Key Insights

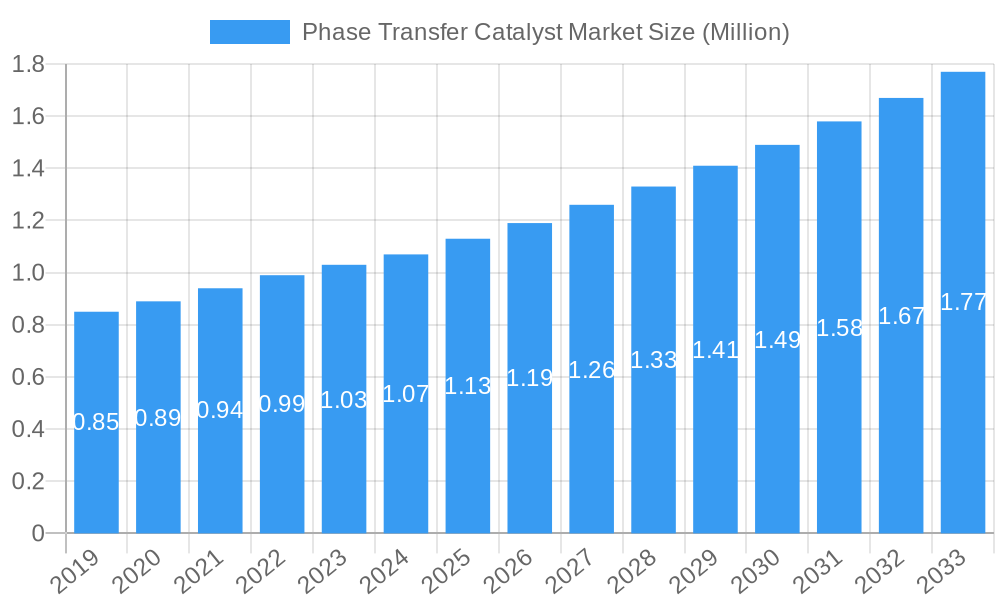

The Phase Transfer Catalyst (PTC) market is poised for significant expansion, with a current estimated market size of 1.07 Billion USD and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 5.79%. This upward trajectory is driven by the increasing demand for efficient and sustainable chemical synthesis processes across a multitude of industries. Key drivers include the growing pharmaceutical sector's need for precise and cost-effective drug manufacturing, the expanding agrochemical industry's requirement for enhanced crop protection solutions, and the chemical industry's continuous pursuit of process intensification and greener synthesis routes. The versatility of PTCs in facilitating reactions between immiscible phases, thereby improving yields, reducing reaction times, and minimizing waste, underpins their growing adoption. Innovations in catalyst design, particularly the development of more stable and recyclable PTCs, are further bolstering market growth.

Phase Transfer Catalyst Market Market Size (In Million)

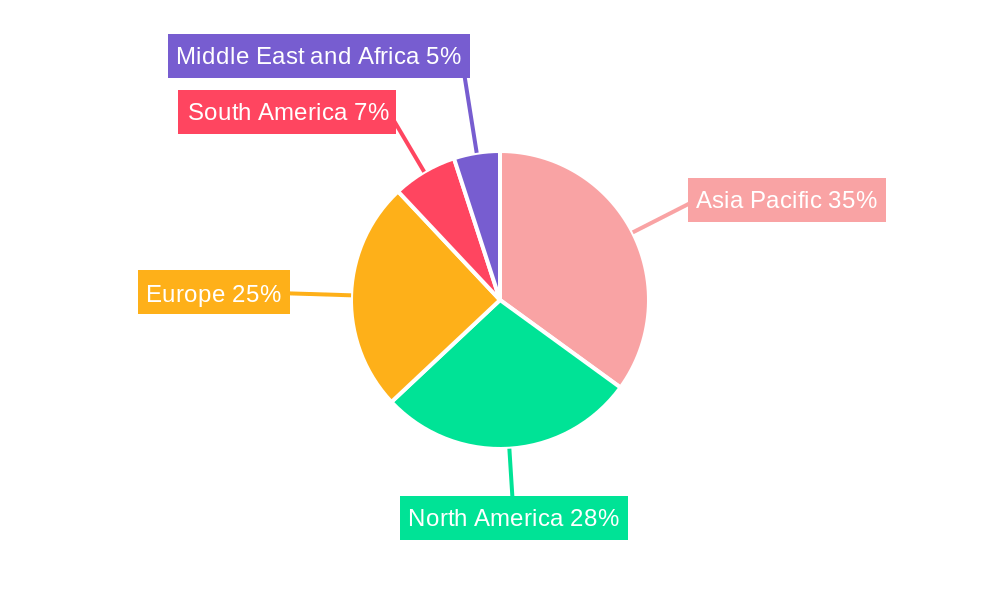

The market is segmented by type, with Ammonium Salts and Phosphonium Salts representing the dominant categories due to their widespread applicability and cost-effectiveness. However, the "Others" segment, encompassing novel and specialized PTCs, is expected to witness considerable growth as research and development efforts yield more advanced catalytic solutions. End-user industries like Pharmaceuticals, Chemical, and Agrochemical are the primary consumers, with emerging applications in materials science and fine chemicals also contributing to market diversification. Geographically, Asia Pacific, led by China and India, is emerging as a powerhouse due to its burgeoning manufacturing capabilities and increasing R&D investments. North America and Europe remain crucial markets, driven by established industries and a strong focus on sustainable chemical practices. While the market presents a positive outlook, potential restraints such as the fluctuating raw material prices and the need for stringent regulatory compliance could influence the pace of growth.

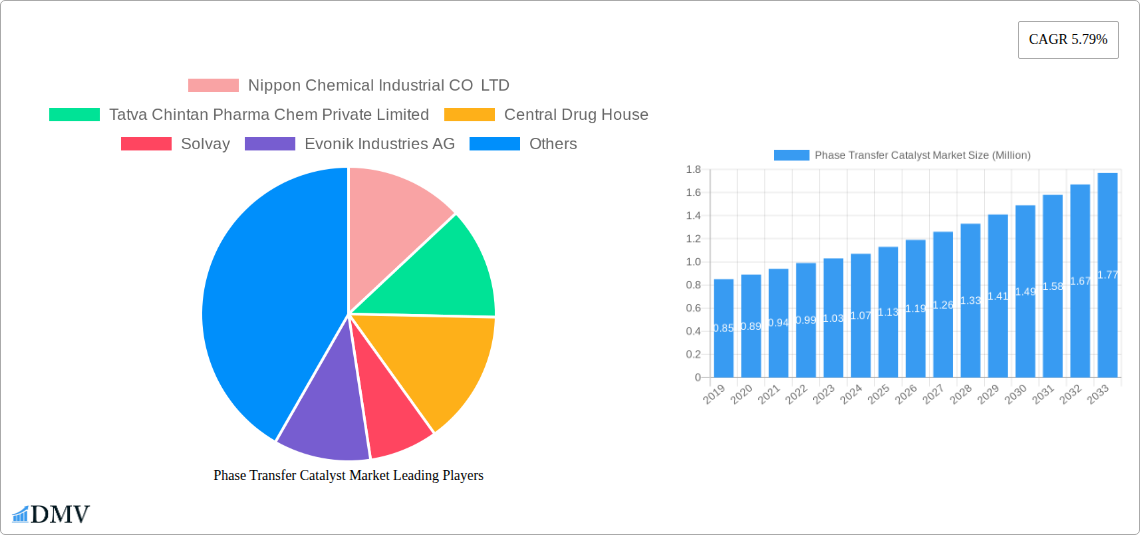

Phase Transfer Catalyst Market Company Market Share

This in-depth report provides a comprehensive examination of the global Phase Transfer Catalyst (PTC) market, offering critical insights for stakeholders navigating this dynamic sector. The study encompasses a detailed analysis of market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities, culminating in strategic forecasts and identification of key players and developments. Our analysis spans the historical period of 2019–2024, with the base year and estimated year both set at 2025, and extends through a robust forecast period of 2025–2033. The study period covers 2019–2033. We project the global Phase Transfer Catalyst market to reach an impressive valuation of over 1500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5%.

Phase Transfer Catalyst Market Market Composition & Trends

The global Phase Transfer Catalyst market exhibits a moderately consolidated landscape, characterized by both established multinational corporations and emerging regional players. Innovation is a key driver, with ongoing research focused on developing more efficient, selective, and environmentally friendly PTCs. The regulatory environment, while generally supportive of chemical innovation, places increasing emphasis on sustainability and reduced hazardous waste generation. Substitutive products, such as ionic liquids and encapsulated catalysts, are gaining traction but currently hold a niche position. End-user profiles are diverse, with the pharmaceutical and chemical industries representing the largest consumers, followed by agrochemicals. Mergers and Acquisitions (M&A) activity has been significant, driven by the desire to expand product portfolios, gain market share, and access new technologies. For instance, the value of M&A deals in the PTC sector has been estimated to be over 300 Million in the last three years. Market share distribution is led by companies specializing in ammonium and phosphonium salts, holding a combined market share of over 65%.

- Market Concentration: Moderately consolidated, with key players dominating specific segments.

- Innovation Catalysts: Focus on green chemistry, improved efficiency, and catalyst reusability.

- Regulatory Landscapes: Increasing emphasis on environmental compliance and sustainable practices.

- Substitute Products: Ionic liquids and encapsulated catalysts are emerging alternatives.

- End-User Profiles: Pharmaceutical and Chemical industries are primary consumers; Agrochemicals and others are growing segments.

- M&A Activities: Driven by market expansion, technology acquisition, and portfolio diversification.

- Market Share Distribution: Ammonium Salts and Phosphonium Salts collectively represent over 65% of the market.

- M&A Deal Values: Estimated at over 300 Million in recent years.

Phase Transfer Catalyst Market Industry Evolution

The Phase Transfer Catalyst market has witnessed a remarkable evolution, driven by relentless innovation and an ever-increasing demand for efficient chemical synthesis. Over the historical period (2019–2024), the market has experienced steady growth, with a projected CAGR of around 7.0% for this phase. This expansion was primarily fueled by the pharmaceutical industry's need for highly selective and scalable synthesis routes for complex drug molecules. The chemical industry, in its pursuit of greener and more cost-effective manufacturing processes, also contributed significantly to this growth. Technological advancements have been a cornerstone of this evolution. The development of novel PTCs with enhanced catalytic activity, improved stability, and wider applicability has revolutionized numerous chemical reactions. For example, the adoption of chiral phase transfer catalysts has opened new avenues for asymmetric synthesis, a critical aspect of modern drug development, with adoption rates in specific pharmaceutical applications increasing by over 20% annually. Consumer demand, particularly from end-user industries, has increasingly favored catalysts that offer reduced reaction times, lower energy consumption, and minimized waste generation. This trend has spurred research into more sustainable and recyclable PTCs. The market has also seen a shift towards specialized PTCs tailored for specific applications, moving away from a one-size-fits-all approach. The estimated market size for PTCs in 2024 was approximately 1200 Million.

Leading Regions, Countries, or Segments in Phase Transfer Catalyst Market

North America and Europe currently dominate the Phase Transfer Catalyst market, driven by their robust pharmaceutical and chemical industries and strong emphasis on research and development. Asia Pacific, however, is emerging as a high-growth region, propelled by the expanding manufacturing capabilities in countries like China and India, and increasing investments in their domestic chemical and pharmaceutical sectors.

Within the Type segment, Ammonium Salts continue to lead the market, accounting for an estimated 55% of the global share. Their widespread availability, cost-effectiveness, and versatility in a broad range of applications make them the preferred choice for many industrial processes. Phosphonium Salts represent the second-largest segment, holding approximately 30% market share. They are often favored for more demanding applications requiring higher thermal stability and stronger catalytic activity, particularly in pharmaceutical synthesis. The "Others" category, encompassing crown ethers and cryptands, though smaller, is witnessing steady growth due to their specialized applications in complex organic synthesis and their ability to complex specific metal cations.

In terms of End-user Industry, the Pharmaceutical sector is the largest consumer of phase transfer catalysts, contributing an estimated 45% to the market. The intricate synthesis pathways for active pharmaceutical ingredients (APIs) often necessitate the efficiency and selectivity offered by PTCs. The Chemical industry, encompassing a broad spectrum of applications from polymers to fine chemicals, accounts for the second-largest share, approximately 35%. The Agrochemical industry is a significant and growing segment, utilizing PTCs for the synthesis of pesticides, herbicides, and other crop protection agents, representing around 15% of the market. The "Others" category, including industries like cosmetics and specialty chemicals, makes up the remaining 5%.

- Dominant Region: North America and Europe lead, with Asia Pacific exhibiting significant growth potential.

- Leading Segment (Type):

- Ammonium Salts: Dominant, estimated 55% market share, due to versatility and cost-effectiveness.

- Phosphonium Salts: Second largest, estimated 30% market share, favored for high-performance applications.

- Others: Niche but growing, used in specialized complex synthesis.

- Leading Segment (End-user Industry):

- Pharmaceutical: Largest consumer, estimated 45% market share, essential for API synthesis.

- Chemical: Second largest, estimated 35% market share, for diverse industrial applications.

- Agrochemical: Significant and growing, estimated 15% market share, for crop protection agents.

- Others: Specialty chemicals and cosmetics, estimated 5% market share.

- Key Drivers for Dominance:

- Investment Trends: High R&D expenditure in North America and Europe; increasing investment in Asia Pacific manufacturing.

- Regulatory Support: Favorable policies promoting chemical innovation in developed regions.

- Manufacturing Capabilities: Rapid expansion of chemical manufacturing in Asia Pacific.

- Demand for Efficient Synthesis: Growing need for cost-effective and environmentally friendly processes across all industries.

Phase Transfer Catalyst Market Product Innovations

Product innovations in the Phase Transfer Catalyst market are predominantly focused on enhancing catalytic efficiency, improving selectivity, and promoting greener chemical processes. Researchers are developing novel PTC structures, including advanced quaternary ammonium and phosphonium salts with tailored functionalities for specific reactions. Innovations also extend to the development of immobilized and recyclable PTCs, which significantly reduce waste and operational costs. The application of machine learning and AI in catalyst design is also a burgeoning area, promising accelerated discovery of high-performance PTCs. Performance metrics such as turnover number (TON) and turnover frequency (TOF) are consistently being improved, leading to faster reaction kinetics and higher yields. For instance, new phosphonium-based PTCs have demonstrated TONs exceeding 10,000 in specific applications.

Propelling Factors for Phase Transfer Catalyst Market Growth

Several key factors are propelling the growth of the Phase Transfer Catalyst market. The relentless demand for more efficient and sustainable chemical synthesis processes across pharmaceuticals, agrochemicals, and the broader chemical industry is a primary driver. Technological advancements in catalyst design, leading to improved activity, selectivity, and recyclability, are creating new application opportunities. Stringent environmental regulations worldwide are pushing manufacturers towards greener chemistry, where PTCs play a crucial role in reducing solvent usage and hazardous byproducts. Furthermore, the growing complexity of molecules in drug discovery and development necessitates sophisticated synthesis techniques, for which PTCs are indispensable. The increasing outsourcing of chemical manufacturing to emerging economies also fuels market expansion.

Obstacles in the Phase Transfer Catalyst Market Market

Despite the positive growth trajectory, the Phase Transfer Catalyst market faces certain obstacles. The development and implementation of novel, high-performance PTCs can be capital-intensive, posing a barrier for smaller companies. Fluctuations in raw material prices, particularly for key precursors, can impact profitability and market stability. Stringent regulatory hurdles for new chemical entities, especially in the pharmaceutical and agrochemical sectors, can lead to extended development timelines. Supply chain disruptions, as witnessed in recent global events, can affect the availability and cost of critical raw materials and finished products. Intense competition among established players and new entrants also exerts pricing pressure.

Future Opportunities in Phase Transfer Catalyst Market

The Phase Transfer Catalyst market is poised for significant future opportunities. The growing focus on green chemistry and sustainability presents a vast avenue for the development and adoption of eco-friendly and recyclable PTCs. The expanding biopharmaceutical sector and the increasing demand for complex APIs offer substantial growth potential. Furthermore, the exploration of PTCs in emerging fields like materials science, renewable energy (e.g., battery electrolytes), and fine chemical synthesis for niche applications will unlock new markets. The digitalization of chemical research, including AI-driven catalyst design, will accelerate the discovery and optimization of novel PTCs, creating further opportunities for market players.

Major Players in the Phase Transfer Catalyst Market Ecosystem

- Nippon Chemical Industrial CO LTD

- Tatva Chintan Pharma Chem Private Limited

- Central Drug House

- Solvay

- Evonik Industries AG

- Dishman Group

- SACHEM Inc

- TCI

- Strem Chemicals Inc

- Alfa Aesar Thermo Fisher Scientific

- Cayman Chemical

Key Developments in Phase Transfer Catalyst Market Industry

- November 2023: Evonik Industries AG launched a new series of highly efficient phosphonium-based PTCs designed for enhanced sustainability in pharmaceutical synthesis.

- July 2023: Tatva Chintan Pharma Chem Private Limited announced a significant expansion of its manufacturing capacity for specialty PTCs to meet growing global demand.

- March 2023: Solvay introduced a novel, water-soluble ammonium salt PTC, enabling greener reaction conditions for various industrial applications.

- December 2022: Nippon Chemical Industrial CO LTD reported breakthroughs in the development of recyclable solid-supported PTCs, aiming to reduce waste and improve cost-effectiveness.

- September 2022: SACHEM Inc. showcased innovative PTC solutions for the electronics industry, highlighting their role in advanced material processing.

- April 2022: Dishman Group expanded its portfolio of chiral PTCs, catering to the increasing demand for enantioselective synthesis in the pharmaceutical sector.

Strategic Phase Transfer Catalyst Market Market Forecast

The strategic Phase Transfer Catalyst market forecast indicates robust and sustained growth driven by innovation and increasing demand for efficient chemical synthesis. The market will continue to benefit from the pharmaceutical industry's ongoing need for complex molecule synthesis and the broader chemical industry's drive for greener and more cost-effective manufacturing. Emerging opportunities in sustainable catalysis, coupled with advancements in AI-driven catalyst design, are expected to unlock new application areas and drive market expansion. The projected market size of over 1500 Million by 2033, with a CAGR of 7.5%, underscores the significant potential and strategic importance of this market segment.

Phase Transfer Catalyst Market Segmentation

-

1. Type

- 1.1. Ammonium Salts

- 1.2. Phosphonium Salts

- 1.3. Others

-

2. End-user Industry

- 2.1. Pharmaceutical

- 2.2. Chemical

- 2.3. Agrochemical

- 2.4. Others

Phase Transfer Catalyst Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Phase Transfer Catalyst Market Regional Market Share

Geographic Coverage of Phase Transfer Catalyst Market

Phase Transfer Catalyst Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Application of Phase Transfer Catalyst in Pharmaceutical Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Pharmaceutical to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phase Transfer Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ammonium Salts

- 5.1.2. Phosphonium Salts

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Pharmaceutical

- 5.2.2. Chemical

- 5.2.3. Agrochemical

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Phase Transfer Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ammonium Salts

- 6.1.2. Phosphonium Salts

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Pharmaceutical

- 6.2.2. Chemical

- 6.2.3. Agrochemical

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Phase Transfer Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ammonium Salts

- 7.1.2. Phosphonium Salts

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Pharmaceutical

- 7.2.2. Chemical

- 7.2.3. Agrochemical

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Phase Transfer Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ammonium Salts

- 8.1.2. Phosphonium Salts

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Pharmaceutical

- 8.2.2. Chemical

- 8.2.3. Agrochemical

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Phase Transfer Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ammonium Salts

- 9.1.2. Phosphonium Salts

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Pharmaceutical

- 9.2.2. Chemical

- 9.2.3. Agrochemical

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Phase Transfer Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ammonium Salts

- 10.1.2. Phosphonium Salts

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Pharmaceutical

- 10.2.2. Chemical

- 10.2.3. Agrochemical

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nippon Chemical Industrial CO LTD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tatva Chintan Pharma Chem Private Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Central Drug House

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Solvay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evonik Industries AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dishman Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SACHEM Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TCI*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Strem Chemicals Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alfa Aesar Thermo Fisher Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cayman Chemical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Nippon Chemical Industrial CO LTD

List of Figures

- Figure 1: Global Phase Transfer Catalyst Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Phase Transfer Catalyst Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Phase Transfer Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Phase Transfer Catalyst Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Phase Transfer Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Phase Transfer Catalyst Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Phase Transfer Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Phase Transfer Catalyst Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Phase Transfer Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Phase Transfer Catalyst Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Phase Transfer Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Phase Transfer Catalyst Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Phase Transfer Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Phase Transfer Catalyst Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Phase Transfer Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Phase Transfer Catalyst Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Phase Transfer Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Phase Transfer Catalyst Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Phase Transfer Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: North America Phase Transfer Catalyst Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: North America Phase Transfer Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Phase Transfer Catalyst Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Phase Transfer Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Phase Transfer Catalyst Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Phase Transfer Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Phase Transfer Catalyst Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Phase Transfer Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Phase Transfer Catalyst Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Phase Transfer Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Phase Transfer Catalyst Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Phase Transfer Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Europe Phase Transfer Catalyst Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 33: Europe Phase Transfer Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Phase Transfer Catalyst Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Phase Transfer Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Phase Transfer Catalyst Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Phase Transfer Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Phase Transfer Catalyst Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Phase Transfer Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Phase Transfer Catalyst Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Phase Transfer Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Phase Transfer Catalyst Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Phase Transfer Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: South America Phase Transfer Catalyst Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: South America Phase Transfer Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South America Phase Transfer Catalyst Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: South America Phase Transfer Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Phase Transfer Catalyst Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Phase Transfer Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Phase Transfer Catalyst Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Phase Transfer Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Phase Transfer Catalyst Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East and Africa Phase Transfer Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Phase Transfer Catalyst Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Phase Transfer Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Middle East and Africa Phase Transfer Catalyst Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 57: Middle East and Africa Phase Transfer Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East and Africa Phase Transfer Catalyst Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Phase Transfer Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Phase Transfer Catalyst Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Phase Transfer Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Phase Transfer Catalyst Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Phase Transfer Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Phase Transfer Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: Global Phase Transfer Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Phase Transfer Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: France Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Global Phase Transfer Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 65: Global Phase Transfer Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 66: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 67: Global Phase Transfer Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Phase Transfer Catalyst Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Phase Transfer Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Phase Transfer Catalyst Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phase Transfer Catalyst Market?

The projected CAGR is approximately 5.79%.

2. Which companies are prominent players in the Phase Transfer Catalyst Market?

Key companies in the market include Nippon Chemical Industrial CO LTD, Tatva Chintan Pharma Chem Private Limited, Central Drug House, Solvay, Evonik Industries AG, Dishman Group, SACHEM Inc, TCI*List Not Exhaustive, Strem Chemicals Inc, Alfa Aesar Thermo Fisher Scientific, Cayman Chemical.

3. What are the main segments of the Phase Transfer Catalyst Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.07 Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Application of Phase Transfer Catalyst in Pharmaceutical Sector; Other Drivers.

6. What are the notable trends driving market growth?

Pharmaceutical to Dominate the Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phase Transfer Catalyst Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phase Transfer Catalyst Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phase Transfer Catalyst Market?

To stay informed about further developments, trends, and reports in the Phase Transfer Catalyst Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence