Key Insights

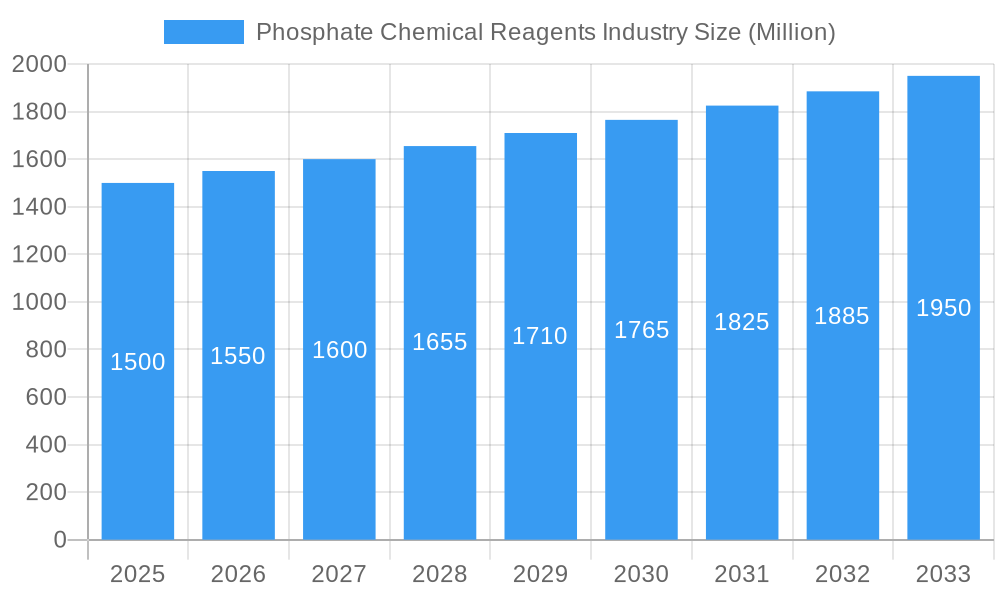

The global Phosphate Chemical Reagents market is poised for robust expansion, projected to reach a significant market size by 2033, driven by a compound annual growth rate exceeding 3.40%. This growth is fueled by the increasing demand across diverse sectors, most notably agriculture, where phosphate reagents play a crucial role in soil testing, fertilizer production, and water quality analysis for optimal crop yields. The food and beverage industry also contributes substantially, utilizing these reagents for quality control, pH adjustment, and as food additives. Furthermore, the expanding detergent industry, coupled with the persistent need for chemical intermediates in various manufacturing processes, reinforces the market's upward trajectory. Innovations in reagent purity, development of more sensitive detection methods, and a growing emphasis on sustainable chemical practices are anticipated to shape market dynamics.

Phosphate Chemical Reagents Industry Market Size (In Billion)

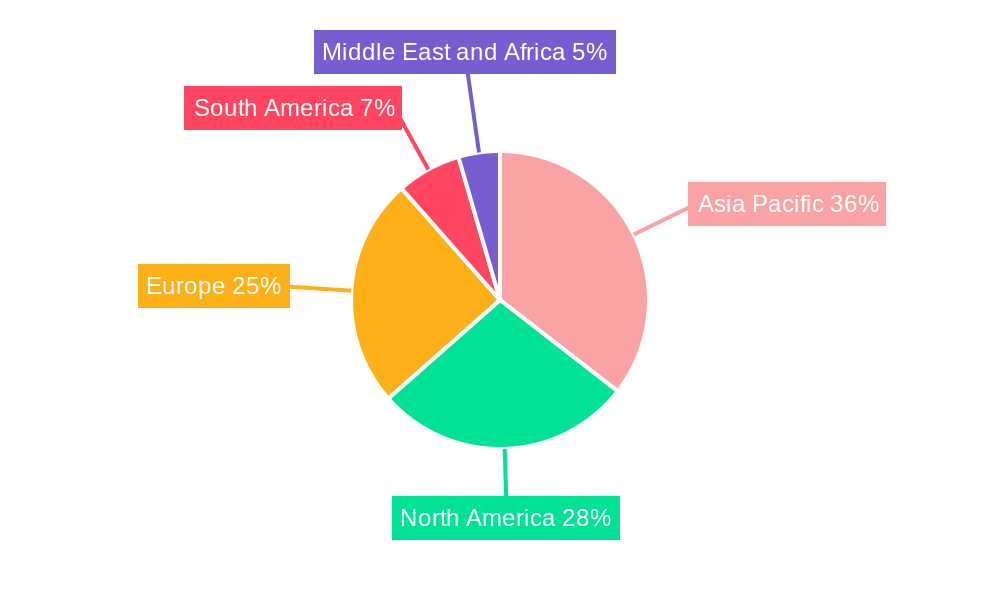

The market's expansion is further underscored by key trends such as the increasing focus on high-purity phosphate reagents for analytical and research purposes, particularly within pharmaceutical and life sciences applications. The integration of advanced manufacturing technologies and automation in reagent production is streamlining processes and enhancing product consistency. However, the market faces certain restraints, including the fluctuating raw material costs, particularly for phosphorus-derived chemicals, and stringent environmental regulations concerning the handling and disposal of certain phosphate compounds. Geographically, the Asia Pacific region is expected to emerge as a dominant force, driven by rapid industrialization, a burgeoning agricultural sector, and increasing R&D investments in countries like China and India. North America and Europe will continue to be significant markets, supported by established industries and a strong emphasis on quality control and research.

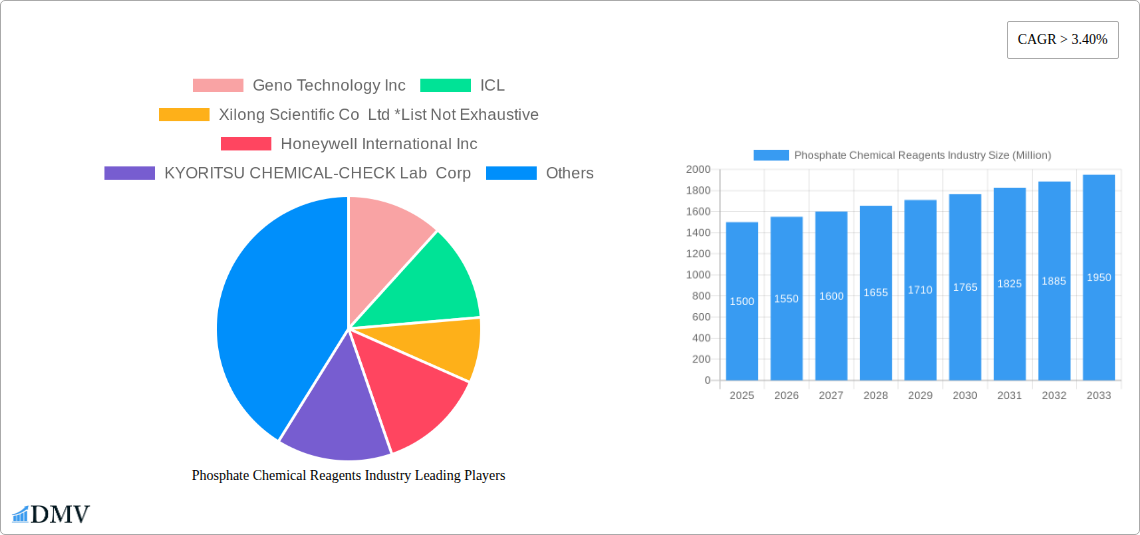

Phosphate Chemical Reagents Industry Company Market Share

Phosphate Chemical Reagents Industry: Comprehensive Market Analysis & 2033 Forecast

This in-depth report offers a strategic analysis of the global Phosphate Chemical Reagents market, encompassing its current landscape, historical evolution, and projected trajectory through 2033. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year, followed by a detailed forecast period from 2025 to 2033. Leveraging high-ranking keywords and precise data, this report provides invaluable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive pressures within the phosphate chemical reagents market, phosphate reagents industry, laboratory chemicals, and specialty chemicals.

Phosphate Chemical Reagents Industry Market Composition & Trends

The Phosphate Chemical Reagents industry exhibits a dynamic market composition influenced by a confluence of innovation, evolving regulatory landscapes, and robust end-user demand. Market concentration varies across different product categories and geographical regions, with key players continuously investing in research and development to introduce novel high-purity phosphate reagents and analytical phosphate reagents. The presence of established giants like Honeywell International Inc. and Sigma-Aldrich Inc. (now part of Merck KGaA) alongside specialized firms such as Geno Technology Inc. and ICL signifies a competitive yet collaborative ecosystem. Innovation catalysts include the increasing demand for advanced analytical techniques in pharmaceuticals, biotechnology, and environmental monitoring, driving the development of more sensitive and selective phosphate compounds. Substitute products, while present in certain applications, often fall short of the performance and purity offered by dedicated phosphate reagents. End-user profiles are diverse, ranging from academic research institutions and contract research organizations (CROs) to industrial manufacturers in the agriculture, food and beverage, and detergent sectors. Mergers and acquisitions (M&A) activities, valued in the hundreds of millions, are strategically shaping market consolidation and market share distribution, with recent deals indicating a focus on expanding product portfolios and geographical reach. For instance, recent M&A activities have seen strategic integrations aimed at enhancing capabilities in areas like biochemical reagents and reagents for water testing. The market share distribution is characterized by a mix of dominant global players and niche regional suppliers, with the top five companies holding an estimated 40-50% of the market share. M&A deal values in the past three years have aggregated over 500 Million, indicating significant strategic investment.

Phosphate Chemical Reagents Industry Industry Evolution

The Phosphate Chemical Reagents industry has witnessed a significant evolution throughout the historical period of 2019-2024 and is poised for continued robust growth in the forecast period. Market growth trajectories have been consistently upward, driven by increasing global expenditure on scientific research and development, coupled with a rising demand for advanced analytical solutions across various industries. Technological advancements have played a pivotal role in this evolution. The development of more sophisticated synthesis techniques has led to the availability of ultra-pure phosphate reagents with enhanced stability and performance characteristics. Furthermore, the integration of automation and miniaturization in laboratory workflows has amplified the need for precisely formulated and reliable phosphate chemical reagents, contributing to a growth rate of approximately 5-7% annually in recent years.

Shifting consumer demands, particularly in sectors like healthcare and environmental protection, have also been instrumental. The burgeoning biotechnology sector's reliance on biochemical reagents for drug discovery and diagnostics, as well as the increasing stringency of environmental regulations mandating accurate water quality testing, have created sustained demand for specialized phosphate compounds. Adoption metrics for new reagent formulations, especially those offering improved efficiency or reduced environmental impact, have been positive, with many applications seeing a 10-15% faster adoption rate for innovative products. The COVID-19 pandemic, while posing initial supply chain challenges, ultimately accelerated research in areas requiring precise chemical analysis, further bolstering the demand for high-quality phosphate reagents. For instance, the expansion of diagnostic testing protocols often necessitates the use of specific phosphate buffers and substrates. The global market size for phosphate chemical reagents was estimated at 3,000 Million in 2024 and is projected to reach 5,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. The increasing focus on precision agriculture also fuels demand for phosphate-based fertilizers and soil testing reagents, adding another significant growth dimension.

Leading Regions, Countries, or Segments in Phosphate Chemical Reagents Industry

The Agriculture application segment stands out as a dominant force within the global Phosphate Chemical Reagents industry, driven by critical factors such as increasing global food demand, the need for enhanced crop yields, and advancements in soil and plant analysis technologies. The region experiencing the most significant dominance is North America, closely followed by Europe and Asia Pacific.

- Key Drivers for Agriculture Segment Dominance:

- Global Food Security Imperative: With a growing global population, the agricultural sector is under immense pressure to increase productivity. Phosphate chemical reagents are indispensable for fertilizer production, soil testing kits, and crop nutrient analysis, directly contributing to improved agricultural output.

- Technological Advancements in Agronomy: The adoption of precision agriculture techniques, including advanced soil mapping, nutrient management software, and sensor-based monitoring, relies heavily on accurate and reliable phosphate chemical reagents for analysis. This enables farmers to optimize fertilizer application and minimize waste, leading to higher yields and reduced environmental impact.

- Regulatory Support and Subsidies: Governments worldwide are increasingly investing in and promoting sustainable agricultural practices, often providing subsidies and support for technologies that enhance crop productivity and soil health, indirectly boosting the demand for agricultural-grade phosphate reagents.

- Research and Development in Plant Nutrition: Continuous research into plant physiology and nutrient uptake drives the demand for specialized phosphate compounds used in experimental fertilizers and plant growth regulators, further solidifying the segment's importance.

- Market Penetration of Analytical Instruments: The increasing availability and affordability of sophisticated analytical instruments used for soil and plant tissue analysis further fuel the demand for the necessary chemical reagents, including a wide array of phosphate compounds.

In-depth analysis of dominance factors reveals that North America's leadership is underpinned by its highly industrialized agricultural sector, significant investment in agricultural R&D, and the presence of major fertilizer manufacturers and distributors. Europe, with its strong emphasis on sustainable farming practices and stringent quality control measures, also represents a substantial market for high-grade phosphate reagents in agriculture. The Asia Pacific region, driven by its vast agricultural land and rapidly growing population, is exhibiting the fastest growth trajectory, with countries like China and India being major consumers of phosphate chemical reagents for agricultural applications. The market for agricultural phosphate reagents alone is estimated to account for nearly 35% of the total phosphate chemical reagents market share, projected to reach over 1,800 Million by 2033. The sub-segments within agriculture include fertilizer production additives, soil nutrient testing reagents, and plant tissue analysis chemicals, all contributing to this dominance.

Phosphate Chemical Reagents Industry Product Innovations

Product innovation in the Phosphate Chemical Reagents industry is primarily focused on enhancing purity, stability, and application-specific performance. Manufacturers are actively developing enzymatic phosphate assay reagents with increased sensitivity and reduced assay times for diagnostic and research purposes. Innovations also extend to novel phosphate buffer systems that offer superior pH stability across a wider temperature range, crucial for sensitive biological and chemical processes. Furthermore, there's a growing trend towards developing eco-friendly and sustainable phosphate reagent formulations, minimizing hazardous byproducts and reducing environmental impact. For example, advancements in chromatographic phosphate reagents are enabling more efficient separation and analysis of complex mixtures. These advancements are crucial for applications in food and beverage quality control, detergent formulation research, and chemical intermediate synthesis, where precise analytical data is paramount. The unique selling propositions often lie in the reagent's ability to provide faster, more accurate, and more reproducible results, leading to improved efficiency and cost savings for end-users.

Propelling Factors for Phosphate Chemical Reagents Industry Growth

Several key growth drivers are propelling the Phosphate Chemical Reagents industry forward. Technologically, the continuous advancements in analytical instrumentation, such as mass spectrometry and high-performance liquid chromatography (HPLC), necessitate the use of high-purity and specialized phosphate reagents for accurate sample analysis. Economically, the sustained global investment in research and development across pharmaceuticals, biotechnology, and material science fuels demand for these essential chemicals. Regulatory influences are also significant; stricter quality control standards in sectors like food and beverage, and the ongoing emphasis on environmental monitoring, mandate the use of reliable and sensitive phosphate testing reagents. For instance, the increasing focus on water quality compliance across industries has driven the demand for phosphate reagents for water analysis, estimated to be a segment worth 300 Million currently.

Obstacles in the Phosphate Chemical Reagents Industry Market

Despite robust growth prospects, the Phosphate Chemical Reagents industry faces several obstacles. Regulatory challenges, particularly in the stringent approval processes for new chemical formulations in sensitive applications like pharmaceuticals and food, can slow down market entry and innovation. Supply chain disruptions, as evidenced during recent global events, can impact the availability of raw materials and lead to price volatility, affecting both manufacturers and end-users. Competitive pressures from both established players and emerging low-cost manufacturers can lead to price erosion, particularly for commodity-grade phosphate reagents. Furthermore, the development and adoption of alternative analytical techniques that might reduce the reliance on traditional wet chemistry methods present a potential long-term restraint, though the inherent versatility of phosphate reagents mitigates this risk to a significant extent. The estimated impact of these barriers could lead to a 1-2% reduction in projected growth rates in specific niche segments.

Future Opportunities in Phosphate Chemical Reagents Industry

Emerging opportunities in the Phosphate Chemical Reagents industry are diverse and promising. The burgeoning field of personalized medicine and advanced diagnostics presents a significant opportunity for highly specialized and ultra-pure phosphate reagents used in genetic sequencing, immunoassay development, and cell-based assays. The growing demand for sustainable and environmentally friendly chemical solutions opens doors for biodegradable phosphate reagents and those derived from renewable resources. Furthermore, the expansion of emerging economies into advanced manufacturing and research capabilities will create new geographical markets for phosphate chemical reagents. The increasing adoption of reagents for environmental testing, including those for phosphate pollution monitoring, is another significant growth avenue. For example, the development of portable, real-time phosphate detection kits for environmental monitoring represents a key future opportunity.

Major Players in the Phosphate Chemical Reagents Industry Ecosystem

- Geno Technology Inc.

- ICL

- Xilong Scientific Co Ltd

- Honeywell International Inc.

- KYORITSU CHEMICAL-CHECK Lab Corp

- Sigma-Aldrich Inc.

- High Purity Laboratory Chemicals Pvt Ltd

- Tintometer GmbH

- Alfa Aesar Thermo Fisher Scientific

- Biosystems S A

- AAT Bioquest Inc.

- Cayman Chemical

- HiMedia Laboratories

Key Developments in Phosphate Chemical Reagents Industry Industry

- January 2024: AAT Bioquest Inc. launched a new series of highly sensitive fluorescent phosphate assay kits, improving detection limits by 20%.

- November 2023: ICL announced significant expansion of its specialty phosphate production capacity to meet growing demand in the food and beverage sector.

- July 2023: Sigma-Aldrich Inc. introduced a range of novel analytical grade phosphate standards with enhanced shelf-life and stability.

- March 2023: Geno Technology Inc. collaborated with a leading university to develop advanced phosphate reagents for agricultural research, focusing on plant nutrient uptake.

- December 2022: Honeywell International Inc. unveiled a new line of ultra-pure phosphate reagents for pharmaceutical applications, meeting stringent pharmacopoeia standards.

- September 2022: Tintometer GmbH released updated reagents for its photometer systems, enhancing accuracy in water quality testing for phosphates.

Strategic Phosphate Chemical Reagents Industry Market Forecast

The strategic Phosphate Chemical Reagents market forecast indicates sustained growth driven by synergistic factors. The increasing demand for high-purity reagents in life sciences and analytical chemistry, coupled with the expansion of industrial applications, will continue to fuel market expansion. Innovations in product development, focusing on sustainability and enhanced performance, will create new market niches and drive adoption. Furthermore, the ongoing digitalization of laboratories and the increasing use of AI in research will indirectly boost the demand for reliable and precisely formulated chemical reagents. The market is poised to witness a CAGR of approximately 6.5% from 2025 to 2033, reaching an estimated 5,500 Million. Key growth catalysts include the pharmaceutical industry's expansion, advancements in food safety, and the persistent need for environmental monitoring solutions.

Phosphate Chemical Reagents Industry Segmentation

-

1. Application

- 1.1. Agriculture

- 1.2. Food and Beverage

- 1.3. Detergent

- 1.4. Chemical Intermediate

- 1.5. Others

Phosphate Chemical Reagents Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Phosphate Chemical Reagents Industry Regional Market Share

Geographic Coverage of Phosphate Chemical Reagents Industry

Phosphate Chemical Reagents Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Agriculture Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Agriculture Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phosphate Chemical Reagents Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Agriculture

- 5.1.2. Food and Beverage

- 5.1.3. Detergent

- 5.1.4. Chemical Intermediate

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Phosphate Chemical Reagents Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Agriculture

- 6.1.2. Food and Beverage

- 6.1.3. Detergent

- 6.1.4. Chemical Intermediate

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Phosphate Chemical Reagents Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Agriculture

- 7.1.2. Food and Beverage

- 7.1.3. Detergent

- 7.1.4. Chemical Intermediate

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Phosphate Chemical Reagents Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Agriculture

- 8.1.2. Food and Beverage

- 8.1.3. Detergent

- 8.1.4. Chemical Intermediate

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Phosphate Chemical Reagents Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Agriculture

- 9.1.2. Food and Beverage

- 9.1.3. Detergent

- 9.1.4. Chemical Intermediate

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Phosphate Chemical Reagents Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Agriculture

- 10.1.2. Food and Beverage

- 10.1.3. Detergent

- 10.1.4. Chemical Intermediate

- 10.1.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Geno Technology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ICL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Xilong Scientific Co Ltd *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KYORITSU CHEMICAL-CHECK Lab Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sigma-Aldrich Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 High Purity Laboratory Chemicals Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tintometer GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alfa Aesar Thermo Fisher Scientific

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biosystems S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AAT Bioquest Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cayman Chemical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 HiMedia Laboratories

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Geno Technology Inc

List of Figures

- Figure 1: Global Phosphate Chemical Reagents Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Phosphate Chemical Reagents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Phosphate Chemical Reagents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Phosphate Chemical Reagents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Phosphate Chemical Reagents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Phosphate Chemical Reagents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Phosphate Chemical Reagents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Phosphate Chemical Reagents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Phosphate Chemical Reagents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Phosphate Chemical Reagents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Phosphate Chemical Reagents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Phosphate Chemical Reagents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Phosphate Chemical Reagents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Phosphate Chemical Reagents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America Phosphate Chemical Reagents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Phosphate Chemical Reagents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Phosphate Chemical Reagents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Phosphate Chemical Reagents Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: Middle East and Africa Phosphate Chemical Reagents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Phosphate Chemical Reagents Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Phosphate Chemical Reagents Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Canada Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: France Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Italy Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Phosphate Chemical Reagents Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Phosphate Chemical Reagents Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phosphate Chemical Reagents Industry?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the Phosphate Chemical Reagents Industry?

Key companies in the market include Geno Technology Inc, ICL, Xilong Scientific Co Ltd *List Not Exhaustive, Honeywell International Inc, KYORITSU CHEMICAL-CHECK Lab Corp, Sigma-Aldrich Inc, High Purity Laboratory Chemicals Pvt Ltd, Tintometer GmbH, Alfa Aesar Thermo Fisher Scientific, Biosystems S A, AAT Bioquest Inc, Cayman Chemical, HiMedia Laboratories.

3. What are the main segments of the Phosphate Chemical Reagents Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Agriculture Sector; Other Drivers.

6. What are the notable trends driving market growth?

Agriculture Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phosphate Chemical Reagents Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phosphate Chemical Reagents Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phosphate Chemical Reagents Industry?

To stay informed about further developments, trends, and reports in the Phosphate Chemical Reagents Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence