Key Insights

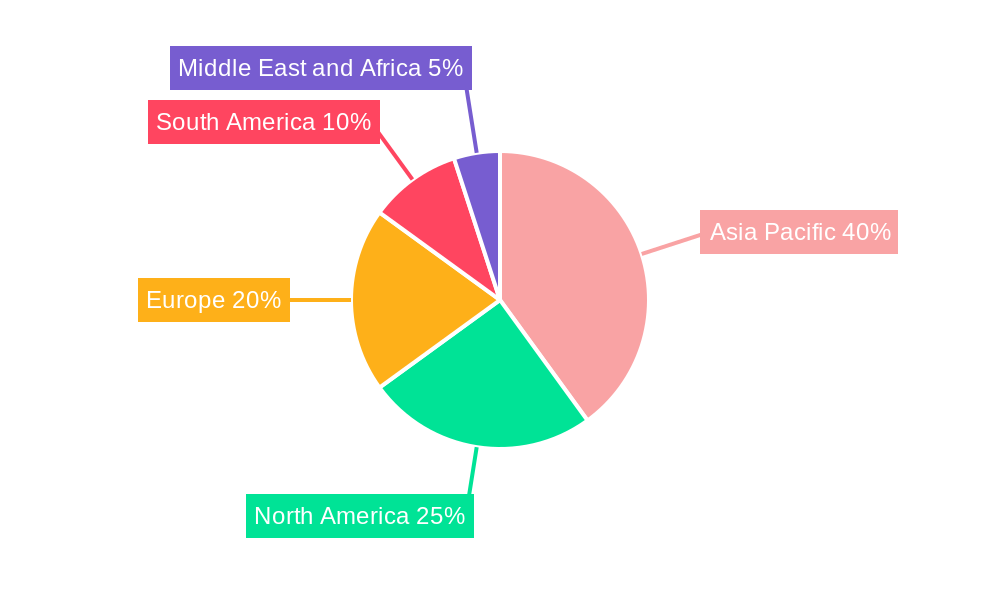

The Nonylphenol Ethoxylate (NPE) market is poised for significant expansion, driven by its broad utility across various industrial sectors. Estimated to reach $14.81 billion in 2025, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.8% through 2033. This upward trajectory is primarily fueled by the increasing demand for effective cleaning agents in industrial applications, the growing paints and coatings industry, and the vital role NPEs play in agrochemical formulations for enhanced crop protection. Furthermore, the textile industry's continuous need for high-performance surfactants and the oil and gas sector's reliance on NPEs for efficient extraction processes are substantial contributors to market expansion. Emerging economies, particularly in the Asia Pacific region, are expected to be key growth engines due to rapid industrialization and increasing consumer spending power.

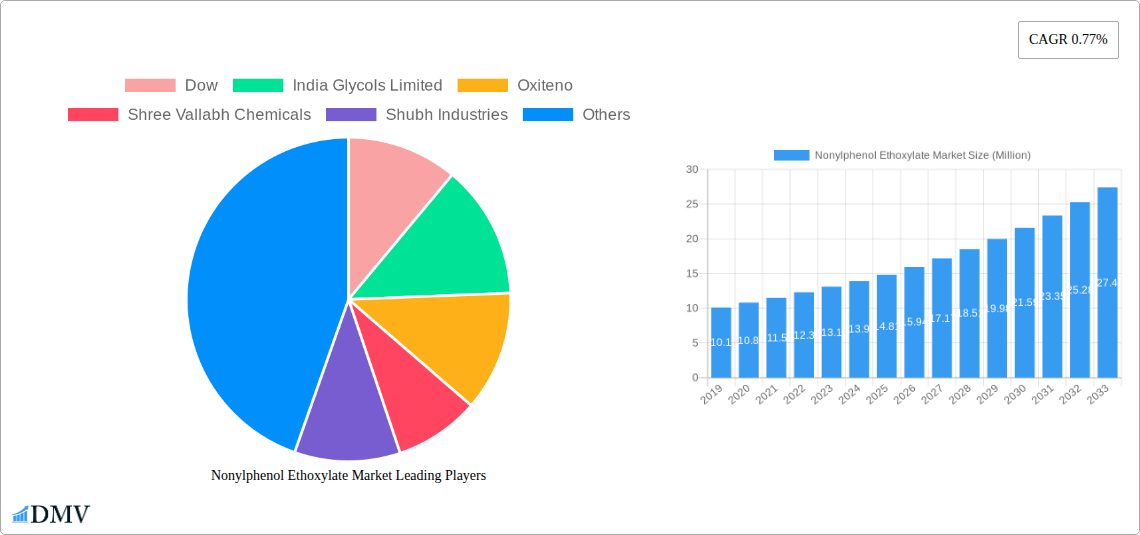

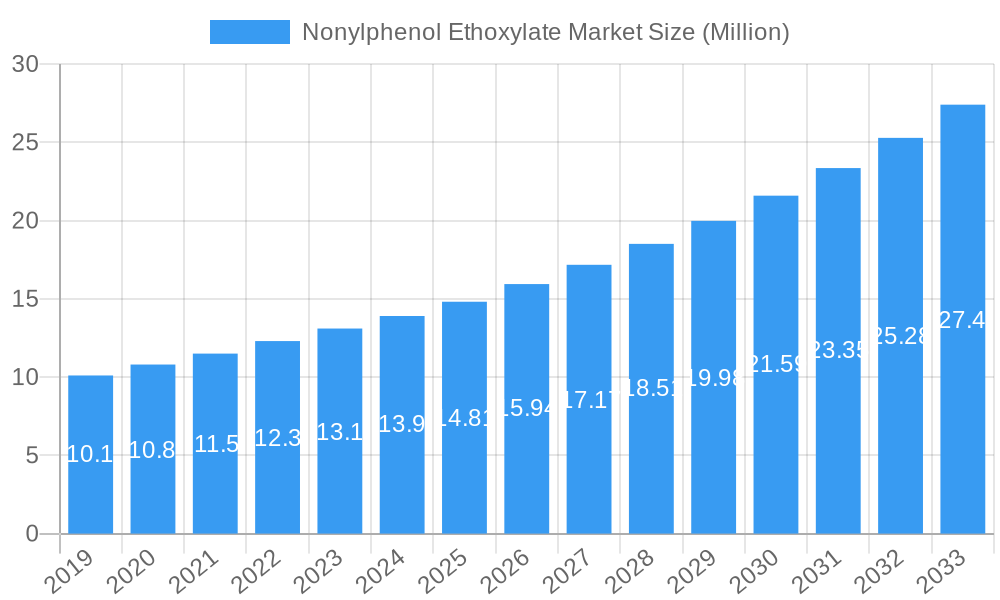

Nonylphenol Ethoxylate Market Market Size (In Million)

Despite the strong market outlook, certain factors may present challenges. Increasing regulatory scrutiny and environmental concerns surrounding the biodegradability and potential ecotoxicity of NPEs are leading to a gradual shift towards more sustainable alternatives in some regions, particularly in North America and Europe. This could temper growth in these specific markets. However, the cost-effectiveness and established performance of NPEs continue to ensure their widespread adoption, especially in regions with less stringent environmental regulations or where readily available, environmentally friendly alternatives are not yet economically viable. Innovations in NPE production and the development of specialized ethoxylates are also expected to play a role in sustaining market demand and addressing some of the environmental concerns.

Nonylphenol Ethoxylate Market Company Market Share

This in-depth report provides a definitive analysis of the Nonylphenol Ethoxylate (NPE) market, offering critical insights into market dynamics, growth trajectories, and future potential. Covering the historical period of 2019–2024 and projecting trends up to 2033, with a base year of 2025, this study equips stakeholders with the strategic intelligence needed to navigate this evolving landscape.

Nonylphenol Ethoxylate Market Market Composition & Trends

The Nonylphenol Ethoxylate market exhibits a moderate concentration, with key players like Dow, India Glycols Limited, Oxiteno, Shree Vallabh Chemicals, Shubh Industries, Solvay, and Stepan Company holding significant market share. Innovation is primarily driven by the demand for more effective and environmentally conscious surfactant solutions across various industries. Regulatory landscapes, particularly concerning the environmental impact of NPEs and their alternatives, are a critical factor influencing market development and the adoption of greener chemistries. The presence of substitute products, such as alcohol ethoxylates and other non-ionic surfactants, presents a dynamic competitive environment. Understanding end-user profiles – from large-scale industrial cleaning operations to specialized agrochemical formulations – is crucial for targeted market strategies. Mergers and acquisitions (M&A) activities are strategically shaping market consolidation, with deal values in the multi-billion dollar range indicating significant strategic investments. The market share distribution reflects a complex interplay of regional production capacities, raw material availability, and the influence of regulatory frameworks.

Nonylphenol Ethoxylate Market Industry Evolution

The Nonylphenol Ethoxylate industry has undergone a significant evolution over the study period, driven by a confluence of economic, technological, and environmental factors. Historically, NPEs have been widely adopted for their excellent surfactant properties, serving as emulsifiers, wetting agents, and dispersants in a vast array of applications. However, growing environmental concerns and stricter regulations in many regions have spurred a shift towards more sustainable alternatives. This has led to a dynamic market where innovation in both the production and application of NPEs, as well as the development of viable replacements, has become paramount. The market growth trajectory, projected to reach an estimated $XX billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033), reflects this ongoing transformation. Technological advancements have focused on optimizing production processes to minimize environmental impact and developing NPEs with improved biodegradability profiles where permitted. Concurrently, shifting consumer demands, influenced by corporate sustainability goals and public awareness, are increasingly pushing industries to adopt greener chemical solutions, impacting the overall demand patterns for NPEs and driving research into bio-based and readily biodegradable surfactants. The adoption metrics for alternatives, while growing, still show a significant reliance on NPEs in specific legacy applications and regions where regulatory pressures are less pronounced. This intricate balance between established performance and emerging sustainability mandates defines the current industry evolution.

Leading Regions, Countries, or Segments in Nonylphenol Ethoxylate Market

The Industrial Cleaning Agents segment stands as a dominant force within the Nonylphenol Ethoxylate market, driven by its indispensable role in formulating a wide range of cleaning solutions for both domestic and industrial purposes. The sheer volume and consistent demand from this sector, encompassing heavy-duty degreasers, institutional cleaners, and household detergents, underpins its leading position. Investment trends in this segment are robust, fueled by the continuous need for effective and cost-efficient cleaning formulations. Regulatory support, while increasingly scrutinizing NPE usage, still allows for its application in numerous industrial cleaning contexts where performance is paramount.

- Industrial Cleaning Agents: This segment's dominance is a testament to the inherent surfactant properties of NPEs, making them highly effective in emulsifying oils, greases, and particulate matter. The global expansion of manufacturing, hospitality, and healthcare sectors directly translates into sustained demand for industrial cleaning products.

- Agrochemicals: NPEs are crucial as emulsifiers and wetting agents in pesticide and herbicide formulations, improving their dispersion and adherence to plant surfaces. Investment in agricultural productivity globally continues to drive demand in this sector.

- Textile Industry: In textile processing, NPEs function as scouring, dyeing, and finishing agents. The growth of the global textile market, particularly in emerging economies, contributes significantly to this segment's demand.

- Oil and Gas: NPEs are utilized in enhanced oil recovery (EOR) operations, drilling fluids, and refinery processes as surfactants and emulsifiers. Fluctuations in global energy prices and exploration activities directly impact this segment.

- Paints: In the paints and coatings industry, NPEs act as dispersing agents and emulsifiers, contributing to the stability and application properties of water-based paints. The construction and automotive sectors are key demand drivers.

The dominance of the Industrial Cleaning Agents segment is further amplified by the widespread adoption of NPEs in numerous formulations due to their cost-effectiveness and performance characteristics, even as environmental regulations encourage the exploration of alternatives in certain applications.

Nonylphenol Ethoxylate Market Product Innovations

Product innovations in the Nonylphenol Ethoxylate market are increasingly focused on developing ethoxylates with specific properties catering to niche applications and addressing environmental concerns. Recent advancements include the development of NPEs with tailored degrees of ethoxylation to optimize solubility and detergency for specialized industrial cleaning agents. Innovations also encompass efforts to improve biodegradability profiles and reduce the overall environmental footprint of these surfactants. For instance, specialized NPE formulations are being designed for enhanced performance in textile processing and agrochemical formulations, offering improved wetting and dispersion capabilities. The key selling proposition for these innovative products lies in their ability to deliver superior performance while aligning with evolving environmental standards where permitted.

Propelling Factors for Nonylphenol Ethoxylate Market Growth

The Nonylphenol Ethoxylate market is propelled by a combination of robust demand from key end-use industries and ongoing technological advancements. The industrial cleaning agents sector, with its unceasing need for effective emulsifiers and wetting agents, remains a primary growth driver. Furthermore, the agrochemical industry's reliance on NPEs for efficient pesticide and herbicide formulations, particularly in regions with expanding agricultural output, contributes significantly. Technological developments focusing on optimizing NPE production processes and creating specialized grades for enhanced performance in demanding applications also fuel market expansion. Economically, the cost-effectiveness of NPEs compared to some alternatives continues to make them an attractive choice for many manufacturers, especially in price-sensitive markets.

Obstacles in the Nonylphenol Ethoxylate Market Market

Despite its established presence, the Nonylphenol Ethoxylate market faces significant obstacles, primarily stemming from increasingly stringent environmental regulations. Many countries and regions have implemented restrictions or outright bans on the use of NPEs due to their potential for bioaccumulation and endocrine disruption. This regulatory pressure is a major barrier to market growth and encourages the substitution with more environmentally benign surfactants. Supply chain disruptions, influenced by fluctuating raw material prices and geopolitical factors, can also impact production costs and availability. Furthermore, the growing availability and adoption of greener alternatives, such as alcohol ethoxylates and bio-based surfactants, present substantial competitive pressure, eroding market share in applications where substitutes perform adequately and meet regulatory demands.

Future Opportunities in Nonylphenol Ethoxylate Market

Emerging opportunities in the Nonylphenol Ethoxylate market lie in the development of more sustainable NPE variants and targeted applications where their unique properties remain indispensable. Research into NPEs with enhanced biodegradability and reduced ecotoxicity, while challenging, could unlock new market segments and appeal to environmentally conscious industries. Furthermore, the continued growth of the oil and gas sector in certain regions, coupled with the demand for effective surfactants in enhanced oil recovery processes, presents a potential avenue for growth. Innovations in specialized formulations for industrial cleaning, textile processing, and agrochemicals that offer a performance edge and comply with evolving regulations will also be key to capitalizing on future opportunities.

Major Players in the Nonylphenol Ethoxylate Market Ecosystem

- Dow

- India Glycols Limited

- Oxiteno

- Shree Vallabh Chemicals

- Shubh Industries

- Solvay

- Stepan Company

Key Developments in Nonylphenol Ethoxylate Market Industry

- 2023/2024: Several major players announced investments in research and development aimed at exploring bio-based alternatives to traditional NPEs, reflecting the growing emphasis on sustainability.

- 2023: Regulatory bodies in key European nations continued to review and tighten restrictions on the use of NPEs in consumer products and certain industrial applications.

- 2022/2023: Some manufacturers focused on optimizing production processes to improve the environmental profile of existing NPEs, including reducing waste and energy consumption.

- 2021/2022: Strategic partnerships were observed between chemical manufacturers and end-user industries to develop tailored surfactant solutions for specific applications, potentially including specialized NPEs.

Strategic Nonylphenol Ethoxylate Market Market Forecast

The strategic forecast for the Nonylphenol Ethoxylate market hinges on navigating the complex interplay between established performance benefits and increasing environmental scrutiny. While regulatory pressures will undoubtedly steer demand towards alternatives in many applications, opportunities will persist in sectors where NPEs offer unparalleled efficacy and cost-effectiveness, provided these are still permitted. Growth catalysts will include ongoing R&D efforts to develop more sustainable NPE variants, alongside continued demand from the industrial cleaning, agrochemical, and oil and gas sectors, particularly in emerging economies. The market's future potential will be shaped by the ability of manufacturers to innovate responsibly, adapt to evolving regulatory landscapes, and strategically target niche applications where their unique surfactant properties continue to provide critical value.

Nonylphenol Ethoxylate Market Segmentation

-

1. Application

- 1.1. Industrial Cleaning Agents

- 1.2. Paints

- 1.3. Agrochemicals

- 1.4. Textile

- 1.5. Oil and Gas

- 1.6. Other Applications

Nonylphenol Ethoxylate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Nonylphenol Ethoxylate Market Regional Market Share

Geographic Coverage of Nonylphenol Ethoxylate Market

Nonylphenol Ethoxylate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For the Industrial Cleaning Agents; Increasing Demand from Other End-user Applications; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand For the Industrial Cleaning Agents; Increasing Demand from Other End-user Applications; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand for the Industrial Cleaning Agents

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nonylphenol Ethoxylate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial Cleaning Agents

- 5.1.2. Paints

- 5.1.3. Agrochemicals

- 5.1.4. Textile

- 5.1.5. Oil and Gas

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Nonylphenol Ethoxylate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial Cleaning Agents

- 6.1.2. Paints

- 6.1.3. Agrochemicals

- 6.1.4. Textile

- 6.1.5. Oil and Gas

- 6.1.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Nonylphenol Ethoxylate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial Cleaning Agents

- 7.1.2. Paints

- 7.1.3. Agrochemicals

- 7.1.4. Textile

- 7.1.5. Oil and Gas

- 7.1.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nonylphenol Ethoxylate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial Cleaning Agents

- 8.1.2. Paints

- 8.1.3. Agrochemicals

- 8.1.4. Textile

- 8.1.5. Oil and Gas

- 8.1.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Nonylphenol Ethoxylate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial Cleaning Agents

- 9.1.2. Paints

- 9.1.3. Agrochemicals

- 9.1.4. Textile

- 9.1.5. Oil and Gas

- 9.1.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Nonylphenol Ethoxylate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial Cleaning Agents

- 10.1.2. Paints

- 10.1.3. Agrochemicals

- 10.1.4. Textile

- 10.1.5. Oil and Gas

- 10.1.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 India Glycols Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oxiteno

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shree Vallabh Chemicals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shubh Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Solvay

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stepan Company*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Dow

List of Figures

- Figure 1: Global Nonylphenol Ethoxylate Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Nonylphenol Ethoxylate Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Nonylphenol Ethoxylate Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Nonylphenol Ethoxylate Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Nonylphenol Ethoxylate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Nonylphenol Ethoxylate Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Nonylphenol Ethoxylate Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Nonylphenol Ethoxylate Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Nonylphenol Ethoxylate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Nonylphenol Ethoxylate Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Nonylphenol Ethoxylate Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Nonylphenol Ethoxylate Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Nonylphenol Ethoxylate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Nonylphenol Ethoxylate Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America Nonylphenol Ethoxylate Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Nonylphenol Ethoxylate Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Nonylphenol Ethoxylate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Nonylphenol Ethoxylate Market Revenue (undefined), by Application 2025 & 2033

- Figure 19: Middle East and Africa Nonylphenol Ethoxylate Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Nonylphenol Ethoxylate Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Nonylphenol Ethoxylate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Canada Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: France Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Nonylphenol Ethoxylate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Nonylphenol Ethoxylate Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nonylphenol Ethoxylate Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Nonylphenol Ethoxylate Market?

Key companies in the market include Dow, India Glycols Limited, Oxiteno, Shree Vallabh Chemicals, Shubh Industries, Solvay, Stepan Company*List Not Exhaustive.

3. What are the main segments of the Nonylphenol Ethoxylate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For the Industrial Cleaning Agents; Increasing Demand from Other End-user Applications; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand for the Industrial Cleaning Agents.

7. Are there any restraints impacting market growth?

Growing Demand For the Industrial Cleaning Agents; Increasing Demand from Other End-user Applications; Other Drivers.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nonylphenol Ethoxylate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nonylphenol Ethoxylate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nonylphenol Ethoxylate Market?

To stay informed about further developments, trends, and reports in the Nonylphenol Ethoxylate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence