Key Insights

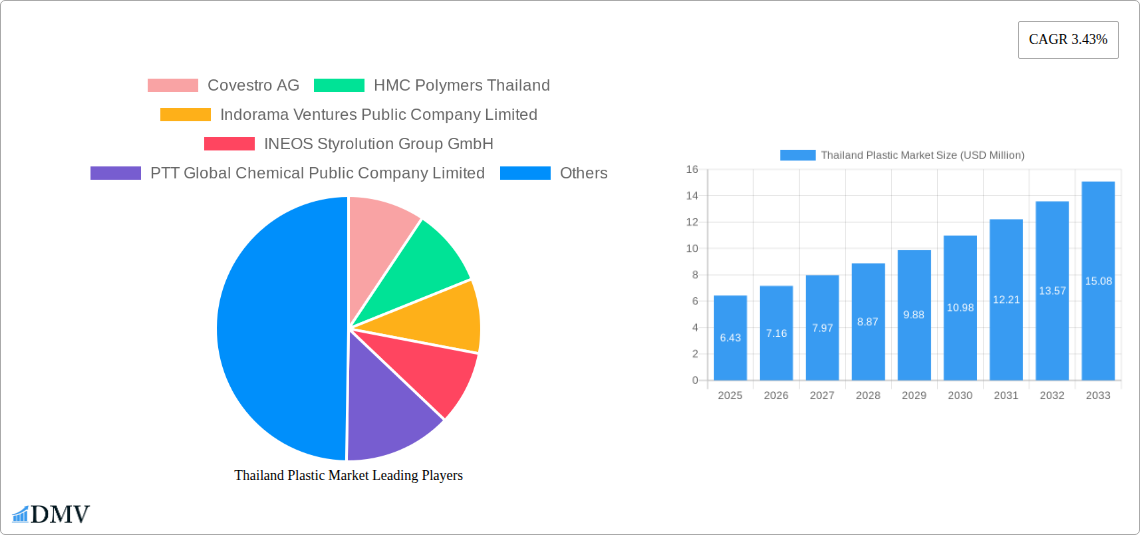

The Thailand plastic market is poised for robust expansion, with an estimated market size of USD 6.43 million in 2025, projected to grow at a significant Compound Annual Growth Rate (CAGR) of 11.35% through to 2033. This impressive growth is fueled by a confluence of dynamic drivers, including the burgeoning demand from the packaging sector, propelled by a growing middle class and evolving consumer lifestyles that favor convenience and ready-to-eat products. The electrical and electronics industry also plays a crucial role, driven by Thailand's position as a manufacturing hub for consumer electronics and automotive components. Furthermore, the expanding construction industry, fueled by infrastructure development and urbanization, contributes to the demand for various plastic types, from pipes and fittings to insulation materials. Emerging trends such as the increasing adoption of bioplastics, driven by environmental consciousness and regulatory pressures, alongside advancements in plastic recycling technologies, are also shaping the market landscape.

Thailand Plastic Market Market Size (In Million)

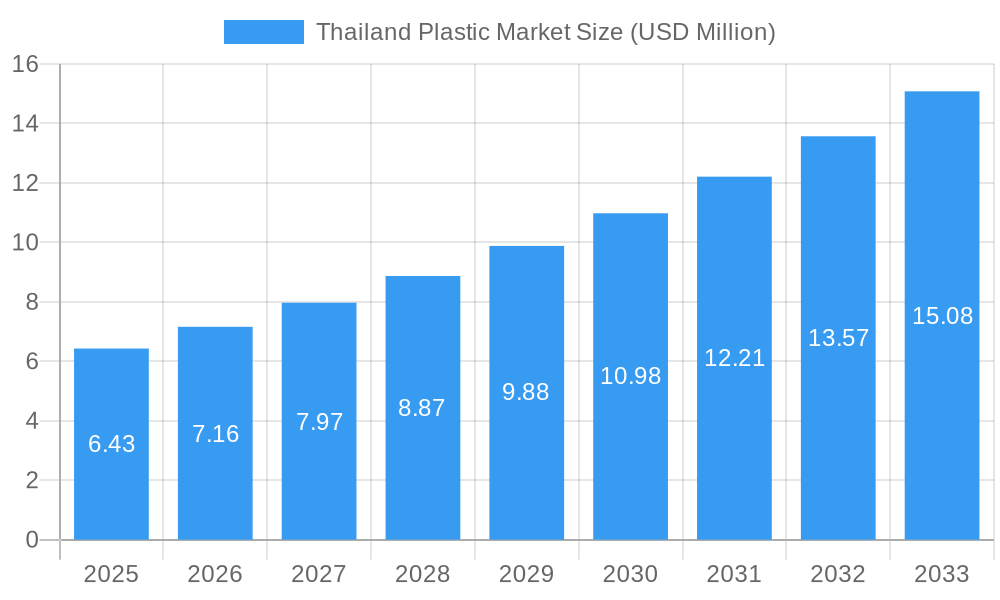

However, the market is not without its restraints. Fluctuations in raw material prices, particularly for petrochemicals, can impact profit margins and investment decisions. Stringent environmental regulations concerning plastic waste management and a growing public awareness of plastic pollution present ongoing challenges. Despite these hurdles, the overarching growth trajectory is strong, supported by the diversification of plastic applications and continued innovation in material science. The market is segmented by type, with traditional plastics like polyethylene and polypropylene dominating, while engineering plastics are gaining traction in specialized applications. Bioplastics, though nascent, are a key growth area. The application landscape is led by packaging, followed by electrical and electronics, building and construction, and automotive. Key players such as Covestro AG, Indorama Ventures, and PTT Global Chemical are strategically positioned to capitalize on these market dynamics.

Thailand Plastic Market Company Market Share

Uncover the dynamic landscape of the Thailand plastic market with this in-depth report, covering a comprehensive study period from 2019 to 2033, with a base year of 2025. This essential resource provides critical insights into market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, and future opportunities. Dive deep into the strategic market forecast, equipped with actionable intelligence for stakeholders in the Thai plastic industry, Southeast Asia plastic market, polyethylene market Thailand, polypropylene market Thailand, and engineering plastics Thailand. Discover key trends in plastic packaging Thailand, automotive plastics Thailand, and the burgeoning bioplastics market Thailand.

Thailand Plastic Market Market Composition & Trends

The Thailand plastic market exhibits a dynamic composition characterized by a moderate to high market concentration, with key players investing heavily in capacity expansions and technological advancements. Innovation catalysts are primarily driven by the growing demand for sustainable and high-performance plastic solutions. The regulatory landscape is evolving, with an increasing focus on environmental sustainability and waste management, impacting production processes and product development. Substitute products, such as paper-based packaging and metal alternatives, pose a competitive challenge in specific applications, particularly in the packaging sector. End-user profiles range from large-scale industrial manufacturers in automotive and electronics to small and medium enterprises in consumer goods. Mergers and acquisitions (M&A) activities are crucial for market consolidation and strategic expansion, with notable deal values in the multi-million dollar range as companies seek to enhance their market share and technological capabilities. The market share distribution is influenced by the dominance of traditional plastics, while engineering plastics and bioplastics are experiencing robust growth.

Thailand Plastic Market Industry Evolution

The Thailand plastic market has witnessed a significant evolution over the historical period of 2019-2024 and is projected to continue its upward trajectory through 2033. This evolution is underpinned by consistent market growth, fueled by a burgeoning domestic economy and strong export demand for plastic-based products. Technological advancements have played a pivotal role, with manufacturers increasingly adopting advanced processing techniques and automation to enhance efficiency and product quality. The adoption of Industry 4.0 principles is becoming more prevalent, leading to smarter manufacturing processes and data-driven decision-making. Shifting consumer demands are a key driver, with a growing preference for lighter, more durable, and increasingly, sustainable plastic solutions. This has spurred innovation in areas like advanced composites and eco-friendly plastics. The market has experienced a compound annual growth rate (CAGR) of approximately 4.5% during the historical period, with projections indicating a continued growth rate of around 5.2% during the forecast period (2025-2033). This growth is supported by substantial investments in research and development, leading to the creation of novel materials with enhanced properties for diverse applications. For instance, the development of specialized polymer grades for automotive lightweighting and advanced barrier properties for food packaging has been a significant trend. The increasing awareness and regulatory push towards the circular economy are also reshaping the industry, encouraging the adoption of recycled plastics and the development of biodegradable alternatives. The Thailand plastic market share is expected to see a notable shift towards higher-value engineering plastics and sustainable materials.

Leading Regions, Countries, or Segments in Thailand Plastic Market

The Thailand plastic market is segmented by product type and application, with Traditional Plastics and Engineering Plastics holding significant market share.

Traditional Plastics:

- Polyethylene (PE): Dominant due to its versatility and widespread use in packaging, films, and containers. Its low cost and excellent properties make it a staple in the Thailand plastic packaging market.

- Polypropylene (PP): Experiencing robust growth, especially in automotive components, consumer goods, and rigid packaging. The expansion of PP production facilities by key players like HMC Polymers signifies its strategic importance.

- Polystyrene (PS): Crucial for disposables, insulation, and electronics housing.

- Polyvinyl Chloride (PVC): Essential for building and construction applications, including pipes, window profiles, and flooring, indicating its strong presence in the building and construction sector Thailand.

Engineering Plastics:

- Polyethylene Terephthalate (PET): A major segment driven by the beverage and food packaging industry, with strong demand for bottles and containers.

- Polyamides (PA): Critical for automotive and electrical/electronic applications due to their high strength and thermal resistance.

- Polycarbonates (PC): Essential for optical media, automotive glazing, and electrical components where clarity and impact resistance are paramount.

- Styrene Copolymers (ABS and SAN): Widely used in consumer electronics, automotive interiors, and appliances for their balance of properties.

- Polybutylene Terephthalate (PBT): Increasingly utilized in automotive and electrical connectors due to its excellent electrical insulation and mechanical strength.

- Polymethyl Methacrylate (PMMA): Known for its optical clarity and weather resistance, finding applications in signage and lighting.

Bioplastics: While still a nascent segment, bioplastics in Thailand are poised for significant growth, driven by environmental concerns and government initiatives promoting sustainable alternatives.

Application Segments:

- Packaging: This remains the largest application, encompassing flexible and rigid packaging solutions. The demand for sustainable and advanced barrier packaging is a key driver.

- Automotive and Transportation: Significant growth is observed due to the lightweighting trend and the increasing use of plastics in vehicle interiors and exteriors.

- Electrical and Electronics: High demand for durable, flame-retardant, and insulating plastic materials.

- Building and Construction: Driven by infrastructure development and the use of PVC, HDPE, and other polymers in pipes, fittings, and insulation.

The dominance of segments like Packaging and Automotive is propelled by Thailand's robust manufacturing base and its position as a regional hub for these industries. Investment trends in new production capacities for high-demand polymers like PP and PET, coupled with supportive government policies for the automotive sector and export-oriented manufacturing, further solidify the leadership of these segments. The engineering plastics Thailand market, in particular, is seeing substantial investment due to its critical role in advanced manufacturing.

Thailand Plastic Market Product Innovations

Product innovations in the Thailand plastic market are increasingly focused on enhancing material performance and sustainability. Key advancements include the development of high-strength, lightweight composite materials for automotive applications, significantly improving fuel efficiency. Innovations in barrier packaging films are extending shelf life and reducing food waste. The emergence of advanced recycled plastic grades, offering comparable properties to virgin resins, is a critical development. Furthermore, the market is witnessing the introduction of bio-based and biodegradable plastics, catering to growing environmental consciousness. Performance metrics such as improved tensile strength, enhanced thermal resistance, and superior chemical inertness are key benchmarks for these innovations. Unique selling propositions often lie in the ability to replace traditional materials like metal and glass, offering cost efficiencies and design flexibility.

Propelling Factors for Thailand Plastic Market Growth

Several key factors are propelling the growth of the Thailand plastic market. Technological advancements in polymer science and manufacturing processes are leading to higher-performing and more specialized plastic materials. The robust growth of key end-use industries, particularly automotive and transportation, packaging, and electrical and electronics, directly translates to increased demand for plastic resins. Government initiatives promoting industrial development, export growth, and the adoption of sustainable practices are creating a favorable business environment. Economic growth in Thailand and the broader ASEAN region is also a significant contributor, increasing consumer spending power and demand for plastic-based consumer goods. The increasing adoption of bioplastics and recycled materials, driven by both consumer demand and regulatory pressures, presents a substantial growth avenue.

Obstacles in the Thailand Plastic Market Market

Despite its robust growth, the Thailand plastic market faces several obstacles. Stringent environmental regulations and increasing pressure for waste management and circular economy solutions can lead to higher compliance costs and the need for significant investment in new technologies. Supply chain disruptions, including fluctuations in raw material prices (especially crude oil derivatives) and logistical challenges, can impact profitability and production schedules. Intense competition, both from domestic players and international imports, puts pressure on pricing and profit margins. Furthermore, the perception of plastics as an environmental hazard, although being addressed by innovation, can still pose a challenge to market expansion in certain sensitive applications.

Future Opportunities in Thailand Plastic Market

The Thailand plastic market is rife with future opportunities. The burgeoning bioplastics market Thailand presents a significant avenue for growth, driven by global and domestic sustainability trends. The increasing demand for advanced packaging solutions, including smart and sustainable packaging, offers substantial potential. The automotive and transportation sector's continued push towards lightweighting and electric vehicles will drive the demand for specialized engineering plastics. Expansion into emerging economies within the ASEAN region presents opportunities for export growth. Furthermore, advancements in recycling technologies and the development of a robust circular economy infrastructure will unlock new value streams and create a more sustainable market.

Major Players in the Thailand Plastic Market Ecosystem

- Covestro AG

- HMC Polymers Thailand

- Indorama Ventures Public Company Limited

- INEOS Styrolution Group GmbH

- PTT Global Chemical Public Company Limited

- SCG Chemicals Co Ltd

- Thai Plastic Industries Co Ltd

Key Developments in Thailand Plastic Market Industry

- December 2022: HMC Polymers announced the opening of its fourth polypropylene production line (PP4 plant) in Map Ta Phut Industrial Estate, Rayong Province, Thailand. This investment of over THB 8,000 million (USD 244.13 million) aims to reinforce HMC Polymers' leadership in the PP resin industry in Southeast Asia. The new facility increases the company's production capacity from 810,000 tons per annum to 1,060,000 tons per annum.

- October 2022: HMC Polymers launched its PP Reborn platform. This initiative focuses on managing PP plastics and other plastic types in Thailand, aiming to enhance knowledge and understanding of plastic sorting and facilitate the collection of orphaned plastic. Collected plastics are intended to be reintegrated into the production system, aligning with circular economy principles.

Strategic Thailand Plastic Market Market Forecast

The strategic Thailand plastic market forecast indicates continued robust growth, propelled by several key catalysts. The increasing adoption of advanced engineering plastics in the automotive sector, driven by lightweighting and electrification trends, will be a significant growth engine. The expanding demand for sustainable and innovative packaging solutions, including bio-based and recyclable materials, will further bolster the market. Government support for industrial modernization and export promotion, coupled with the growing middle class in Thailand and neighboring ASEAN nations, will create sustained demand for plastic-based consumer goods. Investments in recycling infrastructure and the circular economy will not only mitigate environmental concerns but also unlock new market opportunities for recycled plastic resins. The Thailand plastic market size is expected to witness substantial expansion in the coming years.

Thailand Plastic Market Segmentation

-

1. Type

-

1.1. Traditional Plastics

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. Polystyrene

- 1.1.4. Polyvinyl Chloride

-

1.2. Engineering Plastics

- 1.2.1. Polyethylene Terephthalate (PET)

- 1.2.2. Polyamides

- 1.2.3. Polycarbonates

- 1.2.4. Styrene Copolymers (ABS and SAN)

- 1.2.5. Polybutylene Terephthalate (PBT)

- 1.2.6. Polymethyl Methacrylate (PMMA)

- 1.2.7. Other Engineering Plastics

- 1.3. Bioplastics

-

1.1. Traditional Plastics

-

2. Application

- 2.1. Packaging

- 2.2. Electrical and Electronics

- 2.3. Building and Construction

- 2.4. Automotive and Transportation

- 2.5. Furniture and Bedding

- 2.6. Other Applications

Thailand Plastic Market Segmentation By Geography

- 1. Thailand

Thailand Plastic Market Regional Market Share

Geographic Coverage of Thailand Plastic Market

Thailand Plastic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Plastic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Traditional Plastics

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. Polystyrene

- 5.1.1.4. Polyvinyl Chloride

- 5.1.2. Engineering Plastics

- 5.1.2.1. Polyethylene Terephthalate (PET)

- 5.1.2.2. Polyamides

- 5.1.2.3. Polycarbonates

- 5.1.2.4. Styrene Copolymers (ABS and SAN)

- 5.1.2.5. Polybutylene Terephthalate (PBT)

- 5.1.2.6. Polymethyl Methacrylate (PMMA)

- 5.1.2.7. Other Engineering Plastics

- 5.1.3. Bioplastics

- 5.1.1. Traditional Plastics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Packaging

- 5.2.2. Electrical and Electronics

- 5.2.3. Building and Construction

- 5.2.4. Automotive and Transportation

- 5.2.5. Furniture and Bedding

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Covestro AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HMC Polymers Thailand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Indorama Ventures Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 INEOS Styrolution Group GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PTT Global Chemical Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SCG Chemicals Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thai Plastic Industries Co Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Covestro AG

List of Figures

- Figure 1: Thailand Plastic Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Plastic Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Plastic Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Thailand Plastic Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Thailand Plastic Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Thailand Plastic Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Thailand Plastic Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Thailand Plastic Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Plastic Market?

The projected CAGR is approximately 11.35%.

2. Which companies are prominent players in the Thailand Plastic Market?

Key companies in the market include Covestro AG, HMC Polymers Thailand, Indorama Ventures Public Company Limited, INEOS Styrolution Group GmbH, PTT Global Chemical Public Company Limited, SCG Chemicals Co Ltd, Thai Plastic Industries Co Ltd*List Not Exhaustive.

3. What are the main segments of the Thailand Plastic Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging.

8. Can you provide examples of recent developments in the market?

December 2022: the Thailand-based major producer and distributor of polypropylene or PP resin company, named HMC Polymers company limited or HMC Polymers, announced to open of the fourth production line of the polypropylene plant (PP4 plant) in Map Ta Phut Industrial Estate, Rayong Province, Thailand, with an investment of over THB 8,000 million (USD 244.13 million). This new plant will help the company reinforce its leadership in the PP resin industry in the Southeast Asian region. The 4th production facility of HMC Polymers will increase the company's production capacity from 810,000 tons per annum to 1,060,000 tons per annum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Plastic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Plastic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Plastic Market?

To stay informed about further developments, trends, and reports in the Thailand Plastic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence