Key Insights

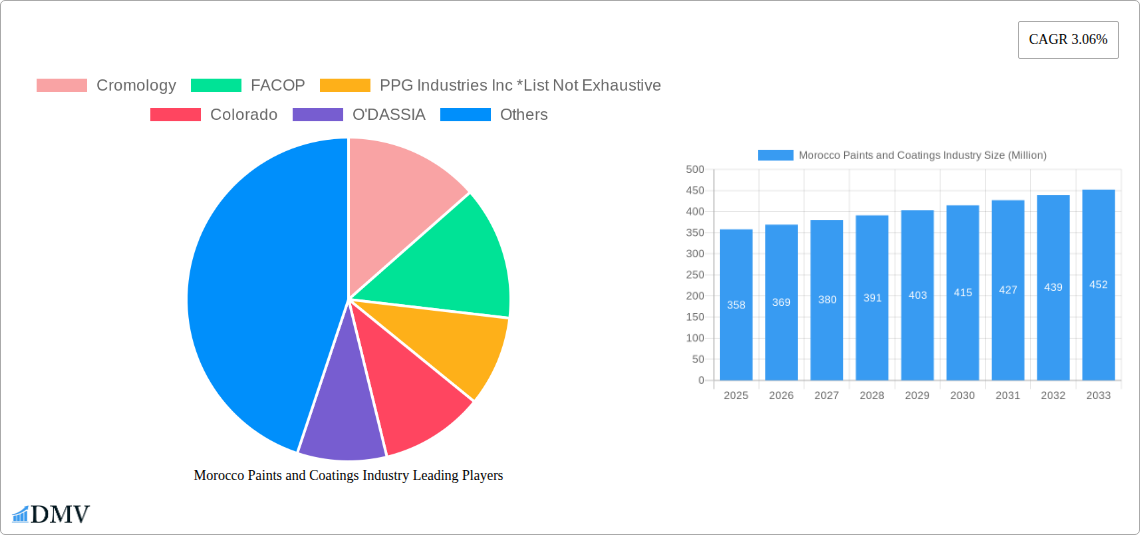

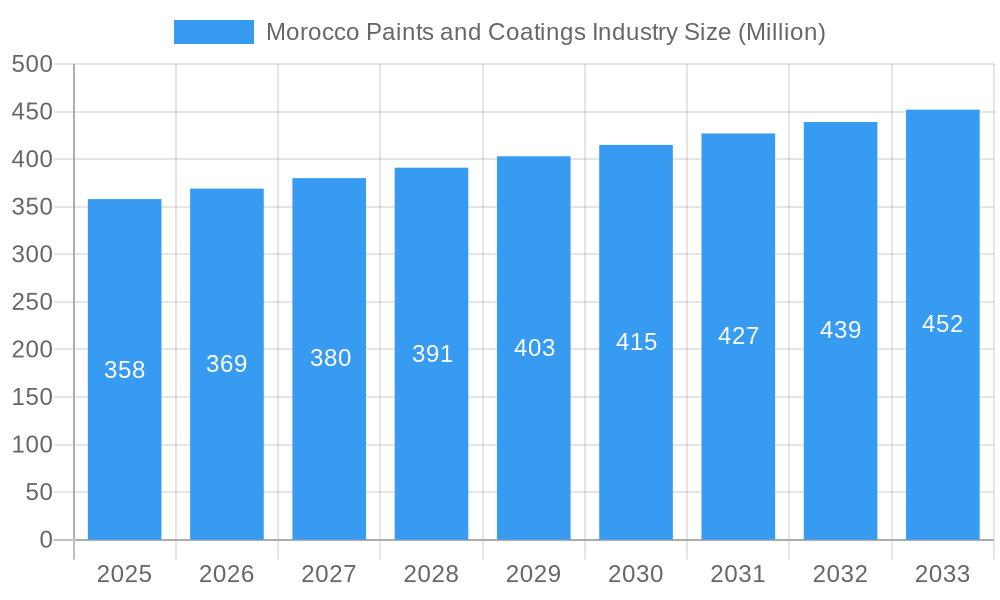

The Morocco Paints and Coatings Industry is poised for steady growth, with a projected market size of $358 million and a Compound Annual Growth Rate (CAGR) of 3.06% from 2019 to 2033. This expansion is largely driven by robust demand from the architectural sector, fueled by ongoing urbanization, infrastructure development projects, and a growing middle class with increasing disposable income. The automotive industry also contributes significantly, with rising vehicle production and a persistent need for coatings that offer both aesthetic appeal and protective functionalities. Furthermore, the industrial segment, encompassing applications in manufacturing, machinery, and protective coatings for infrastructure, plays a crucial role in sustaining market momentum. Trends such as the increasing adoption of water-borne and UV-cured coatings, driven by environmental regulations and a greater consumer preference for eco-friendly products, are reshaping the market landscape. The shift towards these sustainable technologies not only addresses regulatory pressures but also aligns with global sustainability initiatives, offering benefits like reduced VOC emissions and improved worker safety.

Morocco Paints and Coatings Industry Market Size (In Million)

However, the industry faces certain restraints that could temper its growth trajectory. Fluctuations in raw material prices, particularly those linked to petrochemicals, can impact profit margins for manufacturers and influence pricing strategies. Economic uncertainties, both domestic and global, may also affect consumer spending on non-essential goods, including decorative paints. Despite these challenges, the market is actively innovating, with a focus on developing high-performance coatings that offer enhanced durability, corrosion resistance, and aesthetic finishes. Technological advancements in paint formulations, such as the development of self-cleaning and anti-microbial coatings, are expected to open up new avenues for growth. The competitive landscape features established global players alongside local manufacturers, all vying for market share through product differentiation, strategic partnerships, and expanding distribution networks across various end-user industries.

Morocco Paints and Coatings Industry Company Market Share

Morocco Paints and Coatings Industry Market Composition & Trends

The Morocco paints and coatings industry is characterized by a dynamic market composition, driven by increasing construction activities, burgeoning automotive manufacturing, and a growing demand for protective and aesthetic coatings across various sectors. Market concentration is moderate, with key players like Cromology, FACOP, PPG Industries Inc, Colorado, O'DASSIA, Akzo Nobel N.V., ATLAS Peintures, Kansai Paint Co Ltd, Promaflor, and Sothema holding significant shares. Innovation is a key catalyst, with companies investing in R&D to develop eco-friendly, high-performance, and specialized coatings. The regulatory landscape is evolving, with a focus on environmental standards and product safety, influencing the adoption of water-borne and low-VOC (Volatile Organic Compounds) formulations. Substitute products, such as advanced building materials and digital printing technologies, pose a nascent threat but are yet to significantly impact the core paints and coatings market. End-user profiles are diverse, ranging from individual homeowners and large-scale construction firms to automotive manufacturers and industrial enterprises. Mergers and acquisitions (M&A) activities are observed, such as FACOP's acquisition of a local paint manufacturer, signaling a strategic move to consolidate market position and expand product portfolios. The overall M&A deal value is estimated to be in the range of tens of millions of USD, indicating strategic consolidations rather than mega-deals. The market is poised for steady growth, propelled by ongoing urbanization and industrial development within Morocco.

- Market Share Distribution: Dominant players hold approximately 60-70% of the market share, with the remaining fragmented among smaller, regional manufacturers.

- M&A Deal Values: Estimated M&A deal values range from approximately $10 Million to $50 Million USD for significant acquisitions within the sector.

- Innovation Focus: Emphasis on sustainable formulations, advanced durability, and specialized functional coatings.

- Regulatory Influence: Increasing alignment with international environmental standards is shaping product development and manufacturing processes.

Morocco Paints and Coatings Industry Industry Evolution

The Morocco paints and coatings industry has witnessed a significant evolution over the historical period of 2019–2024, with robust growth trajectories driven by a confluence of economic development, infrastructure expansion, and shifting consumer preferences. During the base year of 2025, the market is estimated to be valued at approximately $700 Million USD, with a projected Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period of 2025–2033. This sustained growth is underpinned by substantial investments in the construction sector, spurred by government initiatives aimed at housing development and urban renewal. The automotive industry's expansion, particularly in the Tangier automotive hub, has also been a significant contributor, driving demand for high-quality automotive coatings. Technological advancements have played a crucial role in shaping the industry's evolution. There's a discernible shift towards more sustainable and environmentally friendly technologies, with water-borne coatings gaining considerable traction over traditional solvent-borne alternatives. This transition is driven by both increasing environmental awareness among consumers and stricter regulatory mandates. The adoption of advanced technologies like UV-cured coatings is also on the rise, particularly in niche applications requiring rapid drying and enhanced durability. Consumer demands have become more sophisticated, with a greater emphasis on aesthetic appeal, long-lasting performance, and health-conscious features, such as low-VOC and antibacterial paints. The industry has responded by innovating with a wider range of colors, textures, and functional properties, including coatings that offer improved insulation, corrosion resistance, and fire retardancy. The ongoing economic resilience of Morocco, coupled with its strategic geographic location and increasing trade partnerships, further solidifies the positive outlook for the paints and coatings sector. The estimated market size for the base year, 2025, stands at approximately $700 Million USD, with the forecast period showing a consistent upward trend in market value and volume.

- Historical Growth (2019-2024): Average annual growth rate of approximately 5.8%.

- Forecast Growth (2025-2033): Projected CAGR of 6.5%, reaching an estimated market value of over $1.2 Billion USD by 2033.

- Technology Adoption: Water-borne coatings currently represent approximately 45% of the market, with a projected increase to 60% by 2033.

- Consumer Demand Drivers: Increased preference for low-VOC products has risen by 30% in the last two years.

Leading Regions, Countries, or Segments in Morocco Paints and Coatings Industry

Within the vibrant Morocco paints and coatings industry, the Architectural end-user segment stands as the undisputed leader, driving significant market share and influencing overall industry trends. This dominance is intrinsically linked to the nation's ongoing urbanization, substantial investments in residential and commercial construction projects, and a consistent demand for both new builds and renovations. The architectural segment encompasses a broad spectrum of applications, from interior and exterior wall paints to decorative finishes and protective coatings for building exteriors.

The Resin Type segment is prominently led by Acrylic resins. Their versatility, excellent weatherability, and ability to form durable films make them ideal for a wide range of architectural coatings. Alkyd resins also maintain a significant presence, particularly in industrial and wood applications due to their cost-effectiveness and good adhesion properties. However, there's a notable upward trend in the adoption of Polyurethane and Epoxy resins for specialized industrial and protective coatings, offering enhanced chemical resistance and durability.

In terms of Technology, Water-borne coatings are rapidly gaining market share, reflecting a global and national shift towards more sustainable and environmentally friendly solutions. This trend is driven by stringent environmental regulations and increasing consumer awareness regarding VOC emissions. While Solvent-borne coatings still hold a considerable portion, particularly in industrial and automotive applications where specific performance characteristics are paramount, their dominance is gradually diminishing. Powder coating technology is seeing steady growth in industrial applications like metal furniture and appliances, offering efficient and durable finishes.

Key drivers underpinning the dominance of the architectural segment and the rise of acrylic and water-borne technologies include:

- Investment Trends: Sustained government and private sector investment in housing, infrastructure, and commercial real estate projects across Morocco. Morocco's Vision 2030 plan heavily emphasizes urban development.

- Regulatory Support: Evolving environmental regulations are increasingly favoring low-VOC and water-borne paint technologies, pushing manufacturers to innovate and consumers to adopt them.

- Consumer Demand: Growing demand for aesthetically pleasing, durable, and healthy living environments fuels the market for high-quality architectural coatings. The desire for eco-friendly products is a significant factor.

- Economic Growth: The overall economic growth of Morocco translates into increased disposable income, enabling greater spending on home improvement and renovation.

The Automotive and Industrial end-user industries represent the next significant market segments, each with its own set of driving factors. The automotive sector, especially around the Tangier Free Trade Zone, demands high-performance coatings for both OEM and refinish applications, with PPG Industries Inc and Akzo Nobel N.V. being key players. Industrial coatings, used for protecting machinery, infrastructure, and manufactured goods, are experiencing growth due to Morocco's expanding manufacturing base.

- Dominant Segment: Architectural coatings account for an estimated 55% of the total market revenue.

- Leading Resin Type: Acrylic resins constitute approximately 40% of the resin market share.

- Growing Technology: Water-borne coatings are projected to capture 60% of the market by 2033.

- Key Regional Drivers: Urban centers like Casablanca, Rabat, and Marrakech are major consumption hubs for architectural paints due to high population density and construction activity.

- Automotive Hub Impact: The Tangier automotive cluster is a significant driver for specialized automotive coatings, with an estimated market value of $150 Million USD.

Morocco Paints and Coatings Industry Product Innovations

The Morocco paints and coatings industry is increasingly characterized by a focus on product innovation, driven by the demand for enhanced performance, sustainability, and specialized functionalities. Companies are developing advanced formulations that offer superior durability, weather resistance, and aesthetic appeal. Innovations in acrylic-based coatings are yielding paints with improved stain resistance and ease of cleaning for architectural applications. In the industrial sector, advanced epoxy and polyurethane coatings are being introduced, providing exceptional chemical and corrosion protection, vital for the marine and infrastructure segments. Furthermore, there's a significant push towards eco-friendly solutions, with the development of low-VOC and water-borne paints that meet stringent environmental regulations without compromising on quality. Akzo Nobel's recent launch of sustainable and antibacterial paint solutions highlights this trend, catering to the growing demand for healthier indoor environments. These innovative products are not only addressing existing market needs but also creating new application possibilities, such as self-cleaning surfaces and coatings with enhanced thermal insulation properties.

Propelling Factors for Morocco Paints and Coatings Industry Growth

Several key factors are propelling the growth of the Morocco paints and coatings industry. The robust expansion of the construction sector, fueled by government initiatives for housing and infrastructure development, is a primary driver. Increased foreign direct investment in manufacturing, particularly in the automotive sector, is significantly boosting demand for industrial and automotive coatings. Technological advancements, leading to the development of more sustainable, low-VOC, and high-performance coatings, are attracting environmentally conscious consumers and complying with stricter regulations. Furthermore, rising disposable incomes and a growing middle class are leading to increased spending on home renovations and aesthetic upgrades, further stimulating demand for decorative paints. The strategic geographic location of Morocco also facilitates export opportunities, contributing to market expansion.

- Construction Boom: Significant government investment in housing and infrastructure projects.

- Industrial Expansion: Growth in manufacturing, especially automotive, driving demand for protective coatings.

- Sustainability Push: Increasing consumer and regulatory preference for eco-friendly, water-borne, and low-VOC paints.

- Rising Consumer Spending: Increased disposable income leading to greater expenditure on home improvement.

Obstacles in the Morocco Paints and Coatings Industry Market

Despite the positive growth trajectory, the Morocco paints and coatings industry faces several obstacles. Fluctuations in raw material prices, particularly for petrochemical-based inputs, can impact profitability and pricing strategies. Supply chain disruptions, both domestically and internationally, can lead to production delays and increased logistics costs. Intense competition from both established international players and emerging local manufacturers exerts pressure on profit margins. Furthermore, a lack of skilled labor in specialized coating application techniques can hinder the adoption of advanced coating systems. Stringent and evolving environmental regulations, while a driver for innovation, also present compliance challenges and necessitate significant investment in new technologies and processes for some manufacturers. The informal sector also poses a challenge, with unbranded and lower-quality products often undercutting legitimate businesses on price.

- Raw Material Volatility: Price swings in key inputs like titanium dioxide and petrochemicals.

- Supply Chain Inefficiencies: Challenges in logistics and timely procurement of raw materials.

- Intense Competition: Price wars and market saturation in certain segments.

- Regulatory Compliance Costs: Investment required to meet evolving environmental standards.

Future Opportunities in Morocco Paints and Coatings Industry

The Morocco paints and coatings industry is ripe with future opportunities. The increasing focus on sustainability presents a significant avenue for growth in eco-friendly paints, including bio-based and recycled-content formulations. The expansion of renewable energy projects, such as solar farms, will create demand for specialized protective coatings with enhanced durability and weather resistance. Morocco's growing tourism sector and the development of new hospitality infrastructure will drive demand for decorative and functional architectural coatings. Furthermore, the country's strategic position as a gateway to Africa offers opportunities for export market expansion. The increasing adoption of digital technologies in manufacturing and distribution can also lead to greater efficiency and new business models.

- Green Coatings: Growing market for sustainable and eco-friendly paint solutions.

- Renewable Energy Sector: Demand for protective coatings for solar panels and wind turbines.

- Infrastructure Development: Continued investment in transportation, ports, and urban infrastructure.

- African Export Hub: Leveraging Morocco's strategic location to penetrate new markets.

Major Players in the Morocco Paints and Coatings Industry Ecosystem

- Cromology

- FACOP

- PPG Industries Inc

- Colorado

- O'DASSIA

- Akzo Nobel N V

- ATLAS Peintures

- Kansai Paint Co Ltd

- Promaflor

- Sothema

Key Developments in Morocco Paints and Coatings Industry Industry

- Akzo Nobel launches sustainable and antibacterial paint solutions in Morocco (Month/Year not specified, impacting Q4 2024 onwards) - This development caters to growing health consciousness and environmental regulations, potentially boosting market share for sustainable product lines.

- PPG expands its automotive coatings production facility in Tangier (Month/Year not specified, impacting 2025 onwards) - This expansion signifies increased production capacity and commitment to the Moroccan automotive sector, potentially leading to greater market penetration and supply chain efficiency for automotive coatings.

- FACOP acquires a local paint manufacturer to strengthen its market position (Month/Year not specified, impacting 2024 onwards) - This strategic acquisition allows FACOP to broaden its product portfolio, expand its distribution network, and consolidate its presence in the domestic market, potentially increasing its overall market share.

Strategic Morocco Paints and Coatings Industry Market Forecast

The Morocco paints and coatings industry is projected for substantial growth in the coming years, driven by a confluence of strategic factors. Continued government investment in infrastructure and housing will sustain robust demand from the architectural segment. The burgeoning automotive sector and increasing industrialization will further bolster the need for specialized protective and functional coatings. The global and national shift towards sustainability will accelerate the adoption of eco-friendly, water-borne, and low-VOC technologies, creating new market opportunities for innovative manufacturers. Future growth catalysts include the increasing preference for value-added coatings with enhanced durability and aesthetic appeal, alongside the potential for export expansion into neighboring African markets. The market forecast remains highly optimistic, indicating a positive trajectory for key industry players.

Morocco Paints and Coatings Industry Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Polyester

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-Borne

- 2.3. Powder Coating

- 2.4. UV-Cured Coating

-

3. End-user Industry

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Industrial

- 3.5. Transportation

- 3.6. Packaging

Morocco Paints and Coatings Industry Segmentation By Geography

- 1. Morocco

Morocco Paints and Coatings Industry Regional Market Share

Geographic Coverage of Morocco Paints and Coatings Industry

Morocco Paints and Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Accelerating Growth of the Construction Industry; Growth in the Wood Furniture Market; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Less availability of raw material; Rising VOC concerns

- 3.4. Market Trends

- 3.4.1. Acrylic Resins to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Paints and Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-Borne

- 5.2.3. Powder Coating

- 5.2.4. UV-Cured Coating

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Industrial

- 5.3.5. Transportation

- 5.3.6. Packaging

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cromology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FACOP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PPG Industries Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colorado

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 O'DASSIA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Akzo Nobel N V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ATLAS Peintures

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kansai Paint Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Promaflor

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sothema

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cromology

List of Figures

- Figure 1: Morocco Paints and Coatings Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Morocco Paints and Coatings Industry Share (%) by Company 2025

List of Tables

- Table 1: Morocco Paints and Coatings Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Morocco Paints and Coatings Industry Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 3: Morocco Paints and Coatings Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Morocco Paints and Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Morocco Paints and Coatings Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Morocco Paints and Coatings Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Morocco Paints and Coatings Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Morocco Paints and Coatings Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Morocco Paints and Coatings Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 10: Morocco Paints and Coatings Industry Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 11: Morocco Paints and Coatings Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Morocco Paints and Coatings Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 13: Morocco Paints and Coatings Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Morocco Paints and Coatings Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Morocco Paints and Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Morocco Paints and Coatings Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Paints and Coatings Industry?

The projected CAGR is approximately 3.06%.

2. Which companies are prominent players in the Morocco Paints and Coatings Industry?

Key companies in the market include Cromology, FACOP, PPG Industries Inc *List Not Exhaustive, Colorado, O'DASSIA, Akzo Nobel N V, ATLAS Peintures, Kansai Paint Co Ltd, Promaflor , Sothema .

3. What are the main segments of the Morocco Paints and Coatings Industry?

The market segments include Resin Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 358 Million as of 2022.

5. What are some drivers contributing to market growth?

Accelerating Growth of the Construction Industry; Growth in the Wood Furniture Market; Other Drivers.

6. What are the notable trends driving market growth?

Acrylic Resins to Dominate the Market.

7. Are there any restraints impacting market growth?

Less availability of raw material; Rising VOC concerns.

8. Can you provide examples of recent developments in the market?

Akzo Nobel launches sustainable and antibacterial paint solutions in Morocco.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Paints and Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Paints and Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Paints and Coatings Industry?

To stay informed about further developments, trends, and reports in the Morocco Paints and Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence