, particularly in emerging economies like India, are creating substantial opportunities for PVC-based products. Thirdly, technological advancements in PVC production and formulation are leading to the development of higher-performance and more sustainable PVC grades, catering to evolving end-user needs. The automotive sector's demand for lightweight and durable materials, alongside the expanding electrical and electronics industry requiring specialized insulation, further bolsters market expansion. The cost-effectiveness and versatility of PVC remain fundamental advantages.

Obstacles in the APAC Polyvinyl Chloride Market Market

Despite robust growth prospects, the APAC Polyvinyl Chloride market faces several obstacles. Stringent environmental regulations concerning PVC production and disposal, particularly regarding phthalate plasticizers and dioxin emissions, pose a challenge for manufacturers. Fluctuations in raw material prices, such as ethylene and chlorine, can impact profitability and pricing stability. Intensifying competition from substitute materials like polyethylene and polypropylene in certain applications, especially in packaging, necessitates continuous innovation and cost optimization. Furthermore, supply chain disruptions, as evidenced by recent global events, can affect production and delivery timelines. The perception of PVC as an environmentally unfriendly material in some consumer segments also presents a reputational challenge that requires proactive communication and the promotion of sustainable alternatives.

Future Opportunities in APAC Polyvinyl Chloride Market

The future for the APAC Polyvinyl Chloride market is brimming with opportunities. The growing demand for renewable energy infrastructure, such as solar panel frames and wind turbine components, presents a significant avenue for PVC utilization. The increasing adoption of electric vehicles (EVs) will drive demand for lightweight, durable, and flame-retardant PVC components in automotive interiors and exteriors. Advancements in smart city initiatives will necessitate extensive use of PVC in underground infrastructure, including advanced piping and cable management systems. The burgeoning healthcare sector, with its need for sterile and biocompatible materials, offers opportunities for specialized PVC applications in medical devices and disposables. Furthermore, the continuous development of bio-based and recycled PVC alternatives will tap into the growing green consumer market and align with circular economy principles.

Major Players in the APAC Polyvinyl Chloride Market Ecosystem

- Chemplast Sanmar Limited

- East Hope Group

- Formosa Plastics Corporation

- Hanwha Solutions

- INEOS

- LG Chem

- Reliance Industries Limited

- Shin-Etsu Chemical Co Ltd

- Sinochem Holdings Corporation Ltd

- Westlake Corporation

- Xinjiang Zhongtai Chemical Co Ltd

Key Developments in APAC Polyvinyl Chloride Market Industry

- January 2023: Shin-Etsu Chemical Co., Ltd. introduced new process technologies jointly developed with Dexerials Corporation for the production of micro light-emitting diode (LED) displays, impacting the demand for high-purity PVC materials.

- January 2023: Citroen India established a strategic relationship with Jio-BP, a fuels and mobility joint venture between Reliance Industries Limited (RIL) and BP, to build EV infrastructure and services across its network. Jio-BP will install direct current (DC) fast chargers across Citroen's primary dealership network and workshops across India, indirectly influencing demand for PVC in charging infrastructure and automotive components.

Strategic APAC Polyvinyl Chloride Market Market Forecast

The strategic forecast for the APAC Polyvinyl Chloride market anticipates sustained growth, propelled by a confluence of robust demand from burgeoning infrastructure projects and the expanding automotive sector. The increasing adoption of specialized PVC grades, offering enhanced durability, fire resistance, and eco-friendly attributes, will be a key differentiator. Innovations in sustainable PVC production and recycling technologies are poised to address environmental concerns and unlock new market segments. The projected market value is expected to surpass $XX billion by 2033, driven by investments in advanced manufacturing capabilities and a growing emphasis on high-performance applications. Stakeholders can capitalize on opportunities presented by the evolving needs of the building and construction, automotive, and electrical and electronics industries, further solidifying PVC's indispensable role in the region's economic development.

APAC Polyvinyl Chloride Market Segmentation

-

1. Product Type

- 1.1. Rigid PVC

- 1.2. Flexible PVC

- 1.3. Low-smoke PVC

- 1.4. Chlorinated PVC

-

2. Application

- 2.1. Pipes and Fittings

- 2.2. Films and Sheets

- 2.3. Wires and Cables

- 2.4. Bottles

- 2.5. Profiles, Hoses, and Tubings

- 2.6. Other Applications

-

3. End-User Industry

- 3.1. Building and Construction

- 3.2. Automotive

- 3.3. Electrical and Electronics

- 3.4. Packaging

- 3.5. Footwear

- 3.6. Healthcare

- 3.7. Other End-User Industries

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

APAC Polyvinyl Chloride Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

APAC Polyvinyl Chloride Market Regional Market Share

Geographic Coverage of APAC Polyvinyl Chloride Market

APAC Polyvinyl Chloride Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand from the Construction Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Polyvinyl Chloride Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid PVC

- 5.1.2. Flexible PVC

- 5.1.3. Low-smoke PVC

- 5.1.4. Chlorinated PVC

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pipes and Fittings

- 5.2.2. Films and Sheets

- 5.2.3. Wires and Cables

- 5.2.4. Bottles

- 5.2.5. Profiles, Hoses, and Tubings

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Building and Construction

- 5.3.2. Automotive

- 5.3.3. Electrical and Electronics

- 5.3.4. Packaging

- 5.3.5. Footwear

- 5.3.6. Healthcare

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC Polyvinyl Chloride Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rigid PVC

- 6.1.2. Flexible PVC

- 6.1.3. Low-smoke PVC

- 6.1.4. Chlorinated PVC

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pipes and Fittings

- 6.2.2. Films and Sheets

- 6.2.3. Wires and Cables

- 6.2.4. Bottles

- 6.2.5. Profiles, Hoses, and Tubings

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Building and Construction

- 6.3.2. Automotive

- 6.3.3. Electrical and Electronics

- 6.3.4. Packaging

- 6.3.5. Footwear

- 6.3.6. Healthcare

- 6.3.7. Other End-User Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India APAC Polyvinyl Chloride Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rigid PVC

- 7.1.2. Flexible PVC

- 7.1.3. Low-smoke PVC

- 7.1.4. Chlorinated PVC

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pipes and Fittings

- 7.2.2. Films and Sheets

- 7.2.3. Wires and Cables

- 7.2.4. Bottles

- 7.2.5. Profiles, Hoses, and Tubings

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Building and Construction

- 7.3.2. Automotive

- 7.3.3. Electrical and Electronics

- 7.3.4. Packaging

- 7.3.5. Footwear

- 7.3.6. Healthcare

- 7.3.7. Other End-User Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan APAC Polyvinyl Chloride Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Rigid PVC

- 8.1.2. Flexible PVC

- 8.1.3. Low-smoke PVC

- 8.1.4. Chlorinated PVC

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pipes and Fittings

- 8.2.2. Films and Sheets

- 8.2.3. Wires and Cables

- 8.2.4. Bottles

- 8.2.5. Profiles, Hoses, and Tubings

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Building and Construction

- 8.3.2. Automotive

- 8.3.3. Electrical and Electronics

- 8.3.4. Packaging

- 8.3.5. Footwear

- 8.3.6. Healthcare

- 8.3.7. Other End-User Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea APAC Polyvinyl Chloride Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Rigid PVC

- 9.1.2. Flexible PVC

- 9.1.3. Low-smoke PVC

- 9.1.4. Chlorinated PVC

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pipes and Fittings

- 9.2.2. Films and Sheets

- 9.2.3. Wires and Cables

- 9.2.4. Bottles

- 9.2.5. Profiles, Hoses, and Tubings

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Building and Construction

- 9.3.2. Automotive

- 9.3.3. Electrical and Electronics

- 9.3.4. Packaging

- 9.3.5. Footwear

- 9.3.6. Healthcare

- 9.3.7. Other End-User Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific APAC Polyvinyl Chloride Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Rigid PVC

- 10.1.2. Flexible PVC

- 10.1.3. Low-smoke PVC

- 10.1.4. Chlorinated PVC

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pipes and Fittings

- 10.2.2. Films and Sheets

- 10.2.3. Wires and Cables

- 10.2.4. Bottles

- 10.2.5. Profiles, Hoses, and Tubings

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Building and Construction

- 10.3.2. Automotive

- 10.3.3. Electrical and Electronics

- 10.3.4. Packaging

- 10.3.5. Footwear

- 10.3.6. Healthcare

- 10.3.7. Other End-User Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chemplast Sanmar Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 East Hope Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Formosa Plastics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hanwha Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 INEOS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Chem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Reliance Industries Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shin-Etsu Chemical Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sinochem Holdings Corporation Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Westlake Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Xinjiang Zhongtai Chemical Co Ltd*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Chemplast Sanmar Limited

List of Figures

- Figure 1: Global APAC Polyvinyl Chloride Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Polyvinyl Chloride Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: China APAC Polyvinyl Chloride Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China APAC Polyvinyl Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 5: China APAC Polyvinyl Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: China APAC Polyvinyl Chloride Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 7: China APAC Polyvinyl Chloride Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: China APAC Polyvinyl Chloride Market Revenue (billion), by Geography 2025 & 2033

- Figure 9: China APAC Polyvinyl Chloride Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China APAC Polyvinyl Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 11: China APAC Polyvinyl Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: India APAC Polyvinyl Chloride Market Revenue (billion), by Product Type 2025 & 2033

- Figure 13: India APAC Polyvinyl Chloride Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: India APAC Polyvinyl Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 15: India APAC Polyvinyl Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: India APAC Polyvinyl Chloride Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 17: India APAC Polyvinyl Chloride Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: India APAC Polyvinyl Chloride Market Revenue (billion), by Geography 2025 & 2033

- Figure 19: India APAC Polyvinyl Chloride Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: India APAC Polyvinyl Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 21: India APAC Polyvinyl Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Japan APAC Polyvinyl Chloride Market Revenue (billion), by Product Type 2025 & 2033

- Figure 23: Japan APAC Polyvinyl Chloride Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Japan APAC Polyvinyl Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 25: Japan APAC Polyvinyl Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: Japan APAC Polyvinyl Chloride Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 27: Japan APAC Polyvinyl Chloride Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 28: Japan APAC Polyvinyl Chloride Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Japan APAC Polyvinyl Chloride Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Japan APAC Polyvinyl Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Japan APAC Polyvinyl Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Korea APAC Polyvinyl Chloride Market Revenue (billion), by Product Type 2025 & 2033

- Figure 33: South Korea APAC Polyvinyl Chloride Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: South Korea APAC Polyvinyl Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 35: South Korea APAC Polyvinyl Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: South Korea APAC Polyvinyl Chloride Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 37: South Korea APAC Polyvinyl Chloride Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 38: South Korea APAC Polyvinyl Chloride Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: South Korea APAC Polyvinyl Chloride Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: South Korea APAC Polyvinyl Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South Korea APAC Polyvinyl Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue (billion), by Geography 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Polyvinyl Chloride Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 9: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 14: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 19: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 24: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 27: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 29: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Polyvinyl Chloride Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Polyvinyl Chloride Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the APAC Polyvinyl Chloride Market?

Key companies in the market include Chemplast Sanmar Limited, East Hope Group, Formosa Plastics Corporation, Hanwha Solutions, INEOS, LG Chem, Reliance Industries Limited, Shin-Etsu Chemical Co Ltd, Sinochem Holdings Corporation Ltd, Westlake Corporation, Xinjiang Zhongtai Chemical Co Ltd*List Not Exhaustive.

3. What are the main segments of the APAC Polyvinyl Chloride Market?

The market segments include Product Type, Application, End-User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from the Construction Sector.

7. Are there any restraints impacting market growth?

Growing Demand from the Construction Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

January 2023: Shin-Etsu Chemical Co., Ltd. introduced new process technologies jointly developed with Dexerials Corporation for the production of micro light-emitting diode (LED) displays.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Polyvinyl Chloride Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Polyvinyl Chloride Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Polyvinyl Chloride Market?

To stay informed about further developments, trends, and reports in the APAC Polyvinyl Chloride Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence